The neuroendocrine carcinoma treatment market is experiencing steady growth driven by advancements in targeted therapies, improved diagnostic capabilities, and increasing awareness of rare cancer management. Rising incidence of neuroendocrine tumors, coupled with early detection through advanced imaging and biomarker technologies, has been fostering greater treatment adoption. Pharmaceutical innovation focusing on novel drug formulations and long-acting analogs is enhancing therapeutic efficacy and patient compliance.

Supportive healthcare policies, expanded oncology infrastructure, and greater clinical trial participation are further improving accessibility to advanced treatments. The market outlook remains positive as key players emphasize precision medicine and combination therapy development to optimize patient outcomes.

Growing healthcare expenditure, along with the integration of multidisciplinary care models, is expected to strengthen treatment effectiveness and expand adoption across healthcare settings These factors collectively underline a robust growth trajectory for the neuroendocrine carcinoma treatment market during the forecast period.

| Metric | Value |

|---|---|

| Neuroendocrine Carcinoma Treatment Market Estimated Value in (2025 E) | USD 2.1 billion |

| Neuroendocrine Carcinoma Treatment Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

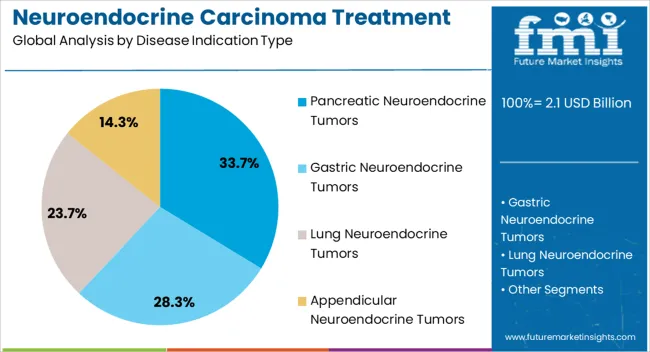

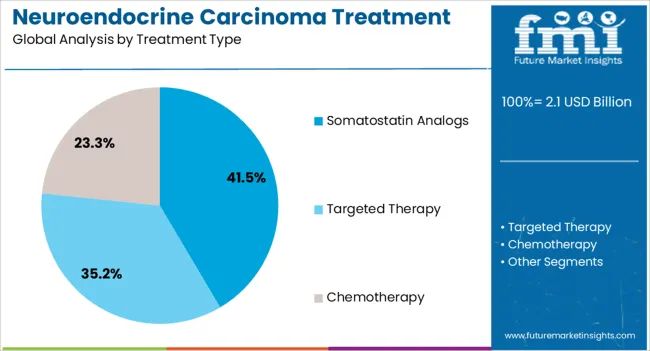

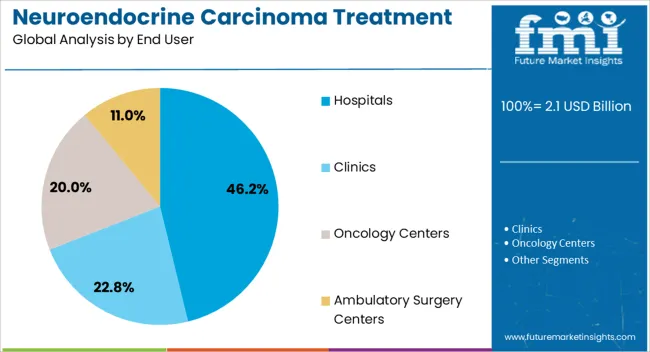

The market is segmented by Disease Indication Type, Treatment Type, and End User and region. By Disease Indication Type, the market is divided into Pancreatic Neuroendocrine Tumors, Gastric Neuroendocrine Tumors, Lung Neuroendocrine Tumors, and Appendicular Neuroendocrine Tumors. In terms of Treatment Type, the market is classified into Somatostatin Analogs, Targeted Therapy (Tyrosine Kinase Inhibitors, mTOR Inhibitors), and Chemotherapy (Antimetabolites, Alkylating Agents, Natural Products). Based on End User, the market is segmented into Hospitals, Clinics, Oncology Centers, and Ambulatory Surgery Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pancreatic neuroendocrine tumors segment, accounting for 33.7% of the disease indication category, has emerged as the leading indication due to its higher prevalence and increasing diagnostic accuracy. Improved imaging techniques and biomarker screening have facilitated earlier detection, enhancing treatment initiation rates.

Therapeutic advancements targeting hormone secretion control and tumor proliferation have supported clinical outcomes, while the integration of genetic profiling has improved therapy selection and monitoring. Ongoing research into tumor biology and the role of peptide receptor radionuclide therapy is expected to further strengthen treatment effectiveness.

The combination of established clinical guidelines and rising patient awareness has maintained consistent demand Market leadership of this segment is anticipated to persist as healthcare providers continue to focus on optimizing personalized treatment protocols for pancreatic neuroendocrine tumors.

The somatostatin analogs segment, holding 41.5% of the treatment type category, remains dominant due to its proven efficacy in managing tumor growth and hormone-related symptoms. Long-acting formulations and improved receptor-targeting mechanisms have enhanced therapeutic durability and patient adherence.

The segment benefits from strong clinical endorsement and inclusion in standard-of-care protocols for neuroendocrine carcinoma management. Manufacturers have focused on expanding global availability through optimized production and supply logistics.

Continuous development of next-generation analogs with higher receptor affinity is further improving treatment outcomes Rising demand from both developed and emerging healthcare systems, coupled with favorable reimbursement policies, continues to reinforce this segment’s strong position within the overall market structure.

The hospitals segment, representing 46.2% of the end user category, dominates the market due to its comprehensive oncology infrastructure and access to multidisciplinary expertise. Hospitals serve as the primary centers for diagnosis, treatment administration, and post-therapy monitoring, ensuring continuity of care for patients.

Centralized procurement systems and availability of specialized oncology units facilitate the use of advanced therapeutic options. Growing investments in hospital-based research and clinical trial participation have enhanced institutional capabilities.

The segment also benefits from robust patient inflow and structured reimbursement mechanisms, ensuring consistent demand for neuroendocrine carcinoma treatments With the ongoing expansion of hospital networks and increasing adoption of integrated cancer care models, this segment is expected to maintain its leading position throughout the forecast horizon.

Growing Adoption of Targeted Therapies is likely to Accelerate Industry Growth

The market is shifting significantly toward targeted medicines, notably somatostatin analogs, which are transforming the approach to managing this difficult illness. These medicines selectively target the hyperactive signaling pathways found in neuroendocrine tumors, resulting in more precise and successful treatment outcomes.

Unlike standard chemotherapy, which frequently produces devastating side effects due to its nonspecific nature, targeted treatments have a better side effect profile, enhancing the quality of life of patients throughout treatment.

The growing use of targeted treatments indicates a paradigm change in NEC management, with healthcare practitioners favoring precision medicine techniques based on genetic profiles and tumor features of individual patients.

This trend is driven by a better understanding of the molecular processes behind neuroendocrine carcinomas and the constant search for novel treatment options. Targeted medicines are gaining traction, further driving the industry.

Immunotherapy Advancements to Propel Market Growth

The use of immunotherapies, particularly immune checkpoint inhibitors, is transforming the neuroendocrine carcinoma treatment industry, providing a glimmer of hope to patients with advanced or metastatic cancer.

These novel medicines operate by boosting the body's immunological response against cancer cells, overcoming the immune evasion methods commonly used by malignancies.

Clinical trials have yielded encouraging results, with significant increases in patient survival rates and quality of life. The efficacy of immunotherapies in treating many malignancies is generating significant investment and research for NEC-specific uses.

As new immunotherapy treatments gain regulatory clearance and become key parts of NEC treatment regimes, this shift toward immunotherapies is not only opening up new treatment options for patients who have exhausted conventional treatments, but also propelling the NEC treatment market forward, promoting new developments, and attracting significant attention from both healthcare providers and the pharmaceutical industry.

Growing Acceptance of Precision Medicine to Drive Industry Growth

The positive impact of precision medicine on neuroendocrine carcinoma treatment is likely to drive its demand. Precision medicine tailors treatments to the genetic profiles of individuals, resulting in more effective and focused medicines.

This tailored method improves the discovery of genetic abnormalities and the role of biomarkers in the diagnosis and treatment of neuroendocrine carcinoma. It allows for the creation of more effective targeted medications with fewer adverse effects than standard treatments.

Advances in genome sequencing and molecular diagnostics allow for earlier and more accurate diagnosis, as well as better patient classification and treatment outcomes. Precision medicine improves the quality of life and survival rates for patients with NEC by addressing specific processes involved in tumor development.

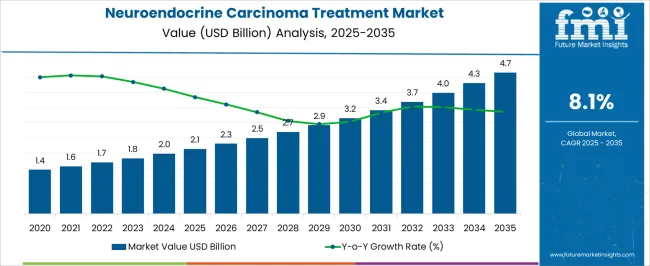

Global neuroendocrine carcinoma treatment demand increased at a CAGR of 7.6% from 2020 to 2025. Projections for the next ten years indicate that expenditure on neuroendocrine carcinoma treatment is on track to record a CAGR of 8.1%.

During the historical period, the neuroendocrine carcinoma treatment market grew due to advancements in diagnostic and treatment techniques, driven by improved knowledge and understanding of this rare and difficult type of cancer.

The increasing prevalence of NEC, together with enhanced diagnostic approaches such as sophisticated imaging and molecular diagnostics, fueled industry expansion. The emergence of innovative medications, such as targeted treatments and immunotherapies, improved the efficacy of NEC care, contributing to increased demand.

Increased clinical trials and research into NEC are expected to lead to the development of novel therapeutic options and a deeper understanding of the condition. Regulatory authorities are also anticipated to expedite approvals for breakthrough medicines, making them more accessible to patients.

The surge in healthcare spending, along with an increased emphasis on early detection and intervention, is driving the industry forward. Enhanced diagnostic equipment and procedures will make early detection easier, enabling more effective treatment at an earlier stage of the disease.

As global healthcare infrastructure develops and availability of modern medical treatments grows, so will the need for NEC treatment. Overall, the neuroendocrine carcinoma treatment market size is expected to develop significantly over the next decade, driven by technical breakthroughs, increasing research, and a greater emphasis on early diagnosis.

The following table shows the estimated growth rates of the top three markets. India and China are projected to exhibit high growth in the neuroendocrine carcinoma treatment market, with CAGRs of 9% and 8.6%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 9% |

| China | 8.6% |

| United Kingdom | 8.4% |

| France | 7.5% |

| United States | 8.3% |

The industry in India is projected to ascend at a CAGR of 9% during the forecast period. Innovations in minimally invasive surgical methods and procedures in India are propelling the neuroendocrine carcinoma treatment market.

Cutting-edge methods, including laparoscopic and robotic-assisted operations, provide patients with shorter recovery periods, less postoperative discomfort, and reduced scarring. This is particularly crucial for NEC patients, who often require complex and delicate surgical procedures.

Adoption of these new treatments has LED to improved patient outcomes, with faster recovery times to normal activities and reduced risk of complications.

Operations have become more accessible as qualified surgeons and innovative surgical equipment become widely available in premium medical institutes in India, leading to more patients opting for these novel therapies and driving growth in the industry.

The industry in the United Kingdom is predicted to surge at a CAGR of 8.4% during the projected period. This growth is likely to be driven by an increased emphasis on holistic and patient-centric treatment.

This concept emphasizes treating the patient as a whole rather than just the cancer and includes supporting therapies such as dietary support, psychiatric counseling, and pain relief.

Healthcare professionals are bringing together multidisciplinary teams to provide complete treatment plans that are tailored to the specific requirements of the patient. This method improves patient outcomes by focusing on the physical, emotional, and social aspects of living with NEC.

Advances in supportive care technology and the creation of individualized treatment regimens are increasing the efficacy of holistic approaches. As a result, patient satisfaction and treatment adherence are increasing, accelerating the neuroendocrine carcinoma treatment market growth in the United Kingdom.

The United States is expected to soar at a CAGR of 8.3% during the assessment period. Ongoing clinical trials in the United States are propelling the neuroendocrine carcinoma treatment market growth.

Researchers are exploring novel drug candidates and cutting-edge therapy combinations that have the potential to improve patient outcomes. The research provides more effective strategies to control NEC by systematically examining the efficacy and safety of cutting-edge medicines such as novel targeted medications and immunotherapies.

The insights gathered from the studies aid in the creation of individualized treatment strategies according to the specific genetic profiles of the patients.

The rapid pace of clinical research expedites the approval and availability of breakthrough therapies, ensuring that patients have access to the most recent advances, further driving industry growth in the United States.

The gastric neuroendocrine tumors category dominated the industry in 2025, accounting for 46.8%. In 2025, the somatostatin analogs segment controlled the industry, with a share of 61.2%.

| Segment | Gastric Neuroendocrine Tumors (Disease Indication Type) |

|---|---|

| Value Share (2025) | 46.8% |

The increasing prevalence and enhanced diagnostic capabilities of stomach neuroendocrine tumors are reflected in the adoption of neuroendocrine carcinoma treatments. Advances in targeted medicines and customized medicine are increasing treatment efficacy, contributing to this rise.

Increased awareness and earlier discovery mean that more patients are receiving prompt and effective therapies. The emphasis on novel therapy techniques and supportive care is strengthening the gastric neuroendocrine tumors category, further driving growth in the neuroendocrine carcinoma treatment market.

| Segment | Somatostatin Analogs (Treatment Type) |

|---|---|

| Value Share (2025) | 61.2% |

The upsurge in the adoption of somatostatin analogs for neuroendocrine carcinoma treatment is due to their ability to manage symptoms and limit tumor development. Their growing acceptance in clinical practice drives the demand for somatostatin analogs. Continuous improvements and novel formulations further propel the adoption of neuroendocrine carcinoma treatment.

Leading pharmaceutical companies in neuroendocrine carcinoma treatment industry conduct well-designed clinical trials that demonstrate clinical excellence. Regulatory compliance, data integrity, and patient safety standards ensure the credibility of their research. The success of their clinical trials strengthens their product portfolios and enhances their industry acceptance.

Mergers and acquisitions within the neuroendocrine carcinoma treatment market can accelerate the development and commercialization of NEC treatments by partnering with academic institutions, research institutes, and other industry players. Technology, expertise, and resources can be accessed through collaboration.

Leading companies invest heavily in research and development to stay at the forefront of innovation. To address unmet medical needs in NEC treatment, they are constantly trying out new therapeutic approaches, drugs, and technology. In order to stay competitive and grow their reach, they stay on top of any advances in science to maintain an edge over their competitors.

Industry Updates

Based on disease indication type, the industry is classified into gastric neuroendocrine tumors, lung neuroendocrine tumors, pancreatic neuroendocrine tumors, and appendicular neuroendocrine tumors.

Based on the treatment type, the industry is categorized into somatostatin analogs, targeted therapy (tyrosine kinase inhibitors, mTOR inhibitors), and chemotherapy (antimetabolites, alkylating agents, natural products).

In terms of end users, the industry is classified into hospitals, clinics, oncology centers, and ambulatory surgery centers.

Key countries of North America, Latin America, East Asia, South Asia, Western Europe, Eastern Europe, and the Middle East and Africa are covered in the regional analysis.

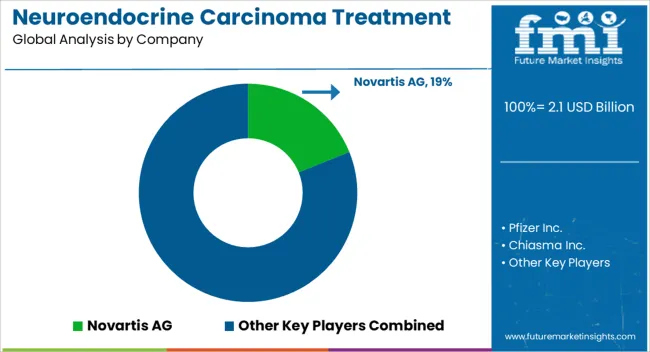

The global neuroendocrine carcinoma treatment market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the neuroendocrine carcinoma treatment market is projected to reach USD 4.6 billion by 2035.

The neuroendocrine carcinoma treatment market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in neuroendocrine carcinoma treatment market are pancreatic neuroendocrine tumors, gastric neuroendocrine tumors, lung neuroendocrine tumors and appendicular neuroendocrine tumors.

In terms of treatment type, somatostatin analogs segment to command 45.2% share in the neuroendocrine carcinoma treatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chloangiocarcinoma (CCA) Therapeutics Market - Growth & Drug Innovations 2025 to 2035

Merkel Cell Carcinoma Treatment Market

Nasopharyngeal Carcinoma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Advance Renal Cell Carcinoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Non-Small Cell Lung Carcinoma (NSCLC) Market Size and Share Forecast Outlook 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

Head and Neck Squamous Cell Carcinoma Market

Gastroesophageal Junction Adenocarcinoma Therapeutics Market by Drug, Diagnosis, Treatment, Distribution Channel, and Region through 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA