The grid scale stationary battery storage market is estimated to be valued at USD 48.1 billion in 2025 and is projected to reach USD 242.5 billion by 2035, registering a compound annual growth rate (CAGR) of 17.6% over the forecast period.

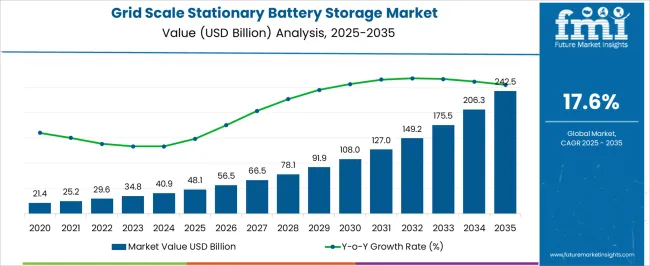

The grid-scale stationary battery storage market is valued at USD 48.1 billion in 2025 and is expected to reach USD 242.5 billion by 2035, with a CAGR of 17.6%. Between 2021 and 2025, the market grows from USD 21.4 billion to USD 48.1 billion, progressing through values of USD 25.2 billion, 29.6 billion, 34.8 billion, and 40.9 billion. This phase reflects the early adoption of grid-scale battery storage solutions, driven by increasing demand for energy storage to support renewable energy integration, enhance grid stability, and meet growing electricity consumption.

The half-decade weighted growth from 2025 to 2030 sees the market expanding from USD 48.1 billion to USD 91.9 billion, with intermediate values passing through USD 56.5 billion, 66.5 billion, 78.1 billion, and 91.9 billion. This acceleration is fueled by large-scale infrastructure projects, declining battery costs, and favorable government policies promoting clean energy and energy storage systems. Technological advancements in battery technologies, such as solid-state and flow batteries, also contribute significantly to the market’s growth.

Between 2031 and 2035, the market continues its robust expansion, reaching USD 242.5 billion. During this period, growth is driven by widespread adoption of stationary battery storage for grid balancing, utility-scale applications, and supporting decentralized energy systems. The significant rise in storage capacities, coupled with increasing investments in energy transition projects, positions the market for long-term growth.

| Metric | Value |

|---|---|

| Grid Scale Stationary Battery Storage Market Estimated Value in (2025 E) | USD 48.1 billion |

| Grid Scale Stationary Battery Storage Market Forecast Value in (2035 F) | USD 242.5 billion |

| Forecast CAGR (2025 to 2035) | 17.6% |

The energy storage market is the largest contributor, accounting for around 35-40%, as stationary batteries provide a reliable solution for large-scale energy storage, ensuring grid stability and energy availability during peak demand periods or supply disruptions. The renewable energy market also plays a significant role, contributing approximately 25-30%, as grid-scale battery storage is crucial for storing energy generated from intermittent renewable sources like solar and wind, allowing for their smooth integration into the grid and providing backup during low-generation periods. The electricity grid and distribution market contributes about 15-20%, as battery storage systems are increasingly used to enhance grid resilience, improve energy distribution efficiency, and balance supply and demand by storing excess power for later release.

The electric vehicle (EV) charging infrastructure market adds around 10-12%, as battery storage systems support the growing demand for EV charging stations by ensuring reliable, fast charging and mitigating pressure on the grid. Lastly, the industrial power generation market contributes approximately 8-10%, as grid-scale battery storage is used in industrial facilities to manage energy consumption and provide backup power, particularly in regions with unreliable grid connections or during power outages. These parent markets underscore the crucial role of grid-scale stationary battery storage in supporting renewable energy integration, grid efficiency, and industrial power management.

The grid scale stationary battery storage market is witnessing accelerated growth as the global energy ecosystem transitions toward renewable power generation and decentralized grid infrastructure. Increasing reliance on intermittent energy sources such as solar and wind is creating a growing need for large-scale energy storage systems that can maintain grid stability, balance supply and demand, and provide ancillary services.

Government mandates focused on decarbonization, alongside aggressive renewable energy targets, are further driving the deployment of grid-scale battery projects across key regions. Continuous advancements in battery technology, falling costs per megawatt-hour, and increased energy density are enhancing the commercial viability of long-duration storage.

Furthermore, the ability to defer costly grid upgrades and enable time-shifting of energy generation is positioning stationary battery systems as critical components in future grid planning As utilities and energy providers prioritize resilience, flexibility, and grid modernization, the demand for scalable, modular, and software-optimized battery solutions is expected to remain strong, paving the way for sustained market expansion over the coming years.

The grid scale stationary battery storage market is segmented by battery type, application, and geographic regions. By battery type, grid scale stationary battery storage market is divided into lithium-ion, sodium sulphur, lead acid, flow battery, and others. In terms of application, grid scale stationary battery storage market is classified into energy shifting & capacity deferral, frequency regulation, black start services, capacity firming, and others. Regionally, the grid scale stationary battery storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

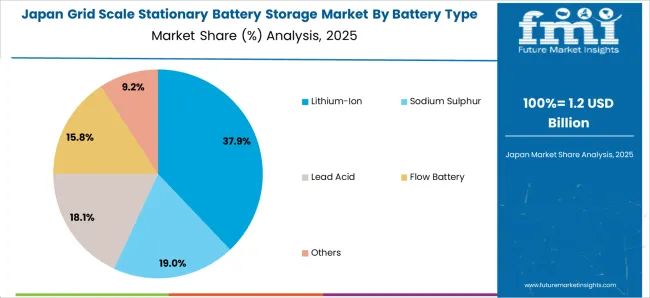

The lithium-ion battery segment is projected to hold 37.9% of the grid scale stationary battery storage market revenue share in 2025, establishing itself as the leading battery type. This dominance is being driven by the technology’s high energy density, cycle life, and efficiency, which make it ideally suited for large-scale energy storage deployments. Lithium-ion systems offer fast response times and flexible scalability, enabling grid operators to integrate renewable energy while maintaining frequency regulation and load balancing.

The rapid decline in manufacturing costs, due to economies of scale and technological improvements, has made lithium-ion solutions increasingly cost-effective for utility-scale installations. Additionally, the well-established supply chain and availability of multiple chemistries within the lithium-ion family provide options to meet specific storage duration and safety requirements.

Investments in battery recycling and second-life applications are also enhancing the segment’s sustainability and lifecycle economics As reliability and performance standards become more demanding, lithium-ion technology is expected to retain its leadership role in the market, supported by its adaptability and continuous innovation in battery cell design and system integration.

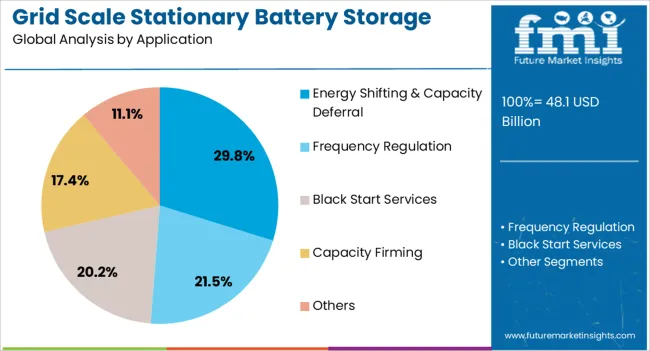

The energy shifting and capacity deferral segment is expected to account for 29.8% of the grid scale stationary battery storage market revenue share in 2025, making it the leading application segment. Its growth is being supported by the increasing demand for cost-effective solutions that allow utilities to delay or avoid investments in transmission and distribution infrastructure upgrades. By shifting energy from periods of low demand to peak consumption hours, battery storage systems are enabling a more balanced and efficient use of grid assets.

This functionality is proving especially valuable in regions with high renewable energy penetration, where storage is essential for managing intermittency and reducing curtailment. The application is also benefiting from improved energy arbitrage opportunities, allowing utilities and energy providers to capitalize on time-of-use pricing structures.

As grid operators look to enhance reliability and defer capital expenditures, the integration of energy shifting and capacity deferral applications into long-duration battery projects is gaining traction The segment’s role in optimizing grid performance and extending asset life is expected to sustain its strong market position in the years ahead.

The grid scale stationary battery storage market is expanding as utilities and industrial sectors increasingly adopt large-scale energy storage solutions to enhance grid stability, energy security, and the integration of renewable energy. These systems store electricity for later use, allowing for better management of energy supply and demand, especially with the growing penetration of intermittent renewable energy sources such as solar and wind. The market is driven by the need for backup power, load balancing, and frequency regulation.

Key drivers include falling battery costs, advancements in battery technologies, and government incentives aimed at promoting energy storage. Challenges in the market include high initial capital costs, regulatory barriers, and the need for more efficient and longer-lasting battery technologies. Opportunities lie in the development of high-energy-density storage solutions and the growing adoption of energy storage as a service (ESaaS) models. Trends indicate a shift toward lithium-ion and solid-state batteries, with an increasing focus on enhancing grid resilience and enabling more sustainable energy transitions.

The demand for grid scale stationary battery storage is growing due to the increasing need for energy storage to balance the variability of renewable energy sources such as solar and wind. These energy sources produce electricity intermittently, making it difficult for grid operators to manage supply and demand in real-time. Grid-scale battery storage systems allow excess energy to be stored when production is high and released when demand exceeds supply.

This technology is crucial for enhancing grid stability, providing backup power, and ensuring a reliable energy supply. As renewable energy generation continues to rise, the need for energy storage to support these systems and improve grid flexibility is expected to drive the market further. In addition, increasing energy security concerns are prompting investments in grid-scale storage solutions across both developed and emerging markets.

The grid scale stationary battery storage market faces several constraints, with high initial capital costs being a major barrier. Despite the declining cost of battery technology, the setup and installation of large-scale storage systems remain expensive, which can limit widespread adoption, especially in emerging markets or smaller utilities. Regulatory challenges related to grid integration, permits, and standards for energy storage technologies also complicate market growth.

In addition, the performance and lifespan of battery systems, particularly in extreme weather conditions, remain a concern. Technical constraints such as the need for high-efficiency batteries with longer cycle lives, faster charging/discharging times, and better energy density continue to drive innovation but also add complexity and cost to the market. Overcoming these technical and financial challenges will be key for expanding the adoption of stationary battery storage solutions globally.

Opportunities in the grid scale stationary battery storage market are particularly strong in the development of high-energy-density batteries such as lithium-ion and solid-state technologies. Lithium-ion batteries, which currently dominate the market, offer high efficiency, relatively low cost, and fast charging/discharging capabilities, making them ideal for grid applications. However, as solid-state battery technologies continue to evolve, they offer promising advantages in terms of energy density, safety, and cycle life, presenting new opportunities for grid-scale applications.

Additionally, energy storage as a service (ESaaS) models are emerging as a cost-effective way for utilities and commercial customers to access energy storage without the need for large upfront capital investments. These models enable companies to lease storage capacity, offering greater flexibility and lowering the barrier to entry. As demand for cleaner, more reliable energy storage solutions increases, these developments are expected to open new avenues for growth in the market.

The grid scale stationary battery storage market is witnessing trends toward automation, smart grid integration, and improved battery longevity. The integration of smart grid technologies is enabling better control and management of battery storage systems, allowing utilities to optimize storage, improve load forecasting, and enhance grid reliability. Additionally, automation in energy storage systems is reducing the need for manual intervention, lowering operational costs, and improving efficiency.

There is also an increasing focus on extending the lifespan of batteries through advancements in battery chemistry and system design. Longer-lasting batteries reduce replacement costs and increase the economic feasibility of energy storage solutions for grid operators. These trends are making grid-scale stationary battery storage systems more reliable, cost-effective, and scalable, accelerating their adoption worldwide.

| Country | CAGR |

|---|---|

| China | 23.7% |

| India | 22.0% |

| Germany | 20.2% |

| France | 18.4% |

| UK | 16.7% |

| USA | 14.9% |

| Brazil | 13.2% |

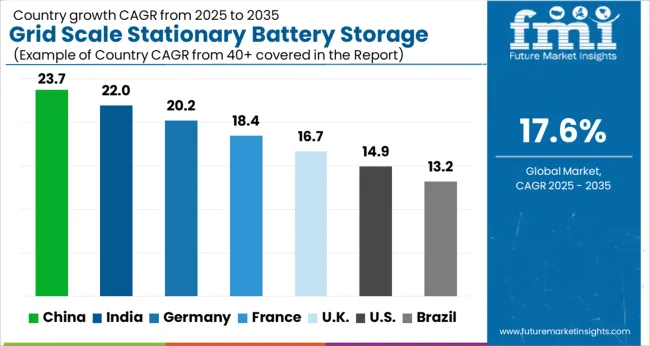

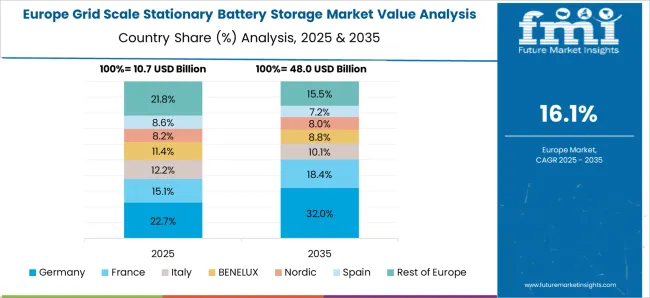

The global grid-scale stationary battery storage market is projected to grow at a CAGR of 17.6% from 2025 to 2035. China leads the market with the highest growth rate of 23.7%, followed by India at 22.0% and Germany at 20.2%. The UK and the USA have moderate growth rates of 16.7% and 14.9%, respectively. The demand for stationary battery storage is driven by the increasing adoption of renewable energy, grid modernization efforts, and government-backed policies. As countries transition to cleaner energy, the need for reliable storage solutions continues to rise. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the grid-scale stationary battery storage market, growing at a CAGR of 23.7% from 2025 to 2035. The demand for battery storage in China is driven by the rapid expansion of renewable energy generation, particularly in wind and solar power, which requires large-scale storage solutions to balance grid stability. China’s push for energy independence and growing investments in energy infrastructure are further boosting the market for battery storage systems.

The country is also focusing on improving energy efficiency, and stationary battery storage plays a crucial role in stabilizing power supply during peak demand. With the government’s continuous focus on enhancing grid reliability and reducing energy consumption, the market for grid-scale storage systems is expanding rapidly. China’s dominant position in manufacturing battery components also provides a strong competitive advantage in the global market.

The grid-scale stationary battery storage market in India is projected to grow at a CAGR of 22.0% from 2025 to 2035. India is focusing on integrating renewable energy into its grid, with ambitious plans to expand solar and wind power capacity. Battery storage is crucial for stabilizing the grid as these renewable sources are intermittent. With India’s energy consumption increasing rapidly, the demand for large-scale storage systems is on the rise to manage grid stability and load balancing.

The country’s growing investments in energy storage technology and infrastructure development are further enhancing the market outlook. India’s transition to electric vehicles also creates a dual demand for battery storage technologies, helping drive market growth. Government policies supporting clean energy initiatives and grid modernization efforts are accelerating the adoption of stationary battery storage.

The grid-scale stationary battery storage market in Germany is expected to grow at a CAGR of 20.2% from 2025 to 2035. As Europe’s largest renewable energy producer, Germany is focusing on enhancing its grid capabilities to accommodate an increasing share of renewable energy sources, which require storage systems to manage supply-demand imbalances. The country’s commitment to energy efficiency, coupled with its increasing demand for clean power, is driving the adoption of large-scale storage systems.

The German government’s policies to reduce emissions and modernize the grid further support the need for reliable battery storage solutions. Additionally, Germany’s manufacturing capabilities and strong R&D efforts in battery technologies position it as a key player in the global market for stationary battery storage.

The UK’s grid-scale stationary battery storage market is expected to grow at a CAGR of 16.7% from 2025 to 2035. The UK is increasingly integrating renewable energy into its grid to meet emissions reduction goals. The growing need for flexible energy storage systems to support renewable sources, such as wind and solar power, is driving the demand for stationary battery storage.

The government’s commitment to reducing carbon emissions and modernizing the grid further strengthens the market. The rise of electric vehicles and energy storage systems for both residential and industrial use is also contributing to growth. As the UK shifts toward a low-carbon economy, grid-scale storage solutions will continue to play a crucial role in managing the stability and reliability of the energy system.

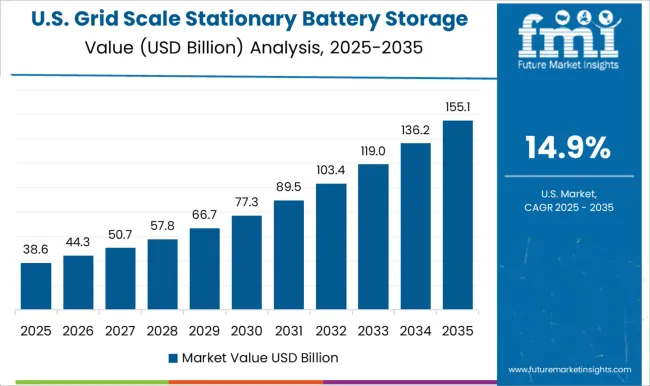

The USA grid-scale stationary battery storage market is projected to grow at a CAGR of 14.9% from 2025 to 2035. The country’s efforts to transition to renewable energy are driving the demand for large-scale storage solutions, particularly to balance the supply and demand of intermittent renewable sources. As the USA expands its renewable energy generation capacity, battery storage systems are becoming essential to ensure grid stability, especially during peak demand periods.

The federal government’s policies, including tax incentives and grants for energy storage solutions, are further encouraging the adoption of stationary battery storage systems. The USA also benefits from its advanced manufacturing and R&D capabilities, positioning the country as a leader in the battery storage market.

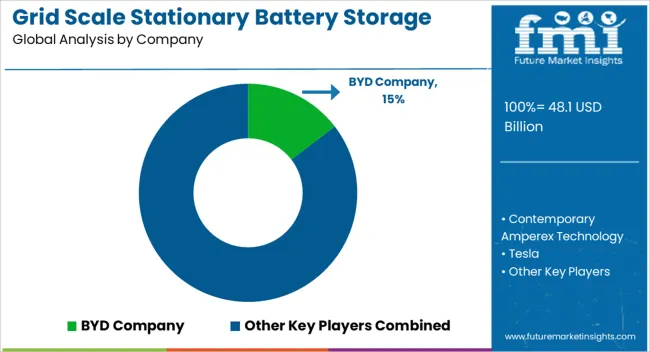

The grid-scale stationary battery storage market is becoming highly competitive as the need for efficient energy storage solutions grows. BYD Company, a major market player, offers large-scale lithium-ion battery systems designed for grid applications. Their strategy focuses on cost-effective, high-capacity solutions tailored for regions with significant renewable energy integration. Contemporary Amperex Technology (CATL), a global leader in battery manufacturing, competes by offering advanced energy storage systems that meet both short-term and long-term storage needs.

CATL’s emphasis on high performance and innovation has solidified its standing in the market. Tesla, with its Megapack, provides high-density energy storage that seamlessly integrates with solar power, ensuring grid stability. Tesla's expertise in both energy storage and solar power has helped it maintain a dominant market position. LG Energy Solution provides robust lithium-ion battery solutions optimized for utility-scale projects. The company focuses on maximizing storage capacity while ensuring long cycle life and high energy density.

SAMSUNG SDI, Panasonic Corporation, and SK Innovation also play significant roles by offering innovative battery technologies for large-scale energy storage. SK Innovation specializes in modular battery systems that offer flexible configurations, while Panasonic continues to be recognized for its advanced storage solutions. Hitachi Energy and Toshiba Corporation compete by integrating energy storage systems with advanced grid management technologies, improving energy reliability and optimizing grid performance.

Johnson Controls, GS Yuasa International, Siemens Energy, HOPPECKE Batterien, and Exide Technologies offer a range of solutions, from lithium-ion to lead-acid batteries, to meet varying energy storage needs. Their strategies center around delivering scalable, cost-effective, and reliable systems that contribute to a smooth energy transition and grid stability. Product brochures from these companies emphasize critical features such as long cycle life, high energy density, and system flexibility, which allow for seamless integration with renewable energy sources.

| Item | Value |

|---|---|

| Quantitative Units | USD 48.1 billion |

| Battery Type | Lithium-Ion, Sodium Sulphur, Lead Acid, Flow Battery, and Others |

| Application | Energy Shifting & Capacity Deferral, Frequency Regulation, Black Start Services, Capacity Firming, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BYD Company, Contemporary Amperex Technology, Tesla, LG Energy Solution, SAMSUNG SDI, Panasonic Corporation, SK Innovation, Hitachi Energy, Toshiba Corporation, Johnson Controls, GS Yuasa International, Siemens Energy, HOPPECKE Batterien, and Exide Technologies |

| Additional Attributes | Dollar sales by battery type, application, and energy capacity are rising, driven by renewable adoption, grid stability needs, and smart grid tech, with strong regional growth in North America, Europe, and Asia-Pacific |

The global grid scale stationary battery storage market is estimated to be valued at USD 48.1 billion in 2025.

The market size for the grid scale stationary battery storage market is projected to reach USD 242.5 billion by 2035.

The grid scale stationary battery storage market is expected to grow at a 17.6% CAGR between 2025 and 2035.

The key product types in grid scale stationary battery storage market are lithium-ion, sodium sulphur, lead acid, flow battery and others.

In terms of application, energy shifting & capacity deferral segment to command 29.8% share in the grid scale stationary battery storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Grid Casting Machine Market Size and Share Forecast Outlook 2025 to 2035

Grid Packings Market Size and Share Forecast Outlook 2025 to 2035

Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Griddles Market

On Grid Residential Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid Solar PV Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

AC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

Microgrid Market Size and Share Forecast Outlook 2025 to 2035

BGA Packaging Market Insights – Size, Demand & Growth through 2034

Smart Grid Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Analytics Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Home Area Network (HAN) Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Technology Market Analysis - Growth, Demand & Forecast 2025 to 2035

Power Grid Market Size, Share, Trends & Forecast 2024-2034

Smart Grid Sensors Market

Ground Grid Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA