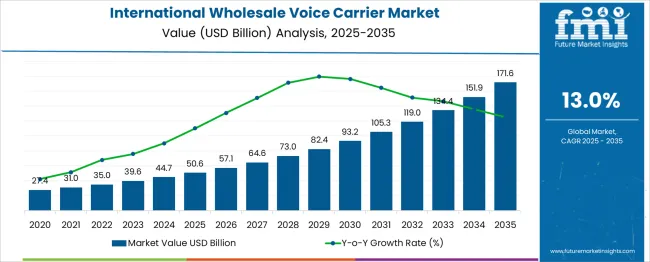

The International Wholesale Voice Carrier Market is estimated to be valued at USD 50.6 billion in 2025 and is projected to reach USD 171.6 billion by 2035, registering a compound annual growth rate (CAGR) of 13.0% over the forecast period.

The international wholesale voice carrier market is set to increase from USD 50.6 billion in 2025 to USD 171.6 billion by 2035, delivering an absolute growth of USD 121.0 billion and achieving a growth multiplier of 3.39x over the decade. This expansion is underpinned by a CAGR of 13.0%, reflecting a highly dynamic market driven by the globalization of business communications, VoIP expansion, and demand for wholesale voice termination in emerging markets. The growth trajectory demonstrates steady acceleration across all phases.

The market rises from USD 50.6 billion to USD 93.2 billion by 2030, adding USD 42.6 billion, which accounts for 35% of the total incremental opportunity, with a five-year multiplier of 1.84x. The subsequent period, 2030 to 2035, contributes a substantial USD 78.4 billion, representing 65% of incremental gains, driven by exponential growth in enterprise cloud communication, carrier partnerships, and integration of AI-based routing for cost optimization.

Annual increments scale progressively, moving from USD 6.5 billion in early years to USD 19.7 billion by the final year, signaling strong acceleration. Providers leveraging SIP trunking, international interconnect hubs, and scalable VoIP solutions will capture the greatest share of this USD 121 billion opportunity, benefiting from surging cross-border digital connectivity.

| Metric | Value |

|---|---|

| International Wholesale Voice Carrier Market Estimated Value in (2025 E) | USD 50.6 billion |

| International Wholesale Voice Carrier Market Forecast Value in (2035 F) | USD 171.6 billion |

| Forecast CAGR (2025 to 2035) | 13.0% |

The international wholesale voice carrier market represents a critical component within global telecommunications and connectivity services. In the telecommunications services market, its share is approximately 4–5%, as mobile data and broadband services dominate overall revenue. Within the international voice traffic market, it accounts for nearly 70–75%, since wholesale carriers handle the majority of cross-border voice termination for operators and enterprises.

In the wholesale carrier services market, its contribution is around 20–22%, sharing space with wholesale data and messaging services. For the VoIP market, the share is approximately 10–12%, as wholesale voice carriers increasingly rely on IP-based technologies to reduce costs and improve routing efficiency. In the global connectivity and roaming services market, its share stands at about 6–8%, given that roaming and data services represent a larger revenue share for operators.

This segment faces both challenges and opportunities due to declining retail voice revenues, rising OTT communication alternatives, and the shift toward IP interconnection. However, demand remains strong for high-quality voice termination in emerging markets and enterprise communications. Strategic adoption of technologies such as VoLTE, cloud-based routing, and fraud management solutions is driving efficiency. As global trade and mobility continue to expand, this market is expected to maintain relevance within these parent categories.

The international wholesale voice carrier market is undergoing a strategic transformation fueled by the convergence of cost optimization, quality enhancement, and technological modernization. Increased cross-border communication, enterprise demand for reliable global voice connectivity, and competitive pressures among carriers have driven the adoption of more efficient transmission and service models.

Enhanced focus on minimizing fraud, improving call quality, and meeting regulatory requirements has further shaped operational priorities. Future growth is anticipated to emerge from investments in next-generation voice technologies, integration of voice with cloud-based platforms, and strategic alliances among carriers to expand reach and reduce costs.

As the industry shifts toward digitalization and value-added services, opportunities are expected to materialize in differentiated offerings, improved scalability, and advanced analytics that support superior customer experience and operational resilience.

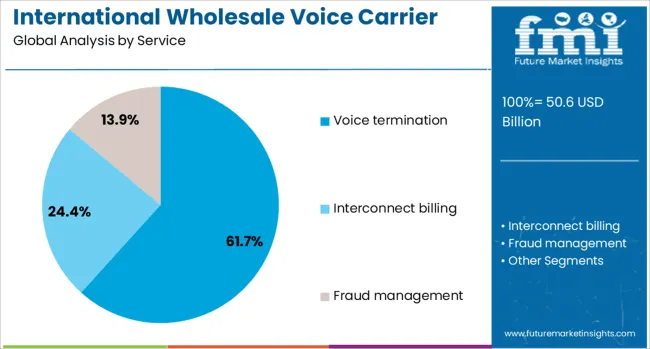

The international wholesale voice carrier market is segmented by service, transmission network, technology, pricing model, and geographic regions. The service of the international wholesale voice carrier market is divided into Voice termination, Interconnect billing, and Fraud management.

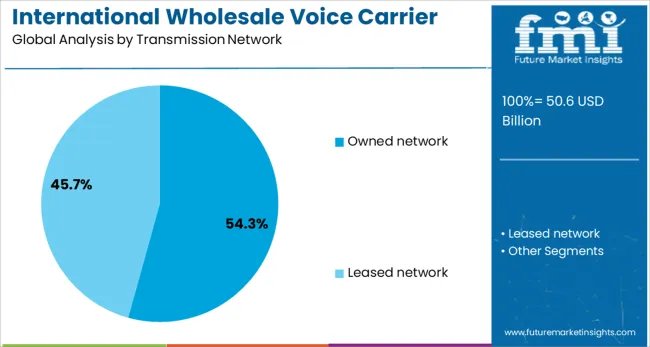

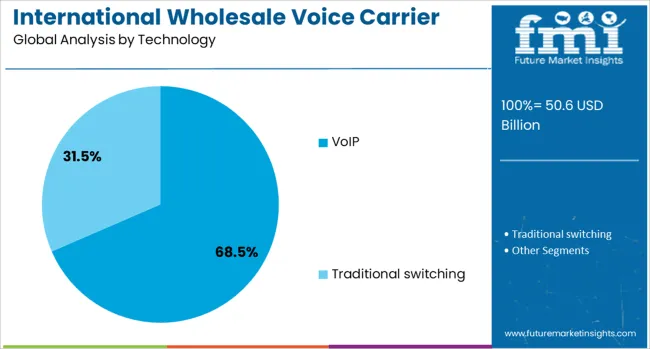

In terms of the transmission network, the international wholesale voice carrier market is classified into owned networks and leased networks. The international wholesale voice carrier market is segmented into VoIP and Traditional switching. Pricing model segments the international wholesale voice carrier market into Post-paid and Pre-paid. Regionally, the global wholesale voice carrier industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by service, the voice termination subsegment is expected to command 61.70% of the total market revenue in 2025, affirming its leadership in the market. This position has been sustained by its fundamental role in enabling carriers to complete international calls efficiently while maintaining profitability.

Rising global call volumes, coupled with the increasing need for reliable and high-quality call completion, have reinforced the importance of voice termination services. Carriers have focused on optimizing termination routes and leveraging partnerships to lower costs and enhance service reliability, which has contributed to the segment’s sustained growth.

Growing customer expectations for clarity and consistency in international calls have motivated providers to prioritize robust termination infrastructure, further entrenching this segment’s leading share.

Segmenting by transmission network reveals that the owned network subsegment is projected to capture 54.3% of the market revenue in 2025, establishing itself as the dominant approach. This has been driven by carriers’ preference for maintaining control over their infrastructure to ensure service quality, reduce latency, and manage costs effectively.

Owned networks have allowed providers to optimize capacity utilization, secure critical routes, and differentiate their offerings in a competitive market. The ability to guarantee higher security, comply with regional regulations, and deliver consistent service levels has made owned networks the preferred choice among leading carriers.

Long-term investments in upgrading owned infrastructure have also provided operational advantages and cost efficiencies, underpinning this segment’s leading market position.

When viewed by technology, the VoIP subsegment is forecast to hold 68.5% of the total market revenue in 2025, positioning it as the dominant technological solution. This dominance has been enabled by the substantial cost savings, scalability, and flexibility offered by VoIP compared to traditional circuit-switched technologies.

Carriers have increasingly migrated to VoIP to capitalize on improved bandwidth utilization, integration with data services, and compatibility with modern communication platforms. The ability to support advanced features, accommodate higher traffic volumes, and align with the shift toward all-IP networks has further accelerated VoIP adoption.

Competitive pricing and the growing availability of robust VoIP infrastructure have reinforced its leadership, making it the preferred technology in the international wholesale voice carrier landscape.

The international wholesale voice carrier market is witnessing robust expansion, driven by intensifying global communication demand, liberalized interconnection frameworks, and soaring VoIP traffic. Opportunities are emerging in AI-based routing, cross-border service bundles, and underserved regional expansion. Trends such as consolidation via mergers, advanced fraud prevention tools, and IoT-focused voice services are shaping the ecosystem. Restraints include regulatory complexity, legacy infrastructure dependency, and price competition from OTT providers. Providers investing in integrated IP platforms, least-cost routing analytics, and multi-service bundles are viewed as best positioned to lead through 2025–2026.

The market growth has been driven by growing cross-border connectivity requirements linked to business expansion and remote work adoption. In 2024, wholesale carriers reported higher VoIP traffic volumes, with enterprises demanding scalable, low-latency connections across global hubs. The migration from legacy circuit-switched systems to IP-based networks has accelerated, allowing carriers to expand international voice origination and termination services. Enhanced routing quality and lower operational costs achieved through IP platforms are seen as critical to strengthening wholesale agreements. It is believed that demand from CPaaS providers and enterprise communication solutions will further amplify this trend.

Opportunities are expected to emerge with the growing shift toward hybrid generator solutions combining diesel and battery storage systems for construction sites. In 2025, several leading rental companies introduced offerings featuring fuel optimization and remote load management. Hybrid systems are being adopted to reduce operational costs and dependency on volatile fuel pricing, especially in regions with unstable grid supply. Opportunities are also increasing in rental equipment supporting renewable energy integration for off-grid construction projects, which are gaining prominence in emerging economies where infrastructure expansion requires flexible and energy-efficient temporary power solutions for sustained project timelines.

The market is witnessing mergers and partnerships aimed at expanding geographic reach and network redundancy. During 2024 and 2025, consolidation initiatives among mid-tier carriers improved scale and cost efficiency. Another notable trend is the introduction of bundled services combining voice with messaging, CPaaS offerings, and virtual number allocations for enterprises. Blockchain-based inter-carrier billing pilots and advanced fraud mitigation platforms have also been implemented to enhance trust and transparency in wholesale operations. It is anticipated that carriers embedding multi-service and compliance-driven solutions will create a competitive edge in a price-sensitive environment.

The market faces regulatory and competitive challenges impacting profitability. Inconsistent interconnect tariffs across regions and licensing restrictions in certain jurisdictions create operational hurdles for wholesale carriers. Over-the-top applications providing low-cost or free international calls continue to erode traditional wholesale revenues, particularly among retail consumers. The pressure to reduce termination rates due to regulatory reforms in Europe and Asia has further compressed margins. Carriers lacking diversified digital service portfolios or strong partnerships may struggle to sustain profitability in the face of rapid OTT penetration and pricing competition.

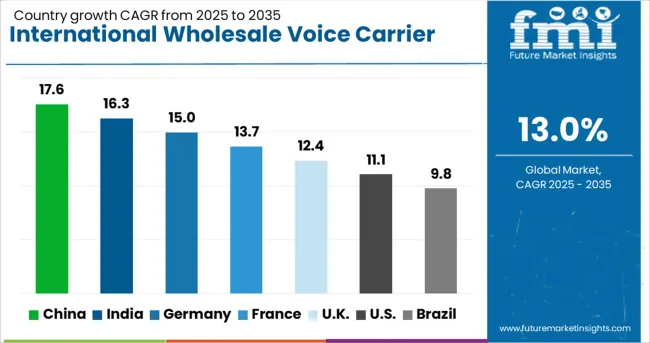

| Country | CAGR |

|---|---|

| China | 17.6% |

| India | 16.3% |

| Germany | 15.0% |

| France | 13.7% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

The global international wholesale voice carrier market is projected to grow at a CAGR of 13% from 2025 to 2035. China leads with 17.6%, followed by India at 16.3% and Germany at 15.0%. France posts 13.7%, while the United Kingdom records 12.4%. Growth is driven by rising international call traffic, VoIP expansion, and the migration to IP-based interconnectivity. China and India dominate adoption through large-scale telecom infrastructure and cost-optimized routing. Germany focuses on premium quality and fraud management solutions, while France and the UK emphasize regulatory compliance and advanced analytics for wholesale traffic optimization.

The international wholesale voice carrier market in China is projected to grow at 17.6%, driven by heavy outbound and inbound call traffic across Asia-Pacific and global trade hubs. IPX-based interconnection dominates, ensuring quality voice and messaging services. Providers invest in AI-driven traffic monitoring to reduce fraud and improve QoS. Strategic alliances with global carriers strengthen China's wholesale market position.

The international wholesale voice carrier market in India is forecast to grow at 16.3%, supported by strong international calling demand and expansion of cloud communication platforms. VoIP-based solutions dominate due to cost efficiency for enterprises and consumers. Providers develop advanced routing algorithms for latency reduction. Regulatory support for IP telephony accelerates wholesale service integration.

The international wholesale voice carrier market in Germany is projected to grow at 15.0%, driven by demand for high-quality termination routes in Europe. Premium voice services dominate enterprise and carrier requirements. Providers implement blockchain solutions for fraud prevention and billing transparency. Strong emphasis on redundancy and SLAs supports mission-critical communication networks.

The international wholesale voice carrier market in France is expected to grow at 13.7%, driven by modernization of legacy PSTN systems and VoIP penetration. Hosted interconnect platforms dominate wholesale routing for mobile operators. Providers introduce real-time analytics to monitor quality metrics. Strategic partnerships with Tier-1 carriers expand global reach and connectivity options.

The international wholesale voice carrier market in the UK is projected to grow at 12.4%, supported by growing enterprise demand for cloud-based unified communication. SIP trunking dominates wholesale connectivity solutions. Providers deploy AI-driven fraud detection systems to mitigate revenue leakage. Integration of voice services with UCaaS platforms fosters a hybrid communication ecosystem.

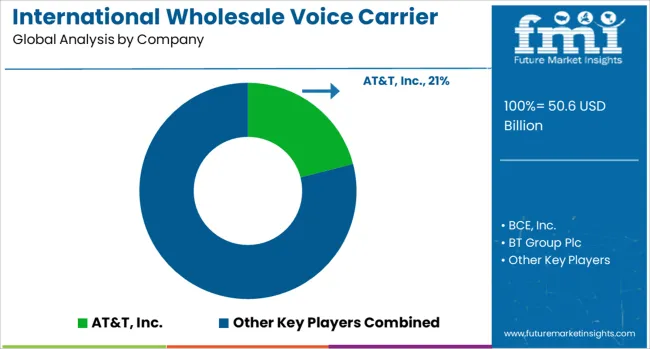

The international wholesale voice carrier market is moderately consolidated, with AT&T, Inc. recognized as a leading player due to its extensive global network infrastructure, interconnection capabilities, and strong partnerships with telecom operators worldwide. The company’s advanced routing solutions and competitive termination rates reinforce its leadership in international voice traffic management.

Key players include BCE, Inc., BT Group Plc, CenturyLink, Inc. (Lumen), China Telecommunications Corporation, Orange SA, Singapore Telecommunications Limited, Sprint (T-Mobile), and Tata Communications Ltd. These companies provide wholesale voice services such as international call termination, VoIP transit, and interconnection solutions to carriers, OTT players, and enterprise customers. They also focus on fraud prevention, routing optimization, and quality monitoring to ensure high call reliability and cost efficiency.

Market growth is influenced by the continued demand for international connectivity, increasing traffic from VoIP services, and the shift toward IP-based networks. Leading providers are investing in next-generation voice platforms, AI-powered fraud detection systems, and real-time analytics for better network performance.

Strategic partnerships and regional interconnection hubs are also being developed to improve global reach and reduce latency. While legacy TDM voice traffic is declining, the adoption of wholesale VoIP and voice over LTE (VoLTE) services is sustaining market growth, especially in regions with high cross-border communication demand such as Asia-Pacific and the Middle East.

| Item | Value |

|---|---|

| Quantitative Units | USD 50.6 Billion |

| Service | Voice termination, Interconnect billing, and Fraud management |

| Transmission Network | Owned network and Leased network |

| Technology | VoIP and Traditional switching |

| Pricing Model | Post-paid and Pre-paid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AT&T, Inc., BCE, Inc., BT Group Plc, CenturyLink, Inc. (Lumen), China Telecommunications Corporation, Orange SA, Singapore Telecommunications Limited, Sprint (T-Mobile), and Tata Communications Ltd. |

| Additional Attributes | Dollar sales distributed across voice termination, origination, and fraud management, with VoIP/SIP dominating over traditional switching. Asia-Pacific drives fastest growth; North America and Europe maintain strong bases. Buyers prioritize cost-efficient interconnect and QoS. Integration focuses on AI-powered least-cost routing, automated fraud detection, and blockchain-based settlements, while innovations improve latency, reliability, and scalability for global wholesale voice networks. |

The global international wholesale voice carrier market is estimated to be valued at USD 50.6 billion in 2025.

The market size for the international wholesale voice carrier market is projected to reach USD 171.6 billion by 2035.

The international wholesale voice carrier market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in international wholesale voice carrier market are voice termination, _pre-paid, _post-paid, interconnect billing, _pre-paid, _post-paid, fraud management, _pre-paid and _post-paid.

In terms of transmission network, owned network segment to command 54.3% share in the international wholesale voice carrier market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

International Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Wholesale Roaming Market Insights – Growth & Forecast 2023-2033

Carrier Screening Market Size and Share Forecast Outlook 2025 to 2035

Carrier Wi-Fi Equipment Market Size and Share Forecast Outlook 2025 to 2035

Carrier Infrastructure in Telecom Applications Market - Forecast 2025 to 2035

Cup Carriers Market Size, Share & Trends 2025 to 2035

Pet Carriers Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Cup Carrier Packaging Suppliers

Multicarrier Parcel Management Solutions Software Market Size and Share Forecast Outlook 2025 to 2035

Bird Carriers Market Size and Share Forecast Outlook 2025 to 2035

Baby Carriers Market

Drink Carrier Poly Bags Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Drink Carrier Poly Bags

Cable Carrier Market

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Flavour Carriers Market Trends – Growth & Industry Forecast 2025-2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Multi-pack Carriers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Multi-Pack Carriers Suppliers

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA