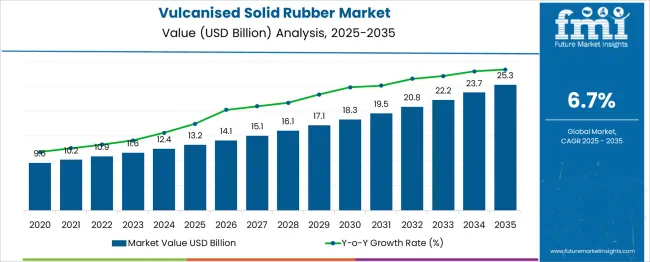

The Vulcanised Solid Rubber Market is estimated to be valued at USD 13.2 billion in 2025 and is projected to reach USD 25.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. Between 2025 and 2030, the market grows consistently, reaching USD 18.3 billion. Annual figures reflect steady gains: USD 14.1 billion in 2026, USD 15.1 billion in 2027, USD 16.1 billion in 2028, and USD 17.1 billion in 2029. This growth pattern supports market share expansion for manufacturers offering high-performance rubber suited for industrial, automotive, and infrastructure applications.

Companies that provide enhanced durability, wear resistance, and customization are well-positioned to capture demand across diverse use cases. In contrast, firms relying on standardised products or outdated production methods may experience share erosion due to rising expectations around consistency, tolerance, and lifecycle performance. Cost-sensitive buyers will favor vendors offering value through longer replacement cycles and reduced maintenance needs. Between 2025 and 2030, market differentiation will depend on production efficiency, global distribution strength, and quality assurance. Players who integrate precision manufacturing, volume scalability, and strong B2B relationships are expected to lead, while laggards may face pricing pressure and reduced visibility in competitive tenders.

| Metric | Value |

|---|---|

| Vulcanised Solid Rubber Market Estimated Value in (2025 E) | USD 13.2 billion |

| Vulcanised Solid Rubber Market Forecast Value in (2035 F) | USD 25.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The Vulcanised Solid Rubber Market is a specialized subset within the broader rubber and elastomer industry, drawing influence from several key parent markets. Most prominently, it falls under the global rubber materials market, which encompasses both natural and synthetic rubber types. Within this umbrella, vulcanised rubber represents a refined category characterized by enhanced elasticity, durability, and thermal resistance achieved through the vulcanization process. One major parent market is the automotive components market, where vulcanised solid rubber is extensively used in tires, mounts, bushings, seals, and vibration-damping parts.

This segment accounts for a substantial portion of overall demand, often estimated to contribute over 30% of the market. Another core parent market is the industrial machinery and equipment sector, which relies on vulcanised rubber for anti-vibration pads, gaskets, rollers, and heavy-duty flooring contributing approximately 20–25% of total usage. The construction and infrastructure industry also serves as a major demand center, particularly in bridge bearings, sealing systems, and protective coatings, accounting for around 15–20% of consumption. Additional contributions come from the aerospace, marine, and rail sectors, where resistance to wear, moisture, and deformation is essential. These diverse yet interlinked parent markets collectively shape the growth trajectory and application range of the vulcanised solid rubber industry.

The Vulcanised Solid Rubber market is experiencing stable growth supported by its indispensable role across a wide range of industrial and commercial applications. Increasing demand from sectors such as automotive, heavy equipment, oil and gas, and construction has driven consistent use of vulcanised rubber products due to their durability, chemical resistance, and ability to perform under extreme stress.

The global shift towards long-life, low-maintenance materials has favored the use of solid rubber products in components such as seals, gaskets, rollers, and vibration isolation systems. Technological advancements in rubber compounding, precision molding, and performance-enhancing additives are contributing to improved mechanical properties and longevity of these materials.

The market outlook remains positive, with growth projected in alignment with increasing industrial automation, infrastructure upgrades, and performance requirements in dynamic load environments. Strategic investments in material innovation and eco-compliant rubber alternatives are further paving the way for future opportunities in this domain..

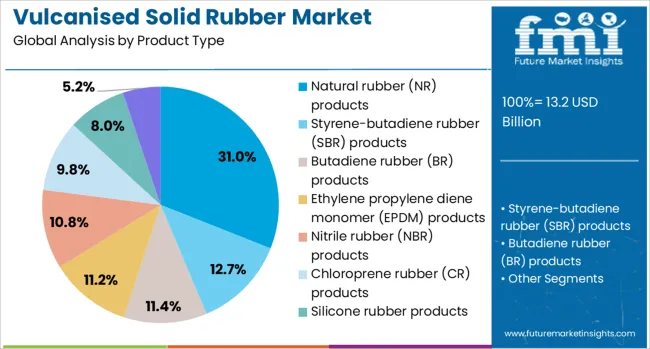

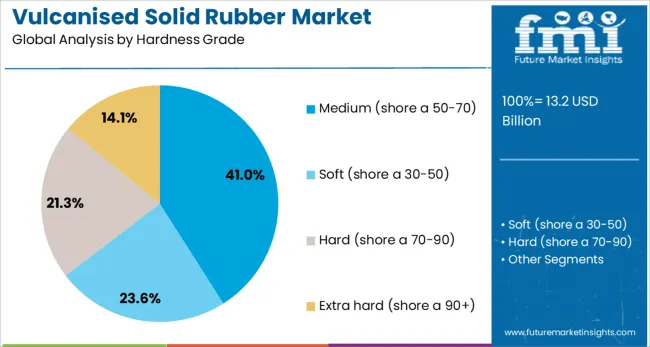

The vulcanised solid rubber market is segmented by product type, hardness grade, manufacturing process, application, and geographic regions. By product type of the vulcanised solid rubber market is divided into Natural rubber (NR) products, Styrene-butadiene rubber (SBR) products, Butadiene rubber (BR) products, Ethylene propylene diene monomer (EPDM) products, Nitrile rubber (NBR) products, Chloroprene rubber (CR) products, Silicone rubber products, and Other specialty rubber products. In terms of hardness grade, the vulcanised solid rubber market is classified into Medium (shore a 50-70), Soft (shore a 30-50), Hard (shore a 70-90), and Extra hard (shore a 90+).

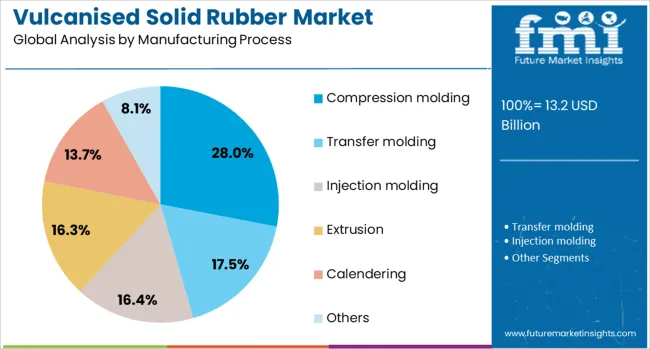

The vulcanised solid rubber market is segmented into Compression molding, Transfer molding, Injection molding, Extrusion, Calendering, and Others. The vulcanised solid rubber market is segmented by application into Automotive & transportation, Industrial machinery & equipment, Construction & infrastructure, Electrical & electronics, Healthcare & medical devices, Consumer goods, and Others. Regionally, the vulcanised solid rubber industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural rubber products subsegment within the product type category is expected to hold 31% of the Vulcanised Solid Rubber market revenue share in 2025. This dominant position has been attributed to the inherent elasticity, tensile strength, and fatigue resistance offered by natural rubber, which make it ideal for dynamic applications requiring repeated deformation and recovery.

The subsegment has benefited from strong demand in automotive, mining, and industrial machinery markets, where high load-bearing capacity and resilience are essential. Natural rubber has also been favored for its superior adhesion properties, which enhance bonding with metals and textiles during composite part fabrication.

Additionally, its renewability and biodegradability have positioned it as a more sustainable material option compared to synthetic alternatives, aligning with global environmental and regulatory standards. The ability of natural rubber to be effectively vulcanised into solid components with controlled mechanical properties has further reinforced its selection as the preferred material in this segment..

The medium hardness grade segment, defined within the range of Shore A 50 to 70, is projected to account for 41% of the Vulcanised Solid Rubber market revenue share in 2025, emerging as the leading hardness classification. This grade has been widely adopted due to its optimal balance between flexibility and rigidity, offering excellent compression set resistance while maintaining sufficient hardness for structural integrity.

Medium hardness rubber components have found extensive use in automotive bushings, industrial pads, protective linings, and mechanical seals, where both energy absorption and load-bearing performance are essential. This segment has also gained traction due to its suitability for high-precision molding and consistent dimensional stability under variable thermal and mechanical loads.

The adaptability of this hardness range for both static and dynamic environments has strengthened its appeal across key end-use sectors. Moreover, its compatibility with multiple rubber types and fillers has allowed manufacturers to tailor properties to exact application needs, thereby expanding its commercial use..

The compression molding subsegment within the manufacturing process category is anticipated to capture 28% of the Vulcanised Solid Rubber market revenue share in 2025, making it the most utilized process. Its dominance has been driven by cost-effectiveness, versatility, and suitability for producing thick, high-strength rubber components with minimal material wastage.

Compression molding has been extensively used for manufacturing gaskets, pads, seals, and structural elements where precise dimensional tolerance and strong mechanical properties are required. The process has remained popular due to its compatibility with both natural and synthetic rubbers and its ability to mold large or complex parts that cannot be efficiently produced through other methods.

Its scalability and relatively lower tooling cost have enabled manufacturers to produce both short and long production runs economically. Furthermore, compression molding allows for enhanced control over vulcanisation cycles, contributing to improved part consistency and performance, which has solidified its relevance in mass and custom manufacturing environments..

The vulcanized solid rubber market is expanding steadily as demand rises in sectors including automotive, industrial equipment, consumer goods, and construction. Vulcanization enhances natural and synthetic rubber by improving elasticity, abrasion resistance, and heat durability. Growth is driven by applications such as conveyor belts, seals, tires, and molded goods in harsh environments.

Manufacturers increasingly use advanced formulations like EPDM, nitrile, and silicone-based vulcanized elastomers tailored to specific performance requirements. Regional expansion is strongest in Asia‑Pacific, North America, and Europe. Lightweight vehicles and durable industrial systems underpin market stability. Ongoing material innovation and regulatory alignment with environmental and safety standards further support steady growth in solid vulcanized rubber demand.

Manufacturers of vulcanized solid rubber must meet demanding quality and performance specifications imposed by OEM and industrial clients. These often include precise metrics for mechanical resilience, resilience to fatigue, thermal stability, and longevity under dynamic load. Material batches require consistency in cure level, hardness, elasticity, and tensile strength. Suppliers must implement robust process control, traceability across compound batches, and validation testing protocols. Certification to ISO standards and compliance with industry-specific norms (such as automotive or mining safety) add administrative effort. Nonconforming batches risk failure in the field, warranty claims, and reputational damage. Achieving uniform quality across high-voltage elastomers, specialty vibration isolators, or seals in corrosive environments is critical. Smaller compounders may struggle with investment in test equipment or qualification support. Until standardized supplier audits and compound libraries mature globally, delivering consistent performance remains a barrier for growth in precision applications.

Demand from industrial equipment segments such as mining, material handling, and heavy machinery provides a strong growth opportunity for vulcanized solid rubber producers. Conveyor systems, roller tires, sealing rings, gaskets, and vibration mounts rely on robust elastomers capable of withstanding abrasion, heat, chemical exposure, and mechanical stress. As infrastructure and manufacturing sectors expand, replacement and OEM demand for tailored compounds increases. High-performance rubbers such as nitrile-based and EPDM-based vulcanized products are preferred for oil, weather, and wear resistance.

Manufacturers offering custom compound services, rapid prototyping, and engineering support deliver added value in equipment-heavy sectors. Contracts for durable components align with maintenance schedules and lifecycle extension goals. Regional industries undergoing mechanization and automation invest in reliable elastomers to support uptime. This sustained industrial demand underpins the base segment of the solid vulcanized rubber market, offering continuous replacement and new-project opportunity streams.

Emerging trends in vulcanization methods and compound chemistry are enhancing solid rubber performance. Advances such as peroxide curing, silane crosslinking systems, and dual cure protocols improve heat resistance and reduce scorch risk. Nano-filler inclusion (such as silica nanoparticles or nanoclay) increases tear strength and abrasion durability while maintaining flexibility. Digital process controls now enable tighter cure cycle optimization, reducing variability across batches. Hybrid elastomer blends combining natural rubber with specialty synthetic monomers deliver tunable modulus or chemical tolerance. Acoustic dampening and cushioning properties are boosted by microcellular structuring and engineered compounding. These innovations expand application scope into dynamic use cases like high-frequency vibration isolators and lightweight structural mounts. Material improvements also support regulatory compliance in safety-critical environments. Suppliers investing in compound engineering and process analytics gain a competitive advantage as elastomer demand shifts toward specialized, high-performance applications.

Despite strong application demand, market expansion faces constraints from raw material cost volatility and sustainability pressures. Key ingredients such as natural rubber, synthetic monomers, curatives, and vulcanizing agents are exposed to fluctuating commodity prices and supply disruptions. Cost instability affects margins and pricing for both OEM and aftermarket channels. Additionally, environmental concerns around rubber production and chemical additives have increased scrutiny.

Manufacturers must address lifecycle impacts and consider bio-based alternatives or recyclable compound designs. Regulatory focus on VOC emissions or rubber composition may increase compliance complexity. Small compounders may struggle to manage sourcing alternatives or invest in greener formulations. Until supply chains stabilize and sustainable elastomer options scale, manufacturers may hesitate to commit to long-term supply contracts. Sustainability credentials and cost consistency remain critical for broader adoption across sensitive industrial and consumer markets.

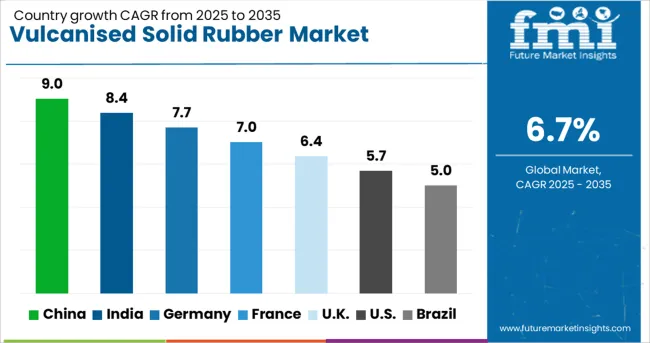

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The vulcanised solid rubber market is projected to grow at a CAGR of 6.7% through 2035, driven by its wide application in heavy-duty industrial, automotive, and infrastructure sectors. China leads the market with 9.0% growth, supported by strong manufacturing demand and infrastructure expansion. India follows closely at 8.4%, spurred by rapid industrialization and increasing use in transport and construction. Germany, growing at 7.7%, benefits from advanced production standards and demand for durable materials. The UK, with 6.4% growth, is investing in high-performance rubber for rail and marine applications. The USA posts a 5.7% CAGR, driven by demand across aerospace and defense industries. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The Vulcanised Solid Rubber Market in China is growing at a CAGR of 9.0%, supported by booming construction, heavy-duty transportation, and industrial manufacturing sectors. Solid rubber components are widely used in shock absorption, vibration control, and high-resilience sealing applications. Demand is fueled by rapid infrastructure expansion and the modernization of rail and heavy machinery systems. Domestic manufacturers are investing in advanced curing technologies and material formulation to improve wear resistance and load tolerance. Local automotive OEMs are also sourcing vulcanised rubber for engine mounts, bushings, and suspension parts, driven by the push for localized component manufacturing. Additionally, the rise in EV production is prompting the development of specialized rubber solutions for insulation and thermal management in battery modules and motors.

Vulcanised solid rubber market in India is expanding at a CAGR of 8.4%, powered by increasing urban development, growth in tire retreading, and demand from heavy engineering industries. The country’s push toward self-reliant manufacturing under “Make in India” has led to investments in rubber processing facilities and downstream rubber goods. Applications in railways, mining, and agriculture continue to drive volume for high-resilience rubber blocks, pads, and mountings. Additionally, the demand for non-pneumatic tires and specialized rubber linings in chemical and fertilizer plants is on the rise. Innovations in natural rubber blends and carbon black dispersion techniques are improving longevity and structural integrity of vulcanised components.

Germany is reporting a CAGR of 7.7 percent in the Vulcanised Solid Rubber Market, underpinned by stringent industrial quality standards and demand from automotive and machinery OEMs. Vulcanised rubber is used extensively in anti-vibration mounts, sealing solutions, and conveyor rollers. German manufacturers prioritize durability, noise reduction, and precision fit, integrating rubber into high-performance engineering applications. Growth is further driven by the renewable energy sector, where wind and solar installations require vibration-dampening pads and support blocks. R&D efforts are focused on heat-resistant formulations and eco-friendly curing agents to comply with EU sustainability goals. Recycling and closed-loop manufacturing practices are increasingly embedded into the rubber supply chain.

The United Kingdom is witnessing a CAGR of 6.4% in the Vulcanised Solid Rubber Market, driven by construction, maritime, and public transport infrastructure upgrades. The post-Brexit focus on domestic sourcing has led to renewed interest in locally manufactured rubber components for safety-critical applications. Vulcanised rubber pads, gaskets, and buffers are used in building foundations, marine fenders, and rolling stock systems. British manufacturers emphasize flame-retardant and weather-resistant formulations to meet coastal and industrial standards. Increased investment in railway modernization projects and port expansions further enhances demand for robust, vibration-resistant materials. Additionally, sustainability requirements are pushing innovation in low-emission curing and recyclable rubber alternatives.

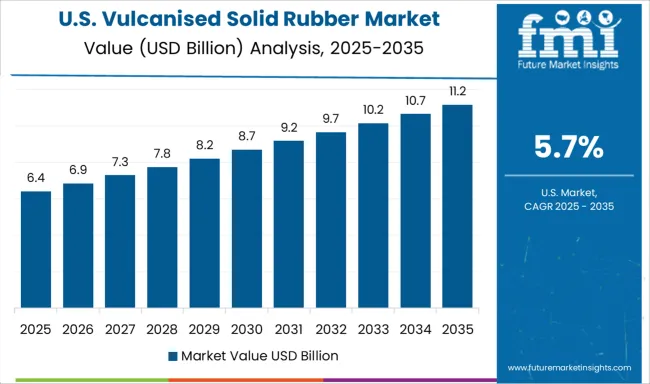

The United States is observing a CAGR of 5.7% in the Vulcanised Solid Rubber Market, driven by industrial automation, aerospace production, and defense applications. Solid rubber parts are essential in isolating machinery vibrations, providing impact resistance, and ensuring long-term material stability. Key sectors include oil and gas, where vulcanised rubber is used in packers, seals, and shock absorbers for drilling rigs and pipelines. Military-grade applications demand rubbers with high fatigue resistance and extreme temperature tolerance. The rise in domestic reshoring of industrial production also creates momentum for USA-based rubber manufacturers, who are investing in precision molding and custom compounding.

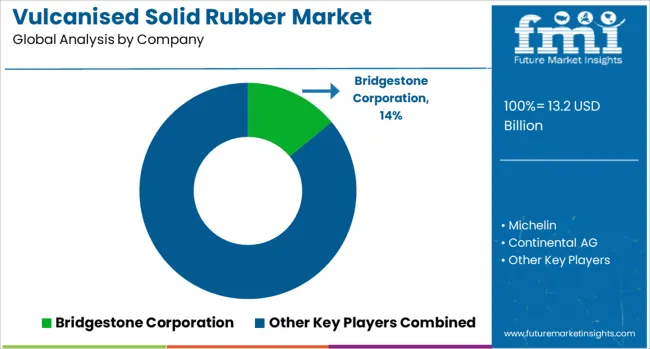

The vulcanised solid rubber market plays a crucial role in industries requiring high durability, heat resistance, and mechanical strength. Used in applications such as industrial tires, seals, gaskets, vibration dampening systems, and heavy-duty flooring, vulcanised rubber offers superior elasticity and resilience. The market is driven by demand from automotive, construction, mining, and heavy manufacturing sectors, where performance and longevity are critical. Bridgestone Corporation, Michelin, and Continental AG lead the market through their advanced rubber compounding technologies and vertically integrated production for industrial and off-the-road (OTR) tires. Their vulcanised rubber products are engineered for extreme stress, abrasion resistance, and load-bearing capacity.

Sumitomo Rubber Industries complements this leadership with innovative rubber processing for both transportation and infrastructure applications. Material specialists such as LANXESS AG, ZEON Corporation, and Dow Inc. focus on the development of synthetic rubbers and chemical additives that enhance vulcanisation performance, thermal stability, and resistance to oil and chemicals. ExxonMobil contributes through its advanced elastomeric materials like EPDM and butyl rubbers, widely used in solid rubber applications. Hexpol AB, a key compounder, provides custom-engineered rubber formulations to OEMs across automotive, oil & gas, and industrial markets. As sustainability and high-performance demands rise, suppliers that offer low-emission, recyclable, and application-specific vulcanised rubber solutions are expected to gain a competitive edge.

As mentioned in LANXESS’s official press release dated February 24, 2025, LANXESS introduced Vulkanox HS Scopeblue, a sustainable variant of the established TMQ antioxidant used in vulcanised rubber and tire manufacturing. This additive contains over 55% sustainable raw materials, is produced in an ISCC PLUS-certified facility, and delivers a 30% lower carbon footprint, all while maintaining identical performance and drop-in compatibility for existing production processes

| Item | Value |

|---|---|

| Quantitative Units | USD 13.2 Billion |

| Product Type | Natural rubber (NR) products, Styrene-butadiene rubber (SBR) products, Butadiene rubber (BR) products, Ethylene propylene diene monomer (EPDM) products, Nitrile rubber (NBR) products, Chloroprene rubber (CR) products, Silicone rubber products, and Other specialty rubber products |

| Hardness Grade | Medium (shore a 50-70), Soft (shore a 30-50), Hard (shore a 70-90), and Extra hard (shore a 90+) |

| Manufacturing Process | Compression molding, Transfer molding, Injection molding, Extrusion, Calendering, and Others |

| Application | Automotive & transportation, Industrial machinery & equipment, Construction & infrastructure, Electrical & electronics, Healthcare & medical devices, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bridgestone Corporation, Michelin, Continental AG, Sumitomo Rubber Industries, LANXESS AG, ZEON Corporation, Dow Inc., ExxonMobil, Hexpol AB, and Others |

| Additional Attributes | Dollar sales by vulcanised solid rubber type including natural rubber, styrene-butadiene rubber, nitrile rubber, and EPDM rubber; by application in industrial rollers, dock bumpers, automotive parts, flooring, and rail pads; by region including North America, Europe, and Asia-Pacific; demand driven by durability requirements, shock absorption, and vibration resistance in heavy-duty environments; innovation in eco-friendly compounding, advanced molding techniques, and anti-abrasive formulations; costs influenced by raw rubber prices, energy consumption, and processing complexity. |

The global vulcanised solid rubber market is estimated to be valued at USD 13.2 billion in 2025.

The market size for the vulcanised solid rubber market is projected to reach USD 25.3 billion by 2035.

The vulcanised solid rubber market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in vulcanised solid rubber market are natural rubber (nr) products, styrene-butadiene rubber (sbr) products, butadiene rubber (br) products, ethylene propylene diene monomer (epdm) products, nitrile rubber (nbr) products, chloroprene rubber (cr) products, silicone rubber products and other specialty rubber products.

In terms of hardness grade, medium (shore a 50-70) segment to command 41.0% share in the vulcanised solid rubber market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solid Terpene Resin Market Size and Share Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Solid Board Market Size and Share Forecast Outlook 2025 to 2035

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Array Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

Solid Vacuum Reclosers Market Size and Share Forecast Outlook 2025 to 2035

Solid State LiDAR Sensor Market Analysis Size and Share Forecast Outlook 2025 to 2035

Solid-State Lighting Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Solid State Drive Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lighting System Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lasers Market Analysis - Growth & Forecast 2025 to 2035

Solid-State Cooling Market Analysis & Forecast by Type, Product, End-user Industry, and Region Through 2035

Solid White Films Market Analysis & Trends 2024-2034

Solid State Relays – Powering EVs & Industrial Automation

Solid Sulphur Market Growth – Trends & Forecast 2024-2034

Solid Bleached Board Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA