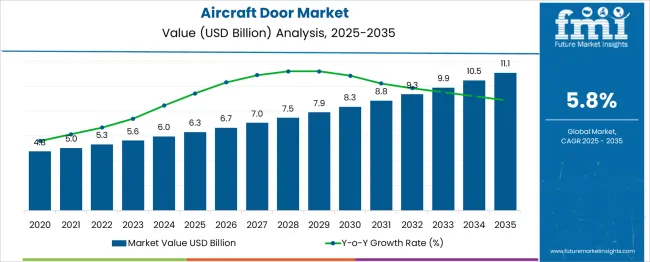

The Aircraft Door Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 11.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 6.3 billion to USD 8.3 billion, driven by increasing air traffic and advancements in lightweight, durable materials for aircraft doors. Year-on-year analysis indicates steady growth, with values reaching USD 6.7 billion in 2026 and USD 7.0 billion in 2027, supported by the expanding fleet sizes and the need for improved safety and operational efficiency in modern aircraft. By 2028, the market is expected to reach USD 7.5 billion, advancing to USD 7.9 billion in 2029 and USD 8.3 billion by 2030.

Innovations in door technologies, such as enhanced sealing systems, electric actuation, and fire-resistant materials will reinforce growth. The ongoing focus on reducing weight and improving fuel efficiency in aircraft will further drive the demand for optimized door solutions. These dynamics position the aircraft door market as a key component of the aerospace industry, offering opportunities for manufacturers to innovate in response to evolving regulatory standards and operational requirements.

| Metric | Value |

|---|---|

| Aircraft Door Market Estimated Value in (2025 E) | USD 6.3 billion |

| Aircraft Door Market Forecast Value in (2035 F) | USD 11.1 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The aircraft door market is witnessing stable expansion, influenced by increasing aircraft production, safety protocol upgrades, and the growing complexity of fuselage integration systems. Demand is being sustained by rising passenger traffic and corresponding fleet modernization initiatives, particularly in the commercial aviation sector.

Regulatory focus on emergency evacuation standards, structural redundancy, and weight optimization has driven manufacturers to invest in advanced materials and integrated actuation technologies. Ongoing developments in aerospace composites and digital engineering are enabling precision design of lighter, more durable door systems that support long-term fuel efficiency and compliance.

Strategic collaborations between OEMs and Tier-1 suppliers are further enabling lifecycle enhancements, while retrofitting opportunities in older fleets present incremental aftermarket growth. As next-generation aircraft platforms prioritize aerodynamic efficiency and smart control systems, door architecture is expected to evolve to support these broader operational and safety mandates.

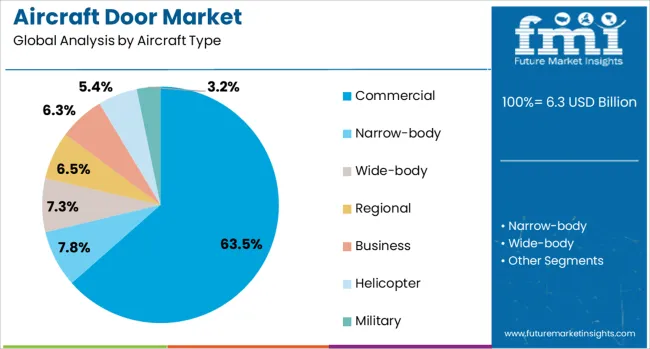

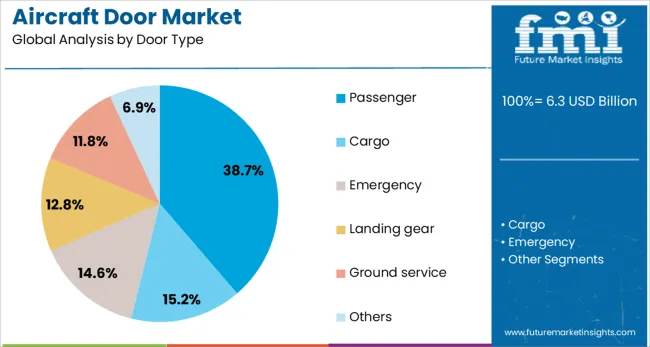

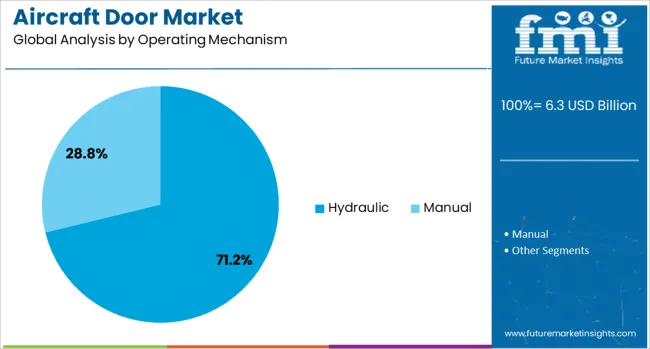

The aircraft door market is segmented by aircraft type, door type, operating mechanism, distribution channel, and geographic regions. By aircraft type, the aircraft door market is divided into Commercial, Narrow-body, Wide-body, Regional, Business, Helicopter, and Military. In terms of door type, the aircraft door market is classified into Passenger, Cargo, Emergency, Landing gear, Ground service, and Others. Based on the operating mechanism, the aircraft door market is segmented into Hydraulic and Manual. The distribution channel of the aircraft door market is segmented into OEM and Aftermarket. Regionally, the aircraft door industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The commercial segment is expected to lead the market by contributing 63.5% of the total revenue in 2025. This dominance is being driven by increased global air passenger movement, strong order books for narrow-body and wide-body jets, and ongoing fleet renewal strategies by major airlines.

Commercial aircraft require multiple door configurations for boarding, service, and emergency exit purposes, resulting in higher unit demand per aircraft. Enhanced focus on cabin safety and comfort, along with new generation aircraft featuring composite fuselages, has made door systems a critical element in weight management and pressure resistance.

Additionally, rising intercontinental travel and regional connectivity programs are prompting emerging economies to expand their commercial fleets, further sustaining this segment's leadership.

Passenger doors are projected to hold 38.7% of the total market share in 2025, establishing them as the most utilized door type across aircraft platforms. Their leadership stems from mandatory integration in all commercial aircraft for boarding, deplaning, and emergency egress.

These doors must meet stringent aviation safety standards concerning rapid deployment, structural integrity, and pressure sealing. Innovations in smart locking mechanisms, pressure sensors, and plug-type configurations have improved operational reliability and reduced manual intervention during operation.

Lightweight materials and seamless integration into fuselage design are enhancing fuel efficiency while complying with modern design constraints. As airline fleets grow and regulatory standards tighten, the focus on optimized and easily maintainable passenger door systems is expected to intensify.

Hydraulic systems are forecast to dominate with 71.2% of the aircraft door market revenue in 2025, positioning them as the primary operating mechanism. This lead is attributed to their superior force transmission capability, reliability under pressure, and established use in large aircraft door operations.

Hydraulic actuation allows for consistent performance across variable altitude and temperature conditions, critical for aircraft door deployment and sealing integrity. These systems have become standard in managing high-load doors such as cargo and passenger entries, where precision and automation are critical.

Enhanced system designs with compact actuators and integrated safety redundancies have improved their overall operational value. Despite emerging interest in electromechanical alternatives, hydraulic mechanisms continue to offer unmatched efficiency for large, high-frequency aircraft applications.

The aircraft door market is experiencing growth driven by the increasing demand for lightweight and durable components in the aviation industry. In 2024 and 2025, growth was supported by advancements in material science, particularly the use of composite materials. Opportunities lie in the expansion of the commercial and defense aviation sectors. Emerging trends include the integration of automated systems in aircraft doors and increased demand for customized solutions. However, high manufacturing costs, stringent regulatory requirements, and challenges in supply chain management remain significant market restraints.

The primary growth driver is the increasing demand for lightweight, durable components that improve aircraft fuel efficiency. In 2024 and 2025, the focus on reducing aircraft weight led to the widespread adoption of composite materials in aircraft door construction. These materials offer enhanced strength-to-weight ratios, improving performance and fuel consumption. As the aviation industry continues to prioritize fuel efficiency, the demand for lightweight aircraft doors remains a significant driver of market growth.

Opportunities are emerging in both the commercial and defense aviation sectors. In 2025, demand for aircraft doors was boosted by the growth in air travel and increasing defense contracts. Commercial airlines sought to reduce weight and enhance safety features in aircraft doors, while defense contractors focused on specialized designs for military aircraft. These developments suggest that manufacturers targeting both sectors with customized, efficient solutions are well-positioned to capture significant market share.

Emerging trends include the integration of automated systems and the demand for customized aircraft doors. In 2024, the aviation industry began to adopt automation for more precise, efficient door operations, reducing the need for manual intervention. Additionally, airlines increasingly sought doors designed to meet specific aircraft requirements, pushing manufacturers to offer tailored solutions. These trends highlight the shift toward automation and personalized components, aimed at improving operational efficiency and meeting the diverse needs of the aviation industry.

Market restraints include high manufacturing costs and stringent regulatory requirements. In 2024 and 2025, the complexity of designing and manufacturing high-performance aircraft doors with advanced materials drove up costs. Additionally, the need to comply with stringent safety and certification standards in the aviation industry created barriers to market entry for smaller players. These challenges underscore the importance of cost-effective production methods and regulatory navigation for manufacturers to compete effectively in the market.

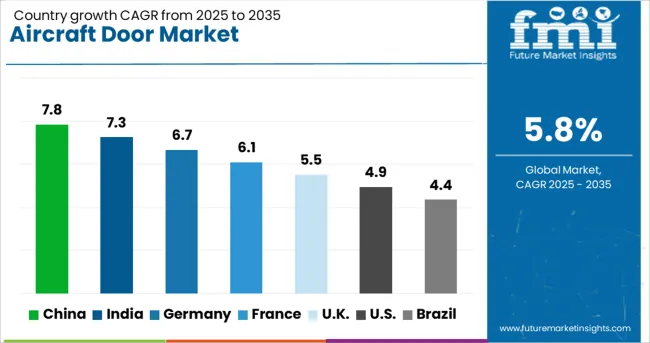

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global aircraft door market is projected to grow at 5.8% CAGR from 2025 to 2035. China leads with 7.8% CAGR, driven by the rapid expansion of the aviation industry and increasing demand for both commercial and military aircraft. India follows at 7.3%, supported by rising air travel demand and growing aerospace manufacturing capabilities. Germany records 6.7% CAGR, with a focus on advanced materials and design innovations for aircraft doors. The United Kingdom grows at 5.5%, while the United States posts 4.9%, reflecting steady demand in mature markets with a focus on lightweight and energy-efficient designs. Asia-Pacific leads growth due to a booming aviation sector, while Europe and North America focus on technological innovations and safety features. This report includes insights on 40+ countries; the top markets are shown here for reference.

The aircraft door market in China is forecasted to grow at 7.8% CAGR, driven by the rapid expansion of commercial aviation and the increasing production of aircraft. The government’s initiatives to boost the domestic aerospace industry and attract global aviation manufacturers further accelerate market growth. In addition, the growing demand for fuel-efficient, lightweight aircraft doors and the development of smart doors with enhanced safety features contribute to market expansion.

The aircraft door market in India is projected to grow at 7.3% CAGR, supported by the country's increasing air travel demand and the growth of its aerospace manufacturing sector. The rise of low-cost carriers and the modernization of existing fleets drive the need for advanced and lightweight aircraft doors. India’s growing role as a manufacturing hub for regional aircraft and components further contributes to the demand for innovative and cost-effective aircraft door solutions.

The aircraft door market in Germany is expected to grow at 6.7% CAGR, driven by the country’s strong aerospace manufacturing industry and increasing focus on safety and efficiency. Germany’s focus on advanced materials, including composite and lightweight metals, leads to innovations in aircraft door technologies. Additionally, the rise of smart aircraft doors, which offer automated features and enhanced security, further contributes to market growth.

The aircraft door market in the United Kingdom is projected to grow at 5.5% CAGR, supported by steady demand for aircraft doors in both commercial and military aircraft sectors. The UK’s aerospace industry focuses on producing high-performance and lightweight doors to reduce fuel consumption and improve aircraft efficiency. Additionally, the rise of next-generation aircraft with larger cabins and advanced safety features drives demand for modern, automated, and energy-efficient aircraft door solutions.

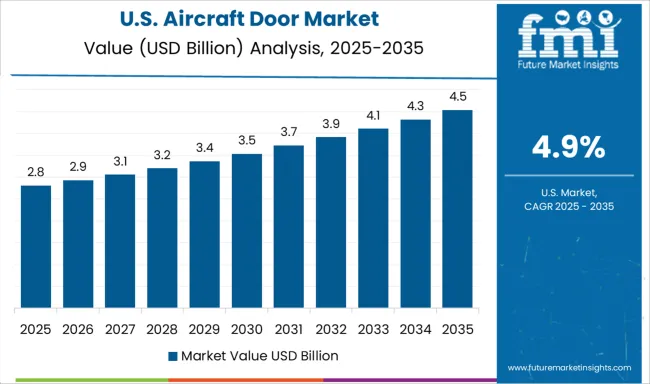

The aircraft door market in the United States is projected to grow at 4.9% CAGR, reflecting steady demand in a mature aerospace sector. The increasing focus on improving fuel efficiency and safety in commercial and military aircraft drives the demand for lightweight and energy-efficient aircraft doors. Additionally, the U.S. government’s investments in aerospace innovation, coupled with increasing international air travel, contribute to the adoption of advanced aircraft door technologies.

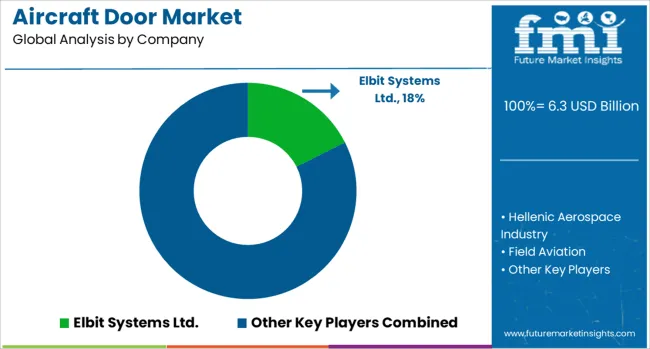

The aircraft door market is dominated by Airbus SE, which secures its leadership through a comprehensive range of high-performance aircraft door systems designed for both commercial and military applications. Airbus’s dominance is supported by its expertise in integrating advanced materials and technologies that ensure safety, durability, and efficiency in aircraft door designs. Key players such as Mitsubishi Heavy Industries Ltd., Bombardier Aerospace, Elbit Systems Ltd., and Saab AB maintain significant market shares by offering innovative solutions, including emergency exit doors, cargo doors, and cabin door systems, that meet the stringent regulations and operational requirements of the aerospace industry. These companies focus on weight reduction, automation, and reliability to enhance overall aircraft performance and safety.

Emerging players like Hellenic Aerospace Industry, Field Aviation, KF Aerospace, Apex Industries, and CHC Group Ltd. are strengthening their market positions by delivering specialized, cost-effective door solutions for both new aircraft and retrofit projects. Their strategies include providing customizable options for regional and private aircraft, as well as enhancing production capabilities to cater to growing demand in the military aviation sector. Market growth is driven by increasing aircraft production rates, rising demand for passenger comfort and safety, and advancements in door mechanisms that support faster turnaround times at airports. Continuous innovation in composite materials and lightweight technologies is expected to further shape competitive dynamics in the global aircraft door market.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.3 Billion |

| Aircraft Type | Commercial, Narrow-body, Wide-body, Regional, Business, Helicopter, and Military |

| Door Type | Passenger, Cargo, Emergency, Landing gear, Ground service, and Others |

| Operating Mechanism | Hydraulic and Manual |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Elbit Systems Ltd., Hellenic Aerospace Industry, Field Aviation, KF Aerospace, Mitsubishi Heavy Industries Ltd., Saab AB, Airbus SE, Apex Industries, Bombardier Aerospace, and CHC Group Ltd. |

| Additional Attributes | Dollar sales by door type and aircraft model, demand dynamics across commercial and military aviation, regional trends in aircraft door installations, innovation in lightweight and energy-efficient door designs, impact of regulatory standards on safety features, and emerging use cases in automated and smart aircraft doors. |

The global aircraft door market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the aircraft door market is projected to reach USD 11.1 billion by 2035.

The aircraft door market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in aircraft door market are commercial, narrow-body, wide-body, regional, business, helicopter and military.

In terms of door type, passenger segment to command 38.7% share in the aircraft door market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Door Dampers Market

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA