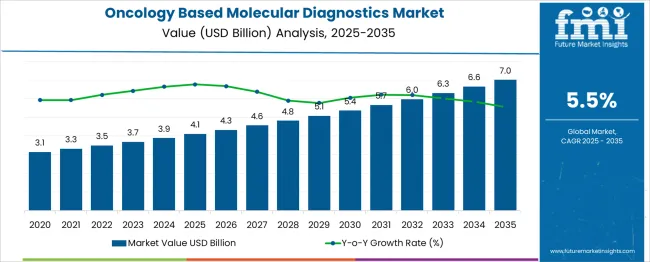

The global oncology based molecular diagnostics market is likely to reach from USD 4.1 billion in 2025 to approximately USD 7 billion by 2035, recording an absolute increase of USD 2.9 billion over the forecast period. This translates into a total growth of 70.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035. The market size is expected to grow by nearly 1.71X during the same period, supported by the rising incidence of cancer worldwide and increasing adoption of precision medicine approaches in oncology diagnostics.

Quick Stats for Oncology Based Molecular Diagnostics Market

Between 2025 and 2030, the oncology based molecular diagnostics market is projected to expand from USD 4.1 billion to USD 5.4 billion, resulting in a value increase of USD 1.3 billion, which represents 44.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising cancer incidence rates, increasing adoption of personalized medicine approaches, and growing awareness of early cancer detection benefits. Healthcare providers are expanding their molecular diagnostic capabilities to address the growing complexity of cancer diagnosis and treatment selection procedures.

From 2030 to 2035, the market is forecast to grow from USD 5.4 billion to USD 7 billion, adding another USD 1.6 billion, which constitutes 55.2% of the ten-year expansion. This period is expected to be characterized by the expansion of liquid biopsy technologies, the integration of artificial intelligence in diagnostic interpretation, and the development of comprehensive genomic profiling platforms across diverse cancer types. The growing adoption of next-generation sequencing and advanced biomarker discovery will drive demand for more sophisticated molecular diagnostic capabilities and specialized laboratory expertise.

Between 2020 and 2025, the oncology-based molecular diagnostics market experienced steady expansion, driven by increasing cancer screening programs and growing emphasis on targeted therapy selection. The market developed as healthcare systems recognized the need for precise molecular characterization of tumors and personalized treatment approaches. Insurance coverage and regulatory approvals began supporting molecular diagnostic adoption to improve patient outcomes and treatment efficacy.

| Parameter | Value |

| Market Value (2025) | USD 4.1 billion |

| Market Forecast Value (2035) | USD 7 billion |

| Market Forecast CAGR | 5.5% |

Market expansion is being supported by the rapid increase in global cancer incidence and the corresponding need for precise molecular characterization of tumors to guide treatment decisions. Modern oncology practice relies on molecular diagnostic technologies to identify specific genetic mutations, protein expressions, and biomarkers that determine optimal treatment strategies for individual patients. Even early-stage cancers can require comprehensive molecular profiling to ensure appropriate therapeutic intervention and monitoring approaches.

The growing complexity of cancer biology understanding and increasing focus on precision medicine are driving demand for advanced molecular diagnostic platforms and specialized laboratory services from certified providers. Healthcare insurance systems are increasingly covering molecular diagnostic tests to ensure optimal treatment selection and improved patient outcomes. Regulatory frameworks and clinical guidelines are establishing comprehensive testing protocols that require sophisticated equipment and trained laboratory professionals.

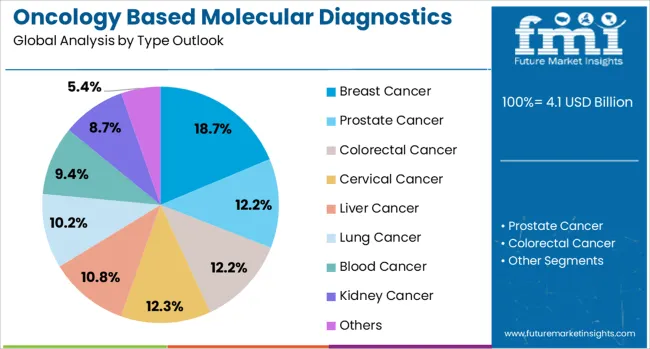

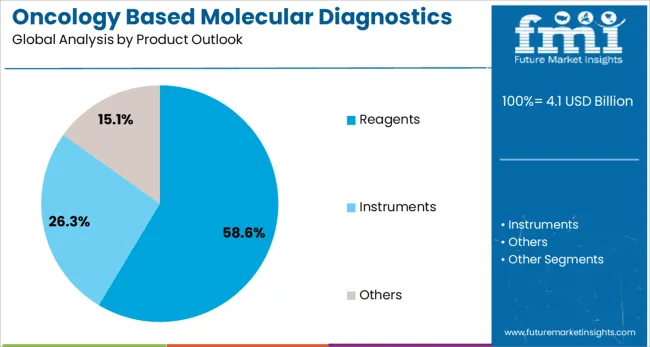

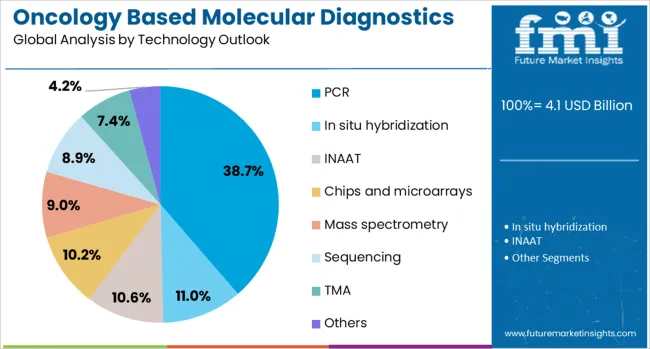

The market is segmented by cancer type, product type, technology, and region. By cancer type, the market is divided into breast cancer, prostate cancer, colorectal cancer, cervical cancer, liver cancer, lung cancer, blood cancer, kidney cancer, and others. Based on product type, the market is categorized into reagents, instruments, and others. In terms of technology, the market is segmented into PCR, in situ hybridization, INAAT, chips and microarrays, mass spectrometry, sequencing, TMA, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Breast cancer diagnostics are projected to account for 18.7% of the oncology based molecular diagnostics market in 2025. This leading share is supported by the high prevalence of breast cancer globally and the well-established molecular diagnostic protocols for hormone receptor testing, HER2 status determination, and genomic profiling. Breast cancer molecular diagnostics provide essential information for treatment selection including targeted therapies and chemotherapy regimens. The segment benefits from comprehensive clinical guidelines and widespread adoption of molecular testing in breast cancer management.

Reagents are expected to represent 58.6% of oncology based molecular diagnostic product demand in 2025. This dominant share reflects the consumable nature of reagents and their essential role in all molecular diagnostic testing procedures. Reagents include primers, probes, enzymes, and other biochemical components required for DNA/RNA extraction, amplification, and detection processes. The segment benefits from recurring revenue generation and continuous technological improvements in reagent formulations and performance characteristics.

PCR technology is projected to contribute 38.7% of the market in 2025, representing the most widely adopted molecular diagnostic technology for oncology applications. PCR provides reliable amplification and detection of specific genetic sequences associated with various cancer types and therapeutic targets. PCR-based assays offer established workflows, comprehensive validation protocols, and broad clinical acceptance across diverse laboratory settings. The segment is supported by extensive clinical evidence and regulatory approvals for oncology diagnostic applications.

The oncology based molecular diagnostics market is advancing steadily due to increasing cancer prevalence and growing recognition of precision medicine benefits. The market faces challenges including high testing costs, complex regulatory requirements, and varying reimbursement policies across different healthcare systems. Standardization efforts and clinical utility studies continue to influence test adoption and market development patterns.

The growing implementation of liquid biopsy technologies is enabling non-invasive cancer detection and monitoring through blood-based testing approaches. Circulating tumor DNA analysis provides real-time information about tumor genetic characteristics and treatment response monitoring. These technologies are particularly valuable for patients where tissue biopsies are challenging or for monitoring treatment efficacy and disease progression over time.

Modern molecular diagnostic platforms are incorporating next-generation sequencing technologies that provide comprehensive genetic analysis of tumor samples. Integration of multi-gene panels and whole genome sequencing enables simultaneous analysis of multiple biomarkers and therapeutic targets. Advanced sequencing technologies also support identification of novel genetic alterations and resistance mechanisms that inform treatment selection and clinical trial enrollment.

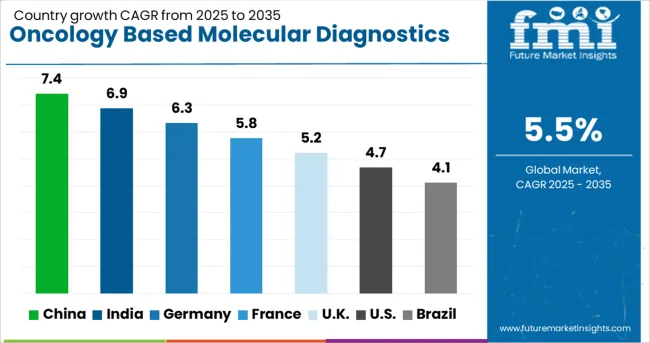

| Country | CAGR (2025-2035) |

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| United Kingdom | 5.2% |

| United States | 4.7% |

| Brazil | 4.1% |

The oncology based molecular diagnostics market is growing steadily, with China leading at a 7.4% CAGR through 2035, driven by expanding cancer care infrastructure, increasing healthcare investment, and growing adoption of precision medicine approaches. India follows at 6.9%, supported by rising cancer incidence, improving healthcare access, and expanding molecular diagnostic laboratory capabilities. Germany grows steadily at 6.3%, emphasizing clinical research excellence and advanced diagnostic technology integration. France records 5.8%, focusing on universal healthcare coverage and comprehensive cancer screening programs. The United Kingdom shows solid growth at 5.2%, prioritizing evidence-based cancer care and systematic molecular testing implementation. The United States maintains steady growth at 4.7%, while Brazil demonstrates emerging market potential at 4.1%. The China and India emerge as the leading drivers of global oncology based molecular diagnostics market expansion.

Revenue from oncology based molecular diagnostics in China is projected to exhibit the highest growth rate with a CAGR of 7.4% through 2035, driven by massive government investment in cancer care infrastructure and expanding precision medicine initiatives across urban and rural healthcare networks. The country's rapidly aging population and increasing cancer incidence rates are creating significant demand for advanced molecular diagnostic capabilities. Major healthcare providers and international diagnostic companies are establishing comprehensive laboratory networks to support the growing population requiring molecular testing for cancer diagnosis and treatment selection.

Revenue from oncology based molecular diagnostics in India is expanding at a CAGR of 6.9%, supported by increasing cancer awareness, expanding healthcare infrastructure, and growing availability of molecular diagnostic services. The country's large population and increasing cancer incidence are driving demand for affordable and accessible molecular testing solutions. Healthcare providers and diagnostic companies are gradually establishing capabilities to serve diverse patient populations requiring molecular diagnostic services for various cancer types.

Demand for oncology based molecular diagnostics in Germany is projected to grow at a CAGR of 6.3%, supported by the country's emphasis on clinical research excellence and systematic integration of advanced diagnostic technologies. German healthcare providers are implementing comprehensive molecular testing capabilities that meet stringent quality standards and regulatory requirements. The market is characterized by focus on precision medicine implementation, clinical evidence generation, and compliance with comprehensive laboratory quality management systems.

Demand for oncology based molecular diagnostics in France is expanding at a CAGR of 5.8%, driven by integration with universal healthcare coverage and emphasis on comprehensive cancer screening programs. French healthcare providers are establishing standardized molecular testing protocols that improve diagnostic accuracy while controlling healthcare delivery costs. The market benefits from coordinated cancer care networks and comprehensive reimbursement policies for molecular diagnostic testing.

Demand for oncology based molecular diagnostics in the United Kingdom is expanding at a CAGR of 5.2%, driven by National Health Service cancer care initiatives and emphasis on evidence-based diagnostic approaches. British healthcare providers are implementing comprehensive molecular testing frameworks that optimize clinical outcomes and resource allocation across diverse patient populations. The market benefits from coordinated cancer care networks and standardized molecular testing guidelines.

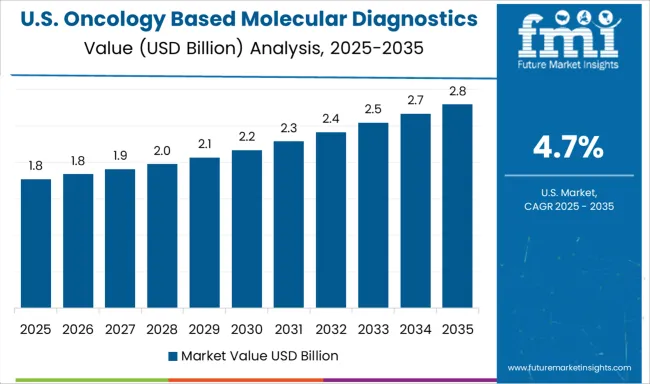

Demand for oncology based molecular diagnostics in the United States is projected to grow at a CAGR of 4.7% through 2035, supported by established cancer care infrastructure and comprehensive insurance coverage for molecular diagnostic testing. American healthcare providers are implementing sophisticated molecular testing platforms that integrate with electronic health records and clinical decision support systems. The market is characterized by advanced regulatory frameworks, established reimbursement mechanisms, and comprehensive clinical validation requirements.

Revenue from oncology based molecular diagnostics in Brazil is expanding at a CAGR of 4.1%, driven by improving cancer care infrastructure and growing recognition of molecular testing benefits. Brazilian healthcare providers are gradually establishing molecular diagnostic capabilities that serve diverse patient populations across urban and regional markets. The country's expanding healthcare access and increasing cancer awareness are creating opportunities for diagnostic technology providers to expand their market presence.

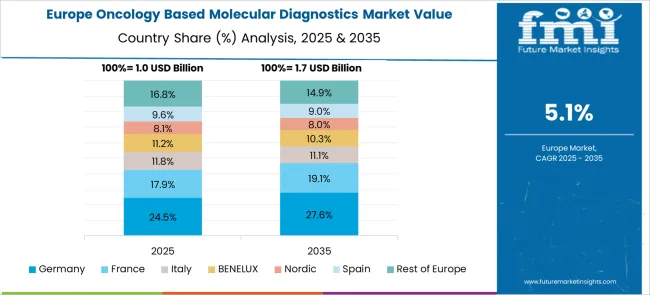

The European oncology molecular diagnostics market is projected to grow from USD 1.12 billion in 2025 to USD 1.89 billion by 2035, registering a 5.3% CAGR. Germany leads with 29.8% market share through advanced healthcare infrastructure and comprehensive cancer care programs. The UK follows at 23.4% driven by NHS cancer screening initiatives, while France holds 19.2% emphasizing universal healthcare coverage. Italy maintains 11.7% through expanding oncology networks, and Spain contributes 8.3% via healthcare modernization. Nordic countries account for 5.9% with advanced population registries, BENELUX holds 4.2% through integrated networks, and Eastern Europe represents 7.5% showing significant growth potential through government healthcare investments and expanding cancer care infrastructure.

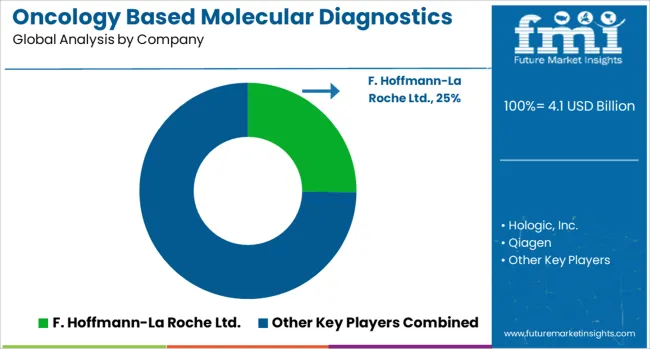

The oncology based molecular diagnostics market is defined by competition among established diagnostic companies, pharmaceutical manufacturers, and specialized molecular testing providers. Companies are investing in advanced testing platforms, biomarker discovery research, regulatory compliance programs, and clinical validation studies to deliver accurate, reliable, and clinically actionable diagnostic solutions. Strategic partnerships, technological innovation, and regulatory approvals are central to strengthening product portfolios and market presence.

F. Hoffmann-La Roche Ltd. (Roche), Switzerland-based, offers comprehensive molecular diagnostic platforms with focus on oncology applications, companion diagnostics, and personalized medicine solutions. Hologic, Inc. provides specialized cancer screening and diagnostic technologies with emphasis on women's health applications. Qiagen N.V. delivers molecular testing solutions with focus on sample preparation, PCR amplification, and next-generation sequencing workflows. Abbott Laboratories emphasizes point-of-care diagnostic technologies and automated testing platforms for oncology applications. Bayer AG offers molecular diagnostic solutions integrated with pharmaceutical development and companion diagnostic programs.

BD (Becton, Dickinson and Company) provides comprehensive laboratory automation and molecular testing platforms for cancer diagnostics. Cepheid (Danaher) delivers rapid molecular testing solutions with focus on point-of-care applications. Agilent Technologies, Inc., Danaher Corporation, Siemens Healthineers, and Sysmex Corporation offer specialized molecular diagnostic expertise, innovative testing platforms, and comprehensive laboratory solutions across global and regional oncology markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Cancer Type | Breast Cancer, Prostate Cancer, Colorectal Cancer, Cervical Cancer, Liver Cancer, Lung Cancer, Blood Cancer, Kidney Cancer, And Others |

| Product Type | Reagents, instruments, and others |

| Technology | PCR, In Situ Hybridization, Inaat, Chips and Microarrays, Mass Spectrometry, Sequencing, Tma, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd (Roche), Hologic Inc, Qiagen NV, Abbott Laboratories, Bayer AG, BD (Becton Dickinson and Company), Cepheid (Danaher), Agilent Technologies Inc, Danaher Corporation, Siemens Healthineers, Sysmex Corporation |

| Additional Attributes | Dollar sales by cancer type, product type, and technology, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established diagnostic manufacturers and emerging precision medicine providers, healthcare provider preferences for integrated platforms versus standalone testing solutions, integration with electronic health records and clinical decision support systems, innovations in liquid biopsy technologies and next-generation sequencing capabilities, and adoption of artificial intelligence analytics with advanced biomarker discovery platforms for enhanced diagnostic accuracy and treatment selection guidance. |

Cancer Type

Product Type

Technology

Region

The global oncology based molecular diagnostics market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the oncology based molecular diagnostics market is projected to reach USD 7.0 billion by 2035.

The oncology based molecular diagnostics market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in oncology based molecular diagnostics market are breast cancer, prostate cancer, colorectal cancer, cervical cancer, liver cancer, lung cancer, blood cancer, kidney cancer and others.

In terms of product outlook, reagents segment to command 58.6% share in the oncology based molecular diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oncology Blood Testing Market Size and Share Forecast Outlook 2025 to 2035

Oncology Nutrition Market Insights - Trends & Growth Forecast 2025 to 2035

Oncology Information Systems Market Analysis - Trends & Forecast 2025 to 2035

Oncology Apoptosis Modulators Market Insights – Forecast 2025 to 2035

The Oncology Adjuvants Market is segmented by Application, Indication and End User from 2025 to 2035

Oncology Imaging Software Market – Growth, Demand & Forecast 2025 to 2035

Oncology-Based In-vivo CRO Market - Growth & Emerging Trends 2025 to 2035

Immuno Oncology Assay Market Size and Share Forecast Outlook 2025 to 2035

Generic Oncology Drugs Market Growth – Industry Forecast 2025 to 2035

Sterile Oncology Injectable Market

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Paediatric Oncology Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Immunology-oncology ELISA Kits Market Analysis - Size, Share & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

Musculoskeletal Oncology Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

AI based Triage Tools Market Size and Share Forecast Outlook 2025 to 2035

Ph Based Lip Balm Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA