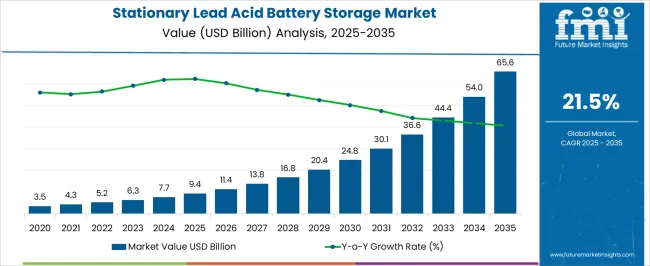

Stationary lead acid battery storage market is projected to expand from USD 9.4 billion in 2025 to USD 65.6 billion in 2035 at a 21.5% CAGR. The Growth Contribution Index indicates strong early lifts from telecom base stations, uninterruptible power supplies in data centers, and industrial emergency systems.

Preference is being shown for VRLA, AGM, and gel formats where predictable maintenance and low upfront cost matter. Procurement policies favor proven chemistries with extensive field data, established service networks, and dependable charge acceptance. Lead-acid banks are being specified for float service, fire pump backup, water treatment, oil and gas facilities, and commercial buildings requiring assured power.

Total cost of ownership is being favored through standardized racks, remote monitoring, and extended warranty programs. Recycling rates and closed-loop lead recovery strengthen supply assurance and pricing discipline. Dependable performance across temperature ranges keeps this chemistry central in stationary backup strategies.

| Metric | Value |

|---|---|

| Stationary Lead Acid Battery Storage Market Estimated Value in (2025 E) | USD 9.4 billion |

| Stationary Lead Acid Battery Storage Market Forecast Value in (2035 F) | USD 65.6 billion |

| Forecast CAGR (2025 to 2035) | 21.5% |

The stationary lead acid battery storage segment is estimated to account for nearly 12% of the energy storage market, about 34% of the backup power and UPS market, close to 26% of the telecom power systems market, around 18% of the industrial batteries market, and nearly 8% of the grid-scale energy storage market. Combined, these proportions equate to roughly 98% across the listed parent categories.

Performance in high ambient temperatures, tolerance to stable float applications, and wide availability of certified racks and containers give lead acid a practical edge in mission critical standby roles. The category has been favored where depth of discharge remains shallow and high cycle life is not the primary criterion, keeping total cost of ownership competitive against alternatives for many stationary profiles.

Clear preference is observed in facilities that require established maintenance regimes, standardized venting, and familiar safety procedures, which lowers operational risk for operators and contractors. In this view, stationary lead acid functions as the conservative benchmark that defines reliability baselines for power continuity. As lifecycle analytics, monitoring electronics, and charge algorithms are refined, the segment is expected to preserve a significant share within its parent markets, sustaining strong relevance in telecom backup, UPS rooms, industrial controls, and grid protection cabinets.

The stationary lead acid battery storage market is experiencing stable yet consistent growth, supported by its critical role in providing reliable and cost-effective energy storage solutions across multiple applications. Increasing investments in grid modernization, backup power systems, and renewable energy integration are driving demand for dependable and proven storage technologies.

The market is benefiting from the established manufacturing base, well-developed supply chains, and long operational history of lead acid batteries, which ensure performance reliability and ease of maintenance. Environmental regulations are encouraging manufacturers to improve recycling processes, enhancing the sustainability profile of these batteries.

While competition from advanced chemistries like lithium-ion is increasing, lead acid batteries continue to hold significant market share due to their low upfront cost, safety advantages, and ability to deliver consistent power in both high and low temperature environments With ongoing advancements in valve-regulated and tubular plate designs, the technology is evolving to meet higher efficiency and longer cycle life requirements, ensuring relevance in both traditional and emerging stationary energy storage applications.

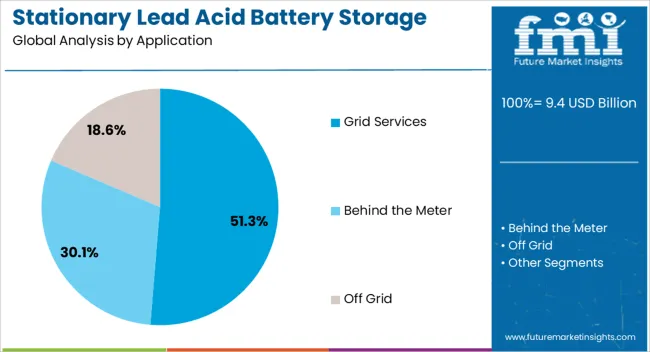

The stationary lead acid battery storage market is segmented by application, and geographic regions. By application, stationary lead acid battery storage market is divided into Grid Services, Behind the Meter, and Off Grid. Regionally, the stationary lead acid battery storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The grid services segment is projected to hold 51.3% of the stationary lead acid battery storage market revenue share in 2025, making it the dominant application area. This leadership is being driven by the segment’s essential role in ensuring grid stability, frequency regulation, and peak load management. Stationary lead acid batteries are widely adopted in grid service applications due to their proven performance in providing short-duration, high-power output required for balancing electricity supply and demand.

Their ability to deliver immediate response to grid fluctuations enhances overall network reliability, which is particularly valuable in regions with increasing renewable energy penetration. Cost competitiveness, ease of installation, and low maintenance requirements further support their adoption in grid-connected energy storage systems.

The segment is also benefiting from regulatory initiatives aimed at improving grid resilience and reducing outage risks, which are encouraging utilities and independent power producers to invest in reliable storage assets. As global electricity demand grows and power systems become more decentralized, the reliance on stationary lead acid battery solutions for grid services is expected to remain strong over the forecast period.

The stationary lead acid battery storage market is expected to grow at a measured but durable pace as utilities, telecom operators, industrial plants, and public facilities prioritize dependable backup power and grid support. Demand is reinforced by UPS installations, substation control rooms, emergency lighting, and telecom base stations. Opportunities are opening in brownfield retrofits, service contracts, and hybrid systems paired with gensets or PV. Trends highlight VRLA formats, remote monitoring, and recycling programs. Challenges persist around raw material volatility, footprint limits, environmental compliance, and competition from lithium-based alternatives in new-build projects.

Demand has been strengthened by the need for reliable stationary energy storage across telecom towers, utility substations, rail signaling, data centers, and hospitals, where continuity of service is critical. Lead acid chemistries such as VRLA AGM, gel batteries, and flooded 2 V cells are favored for predictable float performance, familiar maintenance, and established safety procedures. UPS rooms in commercial buildings and industrial plants rely on battery strings that deliver high surge current and stable voltage during transfer events. Lead acid remains the default choice where specifications reward proven reliability, standardized racks, and rapid serviceability over headline energy density. Replacement cycles in telecom and building services are creating recurring orders as operators refresh aging strings to meet updated runtime requirements. Municipal facilities and water treatment plants further reinforce demand, valuing the technology’s fault tolerance, recyclability pathways, and wide service network coverage.

Opportunities are expanding in brownfield retrofits where legacy battery rooms can be modernized with higher capacity VRLA blocks, optimized rack layouts, and improved ventilation, raising runtime without major civil works. Service-led revenue is growing through preventative maintenance, capacity testing, and remote battery monitoring that flags cell imbalance and sulfation before failures occur. Hybrid architectures that combine lead acid banks with diesel gensets or rooftop PV are creating scope in campuses, warehouses, and public infrastructure seeking longer autonomy at practical costs. We believe the most attractive openings lie in turnkey packages that bundle batteries, chargers, switchgear, and commissioning into a single purchase. Leasing models and performance guarantees are also gaining attention with cash-conscious municipalities. Export opportunities exist where grid stability projects favor familiar chemistries and local recycling streams. Vendors adding rapid swap programs and spare-string staging will capture multi-year service contracts.

Trends point to broader adoption of VRLA AGM and gel batteries for sealed operation, shorter installation times, and reduced routine maintenance compared with flooded cells. Remote battery monitoring platforms that track impedance, temperature, float current, and state of health are moving from optional to standard, enabling predictive replacement rather than calendar-only schedules. Higher purity lead grids, enhanced separators, and refined paste formulations are being selected to limit corrosion and stratification, extending cycle life in partial state of charge conditions. Low-profile racks and front-terminal designs are trending in space constrained rooms, improving airflow and technician access. Recycling participation is being emphasized to stabilize total lifecycle cost. Practical gains in longevity and monitoring transparency matter more than headline capacity, since fewer unplanned outages and faster audits deliver the return that facilities managers and insurers prioritize.

Challenges arise from lead and plastics price volatility that complicates quoting and squeezes margins for manufacturers and integrators. Environmental and safety compliance for battery rooms, including acid containment, ventilation, and hazardous materials handling, adds design time and permitting friction. Space and weight constraints can limit lead-acid adoption in dense urban facilities, pushing some projects toward higher energy density chemistries.

Competing offers from lithium systems market longer cycle life and compact footprints, pressuring incumbents on new builds. Thermal management and equalization practices remain uneven across sites, shortening life when float conditions drift. Logistics for large strings, especially in remote regions, increase downtime when spares are not staged. Vendors that publish transparent capacity test data, offer robust recycling credits, and standardize remote diagnostics will defend share, while price-only approaches will struggle against lighter, longer-life alternatives.

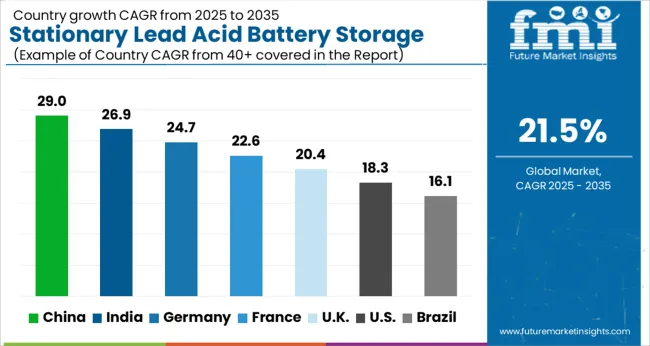

| Country | CAGR |

|---|---|

| China | 29.0% |

| India | 26.9% |

| Germany | 24.7% |

| France | 22.6% |

| UK | 20.4% |

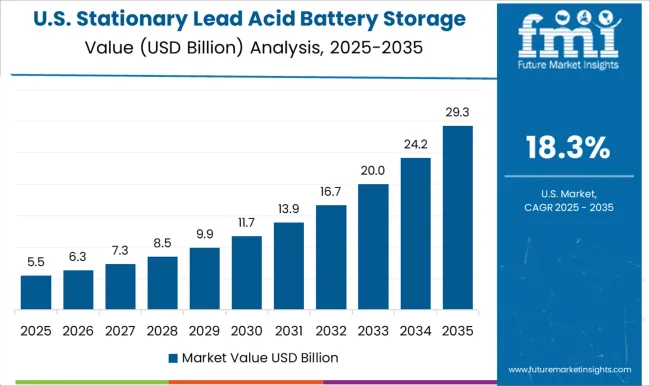

| USA | 18.3% |

| Brazil | 16.1% |

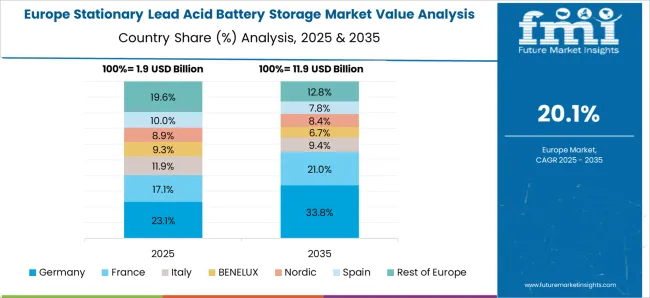

The global stationary lead-acid battery storage market is projected to grow at a 21.5% CAGR from 2025 to 2035. China leads at 29%, followed by India at 26.9% and France at 22.6%. The United Kingdom, with 20.4%, and the United States, with 18.3%, round out the top markets. Demand is being driven by telecom base-station backup, utility substation control power, data-center UPS, rail and metro signaling, and municipal facilities. Proven safety records, mature recycling chains, and competitive $/kWh are supporting VRLA (AGM and gel) and flooded cells. Asia is expected to scale fastest in terms of manufacturing depth and wide backup deployment, while Europe focuses on compliance and long service life; the USA reflects a large installed base and resilience planning. This report includes insights on 40+ countries; the top markets are shown here for reference.

The stationary lead-acid battery storage market in China is projected to expand at a CAGR of 29.0%. Demand is being underpinned by nationwide telecom tower backup, utility substation switchgear support, elevator/lighting UPS in high-rise complexes, and rapid data-center buildouts along coastal hubs. VRLA (AGM/gel) banks are being favored for low maintenance and predictable service intervals, while flooded cells are retained in heavy-duty industrial rooms where space and ventilation are adequate. A dense network of smelters and collection partners enables high recovery rates, keeping the total cost of ownership competitive. Project tenders are being written around long-life plates, anti-sulfation regimes, and remote battery monitoring to control downtime. With strong domestic manufacturing and fast logistics for spares and replacements, China is well placed to anchor exports to Southeast Asia and Africa while meeting rising internal demand.

The stationary lead-acid battery storage market in India is expected to grow at a CAGR of 26.9%. Growth is being pulled by telecom base-station backup across varied climates, commercial UPS for banking and healthcare, and inverter-battery sets in small businesses and residences. Power-quality variances and feeder outages are encouraging larger Ah banks and robust charge controllers. VRLA/AGM units are being preferred for low-touch maintenance in rooftop shelters and passive cooling sites, while gel variants serve hotter regions. Policy-linked demand for backup at rail signaling cabins, data halls, and distribution substations is providing steady order flow. With an extensive collection network and rising secondary-lead capacity, replacements are being processed rapidly, keeping turnaround times tight. As EPCs standardize racks, cabling, and fuse-switch layouts, deployment speed and serviceability are improving across metro and tier-2 clusters.

The stationary lead-acid battery storage market in France is projected to rise at a CAGR of 22.6%. Demand is being shaped by hospital and laboratory UPS, grid-substation DC rooms, rail and metro signaling, and municipal facilities requiring certified backup. Buyers are favoring VRLA/AGM and gel formats with flame-retardant casings, low gas evolution, and strict compliance for enclosed rooms. Data-center operators are retaining lead-acid strings for predictable impedance trends and straightforward acceptance testing, while lifecycle focus is guiding choices toward long-life plates and monitored float-charge regimes. Producer-responsibility frameworks ensure traceable collection and recycling, supporting procurement preferences for established brands with European service networks. With emphasis on reliability, documentation, and room-level safety, France is positioned to scale premium installations and high-availability refurbishments through the forecast period.

The stationary lead-acid battery storage market in the UK is forecast to grow at a CAGR of 20.4%. Critical-national-infrastructure sites, water utilities, transmission substations, emergency services, and data hubs, are relying on proven VRLA banks for assured standby power. Replacement cycles are being prioritized as legacy strings approach end-of-life, with tenders specifying fire-performance ratings, venting provisions, and remote status telemetry. Commercial properties are extending runtimes for lifts, lighting, and life-safety systems, while regional data-center clusters around London and Slough sustain large UPS rooms. Tight compliance and strong recycling coverage support predictable ownership costs. With experienced integrators and hire fleets available for temporary UPS bridging, project downtimes are being contained, keeping the market on a steady path even as alternative chemistries expand in adjacent segments.

The stationary lead-acid battery storage market in the United States is projected to expand at a CAGR of 18.3%. Demand is being supported by data-center UPS, telecom outside-plant, utility switchgear control power, and municipal microgrids that value predictable maintenance and broad field expertise. A very large installed base is creating recurring replacement cycles; NFPA/UL compliance and well-understood safety practices continue to favor VRLA and flooded cells in many rooms. Severe-weather planning is reinforcing backup requirements at hospitals, emergency communications, and water facilities, while recycling infrastructure provides high recovery rates and stable net costs. As operators harden sites and standardize monitoring, lead-acid banks remain competitive for short-to-medium-duration standby, with clear procedures for acceptance testing, equalization, and end-of-life handling.

The stationary lead-acid battery storage market is highly competitive, driven by demand for backup power, renewable energy integration, telecommunications, and industrial applications. Market rivalry is shaped by battery type (flooded, AGM, and gel), capacity, cycle life, efficiency, safety, and cost. Companies differentiate through advanced battery designs, enhanced durability, maintenance-free options, and reliable performance under varied environmental conditions.

Key players such as Exide Industries, Trojan Battery Company, East Penn Manufacturing, C&D Technologies, GS Yuasa, EnerSys, Panasonic, Leoch International, Hitachi Chemical, and Rolls Battery dominate the market by offering high-performance, durable, and technologically advanced stationary lead-acid storage solutions. Strategic partnerships with utilities, telecom providers, and industrial integrators are leveraged to expand market reach. Regional and emerging manufacturers compete by providing cost-effective, scalable, and application-specific solutions. The market is moderately consolidated, with leading companies focusing on product innovation, regulatory compliance, long-term service support, and operational reliability to maintain market share and meet growing global demand for stationary lead-acid energy storage systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.4 billion |

| Application | Grid Services, Behind the Meter, and Off Grid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CD Technologies, Duracell, Enersys, Exide Industries, Furukawa Battery, GS Yuasa, Johnson Controls, Lockheed Martin, Narada, Panasonic, Ritar, and Siemens |

| Additional Attributes | Dollar sales by battery type (flooded, AGM VRLA, gel VRLA, tubular OPzS/OPzV), Dollar sales by application (telecom, UPS, utilities, industrial), Trends in deep-cycle designs and remote monitoring, Role in grid backup and substation support, Growth from 5G, data centers, T&D upgrades, Regional demand across Asia Pacific, Europe, North America. |

The global stationary lead acid battery storage market is estimated to be valued at USD 9.4 billion in 2025.

The market size for the stationary lead acid battery storage market is projected to reach USD 65.6 billion by 2035.

The stationary lead acid battery storage market is expected to grow at a 21.5% CAGR between 2025 and 2035.

The key product types in stationary lead acid battery storage market are grid services, behind the meter and off grid.

In terms of application, the grid services segment is set to register 51.3% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stationary Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Flow Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Geostationary Orbit Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

Grid Scale Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Behind the Meter Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lead-free Brass Rods Market Size and Share Forecast Outlook 2025 to 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Scoring Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA