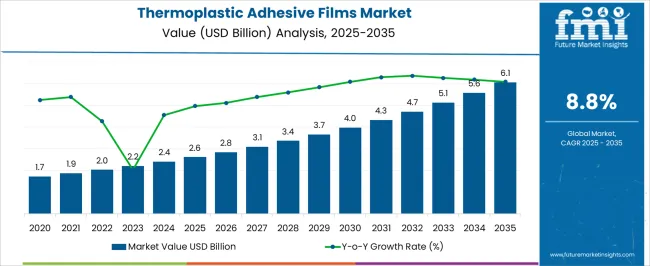

The thermoplastic adhesive films market is set to experience substantial growth, with the market size expected to increase from USD 2.6 billion in 2025 to USD 6.1 billion by 2035, representing a compound annual growth rate (CAGR) of 8.8%. Over the next five years, the market will see steady growth, with the value rising from USD 2.6 billion in 2025 to USD 4.0 billion by 2030. This growth is driven by the expanding demand for high-performance bonding solutions across industries such as automotive, electronics, and packaging.

Thermoplastic adhesive films offer strong adhesion, excellent durability, and are increasingly used in lightweight and energy-efficient applications, which are becoming a priority for manufacturers seeking cost-effective and reliable solutions. The demand for thermoplastic adhesive films is expected to rise due to their versatility and efficiency in various applications, such as electronic device assembly, automotive component bonding, and packaging for sensitive products.

These films provide significant benefits, such as ease of processing, quick bonding times, and the ability to be reused in recycling processes, which are making them an attractive option across numerous sectors. As industries continue to prioritize efficiency and performance, the market for thermoplastic adhesive films is positioned for continued expansion. The growth in demand for lightweight materials, especially in the automotive and electronics sectors, is expected to drive significant opportunities for market players over the next decade.

| Metric | Value |

|---|---|

| Thermoplastic Adhesive Films Market Estimated Value in (2025 E) | USD 2.6 billion |

| Thermoplastic Adhesive Films Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The thermoplastic adhesive films market holds a specialized position within its parent markets. Within the broader Adhesive Films Market, it accounts for approximately 10% of the total market share, reflecting its niche application in various industries. In the Hot Melt Adhesives Market, which encompasses a wide range of adhesive products, the thermoplastic adhesive films segment comprises about 5% of the market, indicating its specific use cases in bonding applications.

Within the Pressure Sensitive Adhesives Market, thermoplastic adhesive films represent around 2% of the market share, as this segment primarily focuses on adhesives that bond without the need for heat or solvents. In the Adhesive Tapes Market, thermoplastic adhesive films hold a share of approximately 3%, highlighting their role in specialized tape applications that require heat-activated bonding.

In the market, which encompasses various types of plastic films, the thermoplastic adhesive films segment accounts for approximately 1% of the market, highlighting their specific application in bonding films for packaging and other uses. These figures illustrate the Thermoplastic Adhesive Films Market's position as a specialized segment within the broader adhesive and film industries, driven by its unique properties and applications across various sectors.

The thermoplastic adhesive films market is experiencing steady expansion, supported by rising demand across automotive, electronics, and packaging industries. The market is being shaped by the shift towards lightweight materials, improved bonding performance, and sustainable manufacturing practices. These films offer consistent adhesive quality, reduced processing time, and compatibility with diverse substrates, making them increasingly valuable in high-performance applications.

Advancements in processing technologies and material engineering have enabled manufacturers to create films with enhanced thermal stability, moisture resistance, and mechanical strength. Additionally, regulatory encouragement for solvent-free adhesive solutions is supporting adoption, particularly in industries aiming to lower environmental impact.

With the ongoing electrification of vehicles, rapid development in consumer electronics, and the need for high-speed production lines, thermoplastic adhesive films are expected to gain further market share Continuous innovations in material formulations and processing methods are anticipated to drive efficiency, expand design possibilities, and ensure long-term growth opportunities across global markets.

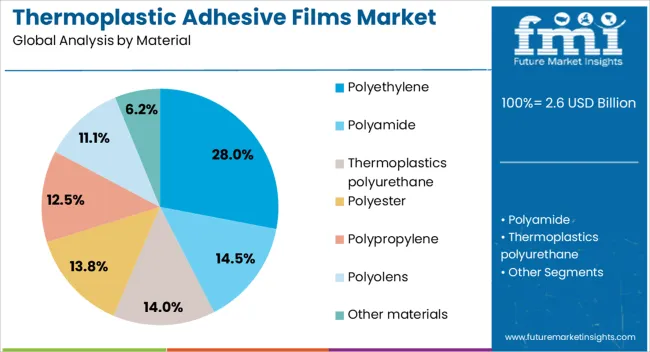

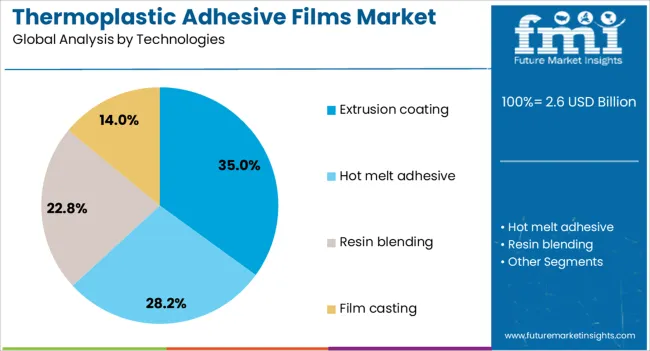

The thermoplastic adhesive films market is segmented by material, technologies, end use, and geographic regions. By material, thermoplastic adhesive films market is divided into Polyethylene, Polyamide, Thermoplastics polyurethane, Polyester, Polypropylene, Polyolens, and Other materials. In terms of technologies, thermoplastic adhesive films market is classified into Extrusion coating, Hot melt adhesive, Resin blending, and Film casting.

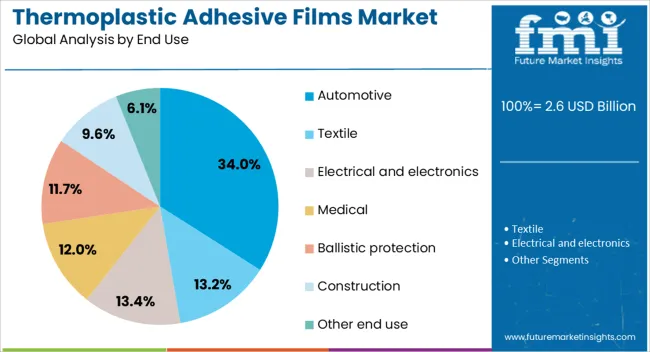

Based on end use, thermoplastic adhesive films market is segmented into Automotive, Textile, Electrical and electronics, Medical, Ballistic protection, Construction, and Other end use. Regionally, the thermoplastic adhesive films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene material segment is projected to hold 28% of the thermoplastic adhesive films market revenue share in 2025, positioning it as the leading material type. Its dominance has been supported by its exceptional flexibility, durability, and cost-effectiveness in adhesive film applications.

Polyethylene’s compatibility with a variety of substrates and its ability to maintain adhesive properties under varying environmental conditions have made it highly suitable for industrial use. The segment has further benefited from advancements in polymer processing that enhance bond strength and reduce film thickness while maintaining performance.

Its recyclability and compliance with evolving sustainability standards have also encouraged broader adoption, particularly in markets with stringent environmental regulations As industries such as packaging, automotive, and electronics continue to prioritize lightweight and high-performance bonding solutions, polyethylene-based adhesive films are expected to maintain strong demand, ensuring their continued leadership in the market.

The extrusion coating technologies segment is anticipated to account for 35% of the thermoplastic adhesive films market revenue share in 2025, making it the dominant technology. Growth in this segment has been driven by its ability to produce uniform coatings with excellent adhesion properties while enabling high-speed manufacturing.

Extrusion coating allows for precise control over film thickness and surface properties, ensuring consistent performance across applications. Its capability to integrate functional layers, such as barrier or heat-seal properties, during production has made it a preferred choice in sectors requiring multifunctional films.

This technology’s scalability and compatibility with various thermoplastic materials, including polyethylene and polypropylene, have further reinforced its market position As manufacturers increasingly adopt automation and high-efficiency production lines, extrusion coating technologies are expected to remain central to meeting demand for high-quality adhesive films, supporting both productivity and product innovation.

The automotive end use segment is estimated to hold 34% of the thermoplastic adhesive films market revenue share in 2025, establishing it as the leading end-use sector. Its leadership has been underpinned by the growing need for lightweight bonding solutions that enhance vehicle performance and fuel efficiency. Thermoplastic adhesive films have been adopted extensively in interior trims, headliners, and composite assemblies due to their ability to deliver strong adhesion without adding significant weight.

The compatibility of these films with automated manufacturing processes has improved production efficiency in the automotive sector. Additionally, the shift toward electric vehicles has driven demand for materials that support thermal management and vibration damping, areas where adhesive films excel.

Compliance with stringent safety and environmental regulations has further encouraged adoption, as these films are solvent-free and recyclable With continued advancements in automotive design and manufacturing, the role of thermoplastic adhesive films in delivering high-performance bonding solutions is expected to strengthen further.

The thermoplastic adhesive films market is poised for growth, driven by increasing demand for efficient bonding solutions in automotive, electronics, and packaging industries. Opportunities in these sectors, particularly in the demand for lightweight and durable products, offer significant market potential. However, challenges related to raw material costs and competition from alternative bonding technologies must be addressed. As industries continue to seek efficient, cost-effective, and high-performance solutions, thermoplastic adhesive films are set to play a crucial role in product assembly and manufacturing.

The thermoplastic adhesive films market is experiencing a surge in demand due to the need for high-performance bonding solutions in various industries. These adhesive films are widely used in automotive, electronics, and packaging applications for their ability to bond materials without the need for curing or solvents. The demand is further driven by their versatility and ease of use, making them a preferred choice in the production of lightweight, durable, and high-quality products. As industries look for cost-effective and efficient bonding methods, thermoplastic adhesive films are increasingly being adopted.

Significant growth opportunities exist for thermoplastic adhesive films in the automotive and electronics sectors. In the automotive industry, the demand for lightweight components and improved fuel efficiency has led to an increased reliance on these adhesives for bonding interior and exterior parts. Similarly, the electronics sector is utilizing thermoplastic adhesive films for components such as displays and batteries. The trend toward miniaturization and the demand for more efficient assembly processes present substantial opportunities for market growth in these high-demand sectors.

A key trend in the thermoplastic adhesive films market is the shift toward more eco-friendly materials. Manufacturers are developing adhesive films with reduced environmental impact, which align with industry regulations and consumer expectations. The growing need for faster production times and cost-effective manufacturing is also driving the adoption of these adhesives. As industries demand high-quality, reliable products with quick assembly capabilities, the preference for thermoplastic adhesive films continues to rise, fueling the market’s expansion across various verticals.

The thermoplastic adhesive films market faces challenges related to the high cost of raw materials and the complexity of manufacturing processes. The price of thermoplastic polymers, crucial in producing these adhesive films, can be volatile, affecting overall production costs. Moreover, competition from alternative bonding technologies, such as pressure-sensitive adhesives and liquid adhesives, poses a threat to market growth. Overcoming these challenges while maintaining cost-effectiveness and product performance will be key to the future success of thermoplastic adhesive films.

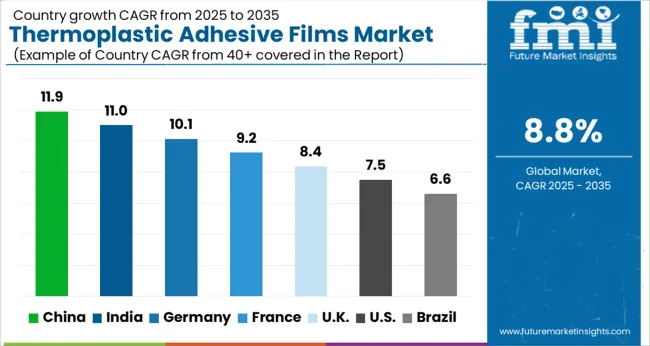

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

The global thermoplastic adhesive films market is projected to grow at a CAGR of 8.8% from 2025 to 2035. China leads with a growth rate of 11.9%, followed by India at 11.0%, and Germany at 10.1%. The United Kingdom records a growth rate of 8.4%, while the United States shows the slowest growth at 7.5%. The demand for thermoplastic adhesive films is driven by the growing need for lightweight, durable, and efficient bonding solutions in industries such as automotive, electronics, and packaging. China and India are seeing higher growth due to industrialization and expanding manufacturing sectors, while mature markets like the USA and the UK focus on advanced product applications and sustainability. This report includes insights on 40+ countries; the top markets are shown here for reference.

The thermoplastic adhesive films market in China is projected to grow at a CAGR of 11.9%. China’s rapid industrialization, strong manufacturing base, and demand for advanced bonding solutions across automotive, electronics, and packaging industries are key drivers of this growth. The country's expanding automotive sector and growing interest in lightweight materials continue to fuel the demand for thermoplastic adhesive films. Additionally, China’s focus on sustainable manufacturing and the adoption of eco-friendly adhesives are contributing to the market's expansion.

The thermoplastic adhesive films market in India is expected to grow at a CAGR of 11.0%. The market is being driven by India’s burgeoning automotive, packaging, and electronics industries, where lightweight and efficient bonding solutions are in high demand. Government initiatives to promote the use of advanced materials in manufacturing and growing awareness of sustainability are also contributing factors. As India continues to focus on industrial modernization, thermoplastic adhesive films are gaining traction for their versatility and efficiency across various applications.

The thermoplastic adhesive films market in Germany is projected to grow at a CAGR of 10.1%. Germany’s well-established automotive, electronics, and packaging sectors continue to demand high-performance bonding solutions. The country’s emphasis on sustainable manufacturing practices and its commitment to reducing carbon footprints further supports the adoption of thermoplastic adhesive films. As industries look for lightweight and durable alternatives to traditional bonding methods, Germany remains a key market for advanced adhesive technologies.

The thermoplastic adhesive films market in the UK is projected to grow at a CAGR of 8.4%. The market is driven by the rising demand for high-performance materials in the automotive, electronics, and packaging industries. The UK government’s regulatory framework, promoting sustainability and eco-friendly materials, is also accelerating the use of thermoplastic adhesive films. As the country increasingly focuses on reducing emissions and adopting green technologies, thermoplastic adhesive films are being seen as a key solution for lightweight, durable, and energy-efficient manufacturing.

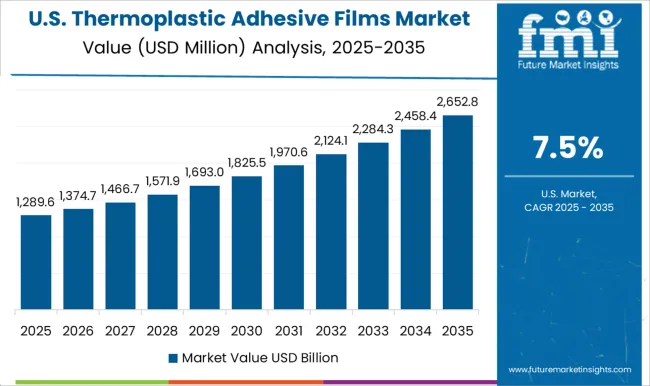

The thermoplastic adhesive films market in the USA is projected to grow at a CAGR of 7.5%. Despite slower growth compared to emerging markets, the USA continues to see strong demand from key sectors such as automotive, packaging, and electronics. The focus on advanced manufacturing technologies and sustainable practices is supporting the adoption of thermoplastic adhesive films in these industries. The USA government’s continued emphasis on innovation, alongside the growing trend of eco-friendly materials, will ensure steady growth in the thermoplastic adhesive films market.

The thermoplastic adhesive films market is led by prominent players such as Henkel, H.B. Fuller, and 3M, who have integrated advanced technologies to develop high-performance adhesive solutions for a variety of industries, including automotive, electronics, and packaging. Henkel, a global leader in adhesives, focuses on providing innovative thermoplastic adhesive films that offer superior bonding strength and versatility across multiple substrates. H.B. Fuller and 3M follow closely with their cutting-edge products, catering to the growing demand for sustainable and efficient adhesive solutions. H.B. Fuller has been focusing on creating thermoplastic adhesive films that can withstand extreme temperatures, while 3M’s product innovations are primarily geared toward improving product safety, functionality, and processing efficiency, making them highly competitive in the market. Bostik (Arkema), Sika, Dow, and Avery Dennison further contribute to the expansion of the thermoplastic adhesive films market with their unique approaches. Bostik, with its advanced film technologies, is known for its high-performance bonding solutions in both automotive and electronics sectors. Sika’s growth in thermoplastic adhesives is backed by its expertise in the construction and automotive industries, where it is recognized for delivering long-lasting and durable bonds. Dow, through its adhesives and polymers business, continues to introduce novel thermoplastic adhesive film solutions designed for high-demand applications, while Avery Dennison focuses on providing custom adhesive products that meet specific end-user needs, particularly in packaging and labeling industries. These market leaders continually push the boundaries of innovation to strengthen their positions, responding to the increasing demand for highly efficient and durable thermoplastic adhesive films.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Material | Polyethylene, Polyamide, Thermoplastics polyurethane, Polyester, Polypropylene, Polyolens, and Other materials |

| Technologies | Extrusion coating, Hot melt adhesive, Resin blending, and Film casting |

| End Use | Automotive, Textile, Electrical and electronics, Medical, Ballistic protection, Construction, and Other end use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Henkel, H.B. Fuller, 3M, Bostik (Arkema), Sika, Dow (Adhesives/Polymers business), Avery Dennison, and Other regional / specialty players |

| Additional Attributes | Dollar sales by product type (single-sided, double-sided), Dollar sales by application (automotive, electronics, packaging, construction), Trends in adhesive bonding strength and temperature resistance, Adoption in eco-friendly and recyclable adhesive solutions, Growth in demand for high-performance bonding in lightweight materials, Regional patterns of thermoplastic adhesive film usage across industries. |

The global thermoplastic adhesive films market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the thermoplastic adhesive films market is projected to reach USD 6.1 billion by 2035.

The thermoplastic adhesive films market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in thermoplastic adhesive films market are polyethylene, polyamide, thermoplastics polyurethane, polyester, polypropylene, polyolens and other materials.

In terms of technologies, extrusion coating segment to command 35.0% share in the thermoplastic adhesive films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermoplastic Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Tape Market Growth - Size & Trends 2025 to 2035

Thermoplastic Ester Elastomer (TPEE) Market Growth - Trends & Forecast 2025 to 2035

Thermoplastic Pipe Market Growth – Trends & Forecast 2025 to 2035

C9 Thermoplastic Resin Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Olefinic Thermoplastic Elastomers Market

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Ultrasoft Thermoplastic Elastomer Market

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Adhesive Tester Market Size and Share Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Modifier Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adhesive Transfer Tape Market Growth, Trends, Forecast 2025 to 2035

Assessing Adhesive Transfer Tape Market Share & Industry Insights

Adhesive for Resilient Floor Market Growth – Trends & Forecast 2024-2034

Adhesive Bubble Wrap Market

Adhesive Removers Market

Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA