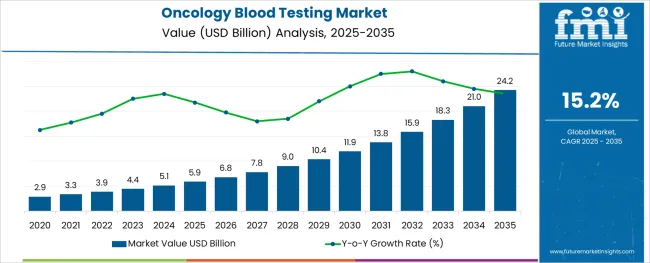

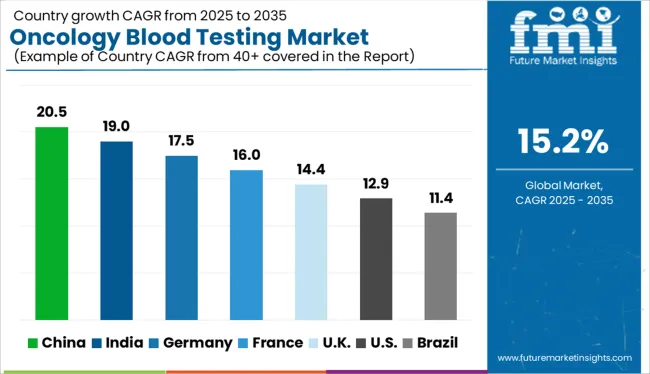

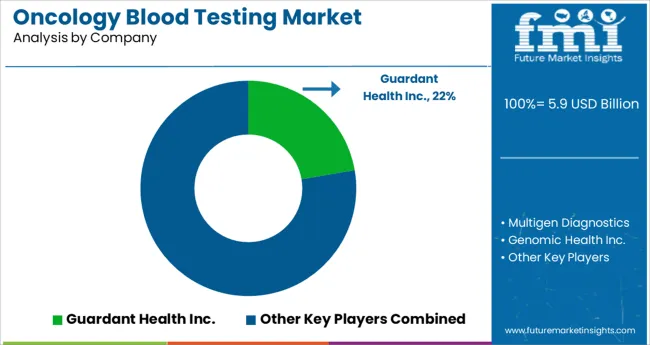

The Oncology Blood Testing Market is estimated to be valued at USD 5.9 billion in 2025 and is projected to reach USD 24.2 billion by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period.

The oncology blood testing market is expanding steadily, driven by the increasing adoption of minimally invasive diagnostic methods and the rising incidence of various cancers globally. Advances in molecular biology and genomic technologies have improved the accuracy and reliability of blood-based cancer tests.

Clinical practice has seen a growing shift towards liquid biopsy assays due to their ability to detect cancer biomarkers in a non-invasive manner, allowing for early diagnosis and treatment monitoring. The rising burden of lung cancer, which requires precise and timely detection, has further stimulated demand for specialized oncology blood tests.

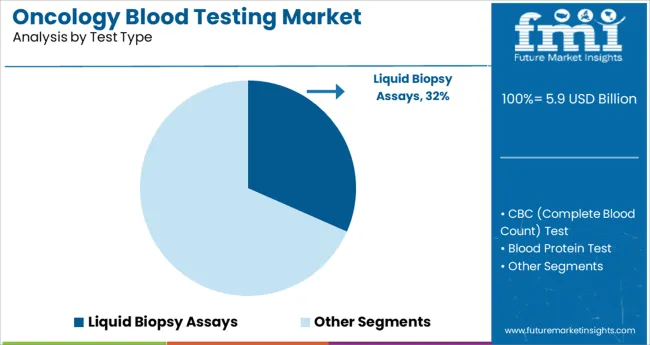

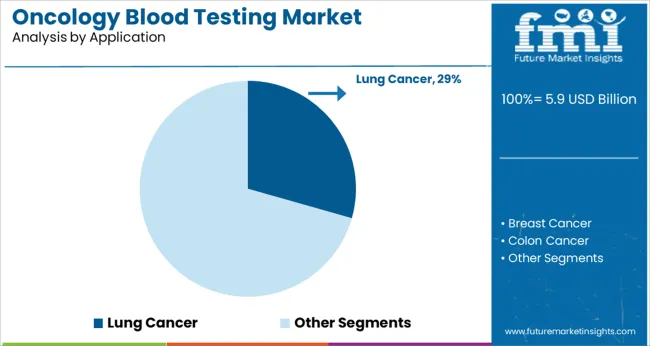

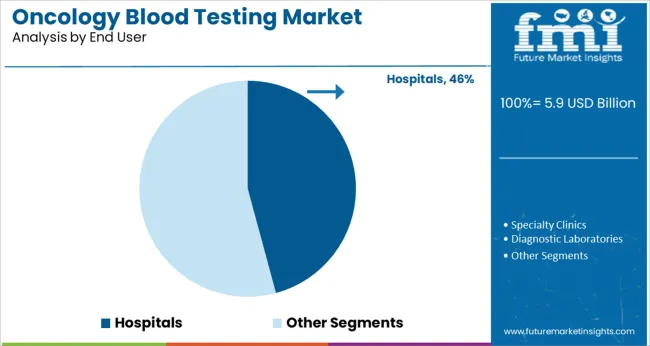

Healthcare systems have increasingly integrated blood testing as part of cancer screening and management protocols. The expanding infrastructure of hospitals and diagnostic centers is enabling wider access to these tests. The market outlook is promising with continuous innovation expected to enhance test sensitivity and application scope. Growth is projected to be led by liquid biopsy assays as the preferred test type, lung cancer as a major application, and hospitals as the primary end-user.

The market is segmented by Test Type, Application, and End User and region. By Test Type, the market is divided into Liquid Biopsy Assays, CBC (Complete Blood Count) Test, Blood Protein Test, Tumor Marker Test, CTC (Circulating Tumor Cells) - based Test, NIPT (Non-Invasive Prenatal Testing) Test, and Exome-Based Liquid Biopsy.

In terms of Application, the market is classified into Lung Cancer, Breast Cancer, Colon Cancer, Melanoma, Ovarian Cancer, and Gastrointestinal Stromal Tumor (GIST). Based on End User, the market is segmented into Hospitals, Specialty Clinics, and Diagnostic Laboratories.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid biopsy assays segment is expected to contribute 31.6% of the oncology blood testing market revenue in 2025, retaining its lead among test types. This segment has gained prominence due to its non-invasive nature, allowing clinicians to obtain vital tumor information through simple blood draws.

Liquid biopsies provide valuable insights into tumor genetics and treatment response without the risks associated with traditional tissue biopsies. The ability to monitor disease progression and detect minimal residual disease has increased the clinical utility of these assays.

As cancer treatment becomes more personalized, the demand for liquid biopsy assays continues to grow, supported by advancements in assay sensitivity and standardization efforts.

The lung cancer segment is projected to account for 29.4% of the oncology blood testing market revenue in 2025, making it a leading application area. This growth is attributed to the high global incidence and mortality associated with lung cancer, which creates urgent demand for early detection and monitoring tools.

Blood tests are increasingly used to identify actionable genetic mutations and guide targeted therapies. The segment benefits from growing awareness among healthcare providers about the value of blood-based diagnostics in managing lung cancer patients.

Continuous research and clinical adoption support the expansion of oncology blood testing within this disease area.

Hospitals are expected to represent 45.8% of the oncology blood testing market revenue in 2025, maintaining their role as the dominant end-user segment. This is due to hospitals being the primary setting for cancer diagnosis, treatment, and monitoring.

The availability of advanced laboratory infrastructure and specialist oncology teams facilitates the integration of blood testing into routine clinical workflows. Hospitals have adopted blood-based tests to complement imaging and histopathology, providing comprehensive diagnostic information.

Additionally, hospitals often participate in clinical trials and research initiatives that promote the use of innovative testing methods. As cancer care continues to evolve, hospitals are likely to sustain their leading position in the adoption of oncology blood testing technologies.

The increasing cost of development and sequencing of the Human Genome Project in the field of genomics owing to the proliferation of sequencing techniques such as NGS propels the oncology blood testing market growth.

Multiple investment programs in precision medicine by key companies drive the demand for oncology blood testing. The adoption of oncology blood testing increases with the hike in the availability of advanced molecular techniques for diagnosis.

Growing awareness about advanced treatment therapies amongst the population expands the oncology blood testing market share. Demand for oncology blood testing grows owing to favorable and uncomplicated reimbursement policies. Increasing cases of hematologic or blood cancer grow the demand for oncology blood testing.

Monitoring the status of minimal residual disease due to rising cases of myeloma cancers and lymphoma along with leukemia in patients escalates the adoption of oncology blood testing. Increasing awareness about blood cancer and its early diagnosis disseminated by government and non-government organizations boosts the oncology blood testing market share.

High prevalence and incidence of cancer, inducing a rapid surge in the burden of sample processing in healthcare facilities, bolsters the oncology blood testing market size. Cancer detection in blood via blood testing assays and kits with the capability of being an efficient diagnostic tool increases the adoption of oncology blood testing. The rising demand for preventative care and accurate diagnosis propels the adoption of oncology blood testing.

The number of cancer cases in the world in 202.9 was 2.9.0 Million, according to the World Health Organisation (WHO), which promises growth of the oncology blood testing market share. Various academic and research witnessing an increase in the number of research studies to develop genetic testing for various blood cancers increases demand for oncology blood testing. The oncology blood testing market size broadens owing to a rise in product approvals.

The presence of healthcare professionals to conduct diagnostic tests surged the adoption of oncology blood testing. The availability of specialized laboratory settings expands the oncology blood testing market share. The affordability of instruments used for blood cancer diagnosis assists in the growth of the oncology blood testing market size.

The effectiveness and credibility of new diagnostic methods elevate the demand for oncology blood testing. The rise in PCR-based tests to detect IDH1 genetic mutations in the bone marrow and blood samples extends the oncology blood testing market growth.

Uncertain reimbursement scenarios in undeveloped regions curb the adoption of oncology blood testing. Diagnostic tools to detect cancer using blood samples, being under development and clinical trial stage, thus being unavailable commercially hinders the oncology blood testing market growth.

High costs associated with molecular diagnostics and budgetary limitations obstruct the demand for oncology blood testing. The requirement and sporadic availability of sophisticated facilities further impede the oncology blood testing market growth.

Improving the efficiencies and precision in cancer diagnostics and prevention via new innovative technologies like fluid biopsies, real-time cancer diagnostics, digital PCR, immunohistochemistry, next-generation sequencing (NGS), molecular testing, and cytogenetics escalates the adoption of oncology blood testing. Public and private partnerships and movements toward molecular pathology escalate the demand for oncology blood testing.

A growing number of FDA approvals for NGS-based tests in the USA further propels the oncology blood testing market growth. Increasing collaborations between manufacturers in the market grow the demand for oncology blood testing. Rising conferences on personalized medicines bolster the adoption of oncology blood testing.

Advancements in genetic testing generating a significant impact on diagnostic trends increase the demand for oncology blood testing. An increase in the availability of technologically advanced products for the diagnosis of acute myeloid and leukemia progresses the oncology blood testing market share.

An increase in the co-development of the drug-diagnostics model further expands the oncology blood testing market size. A greater understanding of diagnostic procedures and the availability of technologically advanced products for diagnosis grows the demand for oncology blood testing. Growth in the expenditure and implementation of R&D activities further expand the oncology blood testing market size.

Europe registers the second largest oncology blood testing market share with a revenue of 30.6% in 2025.

Owing to easy regulatory approval for in-vitro cancer diagnostics, the Europe oncology blood testing market promises growth. The interesting incidence of multiple myeloma across Europe, further fuels the oncology blood testing market growth.

The Asia Pacific is expected to grow in the global oncology blood testing market share.

Growth in the prevalence of blood cancer in several countries of this region.

Increasing number of research activities regulated by various academic research academies further propels the global market growth.

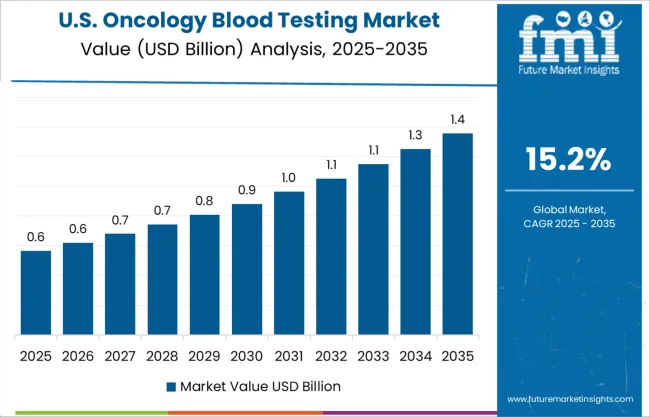

North America dominates the oncology blood testing market share with a revenue of 52.6% in 2025.

This is owing to favourable reimbursement policies and increase in cancer cases amongst the population, along with the awareness on early diagnosis of cancer. This region necessitates the demand for oncology blood testing and advanced technologies to prevent, diagnose and treat cancer.

The growth of the market is further attributed to the rising cases of leukaemia, lymphoma, and multiple myeloma. The survival rate for the disease is approximated to be 86.6% due to the timely diagnosis and emergence of novel therapies.

How is the Start-up Ecosystem in the Oncology Blood Testing Market?

Changes in the market and the advent of new technologies contributing to the research and development of new diagnostic tools that aid in the treatment and prevention of cancer are gaining significant popularity.

The awareness of early diagnosis and an interesting number of cancer patients throughout the world surges the perpetual research work against the constant emergence of this fatal illness.

Certain start-up companies are contributing to the overall market growth by devising strategies to counteract blood cancer in the population.

Adaptive Biotechnologies, Grail, Abingdon Health, Freenome, Vivia Biotech, Genoptix, Biofluidica, SkylineDX, etc. provide clinical diagnostics, gene expression profiling tests for personalized medicine, liquid biopsy tests using CTCs, and help scientists and clinicians in research and drug development.

Some of the key market participants in the oncology blood testing market are Guardant Health Inc., Trovagene Inc., Genomic Health Inc., Foundation Medicine Inc., Exosome Diagnostics, Pathway Genomics Corporation, F. Hoffman-La Roche Ltd., Abbott Laboratories, EntroGen Inc., Qiagen N.V., Cepheid, Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Illumina Inc., CORE Diagnostics, Genoptix Inc., GenPath, NeoGenomics Laboratories Inc., Siemens, MolecularMD, ArcherDx Inc., ARUP Laboratories., Invivoscribe Inc., GenPath, Laboratory Corporation of America Holdings, Luminex Corporation, Myriad Genetics Inc., Roche Holding A.G., Invitae Corporation, Asuragen Inc., Molecularmd, EntroGen, Cepheid, Cancer Genetics, Adaptive Biotechnologies, Grail, Abingdon Health, Freenome, Vivia Biotech, Biofluidica, SkylineDX, Biodesix Inc., NovellusDX, BioNTech SE, etc.

They aim to research and develop diagnostic tools that aid in early detection of cancer in patients. Using liquid biopsies to detect the life threatening disease and try and combat it in time, is the utmost goal of healthcare centers – with the assistance of these key players, the healthcare sector is improving in this arena.

Some of the recent developments in the oncology blood testing market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 15.2% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Types, Application, End User, and Region. |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Guardant Health Inc.; Trovagene Inc.; Genomic Health Inc.; Foundation Medicine Inc.; Exosome Diagnostics; Pathway Genomics Corporation; F. Hoffman-La Roche Ltd.; Abbott Laboratories; EntroGen Inc.; Qiagen N.V.; Cepheid; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories Inc.; Illumina Inc.; CORE Diagnostics; Genoptix Inc.; GenPath; NeoGenomics Laboratories Inc.; Siemens; MolecularMD; ArcherDx Inc.; ARUP Laboratories.; Invivoscribe Inc.; GenPath; Laboratory Corporation of America Holdings; Luminex Corporation; Myriad Genetics Inc.; Roche Holding A.G.; Invitae Corporation; Asuragen Inc.; Molecularmd; EntroGen; Cepheid; Cancer Genetics; Adaptive Biotechnologies; Grail; Abingdon Health; Freenome; Vivia Biotech; Biofluidica; SkylineDX; Biodesix Inc.; NovellusDX; BioNTech SE; etc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global oncology blood testing market is estimated to be valued at USD 5.9 billion in 2025.

It is projected to reach USD 24.2 billion by 2035.

The market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types are liquid biopsy assays, cbc (complete blood count) test, blood protein test, tumor marker test, ctc (circulating tumor cells) – based test, nipt (non-invasive prenatal testing) test and exome-based liquid biopsy.

lung cancer segment is expected to dominate with a 29.4% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oncology Based Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Oncology-Based In-vivo CRO Market - Growth & Emerging Trends 2025 to 2035

Oncology Nutrition Market Insights - Trends & Growth Forecast 2025 to 2035

Oncology Information Systems Market Analysis - Trends & Forecast 2025 to 2035

Oncology Apoptosis Modulators Market Insights – Forecast 2025 to 2035

The Oncology Adjuvants Market is segmented by Application, Indication and End User from 2025 to 2035

Oncology Imaging Software Market – Growth, Demand & Forecast 2025 to 2035

Immuno Oncology Assay Market Size and Share Forecast Outlook 2025 to 2035

Generic Oncology Drugs Market Growth – Industry Forecast 2025 to 2035

Sterile Oncology Injectable Market

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Paediatric Oncology Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Immunology-oncology ELISA Kits Market Analysis - Size, Share & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

Musculoskeletal Oncology Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA