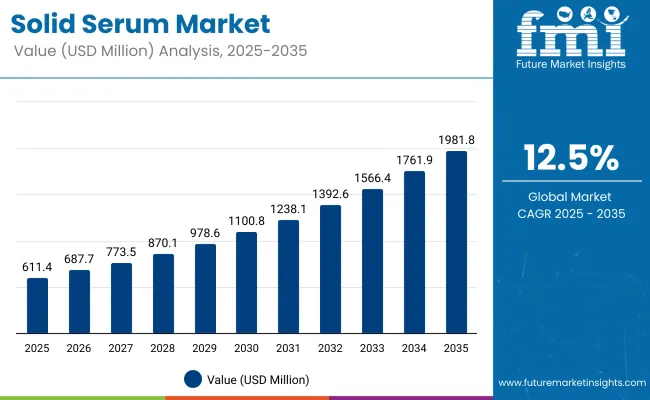

The Global Solid Serum Market is expected to record a valuation of USD 611.4 million in 2025 and USD 1,981.8 million in 2035, with an increase of USD 1,370.4 million, which equals a growth of 224.3% over the decade. The overall expansion represents a CAGR of 12.5% and a 3.2X increase in market size.

Global Solid Serum Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 611.4 million |

| Market Forecast Value in (2035F) | USD 1,981.8 million |

| Forecast CAGR (2025 to 2035) | 12.5% |

During the first five-year period from 2025 to 2030, the market increases from USD 611.4 million to USD 1,100.8 million, adding USD 489.4 million, which accounts for 35.7% of the total decade growth. This phase records steady adoption in North America and Western Europe, driven by the need for hydration-focused skincare in solid, eco-conscious formats. Twist-up sticks dominate this period as they cater to over 49.1% of product delivery formats, offering spill-proof convenience and portability for skincare minimalists and frequent travelers.

The second half from 2030 to 2035 contributes USD 881.0 million, equal to 64.3% of total growth, as the market jumps from USD 1,100.8 million to USD 1,981.8 million. This acceleration is powered by widespread deployment in Asia-Pacific, growth in multi-functional balm serums, and the rise of subscription-based solid skincare in DTC and pharmacy channels. Hydrating and brightening formulations continue to lead, while refillable formats and biodegradable tubes gain retail visibility across urban mass and masstige consumers.

From 2020 to 2024, the Global Solid Serum Market grew from USD 217 million to USD 611.4 million, driven by format-led adoption of waterless skincare products. During this period, the competitive landscape was dominated by DTC and eco-focused skincare brands controlling nearly 60% of revenue, with leaders such as L’Oréal, Unilever, and Estée Lauder introducing refillable or twist-up facial serum sticks.

Competitive differentiation relied on ingredient transparency, solid actives, and packaging minimalism, while software, personalization tools, and loyalty programs were often bundled as value-added services in online channels. Demand for solid skincare serums will expand to USD 1,981.8 million by 2035, and the revenue mix will shift as multi-functional claims and refillable systems grow to over 40% share.

Traditional skincare leaders face rising competition from digital-first players offering ingredient-focused, sustainable solid formats across skin tone correction, aging, and hydration needs. Major brands are pivoting toward hybrid routinescombining solid balms with ampoule boostersto retain user engagement.

Emerging entrants specializing in plastic-free delivery systems, zero-waste retail models, and AI-powered skincare matching are gaining share. The competitive advantage is moving away from legacy packaging and emulsification innovation toward ecosystem strength, repeat purchase incentives, and consumer trust in minimalist skin science.

The global solid serum market is experiencing rapid growth due to rising consumer demand for waterless, eco-friendly skincare products that align with minimalist and sustainable beauty trends. These products eliminate the need for preservatives and excess packaging, appealing to environmentally conscious consumers globally. Hydrating and brightening solid serumstypically delivered in compact stick or balm formatshave gained traction due to their ease of application, mess-free usage, and portability, especially for daily facial care.

Technological innovations in oil-based actives, botanical extractions, and solid-state formulations have significantly improved product performance and shelf stability, fostering broader retail acceptance. Demand is being driven by consumers in North America, Western Europe, and Asia-Pacific, with particularly strong adoption among millennial and Gen Z demographics.

The expansion of direct-to-consumer channels, influencer-led marketing, and zero-waste retail platforms has further accelerated solid serum uptake. Future growth is also expected to be powered by multi-functional product innovation, such as serums that combine anti-aging, hydration, and tone correction in a single solid stick. Refillable packaging formats and solid serum kits are expected to expand the category’s usage across travel, premium skincare, and men’s grooming segments.

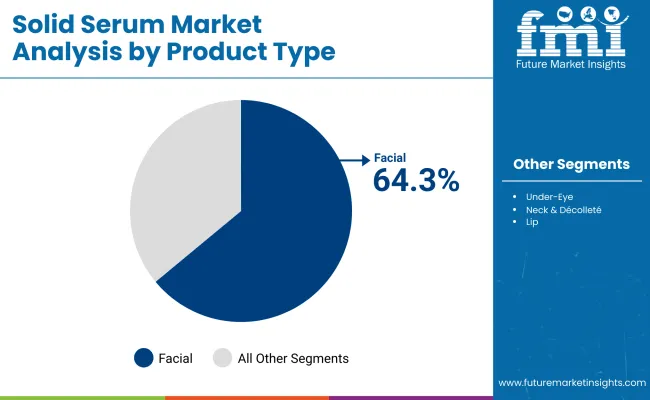

The market is segmented by product type, skin concern, packaging type, sales channel, and region. Product types include facial solid serums, under-eye solid serums, neck & décolleté solid serums, lip solid serums, body solid serums, and scalp & hairline solid serums. Facial solid serums dominate due to daily use, while under-eye and lip formats are gaining traction for their convenience and targeted benefits.

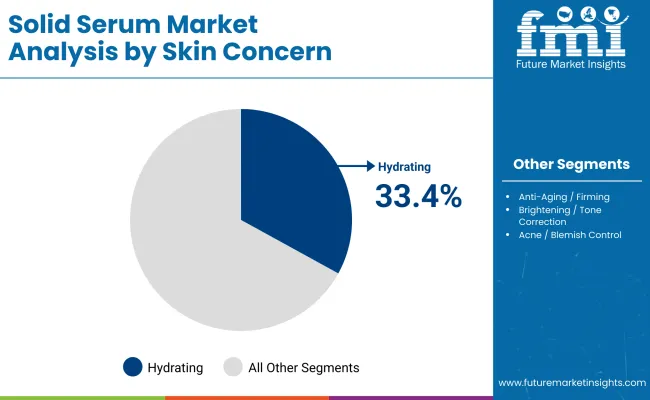

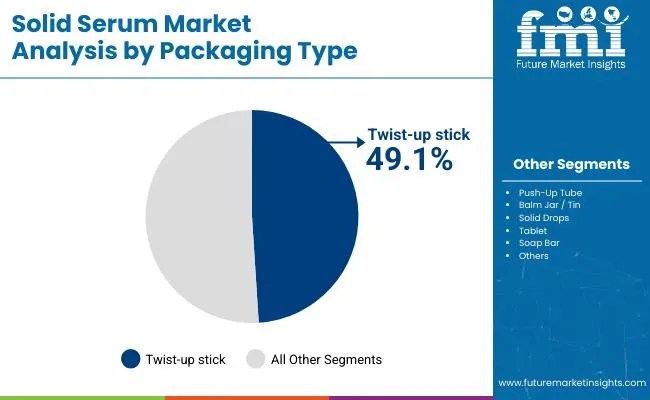

By skin concern, the market is categorized into hydrating, anti-aging/firming, brightening/tone correction, acne/blemish control, barrier repair/soothing, and multi-function/all-in-one. Hydrating serums hold the largest share, driven by universal demand, followed by brightening and anti-aging, particularly in Asia and premium skincare routines. Packaging types include twist-up sticks, push-up tubes, balm jars/tins, solid drops, tablets, and soap bars. Twist-up sticks lead the market due to ease of use and portability, while compostable push-up tubes and refillable jars support sustainability trends.

Solid drops and tablets are emerging formats for travel and minimal routines. Sales channels are divided into online platforms and offline platforms (specialty beauty retailers, pharmacies, zero-waste stores, and travel retail). Online and DTC sales lead the market, supported by strong clean beauty positioning and brand storytelling. Offline formats continue to drive product sampling and eco-conscious retail expansion. Regionally, the market spans North America, Latin America, Europe, Asia Pacific, Central Asia, and the Middle East & Africa, with North America leading in value share and Asia Pacific showing strong volume-driven growth.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Facial Solid Serums | 64.3% |

| Others | 35.7% |

The facial solid serum segment is projected to contribute 64.3% of the global Solid Serum Market revenue in 2025, maintaining its lead as the dominant product category. This strong performance is attributed to the high frequency of facial application across skincare routines and the preference for targeted solid formats among consumers seeking hydration, brightening, and anti-aging benefits.

Brands continue to invest in facial-specific SKUs due to their versatility, visibility on retail shelves, and alignment with clean beauty trends. With increasing demand for convenience and multi-functionality, facial solid serums are expected to remain at the core of brand portfolios in this space.

| Skin Concern Segment | Market Value Share, 2025 |

|---|---|

| Hydrating solid serums | 33.4% |

| Others | 66.6% |

Hydrating solid serums are forecasted to account for 33.4% of total revenue in the Solid Serum Market in 2025, making them the leading skin concern segment. This dominance is driven by the universal need for moisture replenishment across all skin types, climates, and age groups. Hydration remains the foundational benefit in most skincare regimes, and solid serum formats are increasingly being formulated with humectants and barrier-support ingredients like hyaluronic acid, ceramides, and panthenol. As hydration needs bridge across preventive and reparative care, this segment is expected to continue as the largest contributor to concern-based preferences.

| Packaging Type | Market Value Share, 2025 |

|---|---|

| Twist-up stick | 49.1% |

| Others | 50.9% |

The twist-up stick packaging is expected to hold 49.1% of the global market value in 2025, leading the packaging type segment in the Solid Serum Market. Its dominance is supported by strong consumer preference for mess-free, travel-friendly, and sustainable skincare formats. Twist-up sticks offer precise application and align with on-the-go routines, especially in urban markets. Brands favor this format for its compatibility with solid formulation stability and its appeal in both mass and premium segments. With demand for minimalist packaging and refillability on the rise, the twist-up stick format is well-positioned to maintain long-term relevance.

Drivers

Waterless Formulation as a Strategic Sustainability Advantage

Solid serums are inherently waterless, eliminating the need for preservatives and enabling longer shelf life. This attribute has become a critical differentiator in markets like Western Europe and South Korea, where both consumers and retailers are actively prioritizing low-water-footprint products.

Unlike liquid serums that require up to 80% water content, solid formats align with environmental concerns related to water scarcity, positioning them favorably in eco-conscious categories and among refill/reuse packaging systems. This sustainability narrative is not a trendit’s a strategic growth lever driving retailer acceptance and government-backed clean labeling initiatives.

Regulatory Loopholes Around Minimalist Formats in Asia

In several Asia-Pacific markets, including Vietnam, Indonesia, and parts of India, solid-format cosmetics face relatively less stringent regulatory barriers compared to traditional emulsions or active-loaded liquid serums. Since solid serums are often marketed as ‘balms’ or ‘cosmetic sticks’, they bypass stability testing thresholds and preservative toxicity requirements enforced on water-based formulas. This has accelerated local brand entries and fast-paced D2C launches without exhaustive compliance delays, creating a unique driver for early-stage innovation and quicker market validation in emerging regions.

Restraints

Stability Challenges with Oil-Sensitive Actives in Solid Matrix

Many high-performance skincare ingredients like vitamin C derivatives, niacinamide, and peptides are inherently unstable in oil-rich, anhydrous environments. Solid serum bases often rely on waxes, butters, and low-melting-point oils, which may degrade sensitive actives over time or limit their absorption efficacy. This restricts the inclusion of clinically validated, high-efficacy activesespecially in premium positioningmaking it harder to compete with traditional liquid serums in the dermocosmetic segment.

Incompatibility with Certain Skin Types and Climates

Solid serums can pose application challenges in humid or extremely cold regions, where the product either melts excessively or becomes too hard to glide. Additionally, oily or acne-prone users in tropical climates may find the balm-like consistency comedogenic, reducing appeal and market penetration. Despite clean labels, the tactile experience and sensory residue left by certain oil-heavy bases deter repeat usage in warm climates, affecting long-term consumer retention.

Key Trends

Rise of Hybrid “Skincare Stick” Categories Blurring Format Lines

Solid serums are increasingly merging with other stick-based formats, giving rise to multifunctional hybrid categoriessuch as SPF-serum sticks, tone-correcting balms, or cooling anti-fatigue under-eye sticks. These hybrids are redefining the product taxonomy altogether, and brands are leveraging this confusion to position solid serums under multiple shelf categories (sun care, treatment, primer, etc.). This retail shelf fluidity is a rising trend enabling brands to cross-promote formats in mass beauty and prestige segments alike.

Expansion Through Travel Retail and Zero-Waste Concept Stores

Solid serums are becoming flagship products in travel retail and zero-waste stores, especially across airports, clean beauty pop-ups, and refill-only retail formats in Europe, Japan, and Australia. Their solid, spill-proof nature bypasses liquid restrictions in hand baggage and appeals to eco-conscious travelers. Simultaneously, refillable stick systems and naked formats (no outer packaging) are gaining visibility through specialty eco-stores, where solid serums are used as hero SKUs to demonstrate low-waste, long-lasting cosmetic alternatives.

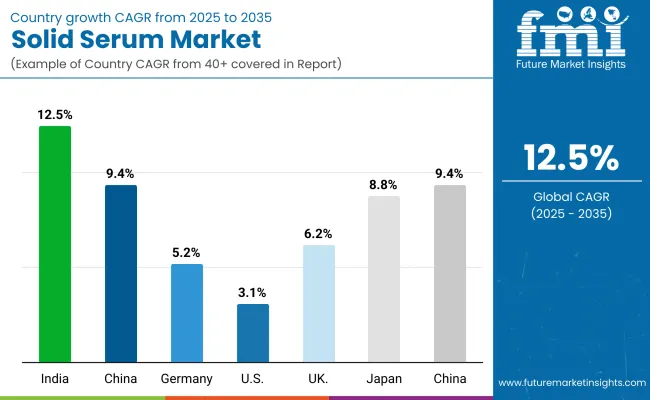

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 9.4% |

| India | 12.5% |

| Germany | 5.2% |

| USA | 3.1% |

| UK | 6.2% |

| Japan | 8.8% |

The global Solid Serum Market shows a pronounced regional disparity in adoption speed, strongly influenced by sustainability-led consumer behavior, regulatory push for waterless skincare, and minimalist beauty preferences. Asia-Pacific emerges as the fastest-growing region, anchored by China at 9.4% CAGR and India at 12.5%. This acceleration is driven by high consumer receptiveness to innovative skincare formats, K-beauty and J-beauty influence across Southeast Asia, and rapid digital brand proliferation.

China’s strong e-commerce ecosystem and demand for portable, multifunctional skin products fuel the uptake of solid serums, particularly among Gen Z and millennial urban consumers. India’s trajectory reflects a rising shift toward sustainable packaging and plant-based actives, with D2C startups leading product launches in ayurvedic and clean beauty formats. Europe maintains a strong growth profile, led by Germany at 5.2% and UK at 6.2%, supported by growing demand in refillable beauty systems and waterless product innovation. Widespread presence of zero-waste stores, government incentives for plastic-free packaging, and strong dermocosmetic branding enable faster retail adoption in Western Europe.

German and Nordic retailers are notably including solid serums under 'slow beauty' and 'skinimalism' formats in both mass and prestige categories. North America shows moderate expansion, with the USA at 3.1% CAGR, reflecting early maturity in clean beauty and widespread availability of stick-based formats. However, growth is being driven more by niche segments like on-the-go travel skincare and anti-aging solid sticks in premium natural brands. The shift is also visible in retail expansion through eco-centric pharmacies and DTC platforms targeting minimalist personal care routines.

Japan, with a CAGR of 8.8%, leads East Asia in precision skincare adoption, with local brands innovating in pH-balanced, all-in-one solid serums targeted toward sensitive skin types. Solid formats are increasingly replacing emulsions in compact, travel-ready regimens, boosted by the country’s low-tolerance formulation trends and refillable container mandates.

| Year | USA Solid Serum Market (USD Million) |

|---|---|

| 2025 | 137.57 |

| 2026 | 153.74 |

| 2027 | 171.82 |

| 2028 | 192.03 |

| 2029 | 214.61 |

| 2030 | 239.84 |

| 2031 | 268.05 |

| 2032 | 299.57 |

| 2033 | 334.79 |

| 2034 | 374.16 |

| 2035 | 418.16 |

The solid serum market in the United States is projected to grow at a CAGR of 3.1%, with revenue reaching USD 457.80 million by 2035. Growth is being driven by rising demand for minimalist and waterless skincare, especially among environmentally conscious consumers. The USA leads global solid serum sales, backed by innovative brands offering high-performance facial stick serums and clean formulations. The Facial Solid Serum segment dominates with 65.2% share, valued at USD 121.58 million in 2025.

The solid serum market in the United Kingdom is forecast to grow at a CAGR of 6.2%. The shift toward plastic-free beauty, supported by policy push and retailer mandates, is accelerating the adoption of solid skincare formats. UK startups are launching niche offerings in hydration and soothing repair balms, especially under private-label eco lines. Solid serums are also penetrating the men’s grooming and scalp care categories through department store-led trials and influencer marketing.

India is projected to register the fastest CAGR of 12.5% in the global solid serum market. This exceptional growth is attributed to rising skincare awareness, influencer-led promotion of minimalist routines, and increasing retail presence in urban and tier-2 cities. Startups and ayurveda-based brands are launching solid formats for acne, brightening, and hydration needs suited to humid climates.

| Market Share | 2025 |

|---|---|

| China | 13.2% |

| India | 5.8% |

| Germany | 10.1% |

| USA | 22.5% |

| UK | 8.1% |

| Japan | 7.3% |

| Market Share | 2035 |

|---|---|

| China | 12.1% |

| India | 6.4% |

| Germany | 9.2% |

| USA | 21.1% |

| UK | 8.3% |

| Japan | 7.5% |

The solid serum market in China is expected to grow at a CAGR of 9.4%, supported by a shift toward high-functionality skincare in portable formats. China holds a 16.2% market share in 2025, growing to 20.1% by 2035, with a total value of USD 99.04 million in 2025. The Brightening / Tone Correction segment is the leading concern, with 36.1% share. Leading local brands are incorporating niacinamide and VC derivatives into solid balm sticks and solid drops for tone correction and pollution protection.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Facial Solid Serums | 65.2% |

| Others | 34.8% |

The USA solid serum market is valued at USD 137.57 million in 2025, with Facial Solid Serums leading at 65.2%, followed by other formats at 34.8%. The dominance of facial solid serums stems from their alignment with American consumers’ preference for high-performance, multi-benefit skincare in convenient formats. This segment benefits from strong innovation in clean formulations, clinical actives, and stick-based delivery systems that cater to both premium and mass-market consumers.

Portability and TSA-friendly formats make facial solid serums a staple in travel skincare kits, while eco-conscious packaging resonates with sustainability-minded buyers. Multi-step facial routines are being condensed into solid sticks, often paired with complementary products for lips, eyes, and hairline, increasing basket size and repeat purchase rates.

| Skin Concern Segment | Market Value Share, 2025 |

|---|---|

| Brightening / Tone Correction | 36.1% |

| Others | 63.9% |

The China solid serum market is valued at USD 80.70 million in 2025, with Brightening / Tone Correction products leading at 36.1%, followed by other concerns at 63.9%. Brightening demand is fueled by the country’s strong beauty culture focus on even skin tone, luminosity, and pollution defense. This segment sees high integration of advanced actives like niacinamide, vitamin C derivatives, and botanical antioxidants in solid stick or drop formats.

China’s robust e-commerce landscape led by Tmall, JD.com, and Xiaohongshu enables rapid market penetration for both domestic innovators and global entrants. Solid serums are increasingly positioned as portable, multifunctional solutions for urban lifestyles, particularly among Gen Z and millennial consumers in Tier-1 and Tier-2 cities.

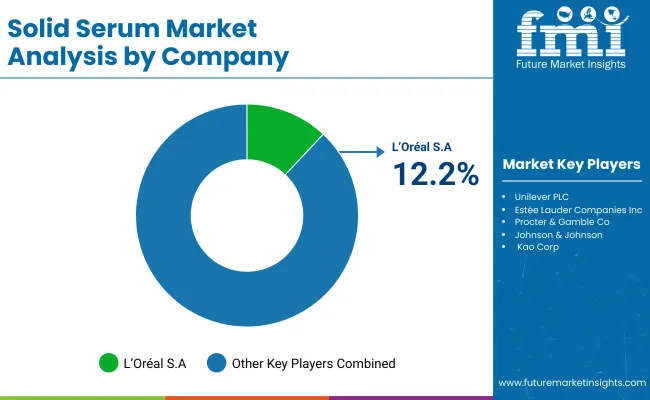

The global Solid Serum Market is moderately fragmented, with a mix of multinational corporations, clean beauty innovators, and niche sustainability-focused players shaping the competitive landscape. L’Oréal S.A. leads the market with a 12.2% value share in 2025, driven by its expansive global distribution, strong investment in solid format R&D, and robust brand equity across skincare and dermocosmetics. The company’s dominance is rooted in its ability to merge advanced formulation science with eco-design principles, launching solid serums across both premium and mass-market brands.

L’Oréal has also been at the forefront of refillable packaging, waterless formulations, and skin diagnostic integration via apps and smart tools. Mid-sized companies and indie brands, particularly from Asia and Europe, are driving category innovation with targeted solid serum offerings focused on hydration, brightening, and anti-aging. These players are leveraging DTC and online-first models, introducing stick-based and drop-solid formats with clean, vegan, and cruelty-free claims to resonate with younger, eco-conscious consumers.

Niche specialists and zero-waste pioneers are emerging in North America and parts of Europe, introducing solid skincare in balm jars, tablet formats, and soap-bar inspired packaging. Their strength lies in storytelling, ingredient transparency, and deep alignment with minimalist skincare movements. Competitive differentiation is shifting from traditional branding and texture innovation to sustainability leadership, packaging circularity, and digital-first consumer engagement. As the market matures, companies offering multi-functional solid formats with proven efficacy and retail visibility in eco-chains and travel retail are expected to gain long-term share.

Key Developments in Global Solid Serum Market

| Item | Value |

|---|---|

| Quantitative Units | USD 611.4 million |

| Product Type | Facial Solid Serums, Under-Eye Solid Serums, Neck & Décolleté Solid Serums, Lip Solid Serums, Body Solid Serums, Scalp & Hairline Solid Serums |

| Skin Concern | Hydrating, Anti-Aging / Firming, Brightening / Tone Correction, Acne / Blemish Control, Barrier Repair / Soothing, Multi-Function / All-in-One |

| Packaging Type | Twist-Up Stick, Push-Up Tube, Balm Jar / Tin, Solid Drops, Tablet, Soap Bar |

| Sales Channel | Online Platform (DTC, E-commerce Platforms), Offline Platform (Specialty Beauty Retailers, Zero-Waste / Eco Stores, Pharmacies & Drugstores, Travel Retail) |

| End-use Industry | Automotive, Aerospace & defense, Consumer electronics, Healthcare, Oil & gas, Energy and power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L’Oréal S.A., Unilever PLC, Estée Lauder Companies Inc., Procter & Gamble Co., Shiseido Company, Beiersdorf AG, Amorepacific Corp., Johnson & Johnson, Kao Corp., Colgate-Palmolive Company, Coty Inc., Glossier Inc., RoC Skincare, SBTRCT Ltd, Ethique Ltd |

| Additional Attributes | Dollar sales by product type, packaging type, skin concern, and sales channel; waterless and zero-waste innovation trends; sustainability-linked packaging; rise of DTC and eco-retailers; growing consumer interest in travel-safe and multifunctional serum formats; increasing dermatologist-backed claims and certifications; regional preference shifts driven by skin concern and price point. |

The global Solid Serum Market is estimated to be valued at USD 611.4 million in 2025.

The Solid Serum Market is projected to reach USD 1,981.3 million by 2035.

The market is expected to grow at a CAGR of 12.5% between 2025 and 2035.

Key product types include Facial, Under-Eye, Neck & Décolleté, Lip, Body, and Scalp & Hairline Solid Serums.

Facial Solid Serums are projected to command the largest share, contributing 64.3% of total market revenue in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

Solid White Films Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Solid Sulphur Market Size and Share Forecast Outlook 2025 to 2035

Solid State Relay Market Size and Share Forecast Outlook 2025 to 2035

Solid Terpene Resin Market Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Solid Board Market Size and Share Forecast Outlook 2025 to 2035

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Array Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

Solid Vacuum Reclosers Market Size and Share Forecast Outlook 2025 to 2035

Solid State LiDAR Sensor Market Analysis Size and Share Forecast Outlook 2025 to 2035

Solid-State Lighting Market Size and Share Forecast Outlook 2025 to 2035

Solid State Drive Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lighting System Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lasers Market Analysis - Growth & Forecast 2025 to 2035

Solid-State Cooling Market Analysis & Forecast by Type, Product, End-user Industry, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA