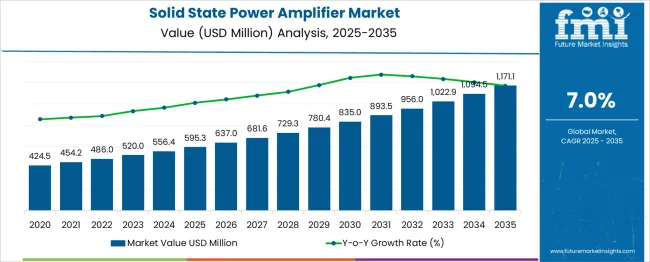

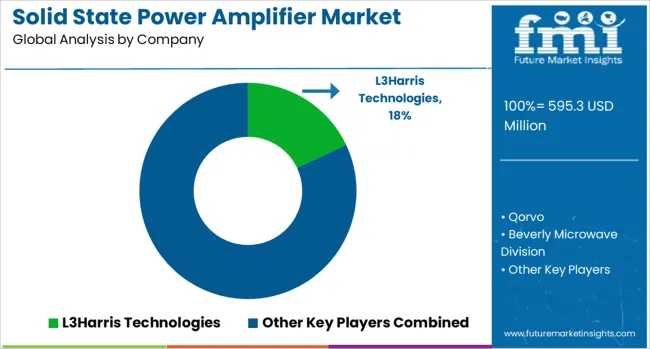

The solid-state power amplifier market is estimated to be valued at USD 595.3 million in 2025 and is projected to reach USD 1171.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The market follows a clear technology adoption lifecycle, driven by demand in defense, aerospace, telecommunications, and satellite communications. From 2020–2024, the market is in the early adoption phase, expanding from smaller-scale deployments and niche defense applications. During this period, traditional SSPAs with well-established semiconductor components dominate, analogous to “hydraulic” technologies, proven, reliable, and cost-effective for initial adoption. Cutting-edge designs with higher efficiency, GaN-based modules, or broadband capabilities resemble “electric hydraulic” technologies and remain in experimental or pilot stages, while highly integrated, intelligent SSPAs with adaptive load and signal management are akin to EPS, representing very early-stage innovation.

From 2025–2030, the market enters the scaling phase, growing from USD 595.3–830 million. Adoption accelerates in commercial satellite communications, 5G infrastructure, and radar applications. GaN-based SSPAs and advanced thermal management solutions (electric hydraulic-like) gain traction, offering higher power density and efficiency. Intelligent, adaptive SSPAs (EPS-like) see limited but growing deployment in high-value aerospace and defense projects. Between 2030–2035, the market transitions to consolidation, reaching USD 1,171.1 million. Growth moderates as mainstream adoption of GaN-based and high-efficiency SSPAs saturates key applications, while intelligent adaptive systems capture niche premium segments. The overall market maturity curve follows a sigmoid pattern, reflecting early experimentation, rapid scaling, and eventual stabilization.

| Metric | Value |

|---|---|

| Solid-State Power Amplifier Market Estimated Value in (2025 E) | USD 595.3 million |

| Solid-State Power Amplifier Market Forecast Value in (2035 F) | USD 1171.1 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The market is undergoing substantial growth, driven by increasing demand for compact, reliable, and energy-efficient RF amplification technologies across defense, aerospace, and telecommunications. The rising adoption of satellite communication, electronic warfare systems, and high-throughput data transmission has significantly elevated the need for solid-state alternatives over traditional vacuum tube amplifiers. Technological advancements in GaN and LDMOS semiconductors have improved performance, enabling high power output with reduced size and heat generation.

The shift toward digitization in radar and communication systems is also reinforcing market momentum, particularly in high-reliability sectors where signal integrity and durability are paramount. Strategic investments in 5G infrastructure, as well as the modernization of military platforms and avionics, are creating sustained growth opportunities.

The market is also supported by regulatory encouragement toward lightweight, solid-state components in airborne and mobile platforms. With the integration of AI-enabled diagnostics and real-time power management, solid state power amplifiers are becoming vital components of next-generation communication and defense ecosystems..

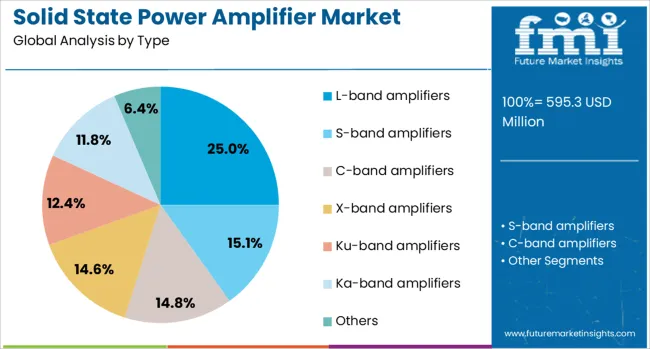

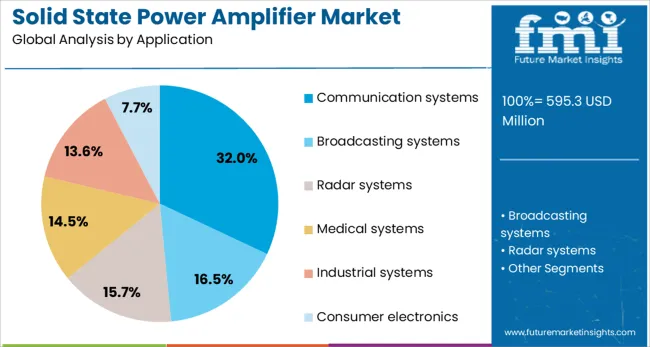

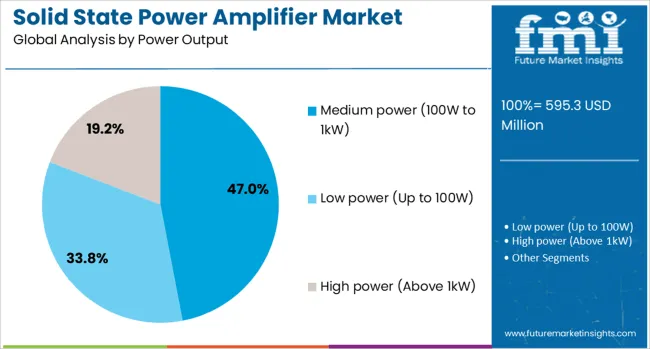

The solid-state power amplifier market is segmented by type, application, power output, frequency range, end-use industry, technology, and geographic regions. By type, the market is divided into L-band amplifiers, S-band amplifiers, C-band amplifiers, X-band amplifiers, Ku-band amplifiers, Ka-band amplifiers, and others. In terms of application, the market is classified into communication systems, broadcasting systems, radar systems, medical systems, industrial systems, and consumer electronics. Based on power output, the market is segmented into medium power (100W to 1kW), low power (Up to 100W), and high power (Above 1kW). By frequency range, the market is segmented into HF (High Frequency), VHF (Very High Frequency), UHF (Ultra High Frequency), SHF (Super High Frequency)EHF (Extremely High Frequency). By end-use industry, the market is segmented into telecommunications, defense and aerospace, broadcasting, healthcare, industrial, and consumer electronics. By technology, the market is segmented into Gallium Nitride (GaN), Gallium Arsenide (GaAs), Silicon (Si), Silicon Carbide (SiC)Others. Regionally, the solid-state power amplifier industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The L-band amplifiers segment is expected to account for 25% of the market revenue share in 2025, making it the dominant type category. This segment’s growth has been supported by its widespread use in radar, satellite, and navigation systems where frequency stability and reliability are essential. The L-band frequency range has been preferred in both commercial and defense applications due to its ability to penetrate environmental obstructions and maintain long-range communication.

These amplifiers have demonstrated optimal balance between bandwidth and efficiency, making them ideal for airborne and maritime systems. Continuous technological improvements have enhanced the signal fidelity and thermal management capabilities of L-band amplifiers, allowing for broader deployment in modern electronic warfare and surveillance systems.

The rising need for secure and interference-resistant communication channels has further elevated their importance. As global investments in air traffic control, satellite networks, and border surveillance increase, the demand for L-band amplifiers is expected to continue growing, solidifying their leadership position in this segment..

The communication systems segment is projected to hold 32% of the market revenue share in 2025, emerging as the leading application area. This dominance has been reinforced by the increasing demand for uninterrupted, high-bandwidth communication across both military and civilian sectors. Solid state amplifiers have been widely adopted in satellite ground stations, telemetry systems, and emergency response networks where high signal integrity is crucial.

The growth of global telecommunication infrastructure, particularly in remote and high-risk zones, has created sustained demand for durable and efficient amplification technologies. Communication systems have also benefited from the enhanced reliability and low maintenance of solid state devices, enabling consistent performance under extreme environmental conditions.

With the ongoing deployment of high-speed mobile networks and expanding satellite constellations, the communication systems segment has remained central to amplifier applications. Continued investment in resilient and scalable connectivity solutions is expected to preserve this segment’s lead as the market matures..

The medium power segment, defined as power output ranging from 100W to 1kW, is projected to command 47% of the market revenue share in 2025, making it the largest power output category. This segment’s leadership has been attributed to its versatility across a wide range of mission-critical applications that require both portability and dependable performance.

Medium power amplifiers have been utilized extensively in mobile communication units, radar systems, and jamming equipment due to their favorable balance between size, output, and energy efficiency. The adoption of advanced semiconductor materials has further optimized performance, allowing for compact form factors without sacrificing output quality.

Their scalability and integration flexibility have made them highly suitable for modular systems deployed in aerospace, defense, and industrial environments. Additionally, as defense modernization programs and satellite communication projects expand globally, demand for amplifiers offering mid-range output with high linearity and low distortion is expected to remain strong, reinforcing this segment’s dominance..

The solid state power amplifier (SSPA) market is growing as demand rises across telecommunications, defense, and broadcasting sectors. SSPAs provide high efficiency, reliability, and compact form factors compared to vacuum tube alternatives. North America and Europe lead due to advanced defense infrastructure and telecom networks, while Asia-Pacific shows growth from expanding 5G deployment and satellite communications. Advancements in GaN and LDMOS technologies enhance performance and thermal management. Increasing demand for high-frequency applications in radar, satellite, and wireless communication is driving consistent market expansion.

Telecommunications and satellite industries are major drivers for SSPAs due to their role in high-frequency signal transmission. The growth of 5G networks, broadband connectivity, and satellite internet requires amplifiers that provide high output power, linearity, and energy efficiency. SSPAs are increasingly deployed in ground stations, satellite payloads, and base stations to enhance signal reliability. Miniaturized and ruggedized designs allow deployment in remote and mobile infrastructures. Rising global data traffic and the need for uninterrupted communication boost adoption across telecom operators and satellite service providers, contributing to sustained market growth.

The use of gallium nitride (GaN) and laterally diffused metal-oxide-semiconductor (LDMOS) technologies enhances power efficiency, thermal performance, and frequency handling of SSPAs. These materials enable compact, lightweight amplifiers capable of operating in harsh environments. Improved thermal management and robust packaging increase device longevity and reduce maintenance requirements. Continuous R&D ensures better linearity, higher power density, and reduced signal distortion. Advances in semiconductor materials allow cost-effective scaling for multiple applications, including radar, aerospace, and communication systems. Enhanced reliability and efficiency make SSPAs an attractive solution for critical operations and high-performance deployments globally.

Military and defense applications require high-power amplifiers for radar, electronic warfare, and satellite communication systems. SSPAs replace legacy vacuum tube amplifiers due to lighter weight, higher efficiency, and lower maintenance. Defense modernization programs across North America, Europe, and Asia-Pacific are driving procurement of high-performance SSPAs. Portable and mobile amplifier solutions enable field-deployable communication and surveillance operations. Governments and defense contractors prioritize amplifiers with advanced thermal management, high linearity, and multi-band compatibility. Continuous military investment ensures a steady demand stream, supporting growth of SSPAs for defense and security applications worldwide.

Manufacturers are collaborating with telecom operators, defense contractors, and semiconductor suppliers to improve SSPA design, performance, and global availability. Joint ventures support development of advanced GaN-based systems, integration in satellite payloads, and compliance with industry standards. Partnerships enable rapid scaling, localized manufacturing, and access to emerging markets. Co-development initiatives facilitate innovation in frequency range, efficiency, and amplifier modularity. By leveraging alliances, companies expand their market presence, improve product reliability, and meet diverse end-user requirements across commercial, industrial, and defense sectors, strengthening their competitive position globally.

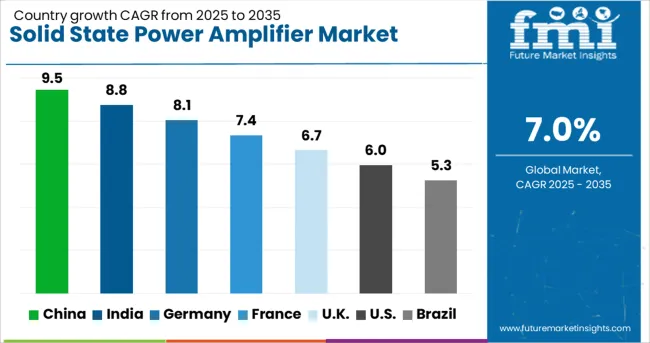

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

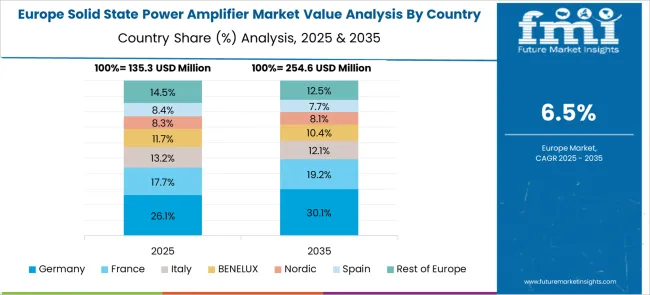

The solid state power amplifier market is projected to grow at a CAGR of 7.0%, driven by increasing demand for reliable and efficient amplification solutions across communication, defense, and industrial sectors. China leads with a growth rate of 9.5%, supported by large-scale investments in telecommunication infrastructure and radar systems. India follows at 8.8%, with adoption in defense and broadcasting applications accelerating market expansion. Germany, growing at 8.1%, focuses on advanced electronics manufacturing and high-performance amplifier technologies. The UK, at 6.7%, and the USA, at 6.0%, are leveraging solid state amplifiers for both military and commercial applications. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the solid state power amplifier (SSPA) market with a 9.5% growth rate, driven by increasing military modernization, telecom expansion, and aerospace development. Compared to India, China benefits from substantial government funding for defense and satellite communication programs, which require high-performance SSPAs. Advancements in semiconductor technologies improve amplifier efficiency, power output, and reliability. Research and development in GaN and GaAs devices supports innovation and high-frequency applications. Expansion in radar, wireless communication, and broadcasting sectors further boosts demand. Domestic production capabilities reduce reliance on imports, enhancing supply chain stability. Export opportunities for aerospace and defense equipment contribute to revenue growth. Environmental regulations also encourage energy-efficient amplifier designs. Continuous technological progress and strategic industrial partnerships enable China to maintain its leadership position in the global SSPA market.

India’s SSPA market grows at 8.8%, supported by defense upgrades, satellite programs, and telecom expansion. Compared to Germany, India focuses on cost-effective and scalable amplifier production for military and communication applications. Investments in research and development improve semiconductor devices, energy efficiency, and high-frequency performance. Rising radar, broadcasting, and wireless infrastructure deployment drives adoption. Government initiatives and strategic defense procurement programs provide steady demand. Export potential exists for regional defense and communication markets. Industrial collaborations with international technology providers accelerate innovation. Regulatory support and renewable energy integration encourage energy-efficient amplifier designs. India’s emphasis on domestic manufacturing, technological upgrades, and growing defense and telecom infrastructure strengthens its market outlook.

SSPA market in Germany grows at 8.1%, driven by aerospace, defense, and industrial communication applications. Compared to the UK, Germany focuses on high-performance, high-reliability amplifier solutions with strict quality standards. Technological innovation in GaN and GaAs devices enhances efficiency, power output, and durability. Government-funded research programs support next-generation radar and satellite communication projects. Industrial demand for broadcasting, wireless communication, and defense systems contributes to steady market expansion. Environmental and energy efficiency regulations encourage sustainable amplifier designs. Export opportunities to European and Middle Eastern markets enhance revenue potential. Germany’s strong R&D ecosystem, regulatory compliance, and focus on high-quality manufacturing sustain its competitive position in the global SSPA market.

The UK market grows at 6.7%, driven by defense modernization, satellite communication, and telecom infrastructure upgrades. Compared to the US, the UK emphasizes regulatory compliance, energy efficiency, and high-reliability amplifier solutions. Adoption is supported by defense procurement programs, research projects, and broadcasting system upgrades. Advances in semiconductor materials improve output power, durability, and frequency performance. Industrial collaborations with global technology providers accelerate innovation. Export opportunities to European and African regions enhance market potential. Sustainable amplifier designs comply with environmental regulations while maintaining efficiency. The UK’s focus on technological innovation, defense investment, and industrial adoption supports steady market growth.

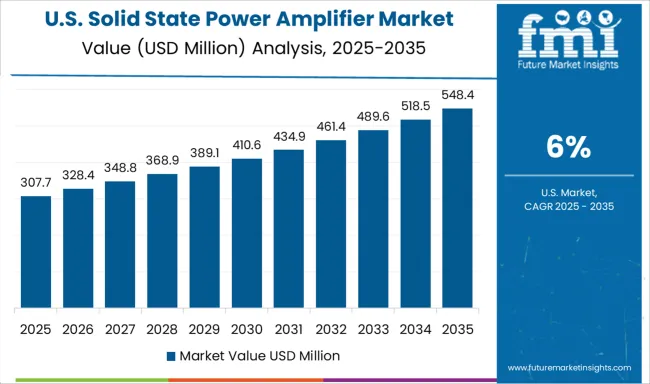

The US SSPA market grows at 6.0%, driven by military modernization, aerospace programs, and telecom expansion. Compared to China, the US emphasizes high-power, high-efficiency amplifiers for defense and satellite communication. Technological advancements in GaN and GaAs devices improve reliability, durability, and output performance. Government-funded research and defense procurement programs ensure stable demand. Industrial applications in broadcasting, wireless communication, and radar systems further boost adoption. Export opportunities to allied nations enhance revenue potential. Sustainable and energy-efficient amplifier designs are increasingly prioritized. The US market benefits from advanced R&D, regulatory support, and growing defense and communication infrastructure investments, sustaining long-term growth.

The Solid State Power Amplifier (SSPA) market is experiencing significant growth due to rising demand in defense, telecommunications, satellite communications, and radar systems. SSPAs are valued for their high reliability, energy efficiency, and compact design compared to traditional vacuum tube-based amplifiers, making them ideal for modern electronic systems. L3Harris Technologies is a leading provider of SSPAs for military and aerospace applications, offering solutions for radar, electronic warfare, and communication systems. Qorvo specializes in high-performance RF solutions, including SSPAs for satellite and broadband communication networks. Beverly Microwave Division delivers ruggedized SSPAs designed for aerospace and defense sectors, focusing on high power and wide frequency ranges. Other notable players include Advantech Wireless, which manufactures SSPAs for commercial and defense applications with emphasis on modular and scalable designs.

Teledyne Technologies provides SSPAs for both radar and satellite systems, leveraging advanced semiconductor technologies for high efficiency and reliability. Ametek Inc. offers a range of SSPAs for industrial, aerospace, and defense markets, focusing on robust, high-power amplifier solutions. Market growth is driven by increasing demand for next-generation communication systems, satellite networks, and advanced radar solutions. Technological advancements in GaN (Gallium Nitride) and GaAs (Gallium Arsenide) semiconductor devices are enhancing the efficiency, power output, and thermal performance of SSPAs. Furthermore, the expanding defense budgets, rising adoption of electronic warfare systems, and growing need for compact and lightweight amplifiers are expected to fuel market expansion globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 595.3 Million |

| Type | L-band amplifiers, S-band amplifiers, C-band amplifiers, X-band amplifiers, Ku-band amplifiers, Ka-band amplifiers, and Others |

| Application | Communication systems, Broadcasting systems, Radar systems, Medical systems, Industrial systems, and Consumer electronics |

| Power Output | Medium power (100W to 1kW), Low power (Up to 100W), and High power (Above 1kW) |

| Frequency Range | HF (High Frequency), VHF (Very High Frequency), UHF (Ultra High Frequency), SHF (Super High Frequency), and EHF (Extremely High Frequency) |

| End-Use Industry | Telecommunications, Defense and aerospace, Broadcasting, Healthcare, Industrial, and Consumer electronics |

| Technology | Gallium Nitride (GaN), Gallium Arsenide (GaAs), Silicon (Si), Silicon Carbide (SiC), and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L3Harris Technologies, Qorvo, Beverly Microwave Division, Advantech Wireless, Teledyne Technologies, and Ametek Inc. |

| Additional Attributes | Dollar sales in the Solid State Power Amplifier Market vary by type including gallium arsenide, gallium nitride, and silicon LDMOS, application across defense, telecommunications, and broadcasting, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for high-efficiency RF amplification, advancements in wireless communication, and rising defense modernization programs. |

The global solid-state power amplifier market is estimated to be valued at USD 595.3 million in 2025.

The market size for the solid-state power amplifier market is projected to reach USD 1,171.1 million by 2035.

The solid-state power amplifier market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in solid-state power amplifier market are l-band amplifiers, s-band amplifiers, c-band amplifiers, x-band amplifiers, ku-band amplifiers, ka-band amplifiers and others.

In terms of application, communication systems segment to command 32.0% share in the solid-state power amplifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA