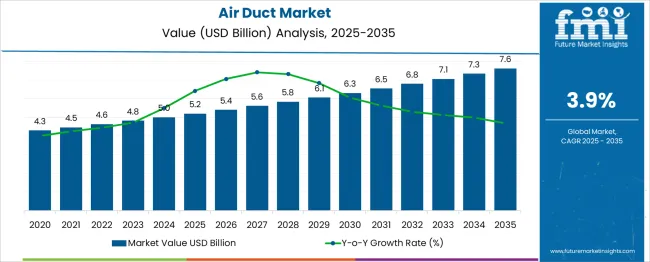

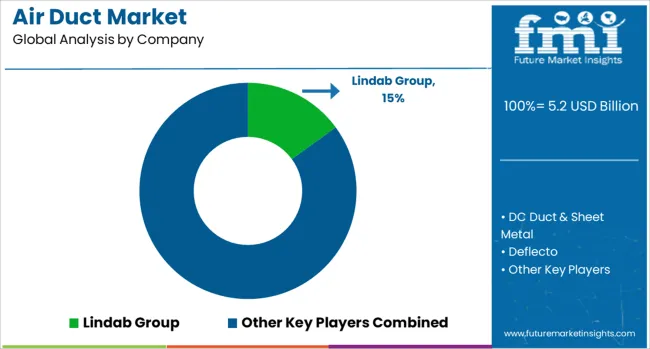

The Air Duct Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. While the pace is moderate compared to high-growth building systems markets, the data indicates a stable market share retention and a gradual gain opportunity for well-positioned players. From 2025 to 2030, the market expands from USD 5.2 billion to USD 6.3 billion, adding USD 1.1 billion, or about 46% of the total decade’s growth.

In this phase, established manufacturers with entrenched relationships in commercial and residential HVAC projects are likely to consolidate share, as market entry barriers remain high due to technical compliance and installation expertise requirements. Between 2030 and 2035, growth continues at a slightly faster pace in absolute terms, with USD 1.3 billion added, representing 54% of the total opportunity.

Gains here may shift toward companies able to offer energy-efficient, lightweight, and pre-insulated ducting solutions as building codes tighten and retrofit demand rises. The consistent YoY value gains, without any periods of stagnation, suggest that incumbents can protect and even expand market share through incremental innovation, while new entrants will need differentiated offerings to penetrate this relatively consolidated sector.

| Metric | Value |

|---|---|

| Air Duct Market Estimated Value in (2025 E) | USD 5.2 billion |

| Air Duct Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The air duct market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.7% of the global HVAC equipment market, supported by demand for efficient air distribution systems in residential, commercial, and industrial settings. Within the building construction and infrastructure sector, a share of approximately 3.1% is assessed as ventilation systems are integrated into new projects and retrofits.

In the indoor air quality solutions industry, around 2.4% is observed due to rising awareness of clean airflow in enclosed spaces. Within the industrial ventilation and exhaust systems market, about 2.9% is evaluated, reflecting application in manufacturing plants and warehouses. In the energy-efficient building materials segment, a contribution of roughly 2.2% is calculated as insulated and low-leakage duct systems gain adoption.

Market expansion has been driven by increasing focus on energy efficiency, indoor comfort, and air quality improvement. Innovations have been directed toward lightweight duct materials, advanced insulation layers, and low-resistance designs that reduce energy loss in HVAC systems.

Interest has been growing in modular duct systems that simplify installation and maintenance, along with ductwork integrated with air purification units. The Asia Pacific region has been observed to show the fastest growth, while North America continues to maintain significant demand through commercial real estate development and retrofit activity. Strategic initiatives have included partnerships between duct manufacturers and HVAC system providers to deliver pre-engineered duct solutions with enhanced sealing technologies, optimized airflow performance, and compliance with green building standards.

The air duct market is expanding steadily, driven by accelerating urban infrastructure development, stricter energy efficiency regulations, and increased HVAC installations in commercial and industrial environments. Emphasis on indoor air quality, especially in post-pandemic construction norms, has enhanced demand for optimized air handling systems.

Innovations in duct material and design, alongside tighter compliance requirements for thermal insulation and noise control, have encouraged facility operators to invest in long-lasting and standardized ducting systems. Future demand will likely be fueled by green building certifications and integration of smart air control systems that require efficient, leak-resistant air distribution networks. Additionally, public investment in smart cities and retrofitting projects is expected to create favorable conditions for the continued modernization of duct networks globally.

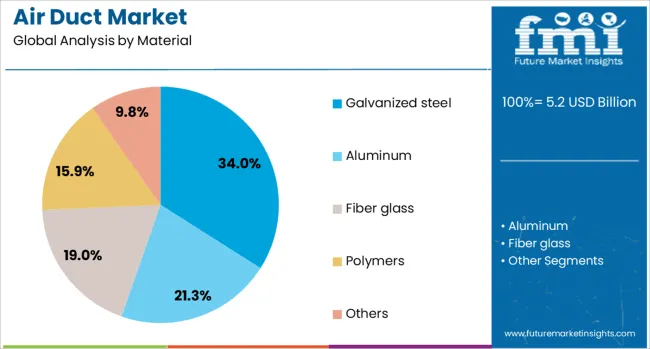

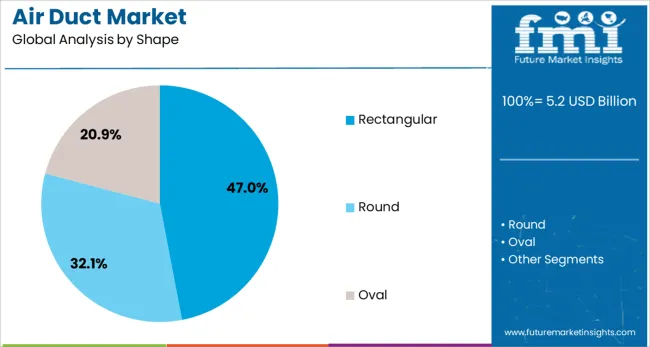

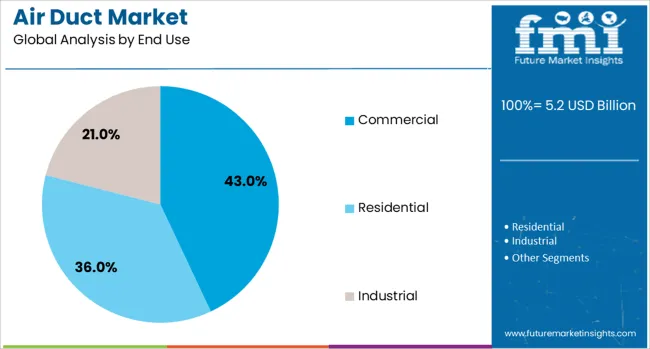

The air duct market is segmented by material, shape, end use, and geographic regions. The air duct market is divided by material into Galvanized steel, Aluminum, Fiber glass, Polymers, and Others. The air duct market is classified by shape into Rectangular, Round, and Oval.

The end use of the air duct market is segmented into Commercial, Residential, and Industrial. Regionally, the air duct industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Galvanized steel is anticipated to account for 34.0% of the total revenue in the air duct market by 2025, establishing itself as the leading material type. Its dominance stems from a balanced performance profile, offering both corrosion resistance and structural integrity, making it ideal for large-scale HVAC applications.

Compliance with fire safety standards, durability under varied temperatures, and ease of fabrication are further driving its widespread use. Moreover, its compatibility with thermal insulation coatings and long service life make it the preferred choice for commercial and industrial installations.

The recyclability of galvanized steel also aligns with growing environmental sustainability goals in construction.

Rectangular ducts are projected to represent 47.0% of the air duct market revenue in 2025, positioning this shape as the most widely adopted. This is largely due to their suitability in space-constrained environments where ceiling height or layout restrictions influence duct placement.

Their simplified manufacturing process, ease of installation, and efficient airflow distribution have made them standard in commercial buildings and large-scale infrastructure. Engineers favor rectangular ducts for their adaptability to retrofitting projects and integration with air balancing systems.

Their capacity to handle large volumes of airflow without compromising pressure efficiency supports continued adoption in multistory commercial settings.

The commercial segment is expected to capture 43.0% of the total air duct market revenue in 2025, marking it as the dominant end-use sector. This leadership is driven by rapid growth in commercial real estate, especially in retail, office, hospitality, and institutional spaces.

Rising demand for centralized HVAC systems in buildings with high occupancy has reinforced the need for efficient and standardized ductwork. Stringent indoor air quality regulations and energy certification mandates are prompting facility managers to upgrade outdated systems with modern ducting infrastructure.

The push for net-zero energy buildings and green certifications in commercial design continues to reinforce investment in reliable and performance-optimized air ducts.

Air ducts have been extensively installed in residential, commercial, and industrial buildings as essential components of heating, ventilation, and air conditioning (HVAC) systems. They have been designed to distribute conditioned air efficiently throughout indoor spaces while maintaining air quality and temperature control. Demand has been influenced by HVAC system upgrades, building renovations, and the need for energy-efficient ventilation solutions. Manufacturers have focused on lightweight materials, corrosion resistance, and improved insulation to enhance performance, reduce energy loss, and meet evolving building efficiency standards.

The expansion of residential and commercial construction projects has significantly supported air duct installations. Renovation and retrofit activities in aging buildings have also fueled demand for duct replacements and upgrades to meet modern HVAC efficiency requirements. In large commercial spaces such as shopping malls, office complexes, and airports, air ducts have been critical for maintaining consistent airflow. The growing number of high-rise buildings in urban centers has increased the need for customized ductwork that can be integrated into compact ceiling and wall spaces. Contractors have preferred pre-insulated and modular duct systems for faster installation and reduced labor costs. Government-backed energy efficiency initiatives and green building certifications have further encouraged the adoption of improved air duct designs in both new and renovated structures.

Advances in duct materials and manufacturing processes have led to improved thermal insulation, lower leakage rates, and greater durability. The adoption of pre-insulated duct panels and flexible ducting has reduced installation time while enhancing system efficiency. Computer-aided design (CAD) tools have been used to optimize duct layouts for minimal airflow resistance, resulting in lower energy consumption by HVAC systems. Antimicrobial coatings have been applied to duct interiors to inhibit mold and bacterial growth, supporting better indoor air quality. Manufacturers in the United States, Europe, and Asia-Pacific have invested in automated fabrication equipment to produce precise and consistent duct components. These innovations have helped reduce operational costs for building owners while extending the lifespan of HVAC systems.

The commercial and industrial sectors have consistently required large-scale air duct systems for climate control in manufacturing facilities, hospitals, data centers, and public infrastructure. These applications demand ductwork capable of withstanding high airflow volumes and variable temperature conditions. Industrial-grade ducts have been produced using galvanized steel, aluminum, or advanced composite materials for enhanced strength and longevity. In sectors such as pharmaceuticals and electronics, air ducts have been used in cleanroom environments to maintain controlled air quality standards. Steady replacement cycles in heavy-use facilities have provided a stable revenue stream for duct manufacturers and installation contractors. The scale and complexity of these projects have favored suppliers with advanced customization capabilities and proven quality control processes.

Air duct systems have required regular inspection, cleaning, and sealing to maintain performance and prevent energy losses. In older installations, duct leakage has been a major source of inefficiency, leading to increased energy bills and reduced HVAC effectiveness. High initial installation costs, particularly for custom-designed ductwork in large buildings, have been a barrier for budget-conscious projects. Flexible duct alternatives have been adopted in some cases to reduce costs, though they may offer shorter lifespans compared to rigid ducts. In developing markets, limited enforcement of building efficiency codes has slowed the replacement of outdated duct systems. Without improved awareness of maintenance benefits and cost-effective installation methods, adoption of advanced air duct solutions may remain concentrated in regulated and high-value construction projects.

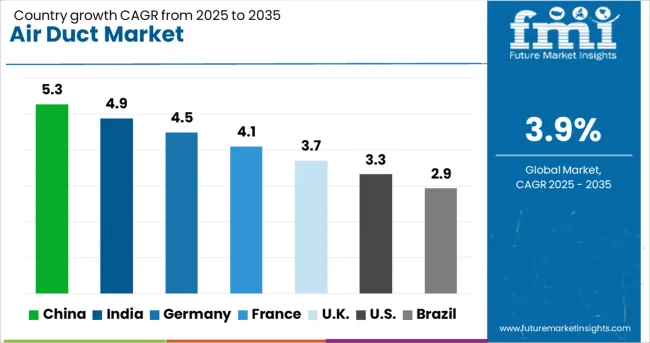

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The air duct market is expected to grow at a global CAGR of 3.9% between 2025 and 2035, driven by rising demand for HVAC systems, energy-efficient ventilation solutions, and infrastructure development. China leads with a 5.3% CAGR, supported by large-scale construction projects and rapid urbanization. India follows at 4.9%, fueled by commercial building expansion and increased HVAC adoption in residential sectors. Germany, at 4.5%, benefits from advanced engineering standards and strong demand for sustainable ventilation systems. The UK, projected at 3.7%, sees growth from retrofitting projects and modernization of building infrastructure. The USA, at 3.3%, reflects stable demand from commercial and industrial HVAC applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.3% from 2025 to 2035 in the air duct market, supported by large-scale commercial construction projects and rapid expansion of HVAC installations. Domestic manufacturers such as Zhejiang Shuangli, Tianjin Longhua, and Suzhou Duck are increasing production capacity for galvanized steel, aluminum, and flexible duct systems. The shift toward energy-efficient ventilation systems in office buildings, hospitals, and airports is creating strong demand for advanced duct designs with improved insulation and airflow control. Smart HVAC systems integrated with automated air regulation are gaining traction in premium developments.

India is forecasted to achieve a CAGR of 4.9% from 2025 to 2035, driven by growing HVAC adoption in commercial complexes, malls, and healthcare facilities. Key suppliers such as Zeco Aircon, KAD Air Conditioning, and Ductofab are focusing on cost-effective duct manufacturing and faster installation methods to meet project timelines. The demand for pre-insulated and fire-rated ducts is increasing in high-rise buildings, while flexible ducts are popular in smaller-scale installations. Government investments in airport and metro projects are further contributing to market expansion.

Germany is projected to post a CAGR of 4.5% from 2025 to 2035, supported by strict building efficiency regulations and a focus on high-performance HVAC systems. Manufacturers such as Trox, Lindab GmbH, and Systemair are introducing ducts with antimicrobial linings and advanced thermal insulation to improve indoor air quality. Precision-engineered duct systems are being used in cleanrooms, laboratories, and advanced manufacturing plants. Digital modeling tools such as BIM (Building Information Modeling) are enabling optimized airflow design before installation.

The United Kingdom is expected to record a CAGR of 3.7% from 2025 to 2035, driven by refurbishment of older commercial buildings and hospital infrastructure upgrades. Players such as BSB Engineering Services, Vent-Axia, and Ductform UK are offering duct solutions that combine corrosion resistance with noise reduction features. Modular duct systems are gaining attention for faster retrofitting in occupied buildings. Compliance with indoor air quality standards is a key factor influencing procurement decisions.

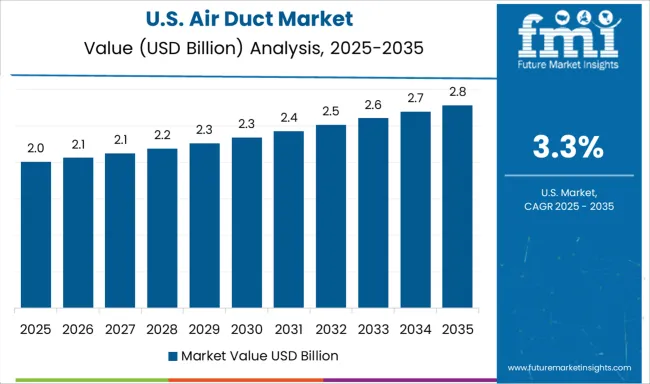

The United States is forecasted to grow at a CAGR of 3.3% from 2025 to 2035, supported by demand in residential HVAC retrofits and large-scale commercial real estate projects. Manufacturers such as DuctSox, KAD Air Conditioning USA, and FabricAir are focusing on fabric duct systems that offer lightweight installation and better airflow distribution. Energy-efficient ducting that meets LEED certification requirements is becoming increasingly important in new constructions. The trend toward duct systems integrated with smart thermostats and IoT-based airflow monitoring is also gaining pace.

The air duct market is led by established HVAC component manufacturers and regional sheet metal specialists supplying residential, commercial, and industrial ventilation systems. Lindab Group and Saint-Gobain dominate with large-scale production of metal and flexible ducting, complemented by fittings, insulation, and airflow control products for complete HVAC solutions.

Lennox International integrates air ducts into its broader heating and cooling systems, targeting both new installations and retrofit projects. M&M Manufacturing, Eastern Sheet Metal, and Tin Man Sheet Metal focus on precision-fabricated galvanized steel ductwork for contractors and distributors, ensuring compliance with airflow efficiency and building code standards. Novaflex Group, Thermaflex, and Deflecto specialize in flexible and insulated duct products suited for quick installation in residential and light commercial applications. Dundas Jafine offers consumer-grade ducting solutions available through major retail channels, catering to DIY and small-scale projects.

Nuaire and Ruskin Titus India serve large infrastructure projects with engineered duct systems, integrating air movement and control products. Rubber World Industries produces duct insulation and sealing materials to improve thermal efficiency and minimize leakage. Sisneros Bros caters to regional markets with custom-fabricated ducts and fittings for specialized ventilation needs.

Key strategies in this sector include expanding insulated and pre-fabricated duct product lines, partnering with HVAC system installers, and maintaining regional distribution hubs for faster project delivery. Entry barriers include high competition from established suppliers, compliance with fire and energy efficiency regulations, and the need for precise fabrication capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Material | Galvanized steel, Aluminum, Fiber glass, Polymers, and Others |

| Shape | Rectangular, Round, and Oval |

| End Use | Commercial, Residential, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lindab Group, DC Duct & Sheet Metal, Deflecto, Dundas Jafine, Eastern Sheet Metal, Lennox International, M&M Manufacturing, Novaflex Group, Nuaire, Rubber World Industries, Ruskin Titus India, Saint-Gobain, Sisneros Bros, Thermaflex, and Tin Man Sheet Metal |

| Additional Attributes | Dollar sales by duct material and end‑use segment, demand dynamics across commercial, residential, and industrial HVAC applications, regional trends in galvanized steel vs flexible vs polymer (PVC/PU) and fiberglass duct adoption across North America, Europe, and Asia‑Pacific, innovation in antimicrobial fabric and prefabricated modular ducts and IoT‑enabled smart monitoring systems, environmental impact of energy consumption, IAQ filtration, material recyclability and lifecycle emissions, and emerging use cases in high‑rise smart buildings, underfloor air distribution zones, transport hubs and acoustic‑optimized duct silencers. |

The global air duct market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the air duct market is projected to reach USD 7.6 billion by 2035.

The air duct market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in air duct market are galvanized steel, aluminum, fiber glass, polymers and others.

In terms of shape, rectangular segment to command 47.0% share in the air duct market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.