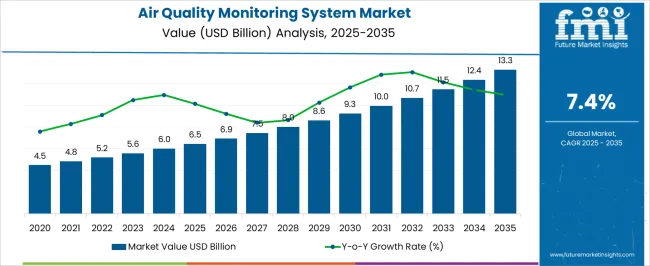

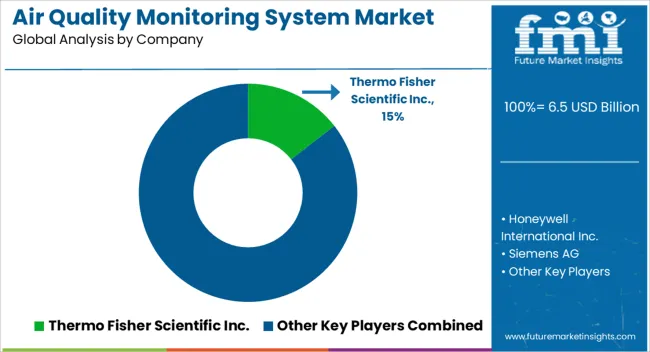

The Air Quality Monitoring System Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Air Quality Monitoring System Market Estimated Value in (2025 E) | USD 6.5 billion |

| Air Quality Monitoring System Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The air quality monitoring system market is witnessing robust expansion, fueled by increasing awareness of pollution-related health risks and the enforcement of stricter environmental regulations. Governments and organizations are investing heavily in advanced monitoring technologies to assess outdoor and indoor air quality, creating strong demand for continuous and real-time data solutions.

Technological progress in sensor accuracy, wireless connectivity, and data analytics has enhanced the reliability and accessibility of monitoring systems. Rising urbanization and industrialization in developing regions have intensified demand for public infrastructure monitoring, while consumer adoption of residential air quality devices has also grown.

Looking ahead, the market is expected to be driven by global efforts toward pollution reduction, climate action strategies, and integration of smart monitoring systems into urban infrastructure projects.

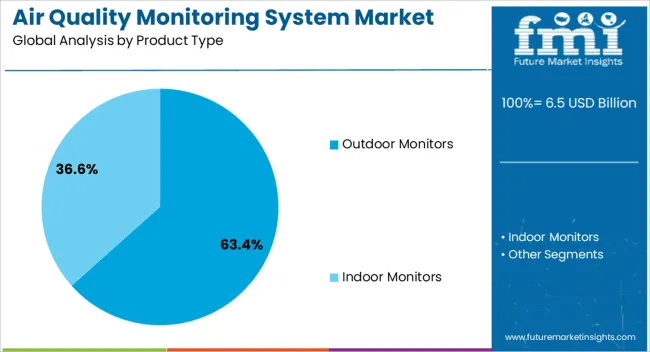

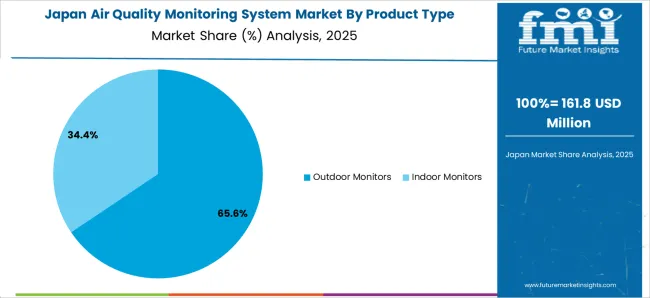

The outdoor monitors segment leads the product type category with approximately 63.40% share, supported by large-scale deployment in urban centers, industrial sites, and government monitoring stations. This segment’s leadership is attributed to its ability to deliver continuous, accurate measurements of particulate matter, nitrogen oxides, and other pollutants critical for public health assessments.

Governments and municipalities rely heavily on outdoor monitors to establish compliance with air quality standards and to design pollution control policies. The segment’s growth has been reinforced by rapid industrialization and increased traffic emissions, necessitating advanced monitoring solutions.

With climate action policies intensifying globally, the outdoor monitors segment is projected to sustain its leading role in the market.

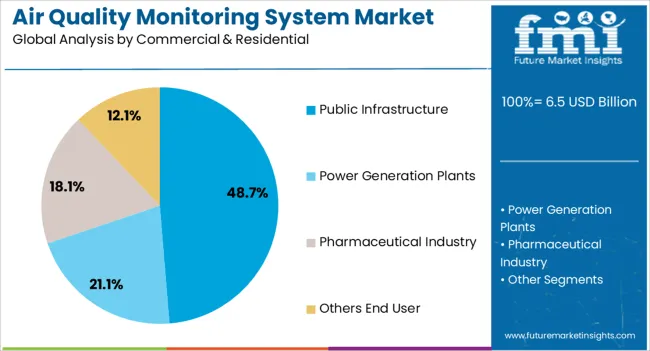

The public infrastructure segment accounts for approximately 48.70% of the commercial and residential application category, reflecting the priority given to community-level air quality monitoring. The segment’s growth is driven by urban development initiatives, where monitoring stations are integrated into transportation hubs, schools, and government facilities to safeguard public health.

Infrastructure projects funded by governments and international organizations emphasize the deployment of air monitoring systems to track pollution trends and enforce regulations. As cities increasingly adopt smart infrastructure frameworks, the integration of air quality monitoring is becoming a standard requirement.

This segment is expected to maintain its prominence as public health awareness and environmental compliance continue to intensify.

Artificial Intelligence and Data Analytics Transforming the Market

AI and data analytics technologies are transforming the air quality monitoring industry. Businesses can now handle and analyze enormous volumes of data, providing better insights into pollution trends. Companies and regulatory agencies can more effectively tackle environmental issues by using predictive modeling, improving the knowledge of air quality dynamics. By streamlining decision-making procedures and enabling the creation of customized pollution control strategies, data analytics for air quality monitoring promotes a more robust and sustainable corporate environment.

Rising Integration in Smart City Initiatives Presents Opportunities in the Market

Real-time air quality monitoring systems are becoming essential for urban planning due to the global move toward smart cities. In addition to fostering sustainable urban development, citywide sensor networks and smart infrastructure also present financial potential for companies in the infrastructure and technology industries. The demand for advanced air quality monitoring systems increases as cities engage in smart solutions, creating profitable opportunities for companies that provide all-encompassing solutions supporting contemporary urbanization and environmental sustainability.

Drone-based Monitoring for Hard-to-Reach Areas Emerges as a Revolutionary Trend

Using drones fitted with air quality sensors to monitor dangerous or hard-to-reach places is an innovative approach. Companies that invest in drone-based environmental monitoring systems are responding to the market's need for flexible and effective monitoring methods. Drones are an invaluable tool for evaluating air quality in various settings because they provide an unmatched level of flexibility in data collection. By leveraging this trend, companies are presenting themselves as leaders in the new field of airborne environmental monitoring and offering creative solutions. This aligns with the industry's emphasis on technology development and highlights companies' marketability in drone-based air quality monitoring.

| Report Attribute | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Challenges |

|

| Top Product Type | Indoor Monitors |

|---|---|

| CAGR (2025 to 2035) | 7.4% |

Based on the product type, the indoor monitors segment is projected to rise at a 7.4% CAGR through 2035.

| Top End User | Commercial & Residential |

|---|---|

| CAGR (2025 to 2035) | 7.2% |

Based on the end user, the commercial and residential segment is anticipated to thrive at a 7.2% CAGR through 2035.

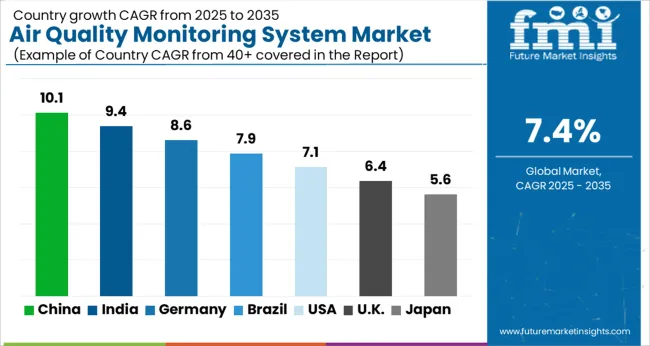

The United States air quality monitoring system market is predicted to expand at a 7.7% CAGR through 2035.

The demand for air quality monitoring systems in the United Kingdom is anticipated to rise at an 8.1% CAGR through 2035.

The air quality monitoring system market in China is estimated to rise at a 7.8% CAGR through 2035.

The air quality monitoring system industry in Japan is predicted to expand at an 8.5% CAGR through 2035.

The demand for air quality monitoring systems in South Korea is projected to rise at a 9.9% CAGR through 2035.

The air quality monitoring system market is marked by fierce competition among leading players, each contending for market dominance in a world driven by global environmental concerns and shifting regulatory frameworks. Prominent industry titans like Thermo Fisher Scientific, Siemens AG, and Honeywell International lead the market, which is attributable to their vast resources, wide range of products, and international presence. These behemoths present themselves as all-inclusive solution providers, offering a range of monitoring services and technology to fulfill the ever-changing and complicated demands of governments and enterprises to comply with strict air quality regulations.

Recent Developments

The global air quality monitoring system market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the air quality monitoring system market is projected to reach USD 13.3 billion by 2035.

The air quality monitoring system market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in air quality monitoring system market are outdoor monitors and indoor monitors.

In terms of commercial & residential, public infrastructure segment to command 48.7% share in the air quality monitoring system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Venison Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Fish Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA