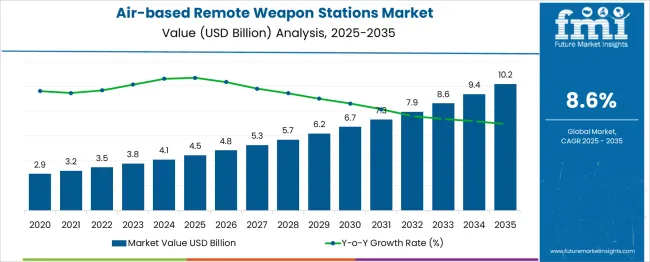

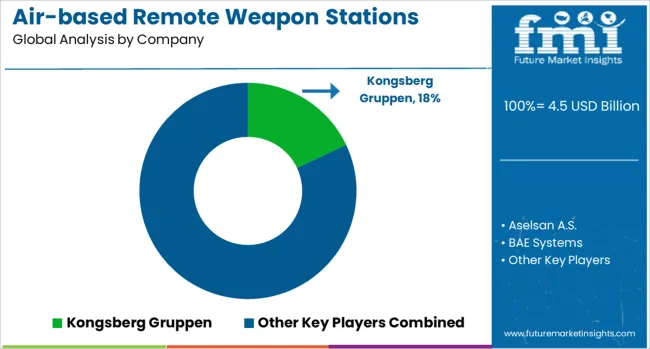

The Air-based Remote Weapon Stations Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

From 2025 to 2030, the market is expected to expand from USD 4.5 billion to USD 6.7 billion, driven by strong adoption of modernization programs for air platforms and rising demand for precision-targeting systems. Year-on-year analysis indicates consistent growth, with values reaching USD 4.8 billion in 2026 and USD 5.3 billion in 2027, supported by integration of advanced electro-optic sensors and fire-control systems. By 2028, the market is projected to reach USD 5.7 billion, followed by USD 6.2 billion in 2029 and USD 6.7 billion by 2030. This trajectory is expected to be reinforced by escalating investments in air superiority capabilities and multi-domain operations. The inclusion of AI-driven target acquisition, lightweight materials, and modular weapon platforms will shape future development strategies. These trends position air-based remote weapon stations as critical components in next-generation aerial combat systems, offering enhanced accuracy, reduced operator risk, and interoperability across diverse mission profiles for global defense forces.

| Metric | Value |

|---|---|

| Air-based Remote Weapon Stations Market Estimated Value in (2025 E) | USD 4.5 billion |

| Air-based Remote Weapon Stations Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The air-based remote weapon stations (RWS) market holds a specialized role within the defense and aerospace ecosystem. In the defense and aerospace systems market, its share is approximately 3–4%, as this market includes a wide range of platforms such as naval, land, and space systems. Within the remote weapon stations market, its contribution is about 18–20%, driven by the increasing deployment of RWS on helicopters, UAVs, and fixed-wing aircraft.

The airborne weapon systems market sees a share of nearly 10–12%, as air-based RWS competes with missile systems, bombs, and guided munitions. In the UAV armament market, its share stands at 6–8%, with growing adoption of lightweight remote-controlled stations for drones used in surveillance and combat missions. For the military aircraft systems and avionics market, the share is modest at 2–3%, as avionics, sensors, and navigation dominate spending.

Growth is supported by rising demand for advanced aerial combat capabilities, precision targeting, and crew protection. Integration of AI-driven fire control, lightweight weapon mounts, and modular platforms further enhances adoption. As military forces modernize fleets for asymmetric warfare and border security, air-based RWS is expected to capture greater share across these parent markets, becoming a critical element in next-generation aerial defense strategies.

The air-based remote weapon stations market is progressing steadily as defense forces prioritize precision engagement capabilities and enhanced operator safety in modern combat environments. Increased focus on minimizing crew exposure and enabling stand-off operations has positioned air-based systems as a preferred solution over traditional manned turrets.

Advancements in lightweight materials and modular architecture have further improved integration on a variety of aerial platforms. Growing geopolitical tensions and the emphasis on network-centric warfare are expected to sustain demand, with future growth opportunities shaped by the incorporation of artificial intelligence-assisted targeting, interoperability standards and next-generation sensor suites.

Emerging programs for unmanned aerial vehicles and modernization of existing fleets are also paving the way for wider adoption across allied and developing nations alike.

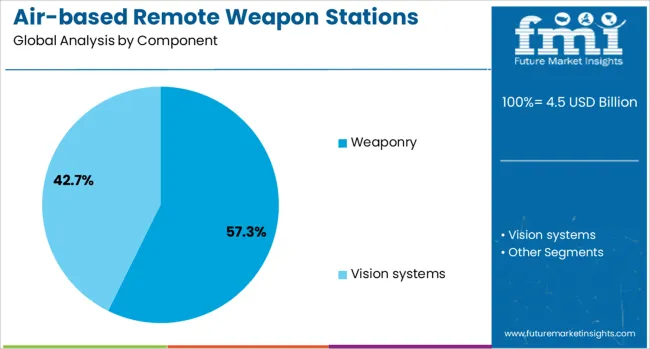

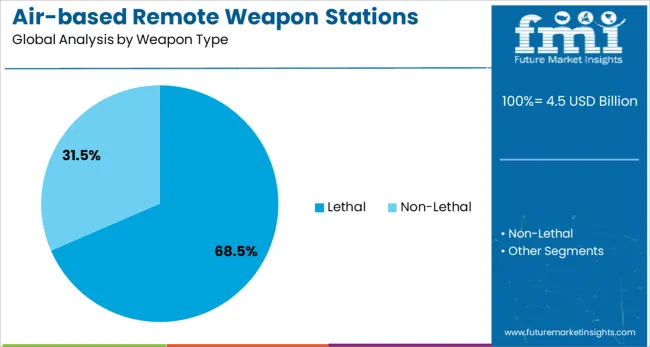

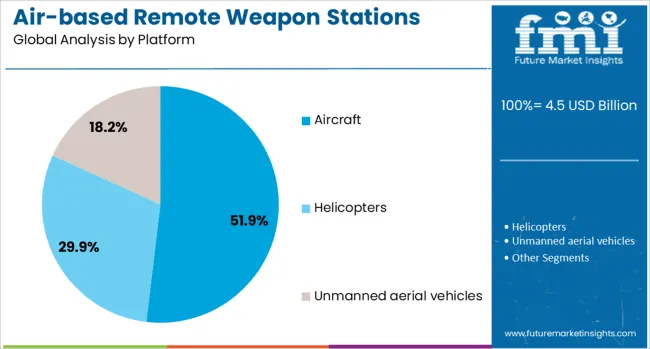

The air-based remote weapon stations market is segmented by component, weapon type, platform, application, and geographic regions. The air-based remote weapon stations market is divided into Weaponry and Vision systems. In terms of weapon type, the air-based remote weapon stations market is classified into Lethal and Non-Lethal. Based on the platform, the air-based remote weapon stations market is segmented into Aircraft, Helicopters, and Unmanned aerial vehicles. By application of the air-based remote weapon stations, the market is segmented into Military and Homeland security. Regionally, the air-based remote weapon stations industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by component, the weaponry segment is projected to account for 57.3% of the total market revenue in 2025, making it the leading component. This leadership has been influenced by the increasing demand for advanced weapons that deliver higher accuracy, extended range and greater lethality while maintaining compactness for airborne integration.

Development of lightweight autocannons, guided rockets and modular machine gun systems has enabled air platforms to carry heavier firepower without compromising maneuverability. Operational requirements to counter both air and ground threats have driven investment in versatile weapon packages that can be quickly reconfigured for various mission profiles.

The emphasis on integrating proven and standardized weapon systems compatible with multiple aircraft types has further reinforced the dominance of the weaponry segment.

Segmented by weapon type, the lethal segment is forecast to capture 68.5% of the market revenue in 2025, securing its position as the primary segment. This prominence has been shaped by defense priorities that favor decisive offensive capabilities in contested environments.

Adoption of lethal systems has been supported by their proven effectiveness in neutralizing high-value targets and providing deterrence against aggression. Technological innovations in guided munitions and stabilization mechanisms have enhanced precision and reduced collateral damage, making lethal solutions more viable in modern rules of engagement.

The increasing requirement to equip air platforms with armaments capable of operating in both symmetric and asymmetric warfare scenarios has reinforced the focus on lethal configurations, ensuring mission effectiveness under diverse operational conditions.

When segmented by platform, the aircraft segment is expected to hold 51.9% of the market revenue in 2025, maintaining its leading role. The widespread deployment of helicopters has driven the dominance of fixed-wing aircraft and unmanned aerial vehicles as key delivery platforms for remote weapon stations.

The ability of aircraft to provide rapid mobility, high altitude overwatch, and deep strike capabilities has aligned well with the operational advantages offered by remote weapon technologies. Investments in modernizing air fleets with modular weapon stations have allowed forces to extend platform lifecycles and enhance mission versatility.

The increasing importance of air superiority in joint operations and the trend toward integrating advanced targeting and self-protection systems have solidified the aircraft segment’s leadership in enabling effective and adaptable firepower.

The air‑based remote weapon stations market has expanded rapidly as defense forces integrate remotely controlled armaments on aerial platforms. In 2024, rising investment in UAVs and helicopter-mounted weapon systems increased deployment across military operations globally. By 2025, demand surged further due to heightened focus on precision targeting, reduced risk to personnel, and enhanced mission flexibility. Vendors offering compact, stabilization‑enabled weapon stations that integrate seamlessly with both manned and unmanned aircraft are now best positioned to meet strategic defense requirements.

Enhanced military spending has been recognized as a principal support for growing demand for air‑based remote weapon stations. In 2024, several nations allocated larger portions of defense budgets to modernizing aerial weapon platforms with remote stations compatible with UAVs and helicopters. By 2025, expansion of tactical capabilities in response to geopolitical tension and modernization programs accelerated procurement of remotely operated systems across air fleets. These dynamics indicate that defense resource allocation is guiding adoption. Suppliers providing certified weapon modules with compatibility across aircraft types and deployment environments are being prioritized in procurement decisions.

The growing use of unmanned aerial vehicles is opening up strategic opportunities for remote station deployment. In 2024, air defense forces scaled use of weapon stations mounted on UAVs for precise engagement missions while maintaining personnel safety. In 2025, interoperability between weapon modules and drones was enhanced through modular design and plug‑and‑play mounting across platform classes. This trend shows that flexibility and system compatibility define market potential. Providers offering adaptable, lightweight stations compatible with diverse unmanned platforms are best placed to capture expansion in both military and security use cases.

In 2024 and 2025, the deployment of air-based remote weapon stations faced major challenges due to integration complexity with diverse aircraft systems. Compatibility issues with avionics, targeting sensors, and communication interfaces resulted in extended development cycles and high engineering costs. Military programs in regions like Europe and Asia reported delays in modernization projects because of these technical hurdles. Smaller defense contractors found it difficult to meet stringent calibration and safety requirements, which further limited adoption. Unless standardized modular systems are introduced, integration complexity will continue to be a major restraint impacting the pace of adoption.

In 2024 and 2025, advanced targeting capabilities integrated with artificial intelligence were increasingly introduced in air-based remote weapon stations. These systems enabled faster threat identification, automated tracking, and optimized ammunition usage during high-intensity missions. Defense programs in North America and select NATO countries incorporated AI-supported fire-control mechanisms to improve mission success rates. Enhanced automation also reduced pilot workload, making weapon operation more efficient in dynamic combat environments. This evolution presents a significant opportunity for manufacturers to differentiate through intelligent systems offering superior accuracy and operational readiness in modern air combat scenarios.

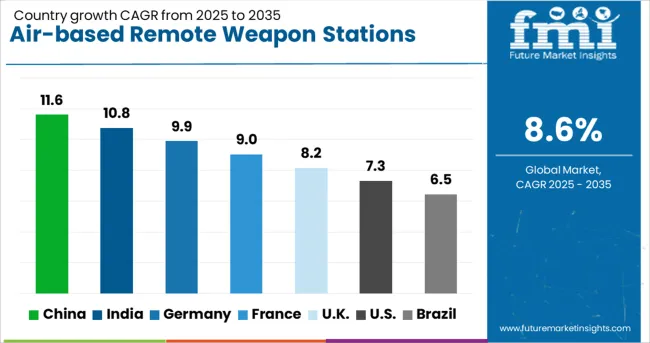

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

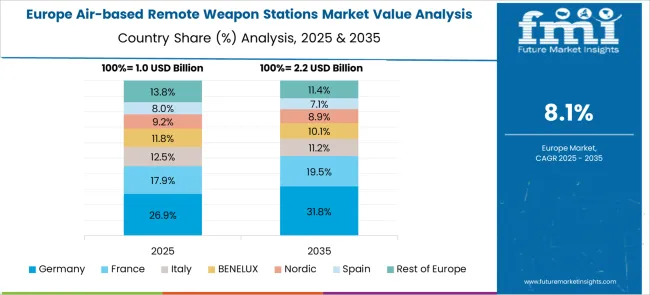

The global air-based remote weapon stations market is projected to grow at a CAGR of 8.6% from 2025 to 2035. China leads with 11.6%, followed by India at 10.8% and Germany at 9.9%. France records 9.0%, while the United Kingdom posts 8.2%. Growth is driven by increasing defense modernization programs, integration of advanced fire-control systems, and rising demand for lightweight remotely operated platforms in aerial applications. China and India dominate adoption through strong defense budgets and indigenous manufacturing initiatives, while Germany focuses on modular RWS designs. France and the UK prioritize system upgrades and interoperability for NATO operations.

The air-based remote weapon stations market in China is forecast to grow at 11.6%, driven by large-scale air defense modernization and enhanced UAV deployment. Turret-mounted RWS dominates integration across combat aircraft and rotary platforms. Manufacturers emphasize AI-enabled target acquisition for increased precision. Strategic partnerships with state-owned defense enterprises strengthen domestic production capabilities.

The air-based remote weapon stations market in India is projected to grow at 10.8%, fueled by indigenous defense initiatives and cross-border security challenges. Lightweight RWS dominates integration in helicopters and UAV platforms. Manufacturers develop modular systems for flexible weapon configurations. Strategic alliances with global defense suppliers support technology transfer and advanced system development.

The air-based remote weapon stations market in Germany is expected to grow at 9.9%, supported by increased adoption in NATO-aligned defense programs. Advanced electro-optical RWS dominates integration in rotary-wing platforms for surveillance and precision strike roles. Manufacturers prioritize integration with digital avionics and automated threat detection systems. Investments in modular architecture strengthen export opportunities across Europe.

The air-based remote weapon stations market in France is forecast to grow at 9.0%, driven by upgrades in multi-role aircraft and rotary-wing fleets. Stabilized RWS with advanced recoil management dominates premium defense projects. Manufacturers introduce AI-enabled fire control for improved situational awareness. Expansion of collaborative European defense initiatives accelerates adoption of interoperable weapon station systems.

The air-based remote weapon stations market in the UK is projected to grow at 8.2%, driven by increased focus on rotary-wing modernization and airborne ISR systems. Compact RWS solutions dominate UAV and light aircraft applications. Manufacturers develop systems with advanced recoil suppression and automated ammunition handling. Integration with NATO-compliant digital communication networks strengthens future combat readiness.

The air-based remote weapon stations market is moderately consolidated, with Kongsberg Gruppen holding a leading position due to its advanced Protector and CROWS systems deployed across NATO and allied forces. The company’s technology integration, precision targeting, and adaptability for helicopters, UAVs, and fixed-wing platforms have positioned it as a dominant supplier in the segment.

Key players include Aselsan A.S., BAE Systems, Bharat Electronics Limited (BEL), Copenhagen Sensor Technology, Elbit Systems Ltd., EVPU Defense, FN Herstal, General Dynamics Corporation, Hornet, Israel Aerospace Industries (IAI), Leonardo S.p.A., Northrop Grumman Corporation, Rafael Advanced Defense Systems, Raytheon Technologies Corporation, Rheinmetall AG, Saab AB, Singapore Technologies Engineering Ltd., and Thales Group.

These companies specialize in advanced fire-control systems, electro-optical sensors, and modular weapon stations engineered for multi-mission adaptability and integration with modern avionics systems. Market growth is fueled by increasing investments in defense modernization, rising adoption of unmanned aerial vehicles, and the demand for precision strike capabilities in asymmetric warfare. Leading companies are focusing on AI-enabled targeting, modular architecture for flexible platform integration, and lightweight designs optimized for aerial platforms.

Emerging trends include autonomous operation capabilities, non-lethal payload integration, and interoperability with network-centric warfare systems. North America and Europe dominate the market, while Asia-Pacific is expected to experience rapid growth driven by regional security dynamics and expanding defense budgets.

Innovation efforts are focusing on integrating AI and machine learning targeting algorithms with high-resolution electro-optical and infrared sensors, advanced stabilization mechanisms, and modular mounting solutions. These advancements enable superior accuracy, rapid adaptability, and multi-platform deployment across aircraft, helicopters, and UAVs, significantly improving combat effectiveness and mission flexibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Component | Weaponry and Vision systems |

| Weapon Type | Lethal and Non-Lethal |

| Platform | Aircraft, Helicopters, and Unmanned aerial vehicles |

| Application | Military and Homeland security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kongsberg Gruppen, Aselsan A.S., BAE Systems, Bharat Electronics Limited (BEL), Copenhagen Sensor Technology, Elbit Systems Ltd., EVPU Defense, FN Herstal, General Dynamics Corporation, Hornet, Israel Aerospace Industries (IAI), Leonardo S.p.A., Northrop Grumman Corporation, Rafael Advanced Defense Systems, Raytheon Technologies Corporation, Rheinmetall AG, Saab AB, Singapore Technologies Engineering Ltd., and Thales Group |

| Additional Attributes | Dollar sales by component (weaponry vs vision systems), Dollar sales by platform (aircraft, helicopters, UAVs), regional demand trends, competitive landscape, buyer preferences for precision and compact systems, integration with command/control platforms, innovations in AI targeting, advanced optics, and lightweight stabilization technologies. |

The global air-based remote weapon stations market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the air-based remote weapon stations market is projected to reach USD 10.2 billion by 2035.

The air-based remote weapon stations market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in air-based remote weapon stations market are weaponry and vision systems.

In terms of weapon type, lethal segment to command 68.5% share in the air-based remote weapon stations market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Naval Based Remote Weapons Station Market Size and Share Forecast Outlook 2025 to 2035

Remote ICU Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Weapon Mounts Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Home Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA