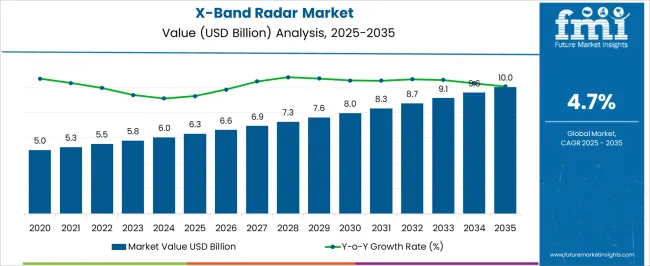

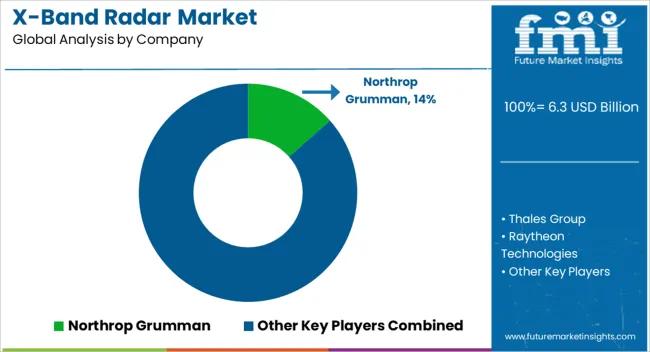

The X-Band Radar Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 10.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| X-Band Radar Market Estimated Value in (2025 E) | USD 6.3 billion |

| X-Band Radar Market Forecast Value in (2035 F) | USD 10.0 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The X-band radar market is expanding steadily, driven by rising defense modernization programs, increasing maritime surveillance needs, and the integration of advanced radar technologies into both military and civilian platforms. Defense journals and industry briefings have underscored the critical role of X-band radars in providing high-resolution imaging and target tracking capabilities under diverse environmental conditions.

Governments and defense organizations are prioritizing investments in radar systems that enhance situational awareness, missile defense, and air traffic management. Technological advancements such as digital beamforming, active electronically scanned arrays, and compact radar modules have accelerated deployment across land, air, and sea domains.

Press releases from defense contractors have highlighted strategic contracts and collaborations focused on next-generation naval and aerospace applications. Looking ahead, the market outlook remains positive, supported by the growing demand for integrated radar networks, increased deployment in border security, and advancements in autonomous defense platforms. The sea-based segment, AESA arrays, and defense applications are expected to remain central to future market growth, supported by continuous technological evolution and national security priorities.

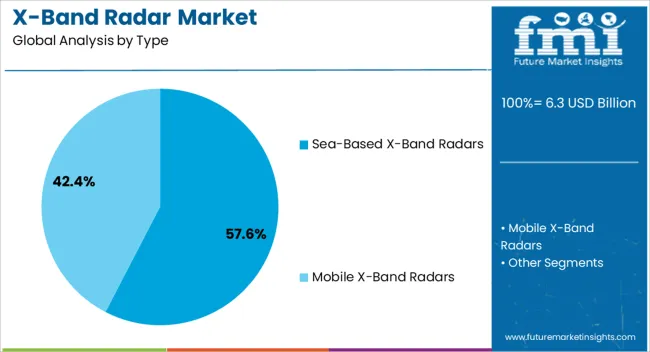

The Sea-Based X-Band Radars segment is projected to account for 57.6% of the market revenue in 2025, maintaining its leading position due to strong adoption in naval defense operations. Growth of this segment has been supported by the critical need for long-range maritime surveillance, early missile detection, and shipborne air defense systems.

Defense agencies have prioritized sea-based platforms to counter evolving threats in contested maritime regions, which has accelerated procurement of advanced radar-equipped vessels. Additionally, naval modernization programs in both developed and emerging economies have integrated sea-based X-band radars for enhanced situational awareness and fleet protection.

These radars’ ability to provide accurate target tracking under harsh weather and sea conditions has further strengthened their operational importance. With increasing naval investments and emphasis on maritime security, the Sea-Based X-Band Radars segment is expected to retain its dominance.

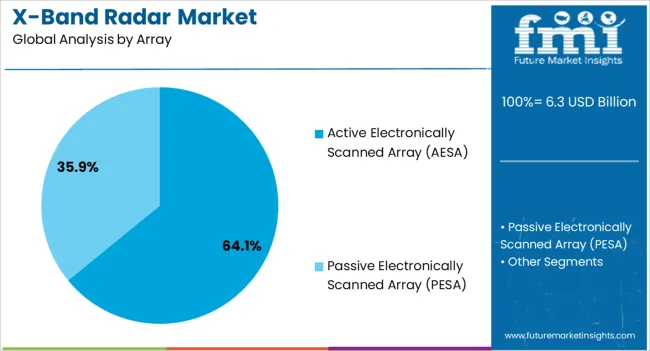

The Active Electronically Scanned Array (AESA) segment is projected to capture 64.1% of the X-band radar market revenue in 2025, reflecting its superiority over traditional radar architectures. AESA technology has been favored for its ability to perform multiple functions simultaneously, including tracking, surveillance, and targeting, without mechanical movement.

Its advantages in terms of faster beam steering, resistance to jamming, and reduced maintenance requirements have driven widespread adoption across naval, air, and ground-based defense systems. Defense contractors have increasingly emphasized AESA integration into next-generation platforms, citing operational efficiency and combat readiness as primary benefits.

Furthermore, AESA’s scalability allows deployment in both large strategic radars and compact mobile systems, widening its application base. With ongoing advancements in semiconductor materials and power efficiency, the AESA segment is expected to sustain its market leadership, reinforcing its position as the preferred radar array technology.

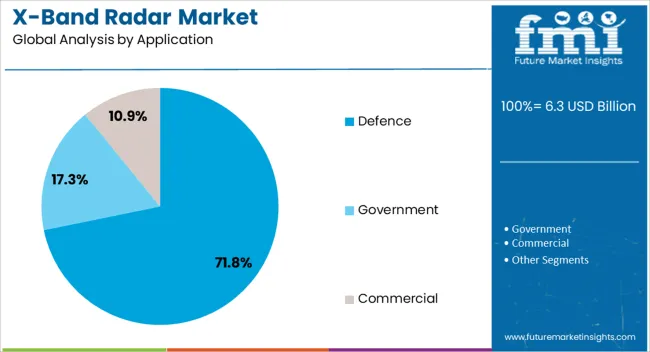

The Defence segment is projected to contribute 71.8% of the X-band radar market revenue in 2025, securing its position as the largest application area. This dominance has been reinforced by heightened global defense spending and the increasing complexity of modern warfare, which requires precision surveillance and threat detection systems.

X-band radars have been integral to missile defense, air defense, and battlefield surveillance, offering high-resolution capabilities critical for tactical and strategic operations. National defense strategies have prioritized radar procurement to strengthen air and maritime security in response to geopolitical tensions and cross-border threats.

Press releases from defense ministries have outlined multi-year procurement contracts for radar systems, reflecting sustained investment in this domain. Additionally, the adoption of radar networks for integrated command and control systems has strengthened the role of X-band radars in defense. With continuing focus on national security, modernization, and technological edge, the Defence segment is expected to remain the primary growth driver in the X-band radar market.

Regions with weak boundaries and coastlines escalated worries regarding border security, illegal immigration, trafficking, and terrorism. This has ushered in the demand for X-band radars for border surveillance, naval security, and coastal tracking usage.

The amplifying frequency and intensity of natural disasters like floods, hurricanes, and tsunamis have prompted an upsurge in the adoption of these radars. These radars are used for weather monitoring, early alert techniques, and disaster management settings. The objectives of these usages are to lower expenses and prevent potential dangers.

Advanced radar systems are necessary to thrive in situational cognizance, surveillance, and missile defense abilities. The surging defense expenditure, especially in North America, Europe, and the Asia Pacific, is the catalyst for X-band frequency radar demand.

| Attributes | Details |

|---|---|

| Valuation for 2020 | USD 5,461.31 million |

| Valuation for 2025 | USD 5,855.51 million |

| CAGR from 2020 to 2025 | 1.8% |

X-band radars are less productive for long-range tracking and surveillance usage since they have lower detection ranges than diverse radar bands. Their X-band frequency radar adoption is inhibited because of distinct use cases or operational contexts.

The different systems and users share the same frequency range, making the X-band bandwidth vulnerable to congestion. This amplifies interference issues hampering the quality of radar performance, needing the adoption of intricate mitigation equipment.

Civil freedoms and privacy constraints crop up from the innovation and technology advancements in X-Band radar systems. This impedes X-band radar market expansion by grabbing the attention of regulators, condemnation from the public, and legal concerns.

The segmented X-band radar market analysis is included in the following subsection. Based on comprehensive studies, the mobile X-Band radars sector is controlling the type category. Similarly, the Active Electronically Scanned Array (AESA) system segment is commanding the array category.

| Segment | Mobile X-band Radars |

|---|---|

| Share (2025) | 45.4% |

The X-band sonars are applied to select a range of environmental shifts and object interference from the radar's detection range. Every location accommodates the setup of an X-band radar. There are some situations where the X-band frequency radar does not need permanent installation.

In such cases, mobile X-band radars are beneficial. So, to curb the weight of the radars or deploy them to be mounted on other vehicles, providers are innovating novel technologies. These factors escalate the sales of mobile X-band radars.

| Segment | Active Electronically Scanned Array (AESA) System |

|---|---|

| Share (2025) | 60.5% |

Earlier, a broad range of marine boats used and installed passive electronically scanned arrays. Contrarily, the industry has witnessed a boom in the adoption of active electronically scanned arrays. Numerous vendors adopted AESA-based X-band radars. The AESA array type experienced a surge with a moderate CAGR between 2025 and 2035.

The X-band radar industry can be observed in the subsequent tables, which focus on the leading economies in Australia, China, the United States, Japan, and Germany. A comprehensive evaluation demonstrates that Australia has significant opportunities in the X-band frequency radar sector.

| Country | Australia |

|---|---|

| CAGR (2025 to 2035) | 8.2% |

Due to its favorable position in the Asia Pacific, Australia has a significant X-band frequency radar industry owing to the amplifying demand for proficient surveillance systems. The focus on monitoring extensive territorial oceans and enhancing early alert systems against potential threats is evident in its investment in X-band radar.

Australia's determination to fortify its marine security and national defense abilities influences the adoption of X-band radar technology. Growth opportunities for local vendors are bolstered by the Australian government's focus on producers for defense and security applications of X-band radar.

| Nation | China |

|---|---|

| CAGR (2025 to 2035) | 5.2% |

China's expanding naval and airborne capacities, which demand advanced tracking and surveillance systems, escalates the X-band sonar market expansion. The concentration on local innovation stimulates the advancements of domestic X-band radar solutions, reducing the dependency on external vendors.

To refine its defensive potential and situational cognizance, China is heavily financing the X-band frequency radar technology to advance its military infrastructure swiftly.

| Nation | United States |

|---|---|

| CAGR (2025 to 2035) | 1.6% |

The objective for prevalence in surveillance, tracking, and missile defense by the United States military escalates the continuing process in X-band radar technology. By employing this radar in multi-layered defensive infrastructures, the United States is able to identify and eradicate fresh adversaries, sustaining the country's security.

Joint ventures and defense agreements with partner states desiring proficient defense capabilities encourage United States-produced X-band frequency radar system export opportunities.

| Nation | Japan |

|---|---|

| CAGR (2025 to 2035) | 0.5% |

Investments in X-band radar technology are stimulated by Japan's active engagement in missile defense, which aims to amplify early warning and interception competence against prospective missile threats.

Japan can employ flexible and transportable surveillance solutions and adapt to shifting security issues due to its focus on development and the reduction of X-band radar technology. The fortifying of maritime security rules and the elevation of regional stability are the advantages of coastal defense infrastructure's incorporation of X-band frequency radar in Japan.

| Nation | Germany |

|---|---|

| CAGR (2025 to 2035) | 0.2% |

Germany's determination to update its defense potential and enhance situational perception in a shifting security environment bolsters the investments in X-band radar technology. The stress Germany places on dual-use utilizations of X-band radar systems makes it easier for civilian uses, like disaster management, air traffic control, and weather supervision.

The defense infrastructure of Germany, like X-band frequency radar, amplifies its capacity to identify and counterbalance shifting threats and augments security and stability in Europe.

There are numerous manufacturers in the global X-band radar market. The X-band sonar vendors face obstacles, like improving and redeveloping solutions while monitoring quality and cost. To flourish in the industry, the present X-band radar tracking providers identify trends and advancements in consumer prospects and modify their offerings correspondingly.

The augmenting use of dual and portable X-band frequency radar boosts competition among novel competitors and exhibits opportunities for producers. To stay relevant in the fiercely competitive sector that presents signs of expanding consolidation, X-band sensor manufacturers must venture apart by dispensing the pre-eminent goods and services.

Noteworthy Observations

| Company | CAES |

|---|---|

| Headquarter | United States |

| Recent Advancement | In August 2025, CAES received a contract of US$ 200 million from RTX Corporation to provide AN/SPY-6 radar for the United States Navy. The AN/SPY-6 radar system comprises an X-band radar designed for skyline investigation, missile communication, accurate tracking, and terminal illuminations. |

| Company | Thales Group |

|---|---|

| Headquarter | France |

| Recent Advancement | The Dutch Command Materiel and IT (COMMIT) and THALES entered into a formal agreement in June 2025 for the manufacturing and transportation of the Above Water Warfare System (AWWS) fire control cluster and detector suite for the Dutch and Belgian Anti-Submarine Warfare Frigates. The novel sensor suite employs technology as per the APAR Block 2 X-band and the SM400 Block 2 S-band radars. |

| Company | Raytheon Technologies |

|---|---|

| Headquarter | United States |

| Recent Advancement | Raytheon created the first radar antenna product in February 2025 for the United States Army's missile defense radar, called the Lower Tier Air and Missile Defense Sensor, which replaces the Patriot air and missile defense sensor. |

| Company | Saab |

|---|---|

| Headquarter | Sweden |

| Recent Advancement | A partnership between Saab and Heart Aerospace was established in September 2025. It envelops the provision of subsystems and the examination of diverse alliances' potentials like certification and manufacturing. |

| Company | Israel Aerospace Industries (IAI) |

|---|---|

| Headquarter | Israel |

| Recent Advancement |

|

The report consists of key types like mobile X-Band radars and sea-based X-Band radars.

The industry is classified into Active Electronically Scanned Array (AESA), and Passive Electronically Scanned Array (PESA).

Key applications present in the industry include government, defense, commercial, and others.

Analysis of the industry has been carried out in key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The global X-Band radar market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the X-Band radar market is projected to reach USD 10.0 billion by 2035.

The X-Band radar market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in X-Band radar market are sea-based X-Band radars and mobile X-Band radars.

In terms of array, active electronically scanned array (aesa) segment to command 64.1% share in the X-Band radar market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Radar Absorbing Materials Market Size and Share Forecast Outlook 2025 to 2035

Radar & LiDAR Technology for Railways - Trends & Forecast 2025 to 2035

Radar Level Transmitter Market Analysis - Growth & Forecast 2025 to 2035

Radar Market Analysis by Platform, Application, Type, and Region through 2035

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Marine Radar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar On Chip Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Market Growth - Trends & Forecast 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA