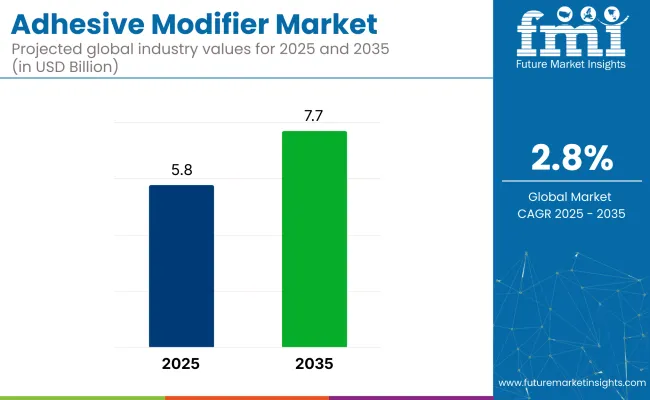

The adhesive modifier market is anticipated to grow from USD 5.82 billion in 2025 to USD 7.7 billion by 2035, reflecting a CAGR of 2.8% throughout the forecast period.

Steady demand is expected from the packaging, construction, and automotive sectors, where adhesives require improved flexibility, durability, and temperature resistance. Asia Pacific continues to dominate production and consumption, while Europe and North America focus more on performance-enhancing and application-specific formulations.

As of 2025, the adhesive modifier market represents a small but strategically important segment across its broader parent markets. Within the global adhesives and sealants market, it holds an estimated 4-6%, as modifiers are essential for adjusting viscosity, adhesion strength, and curing behavior. In the specialty chemicals market, its share is approximately 1-2%, given its role as a performance-enhancing additive.

Within the polymer additives market, adhesive modifiers contribute around 3-4%, as they improve compatibility and bonding characteristics in various polymer systems. In the construction chemicals market, the share stands at 2-3%, driven by demand for enhanced bonding in flooring, tiling, and insulation applications. In the automotive materials market, it accounts for about 1-2%, supporting adhesive systems used in lightweight vehicle assemblies.

Industry players are increasingly investing in bio-based and specialty modifiers aimed at meeting stringent VOC regulations while maintaining performance integrity. The market is also witnessing a gradual shift toward reactive modifiers that form chemical bonds with substrates, enhancing long-term adhesion. With end-user industries requiring adhesives that perform across a broader range of materials and environments, adhesive modifiers are positioned as essential enablers of innovation and structural reliability.

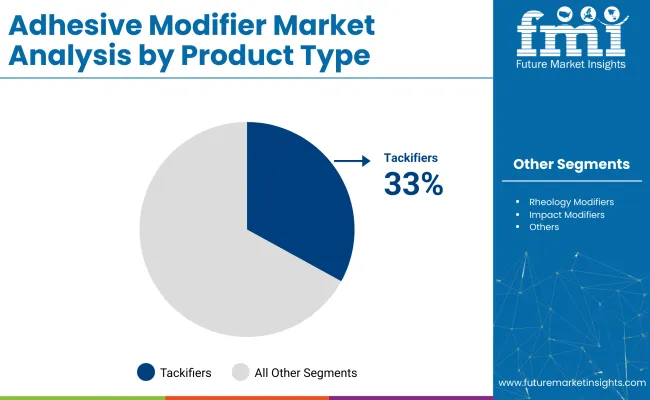

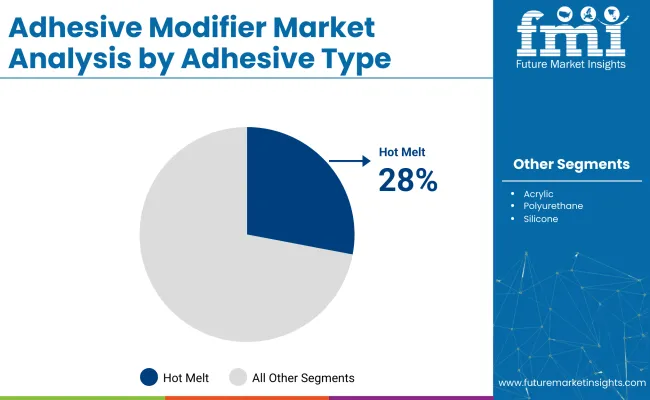

Tackifiers are projected to lead the product type segment with a 33% market share by 2025, while hot melt adhesives are expected to dominate the vehicle type segment with a 28% share. Growing demand across packaging, automotive, and electronics applications is driving increased adoption of high-performance adhesive modifiers.

Tackifiers are projected to dominate the product type segment, capturing 33% of the global market share by 2025. Used extensively to enhance the stickiness and performance of adhesives, tackifiers have been widely adopted in pressure-sensitive applications.

Hot melt adhesives are expected to lead the vehicle type segment, securing a 28% market share by 2025. These adhesives have been widely favored for their quick-setting properties and low volatile organic compound emissions.

The market is expanding due to rising demand for stronger, more flexible, and application-specific adhesives across industries such as automotive, construction, packaging, and electronics.

High Demand for Structural Strength and Industrial Durability

Adhesive modifiers are widely used to improve the mechanical performance of adhesives in structural and load-bearing applications. These include automotive assembly, electronics encapsulation, and aerospace components where adhesives must resist stress, vibration, and temperature changes. Modified adhesives offer better peel strength, shear resistance, and long-term reliability in industrial environments.

Expanding Use in Flexible Packaging, Labels, and Consumer Goods

In packaging and labeling, modifiers are used to improve tack, flexibility, and moisture resistance in adhesives applied to films, foils, and coated papers. Pressure-sensitive adhesives and hot melt systems are enhanced with modifiers to maintain performance under changing temperatures and handling conditions. These additives are also critical for adhesives used in hygiene products and food-safe packaging.

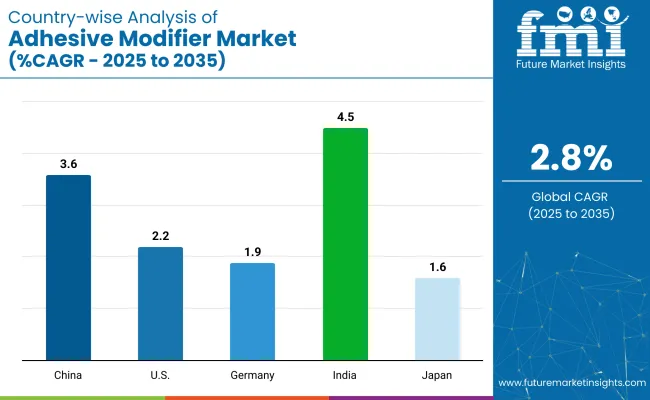

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.5% |

| China | 3.6% |

| United States | 2.2% |

| Germany | 1.9% |

| Japan | 1.6% |

The global market is expected to witness gradual expansion through 2035, as industries prioritize enhanced adhesion, durability, and thermal stability across multiple substrates. Adhesive modifiers are increasingly used to improve bonding strength in automotive, packaging, electronics, and construction sectors.

Among the top countries, India leads with a CAGR of 4.5%, followed by China at 3.6%, reflecting demand from local manufacturing expansion. The United States (2.2%) shows consistent growth tied to high-performance composites, while Germany (1.9%) and Japan (1.6%) reflect stable demand in specialty applications.

BRICS countries such as China and India are driving volume growth through diversified manufacturing and infrastructure expansion. OECD members like the USA, Germany, and Japan are focused on high-specification, niche-formulated adhesive systems for advanced materials.

The report features analysis from over 40 countries. The five profiled below are noted for their industrial relevance and growth momentum.

The adhesive modifier market in India is expected to grow at a CAGR of 4.5%, supported by the expansion of the automotive, electronics, and flexible packaging sectors. As a BRICS and Emerging Market economy, India is seeing increased adoption of modifiers in pressure-sensitive adhesives, hot melts, and laminating adhesives for fast-moving consumer goods.

Local demand is also rising for water-based and heat-resistant systems in automotive trim and EV battery insulation. Domestic manufacturers are investing in specialty resin modification to improve bond strength across diverse substrates.

Demand for adhesive modifier in China is forecast to grow at a CAGR of 3.6%, backed by strong demand from the electronics, solar panel, and general industrial sectors. As a BRICS and Global Manufacturing Hub, China is incorporating modifiers to enhance tack, cohesion, and temperature resistance in structural and sealant adhesives.

Domestic formulators are also focusing on eco-friendly systems for consumer electronics, where precision and long-term adhesion are critical. Growth is particularly strong in coastal provinces where electronics and PV module production is concentrated.

The adhesive modifier market in the United States is expected to grow at a CAGR of 2.2%, with demand primarily driven by aerospace, defense, and high-performance automotive applications. As an OECD and Agri-food Tech Pioneer, the USA places emphasis on modifiers that support extreme temperature ranges, chemical resistance, and compatibility with lightweight composite materials.

Research institutions and private labs are developing next-generation modifiers for structural bonding and thermal cycling environments. Regulatory focus on VOC emissions is also encouraging a shift toward reactive and waterborne adhesive systems.

Demand for adhesive modifier in Germany is projected to grow at a CAGR of 1.9%, reflecting demand from medical device adhesives, electronics packaging, and structural bonding in industrial machinery. As part of the EU27, OECD, and Sustainability-Focused Nations, Germany prioritizes bio-based and recyclable formulations, especially in construction and automotive interior adhesives.

Chemical manufacturers are integrating renewable feedstocks into polyolefin and acrylic modifiers, supporting EU Green Deal compliance. Precision formulation and performance stability remain central to commercial adoption.

Sales of adhesive modifier in Japan is forecast to grow at a CAGR of 1.6%, reflecting stable demand in microelectronics, optical bonding, and specialized coatings. As an OECD economy with high industrial precision, Japan places strong emphasis on clean-room grade adhesive formulations and ultra-low outgassing properties.

Modifier use is concentrated in niche applications such as camera modules, wearable sensors, and semiconductor packaging. Japanese firms are also integrating modifiers in high-reliability bonding agents for 5G base stations and consumer electronics.

The industry is moderately consolidated, with key players such as Dow Chemical Company, Wacker Chemie AG, and Arkema leading the competitive landscape through broad portfolios and strong R&D capabilities. Dow Chemical Company offers innovative polymer-based modifiers that enhance adhesion performance across packaging, construction, and automotive sectors.

Wacker Chemie AG specializes in silicone-based additives that improve elasticity and durability in adhesives. Arkema provides reactive and non-reactive modifiers designed to optimize tack, peel strength, and processing stability in industrial and consumer adhesives.

Companies like Eastman Chemical Company and Kraton Corporation focus on specialty resins and elastomers to meet evolving application-specific demands. Evonik Industries and Ashland Global Holdings deliver high-performance additives that support sustainable and low-VOC adhesive formulations.

Recent Adhesive Modifier Market News

In 2025, USA-China trade tensions intensified with new tariffs of 10 to 20% on industrial adhesive imports to the USA, and China’s retaliatory 34% tariff on USA adhesive products beginning mid-April. This escalation has disrupted raw material flows and pressed formulators to explore domestic and alternative sourcing strategies

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.82 billion |

| Projected Market Size (2035) | USD 7.7 billion |

| CAGR (2025 to 2035) | 2.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Adhesive Types Analyzed (Segment 1) | Epoxy Adhesives, Acrylic Adhesives, Polyurethane Adhesives, Hot Melt Adhesives, Silicone Adhesives, Pressure Sensitive Adhesives |

| Product Types Analyzed (Segment 2) | Rheology Modifiers, Impact Modifiers, Tackifiers, Plasticizers, Other Additives |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Dow Chemical Company, Wacker Chemie AG, Arkema, Eastman Chemical Company, Struktol, Kurarity, Sika, Evonik Industries AG, Ashland Global Holdings Inc., Kraton Corporation |

| Additional Attributes | Dollar sales by adhesive and modifier type, rising focus on performance-enhancing additives, steady demand in construction and packaging, and growing use in flexible bonding applications. |

The market is segmented by adhesive type into epoxy adhesives, acrylic adhesives, polyurethane adhesives, hot melt adhesives, silicone adhesives, and pressure sensitive adhesives.

Based on product type, the market includes rheology modifiers, impact modifiers, tackifiers, plasticizers, and other additive categories.

Regionally, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market size is projected to be USD 5.82 billion in 2025.

The global market is projected to reach USD 7.7 billion by 2035.

The market is expected to grow at a CAGR of 2.8% during the forecast period.

Tackifiers are the leading product type, accounting for 33% of the market share in 2025.

India is forecast to grow at the highest CAGR of 4.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Tester Market Size and Share Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Transfer Tape Market Growth, Trends, Forecast 2025 to 2035

Assessing Adhesive Transfer Tape Market Share & Industry Insights

Market Share Breakdown of Adhesive films market Industry

Adhesive for Resilient Floor Market Growth – Trends & Forecast 2024-2034

Adhesive Bubble Wrap Market

Adhesive Removers Market

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Non-Adhesive Tags Market Growth - Demand & Forecast 2025 to 2035

Gut Modifiers Market

Tile Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Dual-Cure Luting Cement Market Size and Share Forecast Outlook 2025 to 2035

Self-adhesive Tear Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Labels Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA