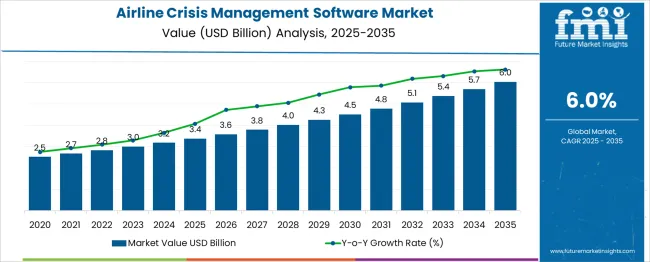

The Airline Crisis Management Software Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. A compound absolute growth analysis shows steady and consistent expansion throughout the forecast period. Between 2025 and 2030, the market grows from USD 3.4 billion to USD 4.5 billion, contributing USD 1.1 billion in growth, with a CAGR of 5.8%.

This early-stage growth is driven by the increasing need for advanced software solutions in the airline industry to enhance operational efficiency, respond to crises effectively, and maintain passenger safety and satisfaction. Factors such as rising passenger numbers, stricter regulations, and the demand for more resilient operational systems contribute to this growth.

From 2030 to 2035, the market continues its upward trajectory, expanding from USD 4.5 billion to USD 6.0 billion, contributing USD 1.5 billion in growth, with a slightly higher CAGR of 6.6%. This phase benefits from increased reliance on digital solutions for crisis management, especially as airlines face more complex challenges related to global disruptions, cybersecurity, and climate-related events.

The overall compound absolute growth analysis highlights a market poised for steady expansion, with strong early growth driven by the demand for sophisticated crisis management systems and continued demand in the latter half of the forecast period.

| Metric | Value |

|---|---|

| Airline Crisis Management Software Market Estimated Value in (2025 E) | USD 3.4 billion |

| Airline Crisis Management Software Market Forecast Value in (2035 F) | USD 6.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The airline crisis management software market is gaining momentum due to the rising frequency of operational disruptions, regulatory mandates for aviation safety, and the growing need for real-time decision-making tools. Airlines are increasingly prioritizing digital solutions to proactively manage incidents, ensure regulatory compliance, and maintain customer trust during emergencies.

Cloud-native platforms are enabling scalable deployment, faster updates, and global accessibility, making them ideal for airlines operating across multiple geographies. As air travel rebounds post-pandemic, operational resilience and continuity planning have become critical focus areas, fueling investments in crisis software suites.

Furthermore, integration with data analytics and AI-driven forecasting tools is improving response accuracy and resource allocation during critical events, helping airlines mitigate downtime and reputation risk.

The airline crisis management software market is segmented by deployment mode, software, functionality, end-use, and geographic regions. The deployment mode of the airline crisis management software market is divided into Cloud-based and On-premises. In terms of software, the airline crisis management software market is classified into Incident management, Emergency response, Business continuity, Risk management, and others.

Based on functionality, the airline crisis management software market is segmented into Real-time monitoring, Communication management, Resource management, Data analytics and reporting, Compliance management, and others. The end-use of the airline crisis management software market is segmented into Commercial, Private, Cargo, Charter, and others.

Regionally, the airline crisis management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

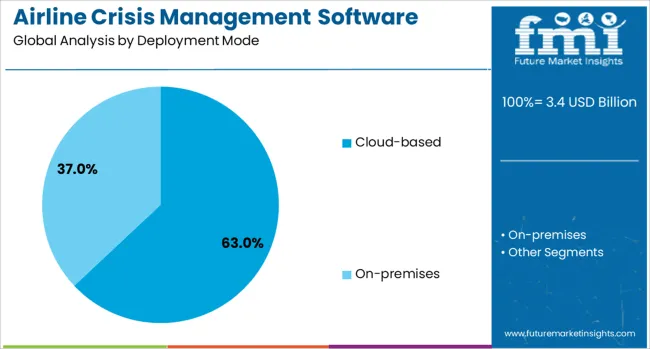

Cloud-based solutions are projected to account for 63.0% of the airline crisis management software market revenue by 2025, making them the leading deployment mode. This dominance is driven by the flexibility, cost-efficiency, and rapid deployment that cloud infrastructure offers.

Cloud-based platforms support remote access and real-time collaboration among geographically dispersed airline teams, ensuring a coordinated response during disruptions.

Additionally, the ability to scale resources dynamically and integrate with other digital aviation systems like flight ops, crew scheduling, and passenger communication tools is further enhancing their adoption.

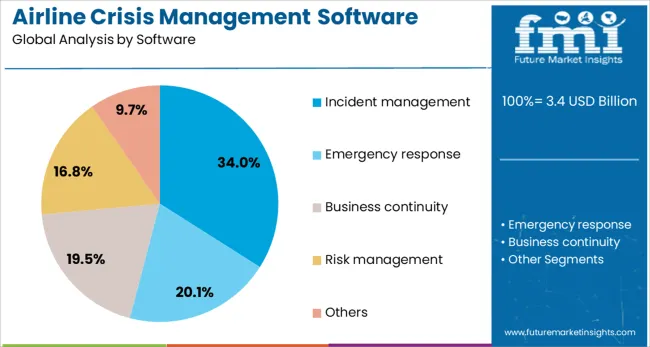

Incident management is expected to capture 34.0% of the market share by 2025, making it the top-performing software category within the airline crisis management domain. Airlines are leveraging incident management tools to streamline workflows, ensure regulatory reporting compliance, and reduce human error in emergency situations.

These platforms provide centralized dashboards, automated alert systems, and integrated communication modules that enhance operational transparency during high-pressure events.

The increasing complexity of airline operations, coupled with regulatory oversight from aviation bodies, has made structured incident response capabilities a critical requirement.

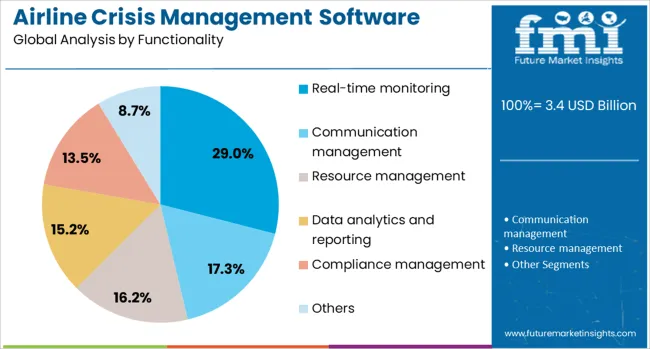

Real-time monitoring functionality is anticipated to represent 29.0% of the market in 2025, ranking as the leading feature segment. This functionality enables airlines to track and analyze unfolding crises across multiple domains—such as safety incidents, cyber threats, or environmental disruptions-in real time.

The ability to visualize data streams from aircraft systems, weather updates, passenger alerts, and airport operations provides actionable intelligence for crisis teams.

Enhanced situational awareness through real-time dashboards and predictive alerts allows for faster, more accurate decisions, improving overall crisis response effectiveness.

The airline crisis management software market is expanding due to the increasing need for airlines to handle emergencies and disruptions in operations effectively. These software solutions enable airlines to plan, manage, and respond quickly to crises, such as natural disasters, technical failures, or security threats, minimizing operational downtime and improving passenger safety. As regulations around safety and emergency response become more stringent, airlines are turning to technology to ensure compliance and enhance operational efficiency. Despite challenges like integration complexities and high initial costs, opportunities are rising with advancements in AI, real-time data analytics, and cloud-based systems.

The growing demand for efficient and rapid crisis response mechanisms primarily drives the airline crisis management software market. Airlines face increasing pressure to handle emergencies such as flight delays, cancellations, security threats, and natural disasters that can disrupt operations and passenger safety. The ability to respond swiftly and coordinate efforts is crucial in minimizing the negative impact on operations. Moreover, with the rise in regulatory requirements surrounding safety and emergency preparedness, airlines must adopt advanced technologies that comply with these standards. Crisis management software helps streamline communication, optimize resource allocation, and ensure airlines are ready to respond effectively to emergencies.

Thermoelectric conversion efficiency remains constrained around 6–8 %, causing cost-per-watt metrics to be 24 % higher than conventional cooling or power generation methods. Precious material usage, such as bismuth telluride and lead telluride, has inflated module cost structures. Dense module stacking and module-to-system integration complexity added procurement friction in 18 % of compact electronics design cycles. Thermal interface mismatches reduced performance in up to 12 % of retrofit installations, demanding precise cooling plate engineering. Lower efficiency in high-temperature industrial contexts limited adoption, where more efficient heat-to-electric systems were required.

The airline crisis management software market presents significant opportunities through advancements in AI, real-time analytics, and cloud-based solutions. The integration of AI enables predictive capabilities, allowing airlines to anticipate potential disruptions before they occur and respond proactively. Real-time data analytics offers valuable insights into operational performance, helping airlines optimize their crisis response strategies. Additionally, the rise of cloud-based solutions is making crisis management software more scalable, cost-effective, and accessible to airlines of all sizes. As airlines look to improve operational efficiency and enhance their crisis management capabilities, these technological advancements present long-term growth prospects in the market.

A significant trend in the airline crisis management software market is the increasing adoption of automated and collaborative tools that enhance communication and decision-making during emergencies. Airlines are implementing automated workflows that streamline the response process, reduce manual intervention, and ensure consistency across different teams. Collaborative tools, such as cloud-based platforms and communication apps, enable real-time coordination between ground control, flight crews, and emergency responders, improving efficiency and reducing response times. The shift towards more integrated, automated, and data-driven crisis management solutions is shaping the future of the market, helping airlines minimize operational disruptions and improve safety during critical situations.

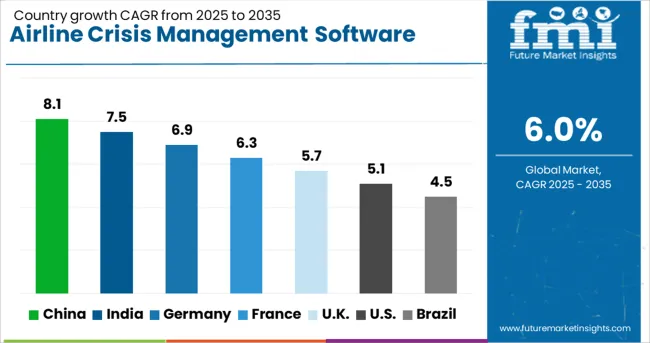

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

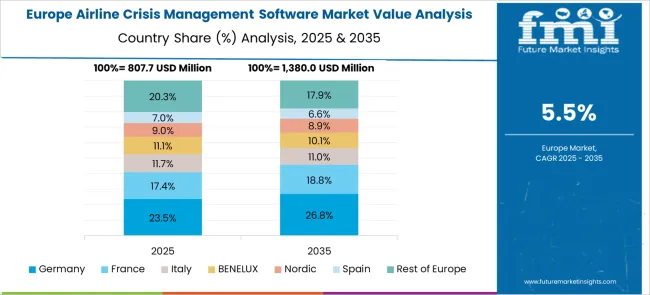

The airline crisis management software market is projected to grow significantly, with strong contributions from China, India, and developed economies like France, the UK, and the USA China leads the market with a growth rate of 7.0%, followed by India at 6.5%, and France at 5.5%. The UK is expected to grow at 4.9%, while the United States shows a growth rate of 4.4%. The expanding aviation industries in China and India, alongside modernization and increasing air travel, are key drivers for this growth. Developed markets such as France, the UK, and the USA are also experiencing steady growth, driven by rising demands for operational efficiency and advanced crisis management systems. The analysis spans 40+ countries, with the leading markets shown below.

China is expected to grow at a CAGR of 8.1% through 2035 in the airline crisis management software market, driven by the rapid expansion of the aviation industry and the increasing need for efficient crisis management solutions. As China becomes one of the largest air travel markets globally, the demand for advanced software systems to handle crises such as delays, cancellations, and emergencies is on the rise. The country’s focus on improving air travel safety and operational efficiency, coupled with the rapid adoption of digital technologies in the aviation sector, further accelerates the need for such systems. With the growing number of domestic and international flights,

India is projected to grow at a CAGR of 7.5% through 2035 in the airline crisis management software market. As one of the fastest-growing aviation markets, India’s aviation industry is increasingly focusing on crisis management solutions to enhance operational efficiency, improve customer service, and ensure safety during disruptions. The expansion of both domestic and international air traffic is creating more complex operational environments, pushing airlines to adopt advanced software for managing emergencies, delays, and cancellations. The growing emphasis on technological advancements, as well as increased competition among airlines, drives the need for better crisis management systems.

France is projected to grow at a CAGR of 6.3% through 2035 in the airline crisis management software market. As a key player in the European aviation sector, France continues to modernize its aviation infrastructure to manage the increasing complexity of air traffic. With a focus on safety and operational efficiency, French airlines are adopting advanced software solutions for crisis management. The integration of digital technologies in crisis management systems allows airlines to handle delays, cancellations, and emergencies effectively while minimizing operational losses. France’s strict regulatory environment, combined with a high standard of passenger service, is driving the demand for more sophisticated crisis management software.

The United Kingdom is projected to grow at a CAGR of 5.7% through 2035 in the airline crisis management software market. The UK’s aviation industry, which is one of the largest in Europe, is increasingly adopting digital crisis management solutions to handle disruptions in air travel, such as delays, cancellations, and emergencies. With high expectations for passenger safety and efficiency, UK-based airlines are turning to advanced software tools to streamline crisis management processes, enhance communication, and reduce operational disruptions. The market growth is supported by the UK’s focus on innovation in air travel systems and increasing investments in aviation technology.

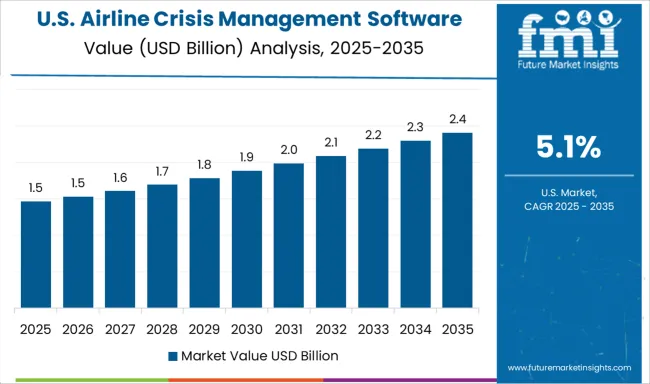

The United States is projected to grow at a CAGR of 5.1% through 2035 in the airline crisis management software market. The USA leads the global aviation industry, and its large-scale air travel operations require sophisticated crisis management solutions. As USA-based airlines continue to modernize their fleet and improve operational efficiency, they are increasingly turning to advanced software tools to manage delays, cancellations, and emergency situations. The growing complexity of air travel systems, along with rising passenger expectations, makes it imperative for airlines to invest in these systems. USA regulations that mandate high standards for operational efficiency and passenger safety are driving the demand for crisis management software.

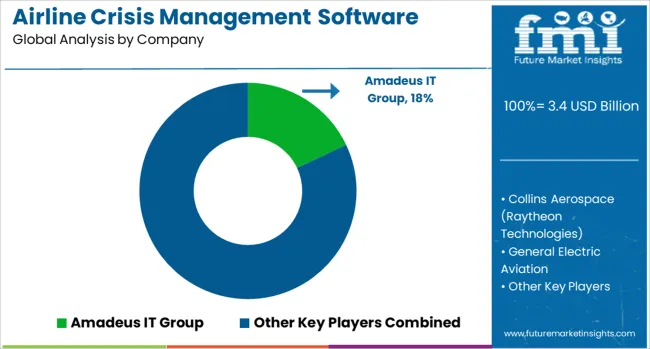

The airline crisis management software market is driven by leading technology companies specializing in solutions that help airlines manage operational disruptions, enhance decision-making, and improve response times during crises. Amadeus IT Group is a key player, offering integrated software solutions that enable airlines to handle emergencies effectively, optimizing operations and ensuring passenger safety.

Collins Aerospace (Raytheon Technologies) provides advanced crisis management platforms, focusing on real-time data analytics, communication, and coordination during flight disruptions and emergencies. General Electric Aviation and Honeywell Aerospace are major contributors, offering advanced software solutions that help airlines manage crisis situations by providing data-driven insights, communication tools, and situational awareness to improve response strategies.

Hexagon AB focuses on providing software solutions designed for air traffic management, which can be critical in times of crisis, offering tools to optimize airspace usage and improve operational responses during disruptions. IBM and Microsoft are prominent technology providers, offering cloud-based crisis management platforms that integrate AI, big data, and machine learning to help airlines anticipate and mitigate potential crises, improve incident response, and streamline recovery processes.

Rockwell Collins and Sabre Corporation also provide advanced software solutions, enhancing airline operations by enabling better communication, passenger management, and logistical coordination during emergencies.SITA offers crisis management solutions that focus on communication and information-sharing across airline staff, passengers, and ground services, ensuring coordinated responses to crises in real-time.

Competitive differentiation in this market is driven by the ability to offer real-time data analytics, cloud-based scalability, integration with existing airline systems, and the speed at which crises can be managed. Barriers to entry include the need for significant R&D investment, integration with existing airline infrastructure, and compliance with aviation regulations. Strategic priorities include expanding cloud-based capabilities, improving software integration with airline operations, and incorporating AI to predict and respond to emerging crises.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Deployment Mode | Cloud-based and On-premises |

| Software | Incident management, Emergency response, Business continuity, Risk management, and Others |

| Functionality | Real-time monitoring, Communication management, Resource management, Data analytics and reporting, Compliance management, and Others |

| End-use | Commercial, Private, Cargo, Charter, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amadeus IT Group, Collins Aerospace (Raytheon Technologies), General Electric Aviation, Hexagon AB, Honeywell Aerospace, IBM, Microsoft, Rockwell Collins, Sabre Corporation, and SITA |

| Additional Attributes | Dollar sales by software type (real-time monitoring, communication tools, predictive analytics, decision-making support) and end-use segments (commercial airlines, cargo airlines, private jets). Demand dynamics are driven by the increasing frequency of operational disruptions, growing demand for enhanced decision-making tools, and the need for efficient crisis response systems in aviation. Regional trends show strong growth in North America and Europe, where major airlines are investing heavily in crisis management technology, while Asia-Pacific is expanding due to rising air travel and modernization of airline operations. |

The global airline crisis management software market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the airline crisis management software market is projected to reach USD 6.0 billion by 2035.

The airline crisis management software market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in airline crisis management software market are cloud-based and on-premises.

In terms of software, incident management segment to command 34.0% share in the airline crisis management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crisis Management Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Cyber Crisis Management Market by Type, Application, Vertical, and Region-Forecast through 2035

Airline Reservation Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Grant Management Software Market - Trends, Size & Forecast 2025 to 2035

Video Management Software Market

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Church Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA