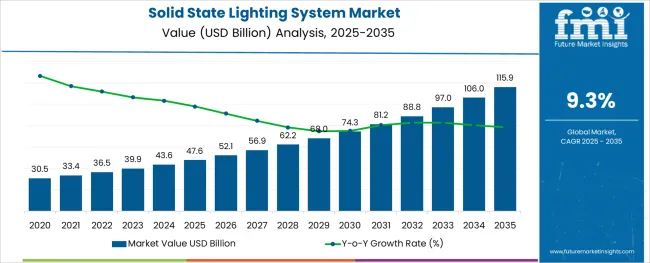

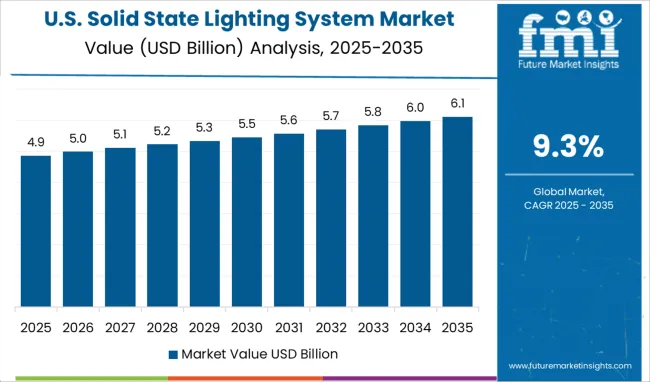

The Solid State Lighting System Market is estimated to be valued at USD 47.6 billion in 2025 and is projected to reach USD 115.9 billion by 2035, registering a compound annual growth rate (CAGR) of 9.3% over the forecast period.

The solid state lighting system market is expanding steadily, driven by rising demand for energy-efficient lighting technologies, regulatory restrictions on incandescent lamps, and increasing investments in smart infrastructure. Government mandates promoting LED adoption, particularly across municipal and public sectors, are accelerating the transition toward long-lasting, low-power lighting systems.

Advances in semiconductor materials, miniaturization of components, and improvements in light quality and color rendering have enhanced consumer acceptance across both developed and emerging economies. Simultaneously, the proliferation of connected lighting platforms and IoT-enabled luminaires is driving adoption in commercial and smart city applications.

Sustainability goals are further influencing procurement policies, with life-cycle cost optimization and carbon footprint reduction becoming key decision-making factors. Over the forecast period, continued R&D in tunable lighting and integration with renewable energy systems is expected to strengthen long-term growth.

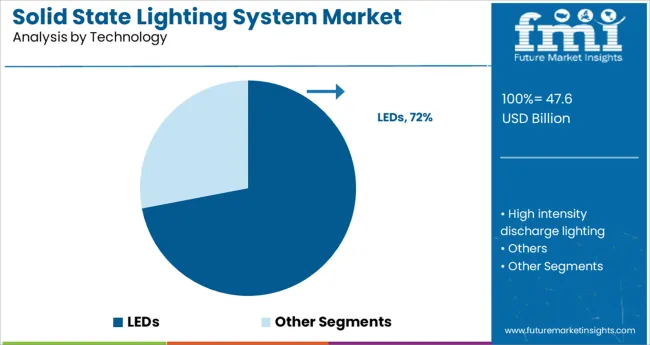

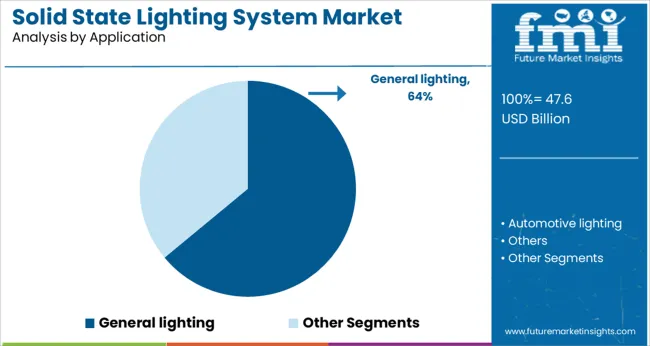

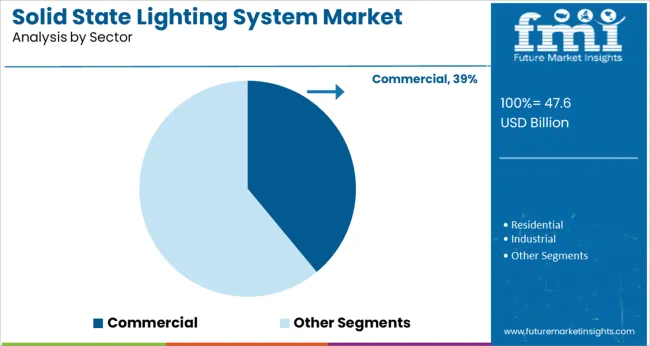

The market is segmented by Technology, Application, and Sector and region. By Technology, the market is divided into LEDs, High intensity discharge lighting, and Others. In terms of Application, the market is classified into General lighting, Automotive lighting, and Others. Based on Sector, the market is segmented into Commercial, Residential, Industrial, and Outdoor and other.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

LEDs are expected to account for 72.0% of total revenue in the solid state lighting system market by 2025, establishing them as the dominant technology segment. Their leadership is being driven by unmatched energy efficiency, extended operational lifespan, and reduced maintenance requirements compared to traditional lighting systems.

The ability of LEDs to deliver superior luminous efficacy and instant illumination has made them highly suitable for diverse applications, from indoor commercial spaces to outdoor industrial environments. Declining component costs and enhanced thermal management designs have made LED systems increasingly accessible, even in price-sensitive markets.

In addition, compatibility with dimming features and integration with smart controls has reinforced their suitability for modern building automation systems.

General lighting is projected to capture 64.0% of total market revenue in 2025, making it the leading application segment. This dominance is attributed to widespread implementation in residential buildings, offices, educational institutions, and infrastructure projects where consistent and efficient illumination is essential.

Adoption is being further supported by energy codes and green building certifications that emphasize the use of low-wattage lighting fixtures. The transition from legacy systems to solid state alternatives is being accelerated by financial incentives, replacement programs, and favorable return on investment for large-scale retrofits.

The flexibility of general lighting systems to support aesthetic, task-specific, and ambient lighting needs has contributed to their broad appeal across architectural and functional use cases.

The commercial sector is forecast to hold 39.0% of the overall market share in 2025, positioning it as the largest sectoral adopter of solid state lighting systems. Growth in this segment is being fueled by heightened demand for energy cost savings, lighting automation, and enhanced visual comfort in workspaces.

Businesses are increasingly leveraging LED-based lighting for environmental branding, employee wellness, and sustainability compliance. The integration of occupancy sensors, daylight harvesting systems, and centralized lighting management platforms is enhancing efficiency in retail, hospitality, and corporate environments.

Moreover, rising awareness of workplace productivity benefits associated with human-centric lighting is accelerating the commercial sector’s preference for tunable white and adaptive solid state solutions.

The solid state lighting system market foundation is anticipated to be strengthened by its important and advantageous features, including toughness, longevity, and energy efficiency. The number of people who use solid state lighting systems is predicted to rise as a result of supportive government initiatives to lower the cost of the technology and generate awareness about energy conservation and sustainability.

The solid state lighting system is environmentally beneficial because it doesn't include any dangerous materials or ultraviolet radiation. The durable weatherproof construction of LED solid state lights with their inherent safety made it possible to be accepted by the general people faster than expected.

In terms of revenue share, the Asia Pacific region ruled the world market in the previous decade as per the solid state lighting system market survey report by FMI in 2024. Due to rising demand, mostly from the rapidly proliferating industrial facilities, the South Asian countries are anticipated to remain the most lucrative region for businesses involved. Additionally, during the course of the projection period, favorable government policies and regulations to comply with the International Carbon Neutrality norms are anticipated to boost regional market expansion.

The overall market is getting highly competitive these days with the emergence of many new market players after the global movement against environmental pollution and fossil fuel depletion. Moreover, government support in the form of encouraging entrepreneurs to work for green energy solutions has resulted in significant investment in the sector.

The market is anticipated to increase rapidly as industries are continuously investing to achieve improvements in light output quality with more compact and flexible lighting fixtures. Because a solid state lighting system application device operates at a lower temperature than a normal CFL, market growth is anticipated to be driven by its growing use in industrial and commercial setups.

But over the projection period, there are certainly major challenges that could restrain the growth of the solid state lighting system application and its market players. Some of the major challenges faced by users include its higher cost compared to incandescent lamps, the need to replace the energy source, temperature control, and limited brightness.

Another major constraint for the market participants is the sourcing of enough raw materials at a lower price. As the semiconductor materials such as Silicon are getting dear day by day due to the increasing amount of electronic devices, it has reduced the profit margin of all businesses, including solid state lighting system manufacturers as well. In response to this growing concern, most of the major players have started shifting some of their production facilities to South Asian and South American Nations with relatively cheaper minerals.

The demand for solid state lighting system is on the rise as they have the potential to reduce lighting energy consumption globally, as they are ten times more efficient than incandescent lighting and twice as efficient as fluorescent lighting.

Moreover, low power consumption, ability to withstand strong vibrations, no mercury content, no or minimum UV and IR radiation, ultra-long source life and digital controllability all contribute to the expanding size of the solid state lighting system market.

The increasing application of solid state lighting system systems in automobiles is anticipated to scale up the solid state lighting system market growth in coming years.

Standard regulations and rising awareness among the population about the key features of solid state lighting systems are expected to encourage the adoption of solid state lighting systems globally, positively impacting the overall market growth.

The innovative products are small and have modules that can be swapped out, which addresses some of the obstacles to the widespread adoption of LED technology, such as precise current and heat management and the requirement for superior illumination through the use of optical design.

The same is anticipated to push forward the solid state lighting system market statistics during the forecast period. Moreover, the solid state lighting system industry is expected to undergo a revolution as a result of the impressive technical features that the technology is still developing.

The growth of the industry is also accelerated by an increase in government-sponsored industry consortiums. In addition, it is anticipated that the development of smart lighting presents lucrative solid state lighting system market opportunities.

The unique format allows lighting fixture OEMs to convert their current fixture designs for LEDs and be ready for future LED technology advances, attracting the attention of solid state lighting system market players.

Smart lighting systems, both outdoors in public spaces such as roads and parking lots and indoors in office buildings and warehouses, are essential in moving forward and in which solid state lighting systems are playing a prime role.

The solid state lighting system market share is affected as it is a challenge for the vendors to offer lighting solutions for the customer at a competitive price featuring all the advanced technologies in it with the spiking number of offering in the lighting space.

Due to the soaring adoption of solid state lighting system across a range of industries, North America is predicted to experience significant growth during the forecast period, with an anticipated market share of 36.3% in 2025.

Furthermore, solid state lighting system is preferred by most businesses as it is widely used in a variety of sectors, including business, healthcare, the automotive industry, and many others.

Due to the high demand for horticulture products over traditional agricultural products, the USA, Canada, and Mexico are likely to dominate the North American solid state lighting system market.

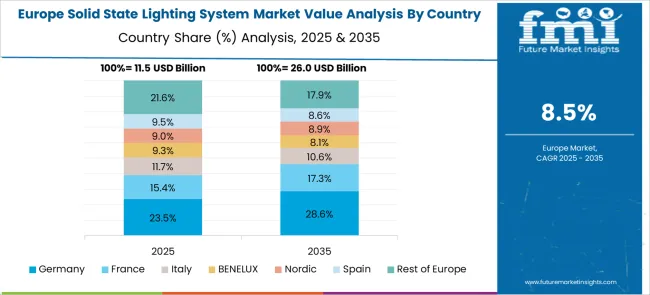

By 2025, Europe is likely to get hold of a solid state lighting system market share of 22.6%, dominated by France, Germany, and the United Kingdom due to evolving EU regulations that support the use of LEDs in exterior automotive applications. They have improved low power consumption, aesthetic appeal, optimal luminosity, and can fit into tight spaces, spiking the demand for the same in the region.

Driver safety concerns at night and during severe weather, along with growing technological innovation in the automotive lighting industry, are likely to spur the solid state lighting system market expansion.

Due to recent advancements in Internet of Things (IoT) technology and the resulting innovations in smart homes and buildings, the solid state lighting system market is humming with activity.

Numerous emerging trends in the solid state lighting system market are brought about by start-ups, including human-centric lighting, which imitates outdoor lighting to provide natural lighting indoors.

Example:

Aurea Lighting, a US-based start-up, creates human-centric LED lighting for workplaces, residences, and educational institutions. The HCL uses a proprietary dye film to transform blue LED light into physiologically appropriate natural light.

The goal of Aurea's HCL solution is to boost daytime worker and student productivity. The solution helps hospital patients recover while also enabling better sleep at night.

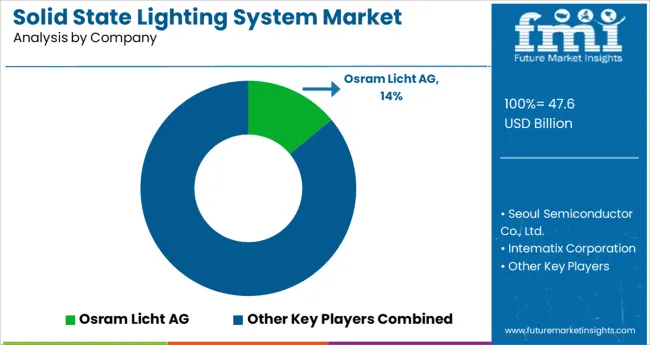

The market for solid-state lighting systems is only slightly fragmented. Overall, there is fierce competition among current rivals.

The solid state lighting system market size is anticipated to be expanded by both large and small business companies' new innovation strategies.

The following are a few significant market developments:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Technology, Application, Sector, Region |

| Regions Covered | North America; Latin America; Asia Pacific; The Middle East and Africa; Europe |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | General Electric Company; Osram Licht AG; Seoul Semiconductor Co., Ltd.; Intematix Corporation; Bridgelux, Inc.; Cree, Inc.; Acuity Brands Lighting, Inc.; Advanced Lighting Technologies, Inc.; Energy Focus, Inc.; LED Engin, Inc.; Toyoda Gosei Co., Ltd.; TCP International Holdings Ltd.; Aixtron Se; Samsung Electronics Co. Ltd.; Panasonic Corporation; Mitsubishi Electric Corporation; Eaton Corporation; NICHIA Corporation; Koninklijke Philips N.V.; Applied Materials Inc.; Bright Light Systems |

| Customization | Available Upon Request |

The global solid state lighting system market is estimated to be valued at USD 47.6 billion in 2025.

It is projected to reach USD 115.9 billion by 2035.

The market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types are leds, high intensity discharge lighting and others.

general lighting segment is expected to dominate with a 64.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

Solid White Films Market Size and Share Forecast Outlook 2025 to 2035

Solid Sulphur Market Size and Share Forecast Outlook 2025 to 2035

Solid Terpene Resin Market Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Solid Board Market Size and Share Forecast Outlook 2025 to 2035

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Solid Vacuum Reclosers Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Solid Bleached Board Market

Solid Oxide Fuel Cell Market

Solid Electrolyte Market

Solid-State Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Solid State Relay Market Size and Share Forecast Outlook 2025 to 2035

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Array Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

Solid State LiDAR Sensor Market Analysis Size and Share Forecast Outlook 2025 to 2035

Solid State Drive Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA