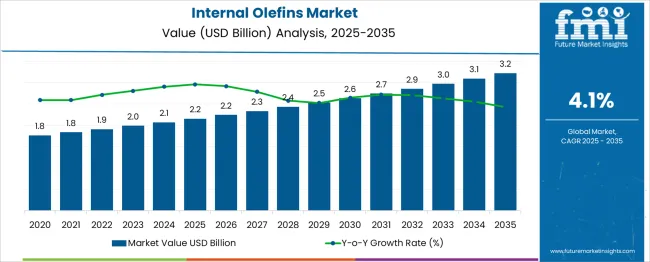

The Internal Olefins Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

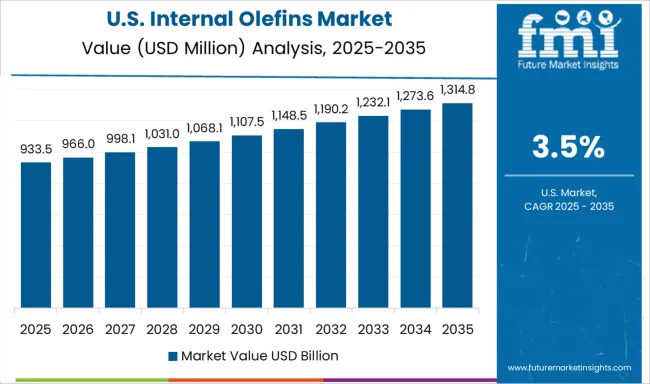

Analysis of the acceleration and deceleration pattern in the provided dataset indicates a steady but moderate growth profile with a slight pickup in momentum toward the later years. From 2025 to 2028, annual increments are minimal, ranging between USD 0.0 and USD 0.1 billion, with year-on-year growth rates around 1.8% to 3.5%. This early phase reflects stable but slow expansion, primarily driven by consistent demand in lubricant additives, drilling fluids, and surfactant production, without significant market disruptions. Between 2029 and 2032, annual growth strengthens to USD 0.1 to USD 0.2 billion, with YoY rates stabilizing near 3.7% to 4.0%. This stage suggests a mild acceleration, possibly linked to broader adoption of high-performance synthetic lubricants and the gradual replacement of less efficient alternatives. In the final period from 2033 to 2035, annual increments remain at approximately USD 0.1 billion, but the percentage growth rate holds steady around 3.2% to 3.3%, indicating a slight deceleration due to the compounding effect on a larger base. Overall, the market reflects a low-volatility growth path with modest acceleration mid-term, followed by a mild slowdown approaching maturity.

| Metric | Value |

|---|---|

| Internal Olefins Market Estimated Value in (2025 E) | USD 2.2 billion |

| Internal Olefins Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The internal olefins market is viewed as a high‑potential yet niche category within broader parent industries. It is estimated to comprise about 2.2% of the global petrochemicals market given its role as a feedstock in advanced chemical production. Within the specialty chemicals industry, a share of approximately 3.4% is assessed based on applications in surfactants and additives. In agrochemicals and lubricants segments an estimated 3.8% share is observed given reliance on olefin derivatives. In automotive and lightweight materials manufacturing a contribution of roughly 2.7% is evaluated given olefin use in engineering polymers. In oil drilling and oil field chemical markets the share is calculated at about 2.9% reflecting use in drilling fluids and lubricant additives.

Trends in this market have been shaped by expansion in agrochemical formulations in agriculture-driven economies where herbicide and pesticide usage is increasing. Oilfield activity and lubricant manufacturing have supported internal olefin use in drilling applications and synthetic base stocks. Volatile ethylene feedstock pricing has been influencing production cost structures. Innovation focus has been on producing cleaner polyalphaolefins and high‑purity internal olefins for compliance with stringent industrial standards. The Asia Pacific region has shown the fastest growth while North America and Europe have retained value through refined product demand under regulated environments. Strategic moves have included capacity expansion by major petrochemical producers and technology collaborations for improved manufacturing efficiency.

The internal olefins market is growing steadily, driven by their versatile applications in specialty chemical synthesis, lubricants, and oilfield chemicals. These compounds are increasingly valued for their chemical stability, biodegradability, and low toxicity, which make them preferable in environmentally regulated end-uses.

Industry adoption is also being boosted by their performance in cold environments and compatibility with advanced formulation systems. Manufacturers are investing in metathesis and olefin oligomerization technologies to improve yield, carbon efficiency, and product customization.

Rising exploration and drilling activities, combined with growing demand for synthetic base oils and specialty surfactants, are expected to sustain long-term demand for internal olefins across industrial sectors.

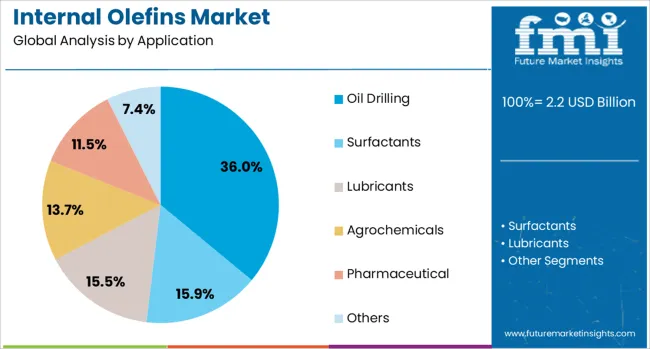

The internal olefins market is segmented by application and geographic regions. By application of the internal olefins market is divided into Oil Drilling, Surfactants, Lubricants, Agrochemicals, Pharmaceutical, and Others. Regionally, the internal olefins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Oil drilling is projected to lead the internal olefins market with a 36.00% revenue share in 2025. This dominance is attributed to the use of internal olefins as key base fluids in drilling mud formulations, particularly in synthetic-based mud systems (SBMs).

Their high biodegradability, thermal stability, and lubricity enhance drilling efficiency while meeting stringent offshore environmental regulations. Internal olefins also contribute to wellbore stability, reduced torque, and improved rate of penetration during horizontal and deepwater drilling.

As global energy demand fuels deeper and more complex drilling operations, the role of environmentally friendly drilling fluid anchored by internal olefins isExpected to become more critical in both offshore and onshore exploration zones.

Internal olefins have been widely utilized in oilfield chemicals, lubricants, surfactants, and specialty chemical synthesis due to their excellent biodegradability, thermal stability, and low pour points. Derived through the isomerization of alpha olefins or from catalytic processes, these compounds have found applications in drilling fluids, synthetic lubricants, and detergent intermediates. Demand has been supported by the expansion of offshore oil and gas activities, as well as increasing use in high-performance industrial lubricants. Manufacturers have been investing in process optimization to improve yield, purity, and cost-efficiency in large-scale production.

The oil and gas sector has been a major consumer of internal olefins, particularly in the formulation of synthetic drilling fluids and completion fluids. These olefins have been selected for their low toxicity, high biodegradability, and effective lubricating properties under extreme downhole conditions. Offshore drilling operations in regions such as the Gulf of Mexico, the North Sea, and West Africa have relied on internal olefin-based fluids to reduce environmental impact while maintaining drilling performance. Their ability to perform in high-pressure, high-temperature environments has made them a preferred choice over conventional mineral oils. Continuous offshore exploration activities and deepwater projects have sustained demand, with suppliers focusing on enhancing supply chain reliability to meet project timelines.

Internal olefins have been incorporated into the production of synthetic lubricants for automotive, industrial, and marine applications due to their stability, low volatility, and favorable viscosity characteristics. In surfactant manufacturing, internal olefins have been converted into alcohols and sulfonates used in detergents, emulsifiers, and wetting agents. These applications have benefited from the chemical’s uniform structure, enabling consistent performance in end products. Producers in North America, Europe, and Asia have developed tailored olefin grades to meet specific lubricant and surfactant requirements. The growing need for high-performance lubricants in machinery, engines, and marine systems, coupled with the demand for biodegradable surfactants in cleaning products, has supported sustained market expansion in these segments.

Advances in catalytic isomerization and metathesis technologies have improved the efficiency and selectivity of internal olefin production. Manufacturers have implemented continuous processing systems to enhance throughput while maintaining product consistency. Integration of feedstock purification systems has allowed for higher-quality outputs with fewer impurities, benefiting applications with strict performance requirements. Research in catalyst development has aimed to increase conversion rates and reduce by-product formation, lowering overall production costs. Companies in the United States, South Korea, and Europe have been optimizing supply chains to ensure consistent availability for large-scale industrial consumers. These technological improvements have reinforced the competitive position of internal olefins as reliable intermediates in multiple high-value chemical processes.

The internal olefins market has faced challenges from feedstock price fluctuations, particularly those linked to crude oil and natural gas-derived alpha olefins. Supply disruptions in petrochemical chains have led to cost instability for manufacturers and end users. Environmental regulations governing offshore drilling fluid formulations have increased compliance costs, particularly in environmentally sensitive regions. In some markets, alternative biodegradable base fluids and synthetic esters have been evaluated as substitutes for internal olefins in oilfield applications. High capital requirements for process upgrades and limited availability of skilled technical resources have also slowed capacity expansion. Without improved feedstock stability, regulatory clarity, and broader technical adoption, market growth may remain dependent on cyclical trends in oil and gas exploration and specialty chemical demand.

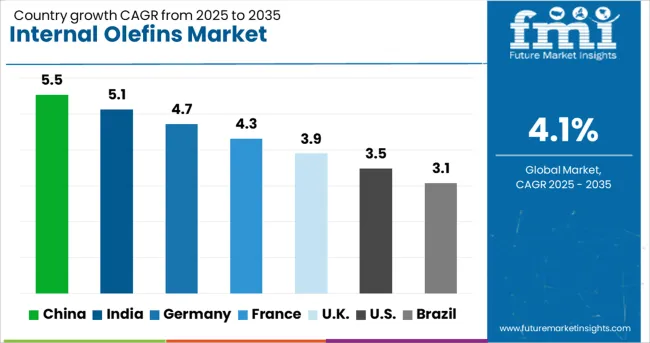

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The internal olefins market is expected to grow at a global CAGR of 4.1% between 2025 and 2035, driven by rising demand in lubricants, surfactants, and oilfield chemicals. China leads with a 5.5% CAGR, supported by large-scale petrochemical production and expansion in industrial applications. India follows at 5.1%, fueled by growing demand in specialty chemicals and manufacturing sectors. Germany, at 4.7%, benefits from advanced chemical processing technologies and strong export capabilities. The UK, projected at 3.9%, sees steady adoption in high-value chemical and lubricant applications. The USA, at 3.5%, reflects stable demand in oilfield operations and industrial manufacturing. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 5.5% from 2025 to 2035 in the internal olefins market, supported by expanding applications in synthetic lubricants, oilfield chemicals, and surfactants. Domestic producers such as Sinopec, PetroChina, and ChemChina are investing in catalytic process upgrades to improve yield efficiency and product purity. The oil and gas industry is a key driver, with internal olefins used in drilling fluids and enhanced oil recovery formulations. Additionally, growth in the detergent and personal care sectors is creating steady demand for high-purity olefin derivatives. Strategic partnerships between Chinese producers and global specialty chemical firms are enabling access to advanced manufacturing technologies.

India is forecasted to achieve a CAGR of 5.1% from 2025 to 2035, driven by its growing oilfield services sector and rising consumption of industrial lubricants. Local companies such as Indian Oil Corporation, Reliance Industries, and Gulf Petrochem are expanding production capabilities to meet domestic demand while reducing import dependency. The detergent manufacturing industry is also adopting internal olefins for biodegradable surfactant production. Furthermore, increased upstream drilling activity is boosting consumption in mud drilling and well completion fluids. Export potential is improving as Indian producers seek to tap Middle Eastern and African markets.

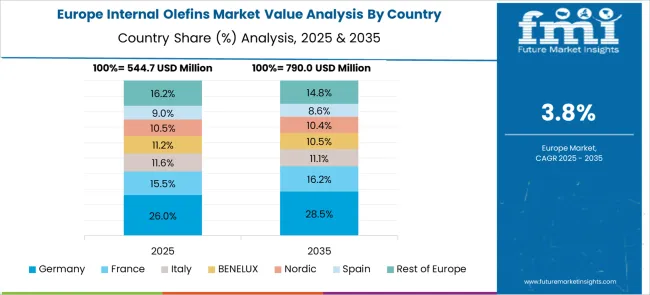

Germany is projected to post a CAGR of 4.7% from 2025 to 2035, supported by strong demand in specialty chemicals and high-performance lubricants. Companies such as Evonik Industries, INEOS, and BASF are focusing on advanced oligomerization technologies to improve consistency in molecular structure for targeted applications. Internal olefins are being increasingly used in environmentally friendly synthetic lubricants for automotive and industrial machinery. The country’s chemical sector is also investing in bio-based feedstocks for olefin production to reduce carbon intensity. Compliance with EU environmental regulations is influencing product development strategies in this market.

The United Kingdom is expected to record a CAGR of 3.9% from 2025 to 2035, driven by demand in offshore drilling, lubricants, and cleaning products. UK-based players such as Shell Chemicals, Sasol UK, and INEOS Oligomers are focusing on high-purity internal olefins for advanced drilling fluid formulations suited to deepwater exploration. The cleaning and personal care industries are also adopting olefins for biodegradable surfactant production. Additionally, strategic imports from Europe and the US are complementing domestic production to meet seasonal demand spikes.

The United States is forecasted to grow at a CAGR of 3.5% from 2025 to 2035, supported by applications in oilfield services, lubricants, and specialty chemicals. Companies such as Chevron Phillips Chemical, Shell Chemical LP, and Sasol USA are developing customized internal olefin grades to meet the needs of enhanced oil recovery, synthetic drilling fluids, and detergent manufacturing. The shale oil boom has sustained a strong supply of feedstock for olefin production. Increasing focus on biodegradable formulations is shaping demand in cleaning products and personal care applications. Strategic R&D investments are being made to optimize catalytic processes for higher yields and better molecular control.

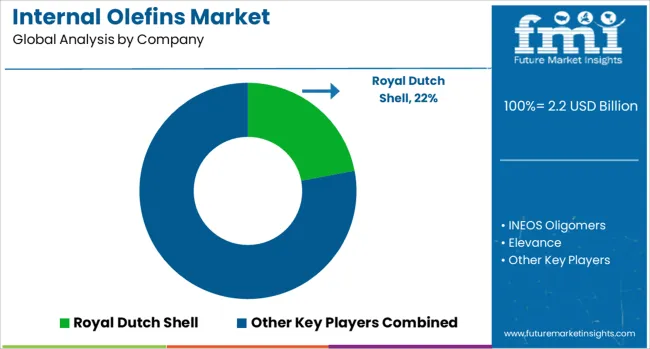

The internal olefins market is led by major chemical producers with strong feedstock integration, advanced oligomerization technologies, and established supply networks across industrial and specialty chemical sectors. Royal Dutch Shell holds a significant position with large-scale production facilities supplying internal olefins for applications in surfactants, lubricants, drilling fluids, and specialty chemicals. INEOS Oligomers leverages its global petrochemical operations to offer a wide range of high-purity internal olefins tailored for performance in industrial formulations. Sasol Ltd utilizes proprietary processes to produce internal olefins with consistent molecular distributions, serving markets such as synthetic lubricants, oilfield chemicals, and plasticizers.

Elevance focuses on bio-based and specialty internal olefins, catering to customers seeking tailored performance characteristics in environmentally considerate formulations. Key strategies among leading players include expanding production capacity, optimizing catalyst technologies for higher selectivity, and securing long-term contracts with downstream chemical manufacturers. Competitive advantage in this market is shaped by cost-efficient feedstock sourcing, consistent product quality, and technical support for formulation development. Entry is limited by high capital investment in oligomerization plants, access to competitive raw material supply, and the need for proven reliability in serving industrial end-users.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Application | Oil Drilling, Surfactants, Lubricants, Agrochemicals, Pharmaceutical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Royal Dutch Shell, INEOS Oligomers, Elevance, and Sasol Ltd |

The global internal olefins market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the internal olefins market is projected to reach USD 3.2 billion by 2035.

The internal olefins market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in internal olefins market are oil drilling, surfactants, lubricants, agrochemicals, pharmaceutical and others.

In terms of , segment to command 0.0% share in the internal olefins market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA