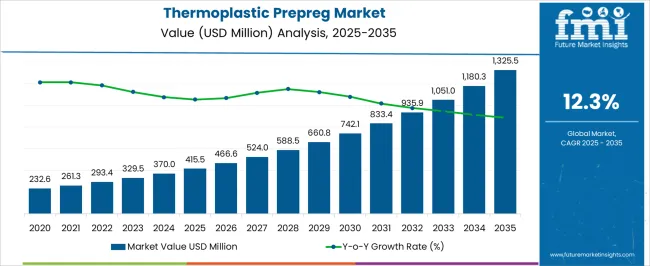

The Thermoplastic Prepreg Market is estimated to be valued at USD 415.5 million in 2025 and is projected to reach USD 1325.5 million by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period. This growth trajectory is driven by an increasing demand for thermoplastic prepregs in industries such as aerospace, automotive, and renewable energy. The market is expected to expand significantly, with YoY growth reaching consistent figures, from USD 415.5 million in 2025 to USD 466.6 million in 2026, followed by further increases, with the value crossing USD 1 billion by 2029.

By 2035, the market value is anticipated to reach USD 1,325.5 million. The steady YoY increases underscore the market’s resilience and the growing adoption of thermoplastic prepreg materials, which offer enhanced performance characteristics like high-temperature resistance, lightweight properties, and durability. As industries seek efficient, high-performance materials for applications such as lightweight automotive parts and aerospace components, the thermoplastic prepreg market is expected to continue benefiting from substantial annual growth, positioning it for long-term value creation.

| Metric | Value |

|---|---|

| Thermoplastic Prepreg Market Estimated Value in (2025 E) | USD 415.5 million |

| Thermoplastic Prepreg Market Forecast Value in (2035 F) | USD 1325.5 million |

| Forecast CAGR (2025 to 2035) | 12.3% |

The unique characteristics of thermoplastic prepregs, including excellent impact resistance, recyclability, short processing cycles, and superior chemical resistance, are positioning them as a preferred choice over traditional thermoset materials. Growing adoption in electric vehicles, advanced aircraft structures, and high-strength industrial components is further boosting market expansion.

Technological advancements in automated manufacturing processes, such as automated tape laying and automated fiber placement, are enhancing production efficiency and scalability. Stringent environmental regulations and the push for sustainable materials are also supporting the shift toward thermoplastic composites due to their reprocessability and reduced waste generation.

Additionally, the rising focus on reducing operational costs and improving fuel efficiency in transportation sectors is increasing the demand for lightweight structural solutions As industries continue to prioritize performance, durability, and environmental responsibility, the thermoplastic prepreg market is expected to maintain strong growth momentum over the coming years.

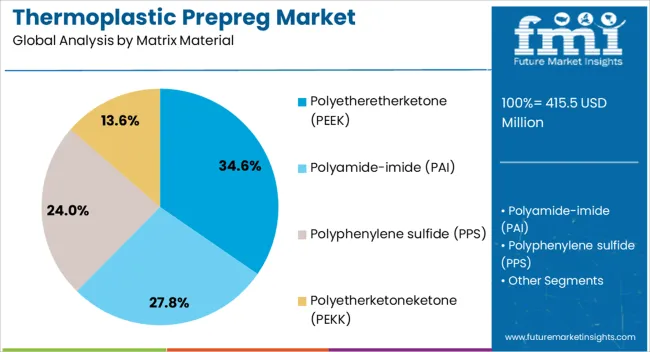

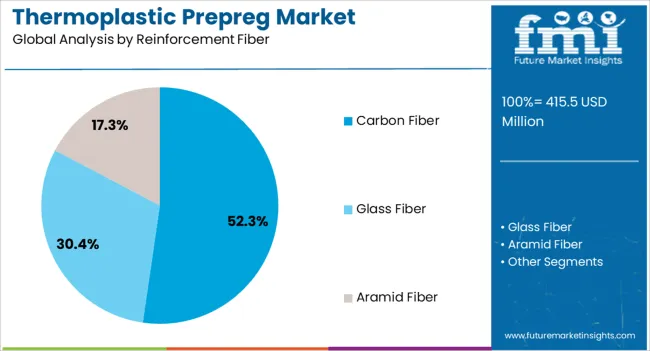

The thermoplastic prepreg market is segmented by matrix material, reinforcement fiber, form, application, end-use industry, and geographic regions. By matrix material, thermoplastic prepreg market is divided into Polyetheretherketone (PEEK), Polyamide-imide (PAI), Polyphenylene sulfide (PPS), and Polyetherketoneketone (PEKK). In terms of reinforcement fiber, thermoplastic prepreg market is classified into Carbon Fiber, Glass Fiber, and Aramid Fiber.

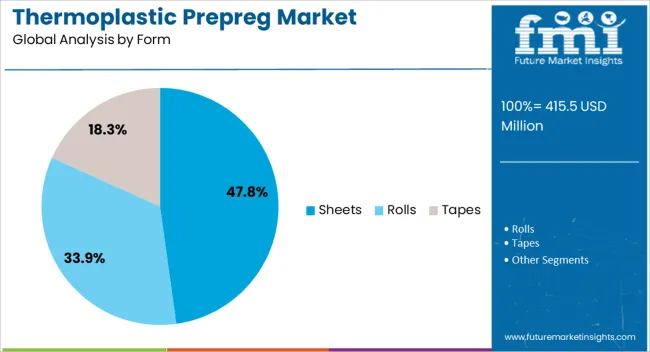

Based on form, thermoplastic prepreg market is segmented into Sheets, Rolls, and Tapes. By application, thermoplastic prepreg market is segmented into Aerospace, Automotive, Medical, Electronics, and Industrial Equipment. By end-use industry, thermoplastic prepreg market is segmented into Aircraft, Automotive Parts, Medical Devices, Electronics Devices, and Industrial Equipment Components. Regionally, the thermoplastic prepreg industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyetheretherketone matrix material segment is projected to hold 34.6% of the thermoplastic prepreg market revenue share in 2025, making it the leading matrix type. This dominance is supported by PEEK’s exceptional mechanical strength, high-temperature performance, and excellent chemical resistance, which make it suitable for critical applications in aerospace, medical, and oil and gas industries. Its ability to retain structural integrity under extreme operating conditions has established it as a preferred choice for high-stress components.

PEEK-based thermoplastic prepregs offer superior fatigue resistance and low moisture absorption, ensuring long-term reliability in harsh environments. The material’s compatibility with automated processing methods enables efficient production of complex parts, reducing manufacturing costs while maintaining precision.

Increasing demand for lightweight yet durable materials in high-performance industries is accelerating the adoption of PEEK in structural and semi-structural applications. As regulations and performance requirements become more stringent, PEEK’s balance of durability, processability, and high mechanical performance is expected to sustain its leadership position in the thermoplastic prepreg market.

The carbon fiber reinforcement fiber segment is expected to account for 52.3% of the thermoplastic prepreg market revenue share in 2025, making it the dominant reinforcement type. Its leadership is driven by exceptional strength-to-weight ratio, rigidity, and fatigue resistance, which are critical in industries that require high-performance composite structures. Carbon fiber thermoplastic prepregs deliver superior stiffness and impact resistance, enabling lightweight solutions without compromising structural integrity.

The segment benefits from increasing adoption in aerospace for primary and secondary structures, in automotive for body panels and crash structures, and in wind energy for high-performance turbine blades. The compatibility of carbon fiber with advanced thermoplastic resins enhances recyclability and allows for shorter manufacturing cycles, meeting both performance and sustainability targets.

Continuous advancements in fiber production technology are improving quality consistency and reducing costs, further encouraging widespread use With growing demand for lightweight, fuel-efficient, and environmentally friendly materials, carbon fiber reinforcement is expected to maintain its dominant market position.

The sheets form segment is anticipated to capture 47.8% of the thermoplastic prepreg market revenue share in 2025, establishing itself as the leading form category. This dominance is attributed to the segment’s versatility, ease of handling, and suitability for a wide range of manufacturing processes, including thermoforming, compression molding, and automated lamination. Sheets offer consistent thickness and fiber distribution, which ensures uniform mechanical properties and reliable performance across applications.

The ability to quickly form complex shapes while maintaining structural integrity makes them ideal for both high-volume and specialized production runs. Demand for sheet-form thermoplastic prepregs is particularly strong in automotive, aerospace, and consumer goods sectors, where production speed and dimensional stability are critical.

Their compatibility with automated manufacturing processes enhances productivity and reduces cycle times, contributing to cost efficiency As industries increasingly seek lightweight, high-performance materials with excellent durability and process flexibility, the sheets form segment is expected to retain its leadership position in the global thermoplastic prepreg market.

The thermoplastic prepreg market is experiencing strong growth driven by increased demand in aerospace, automotive, and consumer electronics sectors. While opportunities in emerging industries like sporting goods and consumer electronics are expanding, challenges related to raw material sourcing and costs persist. Technological advances in automated production are set to enhance manufacturing efficiencies, broadening the market’s application. The market outlook remains optimistic as industries continue to seek high-performance, lightweight solutions.

The thermoplastic prepreg market is gaining momentum due to the increasing adoption of lightweight and high-performance materials in aerospace and automotive industries. With global emphasis on reducing vehicle weight to enhance fuel efficiency and reduce carbon emissions, thermoplastic prepregs have become a preferred material for components like body panels and structural parts. The aerospace industry’s shift toward composites for aircraft production is also driving demand. As these industries continue to expand, the thermoplastic prepreg market is poised for steady growth, offering manufacturers an opportunity to cater to the rising demand for high-strength materials.

Consumer electronics and sporting goods sectors are presenting emerging opportunities for thermoplastic prepregs, particularly in products that require high strength-to-weight ratios, such as mobile phone casings and sports equipment. The ability of thermoplastic prepregs to deliver lightweight, durable, and cost-effective solutions is becoming increasingly valued. Additionally, advancements in automated manufacturing techniques are making it easier to incorporate these materials into mass production. This shift is expected to accelerate the market’s penetration across a variety of consumer-facing industries, adding to its overall appeal.

The market is seeing significant advancements in the automation of thermoplastic prepreg production. Automation is improving production speeds, reducing labor costs, and increasing product consistency, making prepregs more accessible and affordable for industries outside of high-end aerospace. This trend toward automated processes is lowering the barriers to entry for manufacturers and opening up new avenues for product development. With increased production capabilities, thermoplastic prepregs are likely to become more mainstream, enabling wider adoption in various manufacturing processes.

One of the primary challenges facing the thermoplastic prepreg market is the fluctuation in raw material prices. The sourcing of high-quality carbon fibers and thermoplastic resins remains critical to maintaining product performance. Price volatility, coupled with supply chain disruptions, is placing significant pressure on manufacturers. Additionally, while demand continues to rise, the ability to scale production in response to market needs can be hindered by limited availability of key materials. Addressing these challenges will require greater investment in research, sourcing diversification, and logistics improvements.

| Country | CAGR |

|---|---|

| China | 16.6% |

| India | 15.4% |

| Germany | 14.1% |

| France | 12.9% |

| U.K. | 11.7% |

| U.S. | 10.5% |

| Brazil | 9.2% |

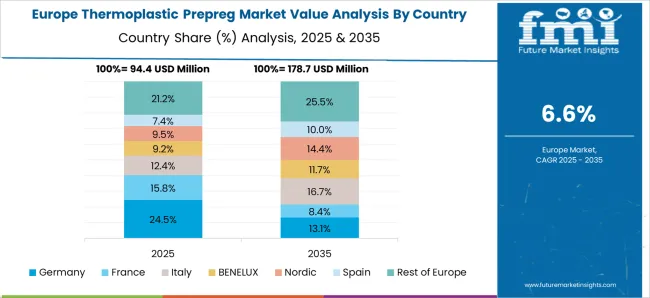

The global thermoplastic prepreg market is projected to grow at a 12.3% CAGR from 2025 to 2035. China leads with a growth rate of 16.6%, followed by India at 15.4%, and France at 12.9%. The United Kingdom records a growth rate of 11.7%, while the United States shows the slowest growth at 10.5%. These varying growth rates are driven by the increasing demand for thermoplastic prepregs in industries such as automotive, aerospace, and wind energy, where lightweight, durable materials are essential. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, increased manufacturing activities, and the rising need for advanced materials in transportation and renewable energy sectors. More mature markets like the U.S. and the U.K. see steady growth, fueled by strong demand in aerospace, automotive lightweighting, and growing investments in green energy technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The thermoplastic prepreg market in China is projected to grow at a robust CAGR of 16.6%. China’s rapid industrial growth, coupled with strong demand from aerospace, automotive, and wind energy sectors, is driving the market. The Chinese government’s support for advanced manufacturing technologies, combined with its booming automotive and aerospace industries, is accelerating the adoption of thermoplastic prepregs. With the country’s growing focus on sustainability and high-performance materials, China is expected to continue dominating the market.

The thermoplastic prepreg market in India is projected to grow at a CAGR of 15.4%. India’s automotive, aerospace, and wind energy sectors are seeing an increasing adoption of thermoplastic prepregs. The country’s growing focus on lightweight and high-performance materials is driving demand, particularly in the production of automotive parts and wind turbine components. With a rapidly expanding manufacturing base and a push for greener energy solutions, India is expected to continue experiencing significant growth in thermoplastic prepreg consumption.

The thermoplastic prepreg market in France is projected to grow at a CAGR of 12.9%. France is seeing significant demand from the aerospace, automotive, and renewable energy industries. The country's aerospace sector, in particular, is increasingly relying on thermoplastic prepregs for the production of lightweight, durable components. Additionally, France’s commitment to sustainability and energy efficiency is driving growth in the wind energy sector, where thermoplastic prepregs are gaining popularity for their performance characteristics.

The thermoplastic prepreg market in the United Kingdom is projected to grow at a CAGR of 11.7%. The U.K. is experiencing strong demand for thermoplastic prepregs in the aerospace, automotive, and renewable energy sectors. With an increasing focus on reducing emissions and improving energy efficiency, thermoplastic prepregs are being widely adopted in the production of lightweight and fuel-efficient components. The growing shift towards green energy, particularly in wind energy, is further contributing to the growth of thermoplastic prepregs in the country.

The thermoplastic prepreg market in the United States is projected to grow at a CAGR of 10.5%. The U.S. is seeing steady demand from aerospace, automotive, and wind energy industries, where thermoplastic prepregs are used for their high strength-to-weight ratio and ease of processing. With an increasing focus on lightweight and durable materials in transportation and renewable energy, thermoplastic prepregs are becoming a preferred choice. The growth in electric vehicle (EV) manufacturing, coupled with ongoing technological advancements in aerospace, is expected to further drive the market in the U.S.

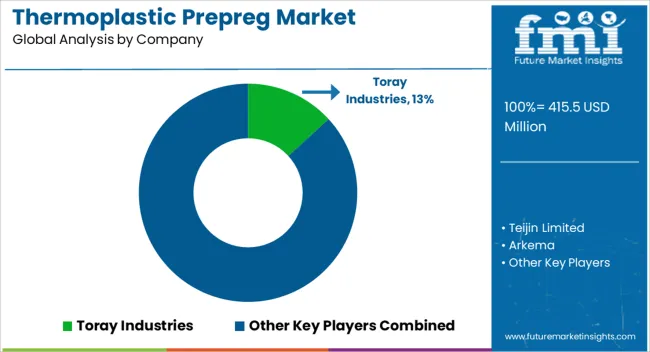

Leading players in the thermoplastic prepreg market, including Toray Industries, Teijin Limited, and Arkema, are capitalizing on their expertise in advanced material science to provide high-performance prepregs for industries such as aerospace, automotive, and electronics. These companies focus on producing lightweight, durable, and high-strength thermoplastic composites that cater to the growing demand for efficient and cost-effective manufacturing solutions. By leveraging their global manufacturing capabilities and R&D strengths, they are enhancing the structural integrity and overall performance of composite materials. In particular, Toray and Teijin have reinforced their positions in the market by investing in sustainable production processes and expanding their product portfolios, which are increasingly used for applications requiring superior heat resistance and impact performance. With their extensive distribution networks, these companies are well-placed to serve both established and emerging markets across the globe.

Companies like SGL Carbon, Evonik Industries, and Huntsman Advanced Materials are increasingly focusing on innovation in thermoplastic prepregs to meet the evolving needs of high-end manufacturing sectors. By offering products that are tailored for specialized applications in automotive, sports equipment, and industrial equipment, these suppliers are gaining traction in niche segments. Suppliers such as Hexcel, Mitsubishi Chemical, and Sumitomo Chemical have also secured a competitive advantage by enhancing the material properties of thermoplastic prepregs, including improving their recyclability and reducing the production cost per unit. Regional players like TPI Composites, Solvay, and Gurit are strengthening their foothold by focusing on advanced production techniques and offering solutions that cater to specific industry needs. Despite a growing number of entrants in the market, the key to long-term success lies in consistent product innovation, strong supply chain management, and the ability to deliver high-quality, tailored solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 415.5 Million |

| Matrix Material | Polyetheretherketone (PEEK), Polyamide-imide (PAI), Polyphenylene sulfide (PPS), and Polyetherketoneketone (PEKK) |

| Reinforcement Fiber | Carbon Fiber, Glass Fiber, and Aramid Fiber |

| Form | Sheets, Rolls, and Tapes |

| Application | Aerospace, Automotive, Medical, Electronics, and Industrial Equipment |

| End-Use Industry | Aircraft, Automotive Parts, Medical Devices, Electronics Devices, and Industrial Equipment Components |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toray Industries, Teijin Limited, Arkema, SGL Carbon, Evonik Industries, Ten Cate Advanced Composites, Huntsman Advanced Materials, Sumitomo Chemical, Mitsubishi Chemical, TPI Composites, Hexcel, AGC, Solvay, Cytec Industries, and Gurit |

| Additional Attributes | Dollar sales by resin type (epoxy, polyester, thermoplastic) and form (unidirectional, woven, hybrid) are key metrics. Trends include increasing demand in aerospace, automotive, and sporting goods applications, along with the growth of lightweight composites. Regional adoption patterns, advancements in curing technologies, and sustainability concerns are shaping market dynamics. |

The global thermoplastic prepreg market is estimated to be valued at USD 415.5 million in 2025.

The market size for the thermoplastic prepreg market is projected to reach USD 1,325.5 million by 2035.

The thermoplastic prepreg market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in thermoplastic prepreg market are polyetheretherketone (PEEK), polyamide-imide (PAI), polyphenylene sulfide (PPS) and polyetherketoneketone (PEKK).

In terms of reinforcement fiber, carbon fiber segment to command 52.3% share in the thermoplastic prepreg market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermoplastic Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Tape Market Growth - Size & Trends 2025 to 2035

Thermoplastic Ester Elastomer (TPEE) Market Growth - Trends & Forecast 2025 to 2035

Thermoplastic Pipe Market Growth – Trends & Forecast 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Olefinic Thermoplastic Elastomers Market

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Ultrasoft Thermoplastic Elastomer Market

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Prepreg Market Growth Analysis & Forecast by Fiber Type, Resin Type, Application and Region Through 2025 to 2035

Tow Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Glass Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fibre Prepreg Market

Non-Woven Glass Fiber Prepreg Market 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA