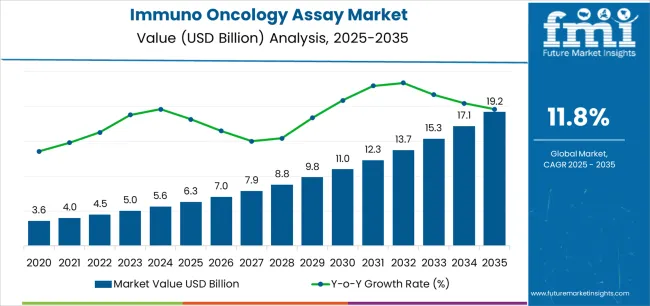

The Immuno Oncology Assay Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 19.2 billion by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period.

The immuno oncology assay market is experiencing robust growth driven by the increasing prevalence of cancer and the rising adoption of immunotherapy in precision medicine. Continuous advancements in assay technologies, combined with the development of biomarkers for personalized treatment, are strengthening diagnostic accuracy and therapeutic monitoring. The market is benefiting from expanding research funding, growing clinical adoption, and the integration of companion diagnostics into oncology pipelines.

Manufacturers are focusing on enhancing assay sensitivity, improving workflow automation, and ensuring compliance with global regulatory standards to meet the growing clinical and research demand. The future outlook remains optimistic as technological innovations such as multiplex platforms and digital immunoassays enhance throughput and reduce turnaround time.

The growing emphasis on early and accurate detection, combined with expanding applications of immuno-oncology in new cancer types, is expected to sustain market expansion Strong collaborations between pharmaceutical companies, diagnostic developers, and research institutions continue to drive product innovation and global accessibility.

| Metric | Value |

|---|---|

| Immuno Oncology Assay Market Estimated Value in (2025 E) | USD 6.3 billion |

| Immuno Oncology Assay Market Forecast Value in (2035 F) | USD 19.2 billion |

| Forecast CAGR (2025 to 2035) | 11.8% |

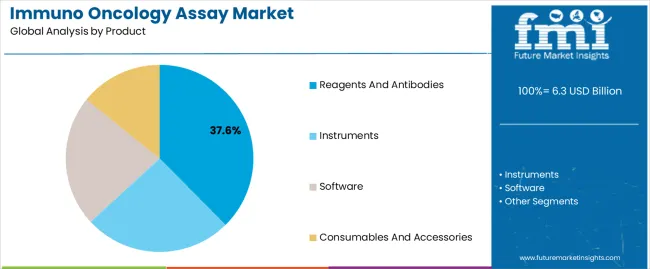

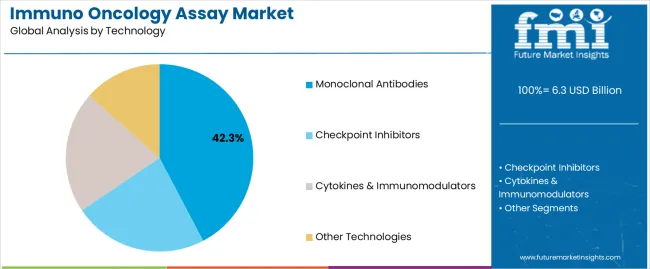

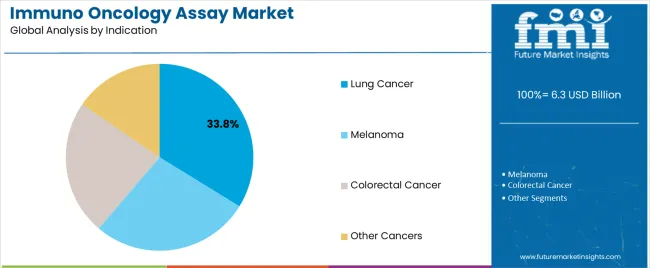

The market is segmented by Product, Technology, Indication, End-User, and Application and region. By Product, the market is divided into Reagents And Antibodies, Instruments, Software, and Consumables And Accessories. In terms of Technology, the market is classified into Monoclonal Antibodies, Checkpoint Inhibitors, Cytokines & Immunomodulators, and Other Technologies. Based on Indication, the market is segmented into Lung Cancer, Melanoma, Colorectal Cancer, and Other Cancers. By End-User, the market is divided into Hospitals, Clinics, and Cancer Research Centers. By Application, the market is segmented into Clinical Diagnostics and Research Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reagents and antibodies segment, holding 37.60% of the product category, has emerged as the leading contributor due to its critical role in assay performance and reliability. High usage in both research and clinical testing environments has supported consistent demand.

The segment’s growth is being driven by innovation in antibody engineering, improved stability, and enhanced binding specificity. Reagents and antibodies are central to ensuring reproducibility and sensitivity across various immunoassay platforms.

Market participants are investing in scalable production, quality assurance, and cost optimization to meet expanding demand from diagnostic laboratories and biopharmaceutical companies Continuous development of validated antibody panels and standardized reagent kits is expected to sustain leadership and reinforce the segment’s essential role in advancing immuno oncology assay applications.

The monoclonal antibodies segment, accounting for 42.30% of the technology category, dominates the market due to its superior specificity and reproducibility in detecting cancer biomarkers. Its wide acceptance in immunohistochemistry, flow cytometry, and ELISA-based assays has strengthened its integration into oncology diagnostics and therapeutic monitoring.

Production advancements, including hybridoma technology and recombinant antibody generation, have improved efficiency and scalability. The segment’s reliability in distinguishing target antigens has enhanced clinical confidence, supporting its continued preference across laboratories and hospitals.

As personalized medicine expands, monoclonal antibodies remain indispensable for accurate immune profiling and therapy response assessment Sustained research investment and the growing availability of high-affinity clones are expected to drive innovation, ensuring that monoclonal antibodies maintain their pivotal role in the global immuno oncology assay landscape.

The lung cancer segment, representing 33.80% of the indication category, leads due to the increasing incidence of the disease and the critical need for early, precise diagnostics. Adoption has been reinforced by the integration of immuno oncology assays into clinical workflows for biomarker detection and therapy monitoring.

Enhanced survival rates associated with early intervention have emphasized the importance of accurate immune profiling in lung cancer management. Continuous advancements in biomarker discovery, including PD-L1 and other immune checkpoint markers, have expanded diagnostic capabilities.

Market demand is further supported by clinical trials evaluating new immunotherapeutic combinations, driving assay utilization in both research and clinical settings The segment’s strong growth outlook is underpinned by rising awareness, healthcare infrastructure expansion, and continuous improvements in test accuracy, ensuring its sustained prominence within the immuno oncology assay market.

From 2020 to 2025, the immuno-oncology assay market experienced a CAGR of 15.4%. The approval of immune checkpoint inhibitors revolutionized cancer treatment, leading to a surge in immuno-oncology research and development.

The immuno-oncology assay market witnessed rapid growth, fueled by increasing investments in research and clinical trials. Technological advancements, such as next-generation sequencing and multiplexed immunoassays, improved assay sensitivity and specificity.

Regulatory approvals for companion diagnostics further accelerated market expansion.

The immuno-oncology assay market is expected to evolve further, with a focus on predictive and prognostic biomarkers, early cancer detection, and monitoring of treatment responses. Strategic collaborations, regulatory support, and reimbursement policies will continue to shape market dynamics.

The immuno-oncology assay market is poised for significant growth in the coming years, driven by ongoing advancements in cancer research, therapeutic innovation, and the increasing adoption of personalized medicine approaches in oncology.

Projections indicate that the global immuno-oncology assay market is expected to experience a CAGR of 12.4% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 15.4% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 12.4% |

South Korea and Japan stand out as the top two revenue-generating countries, as indicated in the table provided. The government and private sector investments in cancer research and immunotherapy initiatives are significant drivers of market growth in South Korea.

Japanese pharmaceutical companies are at the forefront of developing immunotherapy drugs and companion diagnostics. Regulatory support and streamlined approval processes for diagnostic products contribute to market growth.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 12.1% |

| The United Kingdom | 13.9% |

| China | 13.3% |

| Japan | 14.1% |

| South Korea | 15.2% |

The immune-oncology assay market in the United States is expected to expand at a CAGR of 12.1% by 2035. The United States is at the forefront of cancer immunotherapy research and development, with significant investments from both public and private sectors.

The approval and adoption of novel immunotherapies, such as immune checkpoint inhibitors and CAR-T cell therapies, have propelled the demand for immuno-oncology assays to assess treatment efficacy and patient response.

The United States-based companies and research institutions are driving innovations in immuno-oncology assay technologies, including next-generation sequencing, flow cytometry, and multiplexed immunoassays. These technological advancements enhance assay sensitivity, specificity, and throughput, enabling comprehensive profiling of the tumor microenvironment and immune response.

The immune-oncology assay market in the United Kingdom is expected to expand at a CAGR of 13.9% by 2035. The United Kingdom is home to leading research institutions, universities, and biotechnology companies actively engaged in immuno-oncology research and development.

Collaborative efforts between academia, industry, and government agencies fuel innovation in assay technologies, biomarker discovery, and therapeutic development, driving market growth.

The United Kingdom is a significant hub for clinical trials evaluating immunotherapies across various cancer types. The adoption of immune checkpoint inhibitors, CAR-T cell therapies, and other immunotherapeutic agents in clinical practice is increasing, necessitating the use of immuno-oncology assays for patient selection, treatment monitoring, and outcome prediction.

China faces a significant burden of cancer, with increasing incidence rates due to factors such as aging population, lifestyle changes, and environmental pollution.

This high disease burden drives the demand for immuno-oncology assays for early detection, diagnosis, and treatment monitoring. United Kingdom. The immune-oncology assay market in China is expected to rise at a CAGR of 13.3% by 2035.

The Chinese government has prioritized cancer prevention, diagnosis, and treatment as part of its healthcare reforms. Initiatives to improve cancer care infrastructure, enhance access to innovative therapies, and promote research and development in oncology contribute to market growth.

Japan has a growing cancer burden due to factors such as the aging population, lifestyle changes, and environmental factors. The rising prevalence of cancer drives the demand for immuno-oncology assays for early detection, diagnosis, and treatment monitoring. The immune-oncology assay market in Japan is expected to expand at a CAGR of 14.1% by 2035.

Japan has a strong research and development infrastructure in oncology, with leading academic institutions, biotechnology companies, and healthcare centers engaged in cancer research.

The country's contributions to cancer immunotherapy research, including novel therapies and biomarker discovery, fuel the demand for immuno-oncology assays.

South Korea is actively involved in cancer immunotherapy research and development. The adoption of immune checkpoint inhibitors, CAR-T cell therapies, and other immunotherapeutic agents is increasing, driving the demand for immuno-oncology assays to assess treatment efficacy and patient response. The immune-oncology assay market in South Korea is expected to flourish at a CAGR of 15.2% by 2035.

South Korean companies are at the forefront of technological innovation in diagnostics and biotechnology. They are developing advanced immuno-oncology assay platforms, including next-generation sequencing, flow cytometry, and multiplexed immunoassays, to meet the evolving needs of cancer diagnosis and treatment.

The below section shows the leading segment. The reagents and antibodies segment is to rise at a CAGR of 12.2% from 2025 to 2035. Based on technology, the checkpoint inhibitors segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 11.9% from 2025 to 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Reagents and Antibodies | 12.2% |

| Checkpoint Inhibitors | 11.9% |

Based on type, the Reagents and Antibodies segment is anticipated to proliferate at a CAGR of 12.2% from 2025 to 2035.

Reagents and antibodies are essential components of immuno-oncology assays, playing crucial roles in detecting specific biomarkers, antigens, or immune cell markers associated with cancer and immunotherapy response.

Reagents and antibodies are highly specific and sensitive, allowing for the accurate detection and quantification of targets of interest in complex biological samples, such as blood, tissue, or tumor specimens.

Many immuno-oncology assays require multiplexing, where multiple targets are detected simultaneously in a single assay. Reagents and antibodies with multiplexing capabilities enable comprehensive profiling of the immune response and tumor microenvironment, providing valuable insights for cancer diagnosis and treatment.

Based on technology, the checkpoint inhibitors segment is anticipated to rise at a CAGR of 11.9% from 2025 to 2035.

Checkpoint inhibitors have revolutionized cancer treatment by enhancing the body's immune response against cancer cells. These therapies block inhibitory checkpoints, such as PD-1/PD-L1 and CTLA-4, allowing the immune system to recognize and attack cancer cells more effectively.

Biomarkers such as PD-L1 expression levels have been identified as predictors of response to checkpoint inhibitor therapy. Immuno-oncology assays are used to measure these biomarkers, allowing clinicians to identify patients who are most likely to respond to checkpoint inhibitors and tailor treatment accordingly.

The growing number of clinical trials investigating checkpoint inhibitors and combination therapies underscores their importance in immuno-oncology research. Immuno-oncology assays play a crucial role in these trials by assessing biomarker expression, immune cell profiling, and treatment responses.

Collaboration with academic institutions, research organizations, and biotechnology companies enables market players to access complementary expertise, technologies, and resources.

Partnerships facilitate biomarker discovery and validation, clinical validation studies, and the development of companion diagnostics. Collaborations also enhance market penetration, accelerate product development, and mitigate development risks.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 5.6 billion |

| Projected Market Valuation in 2035 | USD 18.1 billion |

| Value-based CAGR 2025 to 2035 | 12.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Product, Technology, Indication, End-user, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | AGILENT TECHNOLOGIES; Sartorius AG; NanoString Technologies; THERMO FISHER SCIENTIFIC; BIO-RAD LABORATORIES; F. HOFFMANN-LA ROCHE LTD.; PERKINELMER; ILLUMINA; QIAGEN N.V.; Charles River Laboratories |

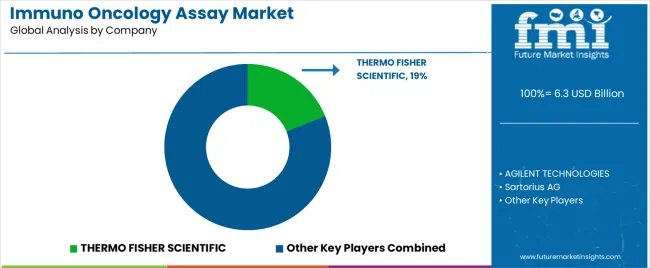

The global immuno oncology assay market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the immuno oncology assay market is projected to reach USD 19.2 billion by 2035.

The immuno oncology assay market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in immuno oncology assay market are reagents and antibodies, instruments, software and consumables and accessories.

In terms of technology, monoclonal antibodies segment to command 42.3% share in the immuno oncology assay market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immunoturbidimetric Kits Market Size and Share Forecast Outlook 2025 to 2035

Immunoadsorption Columns Market Size and Share Forecast Outlook 2025 to 2035

Immunochromatography Kits Market Size and Share Forecast Outlook 2025 to 2035

Immunochemistry Products Market Insights – Growth & Forecast 2025 to 2035

Immunochemistry Analyzer Market Trends and Forecast 2025 to 2035

Immunoglobulin (IgG) Replacement Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Immunostimulants Market Insights - Size, Share & Forecast 2025 to 2035

Breaking Down Market Share in the Immunotoxins Industry

Global Immunomodulator Market Analysis – Size, Trends & Forecast 2024-2034

Immunohistochemistry (IHC) Market Trends – Growth & Industry Outlook 2024-2034

Immunofluorescence Analyzer Market

Immunoassay Market Size and Share Forecast Outlook 2025 to 2035

Immunoassay CDMO Market Analysis – Size, Trends & Industry Outlook 2025-2035

Immunology-oncology ELISA Kits Market Analysis - Size, Share & Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Food Immunomodulators Market – Growth, Demand & Functional Nutrition

Radioimmunotherapy Treatment Market

Radioimmunoassay Market Growth - Trends & Forecast 2025 to 2035

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

The Neuro Immunoassay Market is segmented by product, and end user from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA