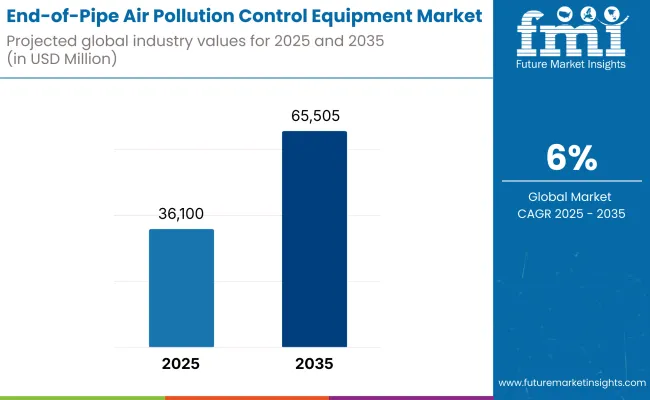

The end-of-pipe air pollution control equipment market is projected to be a highly lucrative market, registering a CAGR of 6.0% over the forecast period and is expected to be valued at USD 65,505 Million in 2035, from USD 36,100 Million in 2025. Cuts in air pollution during the manufacturing process should continue to be driven by improvements made in air pollution control technology and an increased demand for clean industrial processes.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 36,100 Million |

| Market Value (2035F) | USD 65,505 Million |

| CAGR (2025 to 2035 ) | 6.0% |

Such largely known facts implies the scarcity of widespread end-of-pipe technologies to contribute to the mitigation, if not abatement of source harmful emissions from human health/environment damaging industrial sectors. With an increasing number of industries around the world adopting sustainable processes, while more stringent environmental legislation is being put in place, the market is poised for growth.

North America is a big part of the world end-of-pipe air pollution control equipment market. Strict rules by groups like the EPA, the Clean Air Act, and the Canadian Environmental Protection Act create high demand for clean air tech. Factories and companies in the USA and Canada, like those in energy and travel, aim to meet these rules.

They use advanced tools like scrubbers, fabric filters, and electrostatic precipitators to cut down bad air stuff like dust and VOCs. Also, more focus on green living means the government gives money help to firms using clean tech. This support makes the market grow even more.

Europe leads the world in keeping air clean because it values nature. The European Union makes strict laws such as the Green Deal and Clean Air Policy. These rules cut harmful gas from factories, power plants, and cars. Countries like Germany, France, the UK, and the Netherlands work hard to use these new systems, driven by both laws and people wanting a cleaner world.

Europe's push for a circular economy and less harm to nature makes businesses use better tech to cut waste and use less energy.

Europe also uses smart tools like catalytic converters, scrubbers, and good filters to lower pollution. Money is being spent on new green tech to help companies meet their goals. This helps make the environment-friendly tools better and easier to get for European industries.

The end-of-pipe air pollution control equipment market in the Asia-Pacific zone is expected to have the fastest growth. Countries like China and India, as well as Japan and South Korea, are producing more factories, more cities, more cars, and creating more pollution. As these countries climb the wealth ladder, there’s a greater need to combat air pollution and comply with green rules.

The demand for control gear is high due to governments in India and China planning to reduce air pollution. In China, initiatives like the 13th Five-Year Plan for Ecological and Environmental Protection and the National Air Pollution Control Action Plan incentivize the shift to cleaner technologies.

Companies in the region, particularly in energy and manufacturing, are purchasing new air pollution control equipment to comply with the rules. Industrializing states have massive needs for cleaner technology, which drives the market. But the upfront costs of these techs are high and there is a lack of tech talent in many of the growing countries in the Asia-Pacific.

Technological Adaptation and High Initial Costs

Although end-of-pipe air pollution control equipment market gear has clear upsides, some firms struggle to use them. Installing top-notch air scrubbers can be very costly, especially for small and medium firms in developing areas. These systems often need special setups and expert knowledge to fit in with what is already there.

For firms with little money or limited access to top-end tech, the first cost of this gear may seem too much. Also, some modern tools might bring issues like using more power or being hard to keep up, which could put off buyers.

Stringent Environmental Regulations and Industrial Growth

The focus on being green is a big chance for the air pollution control market. Governments make stricter rules about air quality. Companies must follow these rules or face fines. This means companies need to spend more on pollution control systems. Industries now have to meet tight emission rules, so they need to use the latest tech. This is clear in new markets where industry and city growth needs cleaner tech.

Green buildings, switching to renewable energy, and the need for sustainable ways to make things also drive the need for air pollution control. Sectors like pharmaceuticals, cars, and chemicals, which have many rules, offer big chances for market growth.

The market for end-of-pipe air pollution control equipment is healthy from 2020 to 2024, as environmental regulations are increasingly stringent, and it needs to treat air pollution at industrial processes. The invention of smart crisis management technology that leverages smart city connectivity, ICT and industry 4 will create a steady market.

This market will grow between years 2025 and 2035, passed mainly by technology and just for simple-purpose of environment awareness, but the stricter and prevention measures about regulations associated with emitted canister of destruction considerable globle will be imposed Thanks. Furthermore, with increased awareness to improving air quality and public health, further investments within the air pollution management technologies are anticipated to increase.

Market Shifts: 2020 to 2024 vs. 2025 to 2035

| Key Dimensions | 2020 to 2024 |

|---|---|

| Technology Adoption | Implementation of scrubbers, electrostatic precipitators, and fabric filters |

| Industry Applications | Predominantly in power generation, manufacturing, and chemical processing |

| Geographic Demand | Significant demand in North America, Europe, and Asia-Pacific regions |

| Regulatory Environment | Enforcement of emission standards such as Euro 6 and EPA regulations |

| Competitive Landscape | Presence of key players like AAF International, Alstom SA, and FLSmidth Airtech |

| Material Innovation | Development of corrosion-resistant materials for equipment longevity |

| Environmental Concerns | Addressing pollutants like sulfur dioxide (SO₂) and nitrogen oxides (NOₓ) |

| Consumer Awareness | Growing public concern over air quality and health impacts |

| Supply Chain Dynamics | Global supply chains with manufacturing hubs in Asia-Pacific |

| Key Dimensions | 2025 to 2035 |

|---|---|

| Technology Adoption | Integration of advanced technologies like catalytic converters and regenerative thermal oxidizers |

| Industry Applications | Expansion into sectors like transportation, mining, and waste management |

| Geographic Demand | Emerging markets in Africa and Latin America experiencing increased adoption |

| Regulatory Environment | Introduction of more stringent global emission norms and local air quality initiatives |

| Competitive Landscape | Rise of regional players offering cost-effective and customized solutions |

| Material Innovation | Focus on materials that enhance efficiency and reduce operational costs |

| Environmental Concerns | Emphasis on controlling particulate matter (PM) and volatile organic compounds (VOCs) |

| Consumer Awareness | Increased demand for transparent reporting and corporate environmental responsibility |

| Supply Chain Dynamics | Localization of manufacturing to reduce costs and improve responsiveness |

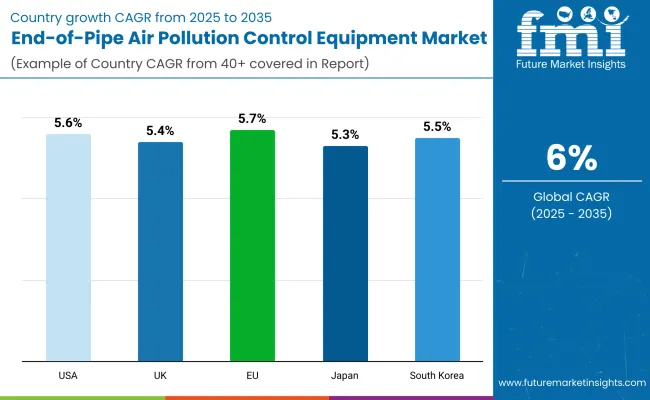

With strict environmental rules and growing industry, the USA end-of-pipe air pollution control equipment market is on the rise. Key reasons include the need to cut air pollution in making goods, power generation, and moving people or goods. The EPA and state agencies enforce emission rules and pollution controls.

New ideas are coming from clean air rules that demand better filters, scrubbers, and catalytic converters. There's also a push for energy-saving air pollution control gear.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

In the UK, the end-of-pipe air pollution control equipment market is moderately growing due to the presence of industrial emission reduction initiatives, improved air quality and adherence to EU air quality standards. The UK Environment Agency and various local governments oversee them.

Rising demand for baghouse filters, electrostatic precipitators, and flue gas desulfurization systems are among the major trends. The growing cognizance of the health issues resulting from air pollution is further driving industry adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

The end-of-pipe air pollution control equipment market in the EU grows due to the EU's promise to clean air, cut factory fumes, and reach green goals. Rules from the European Environment Agency (EEA) and EU laws like the Industrial Emissions Directive (IED) are key market forces.

Germany, France, and Italy top the market with big spends on air pollution tech in factories and power plants. More focus on green habits and clean energy boosts the need for better pollution controls.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.7% |

Japan’s end-of-pipe air pollution control equipment market is growing well. Strict rules, more industry, and new tech in air pollution control are helping it grow. Groups like the Ministry of the Environment (MOE) manage air quality rules and limits on emissions.

Trends show more use of better filters, carbon capture tech, and new low-smoke tools for cars and factories. Japan’s push for green tech is making the market grow even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

The end-of-pipe air pollution control equipment market in South Korea is growing fast. This is due to the government's rules to clean air and cut emissions from big factories. The Ministry of Environment works to make the air better and protect nature.

Some key trends are higher need for air cleaners, dust control tools, and energy-saving options for factories. South Korea also aims to improve pollution control tools in cities and factory areas.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

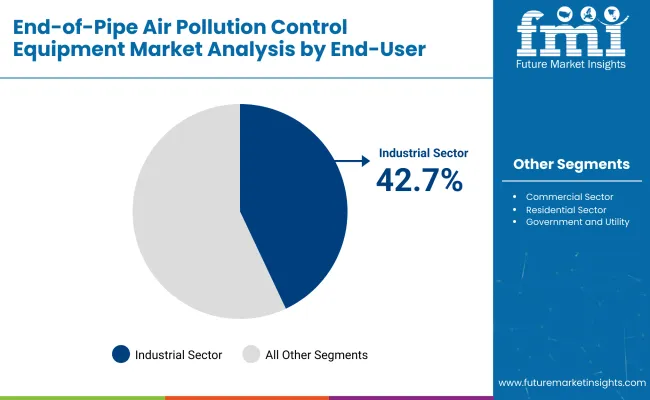

The global end-of-pipe air pollution control equipment market is growing at a rapid pace. The industrial segment, specifically manufacturing and processing plants, is the largest end-user, as companies offer reduction initiatives and devote efforts toward limiting their environmental footprint. Power systems and raw material refining are two major industries driving an increase in the manufacture of air pollution control equipment.

Market Share by End-User Industries (2025)

| End-User Industry | Market Share (2025) |

|---|---|

| Industrial Sector | 42.7% |

The industrial sector is the main part. This is because there is a growing need to follow environmental rules and make work better in the air pollution control equipment market. Air Pollution Control Systems for manufacturing plants, refineries, and chemical processing facilities.

In addition to adopting these technologies to meet regulatory requirements, scrubbers, filters, and electrostatic precipitators are also being implemented in the manufacturing sectors to address emissions associated with cleaner production methods. Demand in the industrial sector will remain encouraged by gradual investments into cleaner technologies and environmental sustainability.

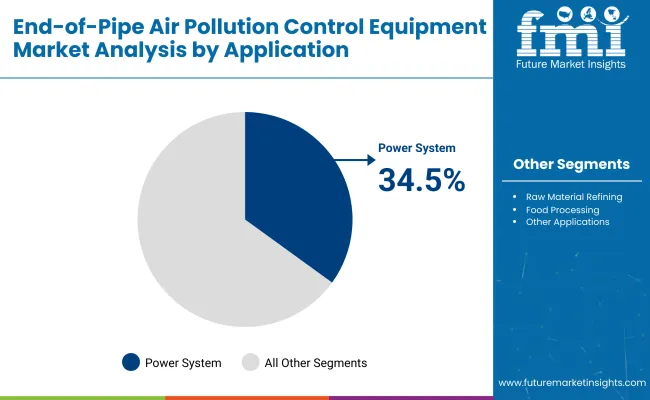

Market Share by Applications (2025)

| Application | Market Share (2025) |

|---|---|

| End-of-Pipe Air Pollution Control Equipment for Power Systems | 34.5% |

Air pollution control systems for power generation plants, particularly coal-fired plants, stand out as one of the largest applications segments. Conventional emissions control systems are critical for effective abatement of SO2, NOx, and PM - the most common pollution emitted from power generation.

Governments are implementing stricter emission standards, resulting in utility companies investing in additional capital in the form of end-of-pipe solutions such as flue gas desulfurization (FGD) units and selective catalytic reduction (SCR) systems to meet air quality standards. With the world moving towards cleaner energy sources, there is also a push towards innovation in pollution control technologies, making them more efficient and lowering emissions even further.

The market for end-of-pipe air pollution control equipment market is growing more due to strict rules and a global move towards greener practices. These tools clean the air before it goes out, helping meet air quality laws and cutting down harm to nature. The market will keep growing, with big chances in areas like power plants, cement, and factories where keeping emissions in check is key.

Top companies are working on new ways to filter and clean, like using scrubbers and static charge cleaners. They’re also adding new products and teaming up with others to grab more of the market, especially in new and fast-growing places. Both old and new companies are making better tech to handle the need for clean air systems.

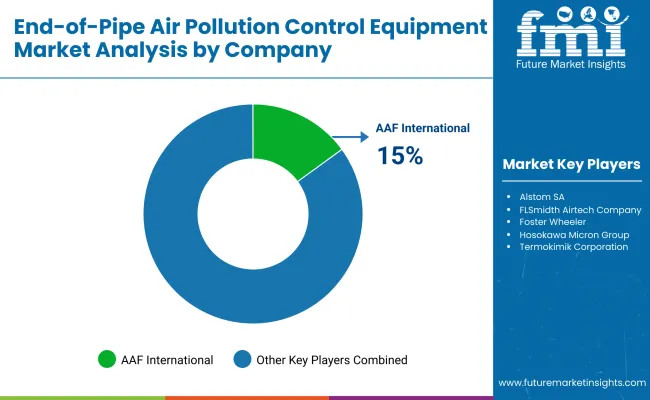

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AAF International | 15-20% |

| Alstom SA | 12-17% |

| FLSmidth Airtech Company | 10-14% |

| Foster Wheeler | 8-12% |

| Hosokawa Micron Group | 6-9% |

| Termokimik Corporation | 5-8% |

| Fisia Babcock Environment GmbH | 4-7% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| AAF International | In 2024, launched new high-efficiency air filters for power plants. In 2025, added more products with advanced multi-stage filters. |

| Alstom SA | In 2024, upgraded flue gas desulfurization systems for cement plants. In 2025, teamed up with big companies to give complete pollution control solutions. |

| FLSmidth Airtech Company | In 2024, made a cheap air pollution control system for cement plants. In 2025, brought out better tools to lower dust from factories. |

| Foster Wheeler | In 2024, launched a new electrostatic filter to meet tougher green rules. In 2025, expanded in new markets with smart deals. |

| Hosokawa Micron Group | In 2024, showed a modular air filter system for small factories. In 2025, grew in Asia with local making. |

| Termokimik Corporation | In 2024, gave new dry and wet scrubbers for better dust removal. In 2025, added more products for oil and gas fields. |

| Fisia Babcock Environment GmbH | In 2024, improved air pollution controls with better rust resistance. In 2025, made new deals in the Middle East for big power plants. |

Key Company Insights

AAF International (15-20%)

AAF International is a major player offering innovative filtration solutions for a wide range of industries, including power generation, oil and gas, and chemical processing.

Alstom SA (12-17%)

Alstom specializes in advanced air quality control technologies, focusing on industries such as cement and power generation, where pollution control requirements are most stringent.

FLSmidth Airtech Company (10-14%)

FLSmidth is at the top in cutting air pollution for cement plants. They give cheap and good ways to cut down emissions.

Foster Wheeler (8-12%)

Foster Wheeler have full services for air pollution control, using electrostatic filters and other high-tech filters.

Hosokawa Micron Group (6-9%)

Hosokawa Micron specializes in providing flexible and scalable air pollution control systems suitable for various industrial applications.

Termokimik Corporation (5-8%)

Termokimik is known for its scrubbing and filtration technologies, offering robust solutions for air pollution control in high-emission industries.

Fisia Babcock Environment GmbH (4-7%)

Fisia Babcock provides advanced air pollution control systems with an emphasis on corrosion resistance, enabling long-term reliability in harsh industrial environments.

Other Key Players (Combined)

Several other companies contribute to the dynamic landscape of the End-of-Pipe Air Pollution Control Equipment Market:

The market size was approximately USD 36,100 Million in 2025.

The market is projected to reach approximately USD 65,505 Million by 2035.

Key drivers include increasing industrialization, urbanization, and a greater emphasis on sustainability in manufacturing and energy sectors.

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa are key contributors to the market.

The market is anticipated to experience significant growth, driven by increasing industrialization, stringent environmental regulations, and growing awareness regarding air quality and health impacts.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Pollution Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Air Pollution Control Systems Providers

Air Pollution Control Systems Market – Applications & Growth Forecast 2025-2035

Air Traffic Control Equipment Market

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Air Audit Equipment Market Growth - Trends & Forecast 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Airborne Fire Control Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lift Control Devices Market

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne SATCOM Equipment Market

Riot Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dairy Processing Equipment Market Outlook – Growth, Demand & Forecast 2023-2033

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pollution Monitoring Equipment Market Insights – Size, Trends & Forecast 2025-2035

Airborne Warning and Control System Market Growth - Trends & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Aircraft Survivability Equipment (ASE) Market Size and Share Forecast Outlook 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA