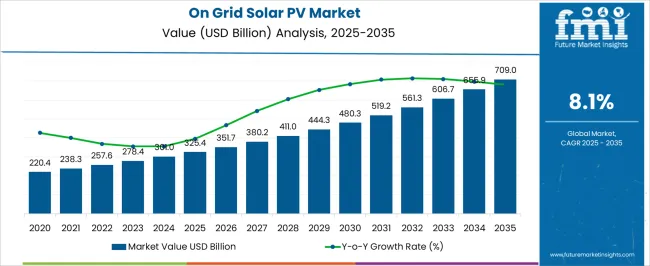

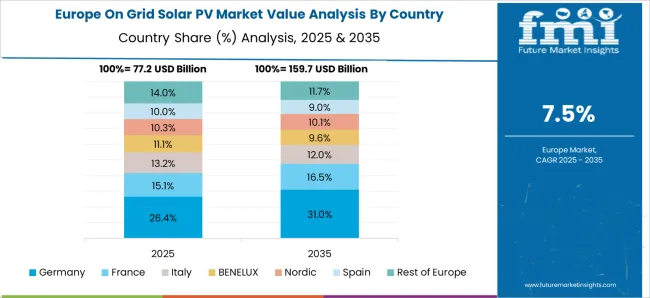

The on grid solar PV market, estimated at USD 325.4 billion in 2025 and projected to reach USD 709.0 billion by 2035 at a CAGR of 8.1%, exhibits pronounced regional growth imbalances driven by policy incentives, infrastructure maturity, and renewable energy adoption. Asia-Pacific dominates the market, accounting for the largest share due to supportive government policies, aggressive solar capacity expansion, and declining photovoltaic module costs.

Countries such as China, India, and Japan are spearheading large-scale installations, leveraging favorable tariffs, tax incentives, and streamlined permitting processes. This regional concentration accelerates cumulative market growth, driving the segment from USD 325.4 billion in 2025 to over USD 519.2 billion by 2030. Europe, while mature in grid integration and technology adoption, experiences moderate growth due to policy stability and high market saturation. Investment in utility-scale projects continues, but incremental capacity additions contribute to slower market expansion compared with Asia-Pacific.

The region is expected to grow from USD 351.7 billion in 2026 to USD 561.3 billion by 2030, reflecting steady but measured adoption rates. North America demonstrates a moderate growth trajectory, driven by federal and state-level incentives, renewable portfolio standards, and corporate sustainability initiatives. Slower grid modernization and comparatively higher installation costs constrain adoption. The regional market is projected to expand from USD 380.2 billion in 2027 to USD 606.7 billion by 2031, highlighting a persistent gap relative to Asia-Pacific dominance. Asia-Pacific’s lead, supported by policy and infrastructure, underscores regional disparities in market expansion and technology deployment.

| Metric | Value |

|---|---|

| On Grid Solar PV Market Estimated Value in (2025 E) | USD 325.4 billion |

| On Grid Solar PV Market Forecast Value in (2035 F) | USD 709.0 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The on grid solar PV market represents a specialized segment within the global renewable energy and solar power industry, emphasizing grid-connected electricity generation, efficiency, and sustainability. Within the broader solar energy market, it accounts for about 5.7%, driven by adoption across utility-scale, commercial, and large residential installations. In the photovoltaic module and panel manufacturing sector, it holds nearly 4.9%, reflecting demand for high-efficiency panels, inverters, and grid integration equipment.

Across the distributed energy solutions and smart grid segment, the market captures 4.3%, supporting energy management, demand response, and network stability. Within the building-integrated solar solutions category, it represents 3.8%, highlighting use in commercial rooftops, solar carports, and façade systems. In the renewable energy services and installation sector, it secures 3.4%, emphasizing operational reliability, monitoring, and maintenance services. Recent developments in this market have focused on module efficiency, inverter technology, and grid integration solutions. Innovations include bifacial panels, high-efficiency monocrystalline modules, and smart inverters for enhanced energy yield and grid compliance.

Key players are collaborating with utilities, EPC companies, and energy service providers to expand deployment and optimize system performance. Adoption of real-time monitoring, predictive maintenance, and IoT-enabled energy management systems is gaining traction for improved operational efficiency. Additionally, floating solar installations, hybrid PV-storage solutions, and advanced mounting systems are being implemented to maximize generation potential and space utilization.

The on grid solar PV market is experiencing rapid expansion driven by increasing global demand for sustainable and renewable energy sources. Current trends indicate a strong preference for grid-connected solar power systems as governments and utilities focus on reducing carbon emissions and enhancing energy security.

The falling cost of photovoltaic panels, coupled with supportive policies and incentives, is accelerating adoption across diverse regions. Growing electricity demand, advancements in inverter technologies, and integration with smart grids are further supporting market growth.

The outlook remains positive as investments in large-scale solar projects and the modernization of power infrastructure continue to gain momentum. Opportunities exist in expanding solar capacity in both emerging and developed markets, with emphasis on improving efficiency and grid stability.

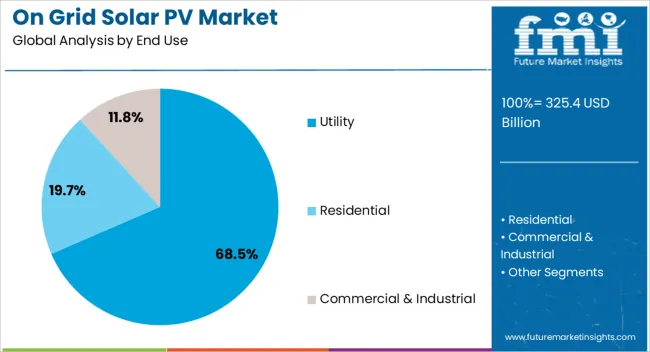

The on-grid solar PV market is segmented by end use and geographic regions. By end use, the on-grid solar PV market is divided into Utility, Residential, and Commercial & Industrial. Regionally, the on-grid solar PV industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Utility end-use segment is anticipated to hold 68.5% of the overall on-grid solar PV market revenue in 2025, making it the dominant segment. This leadership is attributed to the large-scale deployment of solar PV systems by utilities aiming to meet renewable energy targets and diversify energy portfolios. The segment benefits from favorable regulatory frameworks that encourage utility-scale solar farms and grid integration projects.

Additionally, the growing demand for reliable and clean energy supplies has accelerated investment in utility-scale solar infrastructure. The segment’s growth is supported by advancements in system design that enable efficient power generation and easier grid synchronization.

Furthermore, utilities are increasingly leveraging software and hardware innovations to optimize energy output and manage grid stability, reinforcing the prominence of this segment. As the energy transition accelerates globally, the utility segment is expected to remain the key driver of revenue in the on-grid solar PV market.

The market has experienced substantial growth as governments and industries accelerate the adoption of renewable energy solutions to meet increasing electricity demand and reduce carbon emissions. On grid solar photovoltaic systems, connected directly to the utility grid, allow excess power to be fed into the network, offering cost savings and energy efficiency benefits. Expanding investments in large-scale solar farms, rooftop installations, and urban energy infrastructure have strengthened market momentum. Technological advancements in high efficiency solar panels, inverters, and monitoring systems have enhanced power generation and reliability.

Government initiatives, subsidies, and regulatory frameworks have been pivotal in accelerating the deployment of on grid solar PV systems. Feed-in tariffs, net metering policies, and tax credits incentivize both residential and commercial users to invest in solar energy. Utility companies actively collaborate with developers to integrate solar PV systems into existing power grids, enhancing grid stability and energy availability. Strategic renewable energy targets in multiple countries have also contributed to project approvals and funding. These policy measures encourage innovation and large-scale adoption while ensuring predictable returns on investment. As a result, public and private sector initiatives continue to drive widespread installation of on grid solar PV systems globally.

Innovations in photovoltaic technology, inverter efficiency, and energy management software have significantly improved the performance of on grid solar PV systems. High efficiency mono- and polycrystalline panels allow greater power output from limited rooftop or land area. Smart inverters and real time monitoring systems optimize power flow, prevent overloading, and ensure safe interaction with the grid. Integration with energy storage solutions, although limited in pure on grid systems, enhances reliability in hybrid configurations. Technological improvements also reduce maintenance requirements and increase system lifespan. Continuous research in materials, module design, and digital monitoring solutions strengthens the competitiveness of on grid solar PV systems compared to conventional energy sources.

The adoption of on grid solar PV systems has expanded in urban and industrial environments where rooftop space can be effectively utilized. Manufacturing plants, commercial buildings, and residential complexes leverage available roof area to generate electricity while offsetting grid dependency. Large-scale commercial installations benefit from economies of scale, reducing overall energy expenditure. Urban planning and green building certifications increasingly encourage solar PV integration. The industrial parks and warehouse facilities adopt systems to maintain sustainability goals and enhance corporate social responsibility. This trend of rooftop and facility-based installations continues to provide consistent opportunities for manufacturers, installers, and technology providers in the on grid solar PV market.

Despite strong growth, the market faces challenges related to grid infrastructure limitations, regulatory uncertainty, and intermittent power generation. Integration into aging grids requires modernization to handle variable power flow and prevent voltage fluctuations. Policy revisions, delays in subsidy disbursement, and regional discrepancies in regulations can impact project planning and investment confidence. The dependency on sunlight restricts output during cloudy conditions, necessitating supplementary grid power or hybrid solutions. Competition from decentralized storage and off-grid systems adds complexity. To overcome these challenges, stakeholders are focusing on grid upgrades, standardized policies, and hybrid solutions that enhance system reliability while maintaining market expansion.

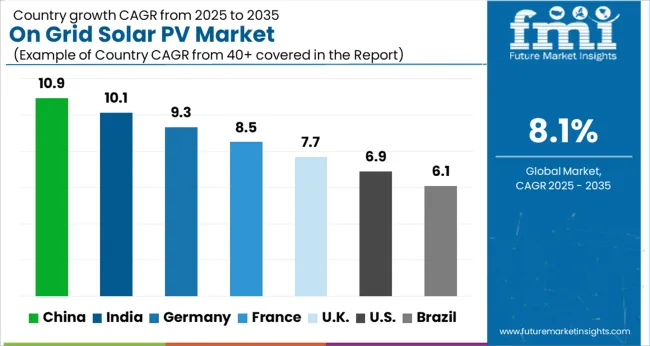

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

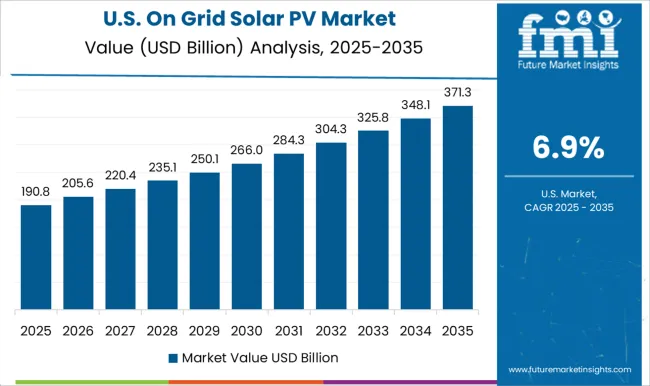

| USA | 6.9% |

| Brazil | 6.1% |

The market is expected to expand at a CAGR of 8.1% between 2025 and 2035, driven by rising renewable energy adoption and supportive policies. Germany, at 9.3% and the UK, at 7.7% are enhancing deployment through the modernization of energy infrastructure and the integration of advanced solar technologies. China leads with 10.9, fueled by large-scale solar installations and government incentives, while India, at 10.1%, demonstrates robust growth with increasing utility-scale projects. The USA, at 6.9%, maintains steady expansion through distributed solar initiatives and technological advancements. Collectively, these countries illustrate a global trend of adoption, production, and innovation in on grid solar PV systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to expand at a CAGR of 10.9%, driven by government policies supporting renewable energy, large scale solar farms, and distributed rooftop installations. Adoption has been reinforced by falling solar module prices, increasing grid integration, and private and commercial sector investments. Chinese manufacturers focus on high-efficiency modules, smart inverters, and energy management systems to enhance performance and reliability. Exports of solar components have also grown significantly, reinforcing China’s position as a global leader. The market outlook remains strong as the country continues to prioritize renewable energy adoption and grid modernization.

India is projected to grow at a CAGR of 10.1%, supported by government initiatives like the National Solar Mission, net metering policies, and incentives for rooftop and utility scale projects. Adoption has been reinforced by increasing demand from commercial and industrial sectors for clean energy solutions. Domestic manufacturers focus on cost effective modules, smart inverters, and integrated energy management solutions. Market growth is expected to remain strong as investments in grid infrastructure and renewable energy integration continue across India.

Germany is anticipated to expand at a CAGR of 9.3%, influenced by strong adoption of distributed rooftop solar, corporate sustainability initiatives, and feed in tariff schemes. Technological improvements in solar inverters, energy storage integration, and monitoring solutions have reinforced adoption. German manufacturers focus on high efficiency modules, quality assurance, and grid compatible solutions. Export of German solar technology to neighboring European countries further strengthens market growth. The outlook indicates steady expansion as renewable energy adoption remains a national priority.

The United Kingdom market is expected to grow at a CAGR of 7.7%, driven by expansion of commercial rooftop solar, industrial applications, and grid connected systems. Incentives, net metering policies, and corporate renewable procurement initiatives have reinforced adoption. Imported high efficiency solar modules are widely used alongside domestic solutions for commercial and industrial applications. The market is expected to grow steadily as renewable energy penetration and distributed generation initiatives increase across the U K.

The United States market is projected to expand at a CAGR of 6.9%, supported by large scale utility projects, corporate renewable energy adoption, and distributed rooftop solar. State incentives, tax credits, and renewable portfolio standards have reinforced adoption. Leading manufacturers and installers focus on high efficiency modules, integrated inverters, and energy management systems for grid connected applications. The market outlook remains positive as investments in clean energy infrastructure and corporate sustainability goals continue to drive demand for on grid solar PV systems.

The market is highly competitive, comprising a blend of multinational manufacturers, regional producers, and technology-driven innovators. Leading global companies such as Trina Solar, Canadian Solar, First Solar, Jinko Solar, and JA Solar Technology Co., Ltd. dominate the market through large-scale production capacities, integrated manufacturing facilities, and extensive international distribution networks. These companies focus on efficiency, module durability, and cost competitiveness to secure utility-scale and commercial installations worldwide.

Regional players, including CSUN Solar Tech, EMMVEE Solar, Renesola, and Shunfeng International Clean Energy, cater to localized markets, often offering tailored solutions aligned with regional policies and grid standards. Tier-one technology providers like LG Electronics, Q CELLS, and Solaria Corporation differentiate through advanced photovoltaic technologies, such as bifacial modules and high-efficiency panels, targeting premium segments and performance-sensitive applications. Pricing strategies, technological innovation, and strong after-sales service networks further intensify competition. Companies increasingly invest in R&D to improve module efficiency, reduce degradation rates, and integrate smart energy management solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 325.4 Billion |

| End Use | Utility, Residential, and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trina Solar, Canadian Solar, CsunSolarTech, EMMVEE SOLAR, First Solar, JA SOLAR Technology Co., Ltd., Jinko Solar, LG Electronics, Q CELLS, REC Solar Holdings AS, Renesola, Shunfeng International Clean Energy, Solaria Corporation, Solar Frontier KK, and Yingli Solar |

| Additional Attributes | Dollar sales by module type and capacity, demand dynamics across residential, commercial, and utility-scale installations, regional trends in grid-connected solar adoption, innovation in efficiency, inverter technology, and smart grid integration, environmental impact of manufacturing and lifecycle energy use, and emerging use cases in net-metering, distributed generation, and urban energy solutions. |

The global on grid solar pv market is estimated to be valued at USD 325.4 billion in 2025.

The market size for the on grid solar pv market is projected to reach USD 709.0 billion by 2035.

The on grid solar pv market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in on grid solar pv market are utility, residential and commercial & industrial.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Online Clothing Rental Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

On-orbit Satellite Servicing Market Forecast and Outlook 2025 to 2035

Onshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Onsite Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

On-shelf Availability Solution Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Oncology Based Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

On-site Preventive Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

On-Board Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Online To Offline Commerce Market Size and Share Forecast Outlook 2025 to 2035

On-Demand Logistics Market Size and Share Forecast Outlook 2025 to 2035

Online Travel Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onboard Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Online Fitness Market Size and Share Forecast Outlook 2025 to 2035

Oncolytic Adenovirus Market Size and Share Forecast Outlook 2025 to 2035

Online Gambling Market Size and Share Forecast Outlook 2025 to 2035

Online Laundry Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA