Rising incidence of autoimmune and hematological disorders is accelerating the adoption of therapeutic apheresis procedures. Increased awareness among healthcare providers and advancements in apheresis technology are fueling global demand. In 2024, Fresenius Medical Care and Terumo BCT introduced next-gen apheresis platforms, enhancing efficiency and patient comfort.

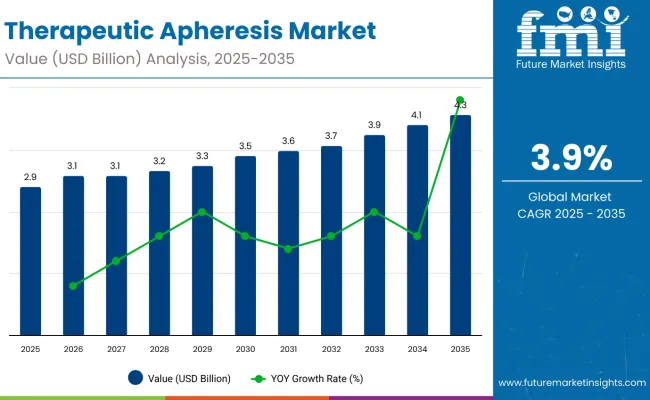

The market stood at USD 2.8 billion in 2024 and will surpass USD 2.92 billion in 2025, progressing to USD 4.28 billion by 2035.

| Attributes | Key Insights |

|---|---|

| Industry Size (2025E) | USD 2.92 billion |

| Industry Value (2035F) | USD 4.28 billion |

| CAGR (2025 to 2035) | 3.9% |

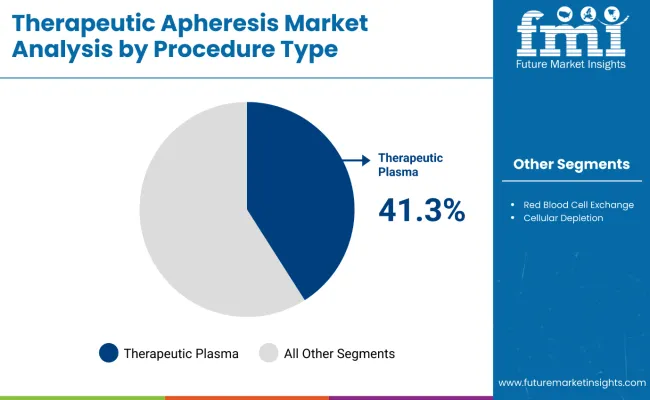

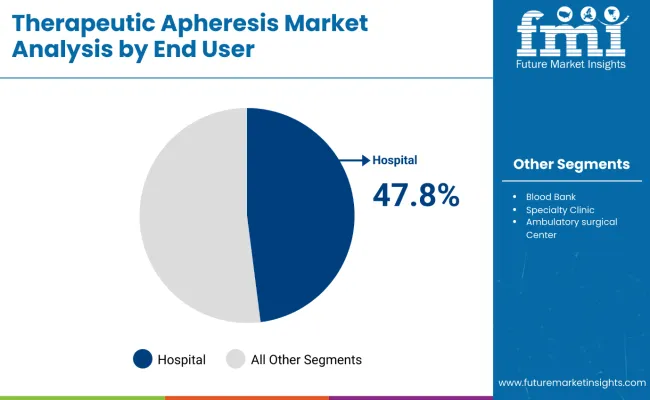

Therapeutic plasma exchange (TPE) will remain the leading procedure type due to its clinical effectiveness in treating neurological and autoimmune diseases. Hospitals dominate the market as they offer advanced infrastructure and a broad patient base for complex procedures.

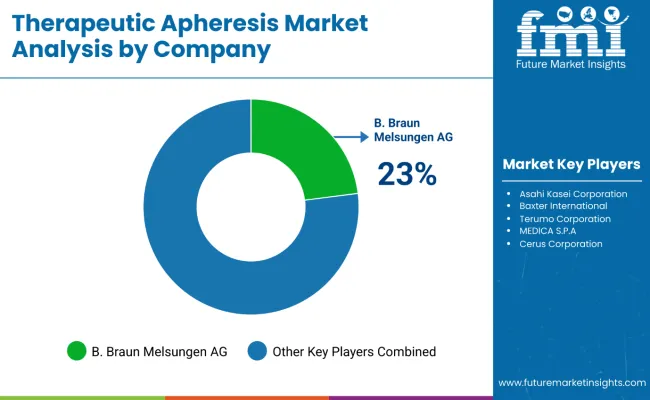

Key players driving the therapeutic apheresis market include Fresenius Medical Care, Terumo BCT, Haemonetics Corporation, Asahi Kasei Medical, Kaneka Corporation, and B. Braun Melsungen AG. These companies are investing in next-gen apheresis technologies, AI integration, and global partnerships. Strategic collaborations with hospitals and research centers remain vital. Continuous innovations in platform efficiency and patient-centric features will strengthen their market positions as demand rises for personalized and advanced therapeutic apheresis procedures.

The therapeutic apheresis market continues to witness significant momentum, driven by advancements in blood component separation technologies and an expanding range of clinical applications. Strategic corporate integrations and investments have also reinforced leadership positions within this evolving field.

Reflecting on such growth, David Pérez, President and CEO of Terumo Blood and Cell Technologies, remarked: “This is an exciting time for our organization. In just 12 months, we combined the businesses of CaridianBCT and Terumo Transfusion to emerge as Terumo BCT, one united global leader in blood component, therapeutic apheresis and cellular technologies.” This consolidation positioned Terumo BCT as a pivotal player in advancing both therapeutic apheresis and cell therapy solutions globally, further catalyzing innovation and market expansion.

Regulatory frameworks cover aspects such as device approval, procedural standards, operator certification, donor and patient protection, and facility accreditation. Since apheresis involves blood component manipulation, both national and international health authorities enforce rigorous compliance protocols for its medical use.

Device Approval and Compliance:

Apheresis machines and related devices must be approved by regulatory bodies before clinical use. In the United States, the FDA regulates these under Class II and Class III medical devices, requiring compliance with 21 CFR Part 820 (Quality System Regulation) and premarket notification (510(k)) or premarket approval (PMA). In the European Union, devices must meet the requirements of the Medical Device Regulation (EU) 2017/745 (MDR) and obtain CE marking for safety and performance.

Procedural and Clinical Guidelines:

Clinical use of therapeutic apheresis is guided by protocols set by medical societies and health authorities. In the U.S., standards are published by the American Society for Apheresis (ASFA) and the AABB, which outline indications, treatment schedules, and monitoring parameters. Many countries adopt or adapt World Health Organization (WHO) and International Society of Blood Transfusion (ISBT) guidelines for uniformity in clinical practice.

Operator Certification and Facility Accreditation:

Personnel performing therapeutic apheresis must be trained and certified. In the U.S., apheresis practitioners often require certification through ASCP (American Society for Clinical Pathology) or equivalent bodies. Facilities offering apheresis must meet accreditation standards set by organizations such as the Joint Commission (JCAHO) or College of American Pathologists (CAP), ensuring quality assurance, infection control, and patient safety.

Donor and Patient Safety Regulations:

Apheresis procedures, especially plasma exchange or stem cell collection, are subject to rules protecting both donors and recipients. In the EU, the EU Blood Directive (2002/98/EC) governs donation, testing, processing, and distribution of blood and blood components. National health ministries may impose additional requirements for eligibility screening, informed consent, and adverse event reporting.

Data Privacy and Reporting Requirements:

Health data collected during apheresis treatments must be handled in accordance with medical data protection laws. In the U.S., compliance with HIPAA is mandatory, while in the EU, GDPR governs patient data processing and confidentiality. Adverse reactions and device malfunctions must be reported under MedWatch in the U.S. or Eudamed in the EU.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the therapeutic apheresis industry outlook between 2024 and 2025 on a six-month basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year.

January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below illustrates therapeutic apheresis market compound annual growth rate (CAGR) comparison between 2024 and 2025 H1 half year CAGR. In summary, this revenue growth report also provides a general idea of the market as a whole. H1 is from January to June, whereas H2 is from July to December.

For H1 of the decade, i.e. 2024 to 2034, the company is projected to grow at a CAGR of 3.9%, meanwhile in H2 of the same decade, it is going to grow at a CAGR of 4.5%.

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2024 to 2034) |

| H2 | 4.5% (2024 to 2034) |

| H1 | 3.9% (2025 to 2035) |

| H2 | 4.3% (2025 to 2035) |

Moving onto the next period, which is H1 2025 to H2 2035, the CAGR is now reduced marginally to 3.9% in the first half and is expected to slightly lower at 4.3% in the second half. It remained the same in the first half (H1) at 0.0 BPS, whereas in the second half (H2), it declined by 16.0 BPS.

The therapeutic apheresis market is evolving with growing demand for advanced treatment modalities. TPE continues to dominate owing to clinical effectiveness across multiple conditions, while hospitals serve as the primary hubs for delivering specialized apheresis care. Technological innovations and expanding healthcare access will further drive segment expansion globally.

Therapeutic plasma exchange (TPE) accounts for 41.3% of the market in 2025 and remains the most widely adopted apheresis procedure. Its effectiveness in managing autoimmune diseases, neurological conditions, and hematologic disorders underpins strong demand. Growing prevalence of diseases such as myasthenia gravis, Guillain-Barré syndrome, and thrombotic thrombocytopenic purpura continues to drive procedure volumes.

Clinical guidelines increasingly recommend TPE as a frontline therapy for specific indications. The American Society for Apheresis’ 2024 updated guidelines further reinforced its use in neurology and nephrology. In parallel, manufacturers are improving system usability and patient outcomes. Terumo BCT’s latest Spectra Optia enhancements now support personalized plasma exchange protocols.

Additionally, adoption is expanding in emerging markets due to rising healthcare infrastructure investments. TPE procedures are being integrated into standard care pathways across hospitals and specialty centers globally. Continued evidence generation, training initiatives, and innovations will sustain robust growth in this segment through 2035.

Hospitals remain the dominant end users of therapeutic apheresis, representing 47.8% of demand in 2025. Their leadership stems from superior clinical capabilities, trained personnel, and integrated multidisciplinary care. Hospitals house specialized departments that manage complex cases, ensuring optimal treatment planning and execution.

Expanding apheresis programs across tertiary and quaternary hospitals is a notable trend. In 2024, several leading institutions in North America and Europe established dedicated apheresis units to address rising patient volumes. Furthermore, public-private partnerships are enhancing hospital-based service capacity in emerging regions.

Advanced technology integration is transforming hospital-based apheresis delivery. AI-enabled platforms, automated workflows, and remote monitoring capabilities are improving operational efficiency and patient experience. Fresenius Kabi and Terumo BCT are collaborating with major hospital networks to deploy such innovations.

As healthcare systems prioritize value-based care, hospitals will continue investing in apheresis services. Their role will remain pivotal in driving procedural adoption, clinical outcomes, and market growth through the forecast horizon.

Growing Demand for Source Plasma Drives the Therapeutic Apheresis Market

The therapeutic apheresis market is witnessing rapid growth as a result in increasing need from end-users for plasma-derived biopharmaceuticals, which also increase source plasma demands. Particularly witness a rise in number of collectors and specialized source plasma collecting centers with increasing application of therapies that mandate utilization of large volumes of plasma.

Biotechnological innovations and the surge in the incidence and prevalence of chronic and rare diseases will fuel the increased growth rate in the plasma-derived biopharmaceuticals market. Immunoglobulins, albumin, clotting factors, and enzyme replacement therapies are products required for patients with autoimmune disorders, hemophilia, and immune deficiency, among others.

Thus, there is going to be a greater demand for those middle-source plasma donation therapies as therapeutic apheresis also propagates as a field in the need for consistent availability of such high-quality plasma.

The combination of educational campaigns directed at the realization of the significance of plasma donation, and donation drives and outreach initiatives, have raised donor participation rates in the field essentially driving the market.

Rising Rare Disease Management with Therapeutic Apheresis, Accelerating the Market

For many rare diseases, a specialized treatment option are being the primary choice for many healthcare professionals as well as the patients. Awareness and diagnosis of these rare conditions are developing, thus providing the unique opportunity for the apheresis provider to gain more exposure to the market.

The rare diseases are usually treated by combinations of healthcare providers, researchers, and patient advocacy groups working together across academic lines. Apheresis providers are thus able to partake in joint research efforts that enhance our understanding of, and ability to treat, uncommon diseases.

Collaboration between therapeutic apheresis providers and researchers along with advocacy groups will bring forth much-needed insight, data, and knowledge toward the development of novel treatments and treatment regimens for rare diseases. This should improve patient outcomes and quality of life.

This, results in an opportunity to the rare diseases and orphan indication patients in therapeutic apheresis market growth. The expansion of apheresis providers to offer treatment services is the means of meeting the unmet medical need, betterment of the outcome of patients, and their success in being at the top position as the service provider for the specific segment.

Development and Innovation of Pathogen Inactivation Technology Opens the Opportunities in the Market

The therapeutic apheresis market will be promisingly growing significantly owing to innovative technologies and advancement of pathogen inactivation. Safety for treatment with therapeutic apheresis could be secured if such procedures utilize pathogen inactivation technologies in proactive ways.

With these technologies, pathogen detection and inactivation-for example, that of viruses, bacteria, and parasites-become very efficient, thereby minimizing the risk of transfusion-transmitted infections (TTIs) and other infectious complications in the apheresis treatment. Therefore, with pathogen inactivation, therapeutic apheresis could be offered in settings not previously considered, especially in blood component therapy.

The advancement and novelty of pathogen inactivation technologies will fuel major growth for the therapeutic apheresis market. Then again, better care assurance, catalyzing a market revolution, and enhancing the chances of the apheresis players in the new healthcare landscape should progress through reconstructing safety protocols, extending application ranges, and facilitating partnership building.

The Market for Therapeutic Apheresis Is Severely Constrained By the Decreasing Transfusion Rates and Lack of Skilled Professionals

The transfusion rate reduction causes a big constraint on the therapeutic apheresis market. Advancements in medical treatments, such as non-transfusion-based therapies, have ultimately reduced the demand for blood transfusions and consecutively reduced the demand for apheresis procedures.

Non-reliability on apheresis treatment in some medical conditions increases the adoption of alternative treatment methods in hospitals and healthcare facilities.

Besides, strict regulations regarding blood and plasma collection operate as a barrier to market development. Regulatory requirements concerning donor eligibility, safety protocols, and quality control measures raise the complexity and cost of operations for blood centers and apheresis service providers. These factors make potential entrants shy away and retard market growth.

Another major restraint is the lack of skilled professionals to perform apheresis procedures. The nature of therapeutic apheresis is very specialized and requires trained personnel.

Workforce shortages limit service accessibility, especially in developing regions. High procedural costs and limited reimbursement policies further restrain market adoption since many healthcare providers and patients cannot afford it.

Added to that, public misconceptions and lack of awareness regarding plasma donation and apheresis bring low donor participation. Since there are not enough plasma donors, not as many life-saving plasma-derived therapies can be produced, restraining overall market growth. The biggest task, for sustainable market development, will thus remain to try overcoming these.

B. Braun Melsungen AG, Terumo Corporation, Fresenius Medical Care (Fresenius SE & Co. KGaA), and Baxter International, Inc. are dominating players in tier 1 and hold 54.1% of the market. These companies have widespread presence globally, high revenue, and strong control in the markets. By spending significantly on the research and development, to hold a strong position in the market.

They also participated in the collaborations with hospitals and research organizations and regulatory authorities.

Tier 2 firms consist of Baxter International, Inc., Asahi Kasei Corporation, and others with around 27.6% market share and are well established in specific regional markets. They are mid-sized firms with a regional or niche orientation, adding to the market but not at Tier 1 levels.

They can specialize in certain apheresis technologies, serve specific geographic markets, or concentrate on cost-efficient solutions. These Tier 2 organizations seek to build globally but cannot match the similar financial or scope of operations in Tier 1 companies.

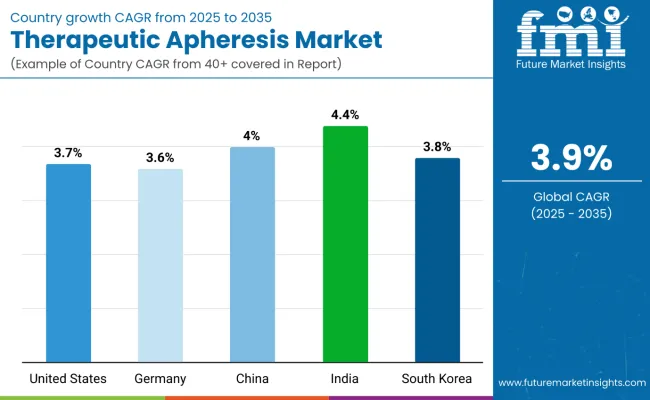

The section below covers the therapeutic apheresis industry analysis for the sales for different countries. The analysis of market demand of the key countries in various regions of the globe is North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

North America is expected to be dominated by the United States, which will post a CAGR of 3.7% during the period until 2035.In South Asia & Pacific, India is likely to post the highest CAGR in the market of 3.6% by 2035.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

| Germany | 3.6% |

| China | 4.0% |

| India | 4.4% |

| South Korea | 3.8% |

The United States therapeutic apheresis market has a CAGR of 3.7% during the forecast period.

The diseases such as neuroimmunological disease are increasing with the aging population due to higher environmental triggers, thus leading to a demand for more frequent plasmapheresis.

In addition, the continuous growth in usage of therapeutic apheresis for the treatment of different uncommon hematological disorders like TTP and sickle cell disease increases its acceptance rate. Due to the expansion in different specialty apheresis centers of hospitals and clinics, access is further being made easier.

The emergence of personalized medicine and targeted therapies also enhances the precision of apheresis, making it one of the preferred choices of treatment. Moreover, biopharmaceutical companies are studying apheresis as a technique for advanced drug delivery in antibody-based and gene therapies. This speaks to the use of apheresis with emerging biotherapeutics that are considered one of the factors for the reshaping of treatment paradigms and contributing to market growth.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.6%.

The growth of organ transplantation in Germany also fuels its therapeutic market for apheresis due to its increasing reliance on apheresis techniques in enhancing transplant success rates.

Germany has emerged as one of the most technologically advanced organ transplant sectors in Europe, thereby making way for plenty of kidney, liver, and heart transplants requiring regular apheresis before and after the procedures to eliminate the risk of rejections.

It is now a standard component in desensitization protocols of patients with high donor-specific antibodies, very much resulting in a significant reduction in organ rejection and better long-term outcomes.

There is also increasingly prevalent hypercholesterolemia and familial hyperlipidemia that support demand for LDL apheresis, a form of specialized therapy for very high-risk cardiovascular patients who are resistant to conventional lipid-lowering treatments. Another extremely emerging trend involves the therapeutic application of apheresis in immunoadsorption, especially with autoimmune diseases and hematological malignancies.

The robust biomanufacturing industry in Germany is also pushing the envelope for innovations in filtration membranes and adsorption columns, thereby making apheresis therapies safer and more effective. All these factors are further solidifying Germany's position as one of the leading European markets for therapeutic apheresis.

China holds a dominant value share in East Asia market in 2024 and will increase with a CAGR of 4.0% in the forecast period.

Therapeutic apheresis in China is expanding very fast due to the fact that the country has rising hematological diseases like leukemia, lymphoma, and aplastic anemia. The growth in the elderly population and change in lifestyle pattern of the Chinese is also influencing the increase in blood-related cancers and disorders for which apheresis treatment becomes inevitable.

Besides, the use of plasma-based treatments has picked up, with China becoming the world's biggest consumer of plasma-based treatments. The fast-rising plasma collection networks and further investments in plasma fractionation facilities around the country are yet another driver for more sophisticated apheresis procedures.

Another critical driver is the further increase of the role apheresis is gaining in the management of severe infectious diseases, especially with respect to sepsis and viral hemorrhagic fevers for which therapeutic plasma exchange is also being evaluated on its prospective life-saving merits.

In addition, China's rising interest in regenerative medicine further supports the usage of apheresis for extracting stem cells and cellular therapies. The applications that are evolving into the future would place China at the forefront as a major growth hub for the therapeutic apheresis market. The continuous technology advancement and the large-scale health infrastructure development continue to accelerate this expansion.

Within this marketplace for therapeutic apheresis, very-active major players are continuously in competition by providing innovations in the fields of automation of the procedures, improved filtration technologies, and incorporation with cell and gene therapies, which increases the effectiveness and accessibility of apheresis therapies.

The competitive market is represented by strategic partnerships, acquisitions, and regulatory approvals, along with an increase in the outpatient and home-based apheresis solutions market development. The environment is more competitive, but advances in automation, precision medicine, and decentralized care will nurture the market.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.92 billion |

| Projected Market Size (2035) | USD 4.28 billion |

| CAGR (2025 to 2035) | 3.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand procedures for volume |

| Segments Analyzed - By Procedure Types | Therapeutic plasma exchange (TPE), Red blood cell exchange (RBCX), Cellular depletions, Other procedures |

| Segments Analyzed - By Technology | Centrifugation, Membrane filtration |

| Segments Analyzed - By Application | Sickle cell disease, Neurology, Nephrology, Familial hypercholesterolemia, Oncology, Autoimmune disease, Graft-versus-host disease (GVHD), Transplant of solid organs |

| Segments Analyzed - By End User | Hospitals, Blood banks, Specialty clinics, Ambulatory surgical centers |

| Regions Covered | North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa (MEA) |

| Key Players Influencing the Therapeutic Apheresis Market | B. Braun Melsungen AG, Asahi Kasei Corporation, Baxter International, Inc., Fresenius Medical Care (Fresenius SE & Co. KGaA), Terumo Corporation, MEDICA S.P.A., Haemonetics Corporation, Cerus Corporation |

| Additional Attributes | Dollar sales by procedure type and application, adoption trends in neurology and autoimmune disorders, advancements in membrane filtration technologies, integration of therapeutic apheresis in personalized medicine, growing demand in outpatient settings, regional reimbursement and regulatory trends shaping market expansion. |

The global therapeutic apheresis industry is projected to witness CAGR of 3.9% between 2025 and 2035.

The global therapeutic apheresis industry stood at USD 2,815.7 million in 2024.

The global therapeutic apheresis industry is anticipated to reach USD 4.28 billion by 2035 end.

China is expected to show a CAGR of 4.0% in the assessment period.

The key players operating in the global therapeutic apheresis industry include B. Braun Melsungen AG, Asahi Kasei Corporation, Baxter International, Inc., Fresenius Medical Care (Fresenius SE & Co. KGaA), Terumo Corporation, MEDICA S.P.A., Haemonetics Corporation, Cerus Corporation and Others

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Procedure Types, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Procedure Types, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Procedure Types, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Procedure Types, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Procedure Types, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Procedure Types, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Procedure Types, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Procedure Types, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Procedure Types, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Procedure Types, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Procedure Types, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Procedure Types, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Procedure Types, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Procedure Types, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Procedure Types, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Procedure Types, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Procedure Types, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Procedure Types, 2023 to 2033

Figure 47: North America Market Attractiveness by Technology, 2023 to 2033

Figure 48: North America Market Attractiveness by Application, 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Procedure Types, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Procedure Types, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Procedure Types, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Procedure Types, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Procedure Types, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Procedure Types, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Procedure Types, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Procedure Types, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Procedure Types, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Procedure Types, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Procedure Types, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Procedure Types, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Procedure Types, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Procedure Types, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Procedure Types, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Procedure Types, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Procedure Types, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Procedure Types, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Procedure Types, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Procedure Types, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Procedure Types, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Procedure Types, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Procedure Types, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Procedure Types, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Procedure Types, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 174: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Procedure Types, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Procedure Types, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Procedure Types, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Procedure Types, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Procedure Types, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Therapeutic Drug Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Robots Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Respiratory Devices Market Overview - Trends & Forecast 2025 to 2035

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Therapeutic Diet for Pet Market Analysis by Age Group, Health Condition, Distribution Channel and Others Through 2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Therapeutic Nuclear Medicine Market Analysis – Size, Share & Forecast 2024-2034

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

Leukapheresis Products Market - Growth & Forecast 2025 to 2035

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Solutions Market Size and Share Forecast Outlook 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Psychotherapeutic Combinations Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sinus Therapeutic Drugs Market – Trends, Growth & Forecast 2022-2032

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

At-Home Therapeutic Beauty Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Elastic Therapeutic Tape Market Growth – Trends & Forecast 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA