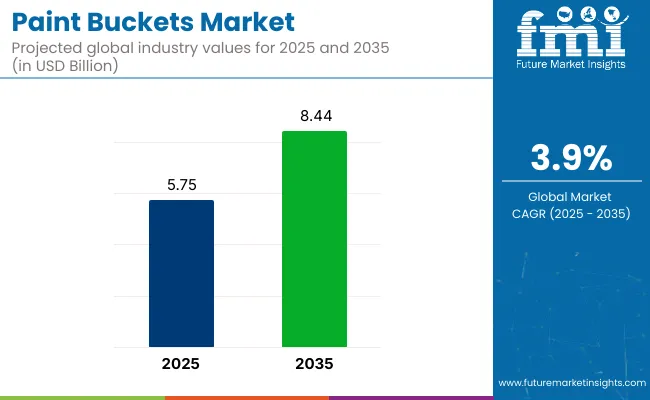

The global paint buckets market is projected to grow from USD 5.75 billion in 2025 to USD 8.44 billion by 2035, registering a CAGR of 3.9% during the forecast period. Sales in 2024 were recorded at USD 5.54 billion. This growth is primarily attributed to the increasing demand for durable and recyclable packaging solutions in the construction and automotive sectors.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.75 billion |

| Industry Value (2035F) | USD 8.44 billion |

| CAGR (2025 to 2035) | 3.9% |

The shift towards sustainable materials and the need for efficient storage and transportation of paints and coatings have further propelled the adoption of innovative paint bucket designs. Recent innovations in the paint buckets market have brought about notable improvements in functionality, safety, and customization. Manufacturers are increasingly adopting advanced materials such as high-density polyethylene (HDPE), polypropylene, and corrosion-resistant coatings to produce buckets that are lightweight yet durable.

These materials enhance chemical resistance and prolong the lifecycle of the containers. Design advancements have also resulted in the development of stackable and space-saving buckets, which improve transportation and storage efficiency across supply chains. Additionally, tamper-evident seals, snap-on lids, and ergonomic handles have become standard features, promoting both safety and convenience during handling and use.

Technological developments in manufacturing processes have further enabled automation compatibility, making these buckets ideal for high-volume industrial operations. Paint buckets are now being designed to seamlessly integrate with automated filling, labeling, and palletizing systems, reducing labor costs and boosting overall productivity.

Customization has also become a key differentiator, as companies offer tailored solutions in various sizes, colors, and shapes, along with in-mold labeling for branding. Furthermore, the growing focus on sustainability has led to the development of eco-friendly paint buckets using recyclable, biodegradable, or reusable materials. These advancements are helping manufacturers align with increasingly strict environmental regulations and meet consumer demand for green packaging solutions.

The global paint buckets market is witnessing robust growth, particularly in emerging regions such as Asia-Pacific. Rapid urbanization, rising disposable incomes, and a surge in infrastructure and construction projects are driving demand across both residential and commercial sectors.

Moreover, the growing popularity of DIY home improvement and decorative painting in developed and developing countries alike has expanded the market beyond traditional applications. To remain competitive, manufacturers are expected to continue investing in innovation, cost optimization, and sustainable practices, thereby offering versatile solutions that cater to a broad spectrum of end users and regulatory environments.

The market has been segmented based on material, capacity, application, end user, and region. By material, metal and plastic have been used to offer durability, chemical resistance, and cost efficiency across various coating needs. Capacity ranges such as less than 1 liter, 1 to 10 liters, 11 to 50 liters, and more than 50 liters have been defined to address diverse usage volumes and handling preferences.

Applications have been categorized into industrial coating and architectural coating, where paint buckets are utilized for protective and decorative purposes. End users such as building and construction industries, paint industries, chemical industries, and others have been included to reflect demand from core manufacturing and infrastructure sectors. Regional segmentation has been structured to cover North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

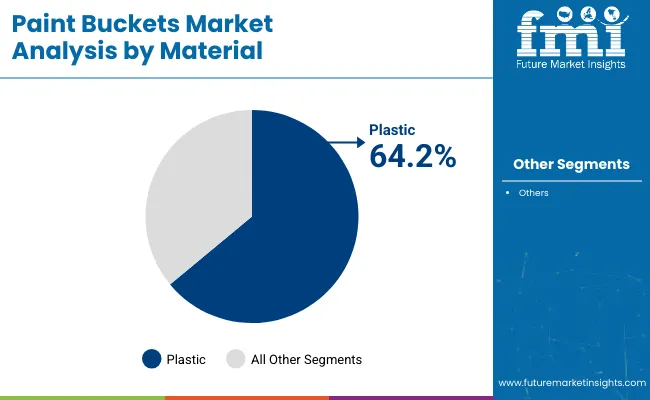

The plastic segment is expected to account for 64.2% of the construction film market in 2025, as usage has been led by material versatility, tensile strength, and ease of deployment. Films composed of polyethylene, polypropylene, and PVC have been widely utilized across vapor barriers, moisture wraps, and protective sheeting. Custom formulations for UV resistance and puncture strength have been increasingly adopted in both indoor and outdoor applications. Lightweight rolls and ease of sealing have enabled faster installation on large-scale construction sites.

Plastic-based films have been engineered to support varying site conditions, including thermal shifts and abrasive surfaces. Recyclable and biodegradable variants have been promoted under green building codes and circular economy policies. Enhanced performance coatings have been introduced to improve durability and extend lifespan in exposed environments. The dominance of plastic has been maintained due to its adaptability to both standard and high-performance construction needs.

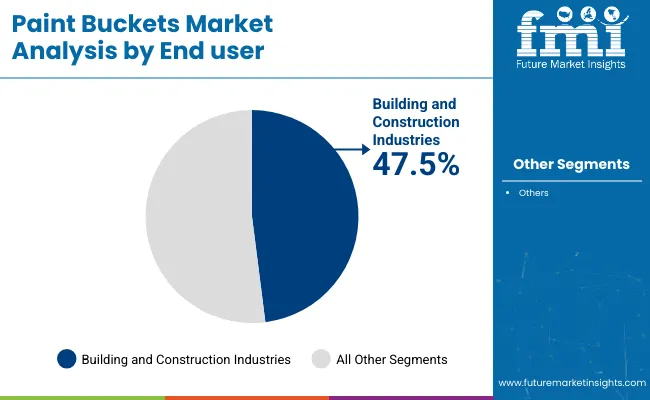

The building and construction industries are projected to lead the end-user segment with 47.5% of the construction film market share in 2025, driven by demand across insulation, roofing, and foundation work. Construction films have been deployed extensively for moisture control, concrete curing, and surface protection in residential and commercial builds.

Compliance with LEED certifications and regional safety standards has been supported through film-grade selection and manufacturing traceability. Large-scale infrastructure projects and green building mandates have expanded film application across all phases of construction.

Multi-layered and reinforced films have been adopted for enhanced durability in aggressive job site conditions. Transparent and printed variants have facilitated inspection, branding, and utility marking during installation. Cost savings, weather protection, and thermal regulation have been delivered through properly specified film systems. Growth in urbanization, modular construction, and retrofit activities has continued to sustain demand from the building and construction sector.

Raw Material Cost Volatility and Environmental Regulations

Although paint buckets facilitate effective storage and transportation, peak concerns include the volatility of resin and metal prices, rising environmental concerns about plastic waste, and tightening regulations on non-recyclable packaging, which companies must also respond to. Market growth is also inhibited by competition from flexible pouches and bag-in-box solutions for industrial paints.

Sustainable Packaging and Smart Paint Containers

The global trend towards the use of biodegradable plastic compounds, growing adaptation of lightweight metal buckets, solid growth in smart packaging with anti-spill technology is opening up new avenues for growth. Long-term market growth is expected to be driven by advancements such as multi-layered polymer coatings for rust resistance, tamper-proof bucket seals, and eco-friendly paint bucket manufacturing.

Further, demand for next-generation paint packaging solutions such as digital-printed branding solutions, reusable & refillable paint buckets, and easy-dispensing paint containers are witnessing an upsurge, which in turn is anticipated to be a guiding factor in driving revenue growth of the paint packaging market over the forecast period.

A USA-based paint bucket market is anticipated to be dominant over the global landscape, owing to the increasing growth of construction and renovation sector, increasing adoption of sustainable and recyclable packaging solutions along with growing trend of DIY home improvement projects. Increasing sustainable paint bucket packaging initiatives are prompting demand for lightweight and biodegradable plastic paint buckets.

Also, initiatives such as spill-proof lids, ergonomic handles and tamper-proof designs have increased the efficiency of products. Other growing trends in the bulk paint industry include the growing prevalence of e-commerce for bulk paint purchases and the increasing utilization of smart packaging for branding and tracking.

| Country | CAGR (2025 to 2035) |

|---|---|

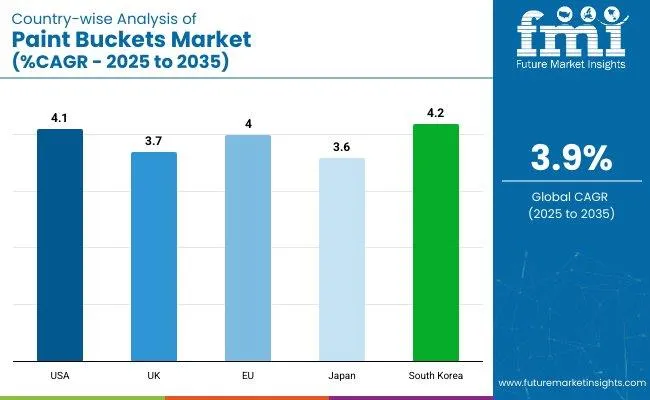

| United States | 4.1% |

The UK paint bucket attributed to the increasing consumer inclination toward sustainable and reusable paint containers, rising investment in green home renovation projects, and surging demand from the commercial construction vertical. The development of water-based and low-VOC paints (volatile organic compounds) is encouraging innovation in designs of corrosion-resistant and leak-proof paint buckets.

Furthermore, the growing utilization of lightweight, stackable buckets to improve storage & transportation efficiency is redounding the market approach. Another driving factor for Cross Flow Filtration are the rising commercial and domestic metal and hybrid-material paint buckets since they are long lasting and are likely to support industry expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.7% |

The United Kingdom is leading the paint bucket market in the European Union, with robust regulations supporting recyclable packaging, rising acceptance of advanced paint container designs, and increasing demand for high-quality packaging solutions in the industrial coatings sector. Policies from the EU to dispose of and reduce plastic waste and promote sustainable packaging alternatives are driving forward demand for reusable and biodegradable paint buckets.

Also, development of new UV-resistant and impact-resistant bucket materials are driving innovation in the industry. Market growth is also being driven by the increasing focus on spill-proof lids, easy-pour spouts, and tamper-evident sealing technologies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

The expanding investments in precision manufacturing, the demand for compact and lightweight packaging solutions, and the positive regulatory environment supporting sustainable knowledge-based materials have opened lucrative opportunities in Japan’s paint bucket market. The nation’s expertise in polymer technology is spurring advances in high-durability plastic-and-metal paint buckets.

Moreover, trends of implementing smart labeling and digital tracking systems for inventory management are impacting the industry trends. Moreover, with the increasing adoption of space-saving and multi-purpose paint buckets for urban residential renovations, the market is witnessing new growth opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

Paint buckets are becoming an essential part of packaging, and the basic structure of the product leads to the trend of miniaturization and high performance and market focusing on the lightness and features of the products. Hybrid-material paint buckets are in high demand as the country embraces packaging solutions that are lightweight and impact-resistant.

Moreover, the new development of moisture-resistant and anti-corrosive coatings for metal buckets is enhancing product durability. Furthermore, the rising role of AI-powered inventory management systems for optimal bucket distribution and storage is contributing to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The paint bucket market is driven by the rising demand for long-lasting and sustainable packaging solutions in the paint and coatings sector, innovations in lightweight and recyclable materials, and the increasing adoption of smart packaging technologies.

Market is thriving with applications in residential, commercial, and industrial painting. Key trends influencing the industry are eco-friendly packaging, tamper-proof lids, and innovations in stackable and ergonomic bucket designs.

The overall market size for the paint bucket market was USD 5.75 billion in 2025.

The paint bucket market is expected to reach USD 8.44 billion in 2035.

The demand for paint buckets will be driven by increasing construction and renovation activities, rising demand for eco-friendly and recyclable packaging solutions, growing use of lightweight and durable plastic buckets, and advancements in tamper-proof and spill-resistant designs.

The top 5 countries driving the development of the paint bucket market are the USA, China, Germany, India, and Brazil.

The plastic paint buckets segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Paint Booth Market Size and Share Forecast Outlook 2025 to 2035

Painting Tool Market Size and Share Forecast Outlook 2025 to 2035

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Paint Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Knife Market Size and Share Forecast Outlook 2025 to 2035

Paint Mixing Market Analysis - Size, Share, and Forecast Outlook for 2025-2035

Market Share Insights of Paint Can Manufacturers

Market Share Breakdown of Paint Protection Film Manufacturers

Paint Additives Market Growth 2024-2034

Faux Paints And Coatings Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Small Paint Pail Market Size and Share Forecast Outlook 2025 to 2035

Metal Paint Tray Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Metal Paint Can Market Trends & Industry Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA