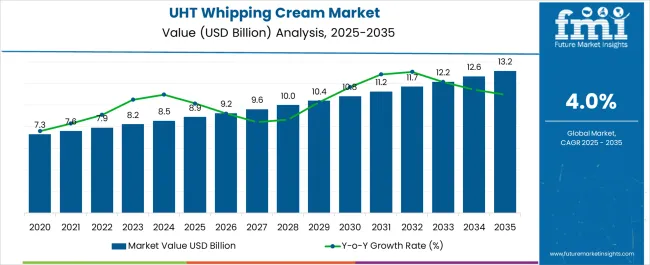

The UHT whipping cream market is estimated at USD 8.9 billion in 2025. It is projected to reach USD 13.2 billion by 2035 at a compound annual growth rate of 4.0 %.

| Metric | Value |

|---|---|

| UHT Whipping Cream Market Estimated Value in (2025 E) | USD 8.9 billion |

| UHT Whipping Cream Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The UHT whipping cream market is expanding due to rising consumer preference for ready-to-use dairy ingredients. Demand for premium desserts and increasing penetration of Western-style bakery and confectionery products in emerging economies are further supporting growth. UHT processing offers long shelf-life while maintaining texture and taste. Investments in advanced dairy processing technologies and innovations in low-fat and lactose-free variants are increasing adoption. Regulatory focus on food safety and preservation is accelerating use of UHT solutions. Consumption patterns are shifting toward convenient, high-quality dairy ingredients aligned with modern lifestyles and diversified culinary applications.

The market is segmented by product type, end use, and sales channel and region. By product type, the market is divided into dairy and non-dairy. In terms of end use, the market is classified into dairy products, bakery confectionery, beverages, snacks, and others. Based on sales channel, the market is segmented into direct sales, indirect sales, hypermarkets/supermarkets, convenience store, specialty stores, and online retailers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

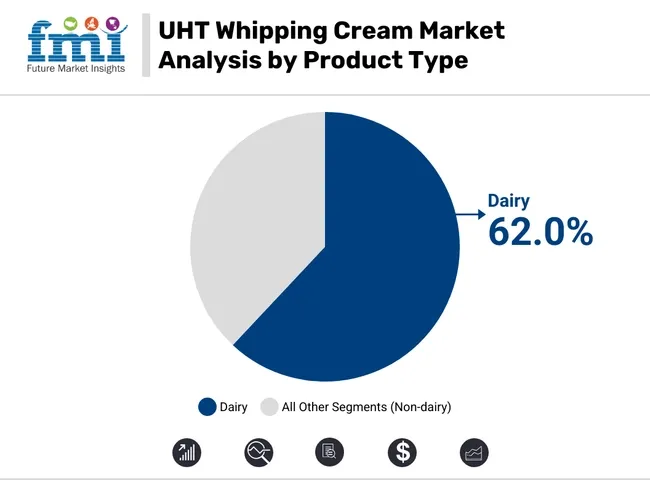

The dairy product type segment is projected to hold 54.70% of total revenue by 2025 within the product type category, establishing itself as the leading segment. This growth is being driven by the broad utilization of dairy based whipping cream in bakery, confectionery, and culinary preparations.

The ability of dairy variants to provide authentic taste, desirable fat content, and superior aeration properties has reinforced their demand. Food service establishments and bakeries have shown preference for dairy based UHT whipping cream due to its performance consistency in both cold and hot applications.

With increasing consumer inclination toward premium and natural ingredients, the dairy product type continues to maintain a strong competitive edge.

The dairy products end use segment is expected to account for 47.20% of the overall market revenue by 2025, making it the largest end use category. This dominance is attributed to the incorporation of UHT whipping cream in a wide range of dairy offerings including desserts, flavored milk, and yogurt based products.

The ability to enhance texture, taste, and visual appeal has supported its adoption across diverse dairy applications. Growing consumption of value added dairy products and consumer preference for indulgent yet convenient options are driving this trend.

Manufacturers are increasingly focusing on innovation to expand product versatility, which continues to strengthen the position of the dairy products end use segment.

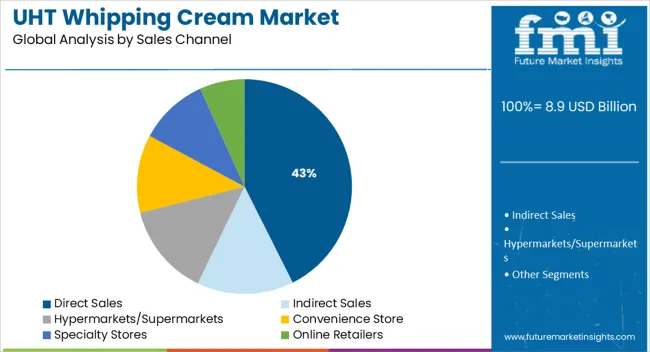

The direct sales channel segment is projected to contribute 42.60% of total market revenue by 2025, securing its role as the leading distribution channel. This growth is supported by strong partnerships between manufacturers and food service providers, bakeries, and retail chains that prefer direct sourcing for efficiency and consistent supply.

Direct sales provide manufacturers with better control over pricing, quality assurance, and customer relationships. The channel supports faster feedback mechanisms and customization opportunities.

As demand from professional kitchens and food processors continues to rise, direct sales are expected to maintain their leadership within the sales channel category.

The UHT whipping cream market in South Korea is getting bigger. Western baking trends are popular there. People want simple dairy products. Companies are putting money into good, useful dairy options. Groups like KFDA and MAFRA make sure these dairy items are safe.

Market trends show people prefer organic and clean-label UHT creams. Korean-style sweets that use UHT creams are getting noticed. There is also more demand for lactose-free and plant-based options. Premium bakery chains are growing, and more people are baking at home. This helps sales go up.

| Product Type | Market Share (2025) |

|---|---|

| Dairy | 62.0% |

Dairy-Based UHT Whipping Cream Leads Market Demand for Natural Texture and Premium Quality

The dominance of dairy-derived UHT whipping cream is due to its rich texture, reliable whipping properties and authentic taste. Bakeries, restaurants and home bakers prefer it. Rising consumer demand for high-quality natural ingredients without preservatives strengthens growth. Innovations such as faster UHT heating, better packaging and clean-label positioning improve shelf-life and product perception. Challenges include fluctuating milk costs, lactose intolerance issues and stringent dairy regulations. Growth opportunities emerge from lactose-free, organic and better-sourced variants.

| End Use | Market Share (2025) |

|---|---|

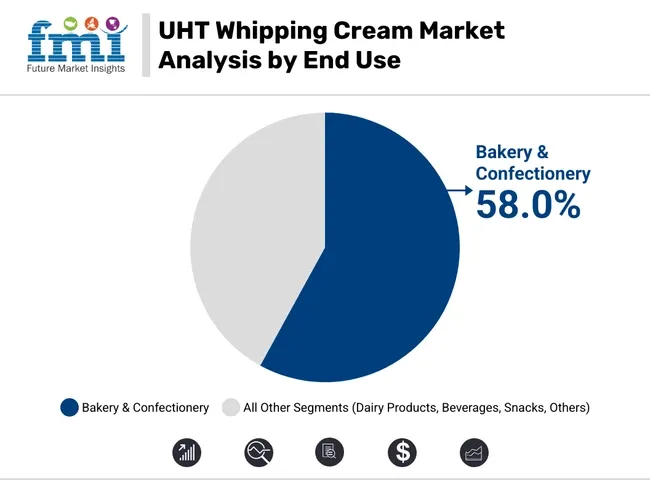

| Bakery & Confectionery | 58.0% |

Bakery & Confectionery Leads Market Demand with Expanding Applications in Cakes, Pastries, and Desserts

The bakery & confectionery segment leads demand for UHT whipping cream because consumers seek better baked goods, café experiences and home-baking options. UHT whipping cream is widely used in cake toppings, pastry fillings, mousse and decorations due to its stability, texture and shape retention. Growth in plant-based whipping creams, low-sugar versions and nutrient-added dairy creams opens newer avenues. Challenges include shifting dairy-ingredient prices, vegan-movement pressure and regulatory constraints on additives. Clean-label whipping creams, improved bakery formulas and premium ingredients promise further growth.

Challenge

High Cost of Production and Storage Requirements

High production and storage costs present a significant challenge for the UHT whipping cream market. Ultra-high-temperature processing demands sophisticated equipment and strict quality-control protocols, driving manufacturing cost higher. Regions with extreme temperature variance or inadequate cold-chain infrastructure face additional storage hurdles. These factors raise product price and reduce affordability for some consumer segments.

Opportunity

Rising Demand for Organic and Plant-Based Alternatives

Rising demand for organic and plant-based alternatives offers major growth opportunity. Increasing consumer awareness of organic dairy and plant-based options drives exploration of grass-fed dairy UHT whipping creams and 100 % vegetable-fat UHT whipping creams based on coconut, almond and soy. Lactose-free items attract consumers with dietary restrictions or intolerances. Manufacturers focusing on sustainable premium products can gain competitive advantage given the evolving market landscape.

The UHT whipping cream market in the U.S. is growing. Demand for easy-to-use dairy ingredients, premium bakery goods and longer shelf-life cream is increasing. Regulation by the FDA and USDA ensures product safety and quality. Plant-based and lactose-free choices gain traction. Professional food-service channels such as hotels and restaurants increase their use of UHT whipping cream.

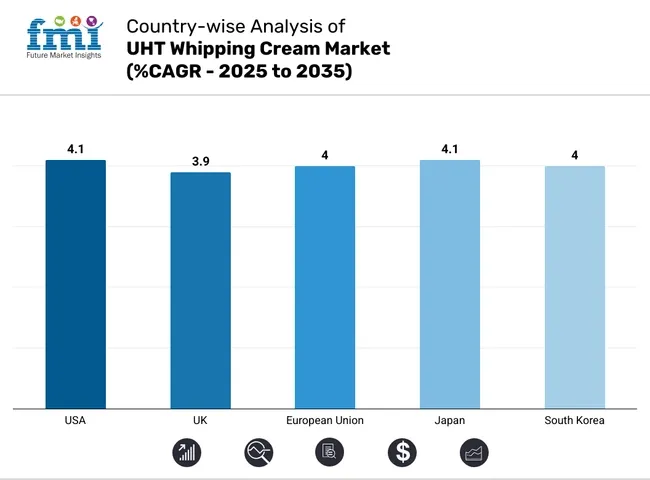

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

The UHT whipping cream market in the UK is growing steadily. Premium dairy products and home-baking trends support consumption. Eco-friendly packaging is gaining focus. Regulation by the UK Food Standards Agency and Dairy UK Association ensures product quality. Clean-label and preservative-free UHT whipping creams rise in popularity. Local dairy sourcing and organic ingredients support growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The UHT whipping cream market in the EU grows due to strict dairy standards, increasing demand for shelf-stable dairy items and strong bakery and dessert industries in countries such as Germany, France and Italy. The European Food Safety Authority (EFSA) and European Dairy Association (EDA) regulate quality, safety and sustainability. Growth in plant-based UHT whipping-cream types also contributes.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

Growth in Japan is moderate. Increasing consumer interest in premium desserts and cafés, more use of UHT whipping cream in bakery and patisserie sectors and emerging processing innovations support growth. Regulation by MAFF and Consumer Affairs Agency ensures quality and safety. Trends include high-fat and premium whipping creams, plant-based and low-fat alternatives and eco-friendly packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The UHT whipping-cream market in South Korea grows as Western baking trends spread. Demand for convenient dairy ingredients increases. Investment in dairy-processing facilities and product development rises. Regulatory bodies such as KFDA and MAFRA ensure dairy product safety. Consumer preference shifts toward organic and clean-label UHT creams. Lactose-free and plant-based options gain attention. Premium bakery chains and home-baking culture are expanding.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

The UHT whipping-cream market evolves with demand for shelf-stable, easy-use dairy ingredients suitable for baking and food-service applications. UHT whipping cream is valued for extended shelf-life, storage convenience and suitability for both household and professional use. Innovations in formulation, clean-labels, non-dairy alternatives and premium textures push market growth. Leading brands develop formulations with better aeration, texture stability and nutritional profiles to meet diverse consumer needs.

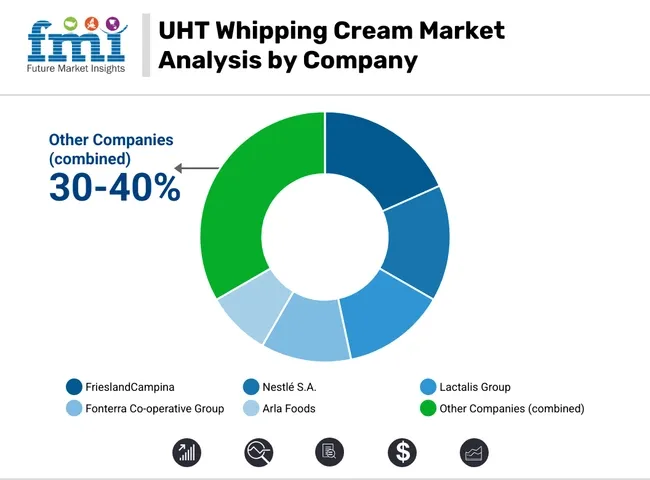

FrieslandCampina (18-22%)

A market leader in UHT whipping cream, offering premium formulations with superior aeration and texture stability.

Nestlé S.A. (14-18%)

Expanding its product range with dairy and non-dairy UHT whipping creams to appeal to a broader consumer base.

Lactalis Group (12-16%)

Focuses on large-scale production and distribution of high-quality UHT whipping cream for retail and foodservice applications.

Fonterra Co-operative Group (10-14%)

Specializes in innovative dairy solutions, including reduced-fat and functional UHT whipping creams.

Arla Foods (6-10%)

Develops organic and sustainably sourced UHT whipping cream products for premium market segments.

Other Key Players (30-40% Combined)

Various dairy processors and specialty food manufacturers contribute to advancements in UHT whipping cream formulations, clean-label ingredients, and functional dairy alternatives. These include:

The global UHT whipping cream market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the UHT whipping cream market is projected to reach USD 13.2 billion by 2035.

The UHT whipping cream market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in UHT whipping cream market are dairy and non-dairy.

In terms of end use, dairy products segment to command 47.2% share in the UHT whipping cream market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UHT Dairy Products Market - Size, Share, and Forecast Outlook 2025 to 2035

UHT Milk Market Growth - Trends, Demand & Industry Forecast 2025 to 2035

Ultra-High Temperature (UHT) Processing Market Analysis by Mode, Form, Application and Region from 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Cream of Tartar Market Size and Share Forecast Outlook 2025 to 2035

Cream Separator Market Size and Share Forecast Outlook 2025 to 2035

Cream Cheese Market Analysis – Size, Share, and Forecast 2025 to 2035

BB Cream Market Analysis by Skin Type, SPF Type, End Uses, Sales Channel and Region through 2025 to 2035

Ice Cream Coating Market Size and Share Forecast Outlook 2025 to 2035

Ice-cream Premix and Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Ice Cream Equipment Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Ice Cream and Frozen Dessert Market from 2025 to 2035

Ice Cream Packaging Market - Outlook 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Ice Cream Parlor Market Analysis by Type, Product Type, and Region Through 2035

Breaking Down Market Share in the Ice Cream Parlor Industry

Ice Cream Container Market Size & Trends Forecast 2024-2034

Dry Cream Substitute Market

Ice-cream Maker Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA