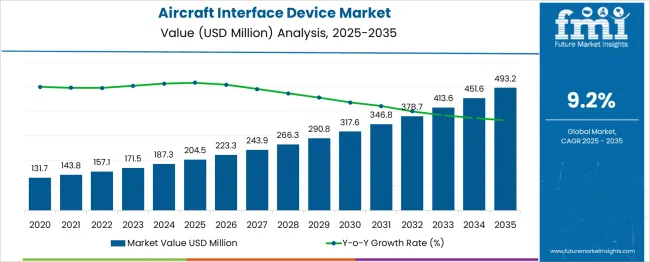

The Aircraft Interface Device Market is estimated to be valued at USD 204.5 million in 2025 and is projected to reach USD 493.2 million by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period. Inflection point mapping reveals key transitions in the market’s growth trajectory. Between 2025 and 2030, the market expands from USD 204.5 million to USD 317.6 million, contributing USD 113.1 million in growth, with a CAGR of 9.3%. This early growth is fueled by the increasing demand for advanced communication systems, real-time data sharing, and enhanced connectivity within aircraft systems, driven by rising air traffic and evolving aviation safety standards.

The first inflection point occurs around 2030, when the market reaches USD 317.6 million, signaling a shift toward more rapid adoption of integrated aircraft interface devices as airlines and aircraft manufacturers prioritize modernization and enhanced performance. From 2030 to 2035, the market continues to expand from USD 317.6 million to USD 493.2 million, adding USD 175.6 million in growth, with a CAGR of 9.3%. The second inflection point indicates a period of sharp acceleration as industry standards mature, technological advancements improve performance, and global demand for smarter, more efficient aircraft systems increases. This phase is characterized by the widespread adoption of aircraft interface devices for data integration, real-time diagnostics, and optimized flight operations, reflecting a strong acceleration in the later years of the market’s growth.

| Metric | Value |

|---|---|

| Aircraft Interface Device Market Estimated Value in (2025 E) | USD 204.5 million |

| Aircraft Interface Device Market Forecast Value in (2035 F) | USD 493.2 million |

| Forecast CAGR (2025 to 2035) | 9.2% |

The Aircraft Interface Device market is experiencing robust growth, driven by the increasing digitalization of aircraft systems and the demand for real-time data exchange between onboard equipment and ground operations. As highlighted in industry journals, investor briefings, and press releases from leading aviation technology firms, the market is being shaped by growing airline investments in connected aircraft and regulatory mandates for enhanced operational safety and efficiency.

The future outlook remains optimistic as airlines and aircraft manufacturers continue to prioritize advanced connectivity solutions to reduce maintenance costs and improve passenger experience. Additionally, technological innovations in wireless communication, edge computing, and cyber-secure data transmission are expected to further support the deployment of software-defined, adaptive devices.

Sustainability initiatives and the drive to optimize flight operations are also contributing to the rising adoption of aircraft interface devices, positioning the market for continued expansion in both established and emerging aviation markets.

The aircraft interface device market is segmented by connectivity, fit, application, end use, and geographic regions. The connectivity of the aircraft interface device market is divided into Wireless and Wired. In terms of fit, the aircraft interface device market is classified into Line Fit and Retrofit. Based on the application, the aircraft interface device market is segmented into Civil and Military. The end use of the aircraft interface device market is segmented into Original Equipment Manufacturer (OEM) and Maintenance, Repair, and Overhaul (MRO). Regionally, the aircraft interface device industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

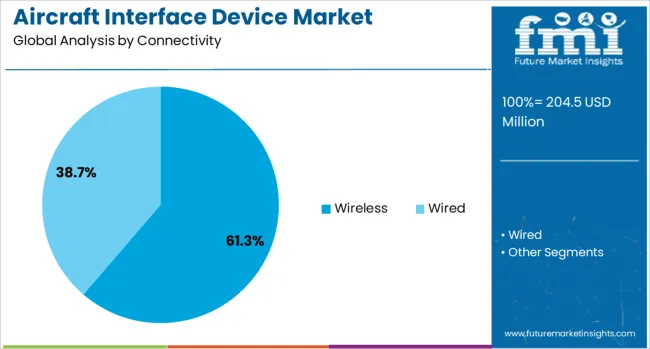

The wireless connectivity segment is projected to hold 61.3% of the Aircraft Interface Device market revenue share in 2025, making it the leading connectivity segment. This leadership has been attributed to the rising preference for wireless technologies that reduce the need for complex wiring and enable easier retrofitting of existing aircraft.

As observed in press releases and product announcements, airlines are increasingly adopting wireless systems to streamline maintenance operations and improve data transfer efficiency without significant modifications to the aircraft structure. The ability to facilitate real-time data communication between cockpit systems, maintenance crews, and operational control centers has further strengthened the appeal of wireless solutions.

Industry publications have highlighted that wireless connectivity also aligns with regulatory requirements for secure and efficient data handling while minimizing installation downtime. These advantages have ensured the dominance of the wireless segment in the connectivity category.

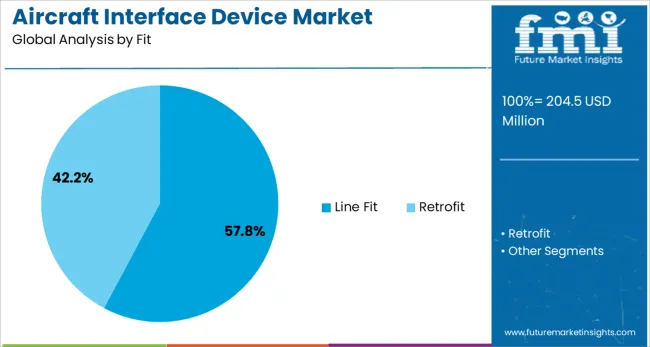

The line fit segment is anticipated to account for 57.8% of the Aircraft Interface Device market revenue share in 2025, establishing it as the leading fit segment. This growth has been supported by the strong integration of interface devices during the manufacturing stage of new aircraft, as reported in aircraft manufacturers’ investor presentations and industry news.

Airlines have been opting for factory-installed systems that meet the latest certification and performance standards, reducing the need for subsequent modifications. The ability to integrate seamlessly with next-generation avionics and to comply with stringent airworthiness regulations has further driven the adoption of line-fit solutions.

According to corporate strategy updates, manufacturers also benefit from economies of scale and optimized supply chains when delivering aircraft with pre-installed interface devices. These factors have collectively contributed to the segment’s continued leadership in the market.

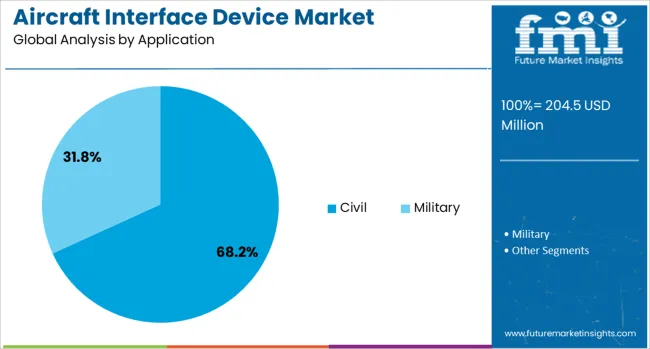

The civil application segment is forecasted to capture 68.2% of the Aircraft Interface Device market revenue share in 2025, maintaining its position as the largest application segment. This dominance has been shaped by the extensive deployment of interface devices in commercial aviation, as highlighted in aviation industry journals and company reports.

Airlines have increasingly adopted these devices to enhance operational efficiency, improve flight safety, and meet evolving regulatory compliance requirements. The segment’s growth has been reinforced by the rising global fleet of commercial aircraft and heightened passenger expectations for seamless connectivity and reliable service.

Investor presentations have noted that civil aviation stakeholders prioritize advanced interface solutions to enable predictive maintenance, optimize flight operations, and support sustainability goals. The ability of these devices to deliver real-time data analytics and facilitate informed decision-making has ensured the civil segment’s prominence in the overall market.

The aircraft interface device (AID) market is expanding due to the increasing complexity of modern aircraft systems and the need for seamless communication between avionics, control systems, and other electronic components. AIDs serve as the critical link for transmitting data between aircraft systems and ground-based systems. The growth of the market is driven by the rise in air travel, the demand for more sophisticated flight management systems, and the ongoing advancements in avionics technology. While challenges like integration costs and cybersecurity concerns exist, there are substantial opportunities in developing more efficient and secure systems for next-generation aircraft.

The demand for integrated avionics systems is a key driver of the aircraft interface device market. As aircraft systems become more complex, the need for efficient data exchange between avionics, flight control systems, and in-flight entertainment networks increases. AIDs enable seamless communication between various aircraft subsystems, improving operational efficiency and safety. The rise in air traffic, coupled with advancements in cockpit technology and flight management systems, further drives the adoption of AIDs. Modern aircraft, especially commercial airliners and military jets, rely on AIDs to improve communication, reduce weight, and enhance overall performance, contributing to the growth of the market.

A significant challenge in the aircraft interface device market is the high cost associated with integrating AIDs into existing aircraft systems. These devices require complex engineering to ensure compatibility with various avionics and control systems. The integration process can be costly, especially for older aircraft models, and requires extensive testing to ensure reliability and compliance with aviation safety standards. Furthermore, cybersecurity concerns related to the transmission of sensitive data between aircraft systems and external networks pose risks. Manufacturers must ensure that AIDs are secure from hacking or interference, increasing the development cost and complexity of these systems.

There are significant opportunities for growth in the aircraft interface device market, particularly through advancements in digital communication and automation. The rise of digital cockpit technologies, which enable more efficient data transmission and processing, is driving demand for more advanced AIDs. The integration of automation systems in aircraft, such as autopilot and advanced navigation systems, presents an opportunity for AIDs to act as the critical link for data exchange between these systems. Furthermore, the development of next-generation flight management systems, which require fast, reliable, and secure communication between aircraft components, provides a strong opportunity for market growth. Emerging markets and new aircraft deliveries further contribute to these growth prospects.

A significant trend in the aircraft interface device market is the adoption of wireless communication technologies and smart systems. With the growing need for reducing the weight of aircraft and improving operational efficiency, manufacturers are increasingly turning to wireless AIDs that eliminate the need for complex wiring systems. These wireless systems enable quicker data exchange, improved flexibility, and easier maintenance. Furthermore, the integration of smart technologies into AIDs, such as real-time data monitoring, predictive analytics, and autonomous control, is enhancing the capabilities of these devices. These trends are helping to reduce operational costs, improve flight performance, and increase the safety and efficiency of modern aircraft systems.

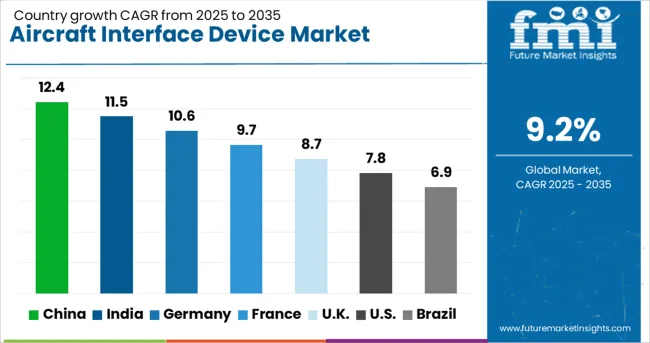

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The aircraft interface device market is projected to grow at a global CAGR of 9.2% from 2025 to 2035. China leads the market at 12.4%, followed by India at 11.5%, and France at 9.7%. The United Kingdom is expected to grow at 8.7%, while the United States is projected to grow at 7.8%. The rapid expansion of the aerospace sector in China and India is driving demand for aircraft interface devices, primarily for improving cockpit and ground operations. In OECD countries like France, the UK, and the USA, steady growth is supported by increasing adoption of advanced avionics systems and demand for better connectivity between aircraft and ground stations. The analysis spans 40+ countries, with the leading markets shown below.

India is projected to grow at a CAGR of 11.5% through 2035, driven by the increasing modernization of the aviation industry, both in commercial and defense sectors. The demand for aircraft interface devices in India is expected to rise as the country focuses on enhancing air traffic management, improving cockpit connectivity, and optimizing aircraft maintenance processes. The Indian aviation market is witnessing significant growth, with both domestic and international flight traffic expanding. These factors contribute to the rising need for advanced avionics systems and effective data transfer technologies.

China is projected to grow at a CAGR of 12.4% through 2035, leading the aircraft interface device market. China’s rapid development in the aviation industry, particularly in commercial and military aircraft, drives the demand for enhanced aircraft systems. The government’s focus on expanding air traffic management infrastructure and introducing advanced avionics is key to the growth of this market. The growing number of new aircraft being introduced in China, along with the country’s ambitions in aviation and defense, is significantly increasing the demand for aircraft interface devices.

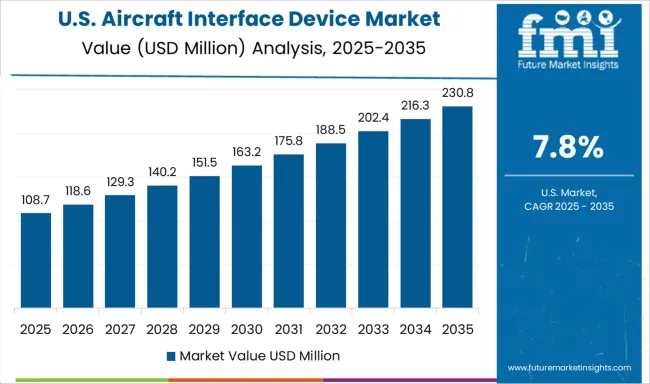

The United States is projected to grow at a CAGR of 7.8% through 2035, driven by the increasing focus on improving flight management systems and aircraft connectivity. The demand for aircraft interface devices in the USA is fueled by growing investments in avionics systems, particularly those related to cockpit modernization and maintenance optimization. The USA is a leader in aerospace technology, and the adoption of advanced aircraft interface devices continues to rise as the country pushes for more integrated and effective aviation systems.

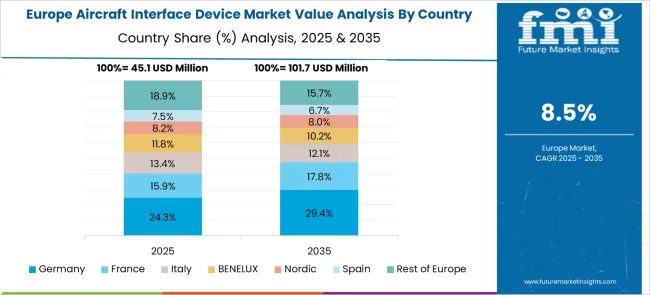

Germany is projected to grow at a CAGR of 9.7% through 2035, driven by its strong aerospace industry and increasing adoption of advanced avionics and interface systems. As the country focuses on enhancing the efficiency and safety of its aviation industry, the demand for aircraft interface devices is expected to rise. Germany’s robust commercial aviation sector and its focus on integrating cutting-edge technologies into aircraft systems are key factors driving market growth. With increasing demands for efficient air traffic control and cockpit modernization, Germany is poised for continued market expansion.

The United Kingdom is projected to grow at a CAGR of 8.7% through 2035, with demand for aircraft interface devices driven by the expansion of the aviation sector and increasing focus on improving aircraft safety and efficiency. The UK has been a key player in developing advanced avionics systems, and with the growing adoption of new aircraft technologies, demand for interface devices continues to rise. UK-based airlines and aerospace manufacturers are investing in advanced communication systems and aircraft management technologies to improve operational efficiency.

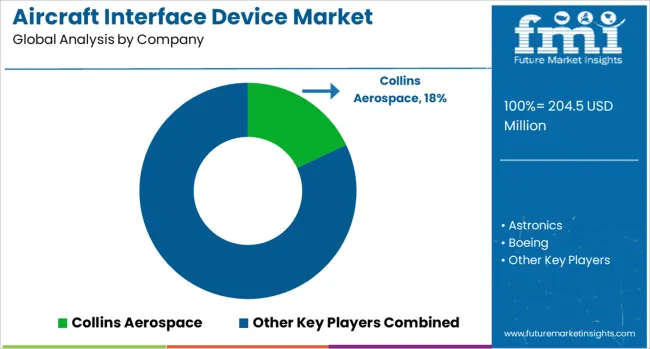

The aircraft interface device (AID) market is driven by leading aerospace companies offering advanced systems that connect aircraft avionics to various external devices, enabling data communication, monitoring, and control. Collins Aerospace is a major player, providing a broad range of interface devices used for improving connectivity between aircraft systems and external data sources. Their systems focus on enhancing communication efficiency, data security, and operational performance. Astronics offers high-performance AID solutions, specializing in in-flight entertainment (IFE), connectivity systems, and cabin management, emphasizing integration with avionics and communication networks.

Boeing is another significant player, offering innovative AID solutions that enhance operational efficiency and safety through advanced data-sharing and communication capabilities. Bytron Aviation Systems and CMC Electronics provide specialized aircraft interface systems for navigation, communication, and in-flight management, with a focus on ensuring seamless integration between systems and enhancing reliability in critical aircraft operations. DAC International and Elbit Systems specialize in providing AID systems for military and commercial aviation, with solutions that optimize communication between flight systems and control stations. GE Aerospace offers cutting-edge technology that focuses on enhancing aircraft connectivity and real-time monitoring, ensuring efficient data transmission between aircraft and ground control systems.Global Eagle Entertainment and Viasat provide AID solutions for in-flight entertainment and connectivity, focusing on enhancing passenger experiences while maintaining high levels of data security. Sanmina, SKYTRAC Systems, and Teledyne Controls offer innovative AID solutions for data management, monitoring, and control across both commercial and military aircraft.

| Item | Value |

|---|---|

| Quantitative Units | USD 204.5 Million |

| Connectivity | Wireless and Wired |

| Fit | Line Fit and Retrofit |

| Application | Civil and Military |

| End Use | Original equipment manufacturer (OEM) and Maintenance, repair, and overhaul (MROs) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Collins Aerospace, Astronics, Boeing, Bytron Aviation Systems, CMC Electronics, DAC International, Elbit Systems, GE Aerospace, Global Eagle Entertainment, Sanmina, SKYTRAC Systems, Teledyne Controls, and Viasat |

| Additional Attributes | Dollar sales by product type (data management systems, communication systems, in-flight entertainment interface devices) and end-use segments (commercial aviation, military aviation, private jets). Demand dynamics are driven by the increasing adoption of in-flight entertainment systems, growing demand for real-time data sharing in aviation, and advancements in connectivity and communication technologies. Regional trends show strong growth in North America and Europe, with increasing demand in Asia-Pacific driven by the growth of air travel and aviation modernization efforts. |

The global aircraft interface device market is estimated to be valued at USD 204.5 million in 2025.

The market size for the aircraft interface device market is projected to reach USD 493.2 million by 2035.

The aircraft interface device market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in aircraft interface device market are wireless and wired.

In terms of fit, line fit segment to command 57.8% share in the aircraft interface device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA