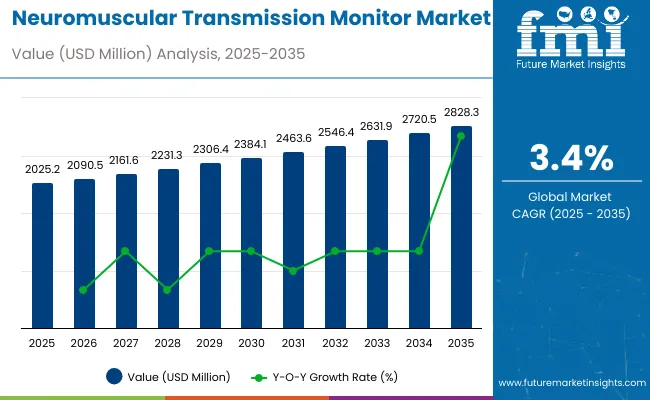

The global market for neuromuscular transmission monitor is forecasted to attain USD 2,025.2 million by 2025, expanding at 3.4% CAGR to reach USD 2,828.3 million by 2035. In 2024, the revenue of neuromuscular transmission monitor was around USD 1,949.6 million.

Evaluating neuromuscular monitoring technology is becoming crucial for an aesthetic practice, allowing clinicians to measure the level of neuromuscular blockade and provide appropriate drug dosing. The heightened emphasis on policies of patient safety and minimizing risks of postoperative complications has raised the demand for these devices among operating rooms and intensive care settings.

Patient-centered care dominates the market, too, where the patient has control over treatment planning and decision making. Although it addresses patients' values, goals, and preferences, it still strives to include them in the caregiving process for them. By incorporating this concept into neuromuscular monitors, the result would be physician-friendly interfaces that are equally friendly and interpretable to patients.

Patient participation is facilitated by these interfaces. Patients can actively engage in anesthesia care through witnessing the action of neuromuscular blocking drugs and the resultant changes that healthcare workers implement. This engagement helps patients question, debate, and collaborate with healthcare teams, enhancing a more participative and informed practice of care.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,025.2 million |

| Industry Value (2035F) | USD 2,828.3 million |

| CAGR (2025 to 2035) | 3.4% |

The significant increase in operations at the international level has been a prime driving force towards increasing demand for neuromuscular transmission monitors within the health care industry. Such monitors are now indispensable tools in various branches of surgery, particularly surgeries involving general anesthesia. The significance of such monitors is due to the fact that patient safety and optimizing conditions of surgery are of utmost concern in the case of modern health care.

Neuromuscular transmission monitors are essential in residual neuromuscular blockade prevention, a condition where patients get weak following surgery. Residual neuromuscular blockade can lead to difficulty in breathing and swallowing, thereby postoperative complications. Neuromuscular function is tracked throughout the surgery and recovery process through these monitors to allow anesthesiologists and healthcare professionals to minimize the occurrence of such complications.

The rise of surgeries globally has driven the demand for neuromuscular transmission monitors, highlighting their importance in current healthcare. Monitors are important not only for patient protection but also for enhancing the surgical room.

Leading medical device manufacturers are integrating advanced technologies such as electromyography (EMG), acceleromyography (AMG), wireless connectivity, and seamless electronic medical record (EMR) integration into their neuromuscular transmission monitors. These innovations enhance monitoring accuracy, streamline clinical workflows, and improve patient safety during surgeries involving neuromuscular blocking agents.

Xavant Technology

Xavant's Stimpod NMS450X+ is the first dual-sensor NMT monitor offering both AMG and EMG modalities in a single portable device. This flexibility allows clinicians to choose the most suitable monitoring method based on the surgical setting, enhancing patient safety and cost-effectiveness.

Nihon Kohden Corporation

Nihon Kohden's Smart Cable NMT Pod utilizes EMG to provide quantitative assessments of neuromuscular blockade. It integrates seamlessly with Nihon Kohden patient monitors, offering real-time visualization of the Train of Four ratio and automatic EMR documentation, supporting informed clinical decision-making.

Neuromuscular transmission monitors are regulated to ensure device safety, accuracy, and reliability in clinical settings. These devices play a crucial role in monitoring the effects of neuromuscular blocking agents during surgery, helping to prevent complications and improve patient outcomes. Regulatory bodies worldwide have established stringent standards for device performance, labeling, and quality control to protect patients and support healthcare providers.

Device Classification and Approval

Regulatory authorities such as the U.S. Food and Drug Administration (FDA) classify neuromuscular transmission monitors as Class II medical devices. Manufacturers must submit premarket notifications (510(k)) demonstrating substantial equivalence to approved devices. In the European Union, these monitors fall under the Medical Device Regulation (MDR) requiring CE marking after conformity assessment. These processes ensure that devices meet safety and efficacy requirements.

Performance and Safety Standards

Standards such as IEC 60601-1 for electrical safety and ISO 14971 for risk management apply to neuromuscular monitors. Devices must deliver accurate and reliable measurements, with safeguards to minimize risks to patients. Compliance with these standards ensures consistent performance in diverse clinical environments.

North America neuromuscular transmission monitor market remains the largest market for neuromuscular transmission monitor management, driven by the increased prevalence of neuromuscular disorders.

The increase in neuromuscular disorders in North America is alarming since it has brought neuromuscular disorders into the limelight of healthcare priority. Such conclusively growing instances of these neurologic disorders have continually demanded neuromuscular monitoring and diagnosis, thus showing an urgent need for research that supports new medical technologies to assist their diagnosis and management.

This increasing trend can be attributed to various factors, such as improved diagnostic facilities and heightened awareness on the part of the medical community. Concerns surrounding an aging population in North America have further expanded the scope of the incidence of these conditions; many neuromuscular disorders that are getting more dominant tend to affect older people. Rising awareness and interest in neuromuscular monitoring/diagnostic tools have, also been driven by the increasing prevalence of disorders in North American.

The Europe neuromuscular transmission monitor market is being increasing as a result of adoption of minimally invasive neurosurgery. Minimally invasive neurosurgeries have experienced major momentum in recent years, propelled by technologies such as MRI intervention, neurosurgical navigation platforms, and MRI-guided laser ablation platforms.

Earlier, neurosurgeries used to be very complicated, with high rates of mortality and morbidity. Minimally invasive techniques in neurosurgery have now improved the results, as doctors now use more efficient devices with the least damaging route to the operative site, increasing surgical precision. With the introduction of minimally invasive techniques, doctors are preferring highly specialized instruments such as power tools, neurovascular embolization devices, and radiosurgery systems such as gamma knifes.

Since minimally invasive surgery has been the focal point of new medical technology, the demand for neuromuscular transmission monitors is growing as well.

The Asia Pacific neuromuscular transmission monitor market is driven by the application of advanced equipment in healthcare systems. Asia Pacific has become a global hub for technological innovation, and this applies to the healthcare sector as well, including the development of neuromuscular transmission monitors.

Regionally based producers have been at the forefront of research and development (R&D) spending to push innovation above what is achievable with these crucial medical devices. The result has been increasingly complex, user-friendly, and technologically advanced neuromuscular transmission monitors transforming the way neuromuscular care is delivered.

Asian manufacturers have been investing in miniaturization and portable configurations, which have rendered neuromuscular transmission monitors more compact and adaptable to various healthcare settings. It is now more feasible to deliver diagnostic assessment at bedside or outpatient's clinics, and this has added to the ease of neuromuscular monitoring.

Challenges

High Instrument Costs and Regulatory Barriers Limiting Access to Advanced Neuromuscular Transmission Monitors

High device costs, lack of awareness in developing regions, and stringent approval processes can slow market penetration. The complexity of integrating monitoring devices with existing anesthesia machines and electronic health records (EHRs) presents technical challenges for healthcare providers. Additionally, reluctance among some clinicians to adopt new monitoring techniques due to training requirements and cost concerns may hinder widespread implementation.

Opportunities

Growing Minimally Invasive Therapeutic Adoption Expanding Opportunities in the Neuromuscular Transmission Monitor Market

Improvements in non-invasive monitoring devices, real-time artificial intelligence analytics, and greater focus on patient-directed anesthesia care represent opportunities for growth. Cross-talk between medical device manufacturers and healthcare providers can further stimulate innovation and access.

Expansion of telemedicine and remote patient monitoring solutions also represents new opportunity for use of neuromuscular monitoring devices in home care and outpatient locations. Increasing research and development expenditure is driving the introduction of more efficient and cost-saving neuromuscular monitoring products, driving market penetration.

Between 2020 and 2024, the neuromuscular transmission (NMT) monitor market increased steadily with increasing surgical volumes, the increasing use of neuromuscular blocking agents (NMBAs) in anesthesia, and the advancement of quantitative monitoring techniques.

The transition from subjective (qualitative) to objective (quantitative) monitoring was driven by regulatory guidelines aimed at patient safety and reducing postoperative residual neuromuscular blockade (PRNB). Adoption barriers, though, were costs, low awareness in emerging markets, and training needs for proper device use.

In the future up to 2025 to 2035, the market will be dominated by AI-enabled monitoring systems, non-invasive NMT devices, and real-time connectivity with anesthesia workstations. Regulatory agencies will strictly enforce rules on mandatory quantitative neuromuscular monitoring to improve patient outcomes and reduce complications. Sustainability measures will focus on reusable electrodes, power-saving monitors, and environmentally friendly manufacturing processes to minimize medical waste.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | ASA and European guidelines encouraged but did not mandate quantitative monitoring. Emphasis on reducing postoperative residual neuromuscular blockade (PRNB). |

| Technological Advancements | Acceleromyography (AMG) and electromyography (EMG) devices improved precision over traditional qualitative monitoring. |

| Consumer Demand | Increased adoption in high-risk surgeries requiring neuromuscular blockade. Hospitals and surgical centers preferred compact, portable monitors. |

| Market Growth Drivers | Surge in surgical procedures, increased awareness of PRNB risks, and improvements in neuromuscular blocking agent (NMBA) reversal techniques. |

| Sustainability | Focus on reducing single-use sensor waste. Some manufacturers introduced rechargeable battery options. |

| Supply Chain Dynamics | Dependence on specialized medical device manufacturers in North America and Europe. Limited adoption in low-resource healthcare settings due to cost constraints. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Mandatory implementation of quantitative NMT monitoring in all surgical settings. Stricter FDA and EU regulations ensure compliance with patient safety protocols. |

| Technological Advancements | AI-driven NMT monitors enhance accuracy and real-time decision-making. Non-invasive NMT monitoring systems gain traction for enhanced patient comfort. |

| Consumer Demand | Rising demand for fully automated NMT systems integrated with anesthesia workstations. Increased use in ambulatory surgical centers due to affordability and ease of use. |

| Market Growth Drivers | Expansion of personalized anesthesia with AI-based neuromuscular monitoring. Growth in outpatient and robotic surgeries boosts demand for portable, real-time monitoring solutions. |

| Sustainability | Adoption of reusable electrodes and biodegradable sensor materials. Energy-efficient NMT monitors minimize environmental impact. |

| Supply Chain Dynamics | Growth in regional production facilities enhances supply chain resilience. Cost-effective NMT monitoring solutions drive adoption in emerging markets. |

The United States’ neuromuscular transmission monitor market is undergoing a continuous expansion due to the raising trend of using anesthesia monitoring during the surgical interventions as well as the increase in the number of chronic diseases such as Parkinson's disease and multiple sclerosis.

Market Growth Factors

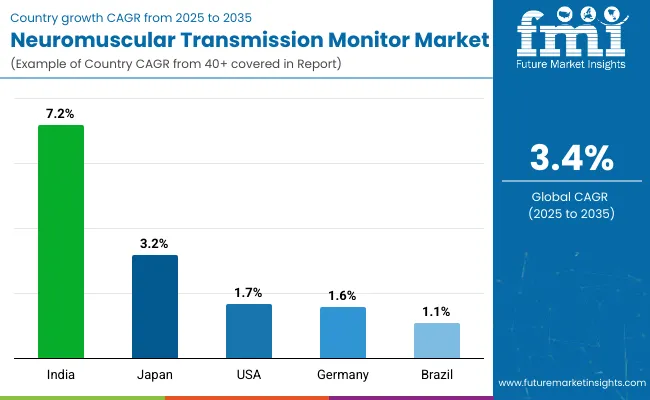

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 1.7% |

Germany's neuromuscular transmission monitor market is expanding due to a robust healthcare infrastructure and a strong focus on patient safety during surgical procedures. The country's emphasis on advanced medical technologies supports the adoption of these monitoring devices.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 1.6% |

India's market for neuromuscular transmission monitors is witnessing significant growth, driven by the rising volume of surgeries and growth in healthcare infrastructure. There is also higher awareness for monitoring and patient safety during procedures, which propels the market forward.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

Japan's neuromuscular transmission monitor market benefits from advanced healthcare technologies and a strong focus on patient safety. The country's aging population and high standards of medical care drive the adoption of these monitoring devices.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

Brazil's market for neuromuscular transmission monitors is experiencing constant growth, underpinned by the enhancement of healthcare services and increased awareness of safety for patients amid surgeries. Growing volumes of surgical procedures require efficient monitoring mechanisms, which drive the adoption of monitoring devices.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 1.1% |

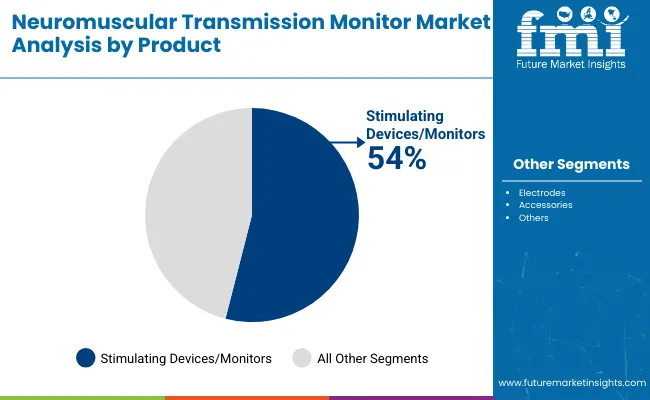

Nerve stimulating devices and monitors are in high demand because they play a crucial role in diagnosing and treating neurological conditions. These devices help detect nerve function, monitor muscle response, and guide therapies for disorders like neuropathy, chronic pain, and nerve injuries.

Their ability to provide real-time, precise data improves treatment accuracy and patient outcomes. Additionally, the rising prevalence of neurological diseases, an aging population, and advancements in medical technology drive demand. Increasing awareness about nerve health and growing use in surgeries and rehabilitation also contribute to their widespread adoption in healthcare settings.

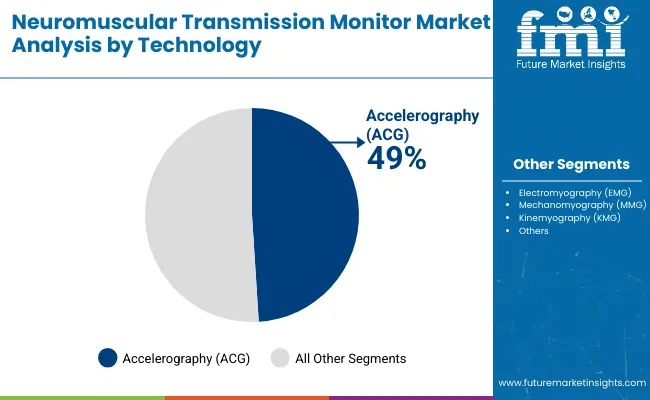

Accelerography technology is widely used for neuromuscular transmission monitors because it accurately measures muscle movement and contraction by detecting acceleration. This precise measurement helps assess the effectiveness of nerve signals reaching muscles during surgeries or treatments.

It provides real-time, objective data on muscle response, allowing clinicians to monitor the depth of muscle relaxation or recovery. Accelerography is non-invasive, sensitive, and reliable, making it ideal for guiding anesthesia and ensuring patient safety. Its ability to detect subtle changes in muscle activity enhances the accuracy of neuromuscular monitoring in medical procedures.

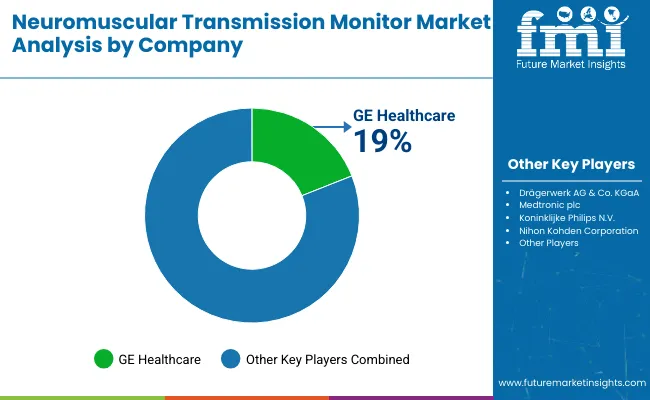

The neuromuscular transmission monitor market is highly competitive, with key global players and regional manufacturers driving innovation and growth. Increasing numbers of surgical procedures, advancement of the monitoring technology, and the increased focus on patient safety during anesthesia have all propelled further technological advancement in neuromuscular monitoring solutions.

Companies compete with where they make investments to improve precision, provide real-time monitoring, and incorporate with anesthesia workstations. The market is shaped by well-established medical device firms and emerging manufacturers, each contributing to the evolving landscape of neuromuscular monitoring technology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GE HealthCare (Applied Precision) | 18.9% |

| Nihon Kohden Corporation | 14.0% |

| Medtronics plc | 10.3% |

| Drägerwerk AG & Co. KGaA | 7.8% |

| Koninklijke Philips N.V., | 0.50% |

| Other Companies (combined) | 48.5% |

GE Healthcare (18.9%)

GE Healthcare is known to have integrated neuromuscular monitoring to its anesthesia workstations so that clinicians may seamlessly access and process patient data that may otherwise hinder intraoperative decision-making.

Drägerwerk AG & Co. KGaA (7.8%)

Dräger seeks to deliver neuromuscular monitoring solutions as precise as possible to help anesthesiologists assess the depth of neuromuscular blockade correctly and thus ensure the safety of the patient.

Medtronic plc (10.3%)

Portable neuromuscular monitors from Medtronic cater to multiple clinical areas so as to acquire reliable measurements that guide anesthesia administration.

Koninklijke Philips N.V. (0.5%)

Philips offers a comprehensive approach to neuromuscular monitoring as an integrated part of its patient monitoring systems supporting effective management of patients throughout the perioperative period.

Nihon Kohden Corporation (14.0%)

Nihon Kohden provides specialized neuromuscular monitoring devices that assist clinicians in optimizing anesthesia delivery and improving patient outcomes.

Other Key Players (48.5% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of advanced neuromuscular monitoring solutions, offering competitive pricing and cutting-edge monitoring technologies.

Nerve Stimulating Devices/Monitors, Electrodes, and Accessories

Accelerography (ACG), Electromyography (EMG), Mechanomyography (MMG), Kinemyography (KMG)

Hospitals, Specialty Clinics, Ambulatory Surgical Centers

North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa

The overall market size for neuromuscular transmission monitor market was USD 2,025.2 million in 2025.

The Neuromuscular Transmission Monitor Market is expected to reach USD 2,828.3 million in 2035.

Increasing incidence of neurological disorders and increasing awareness campaign are boosting the market.

The top key players that drives the development of neuromuscular transmission monitor market are GE HealthCare (Applied Precision), Nihon Kohden Corporation, Medtronics plc, Drägerwerk AG & Co. KGaA and Natus Medical Inc.

Nerve stimulating devices/monitors in product type of neuromuscular transmission monitor market is expected to command significant share over the assessment period.

Table 01: Global Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 02: Global Market Volume ('000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 03: Global Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Technology

Table 04: Global Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End-user

Table 05: Global Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Region

Table 06: Global Market Volume (‘000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Region

Table 07: North America Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

Table 08: North America Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 09: North America Market Volume ('000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 10: North America Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Technology

Table 11: North America Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End-user

Table 12: Latin America Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

Table 13: Latin America Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 14: Latin America Market Volume ('000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 15: Latin America Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Technology

Table 16: Latin America Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End-user

Table 17: East Asia Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

Table 18: East Asia Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 19: East Asia Market Volume ('000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 20: East Asia Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Technology

Table 21: East Asia Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End-user

Table 22: South Asia and Pacific Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

Table 23: South Asia and Pacific Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 24: South Asia and Pacific Market Volume ('000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 25: South Asia and Pacific Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Technology

Table 26: South Asia and Pacific Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End-user

Table 27: Western Europe Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

Table 28: Western Europe Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 29: Western Europe Market Volume ('000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 30: Western Europe Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Technology

Table 31: Western Europe Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End-user

Table 32: Eastern Europe Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

Table 33: Eastern Europe Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 34: Eastern Europe Market Volume ('000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 35: Eastern Europe Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Technology

Table 36: Eastern Europe Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End-user

Table 37: Middle East and Africa Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

Table 38: Middle East and Africa Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 39: Middle East and Africa Market Volume ('000 Units) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Product

Table 40: Middle East and Africa Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Technology

Table 41: Middle East and Africa Market Size (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End-user

Figure 01: Global Market Share, By Product 2023 (E)

Figure 02: Global Market Share, By Technology, 2023 (E)

Figure 03: Global Market Share, By End-user, 2023 (E)

Figure 04: Global Market Share, By Region, 2023 (E)

Figure 05: Global Market Volume Analysis (‘000 Units), 2018 to 2022

Figure 06: Global Market Volume Forecast (‘000 Units), 2023 to 2033

Figure 07: Global Average Pricing Analysis Benchmark USD (Unit) (2022)

Figure 08: Nerve Stimulating Devices/Monitor Pricing Analysis (US$) for Per Unit , By Region, 2022

Figure 09: Needle Electrode Pricing Analysis (US$) for Per Unit , By Region, 2022

Figure 10: Surface Electrode Pricing Analysis (US$) for Per Unit , By Region, 2022

Figure 11: Sensors with Cables Pricing Analysis (US$) for Per Unit , By Region, 2022

Figure 12: Extension Cable Pricing Analysis (US$) for Per Unit , By Region, 2022

Figure 13: Global Market Value Analysis (US$ million), 2018 to 2022

Figure 14: Global Market Value Forecast (US$ million), 2023 to 2033

Figure 15: Global Market Absolute Market Absolute $ Opportunity, 2023 to 2033

Figure 16: Global Market Share Analysis (%), By Product 2023 (E) to 2033 (F)

Figure 17: Global Market Y-o-Y Analysis (%), By Product 2023 to 2033

Figure 18: Global Market Attractiveness Analysis By Product 2023 to 2033

Figure 19: Global Market Share Analysis (%), By Technology, 2023 (E) to 2033 (F)

Figure 20: Global Market Y-o-Y Analysis (%), By Technology, 2023 to 2033

Figure 21: Global Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 22: Global Market Share Analysis (%), By End-user, 2023 (E) to 2033 (F)

Figure 23: Global Market Y-o-Y Analysis (%), By End-user, 2023 to 2033

Figure 24: Global Market Attractiveness Analysis By End-user, 2023 to 2033

Figure 25: Global Market Share Analysis (%), By Region, 2023 (E) to 2033 (F)

Figure 26: Global Market Y-o-Y Analysis (%), By Region, 2023 to 2033

Figure 27: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 28: North America Market Share, By Product, 2023 (E)

Figure 29: North America Market Share, By Technology, 2023 (E)

Figure 30: North America Market Share, By End-user, 2023 (E)

Figure 31: North America Market Share, By Country, 2023 (E)

Figure 32: North America Market Value (US$ million) Analysis 2018 to 2022

Figure 33: North America Market Value (US$ million) Analysis 2023 to 2033

Figure 34: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 35: North America Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis by End-user, 2023 to 2033

Figure 37: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 38: United States Market Share Analysis (%) By Product 2022 and 2033

Figure 39: United States Market Share Analysis (%) By Technology, 2022 and 2033

Figure 40: United States Market Share Analysis (%) By End-user, 2022 and 2033

Figure 41: Canada Market Share Analysis (%) By Product 2022 and 2033

Figure 42: Canada Market Share Analysis (%) By Technology, 2022 and 2033

Figure 43: Canada Market Share Analysis (%) By End-user, 2022 and 2033

Figure 44: Mexico Market Share Analysis (%) By Product 2022 and 2033

Figure 45: Mexico Market Share Analysis (%) By Technology, 2022 and 2033

Figure 46: Mexico Market Share Analysis (%) By End-user, 2022 and 2033

Figure 47: Latin America Market Share, By Product, 2023 (E)

Figure 48: Latin America Market Share, By Technology, 2023 (E)

Figure 49: Latin America Market Share, By End-user, 2023 (E)

Figure 50: Latin America Market Share, By Country, 2023 (E)

Figure 51: Latin America Market Value (US$ million) Analysis 2018 to 2022

Figure 52: Latin America Market Value (US$ million) Analysis 2023 to 2033

Figure 53: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 54: Latin America Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 55: Latin America Market Attractiveness Analysis by End-user, 2023 to 2033

Figure 56: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 57: Brazil Market Share Analysis (%) By Product 2022 and 2033

Figure 58: Brazil Market Share Analysis (%) By Technology, 2022 and 2033

Figure 59: Brazil Market Share Analysis (%) By End-user, 2022 and 2033

Figure 60: Chile Market Share Analysis (%) By Product 2022 and 2033

Figure 61: Chile Market Share Analysis (%) By Technology, 2022 and 2033

Figure 62: Chile Market Share Analysis (%) By End-user, 2022 and 2033

Figure 63: East Asia Market Share, By Product, 2023 (E)

Figure 64: East Asia Market Share, By Technology, 2023 (E)

Figure 65: East Asia Market Share, By End-user, 2023 (E)

Figure 66: East Asia Market Share, By Country, 2023 (E)

Figure 67: East Asia Market Value (US$ million) Analysis 2018 to 2022

Figure 68: East Asia Market Value (US$ million) Analysis 2023 to 2033

Figure 69: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 70: East Asia Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 71: East Asia Market Attractiveness Analysis by End-user, 2023 to 2033

Figure 72: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 73: China Market Share Analysis (%) By Product 2022 and 2033

Figure 74: China Market Share Analysis (%) By Technology, 2022 and 2033

Figure 75: China Market Share Analysis (%) By End-user, 2022 and 2033

Figure 76: Japan Market Share Analysis (%) By Product 2022 and 2033

Figure 77: Japan Market Share Analysis (%) By Technology, 2022 and 2033

Figure 78: Japan Market Share Analysis (%) By End-user, 2022 and 2033

Figure 79: South Korea Market Share Analysis (%) By Product 2022 and 2033

Figure 80: South Korea Market Share Analysis (%) By Technology, 2022 and 2033

Figure 81: South Korea Market Share Analysis (%) By End-user, 2022 and 2033

Figure 82: South Asia and Pacific Market Share, By Product, 2023 (E)

Figure 83: South Asia and Pacific Market Share, By Technology, 2023 (E)

Figure 84: South Asia and Pacific Market Share, By End-user, 2023 (E)

Figure 85: South Asia and Pacific Market Share, By Country, 2023 (E)

Figure 86: South Asia and Pacific Market Value (US$ million) Analysis 2018 to 2022

Figure 87: South Asia and Pacific Market Value (US$ million) Analysis 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness Analysis by Product, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness Analysis by End-user, 2023 to 2033

Figure 91: South Asia and Pacific Market Attractiveness Analysis by Country, 2023 to 2033

Figure 92: India Market Share Analysis (%) By Product 2022 and 2033

Figure 93: India Market Share Analysis (%) By Technology, 2022 and 2033

Figure 94: India Market Share Analysis (%) By End-user, 2022 and 2033

Figure 95: Association of Southeast Asian Nations Countries Market Share Analysis (%) By Product 2022 and 2033

Figure 96: Association of Southeast Asian Nations Countries Market Share Analysis (%) By Technology, 2022 and 2033

Figure 97: Association of Southeast Asian Nations Countries Market Share Analysis (%) By End-user, 2022 and 2033

Figure 98: Australia and New Zealand Market Share Analysis (%) By Product 2022 and 2033

Figure 99: Australia and New Zealand Market Share Analysis (%) By Technology, 2022 and 2033

Figure 100: Australia and New Zealand Market Share Analysis (%) By End-user, 2022 and 2033

Figure 101: Western Europe Market Share, By Product, 2023 (E)

Figure 102: Western Europe Market Share, By Technology, 2023 (E)

Figure 103: Western Europe Market Share, By End-user, 2023 (E)

Figure 104: Western Europe Market Share, By Country, 2023 (E)

Figure 105: Western Europe Market Value (US$ million) Analysis 2018 to 2022

Figure 106: Western Europe Market Value (US$ million) Analysis 2023 to 2033

Figure 107: Western Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 108: Western Europe Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 109: Western Europe Market Attractiveness Analysis by End-user, 2023 to 2033

Figure 110: Western Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 111: Germany Market Share Analysis (%) By Product 2022 and 2033

Figure 112: Germany Market Share Analysis (%) By Technology, 2022 and 2033

Figure 113: Germany Market Share Analysis (%) By End-user, 2022 and 2033

Figure 114: Italy Market Share Analysis (%) By Product 2022 and 2033

Figure 115: Italy Market Share Analysis (%) By Technology, 2022 and 2033

Figure 116: Italy Market Share Analysis (%) By End-user, 2022 and 2033

Figure 117: France Market Share Analysis (%) By Product 2022 and 2033

Figure 118: France Market Share Analysis (%) By Technology, 2022 and 2033

Figure 119: France Market Share Analysis (%) By End-user, 2022 and 2033

Figure 120: United Kingdom Market Share Analysis (%) By Product 2022 and 2033

Figure 121: United Kingdom Market Share Analysis (%) By Technology, 2022 and 2033

Figure 122: United Kingdom Market Share Analysis (%) By End-user, 2022 and 2033

Figure 123: Spain Market Share Analysis (%) By Product 2022 and 2033

Figure 124: Spain Market Share Analysis (%) By Technology, 2022 and 2033

Figure 125: Spain Market Share Analysis (%) By End-user, 2022 and 2033

Figure 126: BENELUX Market Share Analysis (%) By Product 2022 and 2033

Figure 127: BENELUX Market Share Analysis (%) By Technology, 2022 and 2033

Figure 128: BENELUX Market Share Analysis (%) By End-user, 2022 and 2033

Figure 129: Nordic Countries Market Share Analysis (%) By Product 2022 and 2033

Figure 130: Nordic Countries Market Share Analysis (%) By Technology, 2022 and 2033

Figure 131: Nordic Countries Market Share Analysis (%) By End-user, 2022 and 2033

Figure 132: Eastern Europe Market Share, By Product, 2023 (E)

Figure 133: Eastern Europe Market Share, By Technology, 2023 (E)

Figure 134: Eastern Europe Market Share, By End-user, 2023 (E)

Figure 135: Eastern Europe Market Share, By Country, 2023 (E)

Figure 136: Eastern Europe Market Value (US$ million) Analysis 2018 to 2022

Figure 137: Eastern Europe Market Value (US$ million) Analysis 2023 to 2033

Figure 138: Eastern Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 139: Eastern Europe Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 140: Eastern Europe Market Attractiveness Analysis by End-user, 2023 to 2033

Figure 141: Eastern Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 142: Russia Market Share Analysis (%) By Product 2022 and 2033

Figure 143: Russia Market Share Analysis (%) By Technology, 2022 and 2033

Figure 144: Russia Market Share Analysis (%) By End-user, 2022 and 2033

Figure 145: Hungary Market Share Analysis (%) By Product 2022 and 2033

Figure 146: Hungary Market Share Analysis (%) By Technology, 2022 and 2033

Figure 147: Hungary Market Share Analysis (%) By End-user, 2022 and 2033

Figure 148: Poland Market Share Analysis (%) By Product 2022 and 2033

Figure 149: Poland Market Share Analysis (%) By Technology, 2022 and 2033

Figure 150: Poland Market Share Analysis (%) By End-user, 2022 and 2033

Figure 151: Middle East and Africa Market Share, By Product, 2023 (E)

Figure 152: Middle East and Africa Market Share, By Technology, 2023 (E)

Figure 153: Middle East and Africa Market Share, By End-user, 2023 (E)

Figure 154: Middle East and Africa Market Share, By Country, 2023 (E)

Figure 155: Middle East and Africa Market Value (US$ million) Analysis 2018 to 2022

Figure 156: Middle East and Africa Market Value (US$ million) Analysis 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness Analysis by End-user, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 161: Saudi Arabia Market Share Analysis (%) By Product 2022 and 2033

Figure 162: Saudi Arabia Market Share Analysis (%) By Technology, 2022 and 2033

Figure 163: Saudi Arabia Market Share Analysis (%) By End-user, 2022 and 2033

Figure 164: Türkiye Market Share Analysis (%) By Product 2022 and 2033

Figure 165: Türkiye Market Share Analysis (%) By Technology, 2022 and 2033

Figure 166: Türkiye Market Share Analysis (%) By End-user, 2022 and 2033

Figure 167: South Africa Market Share Analysis (%) By Product 2022 and 2033

Figure 168: South Africa Market Share Analysis (%) By Technology, 2022 and 2033

Figure 169: South Africa Market Share Analysis (%) By End-user, 2022 and 2033

Figure 170: Other African Union Market Share Analysis (%) By Product 2022 and 2033

Figure 171: Other African Union Market Share Analysis (%) By Technology, 2022 and 2033

Figure 172: Other African Union Market Share Analysis (%) By End-user, 2022 and 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nucleic Acid and Gene Therapies in Neuromuscular Disorders Market Size and Share Forecast Outlook 2025 to 2035

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission Fluids Market Trends & Demand 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Transmission Oil Pump Market

Transmission Control Unit Market

EV Transmission System Market Growth – Trends & Forecast 2024-2034

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA