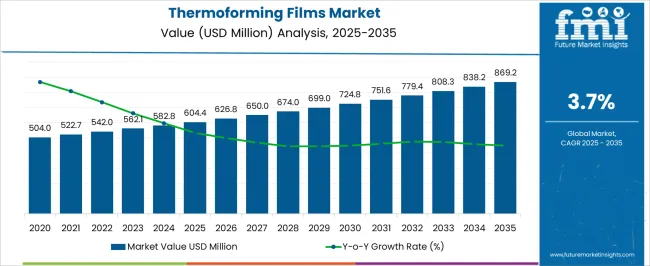

The Thermoforming Films Market is estimated to be valued at USD 604.4 million in 2025 and is projected to reach USD 869.2 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Thermoforming Films Market Estimated Value in (2025 E) | USD 604.4 million |

| Thermoforming Films Market Forecast Value in (2035 F) | USD 869.2 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The thermoforming films market is experiencing accelerated growth as industries transition toward advanced, lightweight packaging formats that offer durability, cost-efficiency, and enhanced shelf appeal. The shift from rigid to semi-flexible and flexible packaging formats has been a key driver, supported by changing consumer preferences and increased emphasis on sustainable packaging. Thermoforming films have gained significant traction due to their ability to form customized, secure, and contamination-resistant packaging, making them highly relevant in food processing, pharmaceuticals, and consumer goods.

Regulatory push for reducing plastic usage has encouraged the development of recyclable and biodegradable variants, further contributing to market expansion. Advancements in multilayer co-extrusion technologies and compatibility with vacuum and MAP (Modified Atmosphere Packaging) systems are providing additional impetus.

The market outlook remains positive, with growing investments from packaging converters and manufacturers focusing on material efficiency, longer shelf life, and smart integration of barrier technologies Continued evolution of automation in packaging lines is expected to drive wider adoption across emerging markets and tier-2 food processors.

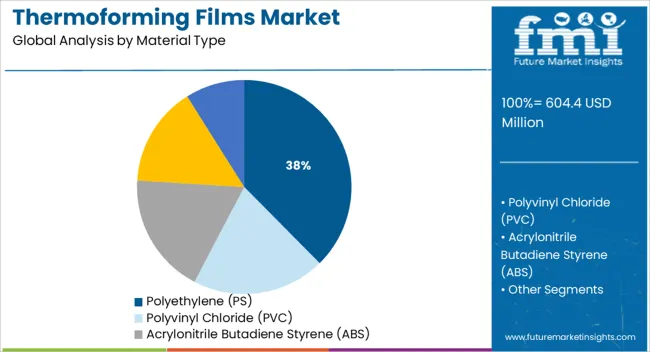

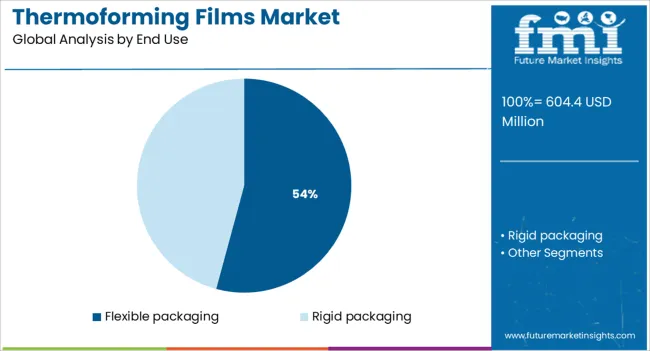

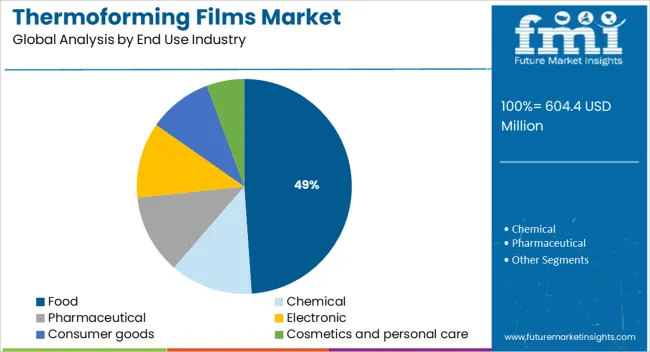

The market is segmented by Material Type, End Use, and End Use Industry and region. By Material Type, the market is divided into Polyethylene (PS), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Ethylene vinyl alcohol (EVOH), and Polyamide (PA). In terms of End Use, the market is classified into Flexible packaging and Rigid packaging. Based on End Use Industry, the market is segmented into Food, Chemical, Pharmaceutical, Electronic, Consumer goods, and Cosmetics and personal care. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene material type segment is expected to capture 37.6% of the total revenue share in the thermoforming films market in 2025, establishing itself as the leading material. The widespread use of polyethylene in thermoforming applications is being driven by its exceptional flexibility, processability, and cost-effectiveness. Its compatibility with multilayer film structures and barrier coatings has made it a preferred choice for manufacturers aiming to balance durability with affordability.

Polyethylene’s favorable sealing properties and resistance to moisture and contaminants have further enhanced its use in packaging solutions that require hygiene and extended shelf life. The material’s adaptability to vacuum and modified atmosphere technologies has also contributed to its growth, particularly in high-volume production settings.

Ongoing innovations in recyclable polyethylene grades and downgauging capabilities have aligned well with sustainability goals, leading to broader acceptance across regulatory-conscious markets Its availability in a variety of grades and densities has allowed tailored solutions for specific end-use formats, strengthening its position as the material of choice in this market.

The flexible packaging segment is projected to hold 54.2% of the total share in the thermoforming films market in 2025, making it the most dominant application segment. Growth in this area is being driven by increasing demand for convenient, lightweight, and portable packaging formats across food, medical, and personal care sectors. Thermoforming films are being used extensively in flexible packaging due to their ability to conform to complex shapes while offering strength and seal integrity.

The ability to integrate barrier properties within flexible layers without compromising visual appeal or structural stability has positioned this segment at the forefront of packaging innovation. Rising adoption of on-the-go and single-serve product formats has further amplified the relevance of flexible packaging, especially in urban and fast-paced consumer markets.

Advancements in film lamination and printing technologies have made it possible to offer enhanced shelf impact and branding potential, while still maintaining cost efficiencies Increasing consumer preference for resealable, compact, and eco-conscious packaging solutions continues to support this segment’s upward trajectory.

The food end use industry segment is anticipated to account for 48.9% of the overall revenue share in the thermoforming films market in 2025, emerging as the most significant consumer of these materials. The segment’s leadership is being driven by stringent food safety requirements, rising demand for packaged and processed foods, and the need for extended shelf life across global food supply chains.

Thermoforming films have become integral to vacuum skin packaging, meat trays, dairy containers, and ready-to-eat meal kits due to their superior clarity, strength, and barrier properties. The compatibility of these films with high-speed packaging machinery and their ability to maintain freshness through advanced sealing and oxygen barrier functions have made them indispensable in food applications.

Growth in cold chain logistics and supermarket penetration in developing economies has also fueled demand for food-grade thermoforming films Consumer expectations for visually appealing, tamper-evident, and convenient food packaging have reinforced this material’s relevance, especially among retailers aiming to reduce food waste and improve sustainability outcomes.

Increasing demand for packed food items and various other products is inspiring packaging manufacturers for to utilize their resources for achieving better & economical packaging solutions to gain the competitive advantage in the market.

In thermoforming process, thermoforming films are transformed into the desired design of molds either by pressure molding or vacuum forming technology. Thermoforming technology is suitable for manufacturing of PA/EVOH based multilayer films and containers thus providing efficient packaging solution without hampering the barrier properties of the packaging.

Thermoforming films are an effective solution for storage of food products which has helped thermoforming films to gain popularity in packaging industry within a short span of time. The type and design of the thermoforming films can be easily obtained according to the industrial requirement by changing the thickness of the thermoforming sheet.

To tap the growing potential of the packaging industry packaging manufacturers are exploiting their resources for providing better packaging solutions to its customers. Thermoforming films is one such packaging solution used by packaging manufacturers for filling the gap in economical packaging in the flexible and rigid packaging market. World packaging market is estimated to around USD 827 Billion and expected to grow at a CAGR of over 4% over the forecast period.

The use of containers manufactured from thermoforming films provides bulk packaging solutions for food and medical industry is one of the key drivers for the thermoforming film's market. Products packed in thermoforming films have the higher turnover ratio as they are packed in transparent films and have higher product visibility without compromising with the barrier properties of the packaging.

Thermoforming films are puncture resistance which enables manufacturers to use their products for packaging of sharp products while increasing the area of application for thermoforming films market. Some other new developments such as the entrance of thermoforming films suitable for microwave cooking is supporting the growth in thermoforming films market.

However, plastic being the most used raw material for manufacturing of the thermoforming films there are speculations against the use of thermoforming films for packaging of food products which may limit its growth.

The increase in the usage of environment-friendly products can hamper the growth of thermoforming films market. However, on the backdrop of rapid growth in flexible packaging, the demand in thermoforming films market may have new opportunities.

Regionally global thermoforming films market is segmented into

APEJ is expected to be the largest and the fastest-growing segment in the world region attributed to the rapid industrialization in the region. North America is the largest precipitate consumer of goods in the world is expected to follow APEJ region in thermoforming films market.

Latin America is expected to grow rapidly over the forecast period. Western & Eastern Europe are expected to grow moderately over the forecast period. MEA despite being the smallest region in thermoforming films market is expected to grow rapidly over the forecast period

Some key players of the thermoforming film's market are Vecom Group, Vishakha Polyfab Pvt. Ltd, Klöckner Pentaplast, DuPont, Soretrac (UK) Limited, SKY-LIGHT A/S, Hypac Packaging Pte Ltd., Peiyu Plastics Corporation, AVI Global Plast., vivavak.mk, Verstraete in mold labels, Synpac Limited, F.H.P. PAK Sp. z o.o., Clifton Packaging Group Limited, Welch Fluorocarbon Inc, RapidMade, Inc. and FLAIR Flexible Packaging Corporation.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain . The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

Thermoforming films market is segmented by material type, by end use, and by end-use industry.

Flexible packaging

The global thermoforming films market is estimated to be valued at USD 604.4 million in 2025.

The market size for the thermoforming films market is projected to reach USD 869.2 million by 2035.

The thermoforming films market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in thermoforming films market are polyethylene (ps), polyvinyl chloride (pvc), acrylonitrile butadiene styrene (abs), ethylene vinyl alcohol (evoh) and polyamide (pa).

In terms of end use, flexible packaging segment to command 54.2% share in the thermoforming films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Thermoforming Films Industry

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Automatic Thermoforming Vacuum Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

MDO-PE Films Market Analysis by Cast Films and Blown Films Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Retort Films Market

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Films Market Size and Share Forecast Outlook 2025 to 2035

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA