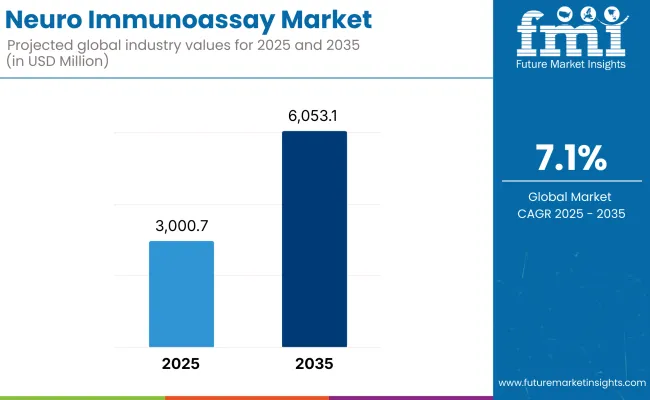

The global market for Neuro Immunoassay is forecasted to attain USD 3,000.7 million by 2025, expanding at 7.1% CAGR to reach USD 6,053.1 million by 2035. In 2024, the revenue of Neuro Immunoassay was around USD 2,801.4 million.

The neuro immunoassaymarket is anticipated to be driven by increasing prevalence of neurological disorders such as Alzheimer’s disease and Parkinson’s disease, which demand advanced diagnostics solutions.

Moreover, increasing demand for early disease detection along with significant improvement in immunoassay technologies stimulates the market growth. The global demand for neuro immunoassay is also surging as they have been broadly used for pharmaceutical analysis, such as pharmacokinetic and bioequivalence of drug discovery, diagnosis of disease, and drug monitoring.

Expanding biotechnology, more investments in neuroscience research and pharmaceutical industries are some of the other crucial elements promoting the market growth of neuro immunoassay.

There is an alarmingly growing number of research and abundant investments done towards neuroscience research. This has encouraged several medical and healthcare giants along with the Governments to promote sanctions towards various research and development, also thereby boosting the neuro immunoassay market growth.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,000.7 Million |

| Industry Value (2035F) | USD 6,053.1 Million |

| CAGR (2025 to 2035) | 7.1% |

North America is the leading region in the neuro immunoassay market, supported by well-established clinical research infrastructure, advanced diagnostic awareness and rapid adoption of biomarker-based testings in neurology.

The United States can build on its progress in implementing Alzheimer’s biomarker panels, FDA-approved diagnostic tools, and NIH-sponsored programs emphasizing brain health and neuroinflammation. Neuro immunoassays are being integrated into standard memory and movement disorder assessments at major hospitals and academic centers.

Canada supports market growth with national brain health strategies and improved access to neurological diagnostics. Industry-academic partnerships and investments in advanced biomarker analytics are further fueling innovation in the region.

Public healthcare systems, advanced neurodegeneration research, and strong regulatory support for diagnostic innovation make Europe a major market for neuro immunoassays.

Alzheimer’s and Parkinson’s research are leading the field of drug development and biomarker validation studies in countries such as Germany, the UK, Sweden, and the Netherlands, and together they are working to drive biomarker testing adoption in neurology clinics.

Alongside, the European Medicines Agency and Horizon Europe funding programmes are also strengthening support for the development of novel assays and their integration into clinical trials.

Biotech companies, diagnostic companies, and existing neurology consortia are collaborating to encourage standardization and expand clinical uptake. Increased demand for early-stage cognitive assessment and dementia screening is likely to propel further growth.

Asia-Pacific is the fastest-growing region in the neuro immunoassay market, driven by rising neurological disease burden, expanding diagnostic capacity, and increasing awareness of cognitive health. Countries such as China, Japan, South Korea, and India are investing in biomarker research, brain imaging infrastructure, and neurology education.

Japan’s aging population and government-led dementia countermeasures are contributing to early testing adoption. China’s large-scale epidemiological studies and public-private partnerships in neurotechnology are fueling biomarker assay development.

Growing availability of automated lab systems, affordable testing solutions, and international collaborations is expected to accelerate adoption across both urban and rural healthcare systems.

Comprehensive Analysis of Challenges Impacting the Neuro Immunoassay Market

The neuro immunoassay market faces several challenges, including assay variability, low biomarker concentration in peripheral samples, and limited standardization across platforms. Despite advances, reliable and scalable cerebrospinal fluid and blood biomarkers for certain conditions remain under development.

The invasive nature of cerebrospinal fluid collection can deter testing, while blood-based assays must overcome sensitivity limitations. Reimbursement barriers and slow regulatory approvals hinder market penetration, especially for multiplex and emerging biomarkers.

Additionally, a lack of trained personnel and infrastructure in low-resource settings affects assay availability and quality. Ensuring assay reproducibility, expanding biomarker panels, and enhancing clinician education remain critical focus areas.

Emerging Opportunities and Innovations Driving Growth in the Neuro Immunoassay Market

Opportunities lie in the expansion of blood-based biomarker testing for Alzheimer’s and Parkinson’s, which promises minimally invasive and scalable diagnostics for early detection and monitoring. Multiplex immunoassays and digital ELISA platforms are enabling simultaneous quantification of multiple neuroinflammatory and neurodegenerative markers.

Integration with imaging, genomic data, and AI analytics is supporting precision neurology and personalized treatment planning. Diagnostic manufacturers collaborating with pharmaceutical companies are unlocking new companion diagnostic opportunities for CNS clinical trials.

At-home sample collection and cloud-connected lab services are expanding access, particularly for cognitive screening in remote or aging populations. The growth of preventative neurology and cognitive wellness is further broadening the use case for immunoassays.

The convergence of neuroimmunology and liquid biopsy, with researchers exploring exosomal, proteomic, and RNA-based signals as complementary biomarkers to immunoassays for comprehensive brain health profiling is one of the emerging ongoing trends in the neuro immunoassay market.

From 2020 through 2024, increasing prevalence of neurological disorders such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis is one of the major factors that derived the growth of the market.The growth was also supported by advancements in immunoassay technologies, which enhanced the detection and quantification of neurological biomarkers, thereby improving diagnostic accuracy and patient outcomes.

For the future of 2025 to 2035, neuro immunoassay market is likely to witness further growth driven by advancements in technology, rising investment in neuroscience research and the increasing focus on personalized medicine.

Ultimately, the next generation of automated immunoassays will blend artificial intelligence through potential high-throughput screening devices, which will enhance the exactitude and efficiency of diagnostics even further.

Additionally, expanding applications of neuro immunoassays in early disease detection and monitoring, along with increasing awareness among healthcare professionals and patients, are anticipated to drive market growth.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Implementation of guidelines ensuring the safety and efficacy of neuro immunoassays, leading to standardized protocols and increased oversight. |

| Technological Advancements | Introduction of advanced immunoassay techniques enhancing sensitivity and specificity in detecting neurological biomarkers, including the adoption of enzyme-linked immunosorbent assays (ELISA) and multiplex assays. |

| Consumer Demand | Increased adoption of neuro immunoassays among healthcare providers, driven by the need for accurate and early diagnosis of neurological disorders, facilitating timely intervention and management. |

| Market Growth Drivers | Rising prevalence of neurological disorders, advancements in immunoassay technologies, and a shift towards improving diagnostic accuracy and patient outcomes. |

| Sustainability | Initial efforts towards integrating sustainable practices in diagnostic device manufacturing, including the use of eco-friendly materials and energy-efficient production processes. |

| Supply Chain Dynamics | Dependence on specialized suppliers for high-quality reagents and assay kits, with efforts to localize production to mitigate supply chain disruptions observed during global events. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Continuous monitoring and potential harmonization of regulations across countries to balance patient safety with technological innovation, alongside expedited approval processes for novel immunoassay technologies addressing unmet medical needs. |

| Technological Advancements | Development of next-generation immunoassays incorporating artificial intelligence, machine learning algorithms, and high-throughput screening methods, improving diagnostic precision, efficiency, and enabling personalized diagnostic approaches. |

| Consumer Demand | Growing preference for personalized and non-invasive diagnostic options, driven by advancements in immunoassay technology and a focus on patient-centered care, leading to widespread adoption across diverse patient populations. |

| Market Growth Drivers | Expansion of healthcare services in emerging markets, increasing investments in neuroscience research and development, continuous technological innovations enhancing immunoassay efficacy, and a global emphasis on early disease detection and personalized medicine approaches. |

| Sustainability | Adoption of sustainable manufacturing processes and development of biodegradable components, aligning with global sustainability initiatives and reducing the environmental footprint of diagnostic devices. |

| Supply Chain Dynamics | Strengthening of local manufacturing capabilities through technological advancements and strategic partnerships, leading to reduced dependency on imports, improved supply chain resilience, and the ability to rapidly respond to emerging diagnostic needs in the neuro immunoassay sector. |

Market Outlook

Due to the high incidence of neurological disorders including Alzheimer’s disease, multiple sclerosis (MS), Parkinson’s disease, and neuroinflammatory syndromes, the United States dominates the neuro immunoassays market.

Widely established biomarker discovery era, high acceptance of immunoassays based on CSF and blood, as well as incorporation into clinical trials, academic neuroscience, and personalized neurology care are supportive of assessment in the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

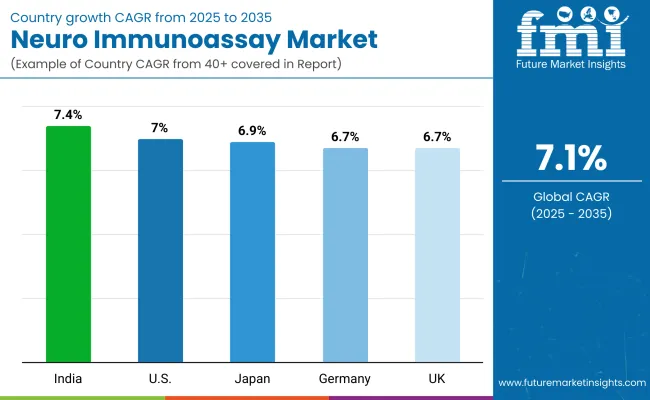

| United States | 7.0% |

Market Outlook

Germany’s neuro immunoassay market is mature and research-intensive, with strong utilization in academic neurology departments, clinical labs, and hospital diagnostic units. The focus is on CSF-based biomarker panels for dementia, autoimmune encephalitis, and demyelinating diseases, alongside a growing presence of multiplex neuroinflammation assays in translational research.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.7% |

Market Outlook

The UK neuro immunoassay market is expanding, supported by NHSled neurodiagnostic programs, large scale brain health studies, and strong clinical focus on early detection of neurodegenerative and neuroinflammatory conditions. Research institutions and biobanks such as UK Biobank and Dementias Platform UK are facilitating assay innovation and validation.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.7% |

Market Outlook

Japan’s neuro immunoassay market is growing, driven by a rapidly aging population and increased focus on Alzheimer’s, Lewy body dementia, and neuroimmune disorders. Japanese diagnostic labs and hospitals are adopting immunoassays for tau, beta-amyloid, alpha-synuclein, and autoantibodies, especially in academic and tertiary centers.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

Market Outlook

India’s neuro immunoassay market is in its early growth phase but gaining momentum, with rising awareness of neurological disorders, increasing availability of advanced diagnostic platforms, and investment in academic neuroscience. While CSF testing is limited to urban tertiary centers, plasma-based immunoassays are emerging as scalable options.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.4% |

Reagents & Kits

Reagents and kits form the core component of the neuro immunoassay market, enabling the quantification of neuro-specific biomarkers such as tau proteins, amyloid-beta, neurofilament light chain (NfL), GFAP, and cytokines.

These are crucial in diagnosing and monitoring neurodegenerative diseases (e.g., Alzheimer’s, Parkinson’s, ALS) and neuroinflammatory disorders (e.g., multiple sclerosis, encephalitis). The growing need for early-stage, minimally invasive diagnostics, especially through blood- and CSF-based biomarker panels, is propelling this segment.

North America and Western Europe dominate due to high investment in neuroscience R&D and availability of advanced testing infrastructure. Asia-Pacific is emerging with increased neuro diagnostics focus in China, Japan, and South Korea. Future innovations include multiplex immunoassay panels, high-sensitivity ELISA (hs-ELISA) kits, and integration with digital readers for decentralized testing.

Analyzers and Platforms

Analyzers used in neuro immunoassay testing such as automated ELISA platforms, multiplex bead-based analyzers (e.g., Luminex), and chemiluminescent immunoassay systems-support high-throughput, reproducible testing essential for clinical labs and neurological research centers.

Demand is growing due to the need for reliable quantification of complex protein profiles in cerebrospinal fluid (CSF) and blood. The rise in centralized lab networks, increasing biomarker-driven clinical trials, and automation of immunodiagnostic workflows is fueling growth.

Hospitals and specialty labs in the USA and EU are primary users, while academic institutions and contract research organizations (CROs) in Asia-Pacific are adopting advanced platforms. Future trends include miniaturized immunoassay systems, AI-enhanced pattern recognition, and lab-on-chip formats for point-of-care neuro biomarker analysis.

Alzheimer’s Disease and Neurodegeneration Leading the Neuro Immunoassay Landscape

The largest and fastest-growing application area, Alzheimer’s disease (AD) diagnostics via immunoassays focuses on detecting amyloid-β peptides, total tau (t-tau), and phosphorylated tau (p-tau) in CSF and increasingly, in blood.

The rising global aging population, coupled with regulatory progress in disease-modifying treatments (e.g., anti-amyloid monoclonal antibodies), is accelerating the need for validated, scalable diagnostic assays.

The USA and EU are leading markets due to large-scale screening initiatives and biomarker-enabled trial enrollment. Future growth will be shaped by blood-based AD immunoassays, multi-marker panels, and AI-driven interpretation models linked to clinical decision support systems.

Multiple Sclerosis (MS) and Neuroinflammation

Immunoassays play a crucial role in monitoring immune-related neurological diseases, especially MS, where markers such as neurofilament light chain, oligoclonal bands, and interleukins are used to assess disease activity, progression, and treatment response.

The shift toward personalized treatment regimens, increasing use of NfL as a surrogate endpoint in trials, and expansion of disease-modifying therapies are supporting demand.

Europe (Germany, Sweden) and North America are dominant in MS testing infrastructure, while Middle Eastern and Asian centers are incorporating biomarker panels for broader neuroinflammatory profiling.

Future trends include home-based sample collection for longitudinal immune monitoring, multiplexed cytokine assays, and integration of immunoassay results with MRI biomarkers for comprehensive MS management.

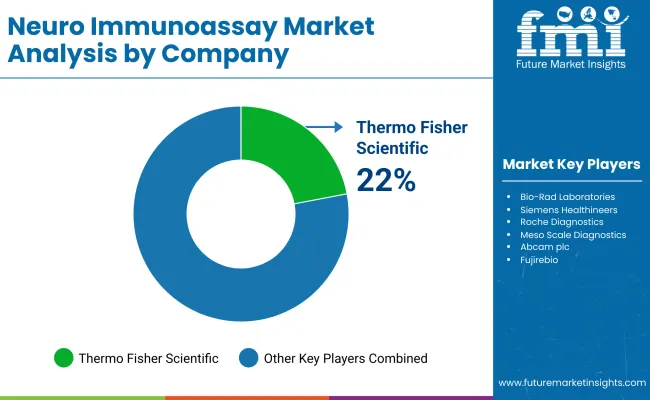

The neuro immunoassay market is experiencing strong growth, fueled by increased prevalence of neurodegenerative and neuroinflammatory diseases such as Alzheimer's, Parkinson's, and multiple sclerosis.

Advancements in biomarker discovery, coupled with rising demand for early and precise neurological diagnostics, are contributing to the market's expansion. Key players include diagnostics companies, biotech firms, and laboratory solution providers specializing in immunoassay technologies for central nervous system disorders.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific | 22-26% |

| Bio-Rad Laboratories | 16-20% |

| Siemens Healthineers | 12-16% |

| Roche Diagnostics | 10-14% |

| Meso Scale Diagnostics | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific | Offers a range of immunoassay platforms and neuro biomarker assays used in both research and clinical diagnostics. |

| Bio-Rad Laboratories | Provides multiplex immunoassay solutions and ELISA kits for detecting neuroinflammatory and neurodegenerative markers. |

| Siemens Healthineers | Develops automated immunoassay analyzers and CNS biomarker panels integrated into laboratory systems. |

| Roche Diagnostics | Supplies immunoassays for early detection of Alzheimer’s and other neurological conditions through cobas systems. |

| Meso Scale Diagnostics | Specializes in electrochemiluminescence-based immunoassays for high-sensitivity neuro biomarker detection. |

Key Company Insights

Thermo Fisher Scientific (22-26%)

Thermo Fisher leads the neuro immunoassay market with a broad product suite and a strong focus on translational neuroscience and clinical adoption.

Bio-Rad Laboratories (16-20%)

Bio-Rad offers flexible multiplexing platforms supporting simultaneous measurement of multiple biomarkers relevant to CNS disease profiling.

Siemens Healthineers (12-16%)

Siemens integrates neuro immunoassay capabilities into its high-throughput analyzers, enabling widespread diagnostic application.

Roche Diagnostics (10-14%)

Roche leverages its advanced diagnostics systems to support early Alzheimer’s detection and biomarker-based neurological screening.

Meso Scale Diagnostics (5-9%)

MSD is known for its highly sensitive detection systems, enabling early-stage biomarker discovery and translational neuroscience research.

Other Key Players (20-30% Combined)

Other significant contributors to the clean room panels market include:

These companies are advancing the field through innovative assay formats, biomarker validation programs, and increased adoption of digital and multiplex diagnostics in neuroscience.

The overall market size for neuro immunoassay market was USD 3,000.7 million in 2025.

The neuro immunoassay market is expected to reach USD 6,053.1 million in 2035.

The Neuro Immunoassay market is driven by increasing neurological disorders like Alzheimer’s and Parkinson’s, necessitating advanced diagnostic solutions.

The top key players that drives the development of Neuro Immunoassay market are, Thermo Fisher Scientific, Bio-Rad Laboratories, Siemens Healthineers, Roche Diagnostics and Meso Scale Diagnostics.

Reagents & Kits segment in product type of neuro immunoassay market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Technology, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Application, 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 174: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Neurovascular Device Market Size and Share Forecast Outlook 2025 to 2035

Neuro-Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Neurodegenerative Disease Market Size and Share Forecast Outlook 2025 to 2035

Neuromorphic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Neuromuscular Transmission Monitor Market is segmented by product, technology and end user from 2025 to 2035

Neurology Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Neuromarketing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Neurological Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Neuronavigation Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Neurovascular Stent Retrievers Market Size and Share Forecast Outlook 2025 to 2035

Neurointerventional Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Neurotrophic Keratitis Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

The Neurotrophins Market is segmented by product type, application, end-user, and region from 2025 to 2035.

Neurology Services Market Overview - Growth & Forecast 2025 to 2035

Neurostimulation Market Growth - Size, Trends & Forecast 2025 to 2035

Competitive Overview of Neuroprosthetics Companies

Neurovascular Guidewires Market Insights – Growth & Forecast 2025-2035

Neurology Digital Therapeutics Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA