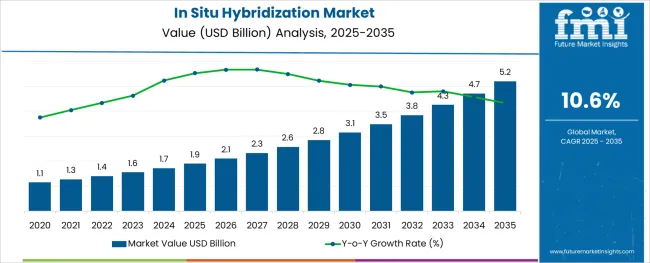

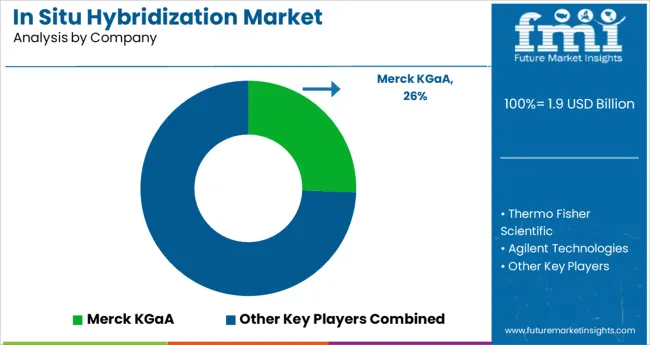

The In Situ Hybridization Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period.

The in situ hybridization market is experiencing strong momentum driven by the increasing demand for molecular diagnostics, personalized medicine, and targeted therapy selection. The technology’s ability to detect specific nucleic acid sequences within preserved tissue samples has positioned it as a critical tool in cancer diagnostics, genetic disease screening, and virology studies.

Ongoing advancements in imaging resolution, probe specificity, and multiplexing have significantly enhanced its diagnostic precision and efficiency. Growing adoption in clinical laboratories, research institutions, and pharmaceutical companies is supported by the need for spatial gene expression analysis and tissue-level insights.

Regulatory focus on accurate diagnostic techniques and the rising prevalence of complex genetic disorders are further contributing to its expansion. The future of this market remains promising as innovation in molecular pathology continues to evolve alongside demand for precise and localized biomarker detection in both research and clinical environments.

The market is segmented by Technology, Probe Type, Product Type, and Application and region. By Technology, the market is divided into Fluorescent In Situ Hybridization (FISH) and Chromogenic In Situ Hybridization (CISH). In terms of Probe Type, the market is classified into DNA and RNA. Based on Product Type, the market is segmented into Services, Instruments, Kits & Probes, and Software. By Application, the market is divided into Cancer, Cytogenetics, Developmental Biology, Infectious Diseases, and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

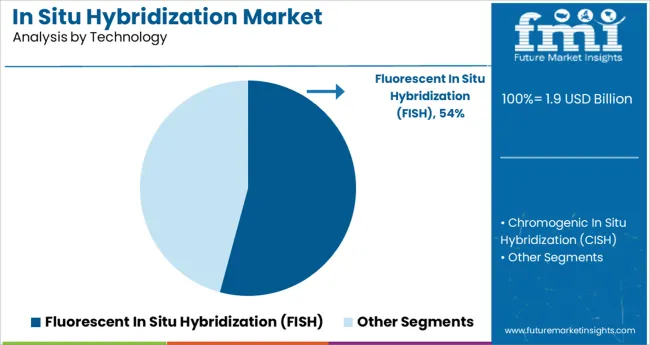

The fluorescent in situ hybridization segment is projected to account for 54.20% of total revenue by 2025 within the technology category, making it the dominant method. This growth is driven by the technique’s high sensitivity, specificity, and capability to detect chromosomal abnormalities and gene rearrangements in intact cells.

FISH enables precise localization of genetic material, making it indispensable in oncology diagnostics, prenatal screening, and pathogen detection. Its application in both research and clinical settings has expanded due to the increasing availability of automated platforms and improved fluorescent imaging tools.

The ability to generate results rapidly with minimal sample preparation and the visual confirmation of genetic alterations have strengthened its appeal. As personalized medicine continues to grow, FISH remains a foundational diagnostic approach due to its accuracy and versatility.

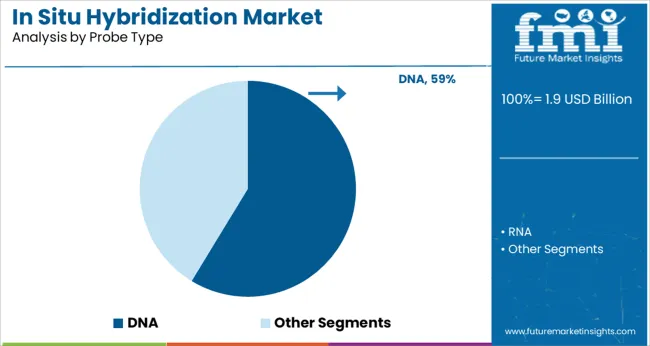

The DNA probe type segment is expected to contribute 58.70% of total market revenue by 2025 within the probe type category, maintaining its leading position. This segment’s growth is supported by the wide utility of DNA probes in detecting specific gene sequences, structural variations, and copy number changes across a broad range of diseases.

DNA probes are highly stable, cost efficient, and suitable for various hybridization formats, enhancing their adoption in laboratories conducting both basic research and clinical diagnostics. Their role in identifying gene mutations and chromosomal rearrangements has become essential in cancer profiling and genetic screening.

With increasing reliance on gene-centric diagnostics and biomarker-based treatment decisions, DNA probes continue to offer unmatched accuracy and application flexibility.

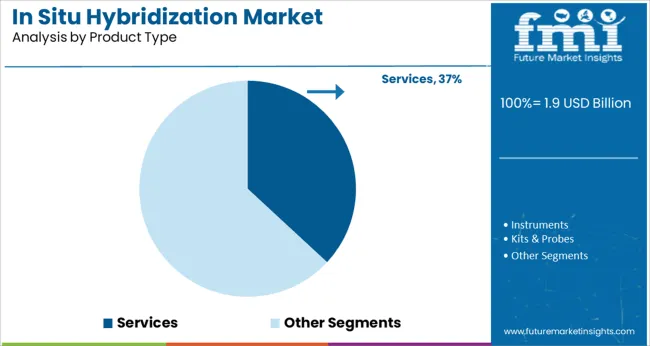

The services segment is anticipated to hold 36.90% of total market revenue by 2025 within the product type category, positioning it as the leading contributor. This dominance is attributed to the growing trend of outsourcing in situ hybridization testing and analysis to specialized laboratories that offer advanced infrastructure, expert interpretation, and faster turnaround times.

Healthcare providers and research institutions are leveraging service-based models to access customized assay development, high resolution imaging, and data interpretation without investing in in house capabilities. The rise of precision diagnostics and increased demand for high complexity tests have further elevated the need for expert service providers.

As laboratories aim to reduce overhead costs and improve testing scalability, service offerings are becoming a preferred choice, cementing their position in the product segment.

As per the In Situ Hybridization industry research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the In Situ Hybridization industry increased at around 9.9% CAGR, wherein, countries such as the USA, the Kingdom, China, South Korea, and Japan held a significant share in the global market. The market is projected to grow at a CAGR of 10.6% over the coming 10 years.

Some of the key factors driving the market include the rising prevalence of specific disorders, increased investments in in-vitro diagnostics, and technological advances in In Situ Hybridization (ISH).

Various research institutions and organizations have spent the last few years conducting extensive R&D in order to develop a technology that can evaluate the molecular profiles of single cells. For example, BIO-PROTOCOL created the Proximity Ligation in the In Situ Hybridization process. The method is expected to be high-performing, low-cost, quick multiplex, and simple to apply.

In situ hybridization technology has become more economical, making it more accessible to developing countries, which are more susceptible to infections and diseases. Regulatory organizations have implemented a variety of regulations and measures to raise public awareness. In August 2024, for example, the Federal Capital Public Health Agency in Nigeria cooperated with WHO to raise infectious illness awareness.

The utilization of ISH products has grown in recent years, resulting in an increase in the number of specialist contract research organizations. Reveal Biosciences, for example, uses in situ hybridization and other methodologies to deliver tissue research and innovative tissue technology services with strict legal capacity and high samples throughout.

For the past several years, cancer cases have been on the rise all around the world. Over the last few decades, extensive investigations on human diseases have identified recurrent genetic aberrations as potential driving factors for a range of malignancies.

Cytogenetic tests, such as ISH, aid in the combination of IHC and DNA FISH in situ, allowing researchers to create, discover and execute next-generation diagnostic approaches. Direct imaging of gene expression in situ at the RNA level gives a new perspective on the interaction between cancer cells and the tumor microenvironment as cancer progresses.

Furthermore, according to a study conducted by McMaster University in Canada, the number of people living with hemophilia has tripled to 1,125,000, up from 400,000 previously. Canada, France, Italy, Australia, the United Kingdom, and New Zealand are the countries most affected. The market is anticipated to benefit from this growth.

North America is expected to be the most lucrative region in the In Situ Hybridization Market throughout the analysis period. The market in the region is expected to be propelled by significant expenditure in healthcare Research and Development (R&D). The market in North America is projected to cross a valuation of USD 5.2 billion by 2035.

The USA dominated the In Situ Hybridization market in 2024, accounting for 44.9% of the total revenue. The existence of a large number of market players, as well as encouraging research programs by the regional government, can be credited for the regional market growth.

Other variables contributing to the country's dominance throughout the projection period include high healthcare spending and strict FDA and Health Canada rules. The USA In Situ Hybridization market has the most patents, whereas the Asia Pacific market has a greater marginal rise than the rest of the world. The presence of Health Canada-funded research initiatives and institutes is estimated to spur the market by a little margin.

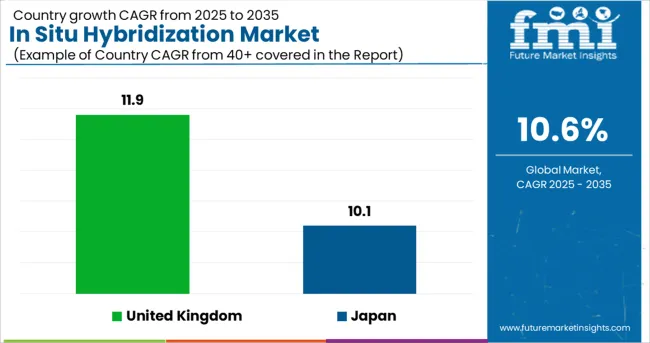

The In Situ Hybridization market in the United Kingdom was valued at USD 1.7 million in 2024. The market in the country is expected to reach nearly USD 5.2 million by 2035. From 2025 to 2035, the market is likely to witness an absolute dollar opportunity of USD 147.1 million, growing at a CAGR of 11.9%

The In Situ Hybridization market in Japan is projected to reach a valuation of USD 183.8 million by 2035, growing at a CAGR of 10.1% from 2025 to 2035. The market is likely to garner an absolute dollar opportunity of USD 1.9 million from 2025 to 2035.

The market in South Korea is expected to reach a USD 75.1 million market value by 2035, growing at a CAGR of 8.5% from 2025 to 2035. During this period, the market is likely to gross an absolute dollar growth of USD 42.3 million.

The Fluorescent In Situ Hybridization (FISH) segment held the largest share of In Situ Hybridization market in 2024, accounting for around 54% of total revenue. This is due to the vast range of uses, including the diagnosis of congenital illnesses such as Edward's Syndrome and Down's Syndrome. The increased use of FISH technology as a result of the rising prevalence and treatment of such diseases is likely to accelerate In Situ Hybridization market growth.

The FISH market's growth is being fueled by low-cost technical advancements. For example, in May 2024, a group of researchers published a report claiming that using chromogen-based RNA in situ hybridization to identify druggable cytokines in atopic dermatitis and psoriasis is an efficient way. Technological progress broadens the scope of In Situ Hybridization and propels segment expansion.

The DNA probe segment held the largest share of in situ hybridization market in 2024, accounting for over 50% of total revenue. However, due to the development of novel nucleic acid-based diagnostic assays and instruments for studying DNA and RNA molecules, the demand for RNA probes grew at a faster rate in the anticipated timeframe.

By hybridization, an RNA probe can indicate the presence of similar nucleic acid sequences. The use of RNA as a hybridization technique is growing due to various advantages, including the fact that the probes are generated in vitro and may be used in practically all applications instead of DNA probes.

Revenue through application dominated the in situ hybridization market in 2024, accounting for over 35% of the total revenue. The expansion is expected to be fueled by an increase in the number of cancer cases. According to the American Cancer Society, about 1.7 million additional cancer cases are projected in the United States in 2024. With the surge in cancer cases, in situ hybridization methods for speedy and accurate diagnosis are in high demand.

Cancer is caused by a variety of reasons, including an aging population, poor health, and the environment. Various organizations are conducting cancer research and are encouraging advancements in cancer therapy. For example, the American Institute for Cancer Research funded around USD 1.7 million in cancer research grants from 2024 to 2024.

During the pinnacle of the epidemic, there was a significant drop in cancer and precancer diagnoses, owing to a decline in the number of screening tests done. In recent months, these characteristics may have hampered the utility of In Situ Hybridization as a molecular tool for cancer diagnosis. However, in the forthcoming years, the considerable development of FISH probes to visualize SARS-CoV-2 RNA in infected cells can have a favorable impact on the sector.

Some of the key players such as Merck KGaA, Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, and Leica Biosystems Nussloch GmbH.

Some of the recent developments of key In Situ Hybridization providers are as follows:

Similarly, recent developments related to companies offering In Situ Hybridization have been tracked by the team at Future Market Insights, which are available in the full report.

The global in situ hybridization market is estimated to be valued at USD 1.9 billion in 2025.

It is projected to reach USD 5.2 billion by 2035.

The market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types are fluorescent in situ hybridization (fish) and chromogenic in situ hybridization (cish).

dna segment is expected to dominate with a 58.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Invar Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA