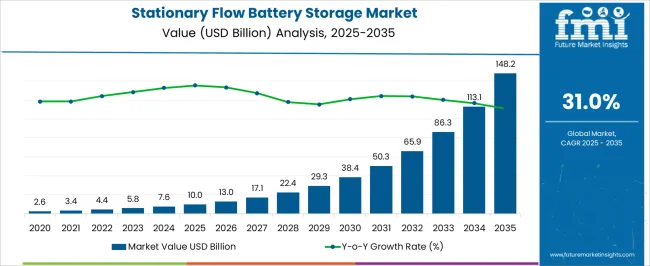

The stationary flow battery storage market is anticipated to reach USD 10.0 billion in 2025 and expand to USD 148.2 billion by 2035, growing at a CAGR of 31.0%. Peak-to-trough analysis reveals a sharp climb from early-stage adoption to widespread integration, with values rising from USD 2.6 billion in the initial phase of the cycle to USD 148.2 billion at the maturity stage. This progression is shaped by increasing reliance on long-duration energy storage for renewable integration, grid balancing, and industrial backup applications.

The trough years highlight the challenges of high upfront costs, technology scale-up risks, and manufacturing bottlenecks, keeping growth moderate between USD 2.6 and USD 7.6 billion during the early cycle. The peak years post-2030 show a rapid surge, as commercialization of advanced vanadium redox, zinc-bromine, and iron flow systems reduces costs, expands deployment, and strengthens grid resiliency. Government incentives for decarbonization and private sector investments accelerate demand, while utility partnerships and pilot projects demonstrate viability. Regional expansion is anticipated to be strongest in North America, Europe, and parts of Asia, where renewable penetration is highest.

| Metric | Value |

|---|---|

| Stationary Flow Battery Storage Market Estimated Value in (2025 E) | USD 10.0 billion |

| Stationary Flow Battery Storage Market Forecast Value in (2035 F) | USD 148.2 billion |

| Forecast CAGR (2025 to 2035) | 31.0% |

The stationary flow battery storage market is influenced by multiple parent markets, each shaping its scale and expansion differently. The renewable energy integration segment accounts for the largest share at 40%, driven by the increasing need for long-duration storage to stabilize intermittent solar and wind power. The grid modernization and utility-scale projects contribute 30%, with utilities adopting flow batteries for frequency regulation, load shifting, and peak shaving to enhance reliability. The industrial and commercial energy storage sector represents 15%, where manufacturers, data centers, and commercial complexes utilize stationary flow batteries for backup power and cost management. The off-grid and remote power applications segment holds 10%, supporting mining, islands, and rural areas with sustainable energy solutions that extend beyond conventional infrastructure.

The research and pilot projects market accounts for 5%, as universities, government agencies, and startups invest in testing new chemistries such as vanadium redox and zinc-bromine to enhance efficiency and scalability. Renewable integration, utility adoption, and industrial demand together make up 85% of the overall share, emphasizing that large-scale energy transition and grid resilience remain the main growth drivers, while remote and experimental deployments provide additional pathways for future market penetration globally.

The Stationary Flow Battery Storage market is progressing steadily due to its critical role in supporting grid stability and enabling renewable energy integration. The growing demand for reliable and scalable energy storage solutions has been amplified by increased renewable power generation, fluctuating energy supply, and the need for energy management systems capable of load leveling and peak shaving.

Investments in smart grid infrastructure and the adoption of clean energy policies globally are fostering the deployment of flow battery technologies. The market outlook remains positive as advancements in battery chemistry and system design improve efficiency, lifespan, and cost-effectiveness.

These developments enhance the attractiveness of flow batteries for large-scale energy storage, facilitating longer discharge times and better operational flexibility The expanding electrification of industries and growing concerns about carbon emissions are further reinforcing the adoption of stationary flow battery solutions worldwide.

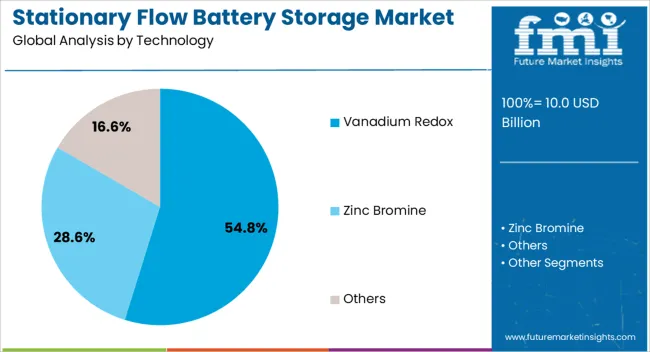

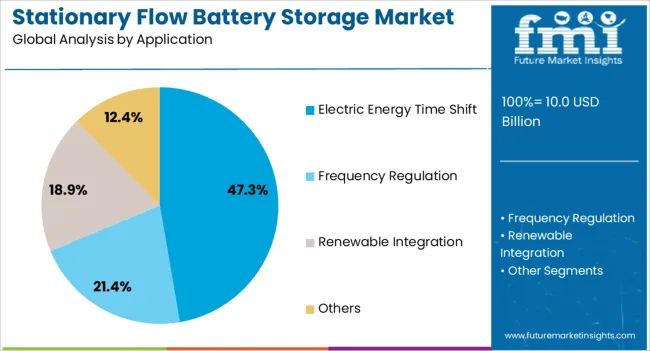

The stationary flow battery storage market is segmented by technology, application, and geographic regions. By technology, stationary flow battery storage market is divided into Vanadium Redox, Zinc Bromine, and Others. In terms of application, stationary flow battery storage market is classified into Electric Energy Time Shift, Frequency Regulation, Renewable Integration, and Others.

Regionally, the stationary flow battery storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Vanadium Redox technology segment is anticipated to hold 54.8% of the Stationary Flow Battery Storage market revenue share in 2025, making it the leading technology. This position is being supported by the technology’s advantages in durability, scalability, and long cycle life, which are essential for large-scale energy storage applications.

The ability to independently scale power and energy capacity provides flexibility unmatched by other battery technologies. Vanadium Redox systems also benefit from well-established manufacturing processes and the availability of raw materials, contributing to their widespread adoption.

The technology’s stable performance in diverse operating conditions has strengthened its position in utility-scale projects and microgrid deployments. Ongoing research to reduce costs and improve electrolyte efficiency is expected to sustain growth and reinforce its dominance within the market.

The Electric Energy Time Shift application segment is expected to capture 47.3% of the Stationary Flow Battery Storage market revenue in 2025, making it the largest application. This growth is being driven by the need to store excess energy generated during off-peak periods and deliver it during peak demand, optimizing grid efficiency and reducing energy costs.

The increasing penetration of intermittent renewable energy sources such as solar and wind has amplified the requirement for effective time-shifting solutions to balance supply and demand. The flexibility of flow batteries to provide long-duration discharge supports their suitability for this application.

Utilities and grid operators are increasingly adopting these systems to enhance reliability, reduce curtailment of renewables, and support demand response programs. The focus on decarbonizing power grids and improving energy resilience is expected to sustain the strong demand for electric energy time shift applications in the coming years.

Stationary flow battery storage growth is fueled by renewable integration, grid modernization, and industrial backup demand. Cost challenges exist, but improving scale and supportive policies ensure long-term opportunities.

The rapid expansion of renewable energy projects has been a defining factor in driving the adoption of stationary flow battery storage. Solar and wind energy, being intermittent sources, require reliable storage to ensure consistent supply to the grid. Flow batteries provide long-duration storage solutions, making them highly effective for balancing generation and consumption over extended hours. Utility companies and developers are increasingly choosing flow batteries for their scalability, efficiency, and suitability in large-scale renewable projects. The growing emphasis on energy transition has made flow batteries a critical component in stabilizing renewable energy grids, ensuring that excess generation is stored effectively and distributed when demand peaks or renewable output fluctuates.

The integration of flow batteries into utility-scale storage projects has become increasingly important for grid modernization. Flow batteries are capable of delivering stable power over longer durations compared to lithium-ion, making them attractive for applications such as load leveling, frequency regulation, and peak shaving. Grid operators are prioritizing such systems to enhance reliability and prevent outages during peak demand. Utility-scale adoption is also being supported by regulatory policies that encourage investment in grid resilience. Flow batteries stand out as the go-to technology for long-duration applications, where grid stability, reliability, and scalability are essential in addressing rising electricity demand and distributed generation.

Flow batteries are steadily gaining ground in industrial and commercial applications, where power reliability and operational efficiency are critical. Data centers, manufacturing plants, and commercial buildings are adopting these systems for backup power, cost optimization, and load management. Unlike traditional solutions, flow batteries allow extended discharge cycles without degradation, making them suitable for high-energy demand facilities.

Despite high potential, the stationary flow battery storage market faces challenges related to upfront costs, system complexity, and competition from lithium-ion alternatives. Manufacturing costs for vanadium and zinc-bromine chemistries remain significant, limiting widespread adoption in some regions. However, opportunities are emerging as economies of scale improve and governments provide incentives for long-duration storage technologies. Pilot projects and demonstration plants are proving the economic feasibility of large-scale flow systems, which will encourage broader deployment.

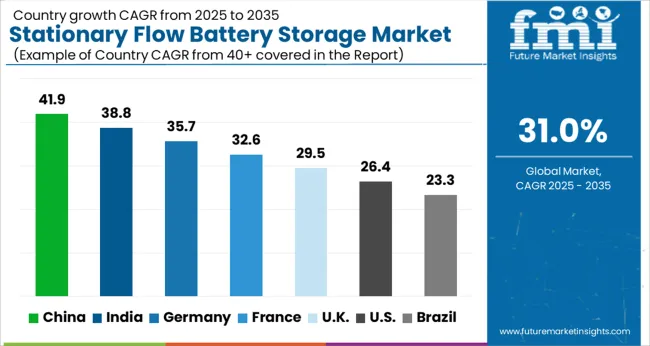

| Country | CAGR |

|---|---|

| China | 41.9% |

| India | 38.8% |

| Germany | 35.7% |

| France | 32.6% |

| UK | 29.5% |

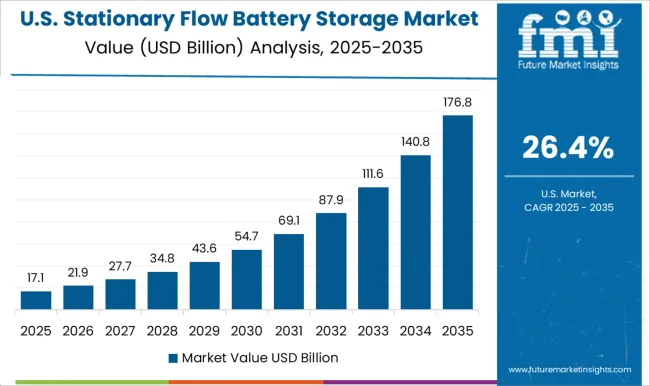

| USA | 26.4% |

| Brazil | 23.3% |

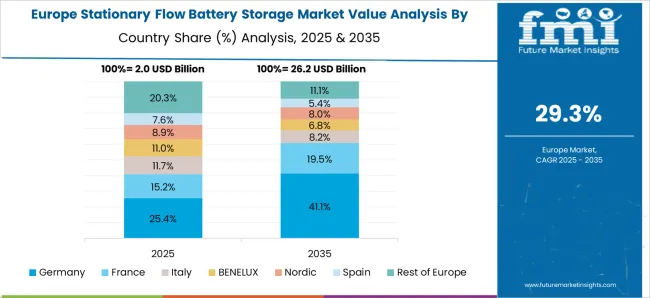

The global stationary flow battery storage market is projected to grow at a CAGR of 31.0% from 2025 to 2035. China leads with 41.9%, followed by India at 38.8%, Germany at 35.7%, the UK at 29.5%, and the USA at 26.4%. Expansion is influenced by the rising integration of renewable power, long-duration storage requirements, and the need for grid stability across major economies. China and India are advancing quickly with large-scale renewable deployments and government-backed incentives for long-duration storage systems. Germany and the UK focus on strengthening grid resilience, emphasizing applications in frequency regulation and energy trading. The USA emphasizes industrial backup systems, data centers, and decentralized energy storage applications. Dollar sales, share indicate that utility-scale projects dominate revenues, while commercial and industrial installations are steadily accelerating adoption. The analysis spans across 40+ countries, with the top-performing regions outlined below.

The stationary flow battery storage market in China is projected to grow at a CAGR of 41.9% from 2025 to 2035, supported by the country’s renewable energy expansion and government-backed storage incentives. Large-scale solar and wind projects are fueling demand for long-duration energy storage, where flow batteries provide efficiency and grid stability. Domestic manufacturers are scaling capacity while collaborating with utilities and international suppliers for advanced chemistries. Partnerships are facilitating pilot programs and large deployments across industrial zones and renewable hubs. Dollar sales, share suggest that utility-scale installations dominate, while industrial and microgrid systems steadily increase adoption. Strategic policy frameworks and renewable integration commitments ensure China remains a global leader in flow battery adoption.

The stationary flow battery storage market in India is projected to expand at a CAGR of 38.8% from 2025 to 2035, driven by the country’s renewable energy targets and electrification programs. Flow batteries are being deployed across solar parks, wind farms, and industrial clusters to address long-duration storage requirements. Domestic firms are investing in cost-effective technologies, while global companies are entering through collaborations and technology transfers. The National Energy Storage Mission and policy-driven subsidies are reinforcing adoption across both grid-connected and off-grid applications. Dollar sales, share indicate utility-scale installations remain dominant, but commercial and microgrid storage solutions are gaining importance. India’s emphasis on rural electrification and renewable backup systems provides consistent momentum.

The stationary flow battery storage market in Germany is projected to grow at a CAGR of 35.7% from 2025 to 2035, supported by the country’s renewable-heavy grid and energy transition commitments. Flow batteries are being integrated for frequency regulation, peak shaving, and renewable integration to ensure stability. Domestic innovators are advancing electrolyte technologies, while utilities and research consortia are piloting commercial-scale projects. Support from European Union initiatives has further strengthened investments in next-generation storage technologies. Dollar sales, share show utility-scale deployments dominate, but adoption in commercial and community storage is growing. Germany’s strong regulatory framework, combined with R&D leadership, positions the country as a major European hub for stationary flow battery development.

The stationary flow battery storage market in the UK is expected to expand at a CAGR of 29.5% from 2025 to 2035, as renewable integration and energy security priorities fuel adoption. Flow batteries are supporting wind farms, solar plants, and urban grid stabilization projects. Domestic firms are introducing modular and scalable systems, while global providers deliver advanced chemistries to meet utility needs. Regulatory emphasis on decarbonization and renewable obligations has attracted strong investment in grid-scale infrastructure. Dollar sales, share indicate utility-scale projects dominate, though distributed storage for commercial and residential users is steadily expanding. Energy trading, frequency balancing, and backup power requirements strengthen diverse use cases.

The stationary flow battery storage market in the USA is projected to expand at a CAGR of 26.4% from 2025 to 2035, driven by demand from industrial facilities, data centers, and renewable integration. Flow batteries are increasingly adopted for long-duration storage, complementing intermittent solar and wind generation. Domestic startups and established firms are investing in cost reduction through new electrolyte chemistries and process optimization. Federal and state-level incentives, alongside clean energy mandates, accelerate pilot projects and commercial-scale deployment. Dollar sales, share reveal utility-scale adoption dominates revenue, while industrial backup and microgrid systems are rapidly gaining traction. Collaborations between manufacturers, utilities, and research institutions strengthen the pace of innovation.

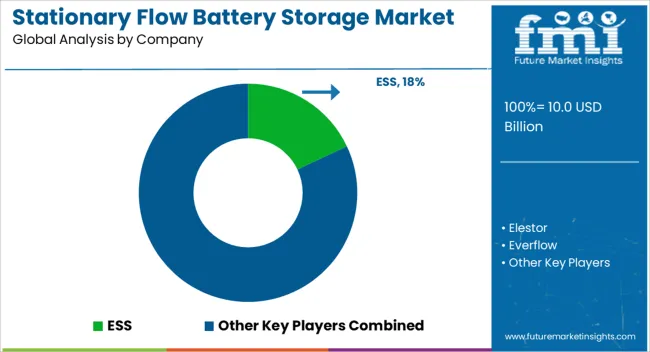

Competition in the stationary flow battery storage market is defined by chemistry innovation, system scalability, project reliability, and integration with renewable energy grids. ESS leads with vanadium redox flow systems designed for long-duration storage, highlighting high efficiency and stable cycle life. Elestor differentiates by developing hydrogen bromine-based flow batteries that emphasize cost competitiveness and scalability for utility-scale deployments. Everflow and Invinity Energy Systems focus on large commercial and industrial applications, offering modular, containerized solutions suitable for grid balancing, renewable integration, and backup operations. Largo leverages its vertical integration in vanadium production to provide stable supply, positioning itself as a critical player for raw material availability and system economics. Primus Power emphasizes zinc-bromine flow battery technology with simplified architecture and enhanced durability, targeting both utility and commercial installations. Redflow, based in Australia, delivers zinc-bromine batteries designed for smaller-scale applications including telecom, off-grid, and microgrid systems, with strong adoption in Asia-Pacific. Voltstorage, headquartered in Europe, focuses on residential and small-commercial flow battery systems with modularity and cost efficiency at the forefront. VRB Energy, a pioneer in vanadium redox technology, operates across China and North America, supplying utility-scale systems and expanding through international partnerships. Market strategies emphasize vertical integration, electrolyte innovation, and turnkey project capabilities. Dollar sales, share suggest utility-scale installations dominate revenue, while small-commercial and microgrid deployments expand overall reach. Players rely on partnerships with utilities, governments, and renewable developers to accelerate adoption. Technical differentiation, such as electrolyte lifetime, safety, and modular configuration, remains the key lever for market share growth. The market remains dynamic, with global and regional players competing through scale, chemistry, and system design innovations that cater to diverse storage needs worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.0 Billion |

| Technology | Vanadium Redox, Zinc Bromine, and Others |

| Application | Electric Energy Time Shift, Frequency Regulation, Renewable Integration, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ESS, Elestor, Everflow, Invinity Energy Systems, Largo, Primus Power, Redflow, Voltstorage, and VRB Energy |

| Additional Attributes | Dollar sales, share, demand by utility, commercial, and residential sectors, key application trends, regional adoption patterns, competitor strategies, raw material supply, government incentives, and future growth opportunities. |

The global stationary flow battery storage market is estimated to be valued at USD 10.0 billion in 2025.

The market size for the stationary flow battery storage market is projected to reach USD 148.2 billion by 2035.

The stationary flow battery storage market is expected to grow at a 31.0% CAGR between 2025 and 2035.

The key product types in stationary flow battery storage market are vanadium redox, zinc bromine and others.

In terms of application, electric energy time shift segment to command 47.3% share in the stationary flow battery storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stationary Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lead Acid Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Geostationary Orbit Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

Grid Scale Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Behind the Meter Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Films Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Machine Market Size and Share Forecast Outlook 2025 to 2035

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Flow Chemistry Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Flow Meter Devices Market Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA