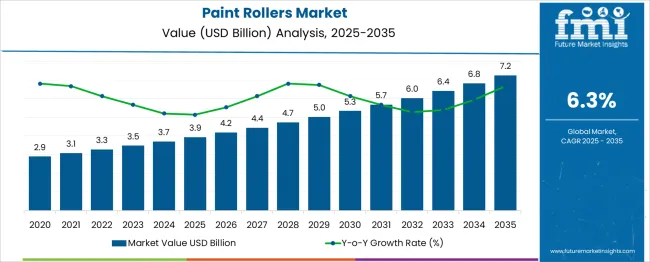

The Paint Rollers Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

Paint roller demand typically peaks during spring and summer months, especially in temperate regions across North America, Europe, and parts of Asia, when outdoor and indoor painting projects surge. Seasonal renovation trends, especially in residential housing, drive a predictable spike in sales during Q2 and Q3 each year. From a cyclical standpoint, the market correlates closely with the real estate and construction sectors, making it somewhat sensitive to broader economic cycles. During periods of economic growth, new housing starts and commercial developments increase, pushing up the demand for painting tools. Conversely, during economic slowdowns or housing slumps, especially in developed economies, demand can soften due to reduced renovation budgets and construction delays. Despite these fluctuations, the overall growth trajectory remains upward, supported by trends such as DIY culture, urbanization, and rising aesthetic preferences globally. Emerging markets like India and Southeast Asia exhibit lower seasonality but high growth momentum, gradually balancing the cyclical vulnerabilities in more mature regions.

| Metric | Value |

|---|---|

| Paint Rollers Market Estimated Value in (2025 E) | USD 3.9 billion |

| Paint Rollers Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Paint Rollers Market is a vital subsegment within multiple interconnected industries. It holds a 23% share of the USD 16.7 billion Painting Tools and Equipment Market in 2025, projected to rise to 25% by 2035 as demand for faster, more efficient paint application tools increases. Within the broader DIY Home Improvement Market, estimated at USD 735 billion in 2025 and expected to reach over USD 1.1 trillion by 2035, paint rollers represent around 0.53% of total value, primarily driven by growing consumer inclination toward home renovations.

The Construction Tools Market, worth USD 130 billion in 2025, dedicates approximately 3% to surface finishing tools, with paint rollers accounting for 1.2% of the total. The Decorative Coatings Market, valued at USD 85 billion in 2025, sees more than 30% of its applications executed using paint rollers. In the Building Renovation Sector, which comprises roughly 38% of global construction activity, paint rollers support about 4% of all painting tool expenditures. Meanwhile, the Interior Finishing Materials Market allocates nearly 2% of its USD 200 billion valuation to paint tools, including rollers. Lastly, within the USD 12 trillion Global Construction Market, paint rollers form a small but essential 0.03% component, highlighting their critical but niche role.

The paint rollers market is witnessing stable demand due to consistent growth in residential and commercial renovation projects, an expanding DIY consumer base, and a greater focus on surface finish quality. Increasing urbanization and home improvement spending are fueling demand for painting tools that offer speed, efficiency, and smoother application.

Professional painters and retail users alike are favoring rollers for their low splatter performance and ability to cover large surface areas evenly. Advances in roller fabrics and ergonomic design are contributing to paint pick-up and release better, while sustainability initiatives are influencing manufacturers to adopt recyclable cores and eco-friendly materials.

The integration of microfiber and blended fabrics to reduce lint and improve coverage per stroke is further driving product evolution, particularly in premium and professional-grade categories.

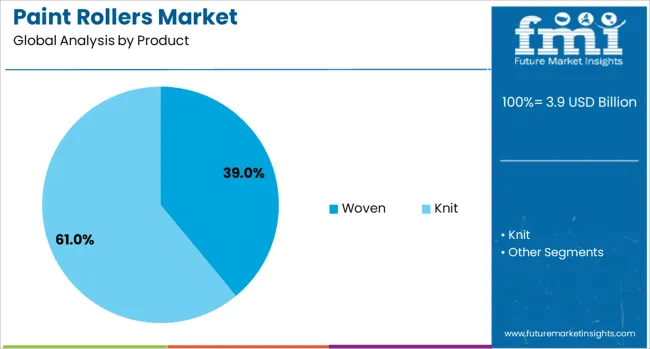

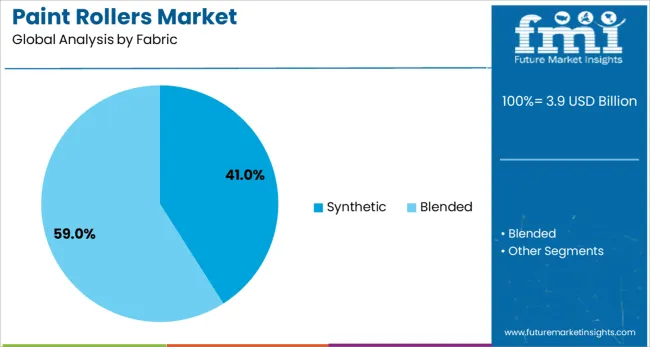

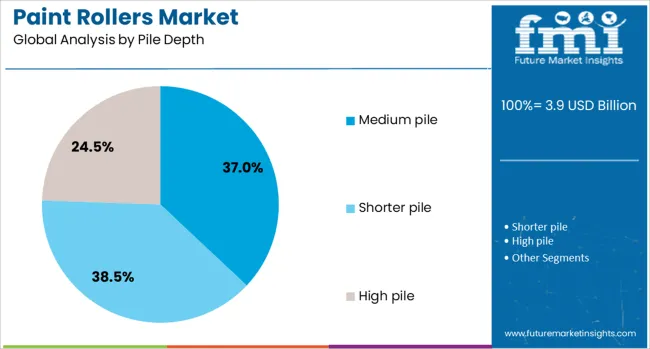

The paint rollers market is segmented by product, fabric, pile depth, application, and geographic regions. The paint rollers market is divided into Woven and Knit. In terms of the fabric, the paint rollers market is classified into Synthetic and Blended. Based on the pile depth, the paint rollers market is segmented into Medium pile, Shorter pile, and High pile. By application, the paint rollers market is segmented into Construction and Appliances. Regionally, the paint rollers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The woven product segment is expected to dominate the market with a 39.0% share in 2025. Woven rollers are increasingly favored for their ability to deliver a smooth, lint-free finish, especially with glossy and semi-gloss paints.

Their tightly constructed fibers reduce matting and deformation over extended use, enhancing both durability and consistency of performance. These rollers are highly preferred by professionals in high-end applications such as cabinetry, doors, and trim work.

The growing demand for ultra-fine finishes in both new construction and luxury remodeling is further solidifying the role of woven rollers in the premium product category.

Synthetic fabrics are anticipated to hold a 41.0% market share in 2025, making them the leading material type for paint rollers. Their dominance is attributed to superior paint absorption and resistance to solvents, enabling wide applicability across both water-based and oil-based coatings.

Synthetic rollers offer cost-effective solutions for interior and exterior surfaces, balancing performance and longevity. In addition, these fabrics are often engineered to mimic natural fibers while enhancing durability, making them ideal for repeated use.

Their compatibility with textured surfaces and consistent performance under varied temperature and humidity conditions makes them a top choice among both DIY and professional painters.

Medium pile rollers are projected to command a 37.0% market share in 2025, leading the pile depth segment. Their popularity stems from their versatility, providing optimal performance on smooth to semi-rough surfaces such as drywall, wood, and lightly textured walls.

Medium pile depth enables adequate paint loading without excessive dripping, ensuring even coverage and minimal waste. This segment benefits from a broad user base, as it balances speed and finish quality for general-purpose applications.

As renovation trends favor matte and eggshell finishes in living and commercial spaces, medium pile rollers continue to serve as the go-to option for mainstream painting needs.

The paint rollers market continues to see consistent demand driven by residential renovations, commercial infrastructure upgrades, and the DIY culture. As a convenient, cost-effective alternative to spraying, paint rollers remain popular for interior and exterior applications across diverse surfaces. Increasing preference for user-friendly, ergonomic, and reusable tools boosts product innovation. Manufacturers are introducing surface-specific roller designs and advanced fabric technologies to meet quality expectations. Growth in real estate development and personal home improvement trends supports expansion across professional and consumer segments globally.

Home renovation and remodeling projects are a key growth driver for the paint rollers market. Property owners increasingly take on personal home improvement activities, preferring tools that are both affordable and easy to use. Paint rollers offer broad surface coverage, speed, and consistent finishes—making them ideal for wall and ceiling applications in residential spaces. Growth in small-scale repair and redecoration further fuels the need for convenient painting tools. In the commercial sector, refurbishment of offices, retail outlets, and institutional buildings creates sustained demand for professional-grade rollers. Builders and contractors often rely on high-performance rollers with superior absorbency and fabric durability to maximize coverage and reduce application time. As housing turnover and rental maintenance cycles continue globally, demand for surface-coating tools remains stable. The market also benefits from rising interest in creative interior design and personalized home aesthetics, both of which encourage frequent use of rollers in do-it-yourself projects.

While paint rollers are essential tools for coating surfaces, the market faces saturation due to widespread availability of low-cost products. Basic roller designs often lack clear differentiation, leading to price-driven competition that limits margin growth for manufacturers. Many products appear similar in appearance and construction, making it difficult for consumers to distinguish between quality levels without trial. This commoditization poses a challenge for brands seeking to build loyalty or expand into premium categories. Additionally, mass-market options may overshadow advanced offerings that feature enhanced ergonomics, surface-specific fabric blends, or improved reusability. Retailers often prioritize low-cost variants, reducing shelf space and visibility for high-end products. Online channels can further intensify the focus on price over performance. Unless manufacturers invest in clearer performance labeling, user education, and visible quality distinctions, elevating product value within this crowded landscape will remain difficult. Achieving premium positioning requires both innovation and effective marketing that communicates tangible application benefits.

The rise of commercial construction, institutional refurbishment, and specialty painting projects creates new opportunities for targeted paint roller innovations. Hotels, schools, hospitals, and offices require frequent repainting for maintenance and visual updates, stimulating professional demand. These environments often use specialized coatings such as anti-microbial, textured, or low-VOC paints—requiring rollers that ensure uniform application and compatibility with unique formulations. Similarly, industrial facilities rely on durable rollers for concrete surfaces, epoxy coatings, or fire-resistant paints. Paint roller manufacturers can address these needs through purpose-built tools featuring high-density fabrics, solvent-resistant cores, and efficient frame designs. Custom-length rollers and corner tools are also increasingly relevant in complex architectural spaces. As contractors seek tools that reduce labor time and improve finish quality, innovation tailored to surface types and paint systems becomes a competitive advantage. Manufacturers and distributors that collaborate with professionals to develop practical roller solutions can secure market share in these performance-driven niches.

One of the key restraints in the paint rollers market is the challenge of waste management and limited product lifespan. Many rollers are designed for single-use or short-term application, especially in DIY settings, leading to increased landfill contribution. Roller covers made from synthetic materials are often not recyclable or biodegradable, raising environmental concerns. Additionally, improper cleaning or storage shortens reusability, further accelerating disposal rates. In institutional procurement, bulk purchasing of disposable painting tools may conflict with sustainability initiatives or facility-wide green targets. While reusable and eco-conscious alternatives exist, they often come at a higher cost or require specific cleaning protocols that users may find inconvenient. This limits their adoption outside professional painting services. Addressing this restraint requires manufacturers to innovate in biodegradable materials, modular designs, and education around cleaning and reusability. Until these concerns are resolved at scale, environmental impact will remain a limiting factor for responsible procurement and eco-conscious consumers.

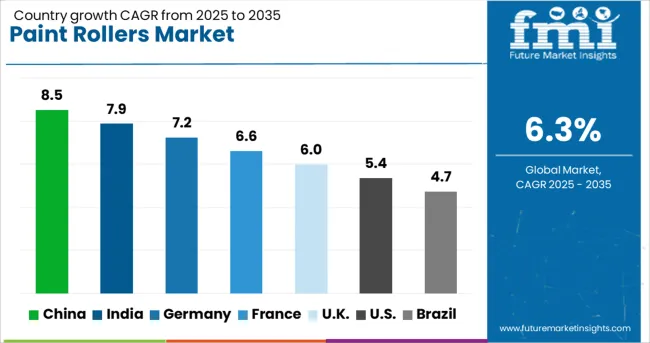

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

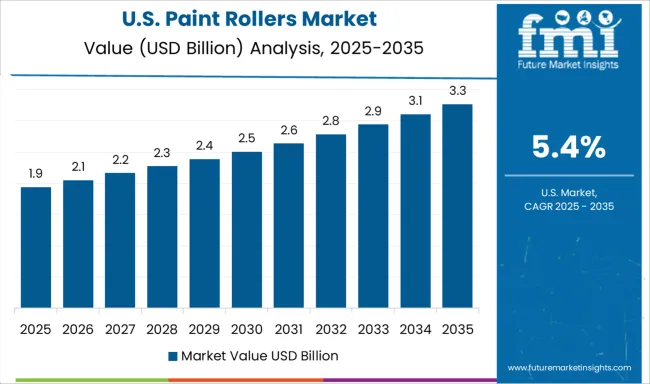

| USA | 5.4% |

| Brazil | 4.7% |

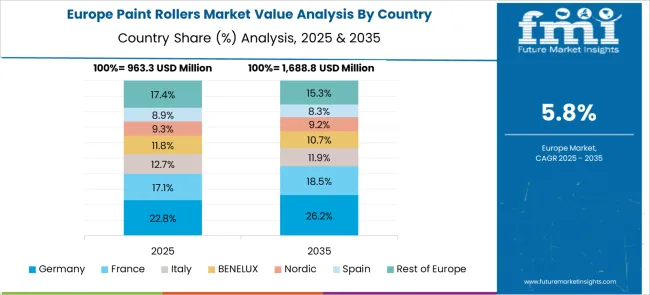

The global paint rollers market is projected to grow at a CAGR of 6.3% through 2035, driven by rising residential and commercial construction, DIY home improvement trends, and increased demand for efficient painting tools. Among BRICS nations, China leads with 8.5% growth, supported by high-volume manufacturing, competitive pricing, and exports to global retail chains. India follows at 7.9%, driven by growth in the construction sector, small-scale tool manufacturing, and expanding domestic demand. In the OECD region, Germany posts 7.2% growth, reflecting demand for high-performance rollers in precision applications and environmentally friendly coatings. The United Kingdom, at 6.0%, emphasizes premium home renovation tools and sustainable material usage. The United States, growing at 5.4%, remains a steady market with focus on ergonomic designs, contractor-grade rollers, and innovation in material composition. This report includes insights on 40+ countries; the top five markets are shown here for reference. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The paint rollers market in China is expanding at a robust CAGR of 8.5%, fueled by increased demand from large-scale residential and infrastructure projects. Regional suppliers are producing advanced roller types that support high-viscosity paints used in prefabricated housing. Cost-efficient manufacturing and domestic sourcing have reduced import reliance and enabled bulk production of microfiber and blended foam rollers. Builders working on high-rise apartment complexes favor rollers that offer high coverage with minimal spatter. Meanwhile, hardware retailers are bundling rollers with wall prep kits to serve new home buyers. Demand is also growing for extendable handle rollers that assist in ceiling and exterior work without scaffolding.

In India, paint rollers market is growing steadily at a CAGR of 7.9%, driven by repainting activity in semi-urban housing and commercial spaces. Smaller paint contractors and DIY users are contributing to the rise in demand for easy-to-clean roller designs. Roller manufacturers are customizing nap lengths to suit varied regional surfaces, such as lime-plastered or concrete walls. Home improvement retailers are seeing strong sales in tier-2 cities, where renovation frequency is increasing. Paint companies have begun offering roller sets as part of promotional painting bundles. Additionally, rollers with textured patterns are finding use in decorative wall finishes, appealing to both aesthetic and functional needs.

In Germany, the paint rollers market is expanding at a CAGR of 7.2%, supported by interior remodeling in homes and public buildings. Demand has shifted toward high-quality rollers that ensure uniform coating without lint shedding. Commercial painters are using synthetic blend rollers to cover large surfaces like offices and hospitals efficiently. Environmental preferences have led to growing adoption of reusable rollers with washable covers. Large homeware stores are featuring rollers with ergonomic handles to reduce strain during prolonged painting. Educational campaigns by paint brands are also promoting the right roller-to-paint pairing, further influencing consumer purchasing patterns.

In the United Kingdom, the paint rollers market is growing at a CAGR of 6.0%, with demand rooted in home redecorating and lease-end refresh projects. Tenants and landlords are buying budget roller kits for repainting before property transitions. Rollers designed for semi-gloss and washable paints are particularly sought after in kitchens and living spaces. Hardware stores have introduced compact roller sets with corner tools for small apartments. There’s also a shift toward quick-drying paint-compatible rollers that help reduce downtime during renovation. Disposable foam rollers are widely used for one-day projects involving trims and moldings.

The United States paint rollers market is registering a CAGR of 5.4%, driven by repainting projects in aging homes and office spaces. Professionals and DIY users are purchasing multi-surface rollers that work across drywall, wood, and textured finishes. Major paint brands offer combo kits that include roller covers for matte and satin paints. Large-format rollers are in demand for open-plan spaces and exterior siding. Regional hardware chains are promoting rollers with shed-resistant technology for premium paint applications. Additionally, replaceable roller sleeves have gained popularity for reducing waste during mid-size maintenance projects.

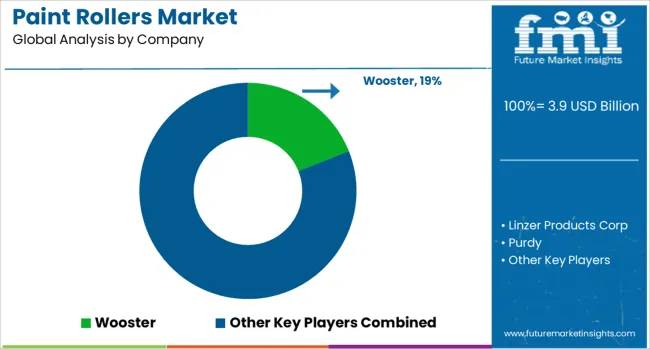

The paint rollers market serves both professional painters and DIY consumers, with demand linked closely to the residential, commercial, and industrial painting sectors. Prominent players such as Wooster, Linzer Products Corp, and Purdy dominate the North American market, offering a wide variety of roller types tailored for different surfaces, coatings, and finishes. These companies maintain strong retail distribution through hardware chains and home improvement stores, ensuring product visibility and customer accessibility. International players like Work Tools International and Beorol have carved niches with specialized offerings and a growing presence in emerging markets.

Their product lines often feature ergonomic handles, durable core materials, and compatibility with a wide range of paints, helping them attract both contractors and homeowners. Product differentiation in this space typically revolves around nap thickness, lint-free finishes, and efficient coverage over various surface textures. Brands like Stanley, Magnolia Brush, and Rust-Oleum contribute to the market with their extensive hardware and painting tool portfolios. These companies leverage strong brand recognition and cross-category expertise to offer complementary painting accessories alongside rollers. Across the industry, ease of use, reusability, and compatibility with low-VOC or water-based paints are becoming standard requirements as customers look for convenience and reliability in painting tools.

On April 29, 2025, Purdy, celebrating its centennial year, officially introduced three new professional-grade products: the Altitude™ Roller Cover (offers 50% more coverage than WhiteDove™), the POLE+ Extension Pole (adjustable up to 16 ft with pin-locks), and the Pro‑Extra™ High‑Capacity Brush (holds 40% more paint when used with premium coatings).

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Product | Woven and Knit |

| Fabric | Synthetic and Blended |

| Pile Depth | Medium pile, Shorter pile, and High pile |

| Application | Construction and Appliances |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wooster, Linzer Products Corp, Purdy, Work Tools International, Beorol, Stanley, Magnolia Brush, and Rust-Oleum |

| Additional Attributes | Dollar sales vary by fabric and pile depth, with woven and medium-pile rollers dominating value, while knit and foam types grow fastest. Asia‑Pacific leads volume, North America holds substantial value. Pricing fluctuates with raw material costs. Growth accelerates via ergonomic designs, eco‑friendly materials, and DIY trends. |

The global paint rollers market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the paint rollers market is projected to reach USD 7.2 billion by 2035.

The paint rollers market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in paint rollers market are woven, _synthetic, _blended, knit, _synthetic and _blended.

In terms of fabric, synthetic segment to command 41.0% share in the paint rollers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Paint Booth Market Size and Share Forecast Outlook 2025 to 2035

Painting Tool Market Size and Share Forecast Outlook 2025 to 2035

Paint Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Knife Market Size and Share Forecast Outlook 2025 to 2035

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Paint Mixing Market Analysis - Size, Share, and Forecast Outlook for 2025-2035

Market Share Insights of Paint Can Manufacturers

Market Share Breakdown of Paint Protection Film Manufacturers

Paint Additives Market Growth 2024-2034

Faux Paints And Coatings Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Small Paint Pail Market Size and Share Forecast Outlook 2025 to 2035

Metal Paint Tray Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Metal Paint Can Market Trends & Industry Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA