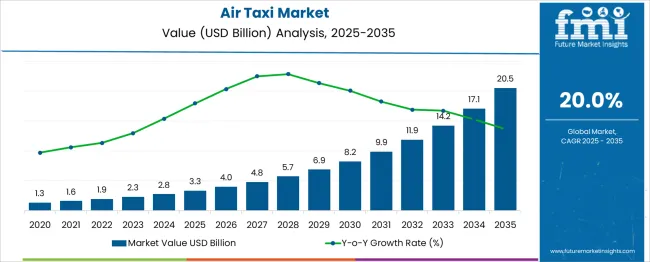

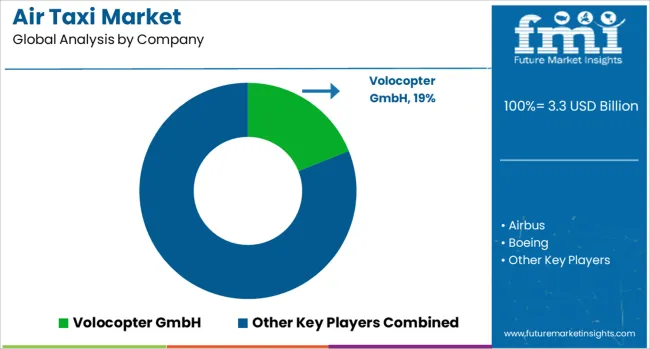

The Air Taxi Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 20.5 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period. A 5-Year Growth Block Analysis shows significant acceleration over the forecast period. Between 2025 and 2030, the market expands from USD 3.3 billion to USD 8.2 billion, contributing an incremental USD 4.9 billion in growth.

This period demonstrates a CAGR of 21.0%, driven by increasing investment in air mobility infrastructure, advancements in electric vertical takeoff and landing (eVTOL) technologies, and rising urban air mobility demand. Early-stage growth is fueled by pilot projects, government support, and innovations in air taxi designs. From 2030 to 2035, the market continues to experience rapid growth, adding USD 12.3 billion, from USD 8.2 billion to USD 20.5 billion.

This phase shows a CAGR of 18.8%, supported by the broader adoption of air taxis in commercial applications, including passenger transport, cargo delivery, and short-haul urban travel. Improvements in infrastructure, regulatory developments, and growing consumer acceptance drive the acceleration in this period. Overall, the 5-year growth analysis highlights a strong expansion trajectory, with the initial phase contributing a substantial share of the market’s growth, while the later years see increased market penetration and technological advancements.

| Metric | Value |

|---|---|

| Air Taxi Market Estimated Value in (2025 E) | USD 3.3 billion |

| Air Taxi Market Forecast Value in (2035 F) | USD 20.5 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The air taxi market is undergoing rapid transformation as advancements in electric propulsion, urban mobility infrastructure, and regulatory frameworks converge to support short-haul aviation services. With increasing urban congestion and a global push toward low-emission transportation, air taxis are emerging as a practical solution for intra-city and inter-city commutes.

Key players are investing heavily in vertical take-off and landing (VTOL) platforms, AI-based route optimization, and lightweight composite materials to enhance safety and performance. Moreover, the integration of autonomous systems is reshaping vehicle design and reducing long-term operational costs.

Governments and private investors alike are funding pilot corridors, vertiports, and air traffic management systems to accelerate commercial readiness. In the coming years, improved battery energy densities and supportive airspace regulations are expected to catalyze market deployment, especially in megacities and tech-forward regions.

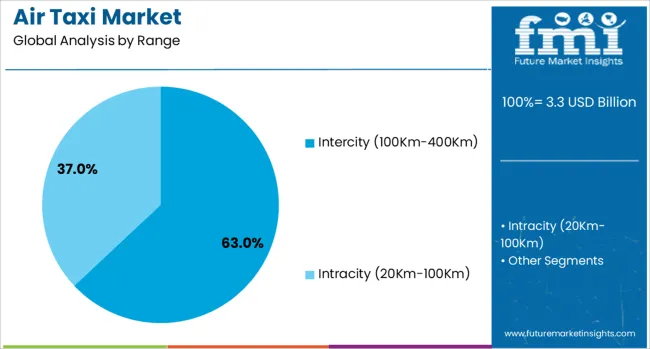

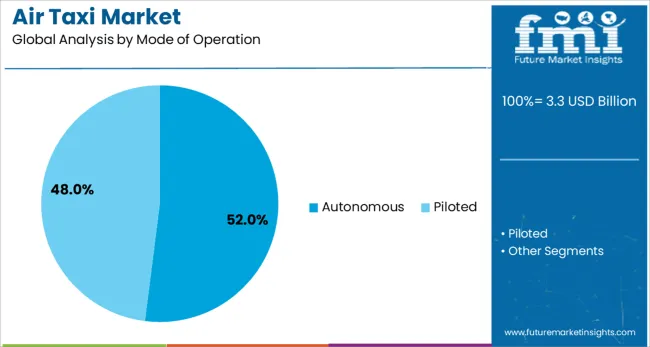

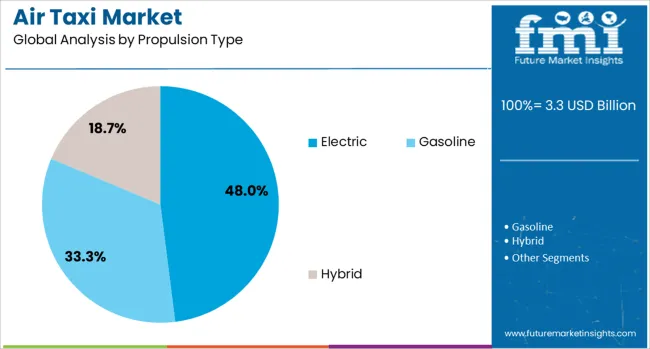

The air taxi market is segmented by range, mode of operation, propulsion type, application, end user, and geographic regions. The range of the air taxi market is divided into Intercity (100Km-400Km) and Intracity (20Km-100Km). In terms of the mode of operation, the air taxi market is classified into Autonomous and Piloted. Based on propulsion type, the air taxi market is segmented into Electric, Gasoline, and Hybrid.

The application of the air taxi market is segmented into Passenger transportation, Medical evacuation, Search and rescue, Cargo transportation, and others. The end users of the air taxi market are segmented into Commercial, Government, and military. Regionally, the air taxi industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The intercity range segment (100 km-400 km) is projected to dominate the air taxi market with a 63.00% revenue share in 2025. This range sweet spot aligns with most business travel and regional connectivity demands, making it ideal for replacing traditional road transport for high-frequency routes.

The segment benefits from growing congestion on inter-urban roads and increased demand for time-saving alternatives in metro clusters. Intercity-capable aircraft offer a balance between payload efficiency and battery performance, making them commercially viable for operators targeting airport shuttles and regional hubs.

Additionally, this range segment faces fewer regulatory constraints than long-haul urban air mobility, enabling faster deployment in priority corridors.

Autonomous air taxis are expected to account for 52.00% of the market share in 2025, becoming the leading operational model. Advancements in AI navigation systems, collision-avoidance technologies, and cloud-based traffic control integration drive this growth.

Autonomous operation significantly reduces pilot-related costs, enhances scalability, and enables consistent safety protocols across fleets. Early-stage implementations are already being trialed in geofenced environments with limited airspace complexity.

The appeal of autonomy lies in its long-term economic advantages and the ability to standardize customer experiences. As certification standards evolve and public acceptance improves, autonomous air taxis are set to define the commercial future of this market.

Electric propulsion is anticipated to hold a 48.00% share of the air taxi market in 2025, marking it as the most adopted power source. The segment’s dominance is supported by a global focus on decarbonizing transportation and reducing noise pollution in densely populated areas.

Battery-electric aircraft offer lower maintenance costs, quieter operation, and zero in-flight emissions, aligning with urban environmental goals. Investments in high-capacity lithium-ion and solid-state battery technologies are further extending flight duration and improving energy efficiency.

Moreover, electric platforms are simpler to certify and scale compared to hybrid or combustion alternatives, enabling a smoother transition into commercial operations.

The air taxi industry is rapidly expanding, fueled by advancements in urban mobility and the need for more efficient transportation solutions. Electric vertical take-off and landing (eVTOL) vehicles are at the forefront, offering the potential to transform short-distance travel in busy cities. These air taxis promise faster, safer, and eco-friendly alternatives to traditional transportation. Despite facing challenges such as high development costs and regulatory obstacles, the market holds significant potential. Both private and government sector investments are accelerating the growth and innovation of air taxi services, paving the way for their future success.

The air taxi market is expanding due to the rising demand for alternative transportation solutions in densely populated urban areas. Traffic congestion and long commute times are pushing consumers and businesses to explore more efficient options. Air taxis offer a viable solution, providing faster, safer, and more flexible transport within cities. The growth of electric vertical take-off and landing (eVTOL) technology is making air taxis more feasible, offering quieter, energy-efficient, and cost-effective solutions compared to traditional helicopters. As governments continue to invest in smart city infrastructure and urban air mobility, the market is set to expand. Furthermore, the increasing focus on reducing carbon emissions and improving urban transportation efficiency is pushing the adoption of cleaner and more innovative mobility solutions like air taxis, which promise reduced congestion and faster transit.

A significant challenge for the air taxi industry is the high cost of development and infrastructure. Developing eVTOL aircraft requires substantial capital investment, and building the necessary infrastructure, such as vertiports and charging stations, adds further financial burden. These high costs can slow down the widespread adoption of air taxis, particularly in price-sensitive markets. Regulatory hurdles are another obstacle. Governments need to create comprehensive policies that ensure the safe operation of air taxis in urban environments. Issues related to air traffic management, airspace control, and safety standards must be addressed. Delays in regulatory approvals and compliance with local and international aviation laws can also hinder progress. Public acceptance and the need for operational safety standards will continue to play an important role in determining the rate at which air taxis are adopted.

The air taxi industry is experiencing key trends related to the integration of smart technology and autonomous flight. eVTOL aircraft are being developed with enhanced features such as real-time monitoring, predictive maintenance, and automated navigation, making them safer and more efficient. Autonomous flying capabilities are another prominent trend, which can reduce operational costs by eliminating the need for pilots, while also improving accessibility and operational efficiency. These advancements, combined with the use of renewable energy sources for aircraft propulsion, are making air taxis a more attractive solution for urban transportation. The adoption of autonomous flight technology also plays a crucial role in reducing human error and enhancing safety. In addition, companies are focusing on developing more efficient battery systems, which are crucial for increasing the range and reliability of eVTOL aircraft.

The air taxi market offers significant growth opportunities, particularly in emerging markets with growing urban populations and increasing traffic congestion. As cities in Asia, Africa, and Latin America expand rapidly, air taxis provide a potential solution for reducing commute times and improving transportation efficiency. Infrastructure development plays a critical role in market expansion, with governments and private companies investing in vertiports, charging stations, and air traffic control systems designed to accommodate air taxis. The rise in electric vehicles (EVs) also presents an opportunity, as air taxis share similarities with electric cars in terms of reducing emissions and energy consumption. Additionally, partnerships between aviation companies, tech firms, and governments present opportunities to create a robust ecosystem for urban air mobility. These opportunities are creating an environment where air taxis can thrive as a long-term solution to urban transport challenges.

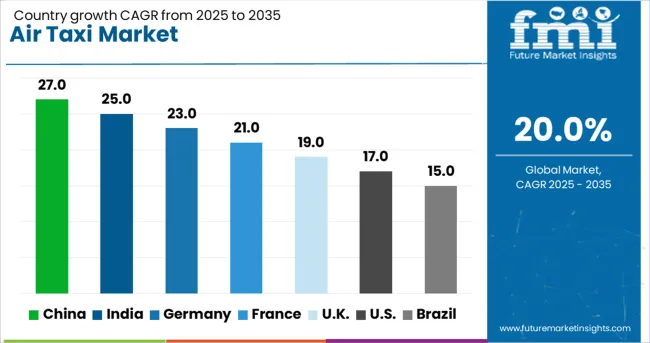

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

The advanced tires market is projected to grow at a CAGR of 8.8% from 2025 to 2035. Among the top five profiled markets, China leads at 11.9%, followed by India at 11.0%, Germany at 10.1%, the United Kingdom records 8.4%, and the United States stands at 7.5%. These rates reflect strong demand in BRICS countries like China and India, driven by industrial expansion, automotive sector growth, and increasing preference for performance-oriented tires. Developed markets such as Germany, the UK, and the USA show steady growth, fueled by advancements in tire technology, including fuel-efficient, durable, and eco-friendly solutions. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 11.9% through 2035, with robust demand driven by rapid growth in the automotive industry. As the world’s largest automotive market, China is witnessing significant shifts toward electric vehicles (EVs) and high-performance tires, driving the demand for advanced tire technologies. The country’s focus on improving fuel efficiency, reducing emissions, and enhancing tire longevity is contributing to the increasing adoption of advanced tires in both passenger cars and commercial vehicles. Additionally, the rise in environmental regulations and government initiatives supporting green technologies further boosts the market for eco-friendly and energy-efficient tires. China’s large-scale infrastructure projects and growing vehicle production capacity also support this trend.

India is expected to grow at a CAGR of 11.0% through 2035, driven by increasing demand in the automotive sector, particularly in electric vehicles (EVs) and commercial vehicles. The Indian market for advanced tires is expanding as vehicle manufacturers focus on improving fuel efficiency, performance, and durability. As India’s automotive industry grows, so does the demand for high-performance tires that meet regulatory standards for safety and environmental considerations. The government’s push for modernizing agriculture and livestock farming practices will continue to support the adoption of these technologies.

Germany is expected to grow at a CAGR of 10.1% through 2035, driven by a strong automotive industry focused on performance and environmental efficiency. Germany, home to leading automotive manufacturers, continues to push for innovations in tire technology, including fuel-efficient, durable, and noise-reducing tires. The shift towards electric vehicles (EVs) and sustainable mobility is further accelerating demand for advanced tires, as EVs require tires designed to improve energy efficiency and handling. The German market also benefits from government policies that support the adoption of green technologies and the reduction of CO2 emissions, which has influenced the demand for eco-friendly and high-performance tire solutions.

The United Kingdom is projected to grow at a CAGR of 8.4% through 2035, with growth supported by the rise in electric vehicles (EVs) and regulatory pressure for more efficient and eco-friendly tires. The UK automotive market is witnessing a shift toward more sustainable transportation solutions, increasing demand for tires that align with new emissions standards and offer better fuel efficiency. The government’s push for reducing carbon emissions and encouraging the adoption of EVs has further propelled the demand for advanced tire technologies. As the UK automotive sector continues to expand, the need for high-performance and durable tires is also expected to grow.

The United States is projected to grow at a CAGR of 7.5% through 2035, with the demand for high-performance tires and growing interest in electric vehicles (EVs). As the USA automotive market continues to focus on fuel efficiency, vehicle performance, and environmental sustainability, the demand for advanced tires that meet regulatory standards for emissions and energy efficiency is rising. The increasing adoption of EVs in the USA also boosts the market for specialized tires that enhance performance and increase energy efficiency. The demand for commercial vehicle tires is another contributing factor, as more vehicles are needed for logistics and transportation.

The air taxi market is rapidly evolving, driven by advancements in electric vertical takeoff and landing (eVTOL) aircraft technologies and the growing demand for urban air mobility (UAM). Volocopter GmbH leads the market with its innovative eVTOL aircraft, focusing on short urban flights with fully electric propulsion systems for passengers and cargo. Airbus and Boeing are major players leveraging their aerospace expertise, investing heavily in UAM and air taxi programs, with Airbus focusing on the CityAirbus eVTOL and Boeing exploring partnerships to develop next-generation urban air mobility solutions.

Textron Aviation Inc., with its subsidiary Cessna, brings expertise in both traditional aviation and electric flight technologies, contributing to the development of hybrid-electric and fully electric air taxis. Beta Technologies focuses on all-electric eVTOL aircraft, with an emphasis on long-range capabilities, regulatory compliance, and scalability for commercial operations.

EHANG specializes in autonomous aerial vehicles and has established itself as a global player with its eVTOL solutions, targeting both passenger and cargo delivery applications. Lilium N.V. is advancing its high-speed, electric air taxi with a unique jet-style configuration that targets regional air travel markets.

Competitive differentiation in this market relies on aircraft range, speed, noise reduction technologies, regulatory approvals, and partnerships with urban infrastructure developers. Barriers to entry include high development and certification costs, complex regulatory frameworks, and the need for extensive testing. Strategic priorities include achieving FAA certification, reducing operational costs, and establishing partnerships with city governments and aviation regulators to integrate air taxis into urban transportation networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Range | Intercity (100Km-400Km) and Intracity (20Km-100Km) |

| Mode of Operation | Autonomous and Piloted |

| Propulsion Type | Electric, Gasoline, and Hybrid |

| Application | Passenger transportation, Medical evacuation, Search and rescue, Cargo transportation, and Others |

| End User | Commercial and Government & military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Volocopter GmbH, Airbus, Boeing, Textron Aviation Inc., Beta Technologies, EHANG, and Lilium N.V. |

| Additional Attributes | Dollar sales by aircraft type (eVTOL, hybrid-electric, autonomous aerial vehicles) and end-use segments (passenger transport, cargo delivery, emergency services). Demand dynamics are driven by the growing interest in reducing urban congestion, lowering travel times, and providing sustainable transportation solutions for cities. Regional trends show North America and Europe as leaders in air taxi development, with significant investments in infrastructure, while Asia-Pacific is expected to emerge as a major market due to rapid urbanization and government support for air mobility initiatives. Innovation trends include advancements in battery technology, autonomous flight systems, and integrated air traffic management systems for UAM. |

The global air taxi market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the air taxi market is projected to reach USD 20.5 billion by 2035.

The air taxi market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in air taxi market are intercity (100km-400km) and intracity (20km-100km).

In terms of mode of operation, autonomous segment to command 52.0% share in the air taxi market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA