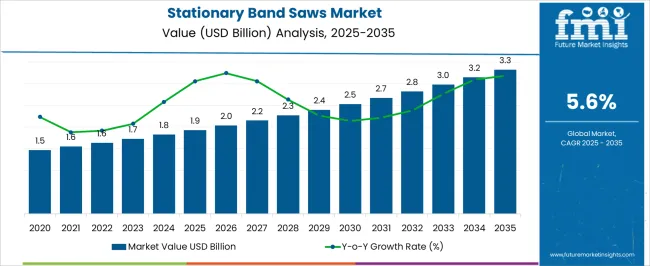

The stationary band saws market is projected to grow from USD 1.9 billion in 2025 to USD 3.3 billion in 2035, advancing at a CAGR of 5.6%. This translates to an absolute dollar opportunity of USD 1.4 billion over the ten-year period. Early momentum will be seen as the market increases from USD 2.0 billion in 2026 to USD 2.4 billion in 2029, setting the foundation for stronger growth ahead. Midway through the forecast, values rise to USD 2.7 billion in 2031, reflecting consistent adoption and demand expansion that provides manufacturers and distributors with scalable revenue opportunities.

The later years present the largest revenue gains, as the market progresses from USD 2.8 billion in 2032 to USD 3.3 billion by 2035, showcasing incremental opportunities of nearly USD 0.5 billion within just three years. This indicates a more accelerated phase of adoption, making capacity scaling and portfolio expansion critical. The cumulative USD 1.4 billion absolute opportunity demonstrates significant long-term revenue potential. Companies that align pricing, distribution, and operational strategies with this projected growth curve will be positioned to capture maximum incremental gains and secure stronger competitive positions in the stationary band saws market.

| Metric | Value |

|---|---|

| Stationary Band Saws Market Estimated Value in (2025 E) | USD 1.9 billion |

| Stationary Band Saws Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

In the stationary band saws market, the first notable breakpoint appears in the early forecast window from 2025 to 2028, where values move from USD 1.9 billion to USD 2.2 billion. This phase marks steady demand expansion and sets the stage for broader adoption, with annual increments of roughly USD 0.1 billion. The following breakpoint occurs around 2029–2031, when the market advances from USD 2.4 billion to USD 2.7 billion, signifying a stronger growth phase. This transition highlights the importance of timely production scaling and efficient distribution to capture incremental revenues during this consistent uptrend.

Major breakpoint occurs in the 2032–2035 period, where the market climbs from USD 2.8 billion to USD 3.3 billion. This stage represents the most concentrated growth momentum in absolute terms, adding nearly USD 0.5 billion in just three years. Intermediate years such as 2033 (USD 3.0 billion) and 2034 (USD 3.2 billion) highlight how the market sustains its trajectory before peaking in 2035. For stakeholders, recognizing these breakpoints allows targeted investment strategies prioritizing early entry for foundational growth and late-stage scaling to capitalize on high-value increments before the market stabilizes near maturity.

The current market landscape is shaped by the rising need for precision cutting and automation, which has elevated the adoption of advanced sawing technologies. The market’s future outlook is strengthened by ongoing investments in industrial automation, growing infrastructure development, and the need for energy-efficient and high-performance cutting solutions. Innovations in cutting mechanisms and integration with smart factory systems are enhancing operational efficiency and accuracy, creating new opportunities.

The shift towards Industry 4.0 practices and the increasing adoption of CNC-controlled machinery are expected to propel the market further, as manufacturers prioritize productivity and precision. This evolving environment is fostering the deployment of versatile band saws adaptable to diverse industrial applications, solidifying the market’s expansion prospects.

The stationary band saws market is segmented by product type, operating technology, application, end-use, distribution channel, and geographic regions. By product type, stationary band saws market is divided into Vertical band saws and Horizontal band saws. In terms of operating technology, stationary band saws market is classified into Computer Numerical Control (CNC) and Conventional.

Based on application, stationary band saws market is segmented into Metalworking, Woodworking, Plastic Manufacturing, and Others (Ceramics & glass fabrication, composites working, etc.). By end-use, stationary band saws market is segmented into Automotive, Aerospace & Defense, Energy & Power, Electronics & Semiconductor, Building & Construction, and Others (Healthcare, marine, etc.).

By distribution channel, stationary band saws market is segmented into Indirect Sales and Direct Sales. Regionally, the stationary band saws industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

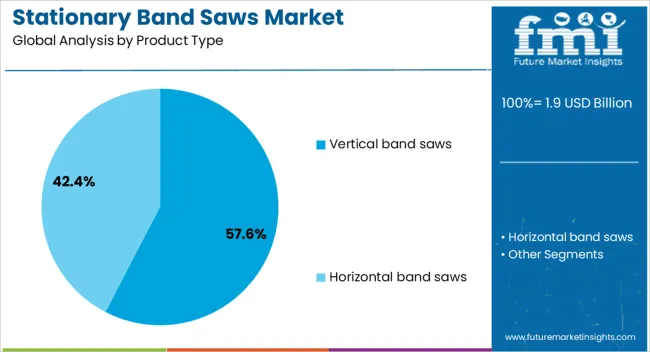

The vertical band saws segment is projected to hold 57.6% of the Stationary Band Saws market revenue share in 2025, establishing it as the leading product type. This prominence is attributed to its superior capability for versatile and precise cutting operations, especially in complex and irregular shapes.

The vertical orientation facilitates ease of material handling and improved operator safety, factors that have accelerated adoption in production facilities. Additionally, vertical band saws support a wide range of blade sizes and cutting speeds, enhancing adaptability for various metal types and thicknesses.

Their robust construction and lower maintenance requirements have made them preferable for heavy-duty industrial use. The growing demand for efficient, accurate, and flexible cutting tools in metal fabrication and manufacturing environments continues to underpin this segment’s strong market position.

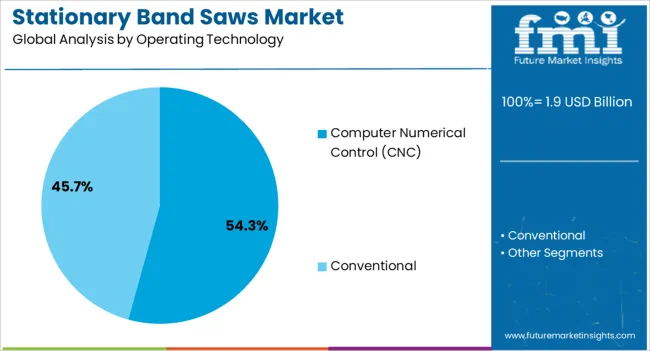

The Computer Numerical Control operating technology segment is anticipated to account for 54.3% of the overall market revenue in 2025, representing the largest share among operating technologies. This leadership stems from CNC’s ability to automate cutting processes with high precision, repeatability, and speed, significantly reducing human error.

The integration of CNC technology enhances productivity by enabling complex cutting patterns and ensuring consistent quality output. Furthermore, CNC-controlled band saws facilitate seamless integration into automated production lines and smart manufacturing systems, aligning with the broader Industry 4.0 trends.

As manufacturers increasingly seek to optimize production efficiency and reduce downtime, the demand for CNC band saws has been steadily rising. The segment’s growth is further supported by advancements in user-friendly software interfaces and remote operation capabilities.

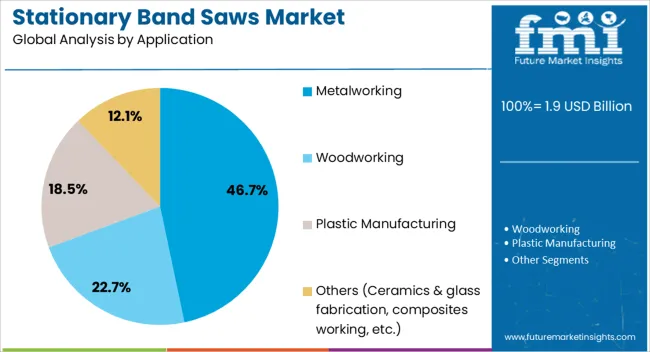

The metalworking application segment is expected to hold 46.7% of the Stationary Band Saws market revenue share in 2025, making it the largest application sector. This dominance is driven by the extensive use of band saws in cutting and shaping metal components across automotive, aerospace, construction, and general manufacturing industries.

The segment’s growth has been fueled by the increasing complexity of metal parts requiring precise cuts and the demand for high throughput in production lines. Metalworking operations benefit significantly from the stationary band saws’ ability to handle various metal types and thicknesses while maintaining dimensional accuracy.

Additionally, the ongoing industrial shift towards automated and integrated manufacturing environments is promoting the adoption of band saws tailored to metalworking needs. The efficiency gains and cost savings achieved through advanced sawing technologies are reinforcing the segment’s leading market position.

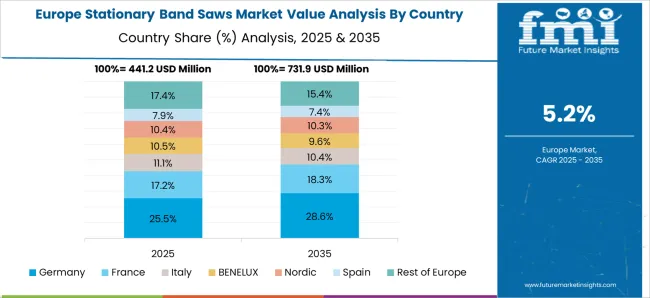

The stationary band saws market is expanding with rising demand from woodworking, metalworking, and manufacturing industries. North America and Europe lead adoption due to strong industrial bases, advanced workshops, and demand for precision tools. Asia-Pacific demonstrates rapid growth, supported by construction, furniture manufacturing, and increasing small workshop setups. Manufacturers differentiate through motor capacity, blade durability, cutting precision, and safety features. Regional differences in industrial investment, price sensitivity, and technological maturity shape adoption trends, procurement choices, and competitive positioning globally.

The quality of blade design, tension control, and cutting precision significantly shapes user adoption of stationary band saws. North America and Europe emphasize high-tolerance cutting for woodworking, metal fabrication, and specialty applications, relying on advanced blade alloys and precision calibration. Asia-Pacific focuses on robust, cost-effective blades suitable for large-scale production and basic workshop needs. These differences affect user satisfaction, tool longevity, and repeat purchases. Leading suppliers invest in premium blade technology, while regional producers provide affordable, functional options. Precision contrasts directly influence competitiveness across both industrial and small workshop markets.

Motor strength and machine durability remain key decision factors. Europe and North America highlight powerful, long-lasting motors capable of continuous operation in advanced manufacturing and professional workshops. Asia-Pacific often prioritizes cost-effective motors balancing adequate performance with affordable pricing for small to mid-size operations. Differences in motor capacity and durability impact efficiency, maintenance cycles, and ROI. Suppliers providing high-capacity, long-life units appeal to premium buyers, while regional firms focus on accessible, durable products. This divergence drives market segmentation across industrial, commercial, and semi-professional woodworking and metalworking users.

Safety features such as blade guards, emergency shutoffs, and ergonomic adjustments are vital in a stationary band saw design. Europe and North America enforce stringent safety regulations, prompting the adoption of certified, operator-friendly machines. Asia-Pacific markets prioritize affordable systems but are gradually incorporating improved safety designs as awareness and regulations increase. Variations in safety focus influence procurement approvals, workshop reliability, and accident risk. Global suppliers offering advanced safety-certified models gain trust in premium markets, while regional manufacturers meet demand for functional, budget-sensitive solutions. Safety contrasts affect adoption patterns and brand credibility worldwide.

Stationary band saws are distributed through industrial suppliers, hardware chains, online platforms, and direct contracts with workshops. North America and Europe rely heavily on professional distributors offering installation, training, and after-sales support. Asia-Pacific emphasizes local dealerships and online marketplaces to reach small workshops and contractors. Differences in distribution affect availability, product visibility, and adoption speed. Leading suppliers employ multi-channel approaches to expand reach, while regional producers focus on cost-efficient, localized distribution. Distribution contrasts define accessibility, user trust, and long-term growth across woodworking, construction, and industrial fabrication markets.

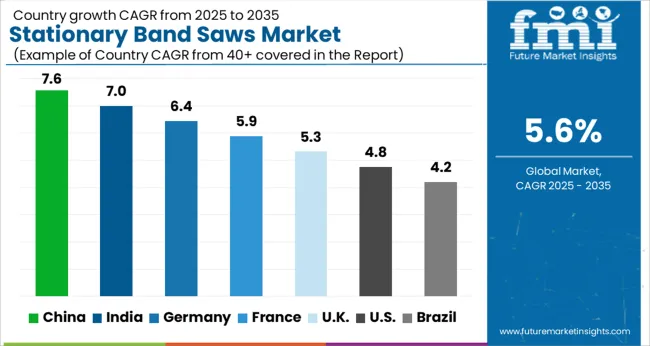

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global stationary band saws market was projected to grow at a 5.6% CAGR through 2035, driven by demand in woodworking, metalworking, and industrial fabrication applications. Among BRICS nations, China recorded 7.6% growth as large-scale manufacturing and assembly facilities were commissioned and compliance with industrial machinery standards was enforced, while India at 7.0% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 6.4% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 5.3% relied on moderate-scale operations for woodworking and light industrial applications. The USA, expanding at 4.8%, remained a mature market with steady demand across commercial and industrial fabrication segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The stationary band saws market in China is expanding at a CAGR of 7.6% driven by rising demand from woodworking, metalworking, and construction industries. Manufacturers are focusing on providing machines with high cutting accuracy, durability, and cost efficiency suitable for industrial as well as small workshop use. Growth is supported by the expansion of manufacturing facilities, furniture production, and infrastructure development. Suppliers are offering advanced stationary band saws designed to handle a wide range of materials, including wood, steel, and composites. Distribution channels include industrial equipment dealers, e-commerce platforms, and direct sales networks, ensuring wide accessibility across cities and industrial zones. Adoption is also supported by rising investments in automation of cutting processes and efficiency improvements in workshops. China remains a leading market due to its strong industrial base, growing demand from manufacturing sectors, and increasing preference for reliable cutting tools.

India is witnessing growth at a CAGR of 7.0% in the stationary band saws market, supported by expanding manufacturing activity, woodworking businesses, and metal fabrication industries. Companies are adopting stationary band saws to achieve precise cutting performance, improve productivity, and reduce material wastage. Growth is fueled by rising demand from construction projects, furniture making, and small to medium scale workshops. Manufacturers are supplying durable machines with features designed for efficiency, safety, and consistent performance. Distribution is facilitated through industrial equipment suppliers, regional dealers, and e-commerce platforms, increasing accessibility for businesses across both urban and semi-urban areas. Adoption is further supported by investments in upgrading production facilities and improving workshop efficiency. India continues to experience strong growth in this market due to expanding industrial activity, rising demand for woodworking equipment, and focus on precision cutting solutions.

Germany is growing at a CAGR of 6.4% in the stationary band saws market, driven by demand from industrial manufacturing, precision engineering, and woodworking businesses. Companies are adopting band saws to achieve high precision cutting, improve material handling, and enhance productivity in workshops. Growth is supported by strong demand from the construction and furniture sectors as well as the presence of advanced manufacturing industries. Suppliers are offering high performance stationary band saws with advanced safety features and durable build quality to meet the requirements of professional users. Distribution channels include equipment dealers, industrial suppliers, and direct sales networks, ensuring efficient access across regions. Adoption is further driven by emphasis on productivity improvement, reliable machinery, and workshop modernization. Germany remains a key European market due to its advanced industrial base, demand for high quality tools, and focus on efficient manufacturing processes.

The United Kingdom market is expanding at a CAGR of 5.3%, supported by demand from woodworking, construction, and metalworking industries. Companies are adopting stationary band saws to achieve precise and consistent cutting performance while reducing material wastage. Growth is supported by rising demand from small workshops, furniture makers, and construction projects. Manufacturers are providing machines designed with durability, safety, and efficiency in mind to meet diverse industrial and commercial requirements. Distribution through equipment dealers, industrial suppliers, and online platforms ensures accessibility across the country. Adoption is also driven by modernization of workshops and growing demand for reliable and cost effective cutting solutions. The United Kingdom continues to see steady growth as businesses focus on productivity, accuracy, and efficiency in their cutting processes.

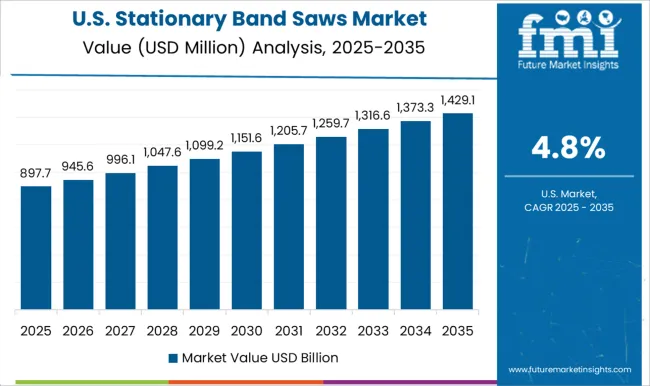

The United States market is growing at a CAGR of 4.8% due to rising adoption of stationary band saws in woodworking, metal fabrication, and construction industries. Companies are implementing these machines to improve productivity, ensure cutting accuracy, and handle a wide range of materials effectively. Growth is supported by demand from furniture making, construction projects, and small to medium scale manufacturing units. Manufacturers are offering durable and high performance stationary band saws equipped with advanced safety and efficiency features. Distribution through industrial equipment dealers, specialized suppliers, and e-commerce platforms ensures wide availability. Adoption is further driven by modernization of workshops, demand for precision cutting solutions, and focus on improving production efficiency. The United States remains an important market due to its large industrial sector, rising demand for woodworking equipment, and growing use of precision tools across commercial applications.

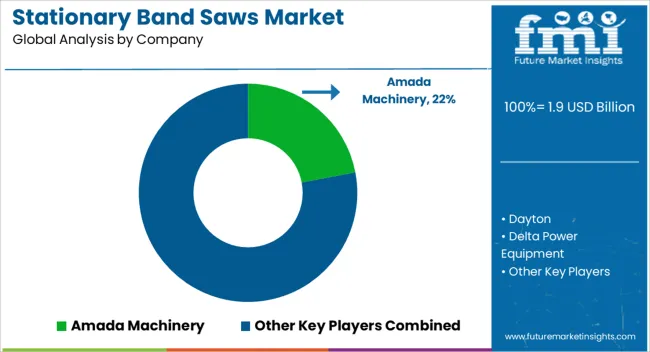

The stationary band saws market is driven by established players such as Amada Machinery, Dayton, Delta Power Equipment, DoAll Saws, Grizzly, HEM Saw, JPW Industries, Laguna Tools, Palmgren, Rikon, and Santec Group. These companies specialize in precision cutting machines that cater to industries including metal fabrication, woodworking, and construction. Their product offerings range from heavy-duty industrial band saws for steel processing to compact models for small-scale workshops. Competition in this market is shaped by cutting capacity, blade durability, and automation features. Companies like Amada Machinery and HEM Saw lead in advanced CNC-integrated saws designed for high-volume industrial use, while brands such as Grizzly, Laguna Tools, and Rikon target the woodworking segment with versatile, user-friendly machines.

Delta Power Equipment and JPW Industries focus on professional-grade equipment with a balance of affordability and performance, whereas Palmgren and Santec Group are known for niche and specialized solutions. Current trends highlight the integration of digital controls, energy-efficient motors, and improved safety mechanisms to meet the growing demand for accuracy and operator protection. Suppliers are also focusing on developing compact models for small and medium-sized enterprises while maintaining high-performance industrial lines for large-scale production. Partnerships with distributors and after-sales service networks remain critical strategies for enhancing market reach and customer loyalty.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Product Type | Vertical band saws and Horizontal band saws |

| Operating Technology | Computer Numerical Control (CNC) and Conventional |

| Application | Metalworking, Woodworking, Plastic Manufacturing, and Others (Ceramics & glass fabrication, composites working, etc.) |

| End-use | Automotive, Aerospace & Defense, Energy & Power, Electronics & Semiconductor, Building & Construction, and Others (Healthcare, marine, etc.) |

| Distribution Channel | Indirect Sales and Direct Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amada Machinery, Dayton, Delta Power Equipment, DoAll Saws, Grizzly, HEM Saw, JPW Industries, Laguna Tools, Palmgren, Rikon, and Santec Group |

| Additional Attributes | Dollar sales vary by product type, including vertical, horizontal, and dual-column stationary band saws; by application, such as woodworking, metalworking, and meat processing; by end-use industry, spanning manufacturing, construction, and food processing; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by industrial automation, demand for precision cutting, and expanding manufacturing and construction activities. |

The global stationary band saws market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the stationary band saws market is projected to reach USD 3.3 billion by 2035.

The stationary band saws market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in stationary band saws market are vertical band saws and horizontal band saws.

In terms of operating technology, computer numerical control (cnc) segment to command 54.3% share in the stationary band saws market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lead Acid Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Flow Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Geostationary Orbit Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

Grid Scale Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Behind the Meter Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Banding Machine Market Growth & Industry Forecast 2025-2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

X-Band Radar Market Size and Share Forecast Outlook 2025 to 2035

Laband Syndrome Therapeutics Market Growth - Trends & Future Innovations 2025 to 2035

Edge Banders Market Size and Share Forecast Outlook 2025 to 2035

Head Band Ophthalmoscopes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA