The neurotrophic keratitis treatment market is valued at USD 5.7 billion in 2025. As per FMI’s analysis, the neurotrophic keratitis treatment industry will grow at a CAGR of 7.1% and reach USD 11.4 billion by 2035.

In 2024, the industry for neurotrophic keratitis treatment underwent a significant resurgence, fueled by rising clinical awareness, a recovery in elective ophthalmic surgical procedures, and accelerating adoption of new therapies. Advances in regenerative therapy and biologics filled long-standing gaps in efficacy, especially in serious cases.

Regulatory agencies were instrumental in providing designations that hastened approval and facilitated increased access globally. The increasing number of contact lens complications and eye infections also added to the pressure of having timely and effective measures.

Looking forward to 2025, the industry is set to grow steadily. Ongoing innovation in targeted therapy and broader clinical use of neuroprotective agents will fuel demand in developed as well as emerging sectors. Stepped-up financing for rare disease research and favorable regulatory conditions will further accelerate R&D pipelines. Broader reimbursement schemes, particularly in high-income economies, will likely enable broader patient access.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 5.7 billion |

| Industry Value (2035F) | USD 11.4 billion |

| CAGR (2025 to 2035) | 7.1% |

The treatment industry for neurotrophic keratitis is in a solid growth pattern, driven by escalating disease incidence, growing clinical awareness, and biologic and regenerative therapy innovation. Investment in rare disease therapy and regulatory support is driving market growth and drug development. Those pharmaceutical companies with sophisticated ophthalmic pipelines are poised to gain, while laggards may lose their competitive advantage.

Accelerate Biologic and Regenerative Therapy Development

Invest in accelerating the development of advanced therapies, such as nerve growth factor-based therapies, to meet clinical needs and gain early-mover advantage in this emerging segment.

Align with Changing Clinical and Regulatory Environments

Remain closely aligned with international regulatory agencies to gain designations such as orphan or breakthrough therapy status, with the potential for faster approval and reimbursement support in major markets.

Strengthen Global Distribution and R&D Partnerships

Establish strategic partnerships with local healthcare providers, academic organizations, and biotech companies to increase reach, improve access to treatment, and speed innovation through collaborative research initiatives.

| Risk | Probability - Impact |

|---|---|

| Negative reimbursement policies in growth economies - Insufficient insurance coverage and absence of price support may limit therapy adoption and hinder market penetration. | High - High |

| Regulatory approval slippages or trial failures - Longer approval periods or trials that fail can sabotage launch schedules and weaken investor morale. | Medium - High |

| High treatment prices constrain patient access in price- sensitive markets - High-cost therapies could continue to be unaffordable for significant patient populations, particularly in low- and middle-income markets. | High - Medium |

| Priority | Immediate Action |

|---|---|

| Advance late-stage pipeline assets in neuro-regenerative care | Conduct detailed feasibility and ROI analysis for accelerating Phase III trials of biologic candidates |

| Strengthen global regulatory alignment | Partner with regulatory affairs experts to gain expedited review routes and orphan drug designations in core markets |

| Expand equitable access in emerging regions | Develop and implement a tiered pricing system underpinned by local health economics and reimbursement research. |

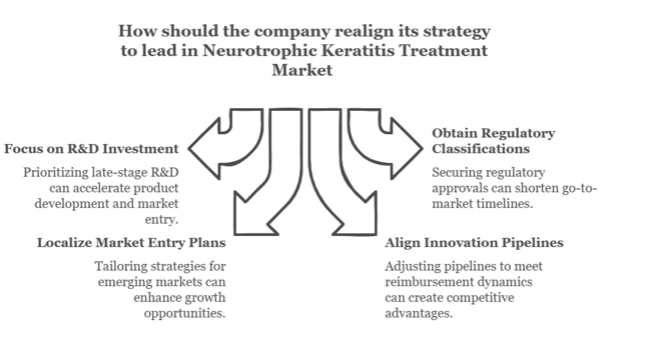

To stay ahead, companies need to act promptly to become leaders in precision ophthalmology by leveraging rare disease incentives, accelerating biologic innovation, and broadening access in emerging markets.Stakeholders need to restructure their roadmap to prioritize late-stage R&D spends, obtain regulatory classifications that drive go-to-market timelines forward, and localize market entry plans for high-growth geographies.

By realigning innovation pipelines with shifting reimbursement dynamics and patient access modalities, firms can create defensible competitive moats while addressing the pressing need for next-generation neurotrophic keratitis therapeutics.

Among the treatments, Recombinant Human Nerve Growth Factors (rhNGF) Eye Drops is the most profitable segment for the forecast period 2025 to 2035. This segment will grow at a CAGR of around 9.4%.

The rapid growth is due to the disease-modifying action of rhNGF therapies, which act directly on the root neurodegeneration instead of providing symptomatic relief only. These therapies are a first-in-class technology with established clinical efficacy, particularly in moderate to severe forms where conventional treatments such as artificial tears or antibiotics cannot restore corneal integrity.

In addition, rhNGF eye drops also enjoy regulatory incentives such as orphan drug designations and fast-track approvals, which speed up their commercialization timeline. As large pharma players are making significant investments in this space, combined with increased physician adoption and reimbursement preparedness in developed economies, this segment is likely to dominate revenue generation in the overall neurotrophic keratitis treatment sector.

Stage III is the most profitable application segment in the neurotrophic keratitis treatment industryfrom 2025 to 2035, and it is expected to increase at a CAGR of about 8.6%.

This later stage is marked by ongoing epithelial damage and corneal ulceration, necessitating intensive therapy. Patients in this group tend to be resistant to initial therapies and rely on biologics, recombinant growth factors, and surgical options like tarsorrhaphy, increasing per-patient treatment expense and longer treatment durations. All these play important roles in generating revenue.

In addition, with greater clinical recognition and enhanced diagnostic features, more patients are being properly staged and addressed earlier in the disease course, enabling appropriate stratification and directed therapies in advanced-stage disease.

Hospital Pharmacies are expected to be the most profitable distribution channel for neurotrophic keratitis treatment between 2025 and 2035, with a predicted CAGR of 7.9%.

Such superiority arises from clinical intricacy in neurotrophic keratitis, particularly in moderately or advanced phases, where medication introduction and supervision are usually administered within specialized facilities. Hospital pharmacies closely interact with ophthalmic departments, ensuring early access to prescription-only biological drugs, surgery follow-up goods, and regulated-use drugs such as recombinant nerve growth factor drops and antibiotics.

Additionally, hospital pharmacies frequently become the main conduit for new or expensive therapies that need physician management, cold-chain distribution, or institutional buying agreements.

The USA is the global leader in neurotrophic keratitis treatment, fueled by its established rare disease regulatory system and expedited FDA approval pathways. The market is supported by a robust pipeline of biologics and extensive penetration of recombinant nerve growth factor (rhNGF) eye drops. Infrastructure for large-scale clinical trials and NIH and private investor funding continue to drive drug development and post-market monitoring.

The growing incidence of diabetes, LASIK procedures, and prolonged contact lens wear has strengthened the patient population. Additionally, the reimbursement environment highly supports pioneering treatments, bolstering commercial sustainability for cutting-edge therapies. FMI opines that the CAGR of the United States will be 7.8%.

India's neurotrophic keratitis treatment sector is evolving at a fast pace, driven by a rising diabetic population, a growing number of corneal injuries, and improving healthcare access. While treatment has hitherto depended on symptomatic treatment, enhancing awareness among ophthalmologists and patients is driving demand for newer biologics and regenerative therapies.

Collaborations with international companies for clinical trials are augmenting research capacity. Rural outreach is still a challenge, but the growth of teleophthalmology and mobile diagnostic vans is bridging the gap. Adoption is also facilitated by a new generation of ophthalmic specialists educated in the management of corneal disease.FMI forecasts that the CAGR of India will be 7.4%.

China's treatment market for neurotrophic keratitis is expanding on the tailwind of an aggressive public health drive towards awareness of rare disease and high-technology healthcare upgrading. The establishment by the Chinese government of a national catalog of rare diseases has enhanced the diagnosis rate, especially in urban tertiary hospitals.

The increase in environmental pollution, overwear and misuse of contact lenses, and raised screen usage has resulted in increasing cases of nerve damage of the cornea as well as of epitheloids. Cross-border collaborations and government-supported biotech incubators are drawing both domestic and international investments in neuro-regenerative ophthalmology. FMI opines that the CAGR of China will be 7.6%.

A developed health system, comprehensive data infrastructure, and positive policy assistance for orphan diseases mark the UK economy. The National Health Service (NHS) covers a broad array of ophthalmologic treatments, such as specialized treatments for neurotrophic keratitis patients. The nation's top academic teaching hospitals and eye research centers have been in the vanguard of assessing innovative biologics, such as rhNGF eye drops and gene therapy solutions.

Patient group and clinical network engagement have enhanced early detection initiatives, particularly in diabetic and post-operative corneal complication scenarios. With the NHS further investing in AI-driven diagnostics, the initiation of treatment is increasingly efficient and stratified.FMI forecasts that the CAGR of the United Kingdom will be 7.2%.

Germany provides a structured and research-focused environment for neurotrophic keratitis treatment. Strong reimbursement policies and physician-led treatment protocols make it among the most developed biologic adoption markets in Europe.

The country's strong clinical trials, especially in the field of ophthalmology, appeal to global sponsors and fuel local innovation. With an increasingly aging population, Germany has an increasing burden of corneal degeneration and ocular nerve injury, especially in diabetics and glaucoma sufferers.

Hospitals are increasingly using high-tech imaging and diagnostics for early diagnosis and staging. German companies are also leading EU-sponsored initiatives on ocular regenerative therapies and sustained release systems. FMI opines that Germany's CAGR will be 7.3%.

South Korea's vibrant health innovation hub is turning the nation into an emerging force in neurotrophic keratitis treatment. The reimbursement strategy for rare diseases by the government and digital health-first infrastructure is enhancing biologics and diagnostic access.

Hospitals use AI-based corneal imaging and deep learning to identify keratitis at an early stage, particularly in urban areas. Pharma and biotech industries in the country are scaling up biosimilar production at a high speed and researching stem cell-based corneal repair options.

Telemedicine services and national electronic medical record systems facilitate remote follow-up of chronic keratitis patients, improving compliance with treatment and data capture. FMI projects that the CAGR of South Korea will be 7.5%.

Japan's excellence in rare disease management and regenerative medicine reinforces the increased options for the treatment of neurotrophic keratitis. Priority review designations from the Pharmaceuticals and Medical Devices Agency (PMDA) expedite orphan drug availability to the market.

Academic centers, supported by the Japan Agency for Medical Research and Development (AMED), are also researching recombinant proteins and minimally invasive repair of the cornea. The country also supports real-world data systems to allow companies to follow outcomes more easily and further tailor product offerings. FMI forecasts that the CAGR of Japan will be 7.4%.

France's highly centralized health system and national policies related to rare diseases make the country a strategic target for ophthalmic innovations. The French National Health Insurance (CNAM) reimburses a large majority of treatment expenditures for neurotrophic keratitis, which guarantees high compliance with therapy. Top-rated hospitals like the Quinze-Vingts Eye Hospital are engaged in multicenter trials and have embraced biologics early on.

Local biopharmaceutical companies are creating drug-eluting ocular inserts and investigating topical gene therapies. Clinical societies are encouraging continuing medical education to enhance early-stage diagnosis in primary care. FMI is of the opinion that CAGR of France will be 7.2%.

Italy's treatment landscape is evolving, courtesy of EU cohesion funding and prioritization of rare disease in national health planning. Ophthalmology departments in hospitals are being refreshed with fresh diagnostics and availability of biologics, particularly for Stage II and III neurotrophic keratitis.

Some rhNGF treatments have been accelerated by the Italian Medicines Agency (AIFA) for reimbursement. Regional hubs of excellence in Milan and Rome are engaging in clinical development for new interventions such as stem-cell-based ocular surface reconstruction. Joint programs with Spain and France additionally enhance the innovation pipeline. FMI forecasts that Italy's CAGR will be 7.1%.

Australia and New Zealand are becoming prominent early adopter hubs for rare disease therapies. The Therapeutic Goods Administration (TGA) and Medsafe have implemented frameworks for fast-tracked approvals and orphan drug availability, increasing the appeal of the market to multinational companies. National interest in precision medicine and high health insurance coverage has fueled the adoption of rhNGF therapies and surgical procedures.

Australia's robust clinical trial infrastructure is backed by government funding and hospital systems, whereas New Zealand is investing in rural outreach ophthalmology to enhance equity of access. Both nations are implementing digital diagnostics to cope with long-term corneal diseases. FMI opines that the CAGR of both regionswill be 7.3%.

| Country | Regulatory Impact and Mandatory Certifications |

|---|---|

| United States | The FDA grants Orphan Drug Designation to drugs such as Oxervate ( cenegermin ) for orphan diseases, providing incentives like tax credits, market exclusivity, and fee waivers, encouraging innovation in neurotrophic keratitis treatments. |

| United Kingdom | MHRA has an Orphan Register and facilitates early access by the Early Access to Medicines Scheme (EAMS), which helps in earlier patient access to treatments such as recombinant nerve growth factor-based eye drops. |

| Germany | Germany, under EMA regulation, acknowledges orphan drug designations like cenegermin, enjoying streamlined EU procedures for quicker market access and reimbursement incentives. |

| France | The French healthcare environment gives priority to rare disease diagnosis and innovation in treatment. The uptake of Cenegermin is supported by hospital formularies and early clinical support. |

| Italy | Italy has a core position in neurotrophic keratitis therapy R&D, especially through Dompé's creation of cenegermin, underpinned by EMA orphan drug designation streams. |

| Japan | The MHLW gives orphan drug designation to drugs of high unmet needs, such as those for neurotrophic keratitis, if the number of patients is less than 50,000. Such drugs are given priority review and subsidization. |

| South Korea | The MFDS facilitates approval of orphan drugs through regulatory incentives and special routes for rare diseases like neurotrophic keratitis, enhancing access in clinical practice. |

| China | The NMPA has also fortified orphan drug policies under its Rare Disease List, favoring expedited reviews and promoting local licensing of global therapies for neurotrophic keratitis. |

| India | While orphan drug channels are limited, the CDSCO offers approval templates for rare disease treatments. Nevertheless, India has no official orphan drug policy unique to neurotrophic keratitis. |

| Australia & New Zealand | The TGA waives 100% of application costs for orphan drug applications, which favors the treatments for conditions such as neurotrophic keratitis. Medsafe in New Zealand requires strong clinical data and permits application for rare diseases under particular registration pathways. |

The treatment market for neurotrophic keratitis is moderately concentrated, with a few major players owning large market shares. They are competing aggressively through innovation in regenerative therapies, biologics, and strategic partnerships to expand global presence and availability of products.

In August 2024, Pandorum Technologies raised $11 million in funding to speed up clinical development of its regenerative corneal therapy "Kuragenx (Liquid Cornea)" for neurotrophic keratitis and associated ocular surface disorders. The funding will help speed up first-in-human trials, demonstrating the growing investor interest in biologics and next-generation eye care technologies.

In November 2024, Aldeyra Therapeutics had FDA approval of its New Drug Application (NDA) for reproxalap, a new treatment for dry eye disease with neurotrophic promise. Aldeyra also broadened its exclusive option agreement with AbbVie to include joint pre-commercial activities-marking a turn toward collaborative commercialization strategies in rare ophthalmic diseases.

DompéFarmaceutici dominates the neurotrophic keratitis market with approximately 35% share, driven by Oxervate® (cenegermin), the first FDA-approved recombinant human nerve growth factor (rhNGF) for treating moderate-to-severe cases. Its leadership is anchored in biological targeting of nerve regeneration in the cornea, supported by strong clinical trial outcomes.

Novartis AG holds around 20% market share, leveraging its ophthalmology experience, particularly through Alcon, offering lubricants, bandage contact lenses, and off-label cyclosporine formulations for mild forms, while actively investing in NGF analogs and gene therapies to expand its reach.

Santen Pharmaceutical captures about 15% of the market, with rebamipide ophthalmic suspension (Mucosta®) leading across Asia, and is making strategic moves into Western markets through Phase III trials and licensing agreements with USA biotechs.

Johnson & Johnson Vision controls roughly 12%, with its Acuvue Therapeutic Contact Lenses widely regarded as a gold standard for mild-to-moderate corneal protection. J&J is also investing in drug-eluting lenses and sustained-release technologies to strengthen its future NK treatment portfolio, supported by strong direct-to-consumer marketing and EMEA/APAC expansion.

Bausch + Lomb accounts for approximately 10% of the market, offering symptom control solutions like Soothe XP® artificial tears and Prokera® amniotic membrane grafts, while actively advancing into stem cell therapies and neuroregenerative biologics through acquisitions like Novagali Pharma.

RegeneRx Biopharmaceuticals, although smaller with about 5% market share, is carving out a niche with its thymosin beta-4 (Tβ4) peptide-based therapies such as RGN-259, bolstered by early progress in peptide therapeutics and orphan drug designations in the USA and EU.

Drugs-Artificial Tears, Recombinant Human Nerve Growth Factors Eye Drops, Antibiotics, Bandage Contact Lens

Surgical Intervention-Tarsorrhaphy

Stage I, Stage II, Stage III

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies

North America, Latin America, Europe, South Asia, East Asia, Oceania, MEA (Middle East and Africa)

Increased prevalence of corneal nerve damage and greater adoption of biologic eye drops are major growth drivers.

Recombinant nerve growth factor therapies and regenerative eye solutions are experiencing robust clinical uptake.

Tighter FDA and EMA regulations are speeding up approvals for orphan drug treatments in eye care.

Asia Pacific is experiencing fast development because of improved diagnostics and enhanced access to healthcare.

Emerging drug delivery systems and preservative-free presentations are improving patient compliance and efficacy.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Treatment Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Europe Market Attractiveness by Treatment Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Treatment Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: MEA Market Attractiveness by Treatment Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Keratitis Treatment Market - Growth & Drug Innovations 2025 to 2035

Fungal Keratitis Treatment Market – Trends & Forecast 2025 to 2035

Herpes Simplex Keratitis Treatment Market – Trends & Forecast 2025 to 2035

Superficial Punctate Keratitis Treatment Market Insights – Demand and Growth Forecast 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA