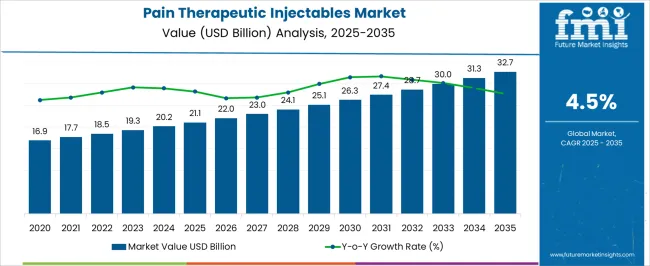

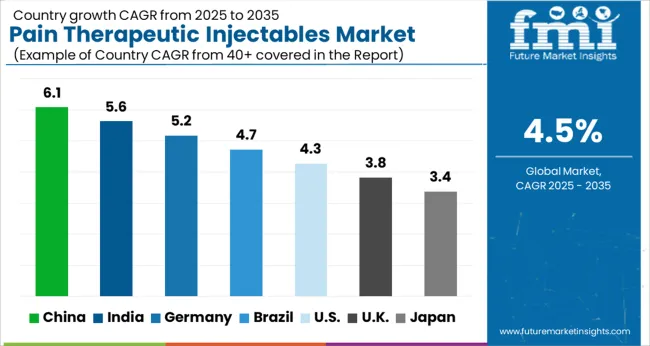

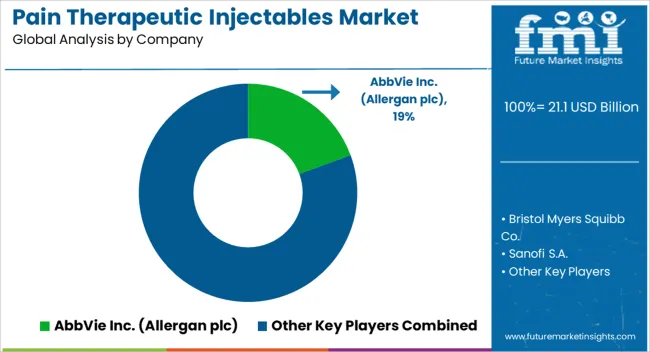

The Pain Therapeutic Injectables Market is estimated to be valued at USD 21.1 billion in 2025 and is projected to reach USD 32.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Pain Therapeutic Injectables Market Estimated Value in (2025 E) | USD 21.1 billion |

| Pain Therapeutic Injectables Market Forecast Value in (2035 F) | USD 32.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The pain therapeutic injectables market is expanding steadily as a result of rising incidences of chronic pain, post operative complications, and musculoskeletal disorders. Growing preference for minimally invasive treatment options and the ability of injectables to provide rapid pain relief are key factors shaping market adoption.

Pharmaceutical advancements in long acting formulations and combination therapies have improved patient outcomes, driving further acceptance in clinical practice. Increasing demand for outpatient care and the surge in surgical procedures globally are reinforcing the need for reliable pain management solutions.

Regulatory approvals for novel therapies and expanding reimbursement frameworks are strengthening accessibility across developed and emerging economies. The overall outlook remains favorable, with continued investment in research, supportive healthcare policies, and increasing patient awareness regarding non oral pain management therapies.

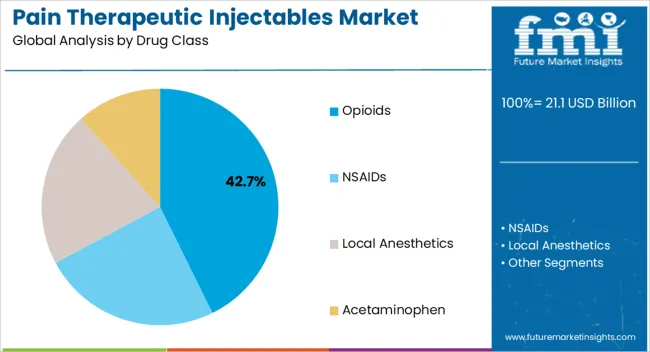

The opioids drug class segment is projected to account for 42.70% of total market revenue by 2025 within the drug class category, making it the leading segment. This dominance is being driven by their efficacy in managing moderate to severe pain, particularly in post surgical and cancer related cases.

Despite ongoing concerns regarding dependency, controlled clinical settings and improved delivery formulations have supported their continued use.

The strong presence of opioids in hospital protocols and their role in multimodal pain management strategies have reinforced their leadership within the drug class segment.

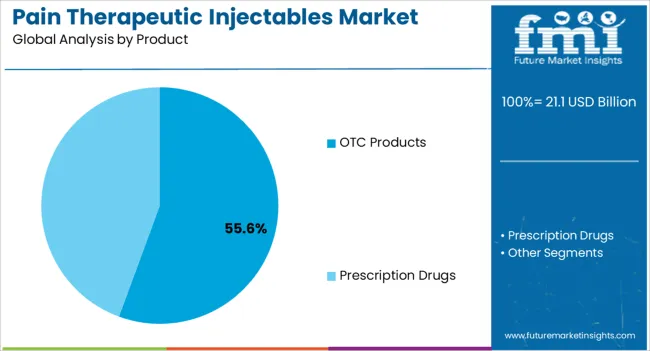

The OTC products segment is expected to capture 55.60% of overall market revenue by 2025 within the product category, making it the largest segment. This is attributed to the wide accessibility of these products, ease of administration, and growing consumer reliance on self management of pain conditions.

The expansion of retail and online distribution channels has improved availability, while increasing awareness of non prescription pain therapies has supported adoption.

Cost effectiveness and suitability for mild to moderate pain further contribute to the growth of this segment, strengthening its market leadership.

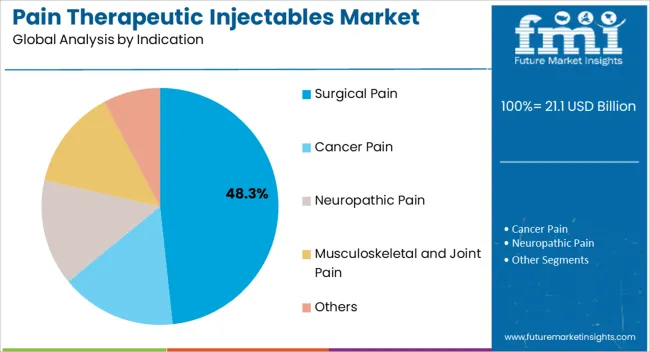

The surgical pain indication segment is anticipated to hold 48.30% of total revenue by 2025, making it the dominant application area. This growth is being fueled by the rising volume of surgical procedures worldwide and the critical need for effective post operative pain control.

Pain therapeutic injectables are recognized for their ability to provide immediate relief, improve recovery outcomes, and reduce hospital stays. Increasing adoption of multimodal analgesia approaches and advancements in anesthetic delivery have supported wider use in surgical settings.

As surgical care expands across both advanced and emerging healthcare systems, this indication continues to hold the strongest position in the market..

5The global market holds around 28.5% share of the overall global painkillers market with a value of around USD 21.1 Billion, in 2025.

The increasing prevalence of chronic pain conditions, such as arthritis, cancer pain, and lower back pain, is one of the primary drivers of the pain therapeutic injectables market. These conditions require long-term pain management, which often includes the use of injectable pain medications. Due to the rise in chronic diseases, the market for pain therapeutic injectables has exhibited a consistent increase.

Apart from this, the market is anticipated to expand in the coming years because of the rising number of surgeries performed worldwide. This eventually demands post-operative pain management. Moreover, technological developments have led to improvements in drug delivery systems which ensures more accurate and effective administration of injectable drugs.

As the importance of pain management becomes more widely recognized, patients are seeking out effective pain relief options that can improve their quality of life. Pain therapeutic injectables are one such option that can provide rapid and effective relief from pain.

Owing to the above-mentioned factors, the global market is expected to grow at a prominent pace, and reach a valuation of around USD 32.7 billion in the year 2035.

There are numerous potentials for innovation and expansion in the market for companies dealing in pain therapeutic injectables. The market is being driven by the rising demand for minimally invasive procedures worldwide.

Minimally invasive procedures, such as injections, are becoming increasingly popular among patients due to their ability to reduce pain and discomfort while minimizing the risk of complications. This is driving the demand for pain therapeutic injectables, which can provide effective pain relief with minimal invasiveness.

The development of this market is anticipated to be aided by a number of new technologies and therapies. Due to their efficiency and patient convenience, injectable pain treatments are anticipated to see increased use.

As the global population ages, the prevalence of chronic pain conditions is expected to increase, which will drive demand for pain therapeutic injectables. The geriatric population is particularly susceptible to chronic pain, making them a key demographic for the pain therapeutic injectables market.

The market is constrained by a number of factors, including expensive injectable drug costs, adverse effects from prolonged use of opioids, and the possibility of drug abuse and addiction. Pain therapeutic injectables can be expensive, which can limit access for some patients. This is particularly true for those who do not have adequate health insurance coverage or who are underinsured.

The regulatory environment is also posing difficulties for the market, particularly when it comes to confirming the efficacy and safety of new injectable treatments before they can be released. The development and approval of new pain medications can be a lengthy and expensive process due to the strict regulatory requirements in many countries. This can limit the number of new products entering the market and slow down innovation.

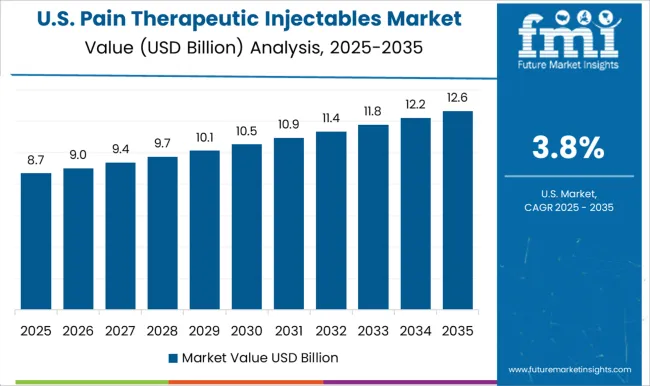

The USA dominates the global region with a total market share of around 39.1% in 2025 and is expected to continue to experience the same growth throughout the forecast period.

The market for pain therapeutic injectables in the USA is expanding due to a number of factors. One of the contributing aspects is the increasing prevalence of chronic pain. Chronic pain is a major healthcare issue in the United States, affecting millions of people each year. This has led to a growing demand for pain management therapies, including pain therapeutic injectables.

Other than this, an increase in awareness and education regarding the advantages of injectable painkillers such as their quicker onset of action and more accurate dosing, among medical professionals and patients, is driving the market in this region. In USA, the growth of the market is also fueled by the creation of novel and sophisticated injectable medications as well as the increased availability of enhanced delivery methods. These advancements are driving growth in the market by providing better treatment options for patients.

Japan contributed around USD 21.1 Billion revenue to the global pain therapeutic injectables market in 2025. The prevalence of chronic pain conditions is increasing in Japan, including osteoarthritis, cancer pain, and lower back pain.

This has led to a growing demand for pain therapeutic injectables. Additionally, as older people are more likely to have chronic pain, Japan's aging population is fueling the demand for pain management therapies, including pain therapeutic injectables.

The development of this market has also been aided by technological developments and the accessibility of new painkillers and treatments in Japan. The demand for pain treatment injectables in Japan has also been significantly influenced by patients' and healthcare professionals' growing knowledge regarding the importance of effective pain management.

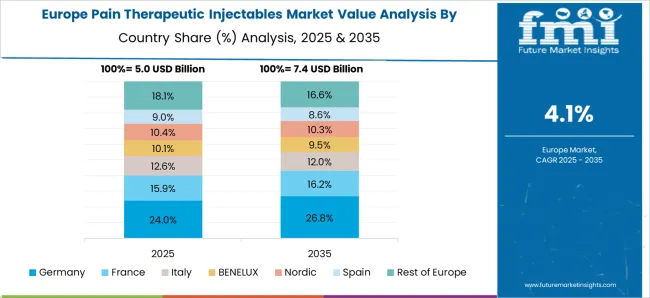

Germany held a market share of 25.6% in the Western Europe pain therapeutic injectables market in 2025.

The market is expanding in Germany due to the growing popularity of minimally invasive procedures for pain management, which frequently involves the use of injectable medications.

Other than this, the demand for pain treatment injectables in the nation is also being fueled by the growing importance of at-home healthcare and self-administration of injectables. Overall, it is anticipated that these factors will continue to fuel the market for pain therapeutic injectables in Germany in the coming years.

Opioids by drug class segment held 53.4% share in the global market in 2025. Opioids are still frequently used to control pain, especially in situations where there is significant acute pain or chronic pain that does not respond to other forms of treatment. In recent years, although there has been a shift towards the use of non-opioid options for pain management, opioids still have a place in some circumstances.

Overall, opioids play a substantial role in the market of therapeutic injectables for treating pain, but their usage needs to be carefully regulated and balanced with other therapies.

Prescription drugs by product segment contributed around USD 21.1 Billion in the global market in 2025. Since they are frequently used to manage pain in individuals who require more intense therapy, prescription medications play a key role in the market of therapeutic injectables for treating pain.

The market for pain therapeutic injectables also has a prescription medicine sector that is significant because it offers healthcare professionals a variety of treatment alternatives to fulfill the various demands of their patients.

Surgical pain by indication segment held more than one-third revenue share in the global market in 2025. Injectable painkillers are in high demand because of the increasing prevalence of surgical pain conditions.

As a result of tissue damage and inflammation, patients who have undergone surgery, are most likely to experience pain so, pain treatment is a crucial component of post-operative care. Since pain therapeutic injectables can offer more immediate and intense pain relief than oral drugs, these are often utilized to alleviate the discomfort due to the pain.

Retail pharmacies is the leading segment with over 27.0% revenue share in 2025 globally. When it comes to distribution channel, retail pharmacies are considered a place which is quite accessible to patients in order to buy these kinds of injectable drugs. Therefore, retail pharmacies play a significant role in this market. Retail pharmacies typically stock a wide range of medications, including prescription drugs, over-the-counter medications, and other healthcare products. This makes it easy for patients to find the medications they need without having to visit multiple locations.

Key differentiating tactics used by producers of pain therapeutic injectables include an increase in product releases and regulatory body approval, growth into other regions, and marketing approvals in other locations. The dynamics of the market have changed as a result of increasing awareness.

Similarly, recent developments related to companies manufacturing pain therapeutic injectables have been tracked by the team at Future Market Insights. These are available in the full report.

| Attribute | Details |

|---|---|

| Historical Data Available for | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan & Baltic Countries; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, France, Spain, Italy, BENELUX, Nordic Countries, United Kingdom, Poland, Hungary, Romania, Czech Republic, India, Thailand, Indonesia, Malaysia, Philippines, Vietnam, Australia & New Zealand, Japan, China, South Korea, GCC Countries, Kingdom of Saudi Arabia, Türkiye, Northern Africa, South Africa, and Israel |

| Key Market Segments Covered | Drug Class, Product, Indication, Distribution Channel and Region |

| Key Companies Profiled | AbbVie Inc. (Allergan plc); Bristol Myers Squibb Co.; Sanofi S.A.; Boehringer Ingelheim International GmbH; Pfizer Inc.; Zydus Lifesciences Ltd. (Cadila Pharmaceuticals); GSK plc.; Abbott Laboratories, Inc.; Novartis AG; Johnson & Johnson (Janssen Pharmaceuticals, Inc.); Sun Pharmaceutical Industries Ltd.; Teva Pharmaceuticals Ltd.; Mallinckrodt Pharmaceuticals; Endo Pharmaceuticals Inc.; Bayer AG; F. Hoffmann-La Roche Ltd.; Procter & Gamble; AstraZeneca; Cardinal Health; Perrigo Company Plc.; Bausch Health Companies Inc.; Viatris; Amneal Pharmaceuticals; Purdue Pharmaceuticals L.P. |

| Pricing | Available upon Request |

The global pain therapeutic injectables market is estimated to be valued at USD 21.1 billion in 2025.

The market size for the pain therapeutic injectables market is projected to reach USD 32.7 billion by 2035.

The pain therapeutic injectables market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in pain therapeutic injectables market are opioids, _tramadol, _oxycodone, _hydrocodone, _other opioids, nsaids, local anesthetics and acetaminophen.

In terms of product, otc products segment to command 55.6% share in the pain therapeutic injectables market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pain Therapeutic Solutions Market Size and Share Forecast Outlook 2025 to 2035

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Paint Booth Market Size and Share Forecast Outlook 2025 to 2035

Painkillers Market Size and Share Forecast Outlook 2025 to 2035

Painting Tool Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Drug Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Robots Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Apheresis Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Paint Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Knife Market Size and Share Forecast Outlook 2025 to 2035

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Therapeutic Respiratory Devices Market Overview - Trends & Forecast 2025 to 2035

Paint Mixing Market Analysis - Size, Share, and Forecast Outlook for 2025-2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA