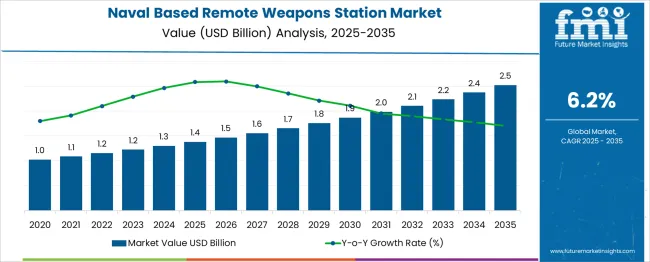

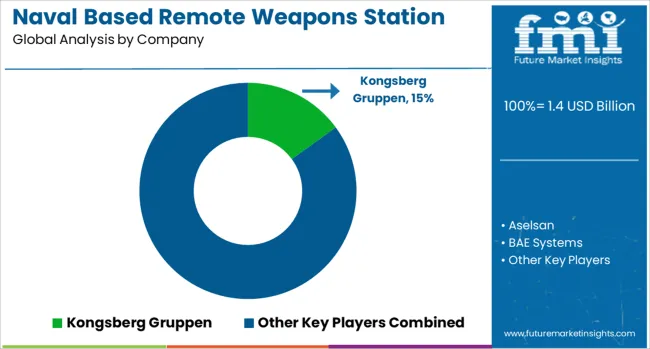

The Naval Based Remote Weapons Station Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. A Growth Contribution Index analysis shows that expansion is evenly distributed across the decade, with a gradual acceleration in later years indicating compounding demand from defense modernization programs.

From 2025 to 2030, the market grows from USD 1.4 billion to USD 1.9 billion, contributing USD 0.5 billion, or approximately 45% of the total decade growth. Annual increments during this period range between USD 0.1 billion and USD 0.2 billion, representing steady procurement cycles and fleet retrofit projects. This phase reflects foundational demand driven by existing naval platforms and incremental upgrades.

Between 2030 and 2035, the market advances from USD 1.9 billion to USD 2.5 billion, adding USD 0.6 billion, or around 55% of total growth. Gains per year in this phase are slightly higher, indicating greater adoption of advanced targeting and stabilization systems, alongside the integration of remote weapon stations into newly commissioned vessels.

The Growth Contribution Index suggests that while the early period builds a stable base, the latter half delivers a marginally higher share of overall expansion. Strategic investments toward the mid-decade point could secure stronger positioning to capitalize on this accelerated phase.

| Metric | Value |

|---|---|

| Naval Based Remote Weapons Station Market Estimated Value in (2025 E) | USD 1.4 billion |

| Naval Based Remote Weapons Station Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The naval based remote weapons station market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.4% of the global naval combat systems market, supported by the need for enhanced shipborne firepower with minimal crew exposure. Within the maritime defense equipment sector, a share of approximately 3.1% is assessed due to integration on patrol vessels, frigates, and offshore security platforms.

In the remote weapon systems market, around 2.7% is observed reflecting naval applications as part of broader multi domain defense strategies. Within the shipboard electronics and sensor integration industry, about 2.5% is evaluated given the role of advanced targeting and fire control. In the coastal and offshore security systems market, a contribution of roughly 2.2% is calculated as naval forces strengthen littoral defense capabilities.

Market growth has been influenced by increased focus on precision engagement, crew safety, and rapid response capabilities in maritime operations. Innovations have been directed toward stabilized weapon platforms, integration with electro optical and infrared sensors, and compatibility with both lethal and non lethal munitions. Interest has been increasing in modular systems that allow quick weapon swaps and upgrades to meet evolving mission requirements.

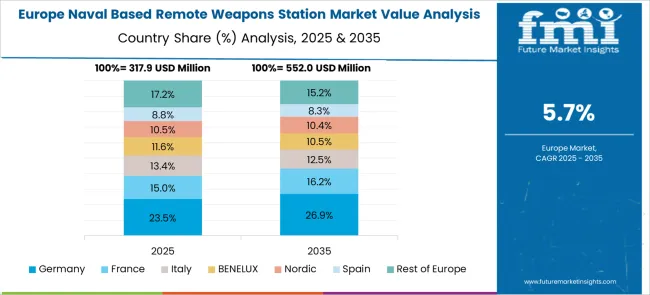

The Europe region has been observed to lead adoption through modernization of naval fleets, while Asia Pacific shows strong growth driven by territorial security initiatives. Strategic initiatives have included collaborations between defense contractors and naval shipbuilders to deliver turnkey remote weapon station solutions with enhanced targeting accuracy, network centric warfare compatibility, and reduced maintenance requirements.

The naval based remote weapons station market is witnessing steady expansion as maritime defense priorities shift toward automation, crew safety, and real-time combat efficiency. Naval forces are increasingly prioritizing remotely operated systems that reduce human exposure in hostile environments while maintaining high targeting accuracy.

Budget reallocations toward modular combat systems and multi-role vessels have further accelerated integration of such weapon platforms across both new-build and retrofit naval assets. Heightened geopolitical tensions and a surge in maritime surveillance operations are compelling nations to upgrade their patrol fleets with enhanced defensive capabilities.

Additionally, collaborations between defense OEMs and navies for indigenization, lifecycle support, and real-time system upgrades are fostering market maturity and long-term deployment strategies.

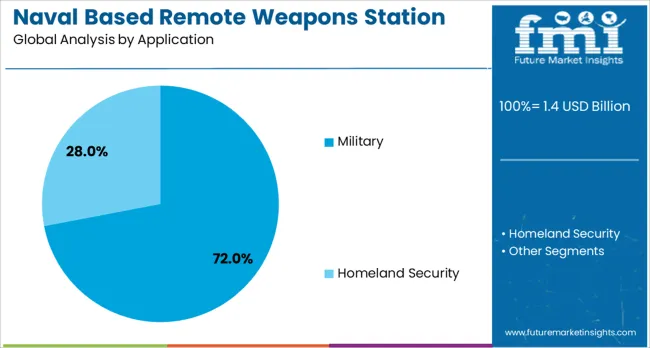

The naval based remote weapons station market is segmented by platform, components, weapon type, and application and geographic regions. By platform of the naval based remote weapons station market is divided into Offshore Patrol Vessels (OPVs), Destroyers, Frigates, Corvettes, Patrol & Mine Countermeasures Vessels, Amphibious Vessels, and Unmanned Surface Vehicles.

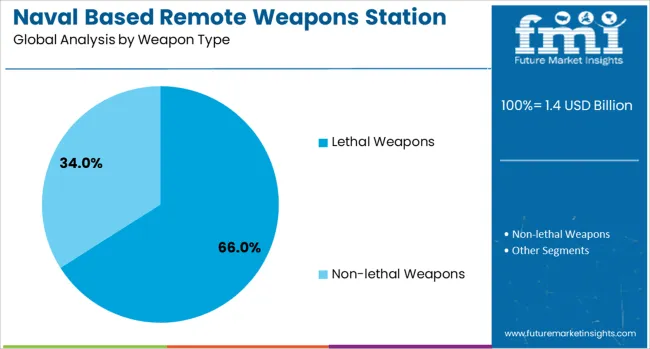

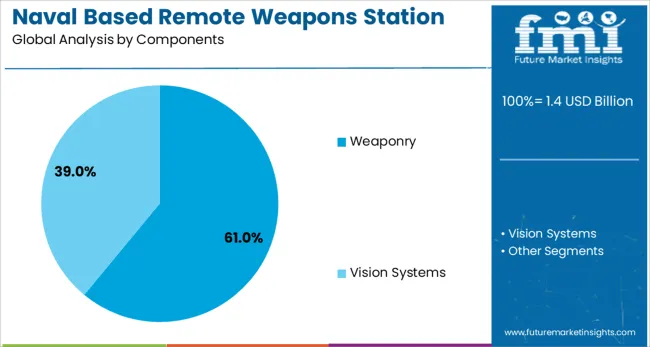

In terms of components of the naval based remote weapons station market is classified into Weaponry and Vision Systems. Based on weapon type of the naval based remote weapons station market is segmented into Lethal Weapons and Non-lethal Weapons.

By application of the naval based remote weapons station market is segmented into Military and Homeland Security. Regionally, the naval based remote weapons station industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Offshore Patrol Vessels (OPVs) are projected to contribute 27.0% of the market revenue by 2025, making them the leading platform for naval-based remote weapons stations. Their prominence is attributed to the growing requirement for agile, multi-mission vessels that can be deployed for coastal defense, anti-piracy, and exclusive economic zone (EEZ) protection.

OPVs offer operational flexibility, cost efficiency, and relatively quicker build times compared to larger combatants, allowing them to be ideal platforms for remote weapon integration.

As modern navies prioritize scalable vessel fleets, the emphasis on equipping OPVs with modular and interoperable systems is driving demand for compact, automated weapon stations.

The weaponry component segment is forecast to dominate the market with a 61.0% share by 2025. Its leading position is being reinforced by increased defense procurement of fire-control modules, integrated targeting optics, and stabilized gun mounts designed for unmanned operation.

Advanced weaponry modules now support multi-caliber compatibility and enhanced lethality, offering greater flexibility during mission-specific configuration. The shift toward higher caliber and recoil-stabilized platforms has created opportunities for upgrade cycles across existing fleets.

Continued innovation in precision-targeting technologies and ruggedization standards further strengthens the demand for durable, high-performance weaponry components within naval architectures.

Lethal weapons are anticipated to hold a commanding 66.0% share of the market by 2025, establishing them as the preferred weapon type for naval remote stations. This dominance stems from naval doctrines emphasizing deterrence and rapid neutralization capabilities in high-risk zones.

The deployment of lethal systems, including medium and heavy machine guns, autocannons, and grenade launchers, is being driven by increased encounters in asymmetric maritime threat environments. Strategic imperatives to secure sea lanes, safeguard energy corridors, and combat small fast-attack crafts are intensifying the focus on lethal weapon integration.

As navies pursue both peacekeeping and force projection roles, demand for deployable, lethal deterrent systems is expected to maintain upward momentum.

Remote weapon stations are being integrated on surface combatants, patrol vessels, and amphibious ships to enhance firepower, accuracy, and crew safety. Increased adoption has been driven by the need for rapid threat response while minimizing crew exposure in hostile environments. Advancements in fire control systems, targeting sensors, and stabilization technology have improved operational effectiveness.

Continuous technological progress has been observed in the development of naval-based remote weapons stations to meet evolving maritime defense requirements. Gyrostabilization and advanced servo systems have been incorporated to ensure precise targeting even in rough sea conditions. Integration of electro-optical sensors, infrared cameras, and automated tracking software has improved target acquisition speed and accuracy. Modular weapon mount designs have allowed compatibility with various calibers, from heavy machine guns to automatic cannons. Network-enabled systems have facilitated integration with shipboard combat management systems, enabling coordinated engagement. Energy-efficient actuation mechanisms and ruggedized components have enhanced reliability in demanding maritime environments, extending service life and reducing maintenance needs for naval operators.

Naval based remote weapons stations have been deployed across a wide range of platforms, including offshore patrol vessels, corvettes, frigates, and fast attack crafts. Their compact design and flexible mounting options have enabled integration without significant structural modifications. In addition to conventional surface warfare roles, these systems have been adapted for anti-piracy operations, coastal surveillance, and protection of strategic maritime assets. Enhanced situational awareness provided by integrated sensors has improved effectiveness in asymmetric threat environments. The growing need for fleet interoperability has prompted standardization of weapon station interfaces, enabling cross-platform use. Such versatility has increased procurement across both advanced and emerging naval forces.

Regional defense priorities have significantly influenced the adoption of naval based remote weapons stations. North America and Europe have maintained steady procurement due to ongoing naval fleet upgrades and the replacement of legacy systems. Asia-Pacific has experienced rapid growth driven by maritime border security concerns and new vessel construction programs in countries such as India, China, and South Korea. Middle Eastern navies have increased investments to secure vital shipping lanes, while Latin America has adopted these systems for counter-narcotics and coastal defense operations. Collaborative programs between defense contractors and local shipbuilders have accelerated delivery timelines and ensured technology transfer, boosting domestic manufacturing capabilities.

Despite favorable demand, certain challenges have constrained market growth. High acquisition and integration costs have been a concern for budget-sensitive naval forces. Compatibility issues with legacy ship systems have necessitated costly retrofits. Dependence on specialized electronic and mechanical components has made supply chains vulnerable to disruptions. Export restrictions and varying defense procurement regulations have complicated cross-border sales. Maintenance requirements in harsh marine environments have necessitated robust service support, increasing life cycle costs. Additionally, rapid technological advancements have shortened system obsolescence cycles, requiring continual upgrades. Addressing these factors has been essential for manufacturers to sustain competitiveness and secure long-term naval contracts.

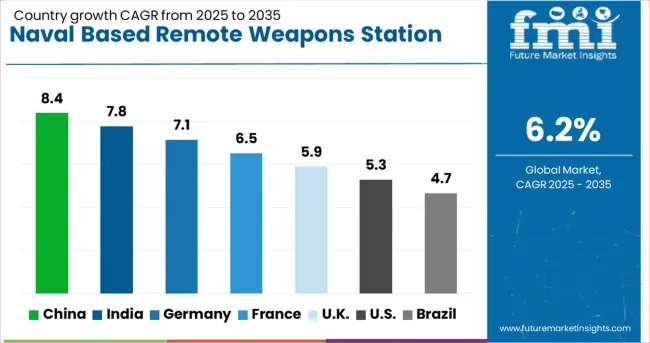

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

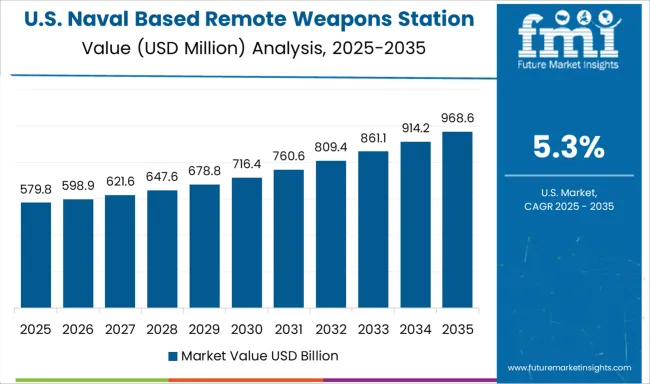

| USA | 5.3% |

| Brazil | 4.7% |

The naval based remote weapons station market is expected to grow at a global CAGR of 6.2% between 2025 and 2035, driven by increasing naval modernization programs, demand for advanced maritime defense systems, and integration of precision targeting technologies. China leads with an 8.4% CAGR, supported by expanding naval fleet capabilities and domestic defense manufacturing. India follows at 7.8%, fueled by indigenous naval defense projects and rising maritime security needs. Germany, at 7.1%, benefits from advanced defense engineering and participation in NATO naval programs. The UK, projected at 5.9%, sees growth from modernization of naval vessels and defense exports. The USA, at 5.3%, reflects steady demand from naval fleet upgrades and foreign military sales. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to record a CAGR of 8.4% from 2025 to 2035, driven by continued naval modernization and an emphasis on coastal defense capabilities. State-owned enterprises such as China North Industries Group and CSIC are developing advanced remote weapon stations with improved fire control systems and autonomous targeting. Integration on patrol vessels, corvettes, and amphibious assault ships is increasing. Naval exercises in the South China Sea have demonstrated operational readiness, boosting procurement programs.

India is projected to grow at a CAGR of 7.8% from 2025 to 2035, supported by indigenous naval shipbuilding programs and defense modernization plans. Public sector companies such as Bharat Electronics Limited (BEL) and private firms are collaborating to supply weapon stations for frigates, offshore patrol vessels, and missile corvettes. Increased defense budget allocation for naval platforms has accelerated procurement cycles. Joint ventures with foreign defense contractors are enhancing technological capabilities and export prospects.

Germany is forecasted to expand at a CAGR of 7.1% from 2025 to 2035, driven by demand for advanced naval defense systems within NATO. Companies such as Rheinmetall and Krauss-Maffei Wegmann are producing remote stations with enhanced stabilization, modularity, and precision targeting. Integration with advanced radar and surveillance systems is a priority for modern frigate and corvette classes. Export demand from allied nations seeking proven naval defense technologies contributes significantly to market revenues.

The United Kingdom is anticipated to post a CAGR of 5.9% from 2025 to 2035, with demand driven by Royal Navy modernization initiatives. BAE Systems leads domestic production, supplying remote weapon stations for offshore patrol vessels, Type 26 frigates, and aircraft carriers. Upgrades in targeting optics, fire control software, and ammunition handling systems are ongoing. Collaboration with allied naval forces strengthens interoperability, ensuring systems meet joint operational standards.

The United States is expected to grow at a CAGR of 5.3% from 2025 to 2035, driven by continued investments in naval combat readiness. Northrop Grumman and General Dynamics are leading suppliers, offering advanced remote weapon stations for destroyers, littoral combat ships, and amphibious vessels. Focus is on increased automation, AI-assisted targeting, and improved lethality against asymmetric threats. Multi-mission adaptability is enhancing adoption across diverse vessel classes in the US Navy fleet.

The naval-based remote weapons station market is led by major defense contractors and specialized military technology companies providing advanced weapon control systems for surface vessels. Kongsberg Gruppen is a key player with its PROTECTOR family of remote weapon stations, widely deployed across NATO naval fleets. BAE Systems and Rheinmetall deliver modular systems capable of integrating various calibers and sensors, ensuring adaptability for different vessel classes.

Aselsan, Bharat Electronics, and Singapore Technologies Engineering serve regional naval forces with cost-effective, locally produced systems, often customized for specific operational requirements. Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries focus on precision targeting, stabilized platforms, and integration with advanced electro-optical and radar systems.

Northrop Grumman, Raytheon Technologies, and General Dynamics emphasize network-centric capabilities, enabling remote operation and integration into broader combat management systems. Leonardo and Saab supply naval weapon stations optimized for patrol vessels, corvettes, and frigates, balancing firepower with lightweight designs.

FN Herstal specializes in small- to medium-caliber naval mounts, while EVPU Defense provides sensor and control subsystems. Copenhagen Sensor Technology contributes advanced imaging solutions to enhance targeting accuracy. Key strategies include enhancing modularity for multi-weapon compatibility, integrating AI-driven targeting assistance, and securing long-term defense contracts with naval forces. Entry into this market is limited by stringent military qualification standards, sensitive export regulations, and the need for proven reliability in maritime combat environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Platform | Offshore Patrol Vessels (OPVs), Destroyers, Frigates, Corvettes, Patrol & Mine Countermeasures Vessels, Amphibious Vessels, and Unmanned Surface Vehicles |

| Components | Weaponry and Vision Systems |

| Weapon Type | Lethal Weapons and Non-lethal Weapons |

| Application | Military and Homeland Security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kongsberg Gruppen, Aselsan, BAE Systems, Bharat Electronics, Copenhagen Sensor Technology, Elbit Systems, EVPU Defense, FN Herstal, General Dynamics, Israel Aerospace Industries, Leonardo, Northrop Grumman, Rafael Advanced Defense Systems, Raytheon Technologies, Rheinmetall, Saab, Singapore Technologies Engineering, and Thales |

| Additional Attributes | Dollar sales by weapon type and platform, demand dynamics across naval patrol vessels, frigates, and offshore security crafts, regional trends in deployment across North America, Europe, and Asia-Pacific, innovation in electro-optical targeting, stabilization systems, and remote control integration, environmental impact of operational energy consumption and material disposal, and emerging use cases in unmanned surface vessels, coastal defense modernization, and integrated maritime surveillance systems. |

The global naval based remote weapons station market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the naval based remote weapons station market is projected to reach USD 2.5 billion by 2035.

The naval based remote weapons station market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in naval based remote weapons station market are offshore patrol vessels (opvs), destroyers, frigates, corvettes, patrol & mine countermeasures vessels, amphibious vessels and unmanned surface vehicles.

In terms of components, weaponry segment to command 61.0% share in the naval based remote weapons station market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air-based Remote Weapon Stations Market Size and Share Forecast Outlook 2025 to 2035

Remote ICU Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Stationery Product Market Forecast and Outlook 2025 to 2035

Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lead Acid Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Naval Destroyers and Submarines Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Flow Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA