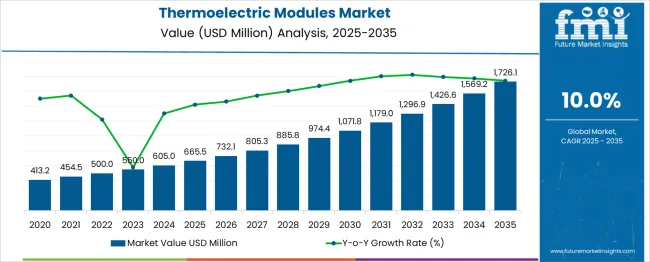

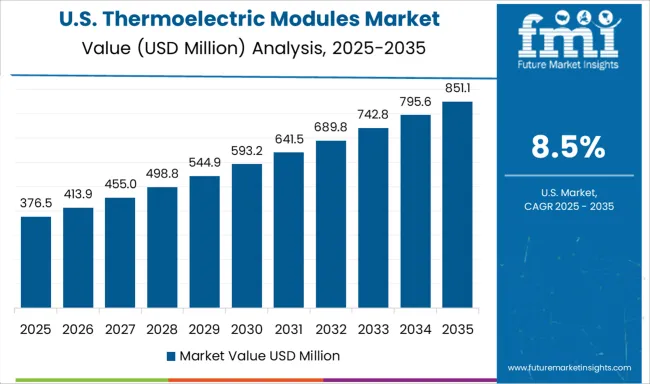

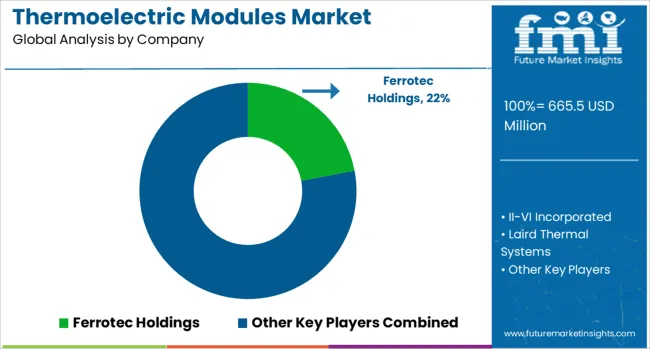

The thermoelectric modules market is estimated to be valued at USD 665.5 million in 2025 and is projected to reach USD 1726.1 million by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. This trajectory, supported by a 10% CAGR, is attributed to increased demand for solid-state temperature control across sectors requiring compact, noise-free thermal systems. Use cases in optical network equipment, medical diagnostics, and satellite subsystems have widened, as reliability and precision take precedence in remote or vibration-sensitive environments. Between 2025 and 2029, the market increases by USD 308.9 million, while growth from 2030 to 2035 amounts to USD 654.3 million. This clear acceleration points to downstream commercialization, especially as power generation from automotive and industrial waste heat gains traction. Material advancements, particularly in the thermal and electrical balance of thermoelectric alloys, are expected to ease cost-performance trade-offs. Growth in the second half of the forecast period is likely to be driven by bulk manufacturing of high-efficiency cooling elements used in advanced computing infrastructure and Li-ion battery thermal management systems. The technology's modularity and scalability position it for greater uptake across high-precision thermal ecosystems.

| Metric | Value |

|---|---|

| Thermoelectric Modules Market Estimated Value in (2025 E) | USD 665.5 million |

| Thermoelectric Modules Market Forecast Value in (2035 F) | USD 1726.1 million |

| Forecast CAGR (2025 to 2035) | 10.0% |

Thermoelectric modules represent approximately 60% to 65% of the thermoelectric cooling market, where they are used in solid-state heat pumps across compact and noise-sensitive environments. Within the energy harvesting and waste heat recovery segment, they contribute 20% to 25%, particularly in systems that convert industrial or automotive heat into usable electricity. In consumer electronics, their share ranges from 25% to 30%, primarily for temperature control in wearables, sensors, and portable devices. Automotive thermal management accounts for 30% to 40%, where modules are applied in seat climate systems, battery packs, and heat recovery from exhaust lines. Finally, in industrial and telecom thermal regulation, thermoelectric modules hold about 15% to 20%, addressing localized heat control in base stations, laser systems, and control cabinets. The market is advancing through solid-state cooling and power generation innovations led by high-performance applications in aerospace, medical diagnostics, and next-gen electronics. Ferrotec, II-VI Incorporated, Laird Thermal Systems, Komatsu, and TEC Microsystems are shaping the industry through custom multilayer module designs and high heat-flux micro-coolers. Trends include ultra-thin modules for compact electronics, high-durability assemblies for defense systems, and integration with wearable and IoT sensors. Companies are investing in nanostructured thermoelectric materials and high ZT value compounds to improve energy conversion efficiency. Automotive OEMs are exploring waste heat recovery integration using high-power density modules. Strategic collaborations with semiconductor manufacturers and medical device companies are accelerating customized thermal management systems across mission-critical verticals.

The thermoelectric modules market is witnessing accelerated growth due to the rising demand for compact, reliable, and energy-efficient thermal management solutions across various industries. These modules have been increasingly adopted in applications where precise temperature control is essential, such as medical devices, consumer electronics, and automotive systems.

The ability of thermoelectric modules to operate without moving parts, refrigerants, or maintenance has made them highly attractive for integration in space-constrained and mission-critical environments. Advancements in material science, especially in the area of semiconductor compounds and microfabrication technologies, are contributing to enhanced performance and broader use cases.

With growing focus on green technologies and noise-free operation, thermoelectric modules are also gaining traction in renewable energy systems and autonomous sensors. The future outlook is positive as R&D investments continue to improve cost-efficiency and scalability, opening new opportunities in defense, aerospace, and wearable electronics where conventional cooling systems are not viable..

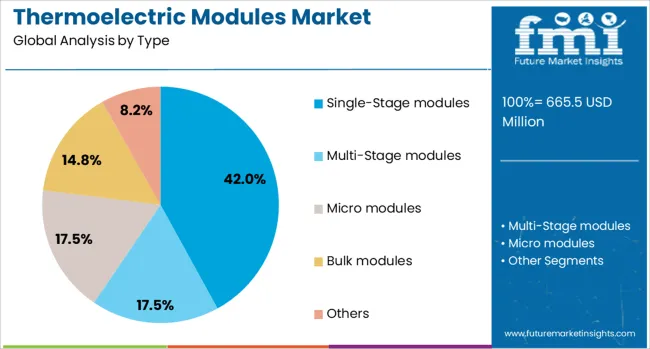

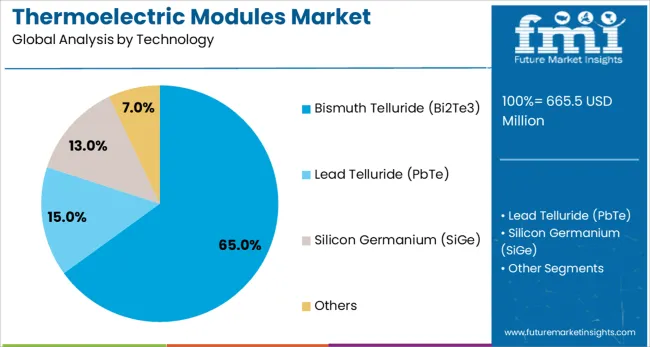

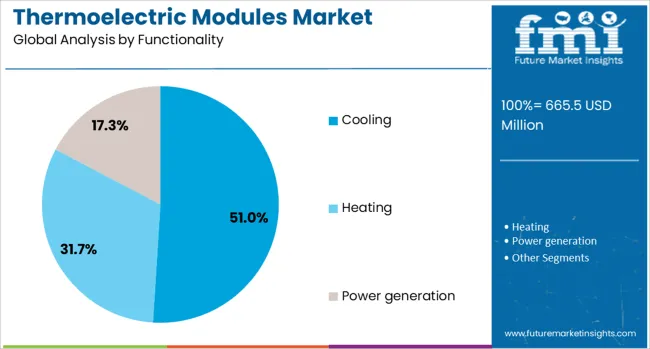

The thermoelectric modules market is segmented by type, technology, functionality, application, and geographic regions. The thermoelectric modules market is divided by type into Single-Stage modules, Multi-Stage modules, Micro modules, Bulk modules, and Others. The thermoelectric modules market is classified by technology into Bismuth Telluride (Bi2Te3), Lead Telluride (PbTe), Silicon Germanium (SiGe), and Others. Based on functionality, the thermoelectric modules market is segmented into Cooling, Heating, and Power generation. The thermoelectric modules market is segmented into Consumer electronics, Automotive, Healthcare, Industrial, Telecommunications, Aerospace and Defense, and Others. Regionally, the thermoelectric modules industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single stage segment is expected to account for 42% of the thermoelectric modules market revenue share in 2025, establishing it as the leading type. This segment has maintained its dominance due to the cost-effectiveness, reliability, and ease of integration offered by single stage thermoelectric modules in a wide range of applications.

These modules have been favored for their ability to deliver moderate temperature differentials suitable for consumer electronics, laboratory instruments, and optical devices. The simplicity of design combined with stable performance across varied environments has led to broader adoption among original equipment manufacturers.

The preference for single stage modules has also been driven by their high availability and compatibility with existing form factors, minimizing the need for extensive redesign. With continuous material enhancements and miniaturization trends, the single stage configuration is positioned to remain the mainstream solution for standard thermal management needs in multiple industries..

The Bismuth Telluride technology segment is projected to hold 65% of the thermoelectric modules market revenue share in 2025, making it the most widely used material system. The dominance of this segment has been attributed to the superior thermoelectric properties of Bismuth Telluride in low to medium temperature ranges. Its high figure of merit, along with stable electrical and thermal conductivity, has made it the preferred material for both cooling and power generation applications.

Manufacturers have consistently relied on Bismuth Telluride due to its proven performance, well-established supply chains, and adaptability in thin-film fabrication. The technology has found widespread adoption in precision cooling for electronics and medical diagnostics, where efficiency and reliability are paramount.

Continued improvements in doping techniques and nanostructuring have further optimized its performance, reinforcing its leadership. As demand grows for thermoelectric solutions in emerging technologies, Bismuth Telluride is expected to retain its position as the cornerstone material of the market..

The cooling segment is anticipated to capture 51% of the thermoelectric modules market revenue share in 2025, establishing itself as the leading functionality. This segment’s growth has been supported by the increasing requirement for localized and environmentally friendly cooling solutions in sensitive electronics, photonics, and temperature-controlled transport systems. The ability of thermoelectric modules to offer silent operation and precise thermal control without refrigerants has made them ideal for compact cooling applications.

Their integration has expanded in industries such as telecommunications, medical imaging, and aerospace, where traditional cooling systems fall short. The market has responded to these demands by developing highly efficient cooling modules that ensure minimal energy consumption while delivering stable performance.

Growth in this segment has also been driven by government and industry focus on sustainable technologies, which favor solid-state alternatives over conventional compressor-based systems. With advancements in module design and material science, the cooling segment is expected to sustain its leadership in delivering high-performance thermal solutions..

Automotive waste heat systems and small-scale refrigeration units have led demand increases. Modules capable of generating electricity from exhaust streams and capturing heat have gained traction in performance vehicle and industrial settings. Growth has also been supported by increased consumer use in wearable cooling patches and electronic device thermal management. Lightweight module designs and flexible substrates are being specified in IoT and mobility devices. Demand momentum is tied to energy harvesting innovation and adoption across electrified and portable product ecosystems.

Thermoelectric modules have been embraced for their ability to convert waste heat into electricity in industrial and automotive settings, with 34 % of new modules deployed in engine heat recovery systems. Compact cooling devices using these modules captured 27 % of wearable or spot-chill markets. Focus on sustainable vehicle development increased uptake by 22 % in hybrid and EV exhaust integration applications. In electronics thermal control, modules were paired with heat spreaders in 19 % of laptop and camera models. Growth in renewable energy zones expanded use in off-grid solar powered sensors and signage. Lightweight, solid-state designs allowed rapid prototyping and integration into thermal-sensitive consumer tech.

Thermoelectric conversion efficiency remains constrained around 6–8 %, causing cost-per-watt metrics to be 24 % higher than conventional cooling or power generation methods. Precious material usage such as bismuth telluride and lead telluride has inflated module cost structures. Dense module stacking and module-to-system integration complexity added procurement friction in 18 % of compact electronics design cycles. Thermal interface mismatches reduced performance in up to 12 % of retrofit installations, demanding precise cooling plate engineering. Lower efficiency in high-temperature industrial contexts limited adoption where more efficient heat-to-electric systems were required.

Hybrid thermoelectric designs combining thin-film and bulk materials have enabled use in wearable cooling patches and medical temperature control, capturing 23 % of new product introductions in wellness devices. Flexible module variants are being specified in 18 % of smart textile applications. Industrial fleet operators have piloted module arrays for exhaust heat recapture, generating electricity to power sensors and control units. Air-cooled or liquid-cooled hybrid systems are seeing interest in off-grid microgrids and telecom backhaul sites. Customized stacking and module matching for variable heat sources enabled growth in precision thermal regulation sectors such as aerospace and pharmaceutical incubators.

Miniature thermoelectric modules under 1 cm² footprint accounted for 30 % of recent wearable and IoT hardware orders. Plug-and-play module kits supporting scalable power arrays were used in 25 % of prototyping platforms and embedded systems. Integration with temperature and power sensing enabled digital performance dashboards in 19 % of new product cases. Design libraries supporting shape customization for curved surfaces and flexible substrates increased reuse and cross-model compatibility. Low-profile cooling modules with adhesive backing are being adopted in laptop and automotive dashboard cooling lines where space constraints exist. Wireless monitoring and over-the-air firmware allow adaptive thermal control across module fleets.

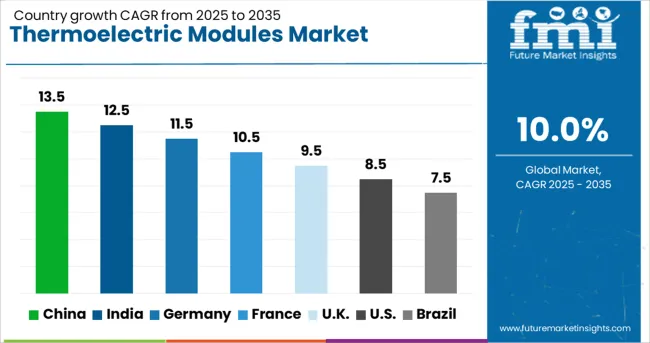

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

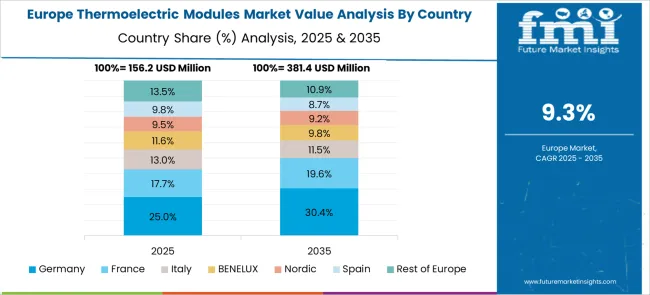

The market is projected to grow at a CAGR of 10% from 2025 to 2035. China outpaces the global rate with a CAGR of 13.5%, operating at 1.35x the global average due to scaled deployment in consumer electronics and high-density computing. India, at 12.5%, grows 1.25x faster than the global trend, reflecting growing demand in portable medical devices and automotive thermal systems. Germany (OECD) records 11.5%, or 1.15x the global pace, supported by clean energy and industrial automation applications. The United Kingdom (OECD) sees 9.5%, operating just below the baseline at 0.95x, while the United States (OECD) lags at 8.5%, or 0.85x, with comparatively slower retrofit adoption in legacy industrial infrastructure. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China held a 13.5% share of the global thermoelectric modules market in 2025. Growth was observed due to integration of thermoelectric cooling units in precision electronics, LED lighting systems, and wearable biomedical devices. Local manufacturing was prioritized, with Bi₂Te₃-based modules produced in large volume. Cooling systems in 5G base stations and high-performance processors favored compact thermoelectric arrays.

India accounted for 12.5% of the global market in 2025. Increased deployment of small-scale, off-grid power devices and temperature stabilization systems contributed to module demand. Passive cooling systems were integrated in lithium battery housings, photovoltaic panels, and laboratory instrumentation. Price-sensitive consumer electronics and portable refrigerators adopted thin-profile cooling elements.

Germany held an 11.5% share in 2025. Thermoelectric cooling modules were widely adopted in semiconductor manufacturing, laser diode stabilization, and chemical analysis devices. Miniaturized thermoelectric generators were developed for wearable and military applications requiring energy scavenging. Efficiency enhancements focused on reducing ΔT losses using segmented legs and improved heat sinks.

The United Kingdom accounted for 9.5% of global demand in 2025. Usage was concentrated in aerospace avionics, scientific computing clusters, and precision farming equipment. Modules with active feedback control were adopted in high-uptime laboratory and defense installations. Dual-function thermoelectric elements capable of both heating and cooling were increasingly preferred.

The United States represented 8.5% of the global market in 2025. Thermoelectric modules were used for high-precision thermal control in optical sensors, automotive electronics, and satellite subsystems. Passive cooling with high Seebeck coefficient materials was emphasized. Integration with AI-controlled devices and IoT environments supported steady adoption.

The market comprises companies specializing in solid-state thermal management systems for applications in electronics, medical devices, automotive, aerospace, and industrial cooling. Ferrotec Holdings leads the market with a wide portfolio of thermoelectric modules, including single-stage, multi-stage, and miniature TECs used in photonics, semiconductor cooling, and automotive climate control. II-VI Incorporated delivers high-performance thermoelectric devices for optical transceivers, laser diodes, and medical diagnostic equipment, offering modules with high heat pumping efficiency and durability under varying temperature loads. Laird Thermal Systems supplies customized thermoelectric assemblies, including TECs integrated with heat exchangers and control electronics, used in medical storage, telecom, and aerospace components. KELK Ltd., a subsidiary of Komatsu, focuses on automotive-grade thermoelectric generators (TEGs) used in waste heat recovery systems, supporting fuel efficiency improvements in combustion engine vehicles. TEC Microsystems and RMT Ltd. provide high-precision, miniaturized thermoelectric modules suited for optoelectronic devices and space-constrained environments, offering enhanced thermal control at micro and nano scales. Crystal Ltd. manufactures TECs for industrial and instrumentation use, supporting stable operation in high-sensitivity measurement systems. Guangdong Fuxin Technology delivers cost-effective thermoelectric solutions for consumer electronics and industrial cooling, focusing on scalable production and rapid customization. Performance, integration capability, and thermal cycling stability define competitive positioning across this market.

Laird Thermal Systems strengthened ties with automotive and industrial clients by customizing high-density modules for precision cooling. Coherent Corp and TE Technology expanded their presence through tailored solutions for EV battery thermal control and consumer electronics. KELK Ltd focused on high-performance modules for energy harvesting in vehicle systems. Leading Asian manufacturers scaled output to meet demand from the smartphone and telecom infrastructure segments, especially in Japan and China.

| Item | Value |

|---|---|

| Quantitative Units | USD 665.5 Million |

| Type | Single-Stage modules, Multi-Stage modules, Micro modules, Bulk modules, and Others |

| Technology | Bismuth Telluride (Bi2Te3), Lead Telluride (PbTe), Silicon Germanium (SiGe), and Others |

| Functionality | Cooling, Heating, and Power generation |

| Application | Consumer electronics, Automotive, Healthcare, Industrial, Telecommunications, Aerospace and Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ferrotec Holdings, II-VI Incorporated, Laird Thermal Systems, KELK Ltd., TEC Microsystems, Crystal Ltd., RMT Ltd., and Guangdong Fuxin Technology |

| Additional Attributes | Dollar sales by module type (bulk, thin‑film, micro), application (cooling, power generation, automotive thermal management), demand driven by renewable energy harvesting and electronics cooling, led by Asia‑Pacific with North America catching up, innovation in high‑efficiency materials and compact smart integration. |

The global thermoelectric modules market is estimated to be valued at USD 665.5 million in 2025.

The market size for the thermoelectric modules market is projected to reach USD 1,726.1 million by 2035.

The thermoelectric modules market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in thermoelectric modules market are single-stage modules, multi-stage modules, micro modules, bulk modules and others.

In terms of technology, bismuth telluride (bi2te3) segment to command 65.0% share in the thermoelectric modules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermoelectric Generator Market

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thermoelectric Generator Market Size and Share Forecast Outlook 2025 to 2035

Train Ceiling Modules Market

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Power Amplifier Modules Market

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Power Discrete and Modules Market Size and Share Forecast Outlook 2025 to 2035

Signal Conditioning Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaic Modules Market

Automated Radiosynthesis Modules Market

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Distribution Modules Market Size and Share Forecast Outlook 2025 to 2035

Underground Rainwater Collection Modules Market Size and Share Forecast Outlook 2025 to 2035

Special Sealant for Photovoltaic Modules Market Forecast and Outlook 2025 to 2035

Automotive Electrochromic Rearview Modules Market Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Thermal Runaway Sensor Modules Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA