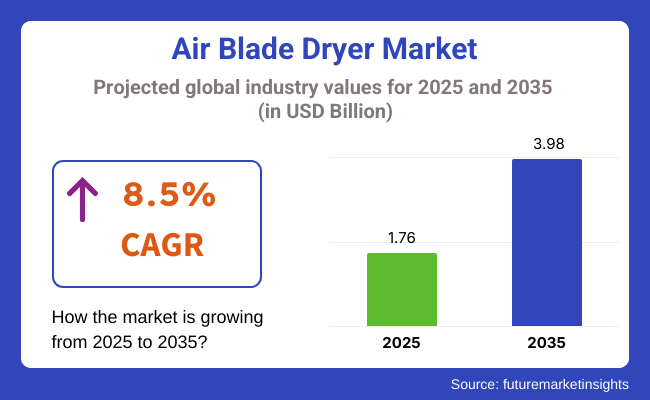

The global air blade dryer market is on a high-growth trajectory, projected to rise from USD 1.76 billion in 2025 to USD 3.98 billion by 2035, registering a CAGR of 8.5%. Strong hygiene regulations, sustainability mandates, and the decline of paper towel usage are shaping this shift.

The United States, China, and Western Europe remain the largest markets, while Japan and South Korea lead demand for compact, energy-efficient designs in space-constrained environments. Dyson leads the global landscape, followed by Excel Dryer and Mitsubishi Electric.

The rise in touchless technology adoption-accelerated by post-pandemic health protocols-has elevated demand for HEPA-filtered, high-speed air blade dryers. Facilities across airports, hospitals, and educational institutions are replacing traditional dryers and paper towels with intelligent, sensor-activated systems to reduce disease transmission.

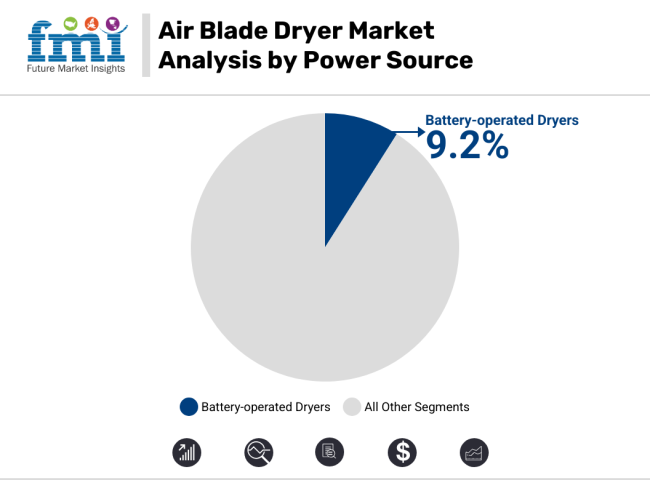

Low-noise operation, antimicrobial coatings, and real-time maintenance diagnostics are now standard requirements. While electric dryers dominate overall demand, battery-operated models are expanding access in off-grid and retrofit installations.

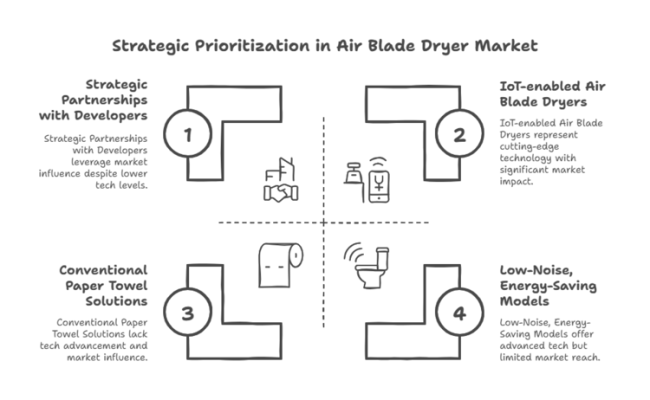

Looking ahead, smart restrooms and IoT-enabled systems will redefine competitive positioning. Western Europe is pushing manufacturers to meet carbon neutrality and recyclability benchmarks, while South Korea is seeing widespread uptake of UV-integrated dryers in malls and transit hubs.

Investments in AI-based monitoring, predictive maintenance, and noise-reduction tech are rising. To win across diverse geographies, manufacturers must localize product strategies-prioritizing sustainability in Europe, compactness in Asia, and connectivity in the United States.

The market is also shaped by regional variations in regulatory pressure, infrastructure maturity, and customer priorities. In the USA, cost savings from eliminating paper towels and integrating predictive diagnostics drive upgrades across office buildings and airports. In contrast, Western Europe’s momentum is regulatory-led, with the EU’s EcoDesign and RoHS directives accelerating demand for energy-efficient, recyclable dryers.

Japan and South Korea, while more cost-sensitive, prioritize ultra-compact, high-speed models suited for dense urban restrooms. Manufacturers are responding with modular designs, hybrid filtration systems, and leasing models to cater to varied price sensitivities and spatial constraints across regions.

Electric air blade dryers continue to dominate the global landscape due to their powerful motors, rapid drying speeds, and suitability for high-footfall environments like airports, malls, and hospitals. These models are typically wall-mounted and offer HEPA filtration and advanced sensors, aligning with commercial hygiene protocols.

However, their reliance on fixed power sources and installation costs can limit adoption in remote or retrofitted buildings. As a result, battery-operated air blade dryers are gaining popularity in off-grid locations and mobile or temporary installations. Recent improvements in lithium-ion battery efficiency have enhanced performance, though airflow strength and battery replacement costs remain constraints.

Healthcare facilities are projected to be the fastest-growing end-user category, driven by strict hygiene standards and increasing replacement of paper towels with HEPA-equipped, touchless air blade dryers. Hospitals and clinics demand noise-controlled, antimicrobial systems to reduce cross-contamination and improve patient comfort.

Commercial buildings-including offices, hotels, and retail chains-remain the largest user segment due to cost savings and sustainability efforts. Educational institutions are upgrading to touchless systems to reduce germ spread among students, while public and industrial facilities demand rugged, vandal-proof models with high throughput and minimal maintenance.

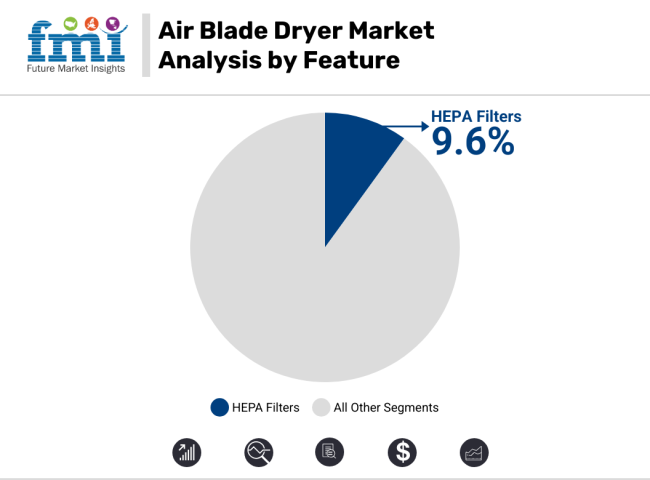

Among features, HEPA filtration is witnessing the strongest growth, especially in sectors like healthcare, food services, and cleanroom operations where air quality is paramount. These filters remove up to 99.97% of airborne contaminants, making them ideal for facilities governed by health and safety compliance. Noise reduction technology is also surging, especially in hotels and office spaces where user comfort is critical.

Touchless operation has become a baseline expectation post-COVID, with nearly all commercial installations demanding sensor-activated drying. Meanwhile, emerging models with IoT integration, UV disinfection, and adjustable airflows are carving out niche demand among smart building developers.

The Air Blade Dryer landscape is seeing robust expansion driven by demand for clean, green, and energy-saving hand-drying equipment in commercial, public, and institutional settings.

This growth trajectory is primarily driven by hygiene trends, technological advancements, and cost-efficiency factors. Companies and operations valuing touchless with high-speed drying solutions are rapidly buying these systems as a way of enhancing hygiene levels and minimizing long-term operational expenses.

On the other hand, conventional paper towel producers are experiencing diminishing sales as companies switch to air blade dryers. Companies investing in energy-efficient, low-noise technologies will lead the industry, particularly as smart cities and green buildings rapidly adopt sustainable hand-drying technology.

Invest in Intelligent, Sanitary, and Green Technology

Executives must make IoT-enabled, touchless air blade dryers with HEPA filters and antimicrobial finishes a priority to address increased hygiene requirements and sustainability expectations. Low-noise, energy-saving models will pay dividends in terms of competitive positioning as companies look for environmentally friendly restroom solutions.

Align with Regulatory and Consumer Trends

Businesses need to keep ahead of regulatory requirements promoting low-carbon, waste-minimizing drying solutions while responding to growing consumer demand for intelligent, automated toilets. Collaborations with commercial real estate developers, airports, and hospitals will secure long-term segment congruence.

Increase Distribution and Strategic Partnerships

Strengthening B2B collaborations with facility management companies, hotel chains, and infrastructure developers will drive large-scale adoption. Investing in R&D for lower noise, quick-drying, and AI-based models and forging M&A options with new-tech industry players will additionally boost sector dominance.

| Risk | Probability & Impact |

|---|---|

| Regulatory Changes & Compliance - Stricter environmental laws or hygiene mandates may require costly product modifications. | Medium Probability, High Impact |

| Supply Chain Disruptions - Raw material shortages or logistical delays could impact production and delivery timelines. | High Probability, High Impact |

| Technological Disruption - Emerging drying technologies or alternative solutions may reduce demand for air blade dryers. | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Product Innovation | Invest in IoT-enabled, antimicrobial, and energy-efficient air blade dryers to stay ahead of competitors. |

| Regulatory Compliance | Monitor emerging environmental and hygiene regulations and adjust product designs accordingly. |

| Strategic Partnerships | Strengthen OEM collaborations and distributor networks to expand industry reach and adoption. |

To sustain momentum, companies need to accelerate investments in smart, hygienic, and energy-efficient air-blade dryers that not only meet emerging anti-viral and safety and health regulatory standards but also the sustainability trends capturing global attention. Further developing OEM partnerships and distribution channels with more reach and penetration in the segment will be guaranteed.

This is especially true in rapidly expanding industries like hospitality, healthcare, and smart infrastructure. In addition, it is now time to adopt IoT and AI-powered monitoring systems to differentiate the brand and address the increasing expectations of hands-free restroom experience.

Key Priorities of Stakeholders

Regional Variance:

Adoption of Smart & Connected Technologies

High Variance:

Divergent Perspectives on ROI:

Feature Preferences & Material Trends

Consensus:

Regional Variance:

Price Sensitivity & Investment Appetite

Shared Challenges:

Regional Differences:

Pain Points in the Value Chain

Manufacturers:

Distributors:

End-Users (Facility Managers, Businesses):

Future Investment Priorities

Alignment:

Divergence:

Regulatory Impact

Conclusion: Variance vs. Consensus

High Consensus:

Key Variances:

Strategic Insight: A "one-size-fits-all" approach will not succeed. Manufacturers must adapt strategies regionally:

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States |

|

| Western Europe (EU) |

|

| United Kingdom |

|

| Germany |

|

| France |

|

| Japan |

|

| South Korea |

|

| China |

|

| India |

|

The USA air blade dryer sector is set to register a CAGR of 7.5% over the period of 2025 to 2035, owing to rising hygiene regulations, sustainability initiatives, and cost-saving implementation in commercial spaces. The Energy Policy Act (EPACT) requires energy-efficient appliances, which pushes businesses and institutions to upgrade their hand-drying systems.

Furthermore, certain states like California and New York are phasing out paper towels, which pushes the air blade dryer industry penetration further. The growing trend toward smart restrooms across airports, shopping malls, and corporate offices has propelled demand for IoT-enabled hand dryers that provide features such as predictive maintenance and energy tracking. Touchless technology is now standard in hospitality and healthcare, with companies leading adoption.

The UK air-blade dryer sector is expected to reach USD 36.2 million by 2035, growing at a CAGR of 8.1% during the forecast period from 2025 to 2035, owing to the increasing presence of net-zero policies and energy efficiency mandates and their growing adoption in commercial buildings. The Building Regulations Part L, which mandates sustainable appliances, is driving an increasing demand for low-energy, high-speed dryers, particularly in new and renovated buildings.

Airports, railway stations, and hotels are also transitioning to hygienic, touchless drying solutions, making the hospitality and transport sectors major growth drivers. Growing awareness of carbon footprints is prompting industries to invest in more environmentally friendly manufacturing models.

The French air blade dryer sector will grow at a CAGR of 7.5% over the forecast period, from 2025 to 2035. The French Energy Transition Law promotes the use of energy-efficient devices among businesses, which makes high-speed, low-energy dryers an interesting investment.

Manufacturers are developing environmentally friendly carbon-neutral drying solutions as important parts of the HQE (High Quality Environmental standard) standard and to counterbalance global warming, as the standard advocates eco-friendly materials and low-energy energy consumption.

The hospitality and public infrastructure sectors in France are early adopters, with airports, universities, and government buildings refurbishing their restrooms. However, the high regulatory barriers and significant competition posed by local EU-based brands are challenges.

From 2025 to 2035, the air blade dryer landscape in Germany is predicted to grow at a compound annual growth rate (CAGR) of 8.0%, which is attributed to energy efficiency directives by the EU, sustainable energy targets, and an increasing need for durable, high-performance products.

The EU EcoDesign Directive requires energy-efficient hand dryers, and the Blue Angel certifies the use of sustainable and recyclable materials. Key industries include Germany’s corporate sector and public infrastructure, with an increasing transition to automated, sensor-based drying solutions. IoT-enabled air blade dryers with energy tracking functionality are increasingly adopted in airports, railway stations, and smart restrooms in commercial spaces

Influenced by increasing tourism to Italy, continuing efforts to improve water efficiency, and modernization to public restrooms, the overall sector for air blade dryers in Italy is expected to grow at a CAGR of 7.3% over the forecast period from 2025 to 2035. The Italian Green Economy Plan encourages companies to replace their non-compliant appliances with ones that are energy-efficient and eco-compatible.

This is generating a constant demand for high-speed and low-energy dryer operational equipment within hotels, restaurants, and cultural sites. Price sensitivity and slow adoption of IoT-enabled dryers. Incentives from the government for carbon-neutral appliances for touchless solutions are reinforcing growth.

The sector for air blade dryers in South Korea is poised to grow at a CAGR of 8.7% from 2025 to 2035, underpinned by urbanization, tech-driven infrastructure, and increasing hygiene awareness among consumers. KEMCO's Energy Labeling Program makes a strict energy efficiency specification, while KC certification ensures higher safety and durability.

Strong growth is expected for smart restrooms, where IoT-connected dryers are fitted in malls, airports, and high-rise office buildings, while UV disinfection products features are also gaining traction. Further driving growth is the government’s focus on smart city infrastructure and public hygiene awareness.

Due to the greater cost sensitivity and preference for compact and minimalistic designs, Japan’s air-blade dryer landscape is the slowest-growing, with a CAGR of 7.2% for the period from 2025 to 2035. But JIS certification and Energy Conservation Act policies are transitioning companies toward energy-efficient appliances.

Public restrooms in train stations, offices, and commercial buildings have already moved to relatively quiet, but there's been no real uptick in smart, IoT-enabled dryers. Consumers and small businesses focused on price prefer low-energy, inexpensive dryers to more expensive dryer models.

China will emerge as one of the fastest-growing sectors for air blade dryers, with a CAGR of 9.1% from 2025 to 2035, aided by urbanization, government sustainability programs, and increasing need for hygiene. The CCC certification guarantees that products meet energy efficiency and safety standards in China, and for the Green Manufacturing Policy, they encourage the use of recycled materials during dryer production.

Among them, the hospitality, healthcare, and commercial real estate industries are the major end-users, driving mass adoption of IoT-based energy-efficient dryers in smart city projects.

Strong hygiene regulations, sustainability mandates, and the increasing adoption of touchless technology are driving the Australia-New Zealand air blade dryer sector, which is expected to grow at a CAGR of 8.3% between 2025 and 2035.

Promotion of low-energy appliances through the National Construction Code (NCC) in Australia and New Zealand’s EECA Energy Efficiency Program has driven a high level of uptake of these air blade dryers throughout both commercial and public spaces.

Airports, malls, and restaurants are driving the transition, with tourism, corporate sustainability goals, and high urbanization rates serving as pillars of growth. Government subsidies for energy-efficient appliances also provide extra encouragement to adoption.

The landscape for air blade dryers in India is anticipated to register a growth at a CAGR of 8.5% over the forecast period of 2025 to 2035. The demand for touchless, energy-efficient dryers in public restrooms, metro stations and commercial buildings is growing due to initiatives like the Smart Cities Mission and Swachh Bharat Abhiyan.

The hospitality, healthcare, and corporate verticals are also driving increasing adoption owing to high set hygiene standards. Though BIS certification ensures implementation of safety and quality, future energy-efficiency guidelines released by BEE are likely to escalate demand for eco-friendly models.

Cost sensitivity and import dependency for high-end models, however, continue to pose major challenges. Local manufacturing is likely to receive an impetus on the back of government incentives under the Make in India initiative.

Leading players in the air blade dryer landscape are competing on the basis of price strategies, technology innovation, strategic alliances, and expansion. Dyson, the segment leader, competes on the basis of premium pricing and innovation, combining energy-efficient motors, HEPA filtration, and noise reduction technology to make its Airblade series stand out.

The growth in this sector is predominantly fueled by emerging sectors, sustainability efforts, and product improvements. Firms are further investing in touchless technology and IoT-connected dryers to respond to expanded hygiene needs in the post-pandemic period.

Industry News Websites:

Company Press Releases:

Trade Publications:

Financial Reports:

Google Alerts:

Social Media:

Electric Air Blade Dryers and Battery-operated Air Blade Dryers

Commercial Buildings, Industrial Facilities, Educational Institutions, Healthcare Facilities, and Public Facilities

Noise Reduction Technology, HEPA Filters, Touchless Operation, and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and The Middle East & Africa

Greater emphasis on hygiene, power efficiency, and sustainability is fueling the use of air blade dryers. Companies and public places like to use touchless dryers in order to limit the germination of germs while minimizing maintenance costs with paper towels.

Air blade dryers employ high-velocity air to strip away moisture rapidly, shortening drying times and energy use. In contrast to traditional warm-air dryers, they reduce bacteria transmission by eliminating the requirement for extended hand exposure to warm airflow.

Other sectors like hospitality, healthcare, commercial property, and public transport stand to gain substantially from their heavy foot traffic and requirement for cost-effective, low-maintenance bathroom facilities. Industrial environments also implement them for cleanliness regulations.

Recent innovations are HEPA filtration for better air quality, noise-reduction technology for quieter machines, and IoT-monitoring capability for predictive maintenance. Some designs also include adjustable temperature and airflow controls to promote user comfort.

Challenges to manufacturers include compliance with regulations, variable raw material prices, and competition from substitute drying technologies. Satisfying energy efficiency, price, and high-performance functionality remains a focus.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by Power Source, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by Power Source, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 & 2033

Table 7: Global Market Value (US$ Million) Forecast by Features, 2018 & 2033

Table 8: Global Market Volume (Units) Forecast by Features, 2018 & 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 11: North America Market Value (US$ Million) Forecast by Power Source, 2018 & 2033

Table 12: North America Market Volume (Units) Forecast by Power Source, 2018 & 2033

Table 13: North America Market Value (US$ Million) Forecast by End User, 2018 & 2033

Table 14: North America Market Volume (Units) Forecast by End User, 2018 & 2033

Table 15: North America Market Value (US$ Million) Forecast by Features, 2018 & 2033

Table 16: North America Market Volume (Units) Forecast by Features, 2018 & 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Power Source, 2018 & 2033

Table 20: Latin America Market Volume (Units) Forecast by Power Source, 2018 & 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End User, 2018 & 2033

Table 22: Latin America Market Volume (Units) Forecast by End User, 2018 & 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Features, 2018 & 2033

Table 24: Latin America Market Volume (Units) Forecast by Features, 2018 & 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Power Source, 2018 & 2033

Table 28: Western Europe Market Volume (Units) Forecast by Power Source, 2018 & 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by End User, 2018 & 2033

Table 30: Western Europe Market Volume (Units) Forecast by End User, 2018 & 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Features, 2018 & 2033

Table 32: Western Europe Market Volume (Units) Forecast by Features, 2018 & 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Power Source, 2018 & 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Power Source, 2018 & 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 & 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by End User, 2018 & 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Features, 2018 & 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Features, 2018 & 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 42: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Power Source, 2018 & 2033

Table 44: East Asia Market Volume (Units) Forecast by Power Source, 2018 & 2033

Table 45: East Asia Market Value (US$ Million) Forecast by End User, 2018 & 2033

Table 46: East Asia Market Volume (Units) Forecast by End User, 2018 & 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Features, 2018 & 2033

Table 48: East Asia Market Volume (Units) Forecast by Features, 2018 & 2033

Table 49: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 50: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Power Source, 2018 & 2033

Table 52: South Asia Market Volume (Units) Forecast by Power Source, 2018 & 2033

Table 53: South Asia Market Value (US$ Million) Forecast by End User, 2018 & 2033

Table 54: South Asia Market Volume (Units) Forecast by End User, 2018 & 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Features, 2018 & 2033

Table 56: South Asia Market Volume (Units) Forecast by Features, 2018 & 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 58: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 59: MEA Market Value (US$ Million) Forecast by Power Source, 2018 & 2033

Table 60: MEA Market Volume (Units) Forecast by Power Source, 2018 & 2033

Table 61: MEA Market Value (US$ Million) Forecast by End User, 2018 & 2033

Table 62: MEA Market Volume (Units) Forecast by End User, 2018 & 2033

Table 63: MEA Market Value (US$ Million) Forecast by Features, 2018 & 2033

Table 64: MEA Market Volume (Units) Forecast by Features, 2018 & 2033

Figure 1: Global Market Value (US$ Million) by Power Source, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by Features, 2023 & 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 9: Global Market Value (US$ Million) Analysis by Power Source, 2018 & 2033

Figure 10: Global Market Volume (Units) Analysis by Power Source, 2018 & 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Power Source, 2023 & 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Power Source, 2022-2032

Figure 13: Global Market Value (US$ Million) Analysis by End User, 2018 & 2033

Figure 14: Global Market Volume (Units) Analysis by End User, 2018 & 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 & 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 17: Global Market Value (US$ Million) Analysis by Features, 2018 & 2033

Figure 18: Global Market Volume (Units) Analysis by Features, 2018 & 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Features, 2023 & 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Features, 2022-2032

Figure 21: Global Market Attractiveness by Power Source, 2022-2032

Figure 22: Global Market Attractiveness by End User, 2022-2032

Figure 23: Global Market Attractiveness by Features, 2022-2032

Figure 24: Global Market Attractiveness by Region, 2022-2032

Figure 25: North America Market Value (US$ Million) by Power Source, 2023 & 2033

Figure 26: North America Market Value (US$ Million) by End User, 2023 & 2033

Figure 27: North America Market Value (US$ Million) by Features, 2023 & 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 33: North America Market Value (US$ Million) Analysis by Power Source, 2018 & 2033

Figure 34: North America Market Volume (Units) Analysis by Power Source, 2018 & 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Power Source, 2023 & 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Power Source, 2022-2032

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2018 & 2033

Figure 38: North America Market Volume (Units) Analysis by End User, 2018 & 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End User, 2023 & 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 41: North America Market Value (US$ Million) Analysis by Features, 2018 & 2033

Figure 42: North America Market Volume (Units) Analysis by Features, 2018 & 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Features, 2023 & 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Features, 2022-2032

Figure 45: North America Market Attractiveness by Power Source, 2022-2032

Figure 46: North America Market Attractiveness by End User, 2022-2032

Figure 47: North America Market Attractiveness by Features, 2022-2032

Figure 48: North America Market Attractiveness by Country, 2022-2032

Figure 49: Latin America Market Value (US$ Million) by Power Source, 2023 & 2033

Figure 50: Latin America Market Value (US$ Million) by End User, 2023 & 2033

Figure 51: Latin America Market Value (US$ Million) by Features, 2023 & 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Power Source, 2018 & 2033

Figure 58: Latin America Market Volume (Units) Analysis by Power Source, 2018 & 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Power Source, 2023 & 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Power Source, 2022-2032

Figure 61: Latin America Market Value (US$ Million) Analysis by End User, 2018 & 2033

Figure 62: Latin America Market Volume (Units) Analysis by End User, 2018 & 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 & 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 65: Latin America Market Value (US$ Million) Analysis by Features, 2018 & 2033

Figure 66: Latin America Market Volume (Units) Analysis by Features, 2018 & 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Features, 2023 & 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Features, 2022-2032

Figure 69: Latin America Market Attractiveness by Power Source, 2022-2032

Figure 70: Latin America Market Attractiveness by End User, 2022-2032

Figure 71: Latin America Market Attractiveness by Features, 2022-2032

Figure 72: Latin America Market Attractiveness by Country, 2022-2032

Figure 73: Western Europe Market Value (US$ Million) by Power Source, 2023 & 2033

Figure 74: Western Europe Market Value (US$ Million) by End User, 2023 & 2033

Figure 75: Western Europe Market Value (US$ Million) by Features, 2023 & 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 81: Western Europe Market Value (US$ Million) Analysis by Power Source, 2018 & 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Power Source, 2018 & 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Power Source, 2023 & 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Power Source, 2022-2032

Figure 85: Western Europe Market Value (US$ Million) Analysis by End User, 2018 & 2033

Figure 86: Western Europe Market Volume (Units) Analysis by End User, 2018 & 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 & 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 89: Western Europe Market Value (US$ Million) Analysis by Features, 2018 & 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Features, 2018 & 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Features, 2023 & 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Features, 2022-2032

Figure 93: Western Europe Market Attractiveness by Power Source, 2022-2032

Figure 94: Western Europe Market Attractiveness by End User, 2022-2032

Figure 95: Western Europe Market Attractiveness by Features, 2022-2032

Figure 96: Western Europe Market Attractiveness by Country, 2022-2032

Figure 97: Eastern Europe Market Value (US$ Million) by Power Source, 2023 & 2033

Figure 98: Eastern Europe Market Value (US$ Million) by End User, 2023 & 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Features, 2023 & 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Power Source, 2018 & 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Power Source, 2018 & 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Power Source, 2023 & 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Power Source, 2022-2032

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 & 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by End User, 2018 & 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 & 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Features, 2018 & 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Features, 2018 & 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Features, 2023 & 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Features, 2022-2032

Figure 117: Eastern Europe Market Attractiveness by Power Source, 2022-2032

Figure 118: Eastern Europe Market Attractiveness by End User, 2022-2032

Figure 119: Eastern Europe Market Attractiveness by Features, 2022-2032

Figure 120: Eastern Europe Market Attractiveness by Country, 2022-2032

Figure 121: East Asia Market Value (US$ Million) by Power Source, 2023 & 2033

Figure 122: East Asia Market Value (US$ Million) by End User, 2023 & 2033

Figure 123: East Asia Market Value (US$ Million) by Features, 2023 & 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 126: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 127: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 128: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 129: East Asia Market Value (US$ Million) Analysis by Power Source, 2018 & 2033

Figure 130: East Asia Market Volume (Units) Analysis by Power Source, 2018 & 2033

Figure 131: East Asia Market Value Share (%) and BPS Analysis by Power Source, 2023 & 2033

Figure 132: East Asia Market Y-o-Y Growth (%) Projections by Power Source, 2022-2032

Figure 133: East Asia Market Value (US$ Million) Analysis by End User, 2018 & 2033

Figure 134: East Asia Market Volume (Units) Analysis by End User, 2018 & 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 & 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 137: East Asia Market Value (US$ Million) Analysis by Features, 2018 & 2033

Figure 138: East Asia Market Volume (Units) Analysis by Features, 2018 & 2033

Figure 139: East Asia Market Value Share (%) and BPS Analysis by Features, 2023 & 2033

Figure 140: East Asia Market Y-o-Y Growth (%) Projections by Features, 2022-2032

Figure 141: East Asia Market Attractiveness by Power Source, 2022-2032

Figure 142: East Asia Market Attractiveness by End User, 2022-2032

Figure 143: East Asia Market Attractiveness by Features, 2022-2032

Figure 144: East Asia Market Attractiveness by Country, 2022-2032

Figure 145: South Asia Market Value (US$ Million) by Power Source, 2023 & 2033

Figure 146: South Asia Market Value (US$ Million) by End User, 2023 & 2033

Figure 147: South Asia Market Value (US$ Million) by Features, 2023 & 2033

Figure 148: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 149: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 150: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 151: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 152: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 153: South Asia Market Value (US$ Million) Analysis by Power Source, 2018 & 2033

Figure 154: South Asia Market Volume (Units) Analysis by Power Source, 2018 & 2033

Figure 155: South Asia Market Value Share (%) and BPS Analysis by Power Source, 2023 & 2033

Figure 156: South Asia Market Y-o-Y Growth (%) Projections by Power Source, 2022-2032

Figure 157: South Asia Market Value (US$ Million) Analysis by End User, 2018 & 2033

Figure 158: South Asia Market Volume (Units) Analysis by End User, 2018 & 2033

Figure 159: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 & 2033

Figure 160: South Asia Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 161: South Asia Market Value (US$ Million) Analysis by Features, 2018 & 2033

Figure 162: South Asia Market Volume (Units) Analysis by Features, 2018 & 2033

Figure 163: South Asia Market Value Share (%) and BPS Analysis by Features, 2023 & 2033

Figure 164: South Asia Market Y-o-Y Growth (%) Projections by Features, 2022-2032

Figure 165: South Asia Market Attractiveness by Power Source, 2022-2032

Figure 166: South Asia Market Attractiveness by End User, 2022-2032

Figure 167: South Asia Market Attractiveness by Features, 2022-2032

Figure 168: South Asia Market Attractiveness by Country, 2022-2032

Figure 169: MEA Market Value (US$ Million) by Power Source, 2023 & 2033

Figure 170: MEA Market Value (US$ Million) by End User, 2023 & 2033

Figure 171: MEA Market Value (US$ Million) by Features, 2023 & 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 174: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 177: MEA Market Value (US$ Million) Analysis by Power Source, 2018 & 2033

Figure 178: MEA Market Volume (Units) Analysis by Power Source, 2018 & 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Power Source, 2023 & 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Power Source, 2022-2032

Figure 181: MEA Market Value (US$ Million) Analysis by End User, 2018 & 2033

Figure 182: MEA Market Volume (Units) Analysis by End User, 2018 & 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by End User, 2023 & 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 185: MEA Market Value (US$ Million) Analysis by Features, 2018 & 2033

Figure 186: MEA Market Volume (Units) Analysis by Features, 2018 & 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Features, 2023 & 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Features, 2022-2032

Figure 189: MEA Market Attractiveness by Power Source, 2022-2032

Figure 190: MEA Market Attractiveness by End User, 2022-2032

Figure 191: MEA Market Attractiveness by Features, 2022-2032

Figure 192: MEA Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA