The solid phase carrier resin for peptide drug synthesis market, expected to grow from USD 145.3 million in 2025 to USD 397.8 million by 2035 at a CAGR of 10.5%, is undergoing innovation cycles that directly influence efficiency, scalability, and therapeutic outcomes. A primary area of innovation is in resin design, where manufacturers are focusing on controlled pore size, optimized functional group density, and chemically stable backbones to enable longer peptide chains with reduced aggregation. Advances in linker chemistry are also enhancing the release efficiency of peptides from resins, minimizing by-products and improving overall yield in synthesis operations. These developments are closely tied to the increasing demand for high-purity peptides in both drug discovery and large-scale commercial production.

Automation-driven peptide synthesizers are further shaping innovation, as carrier resins are being engineered for compatibility with high-throughput systems. This shift is enabling contract manufacturing organizations and pharmaceutical firms to scale peptide production with minimal variability, aligning with stricter regulatory requirements for complex biologics. Another emerging trend lies in the creation of hybrid resins that combine organic and inorganic frameworks, delivering enhanced swelling properties and solvent compatibility. Such improvements are particularly significant for complex or highly hydrophobic peptides, where traditional resins often limit synthesis success.

Environmental and cost-efficiency concerns are also prompting the development of recyclable and reusable resins, aimed at reducing synthesis waste and operational expenditure. Academic research institutions are playing a vital role in piloting these innovations, while biotechnology firms are translating them into commercial-grade solutions. The growth trajectory suggests that peptide drug developers will increasingly rely on differentiated resin technologies not only for drug candidates targeting oncology, metabolic disorders, and infectious diseases but also for advanced therapeutic modalities like peptide–drug conjugates. The next wave of innovation is expected to emphasize integration with digital process control systems, allowing real-time monitoring of resin performance during synthesis.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

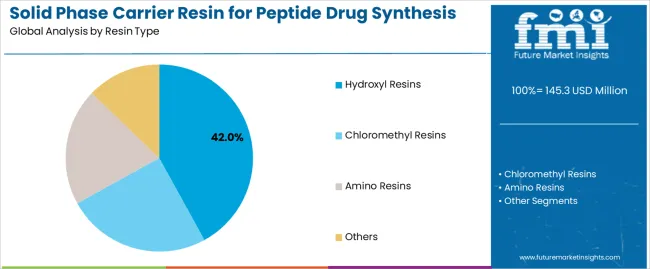

| Today | Hydroxyl resins (orthopedic applications) | 42% | Traditional chemistry, established pharmaceutical applications |

| Chloromethyl resins (cardiovascular) | 31% | Versatile linker chemistry, broad therapeutic use | |

| Amino resins (metabolic diseases) | 19% | Specialized applications, diabetes and obesity treatments | |

| Others (tumor applications) | 8% | Emerging oncology peptides, research applications | |

| Future (3-5 yrs) | Advanced hydroxyl systems | 38-41% | Enhanced loading capacity, improved purity |

| High-performance chloromethyl | 26-29% | Optimized synthesis efficiency, automated compatibility | |

| Specialized amino resins | 16-19% | Novel metabolic targets, precision medicine | |

| Oncology-focused resins | 12-15% | Cancer immunotherapy, targeted drug delivery | |

| Custom therapeutic resins | 6-9% | Rare diseases, personalized medicine applications | |

| Research & development | 4-7% | Academic institutions, early-stage drug discovery |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 145.3 million |

| Market Forecast (2035) | USD 397.8 million |

| Growth Rate | 10.6% CAGR |

| Leading Resin Type | Hydroxyl Resins |

| Primary Application | Orthopedics Segment |

The solid phase carrier resin for peptide drug synthesis market demonstrates strong fundamentals, with hydroxyl resin systems capturing a dominant share through advanced linker chemistry and pharmaceutical application optimization. Orthopedic applications drive primary demand, supported by the increasing development of therapeutic peptides and modernization initiatives within the pharmaceutical industry. Geographic expansion remains concentrated in developed markets with established pharmaceutical infrastructure, while emerging economies show accelerating adoption rates driven by biotechnology sector growth and rising research investments.

Primary Classification: The solid phase carrier resin for peptide drug synthesis market segments by resin type into hydroxyl, chloromethyl, amino, and others, representing the evolution from traditional solid-phase synthesis chemistry to sophisticated linker technologies for comprehensive peptide synthesis optimization.

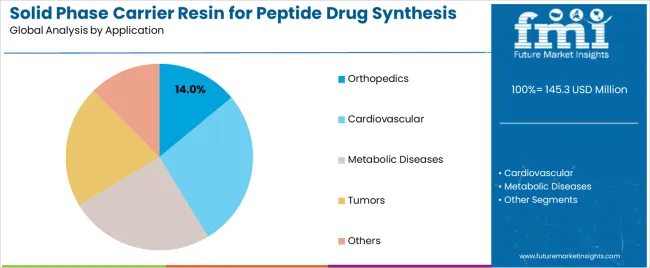

Secondary Classification: Application segmentation divides the solid phase carrier resin for peptide drug synthesis market into orthopedics, cardiovascular, metabolic diseases, tumors, and others, reflecting distinct requirements for therapeutic peptides, synthesis efficiency, and pharmaceutical development specifications.

Tertiary Classification: End-use segmentation covers pharmaceutical companies, biotechnology firms, contract research organizations, academic institutions, and specialty chemical manufacturers, while distribution channels span direct sales, chemical distributors, and specialized pharmaceutical suppliers.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by pharmaceutical industry modernization programs.

The segmentation structure reveals resin progression from traditional hydroxyl chemistry toward sophisticated amino and specialty resins with enhanced synthesis capabilities, while application diversity spans from established orthopedic peptides to emerging oncology therapeutics requiring precision synthesis solutions.

Market Position: Hydroxyl resin systems command the leading position in the solid phase carrier resin market with 42% market share through proven linker technologies, including efficient coupling chemistry, high loading capacity, and synthesis reliability that enable pharmaceutical manufacturers to achieve optimal peptide production across diverse orthopedic and therapeutic applications.

Value Drivers: The segment benefits from pharmaceutical industry preference for established resin systems that provide reliable synthesis performance, consistent peptide quality, and operational compatibility without requiring specialized synthesis infrastructure. Advanced hydroxyl chemistry features enable enhanced coupling efficiency, improved peptide purity, and integration with existing synthesis platforms, where performance reliability and therapeutic effectiveness represent critical manufacturing requirements.

Competitive Advantages: Hydroxyl resin systems differentiate through proven synthesis reliability, versatile linker compatibility, and integration with established peptide manufacturing systems that enhance facility effectiveness while maintaining optimal pharmaceutical standards suitable for diverse therapeutic applications.

Key market characteristics:

Chloromethyl resin systems maintain a 31% market position in the solid phase carrier resin market due to their versatility advantages and broad therapeutic application benefits. These materials appeal to facilities requiring flexible synthesis solutions with enhanced coupling profiles for diverse peptide sequences. Market growth is driven by cardiovascular peptide expansion, emphasizing versatile linker solutions and synthetic efficiency through optimized coupling designs.

Market Context: Orthopedic applications demonstrate strong growth in the solid phase carrier resin market with 14% market share due to widespread adoption of therapeutic peptide programs and increasing focus on bone and joint treatments, operational synthesis efficiency, and peptide therapy applications that maximize therapeutic effectiveness while maintaining pharmaceutical standards.

Appeal Factors: Pharmaceutical operators prioritize synthesis reliability, therapeutic consistency, and integration with existing drug development infrastructure that enables coordinated peptide operations across multiple therapeutic programs. The segment benefits from substantial pharmaceutical industry investment and orthopedic research programs that emphasize the acquisition of premium resins for peptide differentiation and therapeutic outcome applications.

Growth Drivers: Orthopedic peptide development programs incorporate carrier resins as essential components for therapeutic synthesis, while specialized pharmaceutical growth increases demand for synthesis capabilities that comply with regulatory standards and minimize development complexity.

Market Challenges: Varying therapeutic requirements and regulatory complexity may limit resin standardization across different peptides or synthesis scenarios.

Application dynamics include:

Cardiovascular applications capture 31% market share through specialized therapeutic requirements in cardiac peptides, vascular treatments, and pharmaceutical applications. These facilities demand premium resins capable of supporting regulatory requirements while providing therapeutic synthesis access and pharmaceutical development capabilities.

Metabolic diseases applications account for 19% market share, including diabetes treatments, obesity therapeutics, and endocrine applications requiring performance resin capabilities for therapeutic optimization and pharmaceutical effectiveness.

Market Context: Pharmaceutical Companies dominate the solid phase carrier resin for peptide drug synthesis market with an 8.2% CAGR, reflecting the primary demand source for carrier resin technology in therapeutic peptide applications and drug development standardization.

Business Model Advantages: Pharmaceutical Companies provide direct market demand for standardized resin systems, driving volume production and cost optimization while maintaining quality control and regulatory compliance requirements.

Operational Benefits: Pharmaceutical Company applications include therapeutic standardization, synthesis efficiency, and quality assurance that drive consistent demand for resin systems while providing access to the latest synthesis technologies.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Pharmaceutical industry growth & peptide drug development (therapeutic peptides, biologics expansion) | ★★★★★ | Growing pharmaceutical market requires specialized resins with enhanced synthesis capabilities and purity properties proven effective across therapeutic applications. |

| Driver | Therapeutic standards advancement & regulatory requirements (FDA approval, GMP compliance) | ★★★★★ | Transforms resin requirements from "basic chemistry" to "pharmaceutical grade synthesis"; manufacturers that offer quality resins and compliance features gain competitive advantage. |

| Driver | Biotechnology market growth & precision medicine (personalized therapy, targeted treatments) | ★★★★☆ | Biotechnology companies need sophisticated, high-performance resins; demand for specialized and superior synthesis solutions expanding addressable market. |

| Restraint | Cost pressures & development constraints (especially for small biotech companies) | ★★★★☆ | Smaller pharmaceutical developers defer resin upgrades; increases price sensitivity and slows premium resin adoption in cost-conscious markets. |

| Restraint | Alternative synthesis methods competition (liquid phase synthesis, enzymatic approaches) | ★★★☆☆ | Alternative peptide synthesis offer different advantages and established protocols, potentially limiting solid phase resin adoption in traditional applications. |

| Trend | Synthesis technology integration & automation enhancement (automated synthesizers, process monitoring) | ★★★★★ | Advanced synthesis automation, efficiency optimization, and process analytics transform operations; technology integration and performance enhancement become core value propositions. |

| Trend | Customization & application-specific solutions (therapeutic targeting, specialized linkers) | ★★★★☆ | Custom resins for specific therapeutic applications; specialized designs and targeted synthesis capabilities drive competition toward customization solutions. |

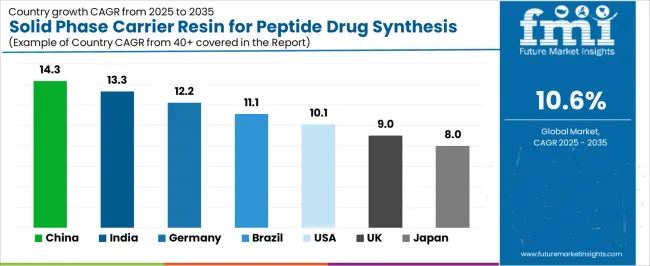

The solid phase carrier resin for peptide drug synthesis market demonstrates varied regional dynamics with Growth Leaders including China (14.3% growth rate) and India (13.3% growth rate) driving expansion through pharmaceutical development initiatives and biotechnology industry modernization. Steady Performers encompass Germany (12.2% growth rate), Brazil (11.1% growth rate), and developed regions, benefiting from established pharmaceutical industries and therapeutic peptide adoption. Mature Markets feature United States (10.1% growth rate), United Kingdom (9.0% growth rate), and Japan (8.0% growth rate), where pharmaceutical advancement and regulatory standardization requirements support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through pharmaceutical expansion and biotechnology development, while North American countries maintain steady expansion supported by resin technology advancement and therapeutic standardization requirements. European markets show strong growth driven by pharmaceutical applications and quality integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 14.3% | Focus on pharmaceutical manufacturing solutions | Regulatory changes; quality standards |

| India | 13.3% | Lead with cost-effective biotechnology applications | Import restrictions; technical barriers |

| Germany | 12.2% | Provide premium pharmaceutical-grade resins | Over-regulation; lengthy approvals |

| Brazil | 11.1% | Offer value-oriented therapeutic solutions | Currency fluctuations; import duties |

| United States | 10.1% | Push technology integration | Compliance costs; scaling challenges |

| United Kingdom | 9.0% | Focus on biotechnology applications | Economic impacts; development costs |

| Japan | 8.0% | Emphasize precision manufacturing | Traditional preferences; adoption rates |

China establishes fastest market growth through aggressive pharmaceutical development programs and comprehensive biotechnology industry expansion, integrating advanced carrier resin systems as standard components in pharmaceutical facilities and research installations. The country's 14.3% growth rate reflects government initiatives promoting pharmaceutical infrastructure and domestic resin capabilities that mandate the use of professional synthesis systems in pharmaceutical and biotechnology facilities. Growth concentrates in major pharmaceutical hubs, including Beijing, Shanghai, and Guangzhou, where biotechnology development showcases integrated resin systems that appeal to pharmaceutical operators seeking synthesis optimization capabilities and therapeutic applications.

Chinese manufacturers are developing cost-effective resin solutions that combine domestic production advantages with advanced synthesis features, including enhanced coupling control and improved purity capabilities. Distribution channels through pharmaceutical suppliers and chemical distributors expand market access, while government support for biotechnology development supports adoption across diverse pharmaceutical and research segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, pharmaceutical facilities and biotechnology operators are implementing professional carrier resin systems as standard equipment for peptide synthesis and therapeutic optimization applications, driven by increasing government pharmaceutical investment and biotechnology modernization programs that emphasize the importance of synthesis quality capabilities. The solid phase carrier resin for peptide drug synthesis market holds a 13.3% growth rate, supported by government pharmaceutical initiatives and biotechnology development programs that promote professional resin systems for pharmaceutical and research facilities. Indian operators are adopting resin systems that provide consistent synthesis performance and quality features, particularly appealing in urban regions where therapeutic development and operational excellence represent critical business requirements.

Market expansion benefits from growing pharmaceutical capabilities and international biotechnology partnerships that enable domestic production of professional resin systems for pharmaceutical and research applications. Technology adoption follows patterns established in pharmaceutical equipment, where reliability and performance drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany's advanced pharmaceutical market demonstrates sophisticated carrier resin deployment with documented synthesis effectiveness in pharmaceutical applications and biotechnology facilities through integration with existing pharmaceutical systems and operational infrastructure. The country leverages engineering expertise in chemistry and quality systems integration to maintain a 12.2% growth rate. Pharmaceutical centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia, showcase premium installations where resin systems integrate with comprehensive pharmaceutical platforms and facility management systems to optimize synthesis performance and operational effectiveness.

German manufacturers prioritize system quality and EU compliance in resin development, creating demand for premium systems with advanced features, including facility integration and pharmaceutical synthesis systems. The solid phase carrier resin for peptide drug synthesis market benefits from established pharmaceutical infrastructure and a willingness to invest in professional resin technologies that provide long-term operational benefits and compliance with international pharmaceutical standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse pharmaceutical demand, including biotechnology modernization in São Paulo and Rio de Janeiro, pharmaceutical facility upgrades, and government healthcare programs that increasingly incorporate professional resin solutions for therapeutic applications. The country maintains a 11.1% growth rate, driven by rising pharmaceutical activity and increasing recognition of professional resin benefits, including precise synthesis control and enhanced therapeutic effectiveness.

Market dynamics focus on cost-effective resin solutions that balance synthesis performance with affordability considerations important to Brazilian pharmaceutical operators. Growing pharmaceutical industrialization creates continued demand for modern resin systems in new biotechnology infrastructure and facility modernization projects.

Strategic Market Considerations:

United States establishes market leadership through comprehensive pharmaceutical programs and advanced biotechnology infrastructure development, integrating carrier resin systems across pharmaceutical and research applications. The country's 10.1% growth rate reflects established pharmaceutical industry relationships and mature resin technology adoption that supports widespread use of professional synthesis systems in pharmaceutical and biotechnology facilities. Growth concentrates in major pharmaceutical centers, including California, Massachusetts, and New Jersey, where resin technology showcases mature deployment that appeals to pharmaceutical operators seeking proven synthesis capabilities and operational efficiency applications.

American pharmaceutical providers leverage established distribution networks and comprehensive technical support capabilities, including synthesis programs and training support that create customer relationships and operational advantages. The solid phase carrier resin for peptide drug synthesis market benefits from mature regulatory standards and pharmaceutical requirements that mandate resin system use while supporting technology advancement and operational optimization.

Market Intelligence Brief:

United Kingdom's pharmaceutical market demonstrates integrated carrier resin deployment with documented synthesis effectiveness in pharmaceutical applications and biotechnology facilities through integration with existing pharmaceutical systems and operational infrastructure. The country maintains a 9.0% growth rate, supported by pharmaceutical excellence programs and synthesis effectiveness requirements that promote professional resin systems for pharmaceutical applications. Pharmaceutical facilities across England, Scotland, and Wales showcase systematic installations where resin systems integrate with comprehensive pharmaceutical platforms to optimize synthesis performance and operational outcomes.

UK pharmaceutical providers prioritize system reliability and industry compatibility in resin procurement, creating demand for validated systems with proven synthesis features, including quality monitoring integration and pharmaceutical synthesis systems. The solid phase carrier resin for peptide drug synthesis market benefits from established pharmaceutical infrastructure and excellence requirements that support resin technology adoption and operational effectiveness.

Market Intelligence Brief:

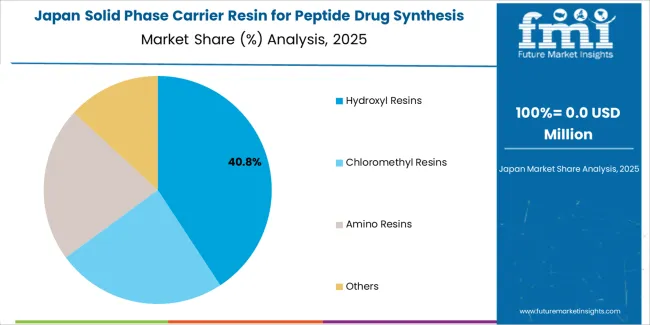

Japan's market growth benefits from precision pharmaceutical demand, including advanced biotechnology facilities in Tokyo and Osaka, quality integration, and therapeutic enhancement programs that increasingly incorporate resin solutions for synthesis applications. The country maintains a 8.0% growth rate, driven by pharmaceutical technology advancement and increasing recognition of precision resin benefits, including accurate synthesis control and enhanced therapeutic outcomes.

Market dynamics focus on high-precision resin solutions that meet Japanese quality standards and synthesis effectiveness requirements important to pharmaceutical operators. Advanced pharmaceutical technology adoption creates continued demand for sophisticated resin systems in biotechnology facility infrastructure and therapeutic modernization projects.

Strategic Market Considerations:

The European solid phase carrier resin for peptide drug synthesis market is projected to grow from USD 31.2 million in 2025 to USD 89.4 million by 2035, registering a CAGR of 11.1% over the forecast period. Germany is expected to maintain its leadership position with a 41.3% market share in 2025, supported by its advanced pharmaceutical infrastructure and major biotechnology centers.

United Kingdom follows with a 28.1% share in 2025, driven by comprehensive pharmaceutical programs and biotechnology excellence development initiatives. France holds a 16.7% share through specialized pharmaceutical applications and regulatory compliance requirements. Italy commands a 9.2% share, while Spain accounts for 4.7% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 2.9% to 3.4% by 2035, attributed to increasing pharmaceutical adoption in Nordic countries and emerging biotechnology facilities implementing pharmaceutical modernization programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global chemical companies | Supply chain reach, broad product portfolios, pharmaceutical relationships | Wide availability, proven quality, multi-region support | Product innovation cycles; customer dependency on pharmaceutical validation |

| Technology innovators | Resin R&D; advanced synthesis technologies; enhanced performance properties | Latest technologies first; attractive ROI on synthesis effectiveness | Service density outside core regions; scaling complexity |

| Regional specialists | Local compliance, fast delivery, nearby customer support | "Close to customer" support; pragmatic pricing; local regulations | Technology gaps; talent retention in customer service |

| Full-service providers | Synthesis programs, technical services, method development | Lowest operational risk; comprehensive support | Service costs if overpromised; technology obsolescence |

| Niche specialists | Specialized applications, custom resins, therapeutic services | Win premium applications; flexible configurations | Scalability limitations; narrow market focus |

| Item | Value |

|---|---|

| Quantitative Units | USD 145.3 million |

| Resin Type | Hydroxyl Resins, Chloromethyl Resins, Amino Resins, Others |

| Application | Orthopedics, Cardiovascular, Metabolic Diseases, Tumors, Others |

| End Use | Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations, Academic Institutions, Specialty Chemical Manufacturers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, Canada, France, Australia, and 25+ additional countries |

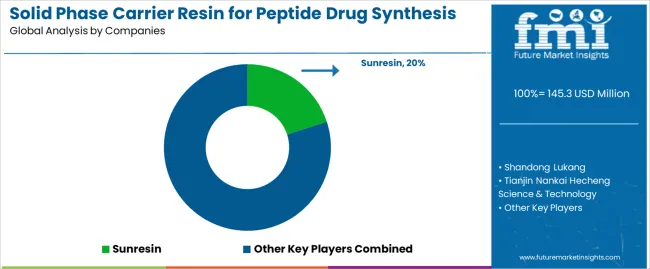

| Key Companies Profiled | Sunresin, Shandong Lukang, Tianjin Nankai Hecheng Science & Technology, Zhejiang Zhengguang, Jiangsu Haipu Functional Materials |

| Additional Attributes | Dollar sales by resin type and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with chemical manufacturers and pharmaceutical suppliers, pharmaceutical operator preferences for synthesis effectiveness and therapeutic optimization, integration with pharmaceutical platforms and quality management systems, innovations in resin technology and synthesis enhancement, and development of advanced carrier resin solutions with enhanced performance and pharmaceutical optimization capabilities. |

The global solid phase carrier resin for peptide drug synthesis market is estimated to be valued at USD 145.3 million in 2025.

The market size for the solid phase carrier resin for peptide drug synthesis market is projected to reach USD 397.8 million by 2035.

The solid phase carrier resin for peptide drug synthesis market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in solid phase carrier resin for peptide drug synthesis market are hydroxyl resins, chloromethyl resins, amino resins and others.

In terms of application, orthopedics segment to command 14.0% share in the solid phase carrier resin for peptide drug synthesis market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solid Board Market Size and Share Forecast Outlook 2025 to 2035

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Array Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

Solid Vacuum Reclosers Market Size and Share Forecast Outlook 2025 to 2035

Solid State LiDAR Sensor Market Analysis Size and Share Forecast Outlook 2025 to 2035

Solid-State Lighting Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Solid State Drive Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lighting System Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lasers Market Analysis - Growth & Forecast 2025 to 2035

Solid-State Cooling Market Analysis & Forecast by Type, Product, End-user Industry, and Region Through 2035

Solid White Films Market Analysis & Trends 2024-2034

Solid State Relays – Powering EVs & Industrial Automation

Solid Sulphur Market Growth – Trends & Forecast 2024-2034

Solid Bleached Board Market

Solid Oxide Fuel Cell Market

Solid Electrolyte Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA