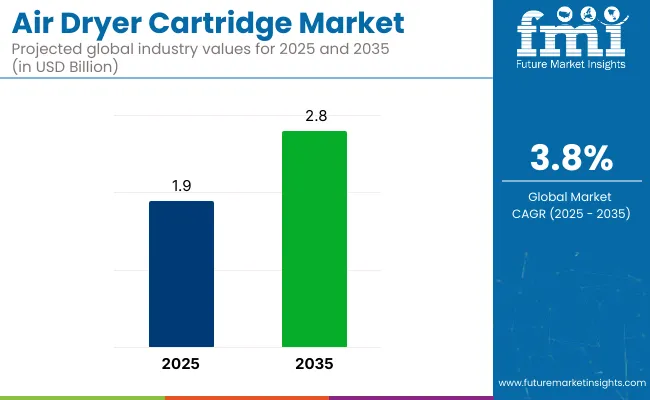

The air dryer cartridge market is projected to increase from USD 1.9 billion in 2025 to USD 2.8 billion by 2035, reflecting a CAGR of 3.8% during the forecast period.

Consistent growth is expected to be driven by the expanding demand in heavy-duty automotive, railways, and industrial compressed air systems. These cartridges, vital for protecting pneumatic equipment from moisture-related damage, are gaining traction as equipment longevity and maintenance efficiency become top priorities across sectors.

As of 2025, the air dryer cartridge market holds a modest yet essential share across its broader parent industries. Within the global compressed air treatment equipment market, it contributes around 6-8%, as cartridges are key components for moisture control in air brake and pneumatic systems. In the commercial vehicle aftermarket, the share is approximately 4-5%, driven by routine replacement demand in fleet maintenance.

Within the heavy-duty vehicle parts market, it accounts for 3-4%, owing to its use in trucks, buses, and off-highway vehicles. In the automotive components market, the share is smaller, about 1-2%, as it’s limited to specific applications. In the pneumatic systems market, air dryer cartridges make up 2-3%, supporting system longevity and performance across industrial and vehicular settings.

JörgSchömmel, Senior Range Manager - Automotive Aftermarket at MANN+HUMMEL, emphasized the importance of application-specific solutions in the air dryer cartridge segment: “Our basic cartridge is suitable for all applications with low compressed-air requirement marathon runners only need dry air, which is why the cost-effective basic solution is completely adequate.”

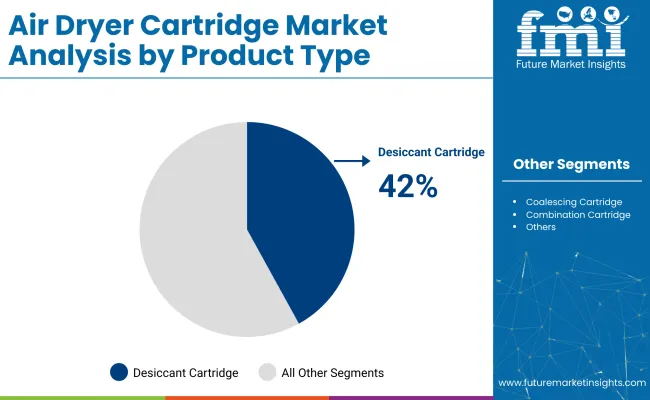

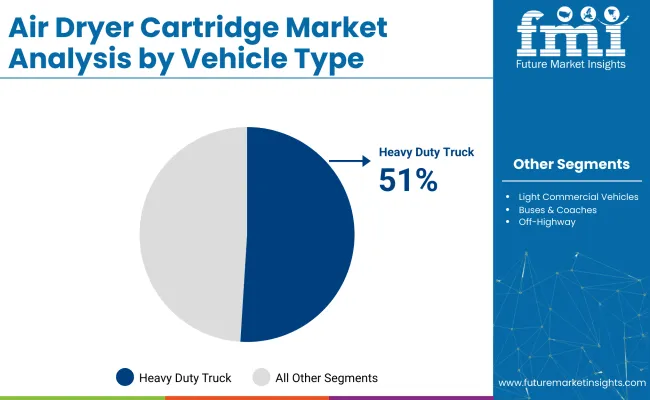

Desiccant-type air dryer cartridges are projected to lead the product type segment with a 42% share by 2025, while heavy-duty trucks are expected to dominate the vehicle type category with a 51% share.

Desiccant-type cartridges are expected to dominate the product type segment, capturing 42% of the global share by 2025. Designed to absorb moisture from compressed air systems, these cartridges have become essential in maintaining brake efficiency and overall air system performance.

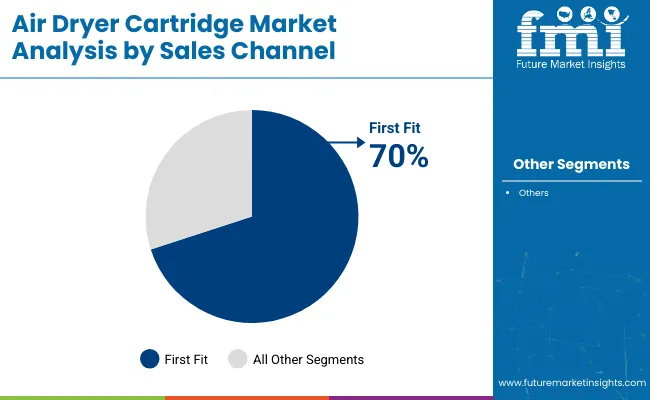

First fit installations are expected to dominate the sales channel segment, accounting for 70% of market share by 2025. Original equipment manufacturers have increasingly incorporated air dryer cartridges into new vehicle designs to ensure compliance and performance from day one.

Heavy-duty trucks are projected to lead the vehicle type segment with a 51% share by 2025. Air dryer cartridges have been widely installed in these vehicles to ensure brake line safety and air system longevity under high-stress driving conditions.

The air dryer cartridge market is experiencing consistent growth due to increased demand for moisture control in heavy-duty vehicles, industrial air systems, and rail applications. Cartridges play a critical role in preventing corrosion, improving pneumatic system efficiency, and extending the service life of air brake and compressor components.

Strong Demand from Commercial Vehicles and Rail Fleets

Air dryer cartridges are essential in heavy trucks, buses, and rail systems to remove moisture from compressed air before it reaches braking systems or auxiliary pneumatic components. Moisture-free air prevents corrosion and freezing, ensuring safe brake operation in extreme climates. Fleet operators are investing in high-performance cartridges to improve reliability and reduce maintenance frequency.

Growing Replacement Demand in Aftermarket and Maintenance Cycles

The aftermarket segment is seeing steady growth as cartridges require regular replacement to maintain system integrity. Workshops and service centers stock a wide range of OEM-compatible and performance-enhanced cartridges tailored to different vehicle types and usage conditions. Quick-change features and integrated oil separators are gaining popularity for ease of installation and added protection.

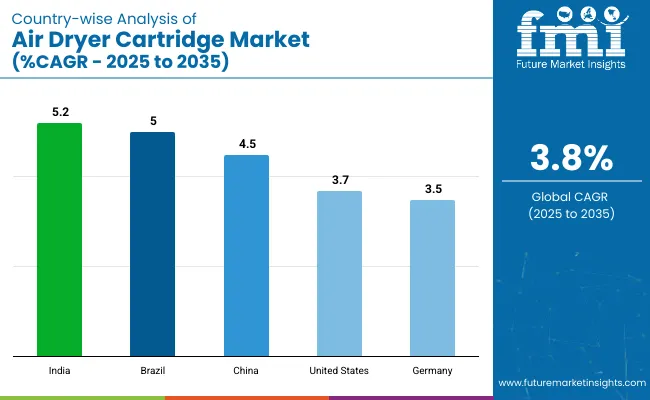

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.2% |

| Brazil | 5.0% |

| China | 4.5% |

| United States | 3.7% |

| Germany | 3.5% |

The global air dryer cartridge market is expected to expand at a steady pace between 2025 and 2035, supported by increasing demand for compressed air systems in automotive, rail, and industrial equipment. Air dryer cartridges are critical for removing moisture, oil, and particulates from compressed air, improving equipment longevity and brake system safety.

India leads growth among the top five countries with a CAGR of 5.2%, followed by Brazil (5.0%) and China (4.5%). Mature economies such as the United States (3.7%) and Germany (3.5%) are investing in replacement cycles and fleet safety upgrades.

BRICS countries such as China, India, and Brazil are driving demand through expansion in heavy-duty vehicles and rail infrastructure. OECD markets like the USA and Germany are focused on safety compliance, aftermarket standardization, and improved moisture removal efficiency.

The report covers detailed insights from over 40 countries. The five highlighted below represent key contributors to market development and application diversity.

India is projected to grow at a CAGR of 5.2%, driven by rising adoption in commercial vehicles, metro systems, and heavy equipment. As a BRICS and Emerging Market, India is expanding its national freight corridors and urban transit fleets, creating strong demand for air drying systems.

Local OEMs are integrating dryer cartridges into brake systems to improve safety performance, especially under humid and dust-prone conditions. The aftermarket segment is witnessing growth due to higher service penetration across tier 2 and tier 3 cities.

Brazil’s market is forecast to grow at a CAGR of 5.0%, supported by demand in long-haul trucks, buses, and agricultural machinery. As a BRICS country, Brazil is investing in fleet modernization and road transport upgrades, which include enhanced pneumatic brake systems.

Local distributors are expanding their product range to include multi-stage dryer cartridges tailored for tropical and high-humidity regions. Maintenance cycles are also shortening due to challenging road and climate conditions, fueling replacement demand.

China is expected to grow at a CAGR of 4.5%, fueled by rapid development in rail logistics, construction equipment, and highway vehicles. As a BRICS and Industrial Manufacturing Hub, China is seeing strong demand for OEM-grade cartridges in commercial and light-duty trucks.

Domestic cartridge suppliers are scaling up automated production for consistent filter media layering and desiccant fill levels. Government mandates around brake performance and emissions are further supporting market expansion.

The USA market is forecast to expand at a CAGR of 3.7%, supported by consistent aftermarket demand and regulatory focus on vehicle braking systems. As an OECD and Agri-food Tech Pioneer, the USA maintains strict DOT compliance requirements for moisture-free air in commercial vehicle systems.

Fleets operating in variable climates are turning to high-efficiency cartridges with integrated oil separation capabilities. The aftermarket remains a strong contributor, with increased adoption of cartridge kits offering simplified installation and longer service intervals.

Germany is projected to grow at a CAGR of 3.5%, reflecting stable demand across freight trucks, regional trains, and municipal fleets. As part of the EU27, OECD, and Sustainability-Focused Nations, Germany is focused on enhancing air quality within brake systems through low-leakage cartridges.

The country’s leadership in component standardization and quality compliance is influencing domestic cartridge suppliers to innovate in filter media and desiccant life extension. Demand is also growing in electric buses and lightweight utility vehicles.

The air dryer cartridge market is moderately consolidated, with prominent players such as Mann+Hummel, Mahle Aftermarket, and Knorr-Bremse leading due to their strong distribution networks and advanced filtration technologies. Mann+Hummel offers high-performance air dryer cartridges designed to protect commercial vehicle brake systems by removing moisture and contaminants.

Mahle Aftermarket delivers cartridges with multi-stage drying and oil separation systems, ensuring optimal performance in diverse climates. Knorr-Bremse specializes in OEM-grade air treatment systems that extend vehicle service life and improve braking safety.

ZF and Bosch Aftermarket enhance product quality through integrated diagnostics and durability-focused designs. Emerging Asian players such as FONHO and Zhejiang Gongzheng Auto Parts provide cost-competitive alternatives, particularly targeting the aftermarket segment.

Recent Air Dryer Cartridge Market News

In April 2024, MANN-FILTER expanded its product portfolio by launching a fourth air dryer cartridge variant. The new basic white cartridge was introduced to the independent aftermarket and joins the existing black (standard), silver (with coalescing filter), and gold (premium) models to meet a broader range of compressed-air system requirements.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.9 billion |

| Projected Market Size (2035) | USD 2.8 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Product Types Analyzed (Segment 1) | Desiccant Cartridge, Coalescing Cartridge, Combination Cartridge, Pre-filter Cartridge |

| Sales Channels Analyzed (Segment 2) | First Fit, Aftermarket |

| Vehicle Types Analyzed (Segment 3) | Light Commercial Vehicles (LCVs), Heavy-Duty Trucks, Buses & Coaches, Off-Highway/Construction Vehicles |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Mann + Hummel, Mahle Aftermarket, Knorr- Bremse, ZF, FONHO, Zhejiang Gongzheng Auto Parts, Bosch Aftermarket |

| Additional Attributes | Dollar sales by product and vehicle type, rising demand for air brake protection, increased aftermarket replacements, and widespread use in heavy-duty and off-highway transport applications. |

The market is segmented by product type into desiccant cartridge, coalescing cartridge, combination cartridge, and pre-filter cartridge.

Based on the sales channel, the market is divided into first fit and aftermarket segments.

By vehicle type, the market includes light commercial vehicles (LCVs), heavy-duty trucks, buses and coaches, and off-highway or construction vehicles.

Geographically, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The global air dryer cartridge market is valued at USD 1.9 billion in 2025.

The market is projected to reach USD 2.8 billion by 2035.

The market is expected to grow at a CAGR of 3.8% from 2025 to 2035.

Desiccant-type air dryer cartridges hold the largest share, accounting for 42% of the market in 2025.

India is projected to register the highest CAGR at 5.2% between 2025 and 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in the Hair Dryer Industry

Air Blade Dryer Market Size, Share, and Forecast 2025 to 2035

USA Hair Dryer Market Outlook – Size, Trends & Growth 2025-2035

China Hair Dryer Market Trends – Demand, Growth & Forecast 2025-2035

India Hair Dryer Market Trends – Demand, Growth & Forecast 2025-2035

Membrane Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Compressed Air Filtration and Dryer System Market Growth - Trends & Forecast 2025 to 2035

Air Compressor Filters and Compressed Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Cartridge Heating Element Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA