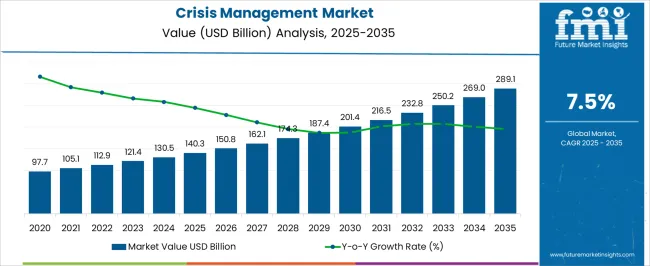

The Crisis Management Market is estimated to be valued at USD 140.3 billion in 2025 and is projected to reach USD 289.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. This five-year period records incremental annual increases averaging around 6-7%, reflecting rising investments in risk mitigation, emergency preparedness, and organizational resilience across various sectors.

Companies are increasingly prioritizing crisis response strategies, which drives steady demand for crisis management solutions. From 2026 to 2035, the market continues its upward trajectory, with YoY growth rates slightly accelerating as businesses and governments face more complex challenges. By 2030, the market is valued at USD 201.4 billion and expands to USD 289.1 billion by 2035. Annual growth rates during this phase range from 7-8%, fueled by heightened regulatory pressures, growing recognition of crisis impact, and adoption of comprehensive crisis management frameworks.

This sustained growth underlines the critical role crisis management plays in maintaining operational continuity and protecting organizational reputation amid evolving threats.

| Metric | Value |

|---|---|

| Crisis Management Market Estimated Value in (2025 E) | USD 140.3 billion |

| Crisis Management Market Forecast Value in (2035 F) | USD 289.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

Organizations are prioritizing business continuity planning, real-time threat monitoring, and coordinated response mechanisms to mitigate operational disruption and reputational damage. Regulatory frameworks across regions are mandating robust incident response strategies, especially in critical infrastructure and public sector entities. Simultaneously, digital transformation is enabling scalable, cloud-based platforms that integrate communication, analytics, and resource deployment in a unified dashboard.

Enterprises are also investing in workforce training, simulation tools, and decision intelligence systems to increase organizational resilience. Looking forward, integration with AI-powered predictive analytics and cross-sector data collaboration is expected to unlock greater situational awareness and agility in crisis response protocols.

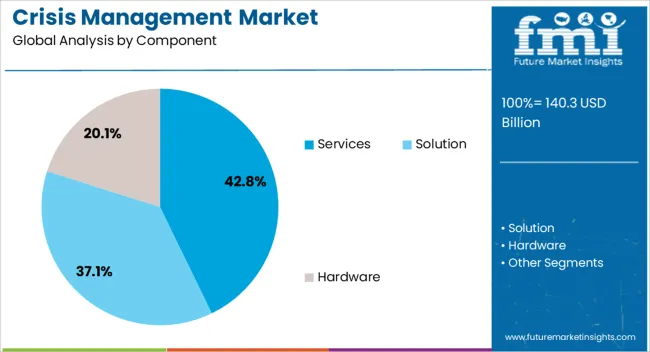

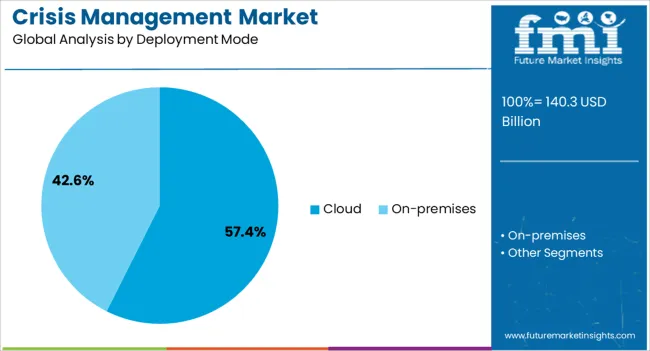

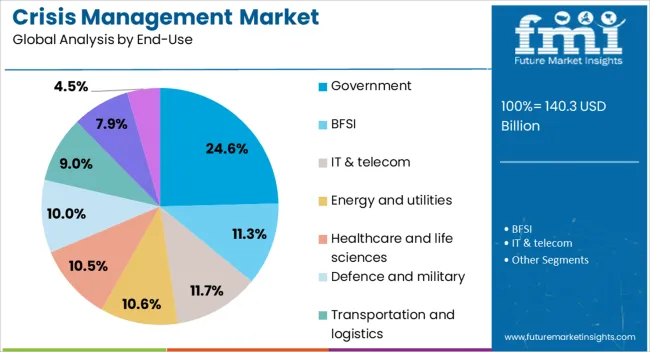

The crisis management market is segmented by component, deployment mode, end-use, and geographic regions. By component, the crisis management market is divided into Services, Solutions, and Hardware. In terms of deployment mode, the crisis management market is classified into Cloud and On-premises. The end-use of the crisis management market is segmented into Government, BFSI, IT & telecom, Energy and utilities, Healthcare and life sciences, Defence and military, Transportation and logistics, Manufacturing, and Others. Regionally, the crisis management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Services are projected to hold 42.80% of the total market share in 2025, making them the dominant component in the crisis management landscape. This leadership is driven by the rising demand for strategic consulting, operational support, and technology integration across public and private sector organizations.

As threats become more multifaceted, reliance on external experts for risk assessment, continuity planning, and tailored training programs has grown significantly. Managed services such as outsourced monitoring, incident command coordination, and emergency communication systems have enabled organizations to scale response capabilities without overextending internal teams.

The continuous evolution of threats has also necessitated regular plan updates, compliance audits, and simulation exercises, further reinforcing the critical role of professional service providers in maintaining operational readiness.

Cloud deployment is expected to account for 57.40% of the market revenue by 2025, making it the leading deployment mode. This growth is being fueled by the need for scalable, real-time, and cost-efficient crisis response platforms that support remote access and multi-location coordination.

Cloud-based solutions enable continuous system updates, rapid integration with emergency communication channels, and flexible data storage factors that have become essential in the post-pandemic digital environment. Increased adoption of hybrid work models and mobile command centers has further highlighted the advantages of cloud-native tools in ensuring business continuity.

Moreover, enhanced cybersecurity features and regulatory-compliant architectures have improved trust in cloud platforms among highly regulated industries and government agencies.

The government segment is forecast to lead the market by 2025 with a 24.60% revenue share, reflecting its pivotal role in national security, disaster management, and public safety. Governments are increasingly investing in integrated crisis management systems that facilitate early warning alerts, resource deployment, and citizen communication during emergencies.

The rise in climate-related disasters, public health crises, and civil unrest has intensified the need for scalable and responsive systems tailored for cross-department coordination. Public sector agencies are also emphasizing compliance with international standards such as ISO 22301 and investing in inter-agency training programs to strengthen preparedness.

The availability of dedicated funding, strategic mandates, and global partnerships is expected to maintain government dominance in driving technology deployment and policy alignment within the crisis management ecosystem.

The crisis management market is expanding as organizations across industries recognize the critical need for preparedness against operational, reputational, and security threats. Increasing incidents of natural disasters, cyberattacks, and public health emergencies are driving demand for robust crisis response solutions. Businesses are investing in comprehensive planning, communication tools, and risk assessment technologies to mitigate impacts. While digital transformation supports rapid information flow and decision-making, challenges in coordination and stakeholder communication persist. Market growth is fueled by increasing regulatory pressures and heightened focus on organizational resilience, with technology providers developing integrated platforms that combine analytics, communication, and recovery management.

Organizations are shifting from reactive to proactive crisis management strategies to minimize downtime and financial loss during disruptions. Comprehensive risk assessments, scenario planning, and continuous monitoring are becoming standard practices. Companies are adopting technology-driven tools to identify vulnerabilities and simulate response plans. The increasing complexity of supply chains and global interdependencies amplifies the need for advanced crisis preparedness solutions. Industries such as healthcare, finance, and manufacturing are leading adoption efforts due to their critical operations and regulatory requirements. Proactive approaches help build resilience and trust with customers, partners, and regulators by demonstrating preparedness and accountability.

Effective communication during a crisis remains one of the most difficult aspects for organizations. Multiple stakeholders, including employees, customers, regulators, and media, require timely and accurate information. Fragmented communication channels and unclear responsibility assignments often lead to misinformation or delayed responses. Crisis management solutions are evolving to integrate multi-channel communication platforms that enable rapid, centralized messaging. However, ensuring message consistency and maintaining stakeholder engagement during high-pressure situations continue to challenge organizations. Training and regular drills are essential to improve coordination and reinforce roles, but resource constraints and organizational silos can limit these efforts.

Advancements in data analytics, artificial intelligence, and cloud computing are enhancing crisis management capabilities. Predictive analytics help identify emerging risks, while real-time dashboards offer situational awareness to decision-makers. Mobile applications facilitate on-the-ground coordination and rapid alerts. Integration of social media monitoring provides early warnings and reputation management tools. However, integrating diverse systems into a cohesive platform requires significant investment and technical expertise. Vendors focus on creating scalable, user-friendly solutions that can adapt to various industries and crisis scenarios. Technology adoption is accelerating, with organizations recognizing the value of data-driven insights for informed, agile crisis response.

Emerging economies are witnessing increased awareness and investment in crisis management solutions due to rising economic activities and vulnerability to natural disasters and political instability. Growing regulatory focus on workplace safety, environmental protection, and business continuity drives demand. Localized solutions tailored to cultural, linguistic, and infrastructural needs enhance adoption in these regions. Collaboration with government agencies and international organizations fosters comprehensive risk management ecosystems. Additionally, small and medium enterprises are increasingly recognizing the importance of crisis preparedness, creating a broader customer base. Penetrating these markets requires strategic partnerships and flexible pricing models to address diverse economic conditions and organizational capabilities.

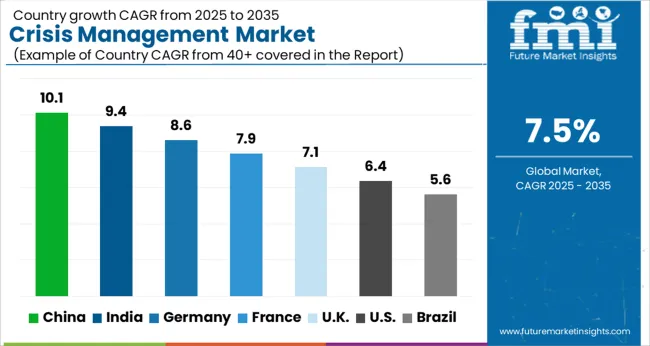

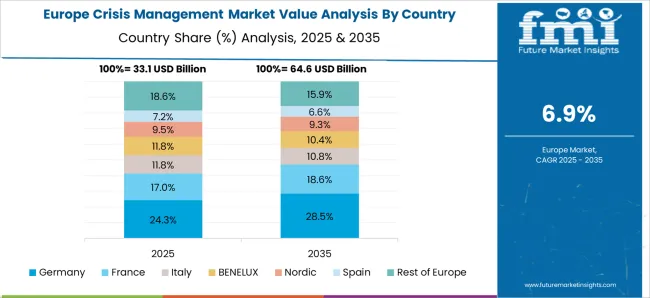

The global crisis management market is growing at a 7.5% CAGR, driven by increasing awareness of organizational risks and the need for effective response strategies. China leads with 10.1% growth, supported by expanding corporate sectors and government initiatives. India follows at 9.4%, fueled by rising demand for risk mitigation and disaster preparedness solutions. Germany records 8.6% growth, reflecting advanced regulatory frameworks and technological innovation. The United Kingdom grows at 7.1%, driven by strong governance and business continuity planning. The United States, a mature market, shows 6.4% growth, shaped by established crisis response systems and evolving security challenges. These countries collectively influence market trends through enhanced risk assessment, regulatory compliance, and technology integration. This report includes insights on 40+ countries; the top countries are shown here for reference

China crisis management market is expanding rapidly at a 10.1% CAGR due to increasing industrial complexity and rising awareness of risk preparedness. Businesses across manufacturing, technology, and infrastructure sectors are investing heavily in robust crisis response systems to handle emergencies ranging from natural disasters to cyberattacks. The government is encouraging adoption of advanced software and services that enhance resilience and ensure business continuity. Compared to Western countries, China sees accelerated digital transformation in crisis management, with AI-powered analytics and real-time monitoring becoming mainstream. Large enterprises are integrating crisis management into overall corporate governance, while SMEs are gradually increasing investments. Training programs and simulation drills are widely adopted to prepare employees for crisis scenarios. Rising regulatory requirements around safety and data security also contribute to the growing market. As a result, China leads global demand for innovative, scalable crisis management solutions.

India crisis management market grows at a strong 9.4% CAGR, driven by increasing corporate awareness and government initiatives focused on disaster preparedness. The country faces frequent natural disasters and infrastructure challenges, leading businesses and public sector organizations to invest in crisis response systems. Indian companies are adopting cloud-based crisis management software to improve communication and coordination during emergencies. Compared to China, adoption of digital tools is rapidly increasing but still developing, especially among SMEs. Training and awareness campaigns run by government bodies and industry groups enhance preparedness at multiple levels. The rise in cyber threats also propels demand for integrated crisis management solutions that address both physical and digital risks. Public-private partnerships help in sharing best practices and technology, further strengthening the market. The combination of growing risk complexity and regulatory pressures supports steady market expansion.

Germany crisis management market grows steadily at an 8.6% CAGR, supported by strict regulatory frameworks and high corporate governance standards. German organizations prioritize comprehensive risk management that integrates crisis response planning with compliance and business continuity strategies. Compared to Asian markets, Germany has a longer history of mature crisis management practices supported by well-established standards and certifications. Demand is strong for software platforms that offer scenario simulation, communication management, and incident tracking. Public sector and critical infrastructure sectors are key adopters, leveraging advanced analytics and AI to improve threat detection and response times. Increasing focus on cybersecurity and data privacy also influences market dynamics. Collaborative exercises between government agencies and private firms help refine crisis response capabilities. The market growth reflects a balance between innovation and regulatory compliance in crisis preparedness.

United Kingdom crisis management market expands at a 7.1% CAGR, driven by growing corporate emphasis on resilience and risk mitigation. Businesses across sectors adopt integrated crisis management platforms that combine risk assessment, communication, and recovery planning. Compared to Germany, UK organizations place more focus on reputational risk and media management during crises. Government agencies actively promote crisis preparedness through regulations and public awareness programs. Cloud-based solutions gain popularity for enabling remote access and real-time updates. Training programs focusing on crisis communication and stakeholder engagement improve organizational readiness. The rising complexity of global risks, including pandemics and cyber threats, increases demand for flexible and scalable crisis management systems. Insurance companies also encourage adoption by linking coverage terms to crisis preparedness levels. This ecosystem supports steady market growth in the UK

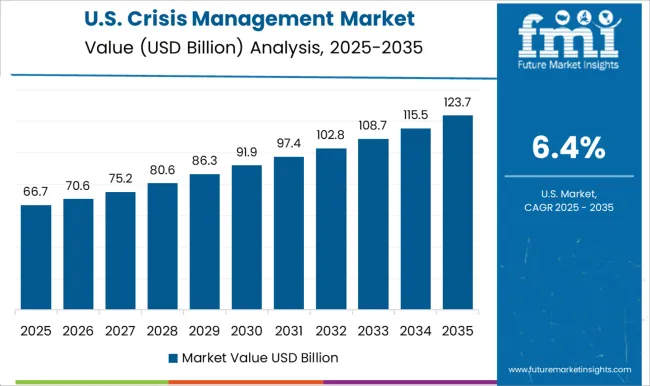

United States crisis management market is growing at a 6.4% CAGR, supported by strong demand from corporate, healthcare, and government sectors. USA organizations adopt comprehensive crisis management solutions that integrate emergency response, risk analytics, and business continuity. Compared to European markets, the USA sees higher emphasis on technological innovation, including AI, machine learning, and predictive analytics. Large corporations and critical infrastructure operators invest heavily in crisis simulation and digital communication tools. Public sector agencies coordinate multi-agency responses using centralized platforms. Increasing cyberattack threats and natural disasters drive continuous market expansion. The USA also leads in developing standards and certifications for crisis management professionals. As a result, the market reflects a blend of advanced technology adoption and mature regulatory frameworks, positioning the USA as a major global player.

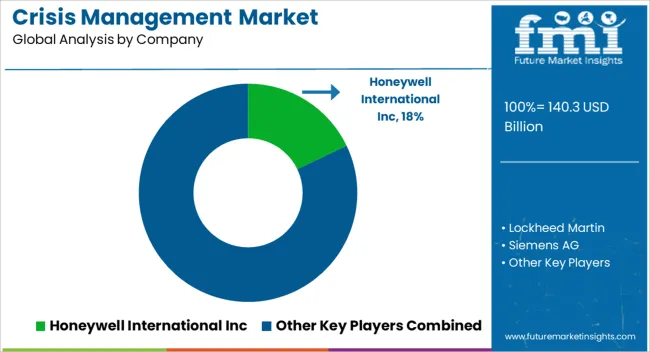

The crisis management market is dominated by several key players known for their comprehensive solutions that address emergency response, risk mitigation, and public safety. Honeywell International Inc. and Lockheed Martin are prominent suppliers, offering advanced technology-driven crisis management systems tailored for government agencies and large enterprises. Their solutions often integrate real-time data analytics, command and control platforms, and secure communication networks.

Siemens AG and IBM Corporation bring strong expertise in digital transformation and IoT, providing smart infrastructure and AI-powered crisis management tools that enhance situational awareness and decision-making during emergencies. Motorola Solutions, Inc., and Johnson Controls specialize in communication and security solutions, delivering reliable hardware and software that facilitate coordinated responses in crisis situations.

Eaton and Hexagon AB contribute by offering critical power management and geospatial analytics, respectively, ensuring operational continuity and precise incident mapping. IT services firm LTIMindtree and GIS specialist Esri provide software and consulting services that enable organizations to implement scalable, data-driven crisis management frameworks. Contrasting these suppliers, companies like Honeywell and Lockheed Martin focus more on integrated defense-grade systems, while firms such as Esri and LTIMindtree emphasize software platforms and analytics.

Motorola and Johnson Controls excel in communication and security hardware, whereas Siemens and IBM blend infrastructure with cutting-edge AI solutions, collectively shaping a robust, multifaceted crisis management market.

Organizations are investing in simulation software and crisis response training to prepare employees and leadership teams for high-pressure scenarios. Virtual and augmented reality technologies are being incorporated into these training programs, providing a more immersive experience for crisis management preparation.

| Item | Value |

|---|---|

| Quantitative Units | USD 140.3 Billion |

| Component | Services, Solution, and Hardware |

| Deployment Mode | Cloud and On-premises |

| End-Use | Government, BFSI, IT & telecom, Energy and utilities, Healthcare and life sciences, Defence and military, Transportation and logistics, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc, Lockheed Martin, Siemens AG, IBM Corporation, Motorola Solutions, Inc., Johnson Controls, Eaton, Hexagon AB, LTIMindtree, and Esri |

| Additional Attributes | Dollar sales vary by sector, including BFSI, manufacturing, cybersecurity, public services, and healthcare; by function, spanning risk assessment, compliance, business continuity, crisis communication, and recovery; by deployment model, such as on-premise, cloud-based, and hybrid solutions; and by region, with North America, Europe, and Asia-Pacific leading. Growth is driven by increasing natural disasters, cyber threats, regulatory pressures, and demand for real-time response capabilities. |

The global crisis management market is estimated to be valued at USD 140.3 billion in 2025.

The market size for the crisis management market is projected to reach USD 289.1 billion by 2035.

The crisis management market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in crisis management market are services, _training & consulting, _eo design and integration, _support & maintenance, solution, _disaster recovery & business continuity, _fire and hazmat, _perimeter intrusion detection, _emergency/mass notification, _web-based emergency management, _geospatial, hardware, _first responder tools, _satellite-assisted equipment, _vehicle-ready gateways and _emergency response radars.

In terms of deployment mode, cloud segment to command 57.4% share in the crisis management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cyber Crisis Management Market by Type, Application, Vertical, and Region-Forecast through 2035

Airline Crisis Management Software Market Size and Share Forecast Outlook 2025 to 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA