The solid state relay (SSR) market is advancing steadily, driven by increasing automation across industrial sectors and the rising need for efficient, reliable switching solutions. Industry developments and electronic component manufacturer reports have highlighted the shift from electromechanical relays to solid state alternatives, owing to SSRs' advantages in durability, noise reduction, and switching speed.

The market has also benefited from greater integration of SSRs into energy-efficient systems, smart grids, and temperature control applications, where precision and longevity are crucial. Technological innovations in semiconductor materials and thermal management solutions have improved product performance and broadened application scope.

Furthermore, increased demand for compact and modular devices in industrial control systems has created growth opportunities for SSRs with varied packaging and output types. Looking ahead, future expansion will likely be supported by trends in Industry 4.0, renewable energy systems, and electric vehicle infrastructure, with strong traction in panel-mounted solutions, AC output configurations, and low-power rated SSRs tailored for compact equipment and high-cycle switching needs.

| Metric | Value |

|---|---|

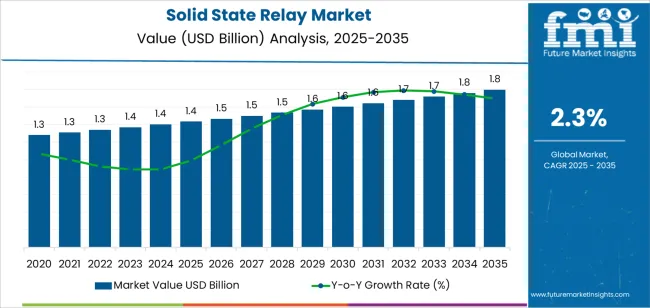

| Solid State Relay Market Estimated Value in (2025 E) | USD 1.4 billion |

| Solid State Relay Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 2.3% |

The market is segmented by Packaging Type, Output Type, Power Rating Type, and Application and region. By Packaging Type, the market is divided into Panel Mount, Din Rail Mount, and PCB Mount. In terms of Output Type, the market is classified into AC Solid State Relay, DC Solid State Relay, and AC/DC Output Relay. Based on Power Rating Type, the market is segmented into Low Power (0‑20A), Medium Power (20A‑50A), and High Power (50A & Above). By Application, the market is divided into Consumer Application, Cooking Appliances, Medical & Healthcare Industry, and Automotive And Transportation Industry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

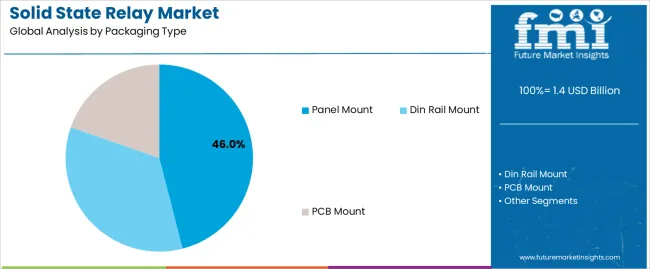

The Panel Mount segment is projected to contribute 46.0% of the solid state relay market revenue in 2025, holding its position as the leading packaging configuration. Growth in this segment has been fueled by its suitability for industrial automation systems where space optimization and ease of installation are essential.

Panel-mounted SSRs have been favored by equipment manufacturers and electrical engineers due to their modular design, which facilitates quick replacement and integration within control panels. Industry reports have emphasized their reliability in high-cycle operations, thermal dissipation efficiency, and adaptability to a wide range of load conditions.

The increasing deployment of control panels in factory automation, HVAC systems, and power distribution networks has further driven demand. As manufacturers aim for scalable and serviceable system architectures, panel mount SSRs are expected to retain their dominance in applications requiring flexible and robust relay performance.

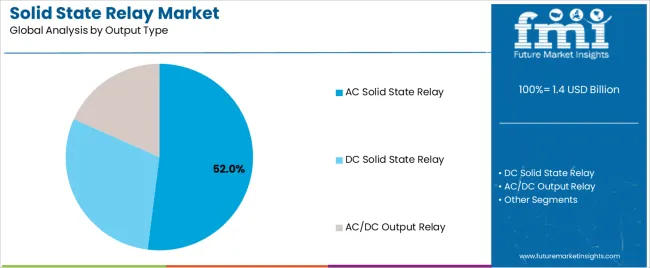

The AC Solid State Relay segment is projected to account for 52.0% of the market revenue in 2025, establishing its leadership among output types. The growth of this segment has been driven by the widespread application of AC SSRs in industrial and commercial systems that operate on alternating current power sources.

These relays have been adopted for their efficient load switching, arc-free operation, and reduced electromagnetic interference, making them suitable for sensitive and high-speed applications. Energy equipment manufacturers and process control industries have increasingly utilized AC SSRs for motor control, heating elements, and lighting systems.

Furthermore, product advancements enabling zero-cross switching and surge protection have enhanced performance reliability under varying load conditions. Regulatory trends promoting energy efficiency and reduced equipment downtime have further validated the segment’s use. As AC power remains the standard in most industrial and commercial environments, the AC Solid State Relay segment is expected to continue leading the output category.

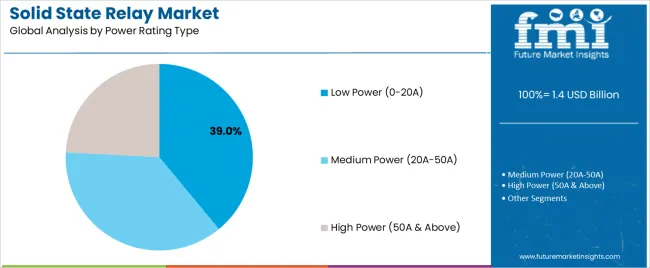

The Low Power (0–20A) segment is projected to capture 39.0% of the solid state relay market revenue in 2025, marking it as the top power rating category. This segment’s dominance has been influenced by the high demand for SSRs in compact, low-current applications such as consumer electronics, test equipment, and embedded control systems.

Electronics manufacturers have prioritized low power SSRs for their ability to offer high switching cycles, minimal heat generation, and compact form factor, which are crucial in constrained design environments. Research in thermal management and miniaturization has led to the development of more efficient low-power SSRs, enhancing their adoption in precise control systems.

Additionally, the growing penetration of smart appliances, building automation technologies, and medical devices has contributed to the steady consumption of low power SSRs. As end-users increasingly require energy-efficient, space-saving relay solutions, the Low Power (0–20A) segment is expected to maintain its stronghold across multiple low-current switching applications.

Despite the numerous advantages and growing demand, the industry faces several restraints. One of the primary challenges is the higher initial cost compared to traditional electromechanical relays. The cost-benefit analysis of SSRs versus traditional electromechanical relays reveals significant advantages in terms of reliability, efficiency, and lifespan.

However, the advanced technology and materials used in SSRs contribute to their higher price, which can be a barrier for cost-sensitive applications and small-scale industries.

The limited availability of raw materials and fluctuations in their prices can impact the manufacturing cost and supply chain stability, presenting solid state relay market risks and challenges that companies must navigate effectively. The role of new materials and technologies is pivotal in overcoming limitations of current SSRs.

Another significant restraint is the potential for heat generation in SSRs during operation, which can lead to thermal management issues and affect their long-term reliability. This necessitates additional cooling solutions, adding to the overall system cost and complexity.

The growing market for counterfeit electronic components and its impact on the reliability and safety of SSRs underscore the need for enhanced quality assurance and anti-counterfeiting measures in the industry. While SSRs offer many benefits, their performance can be affected by electrical noise and transient voltages, requiring careful design and implementation to ensure consistent operation.

The solid state relay market forecast indicates several significant trends shaping its growth trajectory. One significant trend is the increasing integration of Internet of Things (IoT) technologies, which is driving the demand for SSRs in smart devices and connected systems. These relays are essential for managing power and signals in IoT applications, offering the reliability and performance required for seamless operation.

Another trend is the shift toward miniaturization and high-density circuit design in electronics, which is propelling the development of smaller and more efficient SSRs. This trend is particularly evident in consumer electronics and automotive industries, where space-saving components are crucial.

Advancements in semiconductor technologies are leading to the development of next-generation SSRs with enhanced performance characteristics, such as higher voltage and current handling capabilities, improved thermal management, and greater durability.

The growing emphasis on energy efficiency and sustainability is promoting the use of SSRs, as they offer lower power consumption and longer lifespan compared to traditional electromechanical relays. In the industrial automation sector, the trend toward Industry 4.0 is boosting the demand, which is critical for achieving precise and reliable control in automated manufacturing processes.

The industry presents several opportunities driven by emerging technologies and evolving industry needs. One notable opportunity lies in the burgeoning field of electric vehicle (EV) charging infrastructure. As the adoption of EVs accelerates, there is a growing demand for reliable and efficient charging stations. SSRs are crucial in managing the high power requirements and ensuring the safe and efficient operation of these charging systems.

Another opportunity is in the development of advanced medical devices, where the need for precise and reliable switching solutions is paramount. SSRs can enhance the performance and safety of medical equipment, such as MRI machines and surgical instruments, creating significant industry potential in the healthcare sector.

The increasing penetration of 5G technology is another untapped potential applications for solid state relays in emerging industries. The deployment of 5G networks requires robust and efficient switching solutions to manage the complex and high-speed data transmission. SSRs can meet these demands, offering a lucrative opportunity for manufacturers.

The rise of smart grid technology and the modernization of power distribution networks present a significant opportunity. These relays can improve the efficiency and reliability of smart grids, enabling better energy management and future outlook for the solid state relay market.

Research reports on the solid state relay market in the United States indicate that the push toward energy efficiency and sustainability is driving the adoption. This is particularly evident in HVAC systems, lighting controls, and industrial automation, where these relays offer superior performance and reliability compared to traditional electromechanical relays.

A key trend impacting the industry is the rapid development of EV and the corresponding EV charging infrastructure in the United States. SSRs play a crucial role in EV charging stations, providing efficient and reliable power switching solutions. As the demand for EVs continues to rise in the country, the industry in the EV sector is expected to expand significantly.

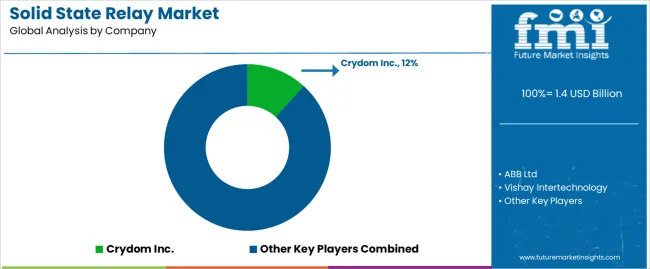

Several companies based in the United States are driving advancements with their recent developments, highlighting the solid state relay market investment potential. One such company is Crydom Corporation, known for its innovative solid state relay solutions across various industries, including industrial automation, HVAC, and transportation.

Crydom's focus on developing compact and high-performance relays has positioned it as a key player in the industry.

An important trend in the United Kingdom is the increasing emphasis on energy efficiency and sustainability across industries. It is one of the key factors to consider before investing in solid state relay market. The focus on reducing carbon emissions and optimizing energy usage in the United Kingdom is propelling the adoption of SSRs in power management and control systems.

Another trend is the emergence of smart grid technology and the modernization of electrical infrastructure in the United Kingdom. SSRs play a vital role in smart grids by providing efficient and precise switching solutions for power distribution and grid management. The integration of renewable energy sources and energy storage systems is further boosting the demand for SSRs in smart grid applications.

Several key players in the solid state relay market headquartered in the United Kingdom are contributing positively to the industry through their recent developments and innovations. One such company is Teledyne Relays, a prominent manufacturer of SSRs serving aerospace, defense, and industrial sectors. Teledyne Relays' commitment to providing reliable and high-performance relay solutions has solidified its position as a leading player in the industry.

Regional trends in the SSR market and growth opportunities in developing economies reveal that China’s emphasis on increasing manufacturing efficiency, reducing labor costs, and improving production processes is driving the demand in automation systems.

Additionally, China's focus on renewable energy and sustainable development is creating opportunities for SSRs in solar and wind power applications, where precise power management and control are essential.

The increasing adoption of electric vehicles (EVs) in China is also backing the industry. This is due to the impact of government regulations on energy efficiency standards and their influence on SSR adoption. The aim is to reduce pollution and promote clean transportation. This trend presents a lucrative opportunity for industry players, as EVs require reliable and efficient power management solutions for their charging infrastructure and battery management systems.

China is set to emerge as the most lucrative country for profit and target consumer base for industry players due to several factors. The sheer size of China's industrial sector and its rapid technological advancements create a vast industry for SSRs across industries such as manufacturing, automotive, and electronics.

Plus, China's growing middle class and urbanization trends are driving the demand for smart home technologies and IoT devices, where SSRs play a crucial role in power management and control.

Panel mount display packaging type holds the top solid state relay market share due to its ease of installation and space efficiency. These displays can be conveniently integrated into control panels and equipment without extensive modifications, making them ideal for applications with limited space.

Their placement on control panels provides easy access for operators to monitor relay status and settings, enhancing usability and simplifying maintenance tasks.

Panel mount displays offer clear visibility with easy-to-read screens or indicators, improving operational efficiency and reducing errors. They also integrate seamlessly with control systems and PLCs, allowing for real-time monitoring and control of SSRs.

Customization options, durability, and reliability in harsh industrial environments further contribute to their dominance in the industry. These provide tailored solutions for diverse industry needs while also reducing environmental impact compared to traditional relays.

AC solid state relay output type dominates the industry as it offers compatibility with a wide range of AC voltage applications. This makes them versatile and suitable for various industries such as HVAC, industrial automation, and power distribution. This compatibility eliminates the need for additional voltage conversion equipment, simplifying system design and reducing costs.

AC SSRs provide fast and precise switching capabilities, allowing for efficient control of AC loads without mechanical wear or noise associated with traditional electromechanical relays. This results in improved reliability and longevity of the relay system.

AC SSRs offer enhanced safety features such as built-in overload protection and isolation, ensuring safe operation in critical applications. These advantages, coupled with their compact size and ease of integration, make AC relay output type the preferred choice for efficient and reliable AC load control across diverse industrial sectors.

The market is fiercely competitive and exhibits both fragmentation and crowdedness due to numerous manufacturers offering diverse products. Companies are strategically innovating their offerings to enhance performance, efficiency, and reliability, targeting industries like automotive, aerospace, and renewable energy.

Market expansion into new regions and industry verticals is a key strategy to broaden customer reach and revenue streams, especially in emerging markets with increasing automation demand. Pricing strategies are pivotal, with solid state relay manufacturers balancing competitive pricing for standard products and value-added services to attract cost-conscious customers while ensuring profitability.

Strategies adopted by leading manufacturers to capture industry share include innovation, expansion, and optimization of pricing strategies. Additionally, mergers and acquisitions activity in the SSR market plays a pivotal role. These tactics are essential in navigating the dynamic and challenging competitive landscape of the industry, ensuring companies remain competitive and retain their industry share.

Industry Updates

Based on packaging type, the industry is trifurcated into panel mount, din rail mount, and PCB mount.

In terms of output type, the industry is categorized into AC solid state relay, DC solid state relay, and AC/DC output relay

Depending on power rating type, the industry is branched into low power (0-20A), medium power (20A-50A), and high power (50A & above)

Based on application, the industry is categorized into consumer application, cooking appliances, medical & healthcare sector, and automotive and transportation sector. The consumer application category is further branched into control power distribution, handling electrical devices, access control, elevator control, and others. The cooking appliances category is further segmented into microwave ovens, automatic coffee machines, and others. The medical & healthcare sector category is further divided into diagnosis & analysis devices, incubators, and others. The automotive and transportation sector category is further classified into electric vehicles, train control systems, I/O interfaces, and others.

A regional industry analysis is conducted in the key countries of North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan (APEJ), Japan, and the Middle East & Africa.

The global solid state relay market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the solid state relay market is projected to reach USD 1.8 billion by 2035.

The solid state relay market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in solid state relay market are panel mount, din rail mount and pcb mount.

In terms of output type, ac solid state relay segment to command 52.0% share in the solid state relay market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solid Sulphur Market Size and Share Forecast Outlook 2025 to 2035

Solid Terpene Resin Market Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Solid Board Market Size and Share Forecast Outlook 2025 to 2035

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Solid Vacuum Reclosers Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Solid White Films Market Analysis & Trends 2024-2034

Solid Bleached Board Market

Solid Oxide Fuel Cell Market

Solid Electrolyte Market

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Array Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

Solid State LiDAR Sensor Market Analysis Size and Share Forecast Outlook 2025 to 2035

Solid-State Lighting Market Size and Share Forecast Outlook 2025 to 2035

Solid State Drive Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lighting System Market Size and Share Forecast Outlook 2025 to 2035

Solid State Lasers Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA