The behind the meter stationary battery storage market is projected to grow from USD 50.5 billion in 2025 to USD 300.2 billion in 2035, reflecting a CAGR of 19.5%. This represents an absolute dollar opportunity of USD 249.7 billion over the decade. The market is expected to expand rapidly, reaching USD 60.4 billion in 2026, USD 86.3 billion in 2029, USD 123.2 billion in 2031, and USD 251.2 billion in 2034. The strong growth trajectory indicates increasing deployment of stationary battery solutions, providing manufacturers and investors with substantial opportunities to capture incremental revenue and strengthen market positioning over the next ten years.

From an absolute dollar perspective, annual incremental growth starts at around USD 10–12 billion in the early years and accelerates to over USD 49 billion in later years, culminating in USD 249.7 billion by 2035. Intermediate values such as USD 42.3 billion in 2025, USD 103.1 billion in 2030, and USD 210.2 billion in 2033 highlight significant inflection points along the growth path. This predictable expansion allows stakeholders to plan investments, scale operations, and optimize distribution channels.

| Metric | Value |

|---|---|

| Behind the Meter Stationary Battery Storage Market Estimated Value in (2025 E) | USD 50.5 billion |

| Behind the Meter Stationary Battery Storage Market Forecast Value in (2035 F) | USD 300.2 billion |

| Forecast CAGR (2025 to 2035) | 19.5% |

A breakpoint analysis highlights critical periods of rapid expansion. Between 2025 and 2027, the market grows from USD 50.5 billion to USD 60.4 billion, representing the early adoption phase where initial installations drive moderate incremental gains. Another key breakpoint occurs around 2029–2031, as the market expands from USD 86.3 billion to USD 123.2 billion, reflecting a period of strong acceleration and higher absolute dollar growth. These stages are pivotal for manufacturers and investors to align production, secure supply chains, and capture revenue during periods of rising demand.

A major breakpoint is observed between 2033 and 2035, when the market surges from USD 251.2 billion to USD 300.2 billion, representing the largest absolute dollar increase in the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 103.1 billion to USD 210.2 billion, acting as bridging stages that maintain growth momentum. Identifying these breakpoints enables stakeholders to strategically plan investments, scale operations efficiently, and maximize revenue potential.

The behind the meter stationary battery storage market is experiencing robust growth, driven by the increasing demand for energy reliability, cost savings, and grid independence among electricity consumers. The shift toward renewable energy integration and the rising adoption of distributed energy resources have accelerated the need for efficient storage solutions that can manage peak loads and reduce reliance on the main grid.

Technological advancements in battery chemistry and management systems have improved performance and safety, making stationary storage a viable option for both residential and commercial users. Additionally, growing environmental awareness and favorable regulatory frameworks encouraging clean energy storage contribute to expanding market opportunities.

The future outlook is positive as ongoing investments in smart grid technologies and demand response programs continue to support market expansion and innovation.

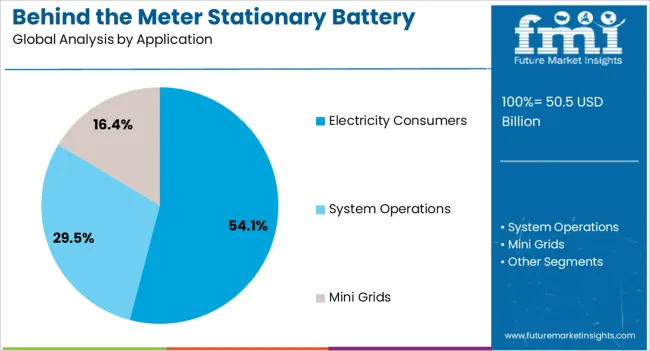

The behind the meter stationary battery storage market is segmented by battery, application, and geographic regions. By battery, behind the meter stationary battery storage market is divided into Lithium-Ion and Lead Acid. In terms of application, behind the meter stationary battery storage market is classified into Electricity Consumers, System Operations, and Mini Grids. Regionally, the behind the meter stationary battery storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Lithium-Ion battery segment is projected to hold 68.5% of the market revenue share in 2025, positioning it as the dominant battery type in the behind the meter stationary battery storage market. This leadership is attributed to the superior energy density, longer lifecycle, and declining costs associated with lithium-ion technology.

The segment’s growth has been supported by advancements in battery management systems that enhance safety and efficiency, making lithium-ion batteries suitable for diverse applications ranging from residential energy storage to commercial power backup. Furthermore, the widespread availability of lithium-ion components and ongoing research into improving charge rates and thermal stability have reinforced its position.

The scalability and modularity of lithium-ion solutions allow users to customize storage capacity based on their specific energy consumption patterns, further driving adoption.

The Electricity Consumers application segment is expected to capture 54.1% of the overall market revenue in 2025, making it the leading application segment for behind the meter stationary battery storage. This prominence is being driven by the increasing need among residential and commercial electricity users to manage energy costs and improve power reliability.

The ability to store excess energy generated from renewable sources such as solar panels for later use enables consumers to reduce peak demand charges and avoid grid outages. Growing concerns over energy security, combined with rising electricity prices and incentives for energy storage deployment, have encouraged widespread adoption.

As smart home technologies and energy management systems become more sophisticated, the demand for behind the meter storage solutions among electricity consumers is expected to sustain its growth trajectory.

The behind the meter stationary battery storage market is expanding as commercial, industrial, and residential consumers adopt energy storage solutions to manage electricity costs, improve reliability, and integrate renewable energy. These systems store electricity on-site from the grid or on-site generation sources, such as solar panels, for later use, enabling peak shaving, load shifting, and backup power.

Rising electricity tariffs, grid instability, and increasing renewable penetration drive adoption. Manufacturers offering modular, scalable, and high-efficiency battery storage solutions with advanced energy management systems gain competitive advantages. Integration with smart meters, IoT-enabled monitoring, and predictive maintenance enhances performance. Global trends in decarbonization, sustainability, and energy independence further support the growth of behind the meter stationary battery storage systems.

High initial investment and technical complexities hinder the widespread adoption of behind the meter battery storage systems. Costs associated with battery packs, inverters, energy management units, and professional installation can be prohibitive, especially for small- and medium-sized enterprises or residential consumers. Integration into existing electrical infrastructure requires compatibility with meters, renewable generation, and grid interconnection protocols.

Thermal management, safety systems, and ongoing maintenance further increase total ownership costs. Consumers often evaluate payback periods spanning multiple years, delaying adoption in cost-sensitive segments. Until manufacturers develop lower-cost, plug-and-play, and modular solutions, growth is likely to be concentrated among high-income households, large commercial operations, and industrial facilities that prioritize reliability and energy optimization.

Technological innovation is redefining the behind the meter stationary battery storage landscape. Modern systems increasingly feature lithium-ion, solid-state, or flow battery chemistries that enhance energy density, lifespan, and safety. Intelligent energy management platforms allow automated load balancing, predictive maintenance, and integration with distributed energy resources.

Cloud-based monitoring and analytics provide actionable insights for energy efficiency and performance optimization. Hybrid setups combining batteries with solar PV or microgrids are becoming common, enabling more sustainable and self-sufficient energy usage. These advancements reflect a broader trend toward digitalized, adaptive, and environmentally conscious energy solutions, which strengthens the value proposition for commercial, industrial, and residential end-users globally.

Growth in the behind the meter stationary battery storage market is tempered by fragmented competition, regulatory hurdles, and battery lifecycle challenges. Numerous global and regional suppliers compete on price, performance, and technology, creating pressure on margins. Regulatory requirements related to safety, grid interconnection, and building codes vary across regions, complicating deployment. Battery degradation, recycling, and disposal present operational and environmental concerns.

Performance guarantees, warranty provisions, and long-term maintenance obligations influence buyer confidence. Until manufacturers optimize cost-effectiveness, regulatory alignment, and sustainable end-of-life management, market adoption may remain concentrated in regions with strong policy incentives, financial support, and technical expertise for localized energy storage systems.

The growing deployment of renewable energy and demand for localized energy independence are key opportunities for behind the meter battery storage. On-site storage enables households and businesses to maximize solar or wind self-consumption, minimize peak demand charges, and maintain operations during outages. Emerging markets with expanding electrification and rising energy costs present fertile growth opportunities. Manufacturers that provide scalable, modular, and integrated solutions can capitalize on these trends. Strategic collaborations with solar installers, energy service providers, and smart home technology companies further enhance adoption potential. The ongoing focus on decarbonization and resilience positions behind the meter battery storage as a critical enabler for sustainable and reliable energy systems.

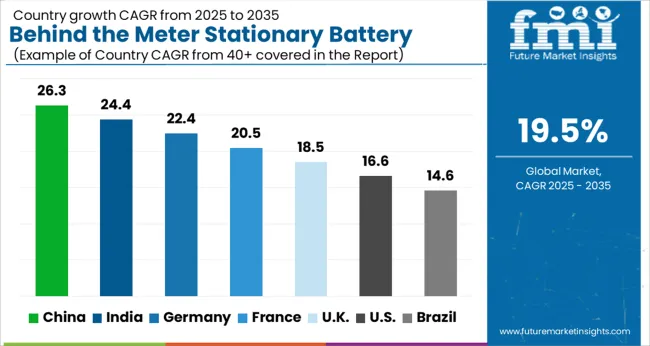

| Country | CAGR |

|---|---|

| China | 26.3% |

| India | 24.4% |

| Germany | 22.4% |

| France | 20.5% |

| UK | 18.5% |

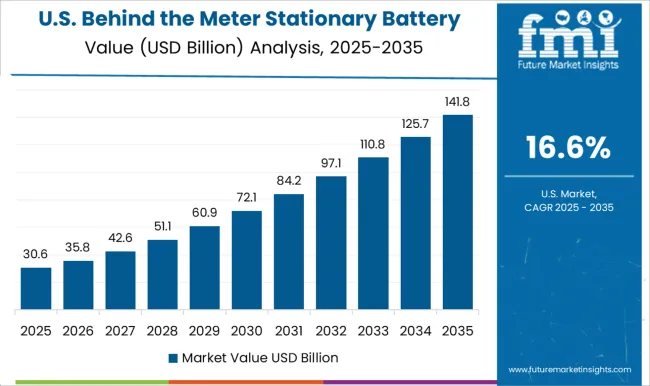

| USA | 16.6% |

| Brazil | 14.6% |

The global behind the meter stationary battery storage market was projected to grow at a 19.5% CAGR through 2035, driven by demand in residential, commercial, and industrial energy storage applications. Among BRICS nations, China recorded 26.3% growth as large-scale manufacturing and installation facilities were commissioned and compliance with energy storage and safety standards was enforced, while India at 24.4% growth saw expansion of production units to meet rising regional energy management needs. In the OECD region, Germany at 22.4% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 18.5% relied on moderate-scale operations for commercial and residential energy storage solutions. The USA, expanding at 16.6%, remained a mature market with steady demand across distributed energy and backup power segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The behind the meter stationary battery storage market in China is growing at a CAGR of 26.3% due to rapid adoption of renewable energy solutions and increasing demand for energy reliability. These systems are installed at homes, commercial facilities, and industrial sites to store excess electricity and provide backup during peak demand or grid interruptions. Growth is supported by government incentives, renewable energy policies, and rising electricity costs encouraging self-consumption and energy management. Manufacturers are offering batteries with high energy density, long cycle life, and intelligent energy management features. Distribution through partnerships with solar installers, energy solution providers, and online platforms ensures accessibility. Growth is further driven by urban development, expansion of commercial infrastructure, and corporate initiatives to reduce electricity costs and enhance sustainability. China continues to lead global adoption due to strong industrial support, favorable regulations, and advanced battery technology development.

India is witnessing strong growth at a CAGR of 24.4% in the behind the meter stationary battery storage market due to rising electricity demand, increasing rooftop solar installations, and need for reliable backup solutions. Commercial, industrial, and residential users adopt these systems to store energy, reduce electricity costs, and maintain operations during grid interruptions. Suppliers provide batteries with high efficiency, long lifespan, and smart management features to optimize energy usage. Growth is supported by government policies promoting solar adoption, renewable energy incentives, and expansion of commercial and industrial infrastructure. Distribution through energy solution providers, solar installation partners, and online platforms enhances accessibility. Increasing awareness of energy cost savings and reliability drives adoption across residential and commercial segments. India’s market is expected to continue expanding rapidly as energy management solutions gain importance in urban and semi-urban regions.

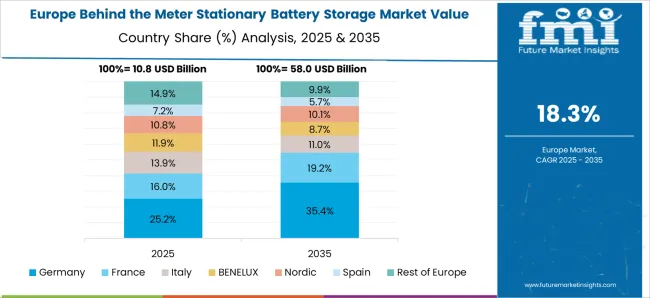

Germany is growing at a CAGR of 22.4% in the behind the meter stationary battery storage market due to widespread adoption of renewable energy systems and residential energy management solutions. Homeowners, commercial buildings, and small industrial facilities are installing batteries to store solar energy, reduce electricity costs, and enhance reliability. Suppliers offer systems with long cycle life, high efficiency, and intelligent energy management. Growth is supported by government incentives for renewable integration, energy efficiency programs, and strong grid infrastructure. Distribution through solar installers, energy solution providers, and retailers ensures accessibility across urban and suburban regions. Adoption is further influenced by rising electricity prices and the desire for self-consumption of renewable energy. Germany’s advanced energy transition initiatives and supportive policies make it a key market for behind the meter stationary battery storage solutions in Europe.

The United Kingdom market is expanding at a CAGR of 18.5% due to increasing interest in energy self-consumption, renewable energy integration, and reliable backup power. Commercial, industrial, and residential users adopt behind the meter battery systems to store energy from solar installations, reduce electricity bills, and maintain operations during outages. Suppliers provide batteries with high efficiency, long cycle life, and smart management capabilities suitable for diverse applications. Growth is supported by government initiatives promoting renewable energy adoption, energy efficiency programs, and rising electricity costs. Distribution through energy solution providers, solar installation companies, and online channels enhances availability. Adoption is further driven by urban development, corporate sustainability goals, and rising awareness of energy management solutions. The United Kingdom continues to see steady growth as battery storage becomes an essential component of modern energy infrastructure.

The United States market is growing at a CAGR of 16.6%, supported by increasing deployment of renewable energy systems and demand for reliable home and commercial backup power. Residential, commercial, and industrial users are adopting behind the meter battery storage to store solar energy, optimize electricity costs, and maintain operations during grid interruptions. Suppliers provide batteries with long cycle life, high efficiency, and advanced energy management features. Growth is further supported by federal and state incentives, expanding renewable installations, and rising electricity prices. Distribution through solar installers, energy solution providers, and online platforms ensures market accessibility. Adoption is also driven by corporate sustainability initiatives and increasing awareness of energy self-sufficiency. The United States continues to see steady adoption of battery storage solutions across residential and commercial segments, making it a significant market for behind the meter stationary energy storage systems.

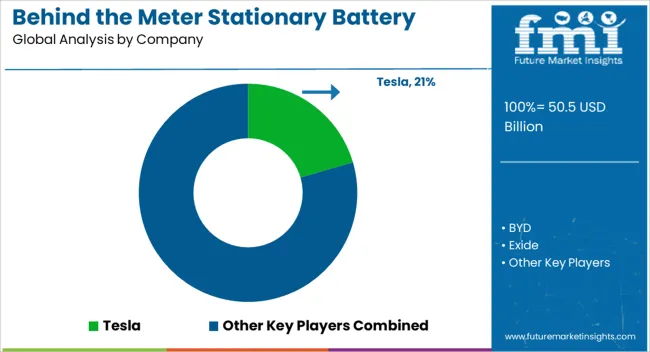

The behind the meter stationary battery storage market is served by leading suppliers including Tesla, BYD, Exide, GS Yuasa, Hitachi, Johnson Controls, Leclanche, LG Chem, Panasonic, Siemens, SK Innovation, Toshiba, and Varta. Product brochures emphasize energy capacity ratings, round-trip efficiency, voltage compatibility, thermal management systems, cycle life, and modular expandability. Units are designed for residential, commercial, and light industrial applications, with features such as integrated inverters, smart energy management software, rapid installation, and compatibility with solar PV systems. Safety certifications and battery chemistries (lithium-ion, lithium iron phosphate, and lead-acid variants) are highlighted to guide buyers and installers. Competition in the market is driven by energy density, reliability, and cost-effectiveness. Tesla and LG Chem focus on high-capacity lithium-ion solutions with integrated software platforms for real-time monitoring and grid interaction. BYD and Panasonic emphasize long-cycle life, modular expandability, and strong warranty offerings.

Hitachi and Johnson Controls prioritize robust thermal management and system integration flexibility, whereas Exide and Varta position on cost-efficiency and regional service networks. Leclanche and SK Innovation leverage advanced battery chemistries to achieve higher energy retention and safer operation. Siemens provides fully integrated storage systems with power electronics for commercial applications. Marketing materials highlight performance under continuous charge-discharge cycles, maintenance schedules, and ease of deployment for behind-the-meter installations. Market strategies focus on regional penetration, customer support, and scalable solutions. Manufacturers provide detailed datasheets, installation guides, and monitoring software instructions to ensure optimal performance. Strategic partnerships with solar installers, utility providers, and energy service companies are emphasized to expand deployment and maximize operational uptime. Tesla and LG Chem target residential energy independence, while Panasonic and BYD cater to commercial buildings seeking peak load management.

| Item | Value |

|---|---|

| Quantitative Units | USD 50.5 Billion |

| Battery | Lithium-Ion and Lead Acid |

| Application | Electricity Consumers, System Operations, and Mini Grids |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tesla, BYD, Exide, GS Yuasa, Hitachi, Johnson Controls, Leclanche, LG Chem, Panasonic, Siemens, SK Innovation, Toshiba, and Varta |

| Additional Attributes | Dollar sales vary by battery type, including lithium-ion, lead-acid, and flow batteries; by application, such as residential, commercial, and industrial energy storage; by end-use industry, spanning utilities, commercial facilities, and manufacturing plants; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising renewable integration, demand for energy cost savings, and grid resiliency initiatives. |

The global behind the meter stationary battery storage market is estimated to be valued at USD 50.5 billion in 2025.

The market size for the behind the meter stationary battery storage market is projected to reach USD 300.2 billion by 2035.

The behind the meter stationary battery storage market is expected to grow at a 19.5% CAGR between 2025 and 2035.

The key product types in behind the meter stationary battery storage market are lithium-ion and lead acid.

In terms of application, electricity consumers segment to command 54.1% share in the behind the meter stationary battery storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Behind-The-Ear Hearing Aid Market Size and Share Forecast Outlook 2025 to 2035

Theranostic NGS Market Size and Share Forecast Outlook 2025 to 2035

Thermostatic Radiator Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Theme Park Market Size and Share Forecast Outlook 2025 to 2035

Thermoform Packaging Market Forecast and Outlook 2025 to 2035

Thermoexpandable Polymer Microsphere Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Containers Market Size and Share Forecast Outlook 2025 to 2035

Thermogravimetric analyzer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Tray Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermostatic Mixing Valve Market Size and Share Forecast Outlook 2025 to 2035

Thermos Drinkware Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermodilution Catheter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA