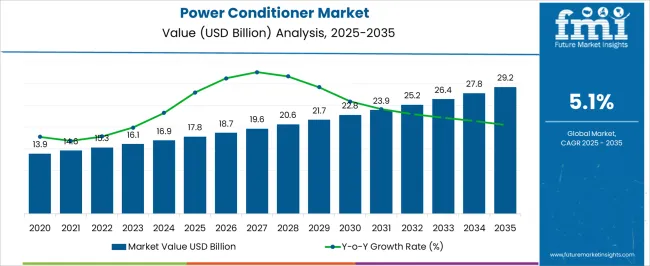

The power conditioner market is expected to grow from USD 17.8 billion in 2025 to USD 29.2 billion by 2035, reflecting a compound annual growth rate of 5.1%. During the early adoption phase (2020–2024), market growth was gradual as industrial and commercial users began integrating power conditioning solutions to improve equipment performance and protect sensitive systems.

Market values increased from USD 13.9 billion to 16.9 billion, driven by pilot deployments and selective installations. Early adopters focused on high-value facilities and critical infrastructure, establishing operational benchmarks and validating reliability, while laying the groundwork for broader market acceptance. From 2025 to 2030, the market enters a scaling phase, rising from USD 17.8 billion to around USD 22.8 billion.

Adoption accelerates across industries as the benefits of stable voltage and reduced downtime become clearer. Production capacities expand, and distributors strengthen reach to meet increasing demand. Between 2030 and 2035, the market moves into consolidation, reaching USD 29.2 billion by 2035. Leading manufacturers consolidate their positions, smaller players are acquired or exit, and growth stabilizes. Adoption becomes widespread, with incremental gains driven by standardized deployment practices and expanded geographic coverage.

| Metric | Value |

|---|---|

| Power Conditioner Market Estimated Value in (2025 E) | USD 17.8 billion |

| Power Conditioner Market Forecast Value in (2035 F) | USD 29.2 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The power conditioner market is part of several broader parent markets in the electrical equipment and energy management sectors. In 2025, the combined parent markets are estimated at over USD 1,200 billion, growing to approximately USD 1,700 billion by 2035, representing a CAGR of around 3.5%. Power conditioners currently account for roughly 1.5% of the total in 2025, increasing to about 1.7% by 2035, reflecting steady adoption in industrial, commercial, and utility applications. Key parent markets include uninterruptible power supplies (UPS), voltage regulators, surge protection devices, switchgear, distribution transformers, industrial automation equipment, motor control centers, energy storage systems, and electrical panels.

UPS systems represent the largest share of the parent market, contributing nearly 25%, driven by critical infrastructure and data center requirements. Voltage regulators and surge protection devices together account for approximately 20%, supporting equipment reliability. Switchgear and distribution transformers make up 18%, ensuring safe and efficient power distribution. Industrial automation equipment, motor control centers, energy storage, and electrical panels represent the remaining 37%, supporting operational efficiency across facilities.

While the overall parent markets grow steadily at a moderate pace, power conditioners outpace this with a CAGR of 5.1%, reflecting targeted adoption in applications requiring consistent and clean power. This growth creates opportunities for manufacturers of complementary equipment, installation services, and system integration solutions.

The power conditioner market is experiencing steady growth driven by rising demand for stable and clean power supply in both industrial and commercial applications. Increasing reliance on sensitive electronic equipment, combined with growing incidences of voltage fluctuations and power quality issues, has accelerated the adoption of power conditioners.

Advancements in energy management systems and integration of smart monitoring features are enhancing operational efficiency and equipment lifespan. The market is further supported by expanding infrastructure projects, renewable energy integration, and regulatory emphasis on energy efficiency.

With industries prioritizing equipment protection, operational continuity, and energy optimization, the adoption of high performance power conditioning solutions is expected to remain strong, positioning the market for consistent long term expansion.

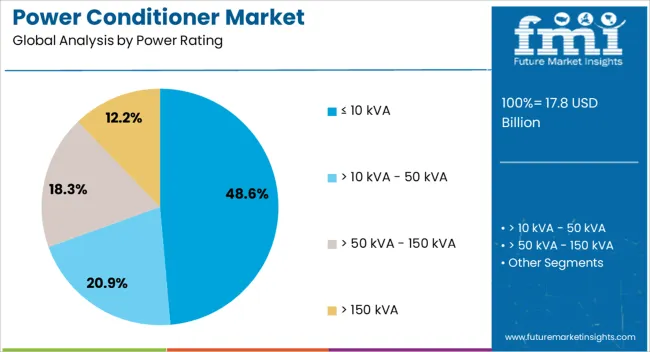

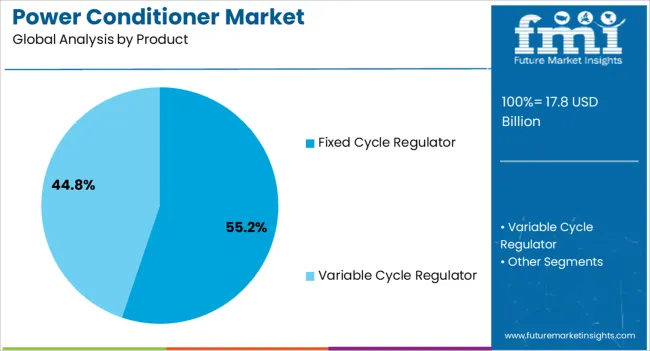

The power conditioner market is segmented by power rating, product, phase, application, and geographic regions. By power rating, power conditioner market is divided into ≤ 10 kVA, > 10 kVA - 50 kVA, > 50 kVA - 150 kVA, and > 150 kVA. In terms of product, power conditioner market is classified into Fixed Cycle Regulator and Variable Cycle Regulator.

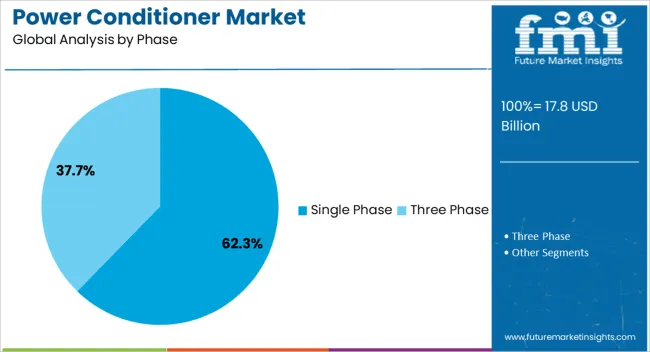

Based on phase, power conditioner market is segmented into Single Phase and Three Phase. By application, power conditioner market is segmented into Residential, Commercial, and Industrial. Regionally, the power conditioner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 10 kVA power rating segment is projected to account for 48.60% of total revenue by 2025 within the power rating category, making it the leading segment. Its dominance is supported by widespread use in residential, small commercial, and light industrial applications where moderate load capacities are required.

The segment’s growth is further driven by its cost effectiveness, compact size, and ease of installation. Increasing adoption in offices, healthcare facilities, and small manufacturing units has reinforced its market share, especially where equipment protection from voltage fluctuations is critical.

These advantages have positioned the ≤ 10 kVA segment as the preferred choice in low to medium capacity applications.

The fixed cycle regulator product segment is expected to capture 55.20% of total market revenue by 2025, maintaining its leadership within the product category. This is attributed to its ability to deliver consistent voltage regulation with minimal maintenance requirements.

Its straightforward design and reliable performance in environments with frequent voltage variations have made it a favored option across various industries. Additionally, fixed cycle regulators offer high durability, making them well suited for long term installations in manufacturing plants, commercial complexes, and public infrastructure.

The combination of reliability, low maintenance, and cost efficiency has secured its position as the dominant product segment.

The single phase segment is anticipated to hold 62.30% of total market revenue by 2025 within the phase category, positioning it as the leading segment. Its growth is driven by its extensive use in residential and small scale commercial applications, where single phase connections are standard.

Single phase power conditioners are widely adopted due to their affordability, ease of installation, and suitability for a range of electronic and electrical devices. They are increasingly preferred for protecting sensitive appliances, computers, and office equipment from voltage fluctuations.

The segment’s strong presence is further reinforced by growing demand in emerging economies, where single phase power supply remains predominant.

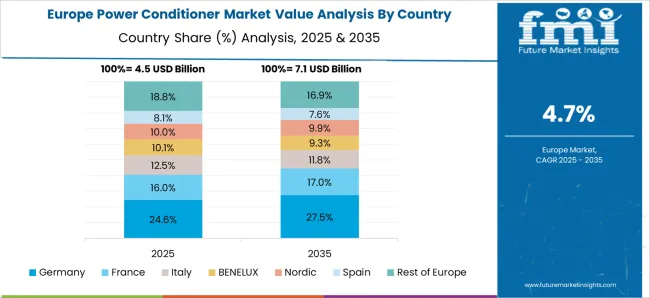

The power conditioner market is expanding due to growing demand for voltage regulation, equipment protection, and uninterrupted power supply in industrial, commercial, and residential applications. North America and Europe lead with high-performance conditioners integrated into data centers, hospitals, and manufacturing facilities. Asia-Pacific shows rapid growth driven by industrialization, renewable energy integration, and increasing sensitivity of electronics to power fluctuations. Manufacturers differentiate through advanced surge suppression, harmonic filtering, and multi-phase control. Regional variations in grid stability, power quality regulations, and equipment sensitivity shape adoption and competitiveness globally.

Adoption of power conditioners is primarily influenced by their ability to maintain stable voltage and protect sensitive equipment. North America and Europe prioritize advanced systems for critical applications like hospitals, data centers, and industrial automation, ensuring minimal downtime and equipment longevity. Asia-Pacific markets focus on cost-effective solutions for manufacturing plants, commercial complexes, and residential buildings where voltage fluctuations can disrupt operations. Differences in regulation stringency, voltage stability, and equipment sensitivity affect system specifications, investment decisions, and adoption rates. Leading suppliers offer multi-stage voltage regulation, surge protection, and real-time monitoring, while regional manufacturers provide affordable, practical solutions. Voltage stability and protection contrasts shape adoption, operational efficiency, and market competitiveness worldwide.

TEG performance depends on seamless integration with vehicle exhaust, battery, and electrical systems. North America and Europe emphasize integration with hybrid and EV platforms to maximize energy recovery, ensure stable power supply, and support auxiliary vehicle systems. In Asia-Pacific, integration often targets mid-sized internal combustion engines or smaller hybrid vehicles with simplified connection systems. Differences in integration complexity affect installation timelines, maintenance, and overall system efficiency. Suppliers providing plug-and-play or OEM-integrated TEG solutions gain higher adoption in advanced markets, while regional producers focus on adaptable, retrofit-friendly systems. Integration contrasts drive adoption, operational effectiveness, and market differentiation across luxury, hybrid, and commercial vehicle segments globally.

Integration with renewable energy systems and sensitive electronic loads is a key market driver. North America and Europe deploy power conditioners with smart controls to stabilize voltage and frequency fluctuations from solar, wind, and hybrid systems. Asia-Pacific markets increasingly adopt conditioners for renewable-assisted grids, industrial facilities, and residential complexes, balancing cost with functionality. Differences in renewable integration and load sensitivity affect product design, deployment strategies, and operational efficiency. Leading suppliers provide grid-tied, adaptive conditioners with real-time monitoring and load compensation, while regional manufacturers focus on versatile, cost-effective models. Integration contrasts shape adoption, energy management, and market competitiveness globally.

Regulatory standards related to power quality, energy efficiency, and electrical safety influence power conditioner deployment. North America and Europe require compliance with IEEE, IEC, and regional codes for industrial and critical applications. Asia-Pacific regulations vary; developed markets follow international norms, while emerging economies implement localized standards to balance cost and safety. Differences in regulatory rigor affect product approval, deployment timelines, and end-user confidence. Suppliers offering certified, regulation-compliant conditioners gain higher adoption, while regional manufacturers deliver locally approved, affordable solutions. Compliance and standards contrasts shape adoption, market credibility, and competitiveness in the global power conditioner market.

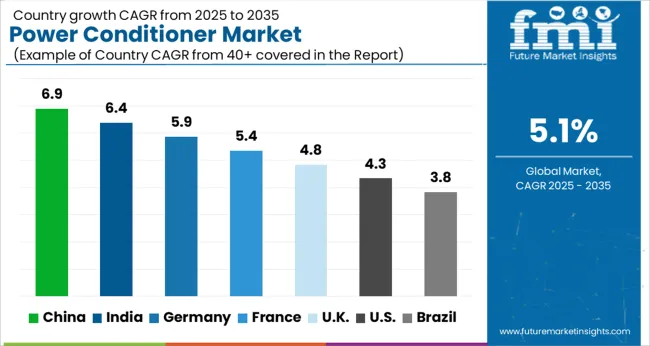

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global power conditioner market is projected to grow at a 5.1% CAGR through 2035, driven by demand in industrial facilities, commercial buildings, and renewable energy integration. Among BRICS nations, China led with 6.9% growth as large-scale manufacturing and installation facilities were commissioned and compliance with electrical standards was enforced, while India, at 6.4% growth, expanded production capacity to meet rising regional demand.

In the OECD region, Germany, at 5.9% maintained substantial output under stringent industrial and regulatory frameworks, while the United Kingdom, at 4.8% operated moderate-scale manufacturing and distribution units. The USA, growing at 4.3%, supported steady adoption across industrial, commercial, and energy sectors, ensuring adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The power conditioner market in China is projected to grow at a CAGR of 6.9%, driven by increased industrial electrification and renewable energy integration. Adoption of power conditioners is being emphasized for stabilizing voltage fluctuations, protecting sensitive equipment, and improving energy efficiency across industrial and commercial sectors. Manufacturers are focused on providing reliable, high-performance, and cost-effective solutions.

Distribution through industrial suppliers, utility providers, and authorized dealers is being strengthened. Research in advanced voltage regulation, harmonic suppression, and compact designs is being pursued. Expansion of industrial facilities, growth of data centers, and rising electricity demand are considered key factors supporting growth of the power conditioner market in China.

The power conditioner market in India is expected to grow at a CAGR of 6.4% due to rising demand for stable power supply in industrial and commercial applications. Adoption is being driven by requirements to protect sensitive electronics, improve energy efficiency, and ensure uninterrupted operations. Manufacturers are being encouraged to provide cost effective, durable, and high performance products. Distribution through industrial suppliers, authorized dealers, and utility partners is being strengthened. Awareness campaigns and technical workshops are being conducted to ensure proper installation and usage. Growing industrial activity, expansion of commercial buildings, and increasing adoption of renewable energy are being recognized as primary drivers of growth for the power conditioner market in India.

The power conditioner market in Germany is projected to expand at a CAGR of 5.9%, supported by the adoption of renewable energy and advanced industrial automation. The market is being strengthened by demand for voltage stabilization, protection of sensitive electronics, and energy efficiency in industrial and commercial applications. Manufacturers are being encouraged to supply reliable, compact, and high performance products. Distribution through industrial suppliers, utility companies, and authorized dealers is being maintained. Research into harmonic suppression, intelligent monitoring, and advanced voltage regulation is being conducted. Renewable energy integration, industrial electrification, and stringent quality standards are considered key contributors to the growth of the power conditioner market in Germany.

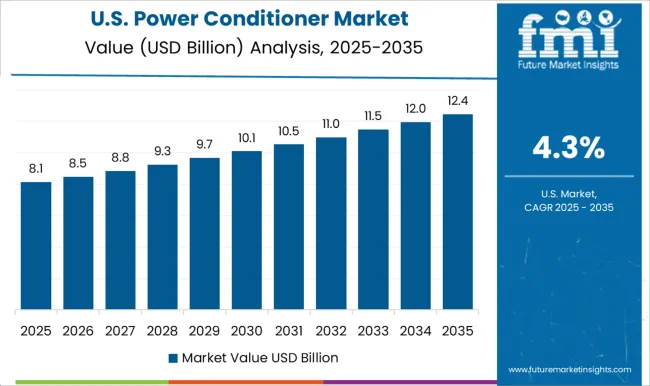

Growing demand for reliable voltage regulation and protection of sensitive equipment has positioned the power conditioner market in the United States to grow at a CAGR of 4.3%. Adoption is being emphasized in industrial facilities, commercial buildings, and renewable energy systems. Manufacturers are being encouraged to deliver high performance, durable, and energy efficient solutions.

Distribution through authorized dealers, industrial suppliers, and utility partners is being maintained. Research in advanced voltage stabilization, harmonic suppression, and intelligent monitoring is being conducted. Increasing industrial electrification, expansion of data centers, and renewable energy projects are considered key factors supporting growth of the power conditioner market in the United States.

Growing demand for reliable voltage regulation and protection of sensitive equipment has positioned the power conditioner market in the United States to grow at a CAGR of 4.3%. Adoption is being emphasized in industrial facilities, commercial buildings, and renewable energy systems. Manufacturers are being encouraged to deliver high performance, durable, and energy efficient solutions. Distribution through authorized dealers, industrial suppliers, and utility partners is being maintained. Research in advanced voltage stabilization, harmonic suppression, and intelligent monitoring is being conducted. Increasing industrial electrification, expansion of data centers, and renewable energy projects are considered key factors supporting growth of the power conditioner market in the United States.

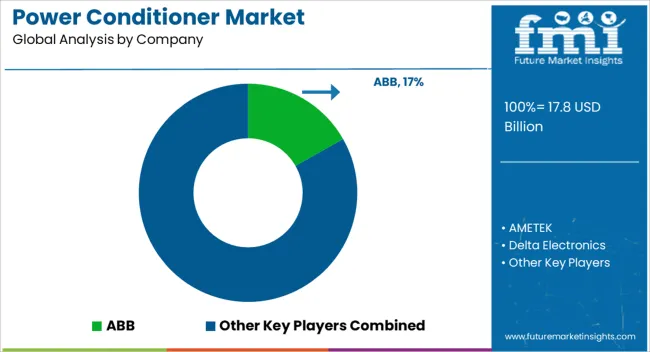

The global power conditioner market has witnessed significant growth due to the increasing need for stable and reliable power supply across industrial, commercial, and residential sectors. Power conditioners are essential in mitigating voltage fluctuations, electrical noise, and power surges, thereby protecting sensitive equipment and enhancing operational efficiency. The rising adoption of automated systems, renewable energy sources, and digital infrastructure has further driven the demand for advanced power conditioning solutions, which ensure the uninterrupted performance of critical devices and reduce downtime. Growing awareness of energy efficiency and equipment longevity is also contributing to market expansion. Prominent companies leading the power conditioner market include ABB, AMETEK, Delta Electronics, Eaton, Emerson Electric, Farmax Technologies, Fuji Electric, Hubbell, Legrand, Mitsubishi Electric Corporation, Panasonic Industry, Schneider Electric, SERVOMAX, Sharp Corporation, SOLAHD, Sollatek, SPECTRUMSTAB INDIA, Static Power, Superior Electric, Unico, Utility Systems Technologies, and Vishay.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.8 Billion |

| Power Rating | ≤ 10 kVA, > 10 kVA - 50 kVA, > 50 kVA - 150 kVA, and > 150 kVA |

| Product | Fixed Cycle Regulator and Variable Cycle Regulator |

| Phase | Single Phase and Three Phase |

| Application | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, AMETEK, Delta Electronics, Eaton, Emerson Electric, Farmax Technologies, Fuji Electric, Hubbell, Legrand, Mitsubishi Electric Corporation, Panasonic Industry, Schneider Electric, SERVOMAX, Sharp Corporation, SOLAHD, Sollatek, SPECTRUMSTAB INDIA, Static Power, Superior Electric, Unico, Utility Systems Technologies, and Vishay |

| Additional Attributes | Dollar sales vary by product type, including AC power conditioners, DC power conditioners, and voltage regulators; by application, such as industrial machinery, data centers, healthcare equipment, and consumer electronics; by end-use industry, spanning manufacturing, IT & telecom, healthcare, and residential; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for power quality, equipment protection, and reliable electrical supply. |

The global power conditioner market is estimated to be valued at USD 17.8 billion in 2025.

The market size for the power conditioner market is projected to reach USD 29.2 billion by 2035.

The power conditioner market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in power conditioner market are ≤ 10 kva, > 10 kva - 50 kva, > 50 kva - 150 kva and > 150 kva.

In terms of product, fixed cycle regulator segment to command 55.2% share in the power conditioner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA