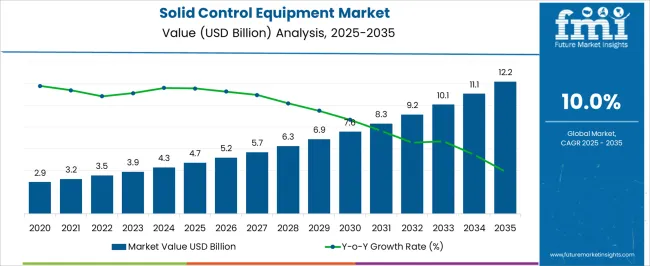

The Solid Control Equipment Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 12.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Solid Control Equipment Market Estimated Value in (2025 E) | USD 4.7 billion |

| Solid Control Equipment Market Forecast Value in (2035 F) | USD 12.2 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The solid control equipment market is experiencing steady growth, driven by the increasing demand for efficient and reliable drilling operations across the oil and gas sector. The market is shaped by the need to optimize drilling performance, reduce non-productive time, and enhance operational safety. Continuous advancements in drilling technology and the adoption of automated and high-efficiency separation systems are improving the recovery of drilling fluids and reducing environmental impact.

Rising investments in upstream oil and gas exploration and production activities are expanding the need for solid control equipment to manage cuttings and maintain drilling fluid quality. Growing focus on cost reduction, energy efficiency, and regulatory compliance is further supporting market expansion. Equipment capable of handling diverse drilling conditions and fluid types is being prioritized by operators globally.

As exploration activities increase in challenging environments and unconventional reservoirs, the market is expected to benefit from the integration of advanced control technologies and modular equipment designs Overall, the combination of operational efficiency, environmental compliance, and technology innovation is establishing a strong foundation for long-term growth in the solid control equipment market.

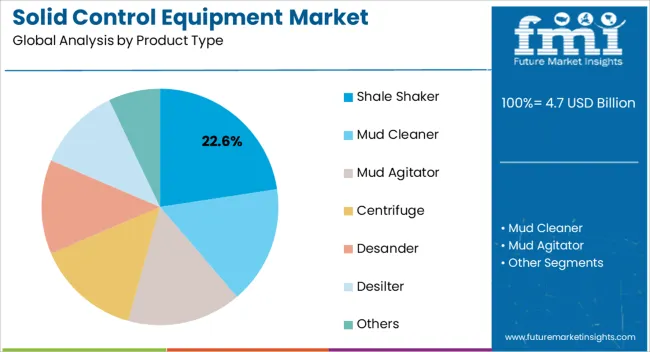

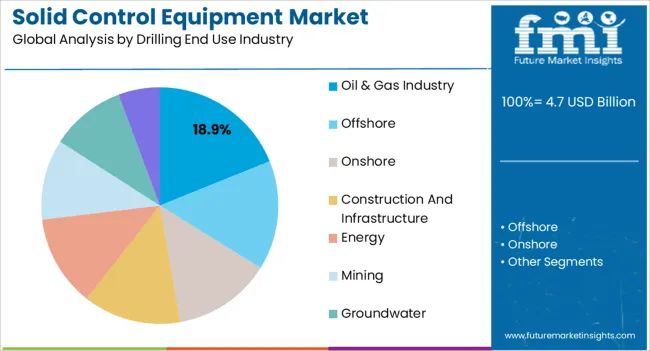

The solid control equipment market is segmented by product type, drilling end use industry, and geographic regions. By product type, solid control equipment market is divided into Shale Shaker, Mud Cleaner, Mud Agitator, Centrifuge, Desander, Desilter, and Others. In terms of drilling end use industry, solid control equipment market is classified into Oil & Gas Industry, Offshore, Onshore, Construction And Infrastructure, Energy, Mining, Groundwater, and Others. Regionally, the solid control equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shale shaker segment is projected to hold 22.6% of the solid control equipment market revenue share in 2025, making it the leading product type. Its leadership is being driven by its critical role in the initial stage of drilling fluid separation, which directly impacts drilling efficiency and fluid recovery. The segment benefits from high adaptability to various drilling fluids, particle sizes, and operating conditions, ensuring reliable performance in both onshore and offshore operations.

Technological enhancements, including vibration optimization, automated screen replacement, and real-time monitoring, are increasing operational reliability and reducing maintenance downtime. The rising demand for environmentally compliant operations is further reinforcing adoption, as shale shakers effectively manage cuttings and minimize the disposal of drilling waste.

Their proven cost-effectiveness and ability to integrate with other solid control equipment modules make them the preferred choice for operators seeking high-performance drilling solutions As oil and gas exploration expands in challenging and unconventional reservoirs, shale shakers are expected to maintain their position as the dominant product type in the market.

The oil and gas industry segment is anticipated to account for 18.9% of the solid control equipment market revenue share in 2025, establishing it as the leading end-use industry. This dominance is being driven by the extensive use of solid control systems in upstream drilling operations, where efficient management of drilling fluids and cuttings is essential to maintain productivity and reduce environmental impact. Growing exploration and production activities, particularly in offshore and unconventional fields, are increasing the demand for advanced solid control equipment.

Operators are prioritizing equipment that can improve drilling efficiency, lower operational costs, and support regulatory compliance related to waste management and environmental standards. Integration of automated monitoring systems and modular designs allows for real-time performance optimization and flexibility in handling diverse drilling conditions.

The rising focus on reducing non-productive time and enhancing safety in drilling operations further strengthens the segment’s adoption As global energy demand grows and oil and gas projects expand, the industry’s reliance on high-performance solid control equipment is expected to sustain strong growth in the coming years.

Factors such as rising energy consumption and growing concerns about the safety and environmental impact of drilling and waste management are projected to boost the market for solid control equipment globally.

Since the inception of drilling industry, drilling fluids and chemical compounds were largely used while drilling boreholes or other drilling activities to improve the efficiency and safety of a tool. The drilling fluid was also applied to push out waste cuttings from boreholes by providing hydrostatic pressure that would also stop formation fluid from entering into the bore well.

Since drilling fluids serve many purposes, they began to be referred to as the “drilling blood “of drilling equipment. These fluids are an essential requirement during the drilling process. Sometimes it so happens that a large amount of solid waste or mud mixes with fluid and enters into the borehole. This hampers the performance of the drilling tool as well as the drilling process.

The new era of waste management is changing the drilling industry very rapidly by providing it with useful waste management equipment like the solid control equipment. During the drilling process, large volumes of solid or waste is produced.

The first step towards waste management practices is getting rid of this solid or waste and stopping it from getting mixed with the drilling fluid. A solid control equipment works as a separator and optimizes drilling efficiency by separating the solids produced while drilling from the drilling fluid.

There are various kinds of solid control equipment. They are often categorized based on their application area and capacity. The solid control equipment market is expected to witness significant growth between 2025 and 2026.

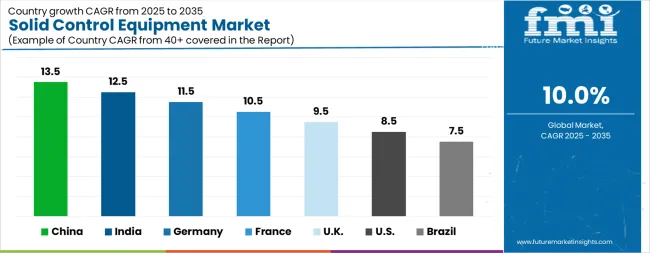

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The Solid Control Equipment Market is expected to register a CAGR of 10.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 13.5%, followed by India at 12.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.5%, yet still underscores a broadly positive trajectory for the global Solid Control Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 11.5%. The USA Solid Control Equipment Market is estimated to be valued at USD 1.7 billion in 2025 and is anticipated to reach a valuation of USD 3.8 billion by 2035. Sales are projected to rise at a CAGR of 8.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 246.9 million and USD 155.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Product Type | Shale Shaker, Mud Cleaner, Mud Agitator, Centrifuge, Desander, Desilter, and Others |

| Drilling End Use Industry | Oil & Gas Industry, Offshore, Onshore, Construction And Infrastructure, Energy, Mining, Groundwater, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

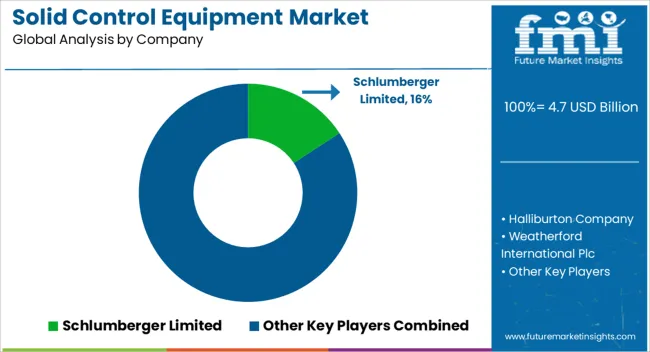

| Key Companies Profiled | Schlumberger Limited, Halliburton Company, Weatherford International Plc, Baker Hughes Company, GN Solids Control, Derrick Corporation, KES Energy Equipment Manufacturing Hebei Co. Ltd, China Petroleum Technology & Development Corporation (CPTDC), KOSUN Machinery Co. Ltd, and ORS International Ltd |

The global solid control equipment market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the solid control equipment market is projected to reach USD 12.2 billion by 2035.

The solid control equipment market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in solid control equipment market are shale shaker, mud cleaner, mud agitator, centrifuge, desander, desilter and others.

In terms of drilling end use industry, oil & gas industry segment to command 18.9% share in the solid control equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Riot Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Combustion Controls, Equipment & Systems Market – Forecast 2025 to 2035

Air Traffic Control Equipment Market

Air Pollution Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

End-of-Pipe Air Pollution Control Equipment Market- Trends & Forecast 2025 to 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

Solid White Films Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Solid Sulphur Market Size and Share Forecast Outlook 2025 to 2035

Solid State Relay Market Size and Share Forecast Outlook 2025 to 2035

Solid Terpene Resin Market Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Solid Board Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA