The thermoplastic pipe market consists of top quality polymer based high performance piping systems for very various industries such as oil & gas, water distribution, chemical processing, mining, and municipal applications.

In comparison to metallic pipes, thermoplastic pipes offer benefits including corrosion resistance, reduced weight, flexibility, and ease of installation. Demand is driven by growing demand for durable and cost-effective piping solutions, rising adoption in offshore and subsea operations, and increased utilization in wastewater treatment.

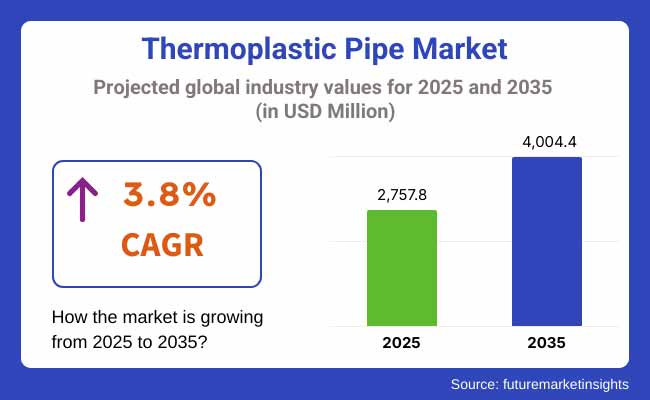

In 2025, the global thermoplastic pipe market is projected to reach approximately USD 2,757.8 million, with expectations to grow to around USD 4,004.4 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 3.8% during the forecast period.

The anticipated CAGR highlights the increasing trend towards polymeric infrastructure systems, nearly maturation of deepwater oil exploration investment, and higher adoption in industrial fluid and irrigation management stems. Moreover, the growth in the market will be impacted by the trends towards recyclable and eco-friendly thermoplastics.

The thermoplastic pipe market owing to high demand from the oil & gas industry, investment in water infrastructure, and usage of advanced thermoplastic composite pipes (TCP). Offshore pipelines uses, fracking operations, lightweight and corrosion resistant pipe replacements with cost also getting high consideration are significantly dominated by USA and Canada. Additionally, government initiatives toward the development of sustainable and efficient pipeline systems are contributing to the market growth.

Europe represents a substantial share of the market, with Germany, France, and the United Kingdom the major markets in chemical processing, renewable energy use, and municipal water schemes. The need for recyclable and non-corrosive thermoplastic piping solutions is being driven by the stringent environmental policies of the European Union. Furthermore, expanding hydrogen pipeline networks and offshore wind energy projects are expected to drive demand for thermoplastic pipes.

The thermoplastic pipe market is expected to grow the most in the Asia-pacific region because of rapid industrialization, increasing urban infrastructure development and increasing water and wastewater treatment market in countries like China, India, Japan and Australia.

The growing oil & gas along with construction industries as well as irrigation networks in the region is propelling the demand for cost-effective and flexible thermoplastic pipes. Additionally, government programs for clean water delivery and smart city initiatives are expected to boost the market growth.

Challenges

High Initial Costs and Performance Limitations in Extreme Conditions

Thermoplastic pipe market is restrained by the capital expenditure requirements which are high compared to conventional metal pipes, limiting the volume of adoption from budget industries. Extreme temperatures, high-pressure and chemical exposure can limit the use of thermoplastic pipes in offshore oil & gas, mining, and industrial processing due to performance restrictions. The need for requisite polymer formulations for better durability, thermal resistance, and mechanical strength is spurring R&D activity but increasing costs.

Opportunities

Growth in Corrosion-Resistant and Lightweight Piping Solutions

The market is on the rise due to the growing demand for corrosion-resistant, flexible, and lightweight piping solutions in the oil and gas, water management, chemicals, and renewable energy industries. New applications are being driven by advances in reinforced thermoplastic composites, high-performance polymers (PE, PP, PVDF, PA, PEEK), and green thermoplastic materials.

Additionally, offshore exploration, hydrogen transportation infrastructure and deepwater pipe developments will continue to create demand for a better alternative to conventional steel pipelines which will ultimately boost the market with the growing scope of thermoplastic pipes.

During 2020 to 2024, there was increasing application of thermoplastic pipes in the oil & gas, municipal water, and industrial markets because these pipes have better corrosion resistance, light weight, and flexibility. Fluctuating raw material prices, limitations of high-temperature applications, and regulatory issues about plastic waste management, however, hindered the penetration of the market.

Tariff and trade implications are expected to remain at a high level, as the market transforms into premium thermoplastic composites, AI-based pipeline monitoring, and polymer-based piping solutions during 2025 to 2035. Remarks: The self-healing thermoplastic pipes, AI-enabled leak detection systems, and recyclable thermoplastic piping materials all ensure a better performance, efficiency, and sustainability for the environment. Expansion in offshore wind farms, hydrogen transport networks, and desalination facilities will create growth opportunities.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with API, ISO, and ASTM standards for thermoplastic pipelines |

| Technology Innovations | Growth in reinforced thermoplastic pipes (RTP), multilayer pipes, and polymer-lined steel pipes |

| Market Adoption | Demand for lightweight, corrosion-resistant piping in oil & gas, chemicals, and water treatment |

| Sustainability Trends | Shift toward non-corrosive, low-maintenance thermoplastic pipes |

| Market Competition | Dominated by industry leaders (TechnipFMC, Baker Hughes, NOV, Pipelife, Shawcor, Simona AG, Wienerberger, Georg Fischer) |

| Consumer Trends | Demand for cost-effective, flexible, and easy-to-install piping solutions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates on recyclable thermoplastic materials, low-emission production, and circular economy initiatives |

| Technology Innovations | Advancements in self-healing thermoplastics, AI-driven pipeline monitoring, and ultra-high-performance polymer pipes |

| Market Adoption | Expansion into hydrogen transport pipelines, offshore wind infrastructure, and smart water management systems |

| Sustainability Trends | Large-scale adoption of biodegradable polymers, closed-loop plastic recycling, and carbon-neutral piping solutions |

| Market Competition | Rise of eco-conscious polymer startups, AI-driven pipeline maintenance firms, and advanced composite material manufacturers |

| Consumer Trends | Growth in smart pipeline solutions, predictive maintenance technologies, and eco-friendly thermoplastic innovations |

The United States thermoplastic pipe market Growth: Even though the Covid-19 outbreak affected almost every window of global economy, but in the long run it will surely contribute to the economic growth. Demand for selection of corrosion resistant as well as lightweight thermoplastic pipes in offshore as well as on-shore applications is fueling market growth.

Only prominent manufacturers are available in the market, and technology is also creating a wide variety of reinforced thermoplastic pipes (RTP) used for high-pressure purposes, which is fueling the market growth. Additionally, the need for government investments in water infrastructure and environmentally-friendly piping systems is creating demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

The United Kingdom thermoplastic pipe market is growing due to an increase in investments for renewable energy schemes and water treatment with advanced piping systems. Growing usage of thermoplastic pipes in geothermal energy, district heating, and for industrial applications has increased the demand.

Furthermore, the strict environmental regulations to utilize the corrosion resistant and energy conservation piping solutions are positively influencing the market trends. Market growth is also being driven by the utilization of recyclable and sustainable thermoplastic products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

The EU thermoplastic pipe market is moderately growing; several factors such as an increasing adoption of the function across the water distribution, construction, and energy sectors are driving the growth of the market. This is driving demand for green and sustainable thermoplastic piping for a low-carbon infrastructure in support of the EU's sustainability agenda.

These main markets are Germany, France, and Italy, with strong demand for industrial water use and municipal water management applications. Also, they have accelerated the market demand because of the development of polymer technology & reinforced composite thermoplastics.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.5% |

Japan thermoplastic pipe market is driven by various factors in the country including high focus on efficiency in industrial piping systems, water saving, and newer manufacturing processes. The increasing use of thermoplastic pipes in chemical processing, marine applications, and wastewater treatment is driving the market demand.

The market is also growing due to the country's higher emphasis on technology innovation and its engineering of high-grade materials. The efforts of Japan to bolster earthquake resistant buildings also drive demand for flexible and sturdy thermoplastic piping systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The South Korea thermoplastic pipe market: A variety of projects are being undertaken in South Korea, including public infrastructure, energy projects, industrial piping applications, etc., which are assisting to the gradual advancement of the South Korean thermoplastic pipe Market.

Market growth is driven by the increasing demand sustainable, lightweight, and high-strength thermoplastic pipes required for offshore oil & gas, desalination, and district heating. Government investment in smart city infrastructure and eco-friendly construction methods also support industry growth. In addition, South Korea's large polymer production and material technology has contributed to the advancement of thermoplastic piping technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

Reinforced thermoplastic pipes (RTP) are experiencing mass adoption in high-pressure and hostile environment applications, as they offer a strong yet flexible alternative to conventional steel and metal piping systems. Made from multiple layers of thermoplastic ingredients reinforced with high-strength aramid, polyester, or glass fiber materials, pipes exhibit extraordinary strength, chemical resistance, and durability.

RTP is having better corrosion resistance than that of traditional steel pipes so its longevity in oil & gas operations, water transportation, and industrial fluid handling is one of the key driving forces for RTP adoption. RTP is small, lightweight, easily installed and requires less maintenance, and therefore it is preferred by most of the energy and infrastructure businesses as compared to pipelines of metal.

In addition, RTP solutions are a high-pressure supporting: Hence, these find broad applicability in oil field flowlines, gas distribution systems, and offshore drilling. RTP is majorly used by oil & gas companies, heavily investing in them for pipeline repair and transportation efficiency improvements, which thus enhance safety and cost efficiency.

Although RTP offers advantages, it also has disadvantages, such as being less resistant to mechanical stress and heat; this has driven RTP manufacturers to develop next-generation RTP with improved reinforcement technologies for better impact resistance and longer thermal stability to optimize performance in harsh environments.

Thermoplastic composite pipes (TCP) are gaining significant traction in the energy, mining, and marine industries, offering lightweight, corrosion-resistant, and fatigue-resistant alternatives to rigid metal pipes. This means RTP is made with layered reinforcement, while TCP is manufactured as a single bonded composite system to provide additional sturdiness and equal pressure distribution.

TCP demand is primarily driven by its ability to withstand extreme operating conditions and is ideal for deep-water offshore applications, high-pressure oil field pipelines, and the transportation of chemically aggressive fluids. TCP is made part of most offshore drilling operations for risers, subsea flowlines, and flexible jumper connections for safer and more efficient offshore operation.

Moreover, TCP is widely used in hydrogen transport, carbon, and renewable power utilization, promoting infrastructure growth aligned to sustainability. In response, pipeline producers increasingly adopt hybrid composite designs and reinforced thermoplastic resins for better long-term performance with reduced environmental burden.

Though beneficial, TCP production is marked by expensive material prices and specialized manufacturing processes causing new businesses to seek layered composite solutions to reduce costs, AI-powered tubing pipeline monitoring systems as well as predictive maintenance systems will ensure longer-lasting implementations and greater industry-wide readjustment.

As organizations are moving from the conventional steel pipelines to RTP & TCP solutions for their cost-effective benefits with lesser installation period and resistance to extreme environmental conditions, the thermoplastic pipes are one among the largest consumers of oil & gas. Due to the low adhesion to thermoplastic pipes, they have higher chemical compatibility, which safeguards operators from transporting hydrocarbons, natural gas, and high-pressure liquids.

RTP and TCP adoption in oil & gas is mainly driven by the growing need for light-weight, flexible pipelines able to withstand corrosive environments, high temperatures and mechanical stresses. Thermoplastic pipes are integrated into the onshore and offshore pipeline infrastructure of several oil companies, as they contribute to increased operational efficiency and lower maintenance costs.

Additionally, thermoplastic pipes are further utilized in pipeline rehabilitation and leak prevention programs for better pipeline life and less environmental hazards. Oil -gas energy companies use and develop advanced polymer-based technology solutions for fracking flowlines, injection wells, gas gathering systems, aimed at ensuring safer and more efficient oil and gas field operations.

Despite the advantages offered by oil & gas thermoplastic pipes, there are limitations regarding their pressure containment capacity and heat resistance, resulting in manufacturers developing new thermally stable polymer composites, more high-pressure reinforced pipeline solutions, as well as AI-based pipeline integrity monitoring systems to increase pipeline reliability as well as lifespan.

Municipal water, private water companies and industrial water treatment facilities are some of the main application segments where thermoplastic pipes find most of their use as these pipe systems resist corrosion, are more durable, and can quickly be installed. RTP and TCP pipes in potable water distribution systems, sewage systems, and desalination facilities provide long-lasting performance for effective water management.

One of the most significant driving forces for the use of thermoplastic pipe in water infrastructure is resistance to biofouling, scaling, and chemical degradation for the clean transmission of water and less maintenance. Due to more significant infrastructure sustainability, the majority of the city's investments prove beneficial; therefore, most of the municipalities continue to invest in thermoplastic pipelines for urban water supply, stormwater drainage, and industrial effluent management, among other applications.

In addition, these thermoplastic pipes are widely utilized in advanced wastewater plants and seawater desalination projects to ensure both reliable fluid transportation and low incidence of pipe failure or contamination. Flexible thermoplastic pipelines reduce the time and cost of pipe laying, which is why most governments and private water utilities are investing in them.

Although water technology is highly beneficial to thermoplastic pipes, involving strict safety and material certification requirements, it lead to the development of NSF-certified drinking water pipes, antimicrobial thermoplastic coatings and leak-detection technologies, ensuring better quality of water and reliability of infrastructure.

The Market for thermoplastic pipes is planned or intended in oil & gas, water management, mining, chemical processing, and municipal infrastructure applications. Thermoplastic pipes are light weight, highly corrosion-resistant, flexible, and generally low-cost compared to metallic pipes. Growth in composite thermoplastics, improved offshore oil drilling, and increased investment in water and wastewater treatment facilities lead to an upturn in the market.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Baker Hughes Company (Flexible Pipe Systems) | 18-22% |

| TechnipFMC plc | 14-18% |

| Prysmian Group | 12-16% |

| Georg Fischer Piping Systems | 10-14% |

| Wienerberger AG | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Baker Hughes Company (Flexible Pipe Systems) | Specializes in reinforced thermoplastic pipes (RTPs) for offshore oil & gas and high-pressure applications. |

| TechnipFMC plc | Develops flexible thermoplastic composite pipes (TCPs) for deepwater and subsea infrastructure. |

| Prysmian Group | Manufactures high-performance thermoplastic piping solutions for industrial and energy applications. |

| Georg Fischer Piping Systems | Provides corrosion-resistant thermoplastic pipes for chemical, water treatment, and industrial sectors. |

| Wienerberger AG | Produces thermoplastic-based pipes for municipal water distribution and drainage systems. |

Key Market Insights

Baker Hughes Company (18-22%)

Baker Hughes leads the thermoplastic pipe market with its flexible pipe systems, designed for oil & gas exploration, subsea applications, and high-pressure environments.

TechnipFMC plc (14-18%)

TechnipFMC focuses on thermoplastic composite pipes (TCPs), which offer enhanced durability and lightweight benefits for offshore energy projects.

Prysmian Group (12-16%)

Prysmian develops reinforced and non-reinforced thermoplastic piping solutions, catering to industrial fluid transport and power applications.

Georg Fischer Piping Systems (10-14%)

Georg Fischer provides high-performance thermoplastic pipes, ensuring chemical resistance and long service life in water and wastewater management.

Wienerberger AG (8-12%)

Wienerberger specializes in plastic pipe systems for municipal infrastructure, including sewage, stormwater, and potable water applications.

Other Key Players (26-32% Combined)

Several emerging and regional players are expanding the thermoplastic pipe market with customized and application-specific solutions, including:

The overall market size for thermoplastic pipe market was USD 2,757.8 million in 2025.

The thermoplastic pipe market is expected to reach USD 4,004.4 million in 2035.

Increasing demand for corrosion-resistant piping solutions, rising adoption in oil & gas and water management industries, and growing preference for lightweight and durable materials will drive market growth.

The top 5 countries which drives the development of thermoplastic pipe market are USA, European Union, Japan, South Korea and UK.

Thermoplastic composite pipes (TCP) expected to grow to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Meters) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 6: Global Market Volume (Meters) Forecast by End-use Industry, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 14: North America Market Volume (Meters) Forecast by End-use Industry, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 22: Latin America Market Volume (Meters) Forecast by End-use Industry, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 30: Europe Market Volume (Meters) Forecast by End-use Industry, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 38: Asia Pacific Market Volume (Meters) Forecast by End-use Industry, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 46: MEA Market Volume (Meters) Forecast by End-use Industry, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Meters) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Meters) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 14: Global Market Volume (Meters) Analysis by End-use Industry, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 38: North America Market Volume (Meters) Analysis by End-use Industry, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 62: Latin America Market Volume (Meters) Analysis by End-use Industry, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 86: Europe Market Volume (Meters) Analysis by End-use Industry, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Meters) Analysis by End-use Industry, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End-use Industry, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 134: MEA Market Volume (Meters) Analysis by End-use Industry, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by End-use Industry, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipette Tips Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pipette Controller Market – Trends & Forecast 2025 to 2035

Thermoplastic Tape Market Growth - Size & Trends 2025 to 2035

Thermoplastic Ester Elastomer (TPEE) Market Growth - Trends & Forecast 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Pipe Flange Market Analysis by Material Type, Facing, End-Use Industry, and Region through 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA