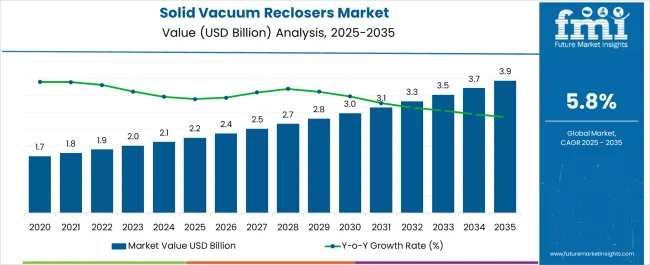

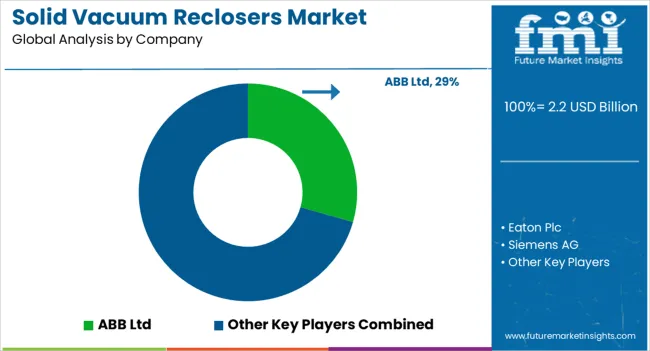

The Solid Vacuum Reclosers Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Solid Vacuum Reclosers Market Estimated Value in (2025 E) | USD 2.2 billion |

| Solid Vacuum Reclosers Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The solid vacuum reclosers market is experiencing consistent growth owing to rising investments in power distribution infrastructure, increasing urbanization, and the need for reliable grid automation. Growing electricity consumption coupled with efforts to minimize downtime and outage-related costs is driving adoption of advanced recloser systems.

Utilities and commercial establishments are prioritizing solid vacuum reclosers due to their operational reliability, minimal maintenance, and suitability for integration with smart grid technologies. Furthermore, regulatory focus on grid modernization and renewable energy integration is reinforcing deployment across developed and emerging markets.

With enhanced demand for resilient power distribution solutions, the outlook remains favorable as solid vacuum reclosers continue to gain traction in diverse applications that prioritize efficiency, safety, and operational continuity.

The single phase reclosers segment is projected to represent 54.70% of total revenue by 2025 within the phase type category, establishing it as the leading segment. Its dominance is attributed to widespread use in rural and suburban distribution networks where single phase lines are prevalent.

The capability to improve service reliability, minimize outage impact, and provide selective fault isolation has supported its adoption. Cost efficiency and ease of installation have further strengthened its appeal across utility and commercial users.

As grid operators continue to enhance distribution networks with automated and efficient equipment, the adoption of single phase reclosers remains firmly established.

The up to 15 kV segment is anticipated to account for 48.60% of total revenue within the system voltage category by 2025, positioning it as the dominant segment. This preference is driven by its compatibility with a large share of urban and semi urban distribution systems.

Its effectiveness in ensuring reliable fault protection and minimal service disruption has supported its deployment. The ability to integrate seamlessly with distribution automation and smart grid technologies has further reinforced its usage.

With rising demand for low to medium voltage applications in urban power distribution, the up to 15 kV category continues to lead.

The commercial segment is expected to contribute 42.30% of overall revenue within the end use industry category by 2025, making it the largest segment. Growth is being fueled by the rising need for uninterrupted power supply in commercial complexes, data centers, and institutional facilities.

The ability of solid vacuum reclosers to reduce downtime, prevent costly interruptions, and ensure safety standards has driven adoption. Additionally, increasing construction of commercial infrastructure and a strong emphasis on energy reliability have reinforced segment dominance.

The commercial sector remains a critical growth driver as investments in power quality and reliability continue to rise globally.

Increased investment in renewable energy: The use of renewable energy sources such as solar, wind, and hydropower is growing rapidly worldwide. Solid Vacuum Reclosers are used in renewable energy systems to protect the equipment from overloads and surges. With increased investment in renewable energy, the demand for Solid Vacuum Reclosers is expected to increase significantly.

Aging power distribution infrastructure: The power distribution infrastructure in many countries is aging, and there is a need for modernization and upgradation. Solid Vacuum Reclosers are a reliable and efficient solution to protect the power distribution infrastructure from faults and outages. The need for modernization and upgradation of power distribution infrastructure is expected to drive the growth of the solid vacuum reclosers market.

Advancements in technology: There have been significant advancements in the technology used in Solid Vacuum Reclosers, such as the use of digital sensors and communication technologies. These advancements have made Solid Vacuum Reclosers more efficient, reliable, and easier to maintain. The growing adoption of these advanced technologies is expected to drive the growth of the Solid Vacuum Reclosers Market.

Expansion in emerging markets: Emerging markets such as Asia-Pacific, Latin America, and the Middle East offer significant growth opportunities for the Solid Vacuum Reclosers Market. These regions have large populations, a growing demand for electricity, and a need for reliable power distribution systems. Solid Vacuum Reclosers can provide an efficient and reliable solution for these markets, and manufacturers can take advantage of these opportunities by expanding their presence in these regions.

Increased adoption of smart grid technologies: The adoption of smart grid technologies is growing rapidly worldwide. Solid Vacuum Reclosers can play a vital role in smart grids by enabling remote monitoring and control of power distribution systems. This can result in improved efficiency, reliability, and cost-effectiveness of power distribution systems. The increasing adoption of smart grid technologies is expected to create significant opportunities for the Solid Vacuum Reclosers Market.

Integration with renewable energy systems: Renewable energy systems such as solar and wind power are becoming increasingly popular worldwide. Solid Vacuum Reclosers can be integrated into these systems to protect the equipment from overloads and surges. The integration of Solid Vacuum Reclosers with renewable energy systems presents a significant opportunity for manufacturers in the solid vacuum reclosers market.

Insights into the Latest Trends Shaping the Solid Vacuum Reclosers Market

Increasing adoption of digital technologies: The use of digital technologies such as sensors, communication systems, and data analytics is increasing in the Solid Vacuum Reclosers Market. These technologies enable remote monitoring and control of power distribution systems, resulting in improved efficiency and reliability. Manufacturers are incorporating these digital technologies into their products to stay competitive in the market.

Growing emphasis on sustainability: The focus on sustainability is increasing in the Solid Vacuum Reclosers Market. Manufacturers are developing eco-friendly and energy-efficient products to meet the growing demand for sustainable solutions. This trend is expected to continue in the coming years as the emphasis on sustainability increases worldwide.

According to research, the Solid Vacuum Reclosers market is projected to grow steadily across regions, with around 6% projected CAGR over the 2024 to 2035 forecast period. These reclosers provide maximum continuity of electric service, in a simple and economical manner, to grid operators and other commercial and industrial customers.

In power distribution and transmission, reclosers act as fundamental powerhouse units. From the substation to the residential utility poles, they are used throughout the power distribution system. They range in size from modest single-phase systems to big-sized three-phase systems, found in substations and on high-voltage power lines.

They cut down on the length and frequency of outages, minimize operating costs, and boost customer service and the system's overall reliability.

These systems are beneficial as they considerably provide protection against many faults, such as different types of earth faults, broken wires, major transient short circuits, islanding, arc flashing, faults in tap changers, high or low power generation, and network overloads. The main advantage of a vacuum recloser is that it takes almost no time for a reclosing operation (between 100-300 msec).

When installed on a radial feeder, as part of feeder automation, reclosers automatically clear the faults in transient and help to isolate the permanent defects. They can be built to isolate failures selectively and guarantee that fewer consumers are impacted.

Thus the solid insulation configuration becomes an intrinsically trustworthy and environmentally friendly piece of intelligent automation. They save electric companies a lot of time and money since they allow power to be restored automatically after just a few flashes.

Solid configured solid vacuum reclosers which are currently available in the market, are designed to be modular, which makes field up gradations easier and aids in simple, effective, and fast retrofits.

The single-phase configuration has a pole rotation mounting bracket for easier installation. Many versions of these products are designed to bear more lightweight, than existing conventional units because the compact design makes it easier to move and install.

Most reclosers are designed to be compatible with various sensors and controls available in the market. They are becoming smart-grid-ready with new provisions in their design such as a provision to add integral load-side voltage sensors or source-side voltage sensors.

The molded vacuum recloser design, in combination with microprocessor controls, accurately detects a wide variety of line disturbances and provides dependable, high-speed isolation for harsh situations.

These units are becoming increasingly popular among utility customers in Europe. The epoxy encapsulation and polyurethane insulation are providing arc tracking resistance, minimize temperature variation, aid heat insulation in control cabinets, and provide superior hydrophobicity in end-use applications.

In Europe, these recloser units are used in feeder automation applications in countries such as Germany and the United Kingdom.

With an increasing no. of industrial clusters, dependable power distribution will be critical to powering the region's next stage of growth, in countries such as India and China. For manufacturing outdoor products for substations, companies are setting up regional facilities in these countries.

Reclosers are also used on overhead power distribution systems to identify and interrupt transitory problems, as well as to increase system uptime. With the rising demand from utility sectors and grid operators, the region is becoming an innovation hub for various medium-voltage power categories.

Some of the leading manufacturers and suppliers include:

With developments in vacuum technology, solid vacuum reclosers manufacturers are providing various solutions with medium voltage components, for distribution and industrial networks. In regions of high growth in the power distribution industry, manufacturers are aiming to expand their base in these markets.

End-users such as power plants (substations and station supply systems), transformer substations at the primary distribution level, and other industrial users are being targeted. They are developing new products with the incorporation of a microprocessor for measuring, controlling, and remote control being one of the most recent advancements in vacuum interrupter technology.

This adds instantaneous tripping, delayed tripping, and over-current protection, as well as the ability to customize tripping duration, reclosing time, and frequency, for varied end-use applications.

The report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators, and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global solid vacuum reclosers market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the solid vacuum reclosers market is projected to reach USD 3.9 billion by 2035.

The solid vacuum reclosers market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in solid vacuum reclosers market are single phase reclosers and three phase reclosers.

In terms of system voltage (kv), up to 15 kv segment to command 48.6% share in the solid vacuum reclosers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

Solid White Films Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Solid Sulphur Market Size and Share Forecast Outlook 2025 to 2035

Solid State Relay Market Size and Share Forecast Outlook 2025 to 2035

Solid Terpene Resin Market Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Solid Board Market Size and Share Forecast Outlook 2025 to 2035

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Array Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

Solid State LiDAR Sensor Market Analysis Size and Share Forecast Outlook 2025 to 2035

Solid-State Lighting Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Solid State Drive Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lighting System Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lasers Market Analysis - Growth & Forecast 2025 to 2035

Solid-State Cooling Market Analysis & Forecast by Type, Product, End-user Industry, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA