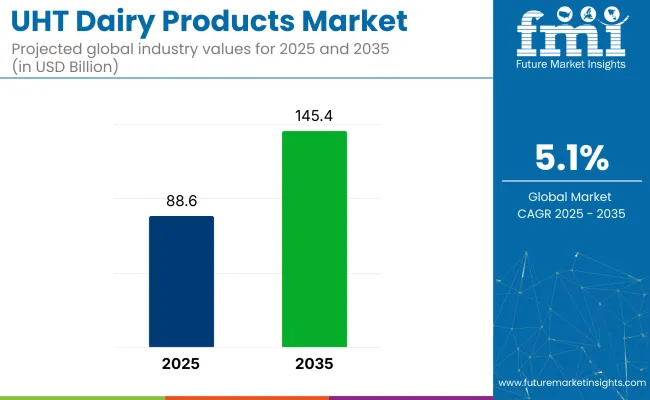

The global UHT dairy products market is valued at USD 88.6 billion in 2025 and is slated to reach USD 145.4 billion by 2035, reflecting a CAGR of 5.1%. The demand is being driven by the rising preference for dairy products with extended shelf life, increasing urbanisation, and limited cold chain infrastructure in developing regions. Additionally, technological advancements in UHT processing and sustainable packaging solutions are supporting market expansion globally.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 88.6 billion |

| 2035 Market Size | USD 145.4 billion |

| CAGR (2025 to 2035) | 5.1% |

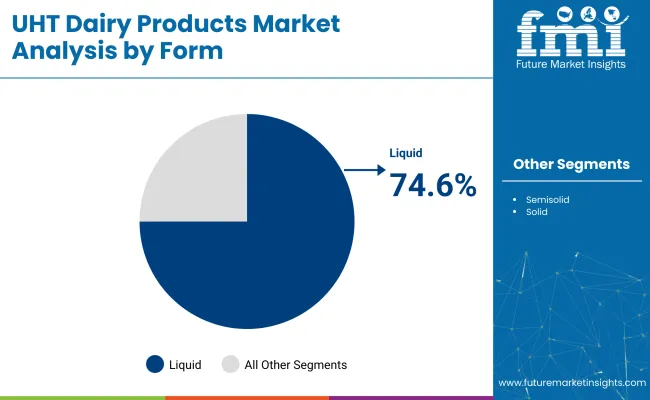

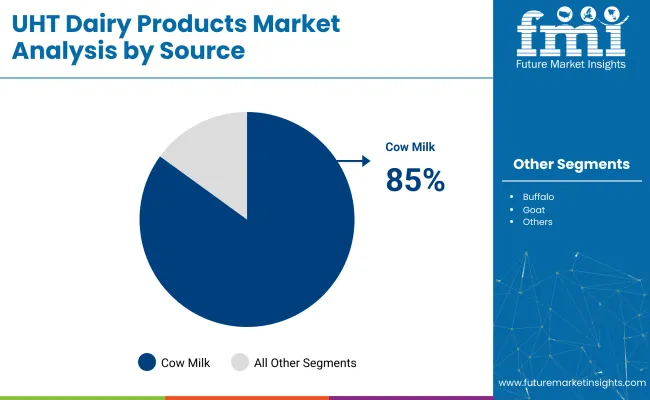

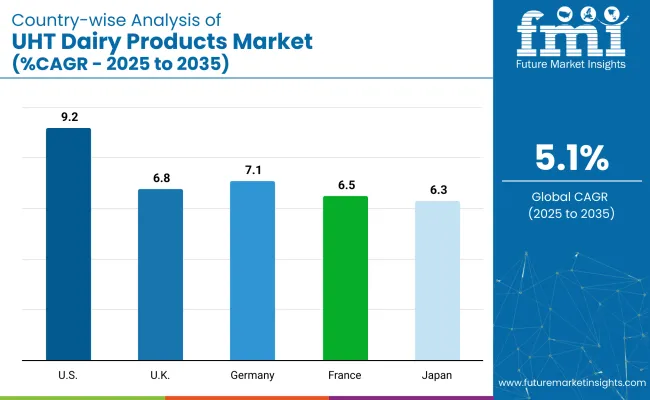

The USA is expected to grow the fastest in the market, with a CAGR of 9.2% from 2025 to 2035, driven by advanced livestock farming, high meat consumption, and strong investments in animal health. Germany follows with a 7.1% CAGR, supported by its focus on animal welfare and feed efficiency, while the UK grows at 6.8% CAGR due to steady demand for quality meat. Cow milk will dominate the source segment with an 85% market share in 2025.UHT liquid milk will lead the product type segment with a 74.6% market share, driven by its widespread daily consumption and long shelf life.

Government regulations are focusing on ensuring food safety standards and extending shelf life without compromising nutritional quality. Many countries mandate strict microbial safety guidelines and packaging standards for UHT dairy products to protect consumers.

Recent innovations include the development of advanced UHT processing technologies that use ultra-high temperatures for shorter durations, preserving taste and nutrients effectively. Companies like Fonterra and Govind Milk have launched UHT-treated products such as probiotic drinks and traditional desserts like Basundi without chemical preservatives. Sustainable and recyclable Tetra Pak packaging solutions are also being adopted widely, aligning with global environmental regulations and consumer preferences.

The UHT dairy products market forms a significant segment within its parent markets. It accounts for approximately 18-20% of the overall dairy products market, driven by its long shelf life and ease of storage. Within the broader food and beverage market, UHT dairy products hold around 4-5% share, reflecting their niche but growing consumer base.

In the processed food market, their share is estimated at 6-7%, as they align with convenience-driven demand trends. Within the packaged food market, UHT dairy products contribute about 5-6%, supported by advancements in packaging technologies ensuring microbial safety and extended product stability.

The UHT dairy products market segments include form, product type, source, sales channel, and region. The market is segmented by form into liquid, semisolid, and solid. By product type, it is categorized into milk, cream, cheese, yogurt, sauces, milk powder, and ice cream mix. By source, it is classified into cow, buffalo, goat, and others (including Camel Milk, Sheep Milk, and Mixed Animal Sources).

By sales channel, the market is divided into B2B and B2C. Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Liquid is the most lucrative segment, holding 74.6% of the market share in 2025.

Milk is the dominant product type segment in the UHT dairy products market, holding the largest share of 74.6% due to its widespread consumption worldwide.

Cow milk is the most lucrative source segment, accounting for the highest share of 85% due to its availability and widespread consumption.

B2C is the leading sales channel segment, holding the market share of 68% in the market.

The UHT dairy products market is experiencing steady growth, driven by rising demand for long shelf-life dairy products, increasing urbanisation, and limited cold chain infrastructure. Growing adoption of advanced UHT processing technologies, along with strong demand from the food and beverage industry for safe, convenient, and nutritious dairy products, is further supporting market expansion.

Recent Trends in the UHT Dairy Products Market

Challenges in the UHT Dairy Products Market

Among the top countries in the UHT dairy products market from 2025 to 2035, the USA shows the highest CAGR at 9.2%, driven by strong demand for UHT milk and lactose-free options. Germany follows with a CAGR of 7.1%, supported by rising flavored UHT milk consumption and foodservice demand.

The UK grows at 6.8% CAGR, driven by urban consumption and private label expansion. France records a CAGR of 6.5%, backed by strong dairy traditions and organic UHT milk demand, while Japan shows steady growth at 6.3% CAGR, supported by premium UHT milk imports and technological advancements in packaging and processing.

This report covers an in-depth analysis of 40+ countries; the five top-performing OECD Countries are highlighted below.

The USA UHT dairy products market is projected to grow at a CAGR of 9.2% from 2025 to 2035.

Sales of UHT dairy products in the UK are expected to grow at a CAGR of 6.8% from 2025 to 2035.

The Germany UHT dairy products revenue is projected to grow at a CAGR of 7.1% from 2025 to 2035.

The France UHT dairy products are expected to grow at a CAGR of 6.5% from 2025 to 2035.

The UHT dairy products market in Japan is projected to grow at a CAGR of 6.3% from 2025 to 2035.

The UHT (Ultra-High Temperature) dairy products market is moderately consolidated, with a few multinational corporations holding significant market shares. Leading companies such as Nestlé, Groupe Lactalis, Fonterra, and Danone dominate the landscape, leveraging extensive distribution networks, diverse product portfolios, and strong brand recognition. These industry leaders focus on innovation, sustainability, and strategic partnerships to maintain their competitive edge.

Top companies are competing through various strategies, including pricing, product innovation, partnerships, and expansion into emerging markets. For instance, Nestlé emphasizes sustainable packaging and nutritional product development, while Fonterra focuses on B2B dairy nutrition solutions. Groupe Lactalis has expanded its global footprint through acquisitions, and Danone invests in health-focused dairy products. These strategies aim to cater to evolving consumer preferences and regulatory requirements.

Recent UHT Dairy Products Industry News

In November 2024, Milky Mist, collaborated with SIG and AnaBio Technologies, unveiled the world’s first long-life probiotic buttermilk packaged in aseptic cartons. (Source: Milky Mist)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 88.6 billion |

| Projected Market Size (2035) | USD 145.4 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in million ton |

| By Form | Liquid, Semisolid, and Solid |

| By Product Type | Milk, Cream, Cheese, Yogurt, Sauces, Milk Powder, and Ice Cream Mix |

| By Source | Cow, Buffalo, Goat, and Others (Camel Milk, Sheep Milk, a nd Mixed Animal Milk Sources) |

| By Sales Channel | B2B, B2C |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Nestle, Dana Dairy Group, Anchor, Amul (GCMMF), Grupo Lala, Fonterra, Groupe Lactalis, Yili Group, Dairy Farmers of America, Arla Foods, and Mother Dairy. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per Form, the industry has been categorized into, Liquid, Semisolid and Solid.

As per Product Type, the industry has been categorized into Milk, Cream, Cheese, Yogurt, Sauces, Milk Powder, and Ice Cream Mix.

This segment is further categorized into Cow, Buffalo, Goat, and Others.

As per the sales channel, the industry has been categorized into B2B, and B2C (Distributor, Dairy Shops, Grocery shops, Supermarkets, and Online Platforms).

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe Eastern Europe, Balkans & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is valued at USD 88.6 billion in 2025.

The market is projected to reach USD 145.4 billion by 2035.

The market is expected to grow at a CAGR of 5.1% during this period.

UHT liquid milk is the leading product type, holding 74.6% market share.

The USA has the highest CAGR in the market, projected at 9.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UHT Whipping Cream Market Size and Share Forecast Outlook 2025 to 2035

UHT Milk Market Growth - Trends, Demand & Industry Forecast 2025 to 2035

Ultra-High Temperature (UHT) Processing Market Analysis by Mode, Form, Application and Region from 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA